A daily market update from FS Insight— what you need to know ahead of opening bell

“The beginning of everything is atoms and void, and everything else is perception.” – Democritus

Overnight

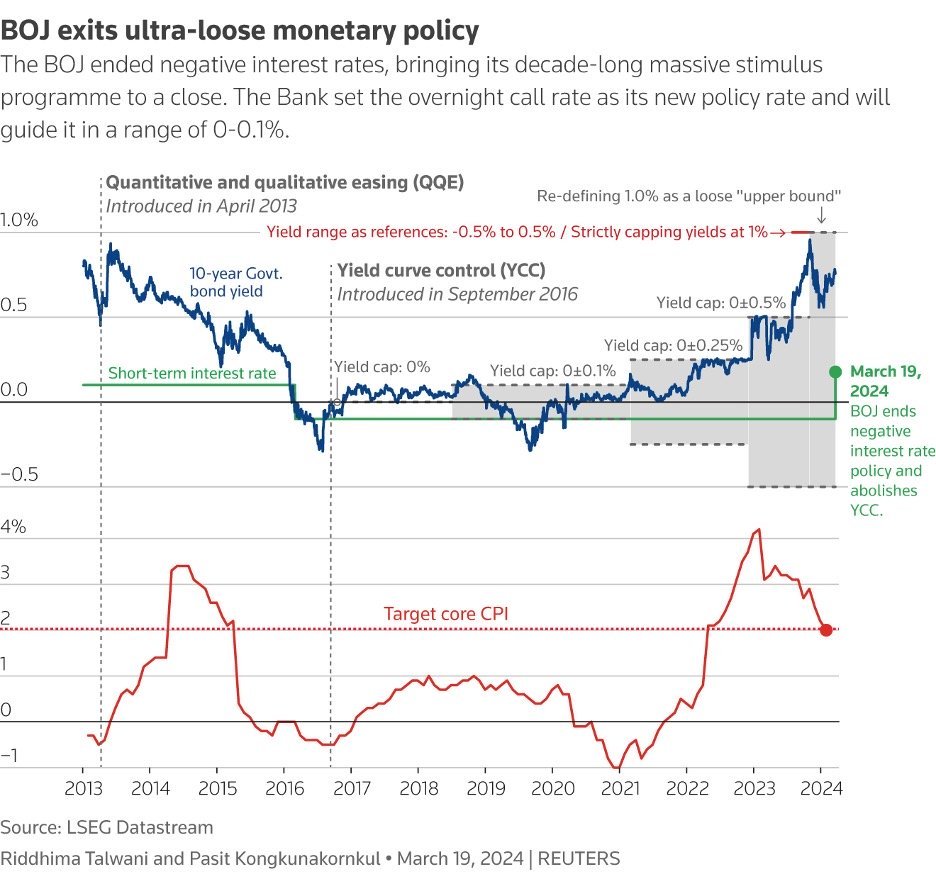

BOJ ends YCC and raises rates for first time in 17 years (CNBC)

Nvidia announces its most powerful AI chip as it seeks to become a platform company like Microsoft and Apple (CNBC)

Apple is in talks to let Google Gemini power iPhone AI features; some analysts skeptical (BBG)

Hong Kong passes local security bill cementing China’s control (BBG)

Exxon CEO says not trying to buy Hess, but eyes its Guyana stake (RT)

UAW wants vote to unionize Volkswagen plant in Tennessee (Axios)

Crafts retailer Joann goes bankrupt as consumers retreat (YF)

Corinthia eyes Barings’ assets after poaching 20+ employees (BBG)

Forty PMs from Citadel, Oaktree, others line up hedge fund launches for 2024 (RT)

PE firms stuck with old assets tap private credit for help (BBG)

Corporate bond rush is defying high-rate refinancing fears (BBG)

Bond vigilantes snooze as Treasury market shrugs off vast US borrowing (FT)

Treasury ETF hit by record losing streak, $2B of outflows (BBG)

Commodity traders are sitting on $120B in cash after years of record profits (FT)

Hedge funds buy largest bulk of bank stocks in a year (RT)

Hedge fund groups sue SEC over broker-dealer rule (FT)

Super Micro Computer joins the S&P 500 (RT)

