A daily market update from FS Insight — what you need to know ahead of opening bell

“Emerging markets serve as a daily, constant reminder that we won’t win unless everybody wins.” — Michael Miebach, Mastercard CEO

Overnight

U.S. national security officials will conduct a closed briefing for senators on the threats posed by Chinese-owned TikTok (Semafor)

Nasdaq and Borse Dubai announce launch of secondary offering of Nasdaq common stock (Nasdaq)

Israeli Prime Minister Benjamin Netanyahu expected to speak via video to Senate Republicans during their lunch today. (X)

Hedge fund groups sue SEC to challenge Treasury dealer rule (FT)

Cuba is on the brink of collapse (BBG)

The U.S. awarded nearly $20 billion in incentives to the chip giant Intel to manufacture cutting-edge semiconductors in the country (Semafor)

Elon Musk’s Grok AI has now been open sourced; code available on GitHub (TechRadar)

A U.S. dollar ‘regime shift’ could threaten stocks, Morgan Stanley warns (MorningStar)

Russian hacker group exploits Microsoft Windows feature in worldwide phishing attack (TechRadar)

Shadow-fleet oil tanker damaged in collision near Denmark (BBG)

Luxury fashion brand Gucci’s sales are expected to fall 20% year-on-year, hit by falling demand in the Asia-Pacific region, particularly China (Semafor)

JPMorgan to set up a dedicated sports IB team (RT)

Wall Street bonuses fell 2% to a ~$176k average in 2023 (RT)

European investment banks cut bonuses in second-straight year (FT)

Bond traders up short bets on fear Fed will dash rate-cut hopes (BBG)

Hedge funds are piling into Euro zone’s $10T sovereign bond market (RT)

CalPERS will invest over $30B more in private markets (FT)

China’s bonds boom as investors face asset famine (RT)

Citigroup has sold most non-U.S. consumer businesses in restructuring progress (RT)

U.K. pension funds snap up real estate at steep discounts (FT)

PIMCO says BOJ rate hike puts Japanese bonds back on the map (BBG)

Small banks demand RTO more than bigger peers (BBG)

Texas schools fund pulled $8.5 from BlackRock over ESG (RT)

Microsoft hired DeepMind’s co-founder to lead consumer AI unit (WSJ)

George Lucas endorsed Disney CEO Bob Iger in proxy fight (WSJ)

First news

- Mnuchin’s TikTok bid to be backed by Gulf nations

- Gulf investors seek to snap up bargains as U.S. pensions and others reduce their China exposure

- Kenya’s shilling rises as expensive recent Eurobond issue is fraught with possibilities and peril.

Charts of the Day

MARKET LEVELS

| Overnight |

| S&P Futures -4

point(s) (-0.1%

) overnight range: -9 to -0 point(s) |

| APAC |

| Nikkei flat Topix flat China SHCOMP +0.55% Hang Seng +0.08% Korea +1.28% Singapore +0.12% Australia -0.1% India +0.05% Taiwan -0.37% |

| Europe |

| Stoxx 50 -0.35%

Stoxx 600 -0.25% FTSE 100 -0.29% DAX +0.07% CAC 40 -0.83% Italy -0.07% IBEX -0.12% |

| FX |

| Dollar Index (DXY) +0.27%

to 104.1 EUR/USD -0.24% to 1.084 GBP/USD -0.26% to 1.2689 USD/JPY +0.6% to 151.76 USD/CNY +0.0% to 7.1996 USD/CNH +0.05% to 7.2155 USD/CHF +0.37% to 0.8914 USD/CAD +0.27% to 1.3603 AUD/USD -0.31% to 0.6512 |

| Crypto |

| BTC -1.14%

to 63022.56 ETH -1.62% to 3225.57 XRP -1.43% to 0.5932 Cardano +0.03% to 0.6037 Solana +0.57% to 170.73 Avalanche -0.9% to 53.07 Dogecoin +0.76% to 0.1331 Chainlink -0.99% to 17.13 |

