Click HERE to access the FSInsight COVID-19 Daily Chartbook.

We are shifting to a 4-day a week publication schedule:

Monday

Tuesday

Wednesday

SKIP THURSDAY

Friday

STRATEGY: Anti-vaxxers turning into vax advocates = good. 4 factors supporting strong OIH 1.32% rally into YE.

Full FDA approval of the vaccines will create a ‘flood’ of vaccine mandates

As many are aware, the COVID-19 vaccines have only been authorized under EUA (Emergency Use Authorization) but a formal FDA approval of one or all the vaccines is expected. And as Dr. Fauci notes, this will embolden colleges, businesses, etc to mandate vaccinations.

– this would be a significant development, as this would ultimately increase the penetration of vaccines

– higher penetration = reduced severity of seasonal waves of COVID-19

– positive for equities and risk-on assets

Source: https://www.usatoday.com/story/news/health/2021/08/06/anthony-fauci-covid-vaccine-mandates-fda-full-approval/5513121001/

Tragedy of “no vax regrets” = boosting future vaccine penetration

We are basically in “wave 4” of COVID-19, this surge driven by the Delta variant. But the public and policy outcry in this wave differs from Waves 1, 2 and 3:

– Waves 1, 2 and 3 –> “lockdown the economy” vs laissez-faire

– Wave 4 –> “get vaxxed” vs “it’s the flu”

The obvious difference is that vaccinations are the new policy/ public tool. And the delta variant surge is creating renewed motivations/ outcry for vaccinations. I am not a scientist. And I agree with fact that the vaccines used today are experimental and with unknown future consequences. However, at the same time, the vaccine seems a better solution than no vaccination, for now. And perhaps the best case(s) is a future therapeutic or even COVID-19 mutates into an eventual harmless disease. But that is the not the case at the moment.

Interestingly, it seems that the advocates for vaccination are those formerly against the vax program.

The latest example is Newsmax host Dick Farrel. He passed away last week due to complications from COVID-19. As the NBC.com article notes, Mr. Farrel is a well-known radio host and a vocal opponent to the vaccination program, which he once called “bogus.”

– however, after contracting COVID-19, he quickly regretted not being vaccinated

– and he then urged followers and friends to get vaccinated

– he said, ‘I wish I had gotten it!’

While any COVID-19 death is needless and tragic, Mr. Farrel urging to “get vaccinated” is a positive legacy.

Source: https://www.nbcnews.com/news/us-news/florida-radio-newsmax-host-who-opposed-covid-vaccine-dies-covid-n1276304

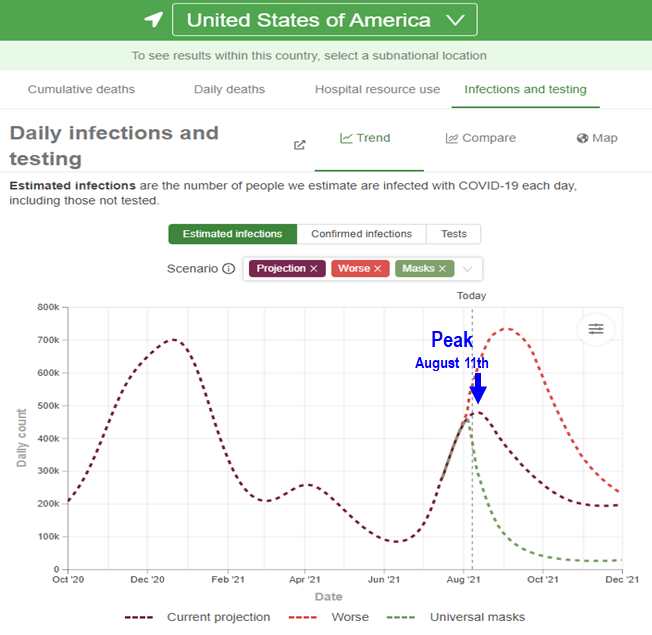

IHME still forecasting USA infections peak August 11th, this week…and curiously no “Fall back to school surge”

While the hysteria around the continued surge in Delta variant infection continues to grow, the IHME (Institute for Health Metrics, forecasters used by global policymakers) forecasts USA COVID-19 infections to peak this week. As shown below, this date is August 11th, or this coming Tuesday.

– the IHME has a good track record of forecasting waves of infections in the USA

– recall we relied heavily on their forecast for the Fall surge of Wave 3

What is also interesting is the IHME is not forecasting a Fall surge. That is, they are not expecting a renewed wave of cases in the Fall. The Fall is back to school season, plus the start of flu season. Yet, the IHME sees this wave petering out.

– this further strengthens our view that we will see an “everything rally” into the end of 2021

– a relief rally possibly further fueled by the sustained rolling over of infections

This forecast is primarily reflecting the view that vaccinations are effective.

Source: https://covid19.healthdata.org/united-states-of-america?view=infections-testing&tab=trend&test=infections

…USA daily cases could be slowing, hard to exactly see in the current data, but if I squint, I sort of see it

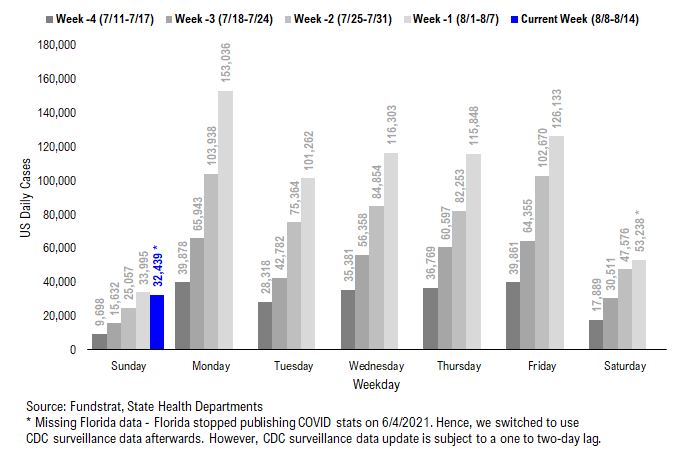

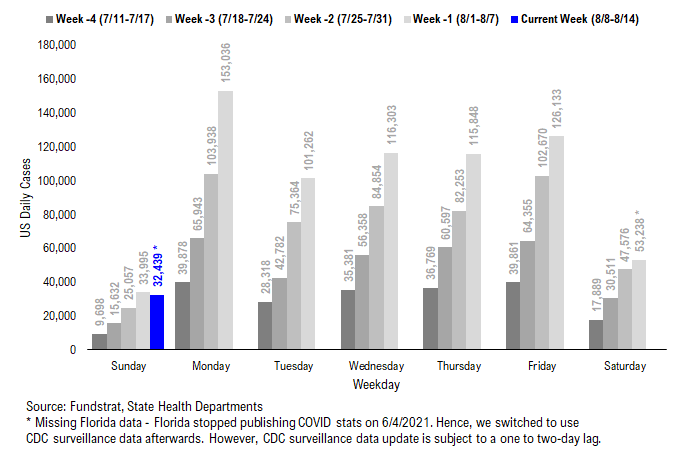

The latest COVID-19 data is shown below, along with cases for the same day for the prior 4 weeks.

– Sunday cases came in at 32,439

– this is lower than cases reported the prior Sunday

This is the first instance of lower cases seen for the past 4 weeks. There is glitchy data on Sunday, as many states do not report. So I would not say that cases are rolling over now.

