Click HERE to access the FSInsight COVID-19 Daily Chartbook.

STRATEGY: DC protest troubling, but financial markets to see through this

In case you missed tuning into the news at some point yesterday, there are protestors who stormed the US Capital building yesterday. At one point, these Trump loyalists, who are protesting the transition of power, even occupied the Senate floor. Financial markets eased from their highs with the Dow, up as much as 600 points intraday, still managed to close up ~430 points.

Source: Fox News

For many, the fact that financial markets managed a positive close seems incongruous with the bizarre events happening in Washington. And there are several ways to interpret this:

– Markets are “under-reacting” and if the situation worsens, financial markets will eventually react

or

– These protests are unlikely to change the transition to power, hence, while it makes great “TV” it hardly matters to the markets

We are in the camp of the latter. That is, this is clearly a surprising development, but should this warrant a larger risk off?

VIX was lower yesterday than it was on Monday… so watch the VIX

Even the VIX, which did rise Wednesday as the events unfolded, is still lower than it was on Monday when it was near 30. So if the VIX is not surging, I am not sure financial markets should necessarily be worried.

Source: Bloomberg

The rebound in Energy is still just a mere blip versus the past 12 months and the past 10 years

We realize we have written too often about Energy this past week and in fact, we will write one more comment and focus on other sectors in the near term. But we just want to highlight a headline that caught our attention yesterday. The EPA reported that the average vehicle fuel efficiency fell in 2019, by 0.2 MPG as the sale of trucks surged. This is also true in 2020, so we think this will fall again.

– This points to the demand side for energy looking stronger than what the consensus might expect

– And supports the rally in oil YTD (helped by OPEC comments).

Source: Reuters

There have been some gains posted by Energy stocks YTD, and the sector is the best performing so far, up ~8% YTD (short year so far). But, take a look at the 10-year price history of Energy vs S&P 500 below:

– The surge in Energy stocks YTD is a mere blip

– Even getting to parity with the start of 2020 levels means a +70% more in Energy stocks

– And look at the decline over the past decade

Needless to say, if Energy proves to be a leader in 2021, this is just the beginning.

Source: Fundstrat and FAMA and Bloomberg

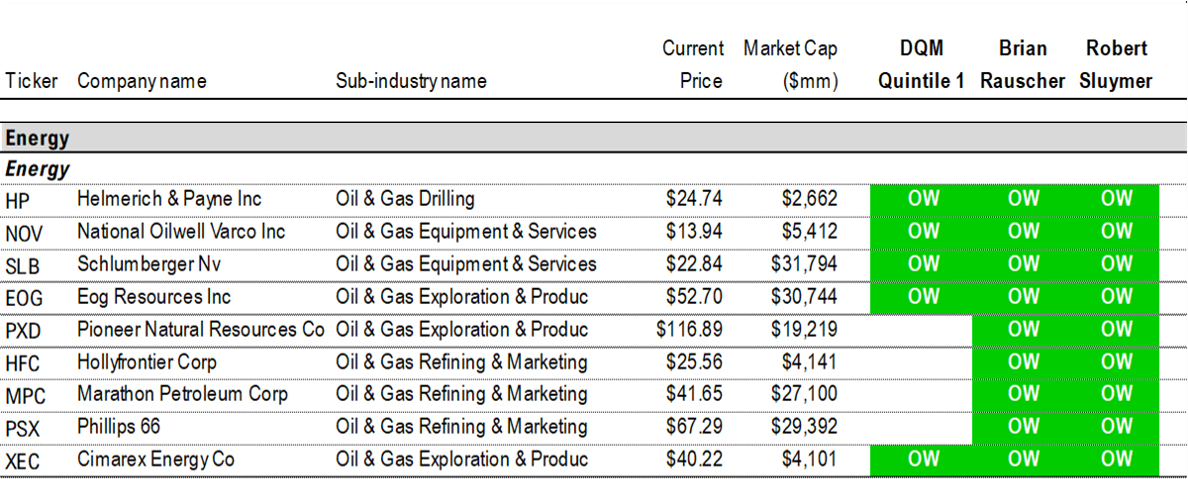

Energy TRIFECTA (*): 9 stocks that our three macro teams like…

Below are the 9 stocks that are the Energy trifecta — rated OW by each of the 3 macro teams.