| Commodities and Others |

| VIX +0.51%

to 13.89 WTI Crude -1.04% to 82.6 Brent Crude -0.7% to 86.77 Nat Gas -0.69% to 1.73 RBOB Gas -1.14% to 2.731 Heating Oil -1.38% to 2.723 Gold -0.11% to 2155.11 Silver -0.23% to 24.86 Copper -0.95% to 4.02 |

| US Treasuries |

| 1M -1.1bps

to 5.3706% 3M -2.9bps to 5.3388% 6M -0.8bps to 5.3264% 12M -5.7bps to 5.0267% 2Y -0.8bps to 4.6746% 5Y -1.2bps to 4.2849% 7Y -1.3bps to 4.2943% 10Y -1.2bps to 4.2807% 20Y -0.8bps to 4.5381% 30Y -0.8bps to 4.4337% |

| UST Term Structure |

| 2Y-3

M Spread narrowed 1.6bps to -73.5

bps 10Y-2 Y Spread narrowed 0.1bps to -39.6 bps 30Y-10 Y Spread widened 0.4bps to 15.1 bps |

| Yesterday's Recap |

| SPX +0.56%

SPX Eq Wt +0.6% NASDAQ 100 +0.26% NASDAQ Comp +0.39% Russell Midcap +0.59% R2k +0.54% R1k Value +0.47% R1k Growth +0.64% R2k Value +0.82% R2k Growth +0.27% FANG+ +0.34% Semis -0.22% Software +0.73% Biotech +0.97% Regional Banks +0.34% SPX GICS1 Sorted: Energy +1.08% Utes +0.92% Cons Disc +0.86% Indu +0.82% Healthcare +0.67% Tech +0.64% SPX +0.56% Fin +0.48% Cons Staples +0.35% Materials +0.03% REITs +0.0% Comm Srvcs -0.17% |

| USD HY OaS |

| All Sectors -1.9bp

to 348bp All Sectors ex-Energy -1.8bp to 336bp Cons Disc -3.0bp to 289bp Indu -2.9bp to 255bp Tech -0.1bp to 429bp Comm Srvcs -0.6bp to 550bp Materials -0.9bp to 318bp Energy -1.9bp to 284bp Fin Snr -2.4bp to 324bp Fin Sub -1.1bp to 246bp Cons Staples -2.1bp to 302bp Healthcare -2.9bp to 426bp Utes -1.9bp to 216bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 3/20 | 2PM | Mar 20 FOMC Decision | 5.5 | 5.5 |

| 3/21 | 9:45AM | Mar P S&P Manu PMI | 51.8 | 52.2 |

| 3/21 | 9:45AM | Mar P S&P Srvcs PMI | 52.0 | 52.3 |

| 3/21 | 10AM | Feb Existing Home Sales | 3.94 | 4.0 |

| 3/21 | 10AM | Feb Existing Home Sales m/m | -1.5 | 3.09 |

| 3/25 | 10AM | Feb New Home Sales | 675.0 | 661.0 |

| 3/25 | 10AM | Feb New Home Sales m/m | 2.1 | 1.5 |

| 3/26 | 8:30AM | Feb P Durable Gds Orders | 1.2 | -6.2 |

| 3/26 | 10AM | Mar Conf Board Sentiment | 106.95 | 106.7 |

MORNING INSIGHT

Good morning!

We see 5 reasons for stocks to rally post-FOMC, even if the Fed sounds cautious on the progress of inflation. Technicals positive and hence, still “gas in the tank”.

Click HERE for more.

