Final Thoughts on Ripple Decision

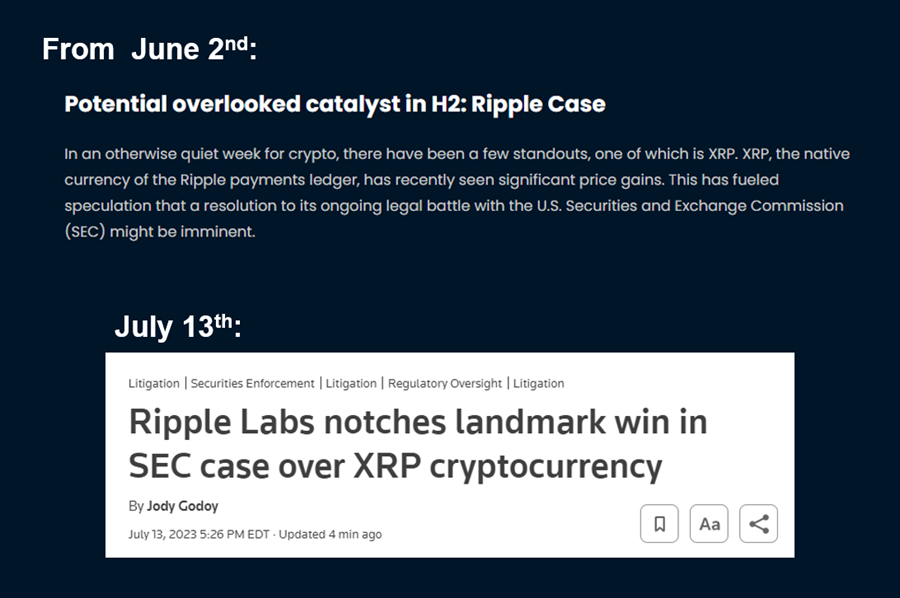

In June, we identified the Ripple case as a possible catalyst for altcoins, as indications of progress for the defendants surfaced. Just last week, Ripple achieved a partial victory, likely benefiting altcoins targeted by the SEC and potentially prompting a shift towards a more legislative approach rather than an enforcement-focused one.

The court ruled that Ripple Labs’ transactions of XRP to institutional investors constituted securities transactions. However, programmatic sales on exchanges, distributions to employees, and other secondary sales from Ripple Labs executives were not considered securities transactions. The classification depended on transaction nature and participants’ awareness.

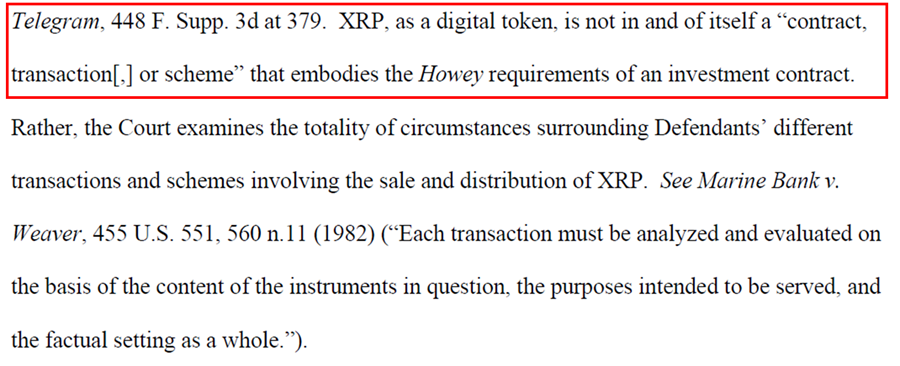

Importantly, the decision clarifies that tokens with characteristics mirroring XRP are not automatically classified as securities. Instead, it emphasizes the need to consider the specific circumstances surrounding the sale and distribution of the token in question.

To put a finer point on our takeaways from the ruling, we have compiled the list of key points to consider below. As an obvious disclaimer, we are not lawyers, and we are simply evaluating the court’s ruling from the perspective of a market participant.