– HP

– NOV

– SLB

– EOG

– PXD

– HFC

– MPC

– PSX

– XEC

Source: Fundstrat

(*) These 9 Energy Trifecta stock ideas are the subset of the “Epicenter” Trifecta stock list we published on December 11th, 2020. To view the full list of stock idea, click here. Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

ADDENDUM: We are attaching the stock lists for our 3 portfolios:

We get several requests to give the updated list for our stock portfolios. We are including the links here:

– Granny Shots –> core stocks, based on 6 thematic/tactical portfolios

– Trifecta epicenter –> based on the convergence of Quant (tireless Ken), Rauscher (Global strategy), Sluymer (Technicals)

– Biden vs Trump –> based on correlation to either candidate odds

Granny Shots:

Full stock list here –> Click here

Tickers: AAPL, AMZN, AXP, BF.B, CSCO, EBAY, GOOG, GRMN, GWW, INTC, KLAC, LEN, LOW, MNST, MSFT, MXIM, NVDA, OMC, PM, PYPL, QCOM, TSLA, XLNX

Trifecta Epicenter (*):

Full stock list here –> Click here

Tickers: AN, GM, F, HOG, GRMN, LEG, TPX, PHM, TOL, NWL, HAS, MAT, PII, MGM, HLT, MAR, NCLH, RCL, WH, WYND, SIX, DRI, SBUX, FL, GPS, LB, CRI, VFC, GPC, BBY, FITB, WTFC, ASB, BOH, FHN, FNB, PB, PBCT, RF, STL, TFC, WBS, PNFP, SBNY, NYCB, MTG, AGNC, EVR, IBKR, VIRT, BK, STT, SYF, BHF, AGCO, OC, ACM, WAB, EMR, GNRC, NVT, CSL, GE, MMM, IEX, PNR, CFX, DOV, MIDD, SNA, XYL, FLS, DAL, JBLU, LUV, MIC, KEX, UNP, JBHT, R, UBER, UHAL, HP, NOV, SLB, EOG, PXD, HFC, MPC, PSX, XEC, LYB, EXP, MLM, CF, MOS, ESI, NEU, NUE, RS, SON, STOR, HIW, CPT, UDR, KIM, NNN, VNO, JBGS, RYN

Biden White House vs. Trump White House:

Full stock list here –> Click here

(*) Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

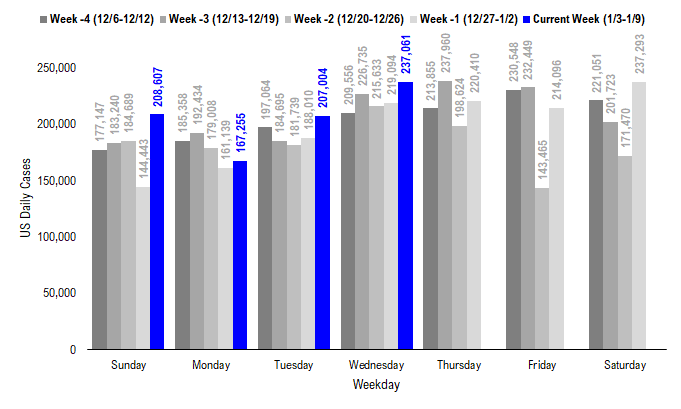

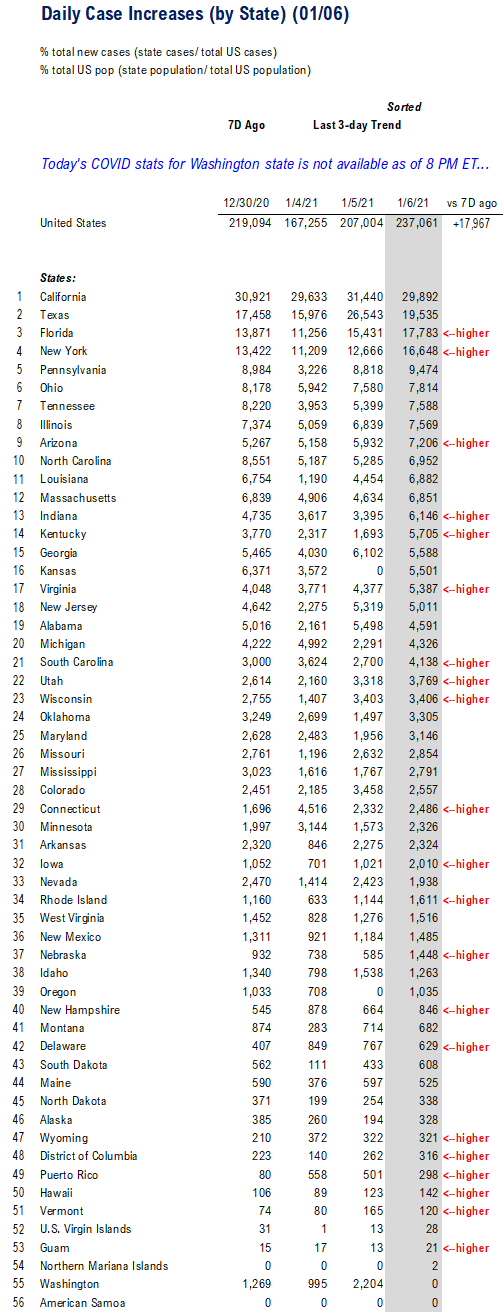

POINT 1: Daily cases 237,061, +17,967 vs 7D ago –> still holiday distortions

The latest COVID-19 daily cases came in at 237,061, up +17,967 vs 7D ago.

