We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

Last two trading days were horrific for equities…

The last two trading days saw stocks fall 5% at lightning speed and with low volumes. The ostensible trigger was bond market’s reaction to Fed Powell and ECB Lagarde at the IMF meetings (fighting inflation) and the resulting push higher for rates and FOMC hikes.

And naturally, many are asking if there is any redemption/case for one to be constructive, if the Fed and ECB are fighting inflation. In fact, many hawks see the only path for Fed is to crash the economy (aka create a recession). But here are some reasons we are not getting incrementally bearish here:

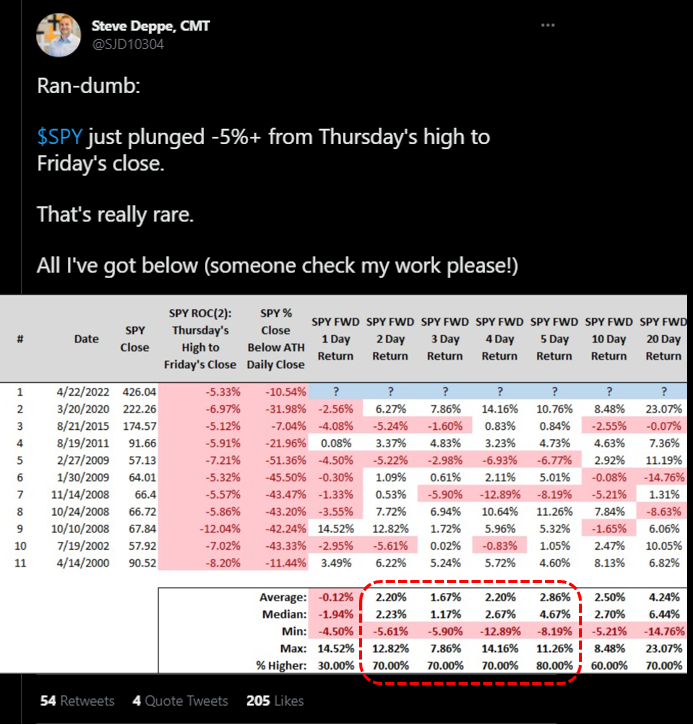

- markets might sell off Monday, but as Steve Deppe, CMT @sjd10304 notes, historically Thu-Fri selloffs turn around on Tuesday (aka turnaround Tuesday)

- this week we get core PCE (Fed preferred inflation) on 4/29 and it could show inflation apexing = good

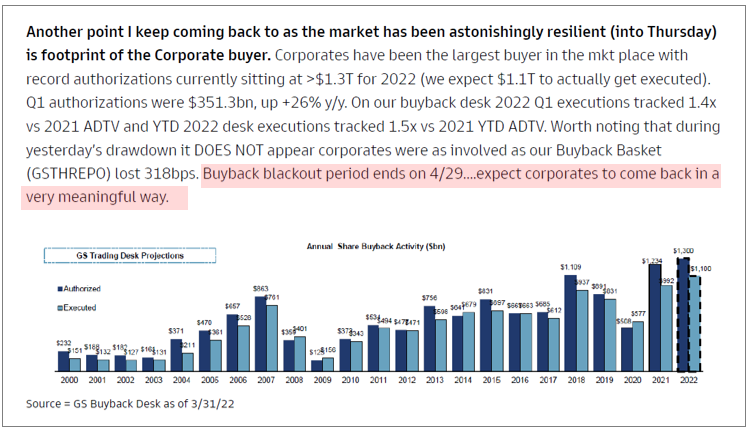

- Stock buyback window re-opens 4/29, and $1 trillion is annual buyback = good

- JPMorgan fixed income team believes bond market is near “max hawkish” and they see limited room for 10-year to rise and limited room for markets to be more hawkish = good