- The court does not categorically classify tokens as securities on a standalone basis. The security status depends on the nature of the transaction and parties involved. This, in our view, is an important distinction.

- The defendant was Ripple Labs, and the court was primarily concerned with Ripple’s potential liabilities and infractions. Thus, before people rush to claim that the courts were unconcerned with retail investors, this ruling does not preclude the SEC fromtargeting exchanges for selling investment contracts to retail customers, but it will depend on the facts and circumstances surrounding whether they promoted an investment of money in a common enterprise with the expectation of profits based on the efforts of others.

- Transactions from Ripple (the token issuer) to institutional investors are considered securities transactions. This aligns with existing regulations (Regulation D), and the court does not introduce any groundbreaking interpretations here. It is likely that Ripple Labs will be hit with a hefty fine for this.

- Programmatic sales on exchanges were not deemed investment contracts. Buyers could not determine if they were investing in Ripple Labs or merely transferring funds to another XRP holder. This is due to the anonymous nature of these transactions where the buyer’s and seller’s identities are not known to each other.

- The distributions of XRP to employees were not securities transactions because they did not represent an investment of capital with an expectation of profit. This is important for firms that wish to pay employees in crypto.

- The court also suggested that secondary sales from Ripple Labs executives on centralized exchanges were not securities transactions, for reasons similar to point 4 above.

- The ruling provides clarification that tokens are not automatically classified as securities. The security status depends on the nature and circumstances of the transaction.

Below we include a table that summarizes the different transaction types that were evaluated and whether each was deemed an investment contract.