TECHNICAL

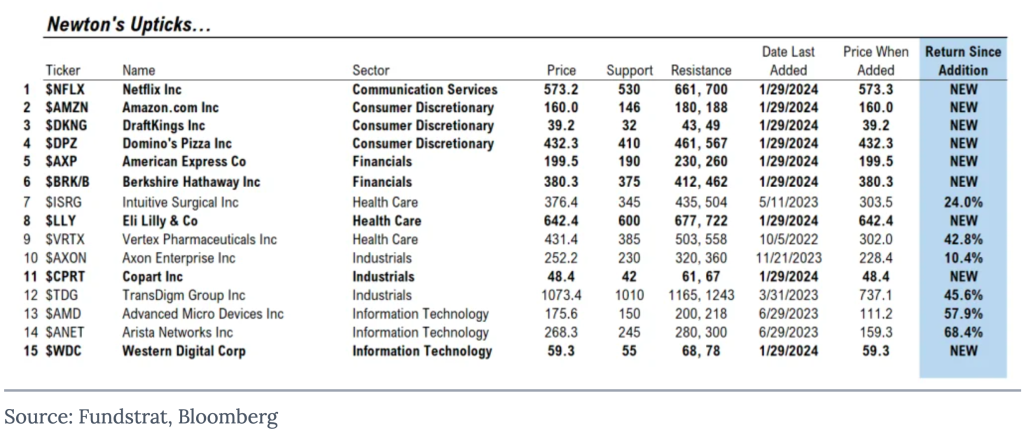

Here are our updated Upticks for March 2024.

CRYPTO

Social Defi platform The Arena (formerly Stars Arena) has announced details surrounding its token launch. ARENA will be an ERC-20 governance token launched on the Avalanche C-Chain. Each ARENA token will serve as one governance vote, and 69 ARENA will be distributed for each airdrop point earned. Points have been accumulating since Stars Arena launched last fall. Over 37 million points have been accumulated from over 100k users, equating to approximately 2.56 billion ARENA available for distribution. Only 10% of earned tokens will be airdropped in the initial phase, with the other 90% being vested over the next year. Users who fail to remain active on the platform will forfeit their future ARENA claims, rewarding loyal users with more relative tokens. New users can also still earn their share of tokens by being active in the Arena. No ARENA was sold to investors, which aligns with The Arena’s vision of being a community-owned project.

Genesis Global has agreed to a settlement with the SEC, resulting in a $21 million civil penalty for engaging in the unregistered offer and sale of securities through its crypto lending program known as Gemini Earn. Under the terms of the settlement agreement, the SEC will not receive any portion of the fine until Genesis pays out all other bankruptcy claims, including Gemini Earn, retail customers. At the time of bankruptcy, Genesis held approximately $900 million of digital assets from about 340,000 Gemini Earn investors. Gemini had agreed to a NYDFS settlement in late February that resulted in the exchange paying a $37 million fine and an agreement that will see Gemini customers receive 100% of their assets in-kind once Genesis’ bankruptcy proceedings are resolved.

Click HERE for more.

FIRST NEWS

TikTok Ping-Pong. Senator Ron Wyden, chair of the influential Senate Finance Committee, has voiced sharp criticism over former Treasury Secretary Steven Mnuchin’s bid to acquire TikTok from its Chinese parent company, citing concerns about Mnuchin’s financial ties to the Middle East.

Last week Mnuchin revealed his plans to assemble a group of U.S. investors to purchase the popular video-sharing platform, after the House passed a bill mandating TikTok be sold or face a nationwide ban within six months over data-privacy fears. The White House is asking the Senate to act swiftly on the bipartisan legislation.

While Mnuchin provided few specifics on putative syndicate, much of the $2.5 billion private equity fund he raised post-government came from Persian Gulf nations like Saudi Arabia, where he frequently traveled during his Treasury tenure, possibly doing future-focused capital raising on the government’s dime.

“Every concern about Chinese influence is equally valid when it comes to a Saudi government that murdered a journalist after planting spyware on his wife’s phone,” said Sen. Ron Wyden, chair of the powerful Senate Finance Committee, referencing the 2018 killing of Jamal Khashoggi.

Reports indicate the Saudi government committed $1 billion to Mnuchin’s Liberty Strategic Capital fund, with $500 million each from Qatar, Kuwait, and the UAE. Mnuchin has confirmed foreign governments as investors. In 2022, Wyden questioned whether Mnuchin improperly fundraised during his final Gulf trip, as he filed paperwork for his firm the day after leaving office.