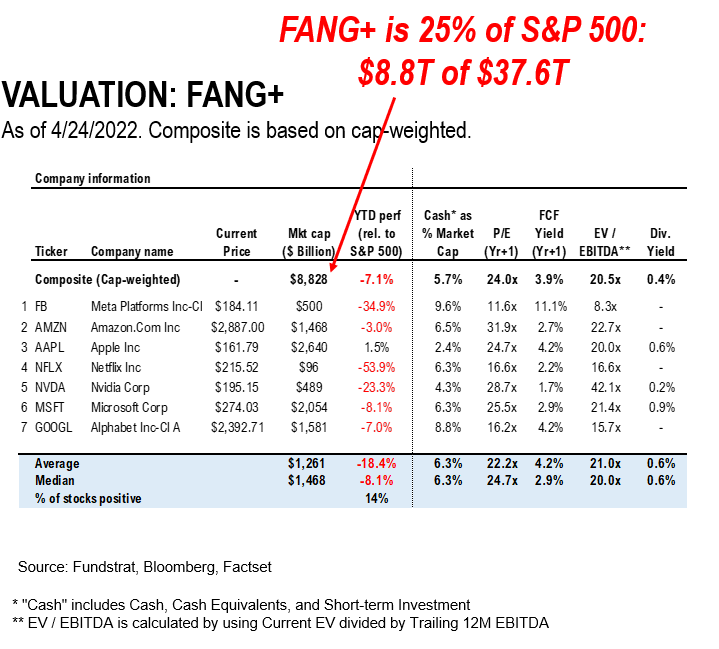

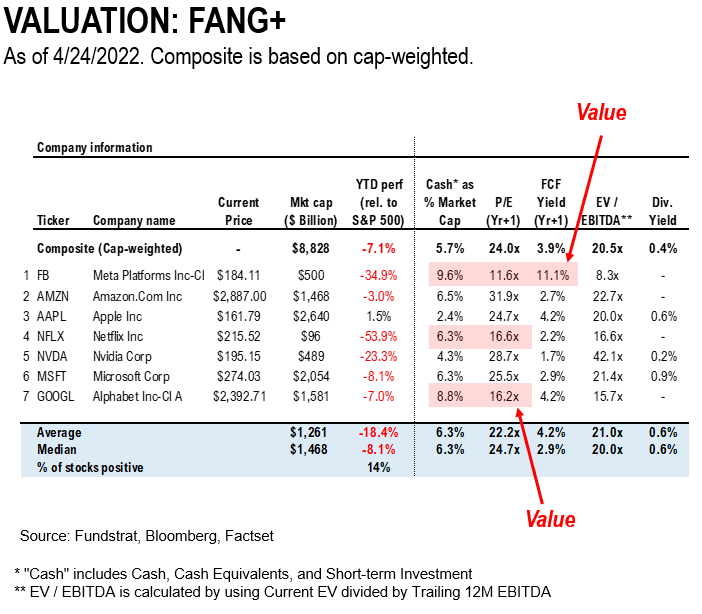

- FANG is 25% of S&P 500 market cap and is arguably showing metrics typical of value stocks = FB has 11% FCF yield, cash is 10% of stock price and could initiate a 33% payout of earnings resulting in a 3% div yield = value

…Powell’s comments last week push bond market to “max hawkish”