Apple is in talks to let Google Gemini power iPhone AI features (BBG)

Musk defends his ketamine use as beneficial for investors (RT)

Berkshire Hathaway speeds up stock buybacks (RT)

Saudi Aramco CEO says energy transition is failing (CNBC)

European patent applications hit record high in 2023 (RT)

Evergrande accused of falsifying revenue by $78B (BBG)

Hedge fund industry groups sue US SEC over Treasury market dealer rule (RT)

Drones shut down 600,000 barrels of Russian refining (YF)

Evergrande accused of falsifying revenue by $78 billion (YF)

Damaged undersea cables disrupting Africa’s internet will take weeks to repair (Semafor)

Bakkt Holdings replaces CEO as NYSE threatens to delist crypto exchange (BBG)

Encyclopaedia Britannica seeking $1 billion valuation in IPO (BBG)

More Americans doubt they’ll get approved for auto, home loans (BBG)

First news

- The AI-themed dalliance between Apple and Microsoft may make superficial sense, but given Apple’s DNA, it does not

- Reversal of the massive 2022 SPR drawdown happening.

Charts of the Day

MARKET LEVELS

| Overnight |

| S&P Futures -8

point(s) (-0.1%

) overnight range: -12 to +4 point(s) |

| APAC |

| Nikkei +0.66%

Topix +1.06% China SHCOMP -0.72% Hang Seng -1.24% Korea -1.1% Singapore +0.05% Australia +0.36% India -1.03% Taiwan -0.11% |

| Europe |

| Stoxx 50 +0.1%

Stoxx 600 -0.07% FTSE 100 -0.05% DAX +0.15% CAC 40 +0.17% Italy +0.04% IBEX +0.22% |

| FX |

| Dollar Index (DXY) +0.38%

to 103.98 EUR/USD -0.32% to 1.0837 GBP/USD -0.45% to 1.2672 USD/JPY +0.99% to 150.62 USD/CNY +0.01% to 7.1993 USD/CNH +0.09% to 7.2126 USD/CHF +0.06% to 0.8883 USD/CAD +0.34% to 1.358 AUD/USD -0.85% to 0.6504 |

| Crypto |

| BTC -5.33%

to 63760.31 ETH -6.57% to 3277.35 XRP -3.05% to 0.589 Cardano -6.57% to 0.6119 Solana -9.43% to 177.31 Avalanche -6.51% to 56.73 Dogecoin -9.22% to 0.13 Chainlink -7.64% to 17.02 |

| Commodities and Others |

| VIX +1.74%

to 14.58 WTI Crude -0.3% to 82.47 Brent Crude -0.38% to 86.56 Nat Gas +1.82% to 1.73 RBOB Gas -0.77% to 2.736 Heating Oil -0.91% to 2.763 Gold -0.33% to 2153.28 Silver -0.54% to 24.9 Copper -0.63% to 4.088 |

| US Treasuries |

| 1M -3.7bps

to 5.356% 3M -8.9bps to 5.3004% 6M -0.2bps to 5.3317% 12M -4.1bps to 5.0377% 2Y -0.8bps to 4.7235% 5Y +0.0bps to 4.3417% 7Y flat at 4.3443% 10Y -0.2bps to 4.3223% 20Y +0.4bps to 4.5647% 30Y +0.1bps to 4.4493% |

| UST Term Structure |

| 2Y-3

M Spread narrowed 6.5bps to -73.4

bps 10Y-2 Y Spread widened 0.7bps to -40.3 bps 30Y-10 Y Spread widened 0.3bps to 12.5 bps |

| Yesterday's Recap |

| SPX +0.63%

SPX Eq Wt +0.27% NASDAQ 100 +0.99% NASDAQ Comp +0.82% Russell Midcap +0.16% R2k -0.72% R1k Value +0.22% R1k Growth +0.9% R2k Value -0.56% R2k Growth -0.87% FANG+ +1.69% Semis +0.2% Software +1.14% Biotech -1.86% Regional Banks -0.63% SPX GICS1 Sorted: Comm Srvcs +2.95% Cons Staples +0.82% SPX +0.63% Cons Disc +0.62% Tech +0.51% Fin +0.5% Utes +0.46% Energy +0.42% Materials +0.17% Indu +0.17% REITs -0.01% Healthcare -0.02% |