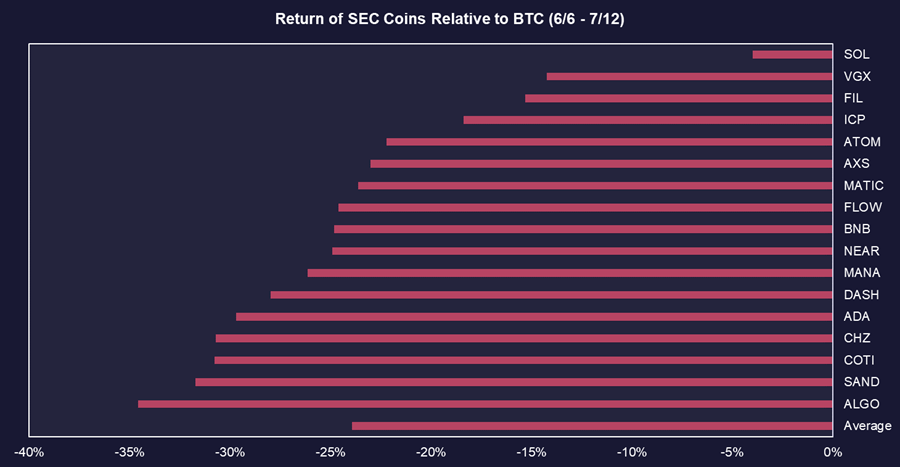

Repricing of Regulatory Risk = Mini Alt Season

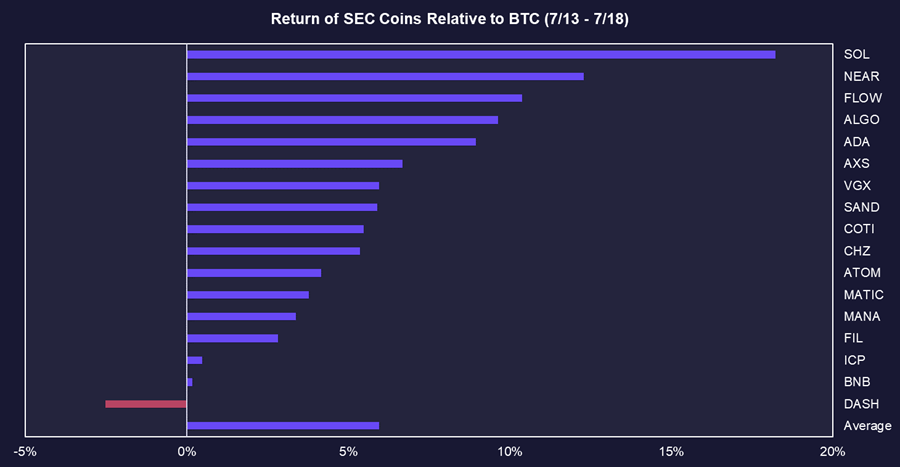

As observed with bitcoin and bitcoin-related equities after the Blackrock ETF application, the Ripple victory triggered a notable reassessment of regulatory risk. Below is the performance of all the coins listed in the Coinbase and Binance complaints from early June through July 12th, the day prior to the Ripple victory. The underperformance relative to bitcoin is clear.

From the market open on 7/13 through 7/18, we witnessed significant relative outperformance from the majority of these same assets. The average outperformance against bitcoin during this period exceeded 6%.

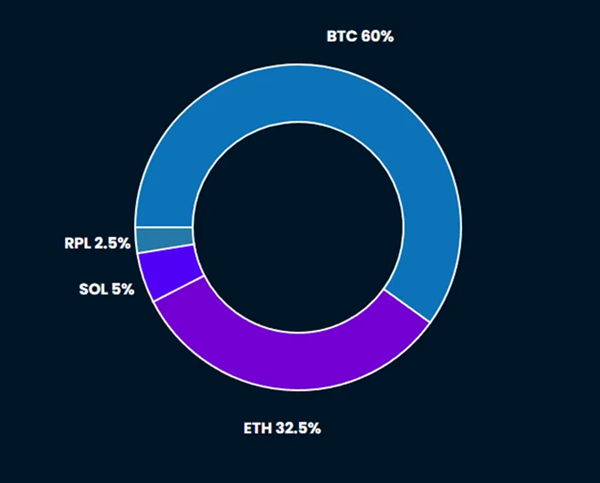

In our Core Strategy, we maintained exposure to Solana as a call option on regulatory victories like this. We believe it is reasonable to anticipate continued relative strength from these assets during market rallies.

We have observed a significant trend reversal in bitcoin dominance, with it dropping from a multi-year high of 52% to nearly 49%. In our view, this shift can be attributed to the SEC coins rallying and an intriguing dynamic where the majors have completely stalled out, despite the rallies in both altcoins and crypto equities.

Below, we explore potential explanations for this market behavior.

Reasons that BTC and ETH are Stalling Out

There are three reasons why we think we are seeing weakness in BTC and ETH:

- Altcoins and equities siphoning liquidity that would have otherwise gone to BTC or ETH.

- The US Government has been unloading a portion of its bitcoin holdings over the past week, creating excess sell pressure, and importantly, creating a fear of buying into weakness.

- Pronounced selling from miners that are coming off a financially impressive quarter.

