Bitcoin ETFs Experience First Net Outflows Since March 1st, The Arena Announces Airdrop Details

Market Update

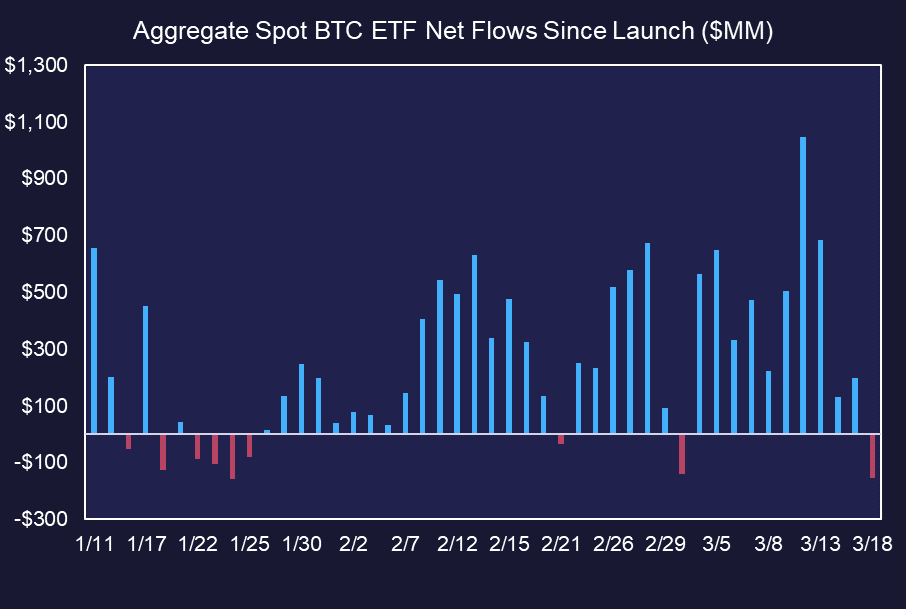

- Crypto markets are experiencing sharp declines, with $BTC (-4.94%) falling to $64k and $ETH (-6.01%) dropping to $3,310. Yesterday represented the first day of net outflows from Bitcoin ETFs since March 1st, with total outflows of $154.3 million. GBTC saw daily outflows of $642.5 million, setting a new daily record previously set on January 22nd. The Bank of Japan moved to end its negative interest rate regime, raising target policy rates from -0.1% to a range of 0%-0.1%, the first interest rate raise since 2007, while also abandoning its yield curve control policies. The Yen has fallen in response to the BOJ’s policy move, contributing to the DXY’s (+0.31%) move upwards. Domestic interest rates are widely expected to be held unchanged at tomorrow’s FOMC meeting, although investors may be fearful of a potentially hawkish tone from Jerome Powell when considering recent economic data. The SPY and QQQ have declined -0.11% and -0.46%, respectively in today’s trading.

Source: Farside Investors, Fundstrat

- Social Defi platform The Arena (formerly Stars Arena) has announced details surrounding its token launch. $ARENA will be an ERC-20 governance token launched on the Avalanche C-Chain. Each ARENA token will serve as one governance vote, and 69 ARENA will be distributed for each airdrop point earned. Points have been accumulating since Stars Arena launched last fall. Over 37 million points have been accumulated from over 100k users, equating to approximately 2.56 billion ARENA available for distribution. Only 10% of earned tokens will be airdropped in the initial phase, with the other 90% being vested over the next year. Users who fail to remain active on the platform will forfeit their future ARENA claims, rewarding loyal users with more relative tokens. New users can also still earn their share of tokens by being active in the Arena. No ARENA was sold to investors, which aligns with The Arena’s vision of being a community-owned project.

- Genesis Global has agreed to a settlement with the SEC, resulting in a $21 million civil penalty for engaging in the unregistered offer and sale of securities through its crypto lending program known as Gemini Earn. Under the terms of the settlement agreement, the SEC will not receive any portion of the fine until Genesis pays out all other bankruptcy claims, including Gemini Earn, retail customers. At the time of bankruptcy, Genesis held approximately $900 million of digital assets from about 340,000 Gemini Earn investors. Gemini had agreed to a NYDFS settlement in late February that resulted in the exchange paying a $37 million fine and an agreement that will see Gemini customers receive 100% of their assets in-kind once Genesis’ bankruptcy proceedings are resolved.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Recent consolidation looks to be nearing important support for coins like TRON, and it's likely that this stabilizes and starts to turn back higher towards new monthly highs into the month of April. Recent deterioration in prices have resulted in little to no intermediate-term damage to its trend, and the area near $0.115 should represent attractive support following its sharp pullback from $0.145 just a few weeks ago. While momentum gauges like MACD remain negatively sloped on daily charts, they remain quite positive on monthly charts and have not officially made negative crossovers on a weekly basis, either. Daily RSI has reached oversold territory just as price has reached the support trendline drawn from lows established last August. Overall, i expect a push back above $0.145 into mid-April which could hit targets near $0.18, near all-time highs before any Spring stallout gets underway. At present, $TRON looks appealing at current levels as a good risk/reward following this recent pullback.