– the 7D delta in daily cases has been flat over the past two days

– but the holiday effect is going to cause distortions for several weeks

– over Thanksgiving, it was not until a full two weeks after Thanksgiving that underlying trends were visible

– this will be the case with current data, meaning mid-Jan is when we can start to get a better handle on trends

Source: COVID-19 Tracking Project and Fundstrat

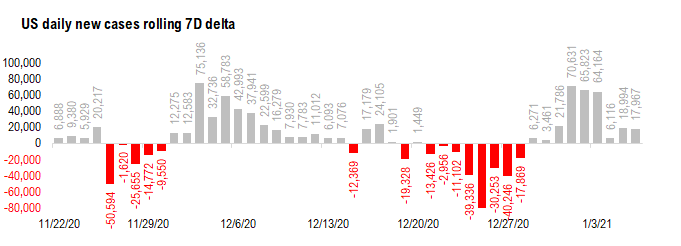

The 7D delta turned positive, but this 7D delta has been flat in the past two days

– because of holiday scheduled closures/etc, distortions in the data will be prevalent until mid-Jan

– so I would look at trends with a grain of salt

Source: COVID-19 Tracking and Fundstrat

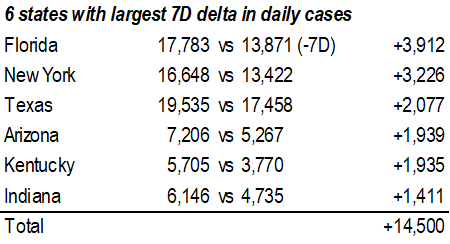

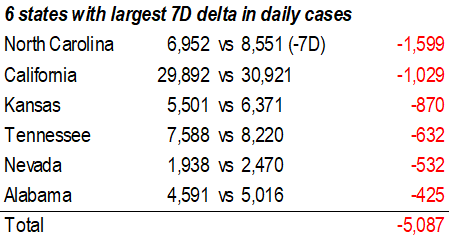

Florida, New York, Texas and Arizona, the epicenter states in wave 1 and 2 , see the largest increase in cases vs. 7D ago. California remains the state with the highest daily count in cases and still has near 30,000 new cases per day.

Source: COVID-19 Tracking and Fundstrat

Source: COVID-19 Tracking and Fundstrat

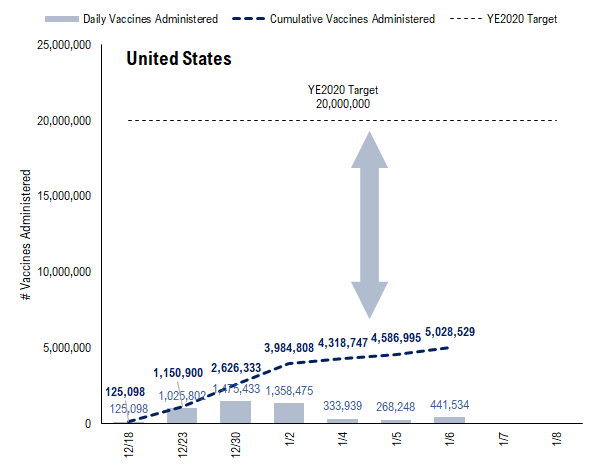

POINT 2: US vaccinated 441,534 Americans past 24 hours, pace ramping up

The CDC reported that 441,534 Americans were vaccinated in the past 24 hours. This is a ramp-up from the pace of 333,939 reported two days ago. The CDC is now providing daily updates for COVID-19 vaccinations.

I don’t know what the explicit CDC target is for vaccinations, but a doubling of this pace would lead to ~1 million per day. If 30% of Americans is the target level (to reach “herd immunity” to factor those already infected), that means about 100 million Americans need to be vaccinated.