Diverting Liquidity

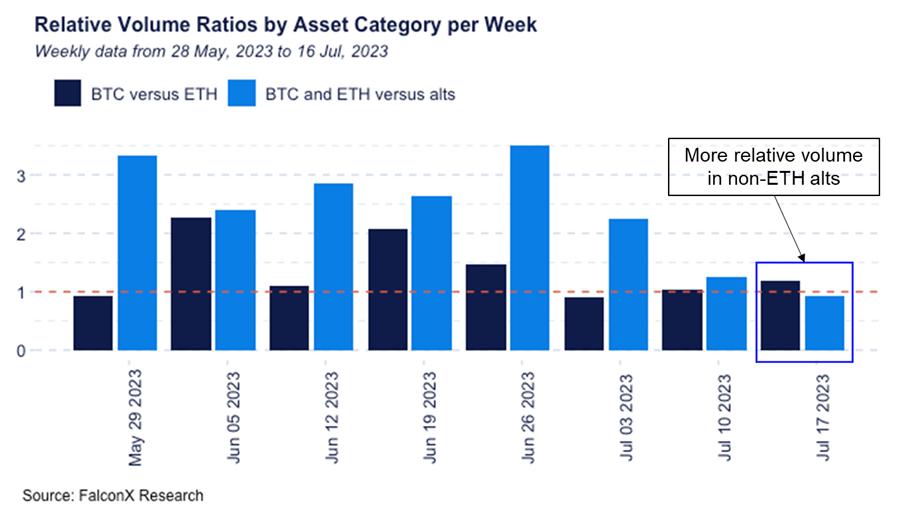

The first reason for BTC and ETH weakness is relatively self-explanatory. As demonstrated by the chart below, compiled by David Lawant at FalconX, we can see that the week through 7/17 witnessed greater volume in altcoins as compared to BTC and ETH combined.

This was undoubtedly catalyzed by the Ripple ruling and is certainly a change of pace from a market that has been dominated by bitcoin for the better part of this year.

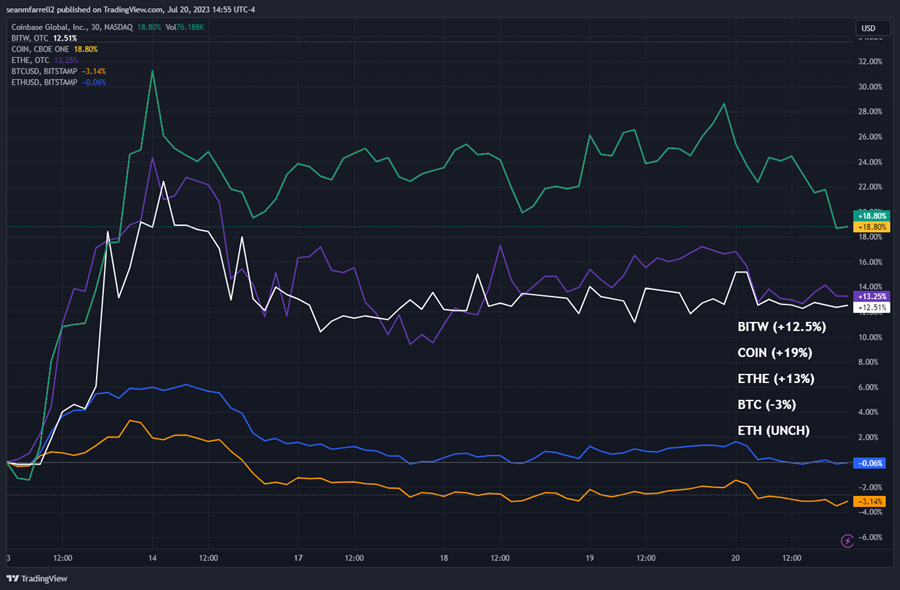

Further, the implied reduction in regulatory risk from the Ripple case was a positive tailwind for most crypto related equities, but particularly for Coinbase (COIN 17.12% ) and trust products that contained altcoins (ETHE 7.36% , BITW 5.55% ). These names benefit from a world in which there is a regulatory regime that allows for altcoins to exist in the US without overly burdensome registration and reporting requirements. Any SEC win or loss is also a proxy win or loss in the battle between the SEC and Coinbase.

Thus, we saw all these names spike following the ruling. Presumably a lot of the buyers of these names were those who otherwise would have bought BTC or ETH in the spot market. Further, unlike an ETF, buying shares in trust products on the secondary market does not create any spot market demand for the underlying asset.