– but it sure supports the forecast by IHME that cases could peak this week

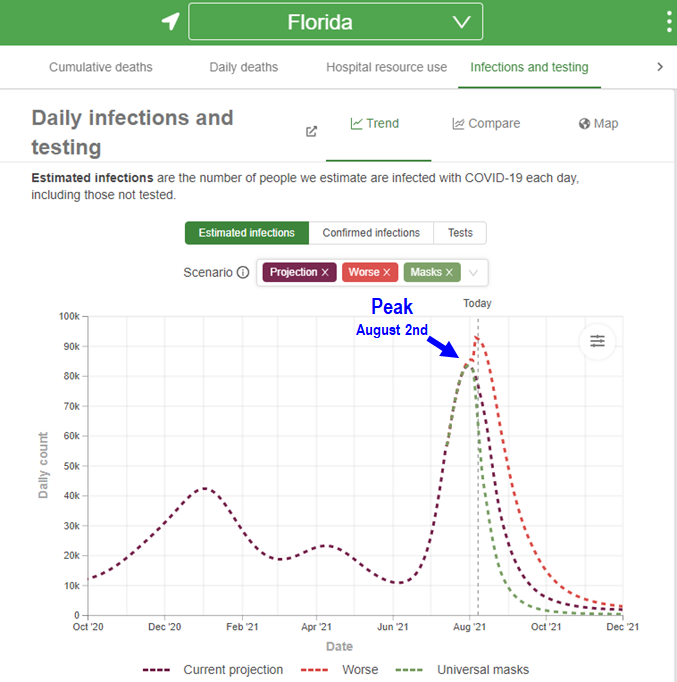

…IHME still views August 2nd as date of “peak infections” for Florida

Additionally, their model continues to view FL as past its peak in infections. In other words, the Delta variant surge in FL is largely over.

– granted, IHME forecasts are subject to change and are not foolproof

– however, as we stated in the past, the IHME has a great track record of forecasting the path of COVID across waves in the past 18 months

Source: https://covid19.healthdata.org/united-states-of-america/florida?view=infections-testing&tab=trend&test=infections

STRATEGY: If IHME forecasts no “Fall surge” = more reason to see everything rally into YE 2021

If we asked investors to list the two largest concerns in 2021, we think most would cite:

– falling US interest rates –> bond market knows something –> foreboding sign

– Delta surge and likely “Fall surge of COVID-19” as flu season kicks in –> more uncertainty

Thus, to the extent these two issues are mitigated/reversed, this would represent further fuel for risk-on.

…last week, we made a revision to our view, and now believe we are “full risk-on” into end of August, and probably thru Sept

Last week, we made an abrupt revision to our “July/August chop” view and believe the chop ended last week. While multiple factors are at work, the key conclusion is that we see several key inflections:

– USA COVID-19 cases likely peaking soon (per IHME) ala UK = risk-on

– fundamentals therefore are stronger than consensus expects = risk-on

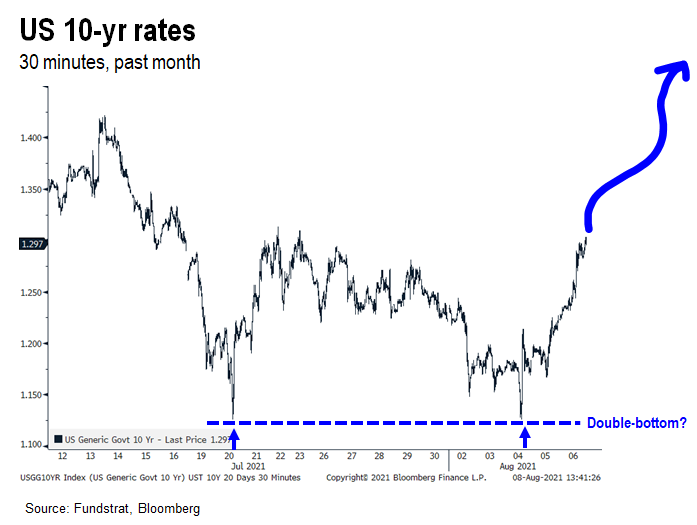

– US 10-yr rates appear to be reversing higher after a double-bottom = risk-on, epicenter

– Investors are positioned for risk-off, evidenced by anecdotal bearish sentiment = risk-on, epicenter

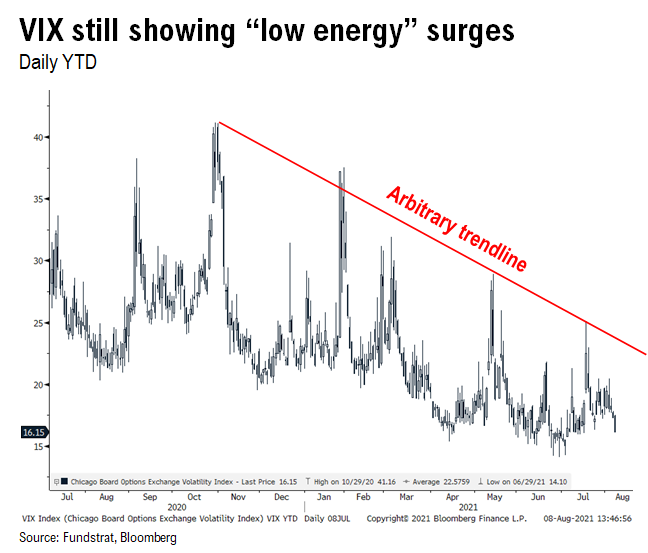

– VIX is continuing to fall = risk-on, epicenter

– Bitcoin has held easily above $40,000, despite renewed legislative risk in USA = risk-on, everything rallies

So, you can see the mounting reasons to be full risk-on.

…Key is US rates to grind higher + VIX to grind lower

But central to this case is the expectation that US interest rates trend higher. As we flagged last week, it does seem like the US 10-yr has reversed higher, after posting a double-bottom. A move above 1.4% would be seen as affirming this reversal is indeed underway

– watch 1.40%, that is the key level

And as we noted in multiple recent commentaries, the VIX remains in a downtrend with mere “low energy” surges

These low energy surges are simply countertrend increases, but the VIX surely seems on track to dip towards 13-14 in 2H2021

– a sub-15 VIX would be a strong risk-on signal

…Investor anger/frustration to Energy stocks/ OIH 1.32% = countertrend signal = Energy expected to lead in 2H2021

In this scenario of “everything rally” we believe Epicenter stocks will regain their leadership. The Cyclicals aka Epicenter have been selling off for 5 months now, as the surge in COVID-19 cases globally coupled with sinking interest rates undermined investor confidence about the global economic recovery.

But we expect Epicenter to see the strongest reaction to:

– retreat in USA COVID-19 cases –> Epicenter rallied after each COVID-19 wave peaked

– rise in US 10-yr –> Signals rotation away from Growth/Defensives

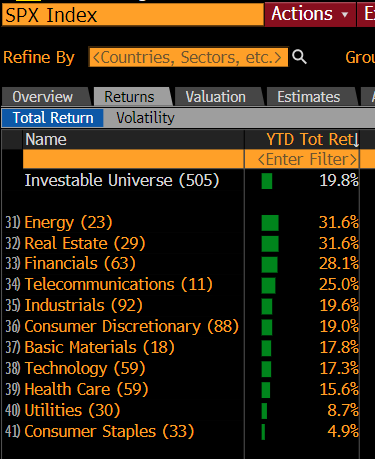

And among these groups, we believe the sector poised to post the strongest gains into YE is Energy/ Oilfield Services. We have written extensively about our OW on Energy. Energy YTD is the best performing sector +32% (tied with Real Estate).

– so even with the recent sell-off in Energy stocks, Energy remains the best performing sector.