Daily Important Metrics

All metrics as of March 19, 2024 11:52 AM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $1.27T | $64,406 | ↓ -4.53% | ↑ 52% | |

ETH ETH | $398B | $3,313 | ↓ -6.01% | ↑ 46% | ↓ -6.90% |

SOL SOL | $81B | $184 | ↓ -9.48% | ↑ 80% | ↑ 28% |

ADA ADA | $22B | $0.6261 | ↓ -4.60% | ↑ 5.62% | ↓ -47% |

DOGE DOGE | $19B | $0.1348 | ↓ -5.44% | ↑ 51% | ↓ -1.11% |

DOT DOT | $13B | $9.21 | ↓ -6.30% | ↑ 14% | ↓ -39% |

LINK LINK | $10B | $17.78 | ↓ -4.07% | ↑ 19% | ↓ -34% |

MATIC MATIC | $9.6B | $0.9684 | ↓ -6.25% | ↑ 0.85% | ↓ -52% |

NEAR NEAR | $7.3B | $6.92 | ↓ -5.17% | ↑ 92% | ↑ 40% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↑ 1.04% | $64.31 | ↑ 5.24% | ↑ 75% | ↑ 22% |

| BITW | ↓ -34% | $37.40 | ↑ 1.38% | ↑ 52% | ↓ -0.22% |

| ETHE | ↓ -21% | $34.16 | ↓ -0.96% | ↑ 76% | ↑ 23% |

| BTCC | ↓ -0.00% | $13.12 | ↑ 4.13% | ↑ 60% | ↑ 7.89% |

News

QUICK BITS

Bitcoin Magazine Japan's $1.5 Trillion Pension Fund Explores Diversifying Into Bitcoin The world's largest pension fund managing over $1.5 trillion in assets has announced it will explore diversifying a portion of its portfolio into Bitcoin. |

The Block The Block launches Emergence, a premier conference for the digital assets industry The Block is expanding its business with the launch of Emergence, a premier global conference to take place at The Prague Congress Center. |

MARKET DATA

The Block Grayscale’s GBTC spot bitcoin ETF sees record $642.5 million daily outflow Despite $451.5 million in inflows to BlackRock’s IBIT, the spot bitcoin ETFs slumped to $154.4 million in net daily outflows yesterday. |

CoinDesk Bank of Japan Ends Eight-Year Negative Rates Regime; Bitcoin Slides to $62.7K The BOJ hiked the benchmark borrowing cost by 10 basis points, abandoning the prolonged negative interest rate policy. |

Bitcoin.com Microstrategy Expands Bitcoin Holdings: Acquires 9,245 BTC After Successful Convertible Note Sale On Tuesday, the business intelligence firm Microstrategy announced it completed a $603.75 million offering of convertible senior notes due 2031. After the annou... |

PRODUCT UPDATES AND PARTNERSHIPS

CoinDesk Brevan Howard-Backed Tokenization Firm Libre Goes Live Libre has added a tokenized version of a BlackRock money-market fund so investors can earn yield while parking their capital. |

The Block Centrifuge launches on-chain fund management platform for efficient operation of investments Centrifuge’s new platform aims to connect on-chain and off-chain investment portfolio data for fund managers. |

INVESTMENT PRODUCTS

BTC Manager Fidelity adds staking feature in amended spot Ethereum ETF filing Fidelity, a financial services behemoth, is seeking approval to stake a portion of the Ether held by its proposed spot Ether exchange-traded fund (ETF) in order... |

CoinDesk Galaxy Digital to Introduce Exchange-Traded Products in Europe in 'Matter of Weeks' Galaxy Digital teamed up with asset manager DWS last April to develop ETPs designed to give Europeans access to digital-asset investment through traditional bro... |

The Block Sygnum issues $50 million of Matter Labs’ reserves as Fidelity ILF security tokens on zkSync Sygnum tokenized Matter Labs' treasury reserves onto the zkSync Layer 2 in the form of Fidelity International's Institutional Liquidity Fund (ILF) security toke... |

HACKS, EXPLOITS, AND SCAMS

The Block Genesis agrees to $21 million penalty, with bankruptcy claims to be paid first Genesis' payment to the SEC will only follow the payment of all allowed claims by the bankruptcy court, including retail investors from Gemini Earn. |

Reports you may have missed

Major equity indices are rallying on the back of solid earnings, with both the $SPX and $QQQ up over 1%. Meanwhile, crypto markets are churning lower, which is understandable as we should not expect crypto to rally alongside equities during an earnings-driven market. Crypto remains an apparently undecided market ahead of next week's FOMC meeting and the Quarterly Refunding Announcement (QRA), evidenced by another day of ETF outflows and a...

U.S. equity indices are under pressure today following disappointing economic growth in conjunction with hotter-than-expected prices paid, sparking stagflation fears and reducing the chances of rate cuts. The $SPY has declined 0.91% to test $501 and the $QQQ has dropped 1.12% to $421, being weighed down by a 12% drop in META following its Q1 earnings release. Crypto markets are faring better, with BTC -2.59% (-0.28%) trading at $64k and ETH -4.01% ...

It has been a challenging day for crypto prices, with $BTC giving back yesterday's gains to fall to $68.5k, $ETH declining to $3,500, and $SOL currently trading around $176. Most altcoins are also experiencing downturns. The lone standout among large cap crypto assets today is $TON, which is rallying on rumors of USDT launching on the TON Network. Equity indices also faced a drawdown earlier in the day, sliding after...

Crypto assets are building on the weekendâs gains. $BTC (+3.47%) eclipsed $72.7k this morning before paring gains to approximately $71.8k. $ETH (+5.58%) is showing relative strength today, gaining to $3,650, helping the ETHBTC ratio reclaim the .05 mark. Last weekâs ETF net flows totaled $484 million, displaying the continued demand for exposure among traditional investors. Equity indices are relatively flat today, with the SPY and QQQ both gaining about 0.05%...