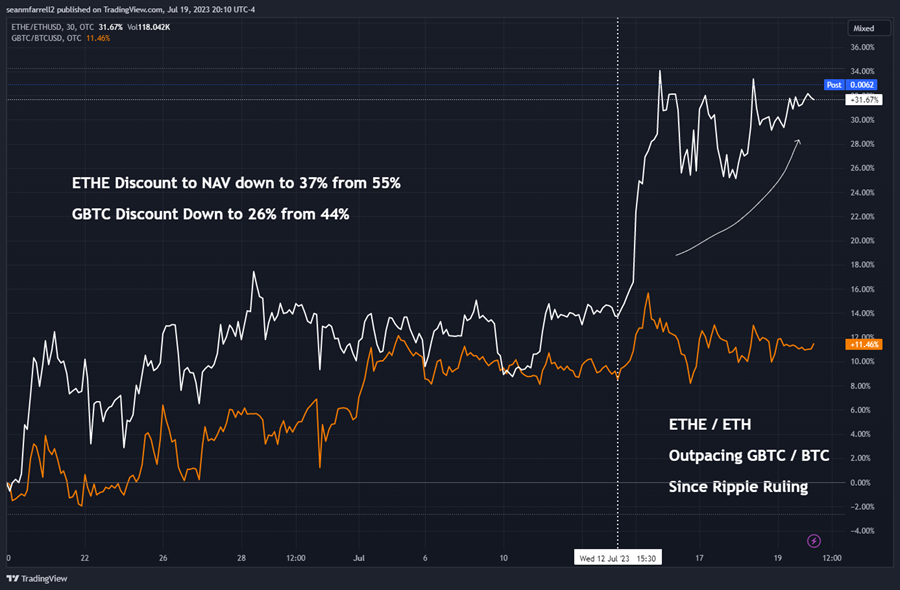

The rally of ETHE 7.36% in comparison to GBTC 5.61% is particularly interesting. Although there are no current Ethereum ETF applications, there is a growing belief that the recent ruling on Ripple, declaring XRP as a non-security, implies that ETH would also be considered a non-security by the courts. This development paves the way for a potential Ethereum ETF in the future, provided there is enough demand. The discount of ETHE to its net asset value (NAV) has decreased from approximately 55% to 37% in the past week.

Considering the Ripple ruling and the potential for ETF-related momentum, we maintain a positive outlook on GBTC and suggest considering ETHE as well, as its performance is likely to be correlated with GBTC going forward. We also believe that BITW 5.55% is likely to benefit similarly to ETHE. However, it is important to note that BITW holds assets beyond ETH, which introduces additional risk compared to ETHE.

US Government Sell Pressure

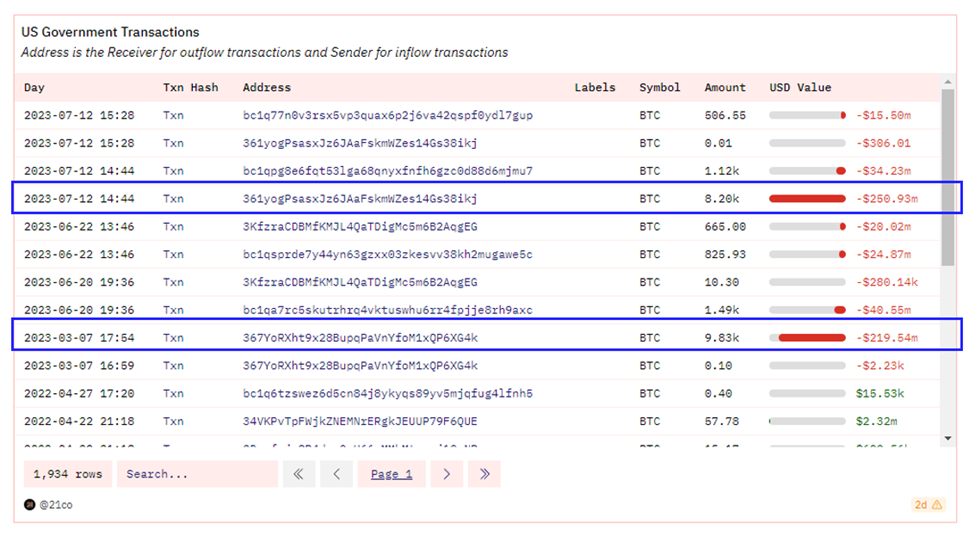

Late last week, two U.S. government wallets associated with the Silk Road seizure transferred 9,825 BTC, equivalent to over $300 million, to a different address. This movement of coins, which were planned to be sold by the government this year, resulted in a drop in BTC price and contributed to the recent weakness in the spot market.