…4 reasons we expect Energy to lead into YE

Below are 4 reasons we expect Energy to lead into YE. These are not in any particular order, but are shown to better reflect why we see upside in Energy, particularly Oilfield Services (OIH 1.32% ETF):

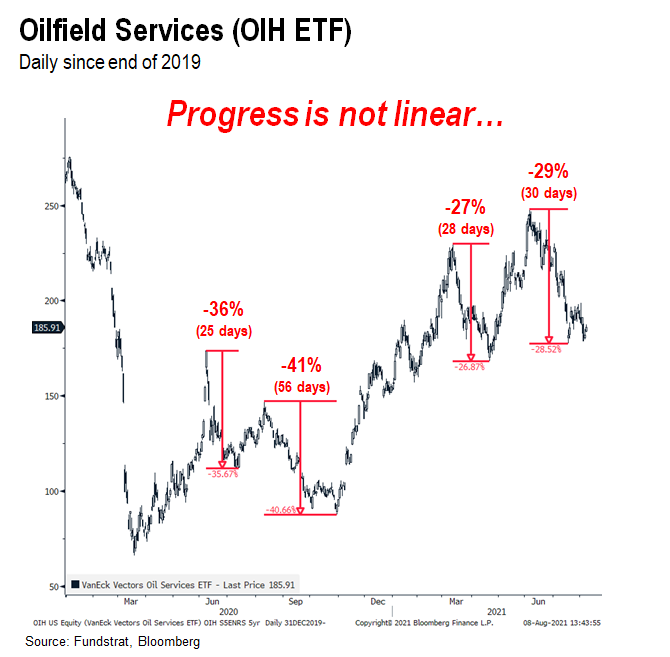

– Progress is not linear –> OIH 1.32% declined 29% over 30 days, the 4th time we have seen short-cycle sell-off since the March 2020 bottom

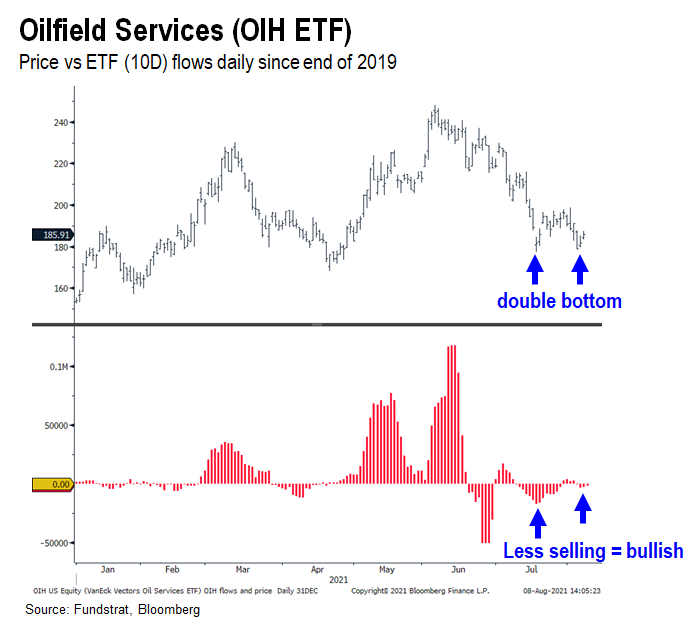

– OIH 1.32% ETF flows reversed at this most recent ‘double bottom’ = stronger signal = accumulation underway

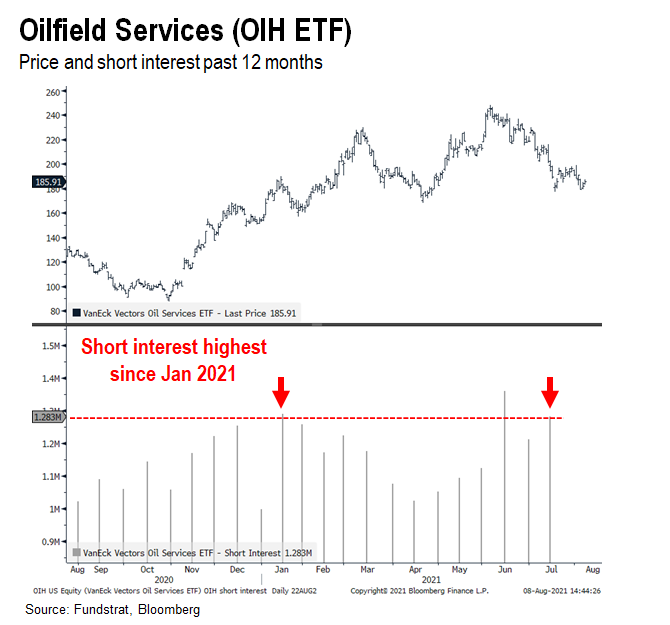

– OIH 1.32% short interest is the highest since Jan 2021 (essentially) = upside fuel

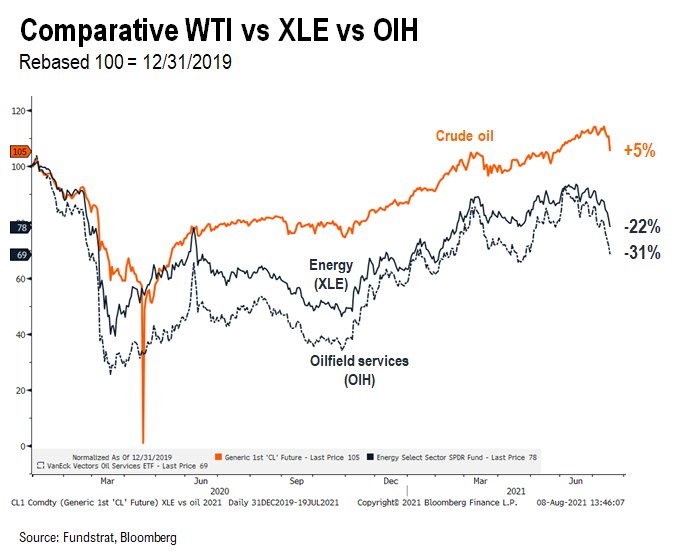

– OIH 1.32% still lagging recovery in oil –> since end of 2019, Oil +5%, OIH 1.32% -31%

Bottom line, there are multiple positive catalysts/drivers for OIH from here.

…4th sell-off of -30% for OIH 1.32% since March 2020

OIH 1.32% has risen +185% since March 2020 and up 21% YTD, both easily outperforming the S&P 500.

– however, OIH 1.32% rise from $66 to $186 has not been linear

– since March 2020, OIH has fallen -30% 4 times (see below)

– the median decline is 27 days

– this most recent sell-off is 30 days and down -29%

See a pattern? This is a reason we think the OIH sell-off is over.

…OIH 1.32% ETF flows are reversing at this second “retest” = bullish

OIH 1.32% ETF flows (10D avg) are on the verge of reversing into positive inflows. This is coming just as OIH 1.32% is retesting its July lows.

– this is a positive divergence

– OIH 1.32% double bottom

– ETF flows reversing into inflows

The message? Investors are beginning to accumulate OIH 1.32% again. Think of accumulation as akin to buying. This, in our view, supports the start of a rally.

…OIH 1.32% short interest is at January 2021 highs = upside fuel

Additionally, OIH 1.32% short interest stands at essentially a 1-year high (see below) surpassed only by the July high. High short interest is a potential source of buying power, once investors cover their short interest.

– with a positive catalyst, OIH 1.32% could see significant short covering

…OIH 1.32% still lagging WTI Oil by 2,600bp since December 2019

Lastly, OIH 1.32% has underperformed the recovery in oil. When oil is rising, OIH 1.32% should be outperforming given oilfield services’ sensitivity to rising activity.

– but as shown, since December 2019

– WTI is up +5%

– OIH 1.32% is down -31%

We see this gap closing into YE. Thus, Energy stocks (XLE 1.41% ETF) and Oilfield Services (OIH 1.32% ETF) are our top pick for sectors.

__________________________

Granny Shots:

We performed our quarterly rebalance on 07/30. Full stock list here –> Click here