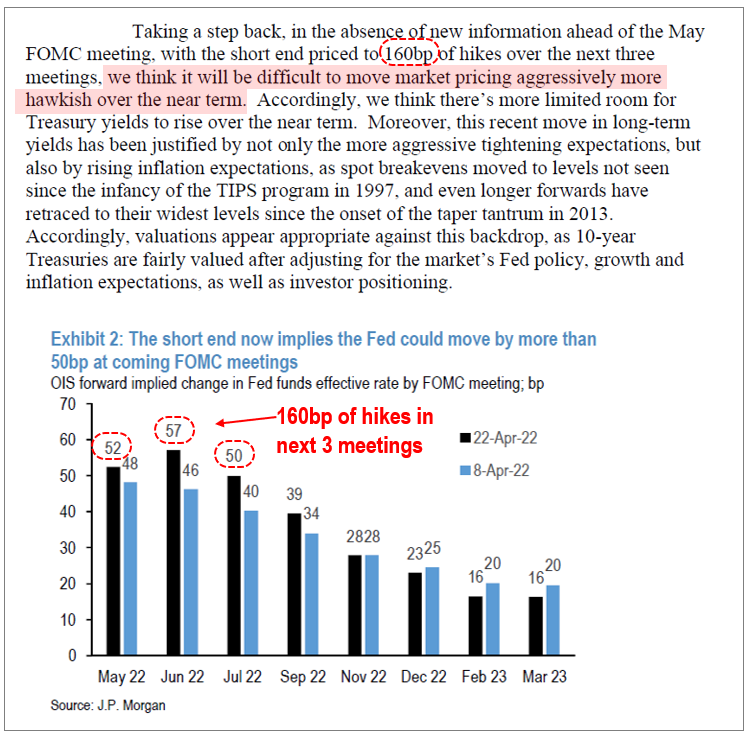

At the IMF forum last week (Thursday), several central bankers spoke (Powell, Lagarde) and the focus on containing inflation was clear. And Powell noted the need for monetary conditions to be “tight” (vs tighter) and this solidified market expectations for a series of 50bp hikes in the next few meetings. As the JPMorgan Economics team notes (below), there is now:

- 160bp of hikes priced in over next 3 meetings, or >2 hikes per meeting

- JPM Economists believe this is close to max “hawkish” near term and thus “limited room for Treasury yields to rise over the near term”

- Their fair value models show bonds appropriately priced

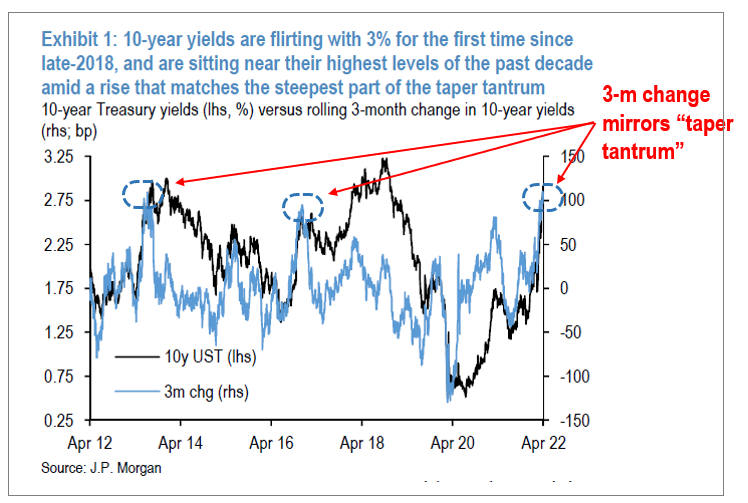

And their chart below shows the 3-month move in yields is nearing the velocity seen at the taper tantrum. In other words, this massive move in yields could be reaching a near-term apex. This is consistent with the views from Mark Newton, Fundstrat’s Head of Technical Strategy. He sees 3-3.25% as the upper end of the 10-year yield in the near term.