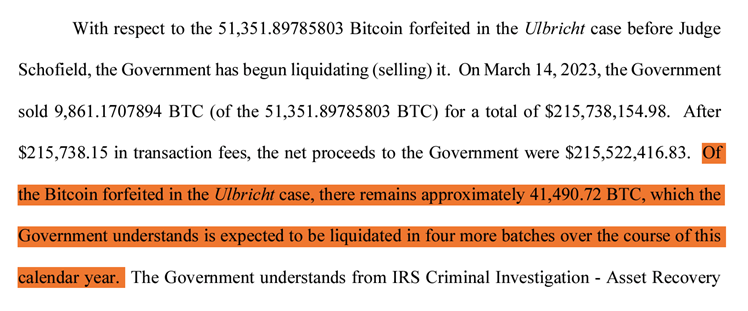

This is not the first occurrence of the government selling coins this year. In March, the same wallet transferred a similar amount of BTC, leading to a price decline.

According to the legal documents related to the seized BTC, the Federal government acquired a total of 41,490 BTC from the defendants. These coins are expected to be sold in at least four increments throughout the year, meaning there are at least two more bulk sales scheduled over the next five months.

Many are wondering why the government’s sale of coins in March did not have a lasting impact on the spot market. The reason is quite simple. The initial bitcoin sale on March 7th was quickly followed by the collapse of SVB, which created narrative-based tailwinds and increased the demand for bitcoin. This surge in demand resulted in a spike in trading volume. In essence, the government’s BTC was absorbed more smoothly in March due to favorable market conditions at that time.

Miners Unloading Their Stack

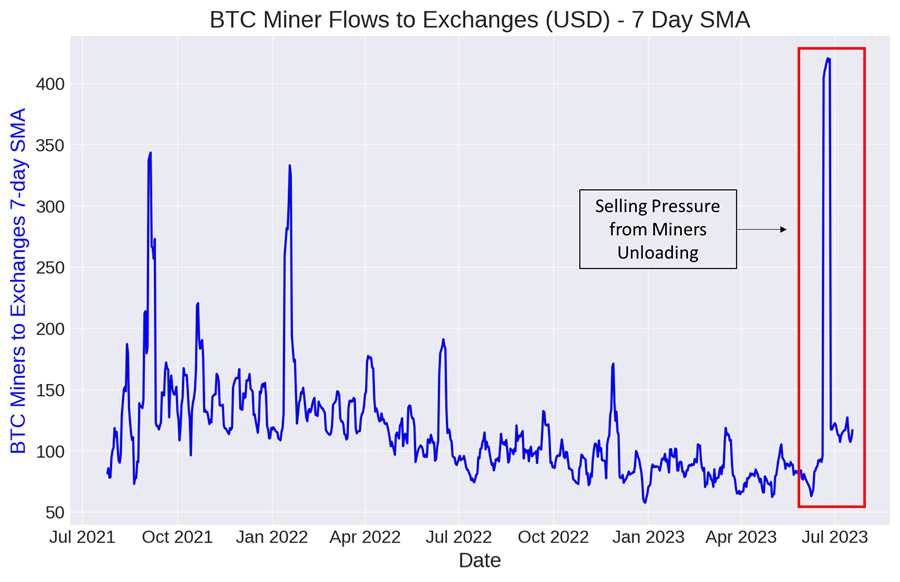

In addition to (1) liquidity being diverted from the majors to alts and equities, and (2) incremental selling pressure from the government, we also can assume that some incremental supply from miners entered the market over the past couple of weeks. Below, we can see a huge spike in transfer volume from bitcoin miner wallets to exchanges. It is likely that much of this stack was sold into the sideways market, contributing to the seemingly abnormal weakness.