___________________________

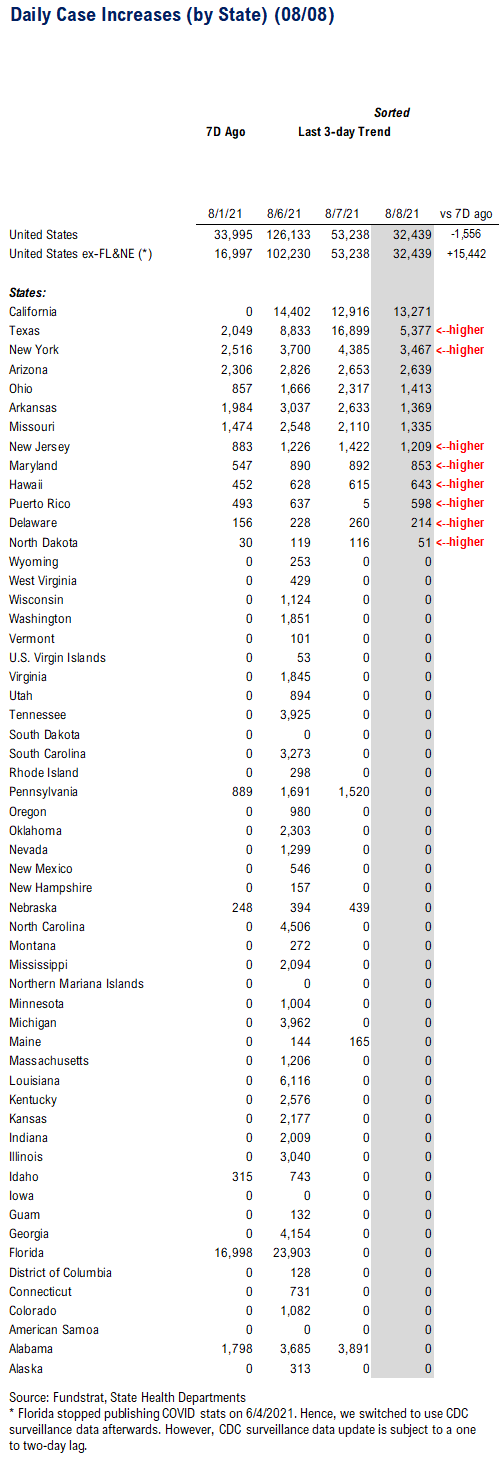

POINT 1: Daily COVID-19 cases 32,439, up +15,442 (ex-FL&NE) vs 7D ago…

_____________________________

Current Trends — COVID-19 cases:

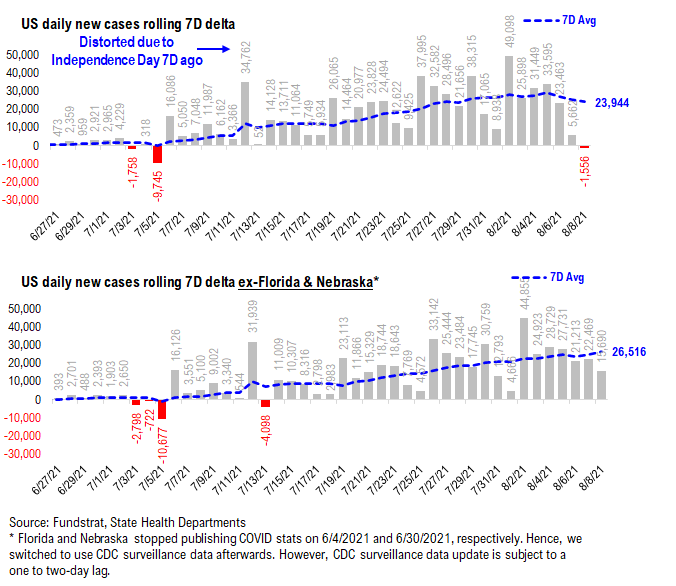

– Daily cases 32,439 vs 82,253 7D ago, down -1,556

– Daily cases ex-FL&NE 32,439 vs 64,922 7D ago, up +15,442

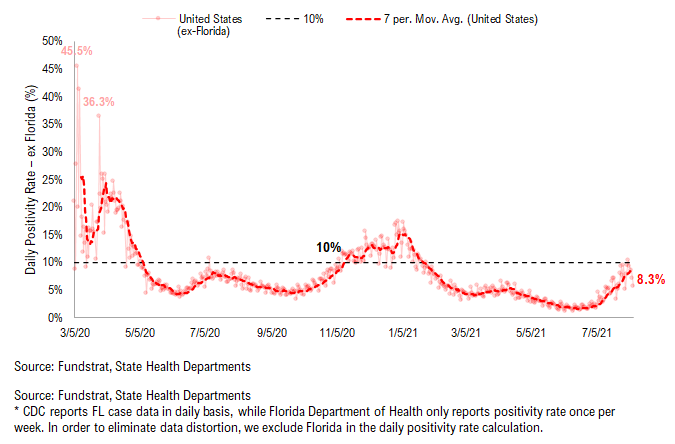

– 7D positivity rate 8.3% vs 7.5% 7D ago

– Hospitalized patients 62,567, up +34% vs 7D ago

– Daily deaths 496, up +39% vs 7D ago

_____________________________

*** Florida and Nebraska stopped publishing daily COVID stats updates on 6/4 and 6/30, respectively. We switched to use CDC surveillance data as the substitute. However, since CDC surveillance data is subject to a one-to-two day lag, we added a “US ex-FL&NE” in our daily cases and 7D delta sections in order to demonstrate a more comparable COVID development.

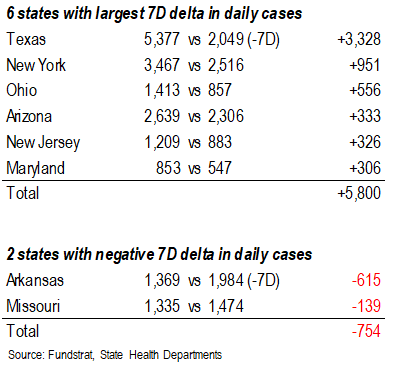

On Sunday, 12 states and Puerto Rico reported a total of 32,439 new cases. All 12 states and PR except AR and MO reported higher daily cases than 7D ago. The 7D delta in daily cases ex-FL&NE rose from 4,666 (7D ago) to 15,442. But this is primarily because California now reports COVID cases 7 days a week (used to report only on weekdays).

As less than 1/4 of US states report cases, Sunday’s data does not provide us with many insights on the COVID trend. However, the COVID development next week is important to watch. If US cases are truly going to roll over in 2 weeks, we should start to see some early signs next week such as 7D delta rollover.

7D delta in daily cases is still rising…

Previously, we noted that the 7D delta in daily cases appeared to be apexing. However, recent data suggests that the rise in 7D delta persists. Again, we are waiting for the 7D delta to apex because that is the first sign of case rollover. However, US cases will continue to rise but will do so at a slower speed until the day that 7D delta turns to negative.

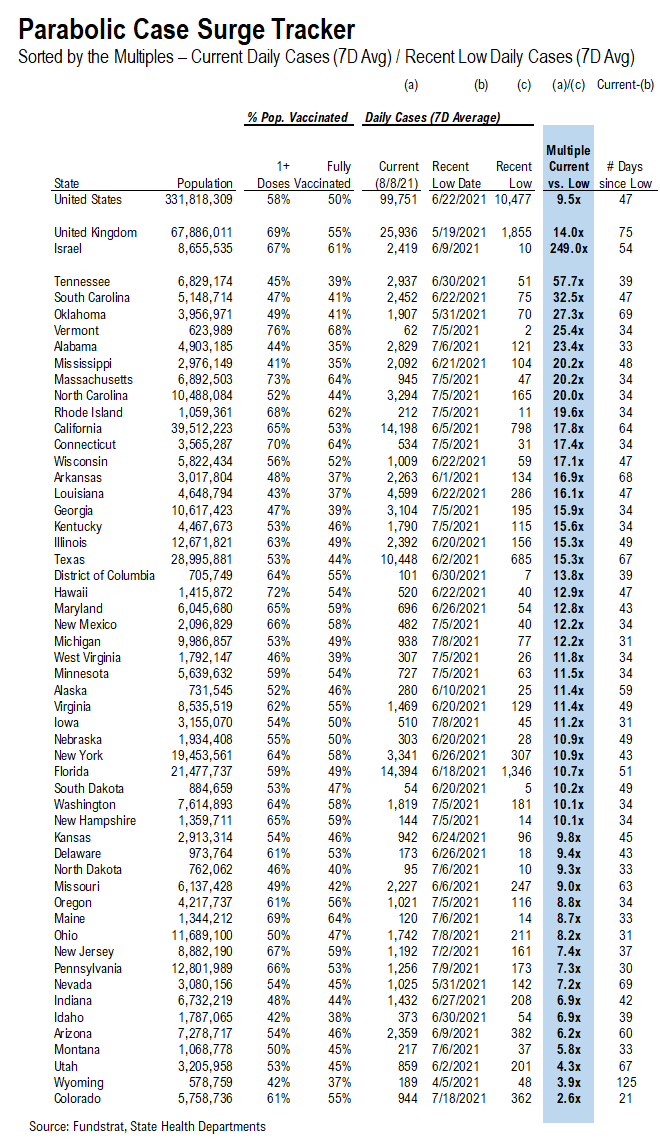

Low vaccinated states seem to have a larger increase in daily cases compared to their recent low…

Below, we added a new section called “Parabolic Case Surge Tracker” to monitor the possible parabolic surge in daily case figures. In the table, we included both the vaccine penetration and the recent case trend for 50 US states + DC. The table is sorted by the multiple of their current daily cases divided by their recent low in daily cases.