| USD HY OaS |

| All Sectors -1.8bp

to 350bp All Sectors ex-Energy -1.9bp to 337bp Cons Disc -1.1bp to 292bp Indu -3.6bp to 258bp Tech -1.1bp to 429bp Comm Srvcs -1.2bp to 551bp Materials -3.1bp to 319bp Energy -2.5bp to 286bp Fin Snr -2.0bp to 327bp Fin Sub -2.2bp to 247bp Cons Staples -0.7bp to 304bp Healthcare -2.4bp to 429bp Utes -1.3bp to 218bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 3/19 | 4PM | Jan Net TIC Flows | n/a | 139.845 |

| 3/20 | 2PM | Mar 20 FOMC Decision | 5.5 | 5.5 |

| 3/21 | 9:45AM | Mar P S&P Manu PMI | 51.8 | 52.2 |

| 3/21 | 9:45AM | Mar P S&P Srvcs PMI | 52.0 | 52.3 |

| 3/21 | 10AM | Feb Existing Home Sales | 3.94 | 4.0 |

| 3/21 | 10AM | Feb Existing Home Sales m/m | -1.5 | 3.09 |

| 3/25 | 10AM | Feb New Home Sales | 675.0 | 661.0 |

| 3/25 | 10AM | Feb New Home Sales m/m | 2.1 | 1.5 |

MORNING INSIGHT

Good morning!

The March FOMC is this week.

Multiple factors support a dovish Fed, even if market expectations are playing down the chances of a rate cut by the Fed – even if there are zero cuts.

Thus, we are ready to buy the dip on a Fed-driven selloff.

Click HERE for more.

TECHNICAL

We continue to see the US stock market as being attractive, technically speaking, and do not feel sufficient risk is there to warrant a selloff at this time. While price action has been a bit more subdued in recent weeks following momentum gauges having gotten overbought, there remains precious little other evidence with regards to frothy speculation to excessive valuation measures that would warrant a major selloff. Rallies up to SPX-5250-5300 look possible ahead of a possible late March pullback into April. Both Treasury yields and the U.S. Dollar could be prone to trend reversal following this week’s FOMC meeting.