A Solid Quarter for Miners

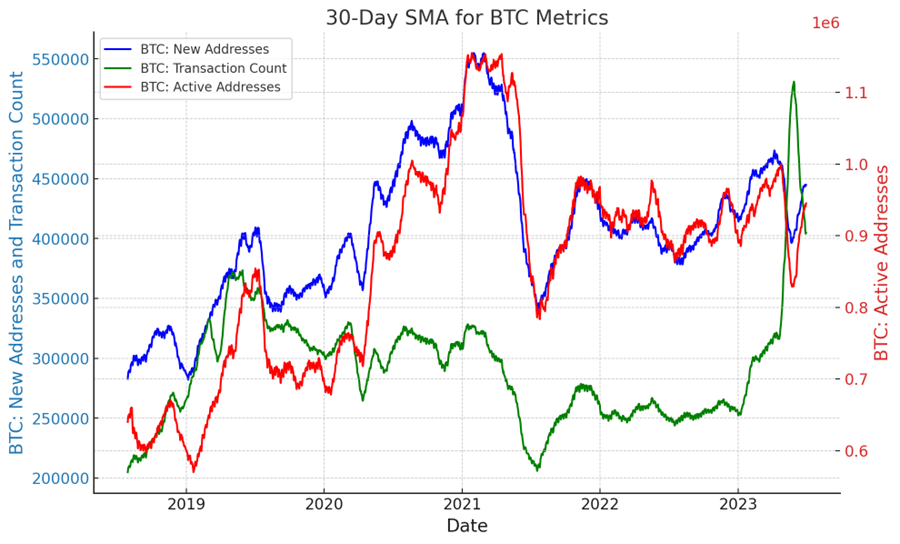

Despite the churning BTC spot market, bitcoin miners are in the best position that they have been in since the latter innings of the last bull market. Many will recall that on-chain activity on the bitcoin network has spiked over the last several months due to the emergence of Ordinals, a protocol bringing NFTs to bitcoin. This has increased the demand for blockspace and has thus led to an abnormally high percentage of miner revenue attributed to transaction fees.

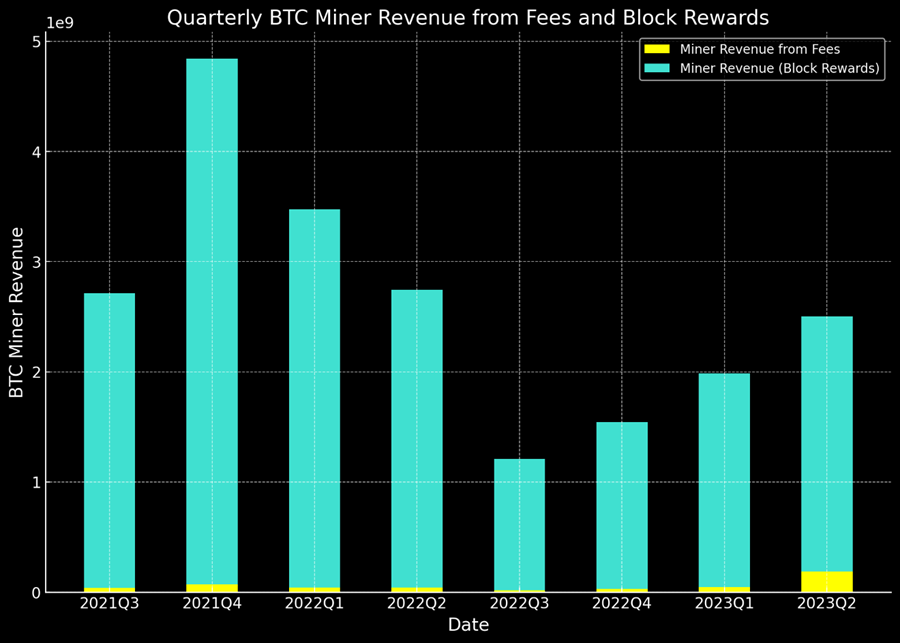

Below we can see that quarterly miner revenue was substantially higher than the preceding three quarters, and there was a clear boost to revenue attributed to fees.