– The states with higher ranks are the states that have seen a more significant rise in daily cases

– We also calculated the number of days between now and the recent low date; a state with a high multiple but low number of days since its low means the state is facing a relatively rapid surge in daily cases

– The US as a whole, UK, and Israel are also shown at the top as a reference

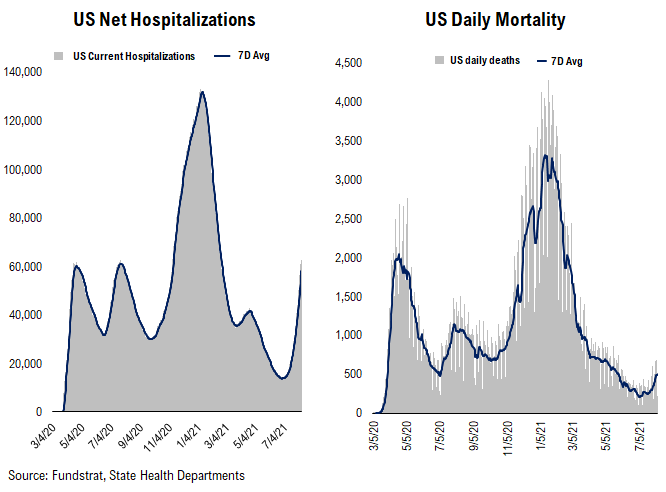

Hospitalization and positivity rate continue rising… Daily deaths is also trending upwards now…

Below we show the aggregate number of patients hospitalized due to COVID, daily mortality associated with COVID, and the daily positivity rate for COVID.

As you can see, hospitalization and positivity rate have exceeded the peak level we’ve seen in April’s “mini” wave. Daily deaths have been trending upwards recently, but far less “dramatic” than the cases or hospitalization trends.

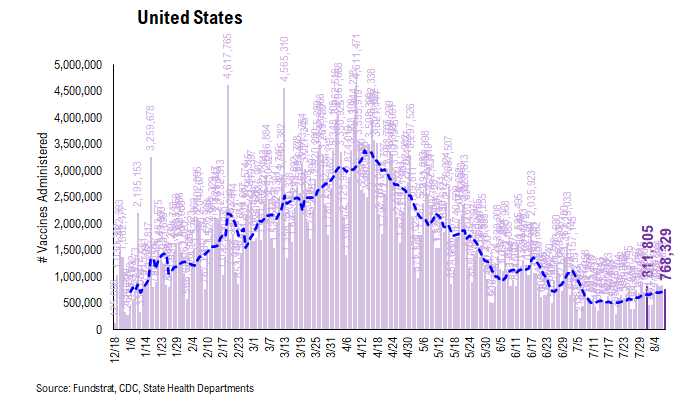

POINT 2: VACCINE: vaccination pace has been gradually rising over the past three weeks… Over half of Americans are fully vaccinated…

_____________________________

Current Trends — Vaccinations:

– avg 0.7 million this past week vs 0.7 million last week

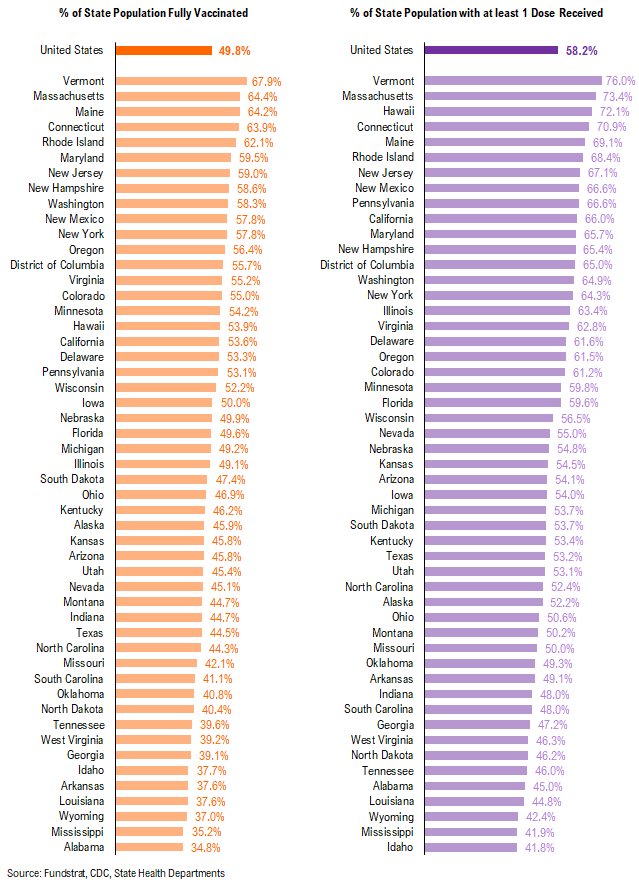

– overall, 49.8% fully vaccinated, 58.2% 1-dose+ received

_____________________________

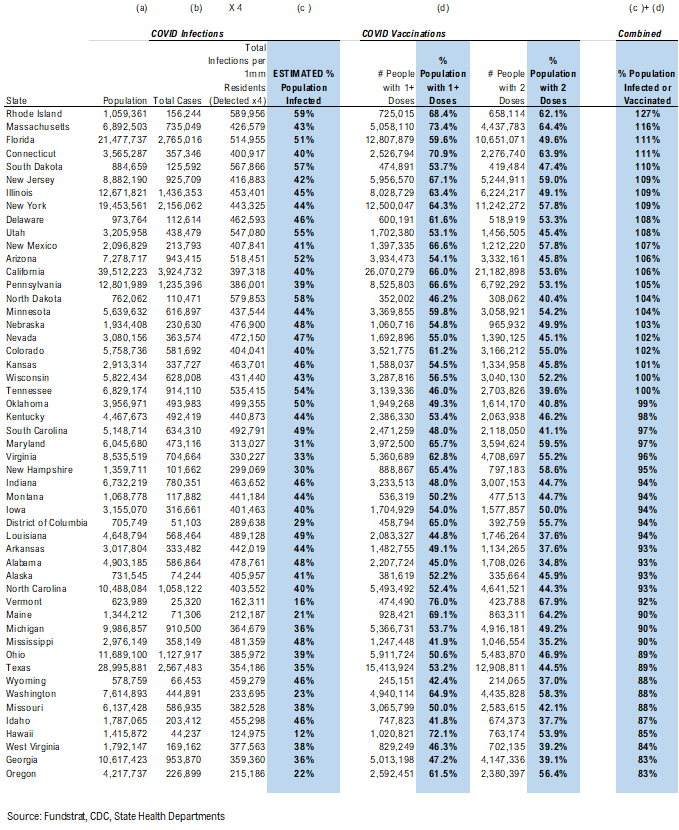

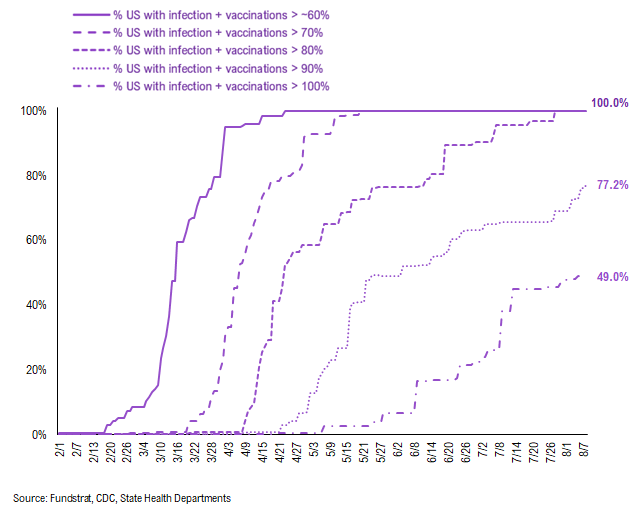

Vaccination frontier update –> all states now near or above 80% combined penetration (vaccines + infections)

Below we sorted the states by the combined penetration (vaccinations + infections). The assumption is that a state with higher combined penetration is likely to be closer to herd immunity, and therefore, less likely to see a parabolic surge in daily cases and deaths. Please note that this “combined penetration” metric can be over 100%, as infected people could also be vaccinated (actually recommended by CDC).