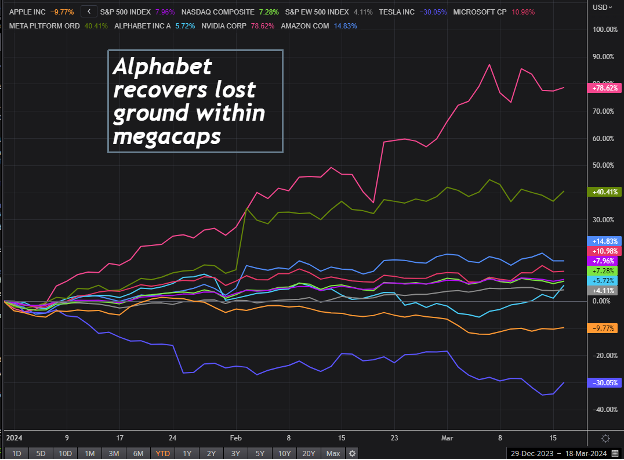

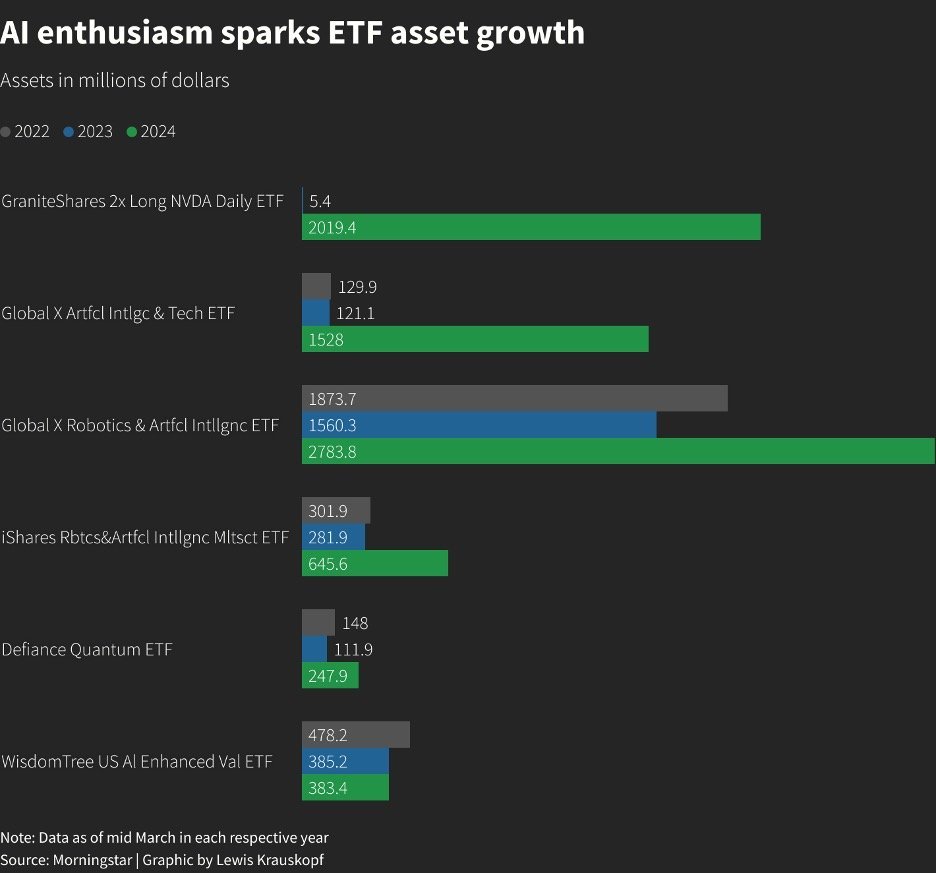

The focus has turned to Semiconductors heading into NVDA’s Artificial Intelligence (AI) event this week, which, coupled with FOMC and BOJ meetings and a possible government shutdown, makes this recent uptrend worth watching carefully for evidence of any turbulence.

Click HERE for more.

CRYPTO

Bitcoin ETFs witnessed inflows exceeding $2.5 billion throughout the entirety of last week. Net flows remained consistently positive over the week, though it’s important to highlight that Thursday and Friday experienced a notable decline in comparison to daily totals earlier in the week. This decrease coincided with the Coinbase premium transitioning into a discount, indicating that BTC was slightly pricier on Binance than on Coinbase. This shift suggests a diminished net-buying pressure from U.S. investors, possibly attributable to relatively reduced demand from ETFs as well. The Coinbase discount has continued into today, but has begun to show signs of a rebound in recent hours. While not the sole indicator for BTC price, the metric’s return to premium status would be a promising sign.

Despite the profit-taking observed in L2 tokens such as OP and ARB, the fee reductions across major L2 networks following the Dencun upgrade have been promising. This upgrade, focusing on scalability and considered one of the most crucial since the Merge, introduced data blobs to optimize transaction speed and cost on the mainnet. The median fee on Arbitrum has dropped from over $0.60 to $0.05, while Optimism’s median fee has decreased from nearly $0.50 to less than $0.01. Base has seen the most significant decline, with fees dropping from over $0.50 to as low as $0.002 per transaction. Much of the discrepancy is likely due to the varying amounts of data being posted to the mainnet, as costs increase with the amount of data being transferred to blobs on Ethereum, as opposed to just transaction counts. It’s also probable that as competition for blob space intensifies, fees will rise from their current levels, although they are likely to remain significantly lower than pre-Dencun upgrade levels. Nonetheless, this represents a positive step towards Ethereum’s endeavor to scale in a modular fashion.

Click HERE for more.

FIRST NEWS

Rumors of This Marriage Have Been Greatly Exaggerated. Despite rumors that Apple may license Google’s powerful Gemini AI models for on-device iPhone capabilities – and despite the fact that, predictably, Google’s parent Alphabet jumped on a media report that Apple was in talks to build Google’s Gemini AI engine into the iPhone – there are compelling reasons why such a partnership seems improbable.