- slowing the ascent of rates would be positive

…Incoming Inflation data (for March) coming this Friday 4/29…

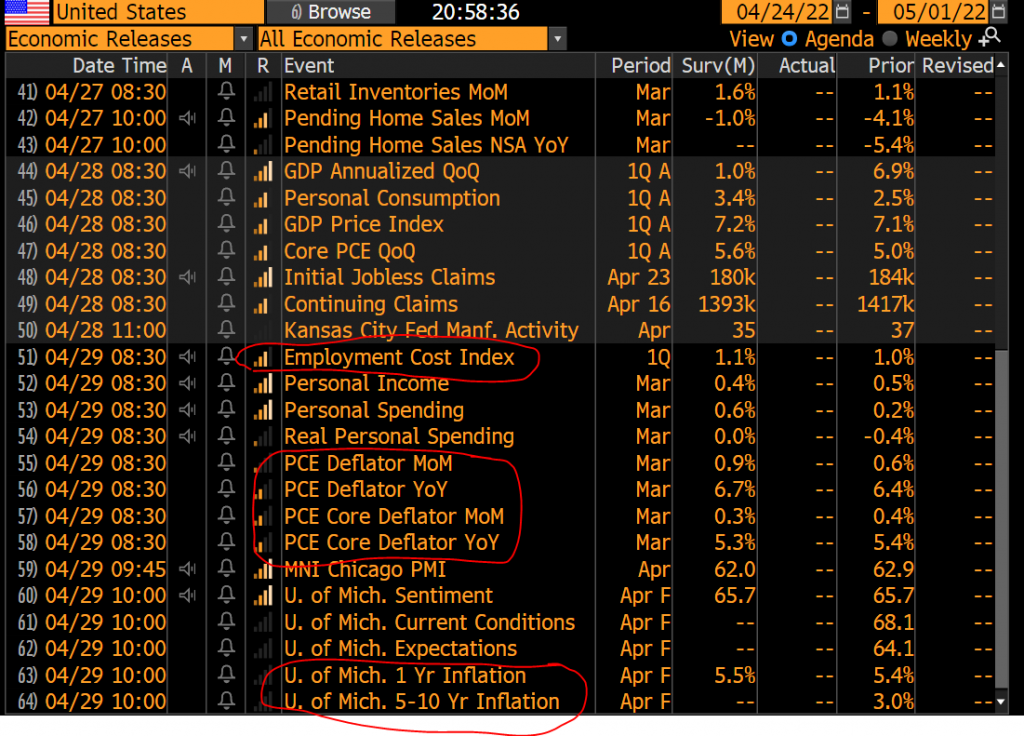

Some key incoming inflation data, the last set before the May FOMC meeting, is coming this week (4/29). As highlighted, it is

- employment cost index

- PCE deflator (Fed preferred metric)

- some sentiment measures as well (U Mich)

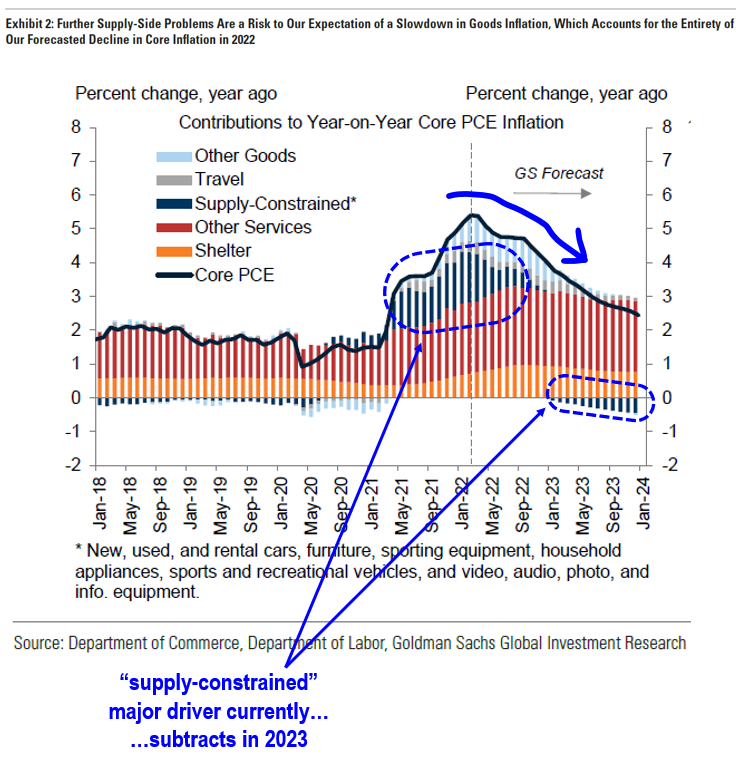

Goods-related inflation likely peaking

But the key issue for markets and Fed is where inflation tracks relative to what is priced into asset markets. For much of 2022, this has been a “chase” as incoming inflation data has come in stronger than forecast. Used car prices are already flat/falling and this will abet the downturn in goods-related CPI.