– Currently, all states are near or above 80% combined penetration

– RI, MA, SD, CT, NJ, IL, NY, DE, NM, UT, PA, ND, AZ, MN, CA, FL, NE are now above 100% combined penetration (vaccines + infections). Again, this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within each state is either infected or vaccinated.

Below is a diffusion chart that shows the % of US states (based on state population) that have reached the combined penetration >60%/70%/80%/90%/100%. As you can see, all states have reached 80% combined vaccination + infection. 71.9% of US states (based on state population) have seen combined infection & vaccination >90% and 48.1% of US states have seen combined infection & vaccination >100% (Reminder: this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within the state is either infected or vaccinated).

There were a total of 768,329 doses administered reported on Sunday. The vaccination pace apparently has improved over the past three weeks (although slowly). As we noted earlier this week, it seems that people are becoming more inclined to get vaccinated over growing Delta variant concerns. Especially, the states with lower vaccine penetration appear to have a greater improvement. This is a great sign.

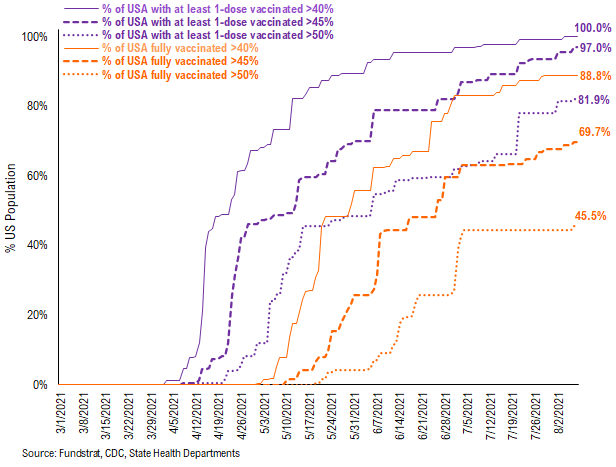

81.6% of the US has seen 1-dose penetration >50%…

To better illustrate the actual footprint of the US vaccination effort, we have a time series showing the percent of the US with at least 45%/45%/50% of its residents fully vaccinated, displayed as the orange line on the chart. Currently, 88.8% of US states have seen 40% of their residents fully vaccinated. However, when looking at the percentage of the US with at least 45% of its residents fully vaccinated, this figure is 68.8%. And only 44.5% of US (by state population) have seen 50% of its residents fully vaccinated.

– While all US states have seen vaccine penetration >40%, 95.5% of them have seen 1 dose penetration >45% and 81.6% of them have seen 1 dose penetration > 50%.

– 88.8% of the US has at least 40% of its residents fully vaccinated, However, only 68.8% of US has fully vaccinated >45% and 44.5% of US has fully vaccinated >50%.

This is the state by state data below, showing information for individuals with one dose and two doses.

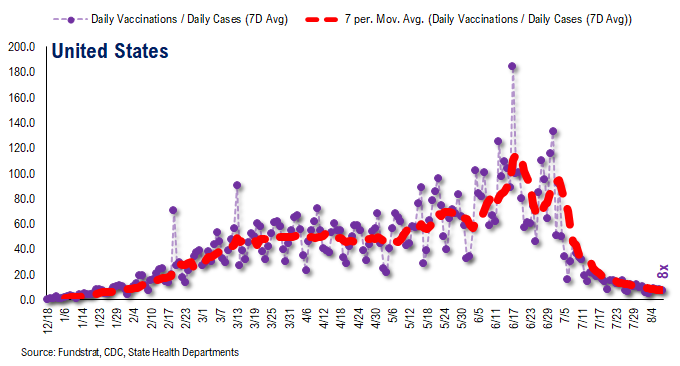

The ratio of vaccinations/ daily confirmed cases has been falling significantly (red line is 7D moving avg). Both the surge in daily cases and decrease in daily vaccines administered contributed to this.

– the 7D moving average is about ~10 for the past few days

– this means 10 vaccines dosed for every 1 confirmed case

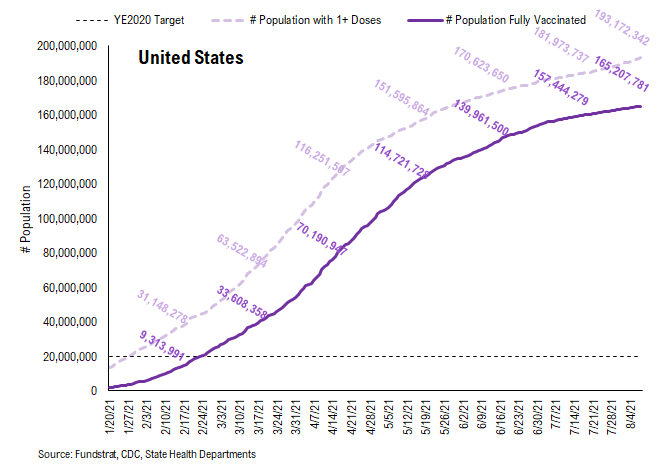

In total, 347 million vaccine doses have been administered across the country. Specifically, 193 million Americans (58% of US population) have received at least 1 dose of the vaccine. And 165 million Americans (50% of US population) are fully vaccinated.