Privacy hurdles

A core tenet of Apple’s AI strategy is prioritizing user privacy by running machine-learning models on-device rather than sending data to the cloud. The only Gemini variant that could potentially meet this requirement is the limited Gemini Nano model for basic text operations; yet Nano likely falls well short of delivering the generative AI leap Apple aims for on future iPhones.

Desire for homegrown

Apple has a long history of developing its own core technologies, from processors to operating systems. For fear of stating the obvious, AI represents one of the most transformative innovations of our era – and this provides egoic Apple strong motivation to create a proprietary generative AI solution rather than relying on another company’s – also a competitor’s – models. This protects differentiation and allows full control over the experience.

Competitive dynamics

Licensing Google’s AI at scale could power Gemini well past rivals like OpenAI and risk Apple’s AI efforts never recovering if all those iPhone users gravitate toward Google’s models en masse. Apple likely wants its own seat at the AI table rather than amplifying a competitor’s platform.

Infrastructure challenges as a red herring?

Some analysts note that, given the high cost of developing large language models, Apple may struggle to match Google’s global infrastructure for powering AI services at iPhone’s massive scale, making partnerships attractive from an economic perspective. And yet, for years, Apple spent $1 billion a year on a car project, cars not even being close to the company’s core product line. Given how integral AI has become to the use of computers and smart phones – which, after all, are Apple’s core product lines – infrastructural expense is unlikely to be an insurmountable ideological hurdle.

Revenue implications

It seems that Apple and Google could offset potential search revenue losses if iPhone defaults change. However, differentiation and controlling the AI experience seem higher priorities for Cupertino than simply replicating Android’s generative AI capabilities.

Apple has been exploring AI for decades and recently began accelerating its efforts through acquisitions and partnerships. While the scale and complexity say that it’s wise not to rule out unconventional routes, most signs point to Apple pushing to develop a distinct, privacy-centric generative AI platform that would deliver a competitive edge over what Google or others can offer on iPhone. Tech Radar

Takes a Low to Seek a High. Following a major 180 million barrel drawdown in 2022, the U.S. will replenish its Strategic Petroleum Reserve (SPR) to prior levels, said Energy Secretary Jennifer Granholm on Monday. Granholm’s comments at the CERAWeek energy conference in Houston provided clarity on the administration’s plans to restock the emergency oil supply following last year’s unprecedented sale. The drawdown, the largest ever from the SPR, aimed to help lower gasoline prices after Russia’s invasion of Ukraine roiled global energy markets.

While the Department of Energy expects to purchase around 40 million barrels by year-end to begin replacing the 180 million barrel sale, another 140 million barrels will effectively be “restocked” due to the cancellation of previously mandated sales from 2024-2027. The agency declined to provide a target year-end inventory level for the reserve, which currently holds roughly 362 million barrels compared to 565 million before the drawdown announcement in March 2022.

Granholm indicated the administration is open to canceling additional congressionally-mandated SPR sales to make the replenishment process smoother, which she termed “a congressional priority.” Upcoming maintenance at an SPR site will also allow for increased purchase volumes. On LNG exports, the secretary sought to assuage concerns about the administration’s permitting pause, stating it would be “long behind us by this time next year” and should not impact major global investment decisions as it is “simply a temporary pause” for study purposes.

Finally, Granholm defended the $60/barrel price cap on Russian oil imposed by U.S. allies in December, calling it effective while leaving room for potential adjustments “as circumstances change.” Yahoo Finance

Book Nook. A war correspondent’s final assignment amounts to staring death in the face, daily. For three decades, Rod Nordland lived on the front lines as one of his generation’s most intrepid war correspondents. Reporting on conflicts from over 150 countries, he witnessed more than his share of tragedy, but when personal tragedy struck during a morning jog, the man who had shadowed death across the globe now came face-to-face with his own mortality. In this ultimate battle, confined to a hospital bed, Nordland reconciled with his estranged children and mended a 20-year rift with his best friend. The arrogance that once drove him gave way to an all-pervading humility and generosity. His tragedy became “a gift that has enriched my life.”

In Waiting for the Monsoon, Nordland chronicles his transformative experience, showing us how confronting the vast unknown can shift our perspective toward a kind of wisdom. His book is a raw, real testament to human resilience and the possibility of renewal despite long odds, even when we find ourselves face-to-face with oblivion.