- Goldman Sachs economists see core inflation (PCE) falling to under 4% by YE, versus 5.4% currently

- A big contributor is the “supply-constrained” goods swinging from major PCE inflators to deflators

- We wrote several times that auto-related CPI contribution was 197bp of the 393bp rise in core CPI

- So, this effect is already underway, to an extent

- The upcoming 4/29 report will provide further insights

STRATEGY: FANG is 25% of S&P 500 and many of these names are now “value” stocks…yup

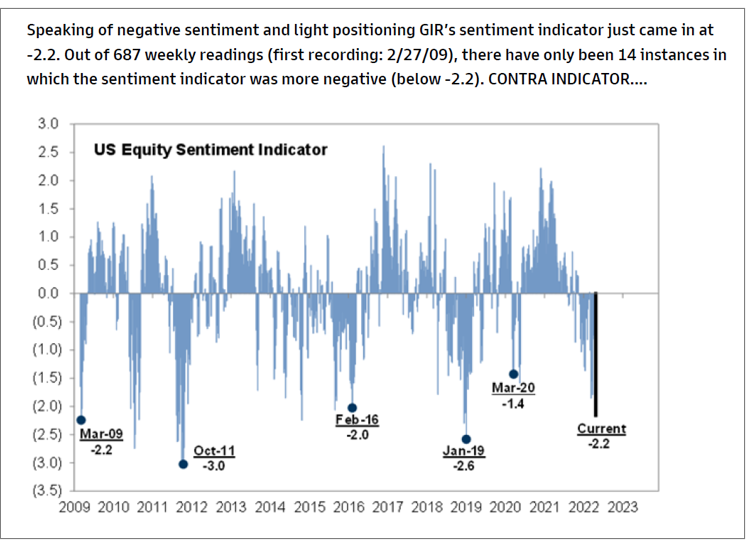

Goldman Sachs GIR Sentiment Indicator -2.2, the 14th lowest reading of 687 readings

Speaking of investor sentiment, it continues to be awful. Goldman’s sentiment indicator (GIR = Goldman Sachs Investment Research) shows an extreme negative reading:

- -2.2 for the latest week

- in March 2020, this was -1.4 and in Feb 2016 it was -2.0

- one week after Dec 2018 crash, this figure was -2.6

- So, -2.2 is a pretty extreme reading as shown below and the 14th lowest in history

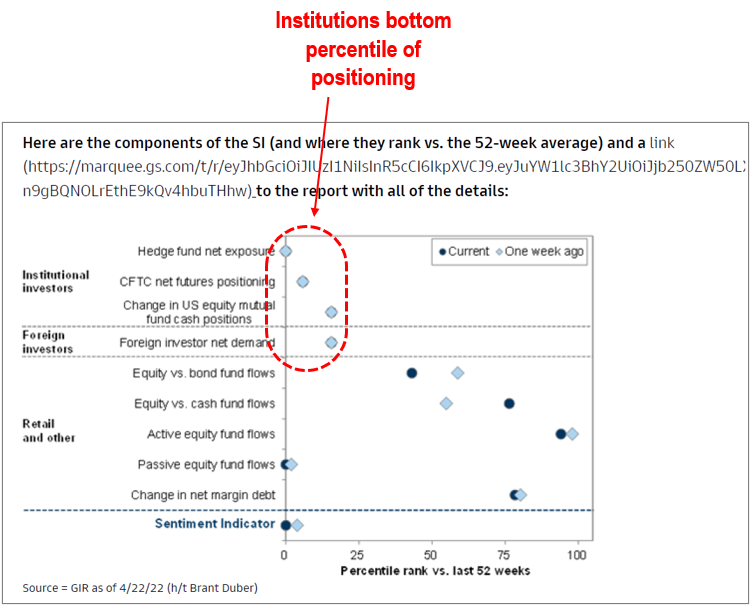

The components of this sentiment indicator (SI) are shown below and the table shows the range of values. The more “left” a figure, the more extreme the negative sentiment/bearish view:

- institutional investors are maximum bearish

- passive retail flows very bearish

- but TINA is keeping retail flows from getting extreme — falling bonds = rotation into stocks

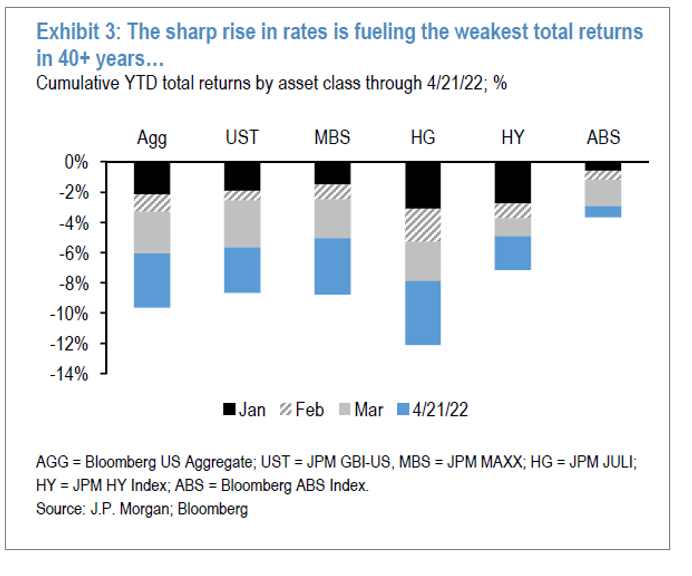

…Bonds are having worst YTD returns in 40-years

As for why there are rotations out of bonds, it is because bonds are losing money in a substantial way in 2022. The surge in rates is driving overall negative returns in credit.

- US households own $55 trillion worth of bonds (US + corporates)

- This portfolio is down 10%-plus so far in 2022

- Or a $5 trillion wealth effect hit

- S&P 500 market cap is $37.6 trillion

- It is down 10% from highs, or a loss of ~$4 trillion

- combined the wealth effect hit is nearing $10 trillion… wow

A few implications come to mind. First, this is a huge hit to household net worth already, and we could start to see this affect real GDP in 2H2022. But this also explains why investors are favoring equities. I am not sure the retail portion of the GIR SI can get negative, unless investors start buying bonds.

Stock buyback blackout ending Friday…Goldman Sachs macro strategist points out that April 29th

Another useful insight from Goldman Sachs recently is the buyback blackout period ends April 29th (Friday). Announced buybacks are $1.1 trillion, so it is a huge bid for equities

- even those who are bearish, this is a flows argument supporting stocks short-term