There’s no certainty either on the Senate passing the TikTok bill or on how a forced sale might unfold, but Mnuchin’s recent and remarkably swift $1 billion fundraise for a distressed bank has bolstered his credibility as a buyer of complex deals. His former position and perceived ties to Trump could give him an inside track.

A Liberty spokesperson said Mnuchin aims for TikTok to be “controlled by U.S. investors”, with no single entity owning over 10%. Semafor

Western Firms Say Farewell, Abu Dhabi Fund Says Nǐ Hǎo. The Abu Dhabi Investment Authority (ADIA) is looking to capitalize on the retreat of Western investors from China by offering to buy out investors fleeing China’s private equity space, purchasing their stakes in funds managed by Hong Kong-based private equity firm PAG at a discount.

The move by Abu Dhabi’s main sovereign wealth fund signals a trend: Gulf investors seek to snap up bargains while U.S. pensions and other institutions reduce their China exposure amid heightened geopolitical tensions and Beijing’s regulatory crackdowns. It’s a transition from U.S. investors who favored China toward Middle Eastern investors unburdened by the same concerns.

PAG, which counts Blackstone as a minority investor, has built a reputation for giving global institutions access to deals in China, leveraging the connections of its chairman Weijian Shan, an Alibaba board member. The $55 billion firm’s investors span state pensions in California, Texas, Florida, and Iowa, not to mention funds in Canada, Australia, and Europe.

Still, PAG has faced fundraising headwinds since Shan dared to criticize Beijing back in 2022. Its planned $2 billion IPO, which could have valued it at $15 billion, has stalled, while four of its five largest deals since 2019 were domestic investments such as Wanda’s malls and iQIYI.

According to U.S. pension filings, as of mid-2022, two PAG funds from 2015 and 2018 had returned just 53% and 13% of investors’ cash, below the 1.8x multiple for its 2012 flagship fund by that time.

While PAG had raised around $3 billion for its new fund targeted at $9 billion by early 2023, some U.S. and European investors are now reluctant to continue with their China exposure.

Under the prospective deal, in a transaction facilitated by the buyout firm itself, ADIA would offer to purchase stakes in PAG’s funds from existing investors at a discount. One investor said that, after some Western groups got cold feet, PAG wants “committed” China backers. FT

From Africa with Alpha. Kenya’s shilling has staged a comeback that has vaulted it from the pits to the podium in less than three months. The shilling’s year-to-date gain puts it far ahead of the world’s second-best performer, the Sri Lankan rupee, which is up 6.1%. As recently as Jan. 26, the shilling was the third-worst performer globally, bottom-feeding at a record low versus the dollar. Since then, it is up more than 20%, helped along by a mix of factors, including a recent Eurobond issue.

The effective interest rate on Kenya’s newly issued seven-year, $1.5 billion Eurobond maturing in 2031 is 10.375%. Kenya’s return to the international bond market is expected to alleviate pressure on domestic debt interest rates, though analysts are merely engaging in Master-of-the-Obvious predictions when they say that the high interest rate could lay the groundwork for a future crisis. The National Treasury said the proceeds of the bond, to be repaid in three equal installments over 2029-2031, will help finance the repayment of $2 billion in debt (with a much lower 6.875 yield), set to mature in June.

The National Treasury issued a statement saying “Kenya received strong demand with a high-quality order book exceeding $6 billion, allowing for tighter pricing and an increased issuance compared to initial guidance.” Perhaps it could also mean that the current issuance won’t be mostly a case of robbing Peter to pay Paul (i.e. borrowing merely to pay back an earlier debt), but would see Kenya make use of the excess demand to pay for revenue-producing or at least productivity-boosting projects.

Then again, a debt-fueled infrastructure binge is partly to blame for Kenya’s debt-to-GDP ratio, which tops 70%. Credit ratings agency Fitch estimates the country will spend almost a third of its government revenues this year on interest payments alone. FT, Semafor, Reuters