– at a pace of 1 million per day, this would take ~100 days to reach that level

Source: CDC, Johns Hopkins and Fundstrat

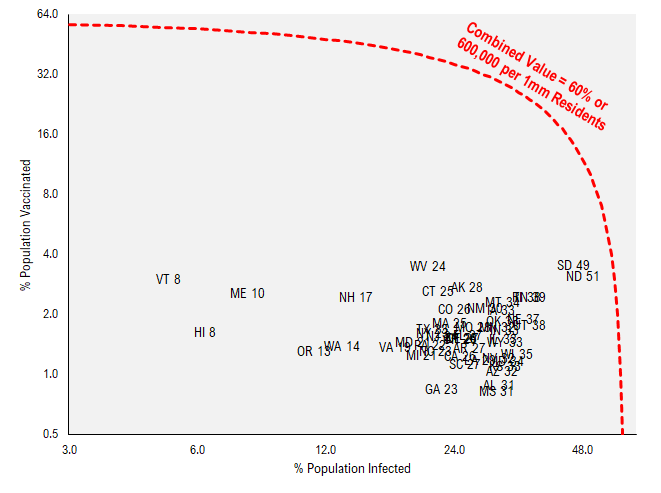

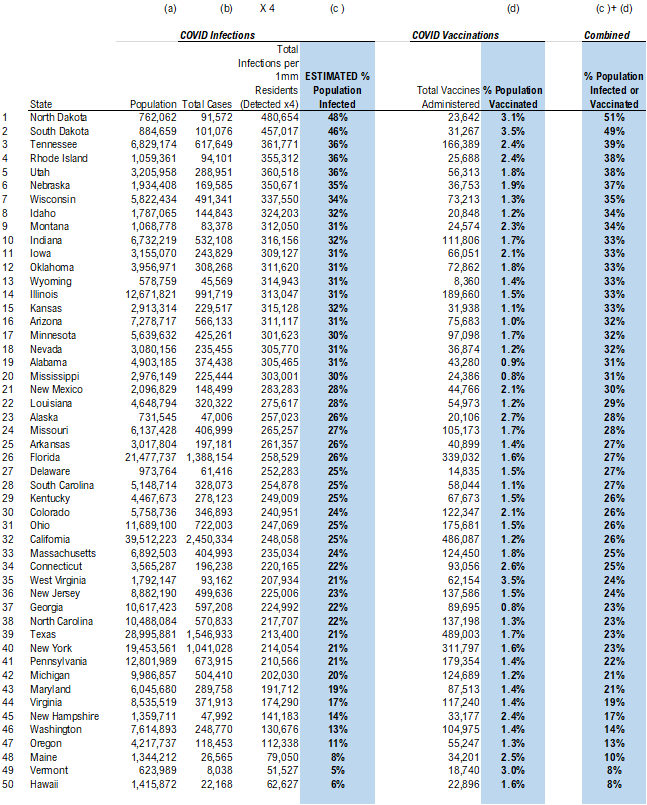

We have referred to this immunity frontier previously, which is the combination of vaccination + prior infected = 60%. And this red line represents that matrix. As shown below, we believe two states are closest to this level:

– ND 51%

– SD 49%

And if this is true, these two states will be the test for whether this 60% matters. We should expect to see these states to see a deep and sustained decline once that figure approaches/exceeds 60%.

Source: CDC, Johns Hopkins and Fundstrat

We explain how we calculate the infection rate (later below) but the basic calculation is looking at confirmed cases and applying a multiplier that “true infections” are some multiple of confirmed. We used a 4X multiplier. Meaning if a state has 1,000 cases, our adjustment is that true infections is 4,000. The obvious question is how we calculated the ‘% of population infected’ and this calculation is shown below. The figure is based upon a simple calculation:

– total confirmed cases

– we est. “infections” is 4X confirmed cases

– divide by population to calculated “% infected”

Source: CDC, Johns Hopkins and Fundstrat

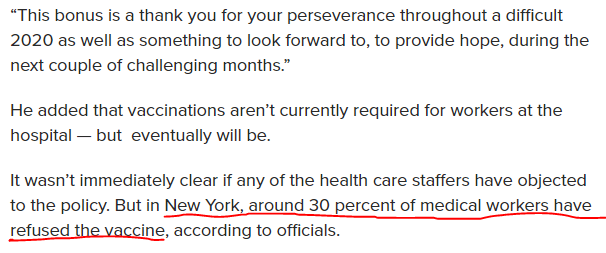

POINT 3: Texas hospital offering $500 bonus to hospital workers to get vaccine

The Houston Methodist Hospital is offering a $500 bonus to workers who get the COVID-19 vaccine. The stated reason, per the article, is a “thank you” to reward employees for working throughout 2020. At the moment, vaccinations are not required for employees at that hospital.

Source: NY Post

But part of the reason for this bonus is to perhaps incentivize employees to take the vaccine. This hospital does not require a vaccination, and the level of vaccination rate is not known. However, as the article notes, ~30% of NY medical workers have declined to take the vaccine.

Source: NY Post