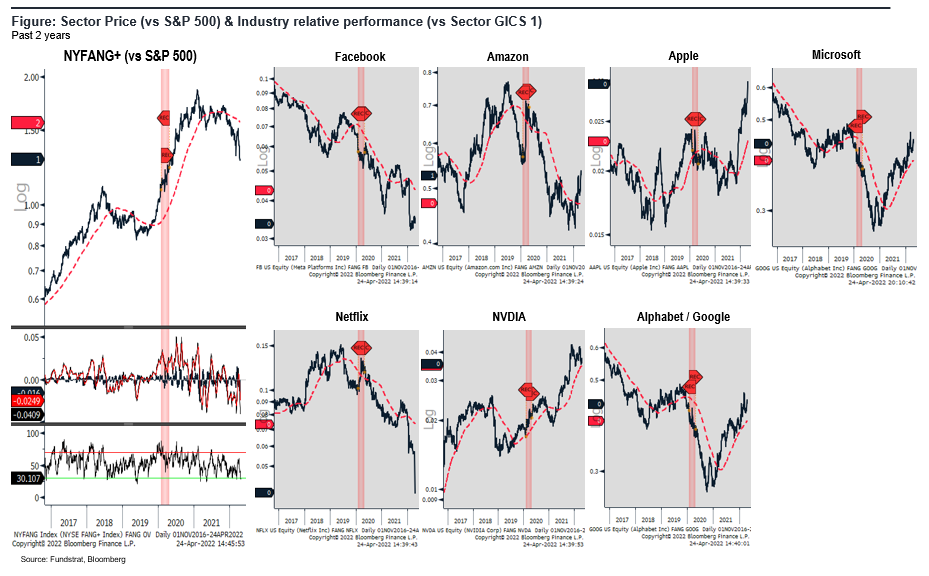

…FANG acting like death

FANG (FB AMZN 3.74% NFLX 1.11% GOOG 0.88% plus NVDA 1.39% MSFT 0.97% AAPL -0.43% ) is 25% of the S&P 500 market cap — $8.8 trillion of $37.6 trillion. Hence, this group is important when assessing:

- overall market direction

- especially true since FAANG is so widely held

- impacts market valuation as well, given their large weight

…Meta and Netflix are the big drags

As the relative performance charts below highlight, of these 7 key names, two are contributing to the poor performance of FANG:

- Netflix NFLX 1.11% down -54% YTD

- Meta down -35% YTD

- Nvidia is down -23%, do it hurts, but not nearly as much as NFLX

Lot of “value” now in FANG — cash as % market cap and low P/E

While valuations never mark a bottom, they do give us a sense of risk/reward. Much of technology has been challenging in 2022, but FANG is the most scrutinized because they are the bellwethers. And two names have been massacred in 2022:

- Meta FB has an 11% free cash yield, 11X P/E and nearly 10% in cash

- If Meta initiated a dividend of only 33% of its $16 EPS, that would be a $5.33 dividend

- That would be a 3% dividend yield, higher than the US 10-year

- Google GOOG 0.88% GOOGL 0.87% has 9% cash as percent of market cap and a 16X P/E

- this is a P/E discount to S&P 500

Bottom line, if FANG is reasonably valued, not sure there is a case for stocks to have significant further downside. But the future is uncertain.

STRATEGY: We lean “bullish” into 2Q2022, but warn of jagged next few months… Stick with BEEF

To recap on equity strategy, we are leaning bullish into 2Q2022.

Stocks have continued to be treacherous in 2022. Investors are on a hair trigger.