POINT 3: Tracking the seasonality of COVID-19

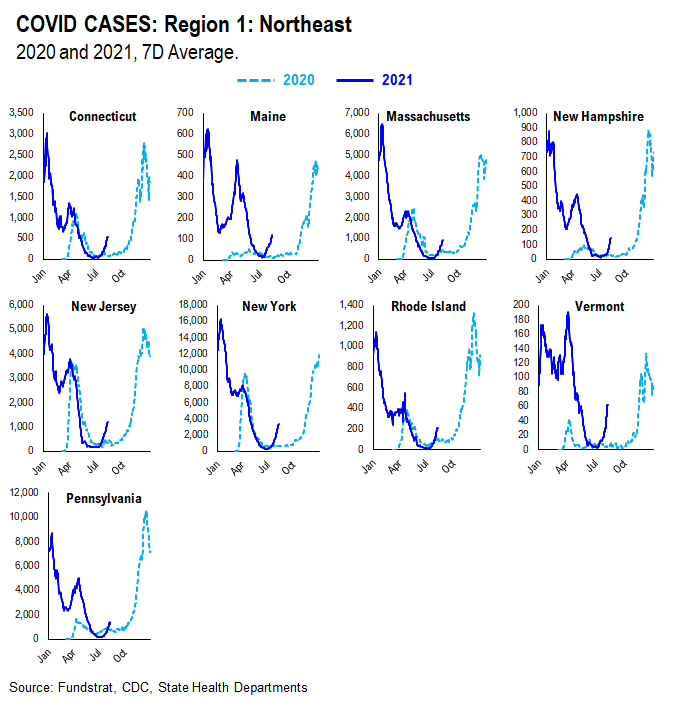

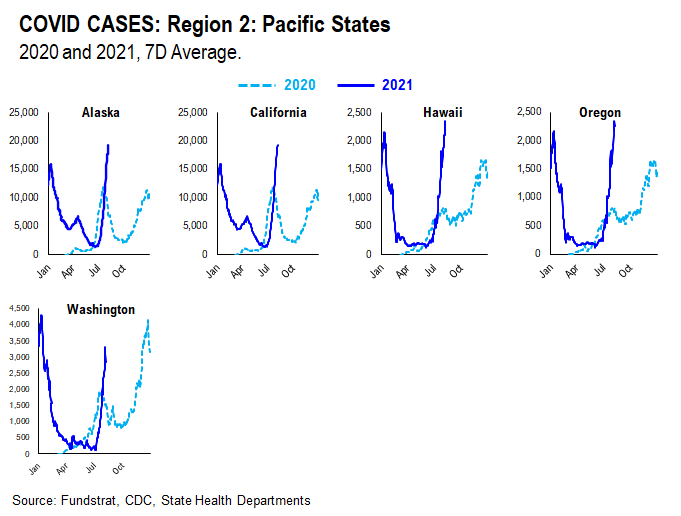

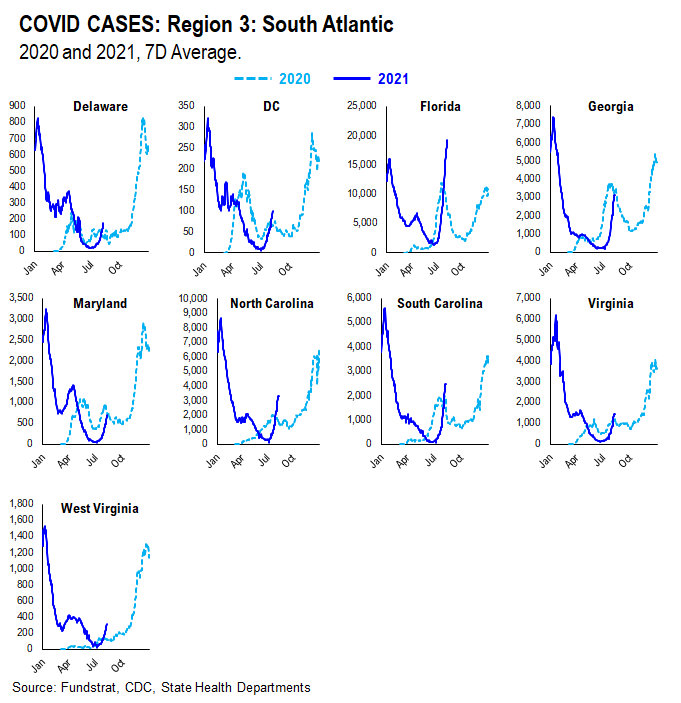

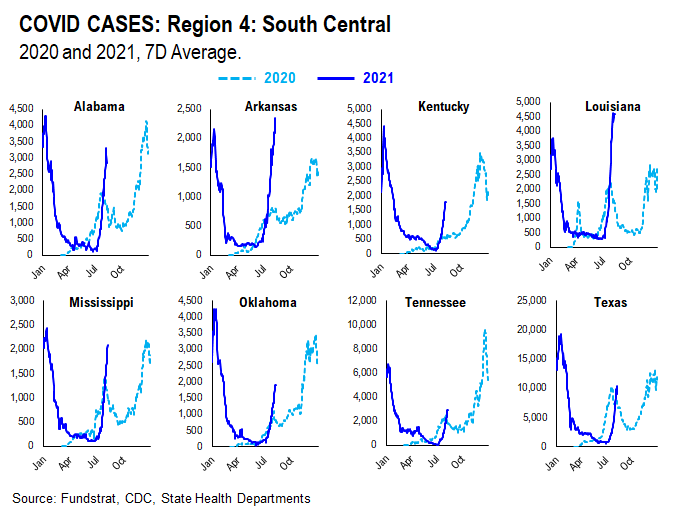

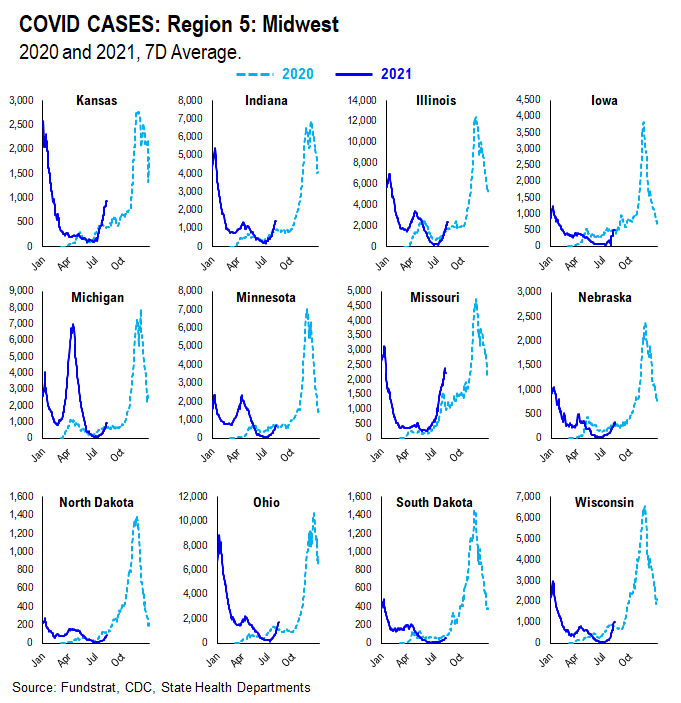

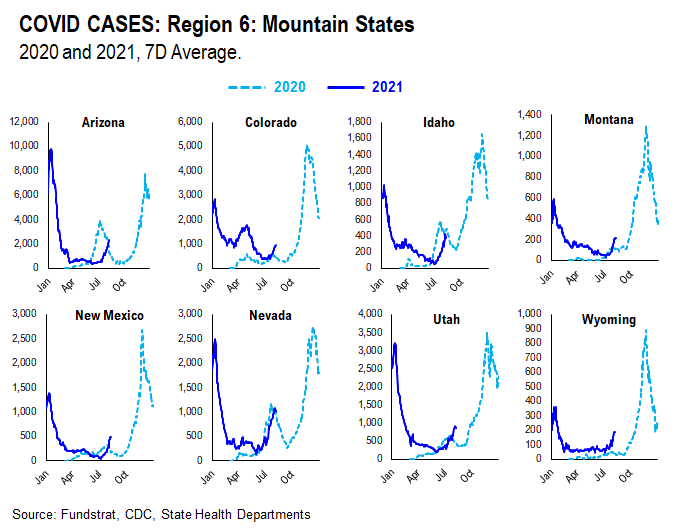

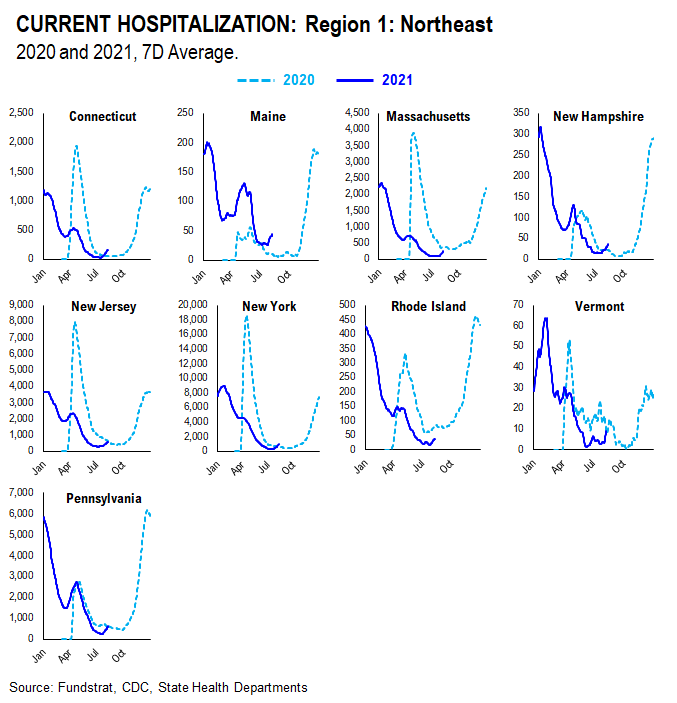

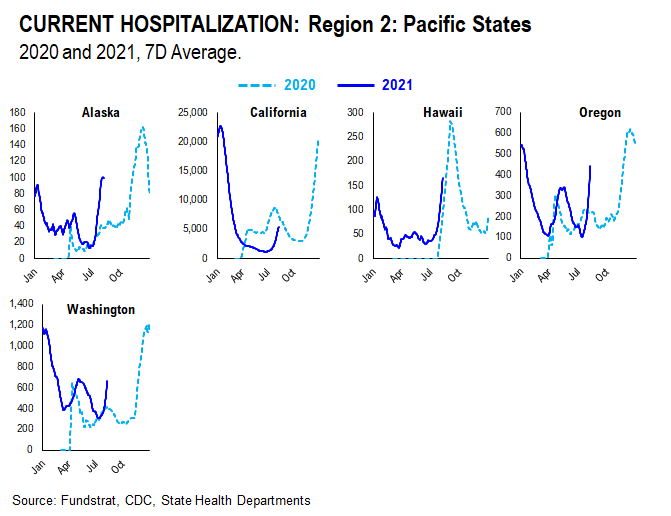

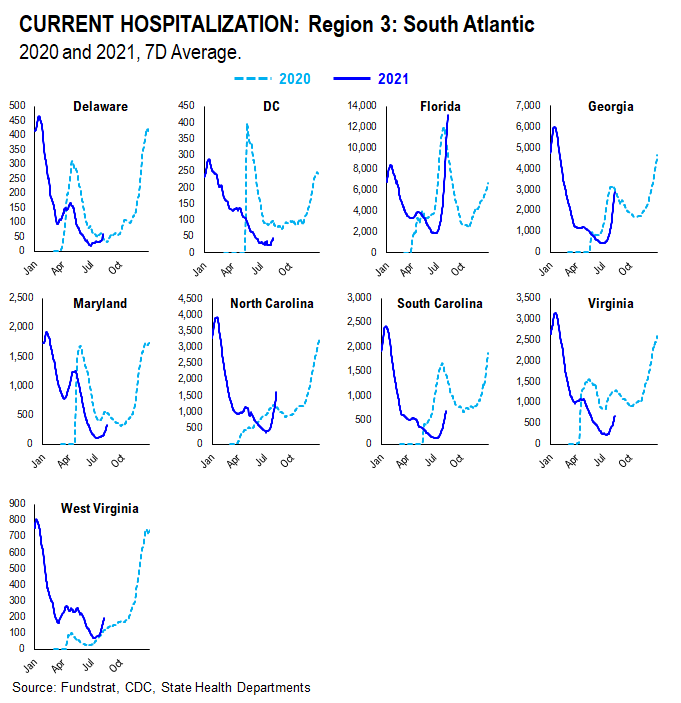

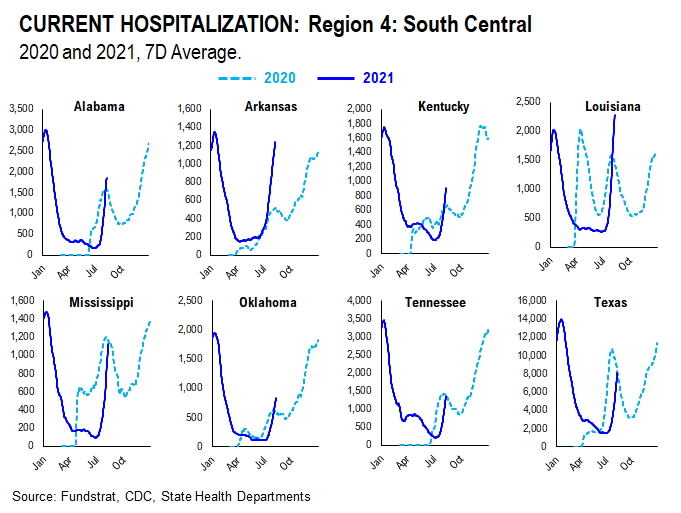

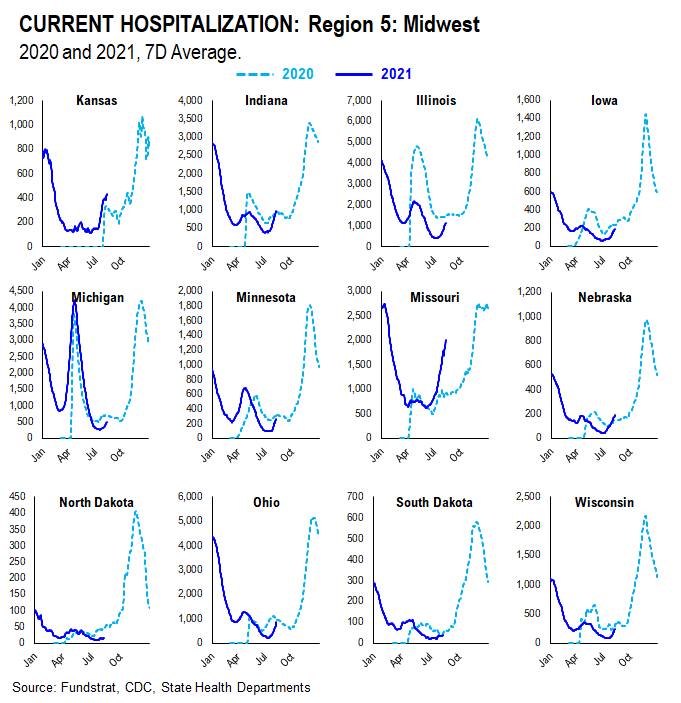

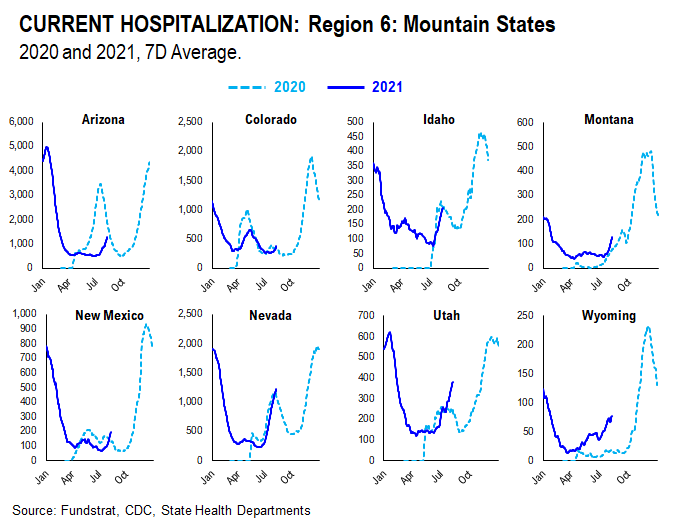

In July, we noted that many states experienced similar case surges in 2021 to the ones they experienced in 2020. As such, along with the introduction of the more transmissible Delta variant, seasonality also appears to play an important role in the recent surge in daily cases and hospitalization. Therefore, we think there might be a strong argument that COVID-19 is poised to become a seasonal virus.

The possible explanations for the seasonality we observed are:

– Outdoor Temperature: increasing indoor activities in the South vs increasing outdoor activities in the northeast during the Summer

– “Air Conditioning” Season: similar to “outdoor temperature”, more “AC” usage might facilitate the spread of the virus indoors

If this holds true, seasonal analysis suggests that the Delta spike could roll over by following a similar pattern to 2020.

We created this new section within our COVID update which tracks and compare the case and hospitalization trends in both 2020 and 2021 at the state level. We grouped states geographically as they tend to trend similarly.

CASES

It seems as if the main factor contributing to current case trends right now is outdoor temperature. During the Summer, outdoor activities are generally increased in the northern states as the weather becomes nicer. In southern states, on the other hand, it becomes too hot and indoor activities are increased. As such, northern state cases didn’t spike much during Summer 2020 while southern state cases did. Currently, northern state cases are showing a slight spike, especially when compared to Summer 2020. This could be attributed to the introduction of the more transmissible Delta variant and the lifting of restrictions combined with pent up demand for indoor activities.

HOSPITALIZATION

Current hospitalizations appear to be similar or less than Summer 2020 rates in most states. This is likely due to increased vaccination rates and the vaccine’s ability to reduce the severity of the virus.