– this is in context to a challenging 1H2022

– so jagged next 3 months

– but > 88% probability that bottom for 2022 is in

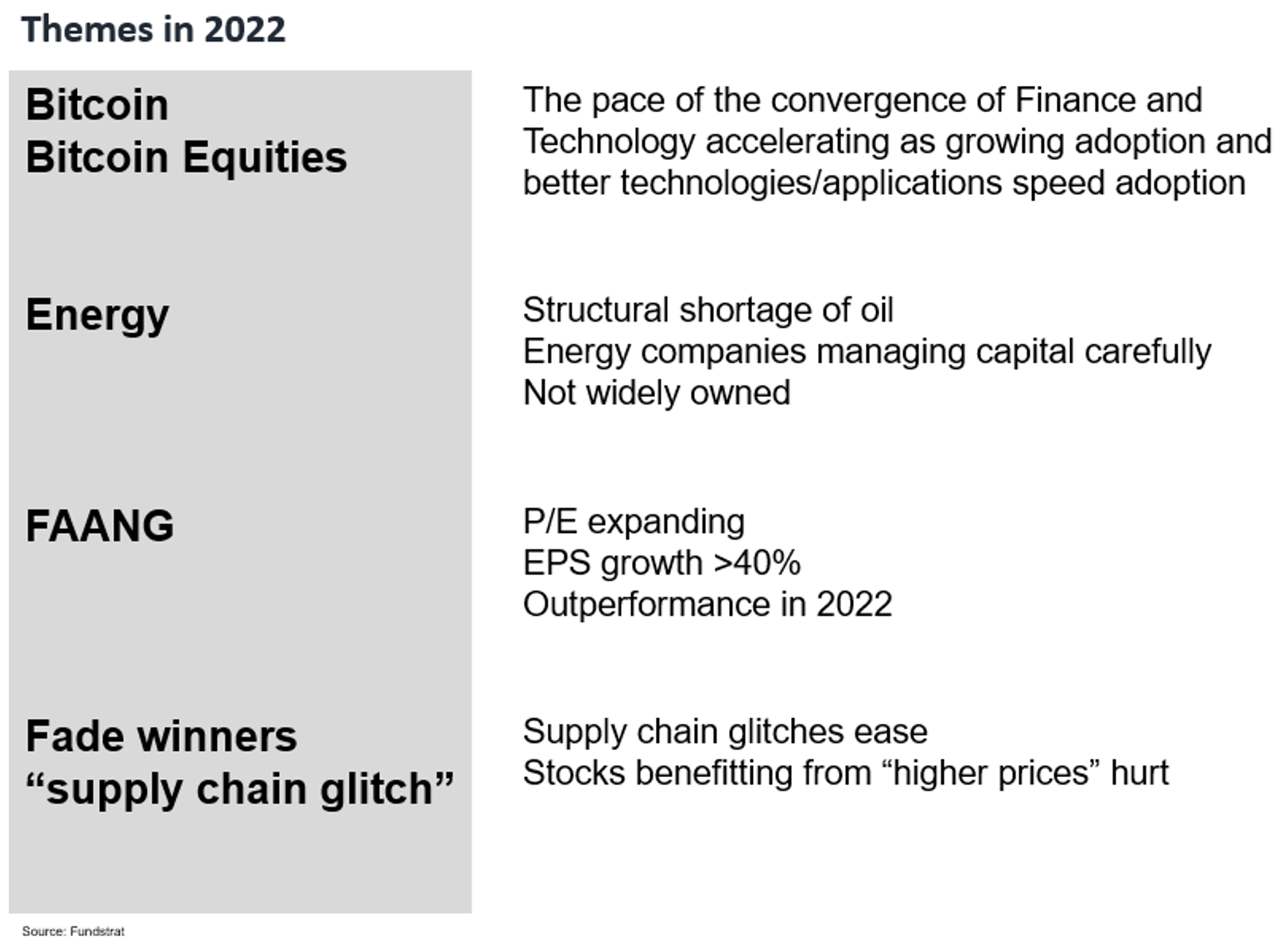

Broadly, our existing sector strategy of BEEF remains valid. Even in war. Even with inflation. In fact, the last few weeks are strengthening the case for our “BEEF” strategy. That is, BEEF is

– Bitcoin + Bitcoin Equities BITO -0.78% GBTC -0.97% BITW -2.01%

– Energy

– FAANG FNGS 1.35% QQQ 1.15%

Combined, it can be shorted to BEEF.

Why is this making stronger BEEF?

– Energy supply is now a sovereign priority

– this helps Energy stocks

– Ukraine and Russia both want access to alternative currencies

– this strengthens case for Bitcoin and bitcoin equities

– if Global economy slows, growth stocks lead

– hence, FANG starts to lead FB AAPL -0.43% AMZN 3.74% NFLX 1.11% GOOG 0.88%

All in all, one wants to be Overweight BEEF

_____________________________

31 Granny Shot Ideas: We performed our quarterly rebalance on 4/5. Full stock list here –> Click here

_____________________________

POINT 1: Daily COVID-19 cases

This data will be updated every Friday.

POINT 2: Vaccination Progress

This data will be updated every Friday.

POINT 3: Tracking the seasonality of COVID-19

This data will be updated every Friday.