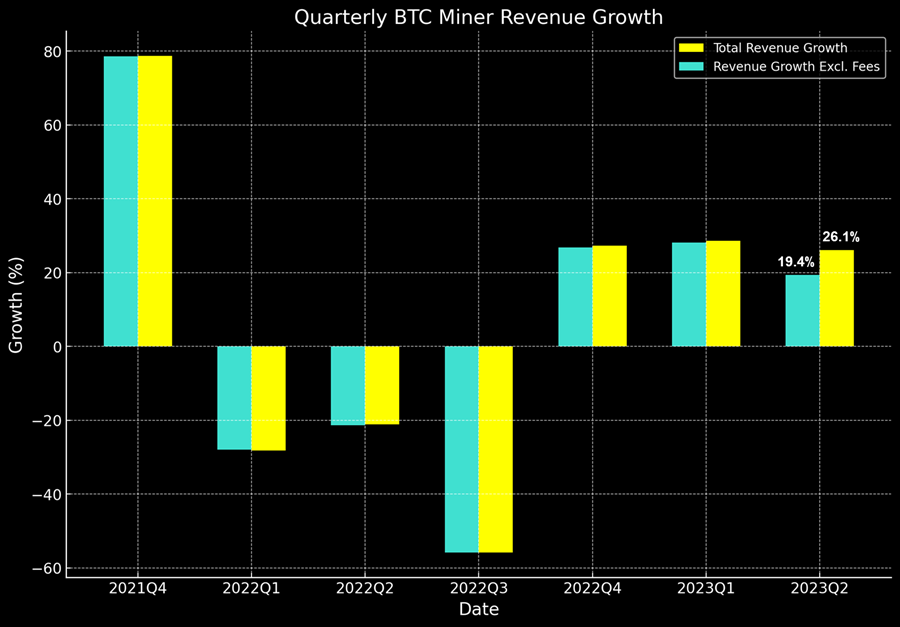

The chart below is a better articulation of the impact of the miner transaction fees. Revenue growth without fees would have been 19%, while revenue growth with fees is above 26%.

This is quite the topline boost and is something to keep in mind as we navigate through earnings season. We would stop short of making a tactical trading call around earnings given the possible overextension of certain names, but it is possible that this revenue boost from NFT activity coupled with declining energy prices will lead to surprising results for publicly traded miners. Overall, we remain constructive on miners (MARA 9.38% , RIOT 7.18% , WGMI 3.09% ) on an intermediate term basis and view dips worthy of buying.

Short-term Traders Still Selling the Rip

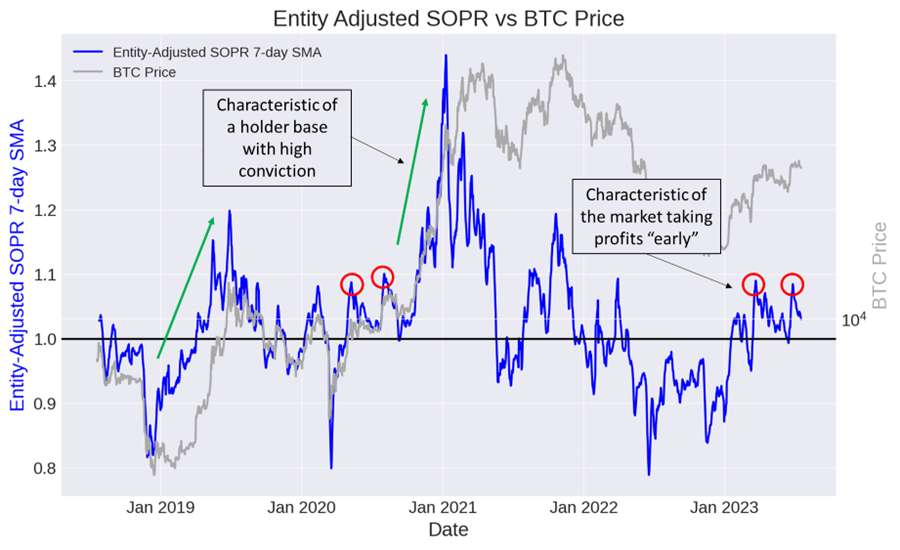

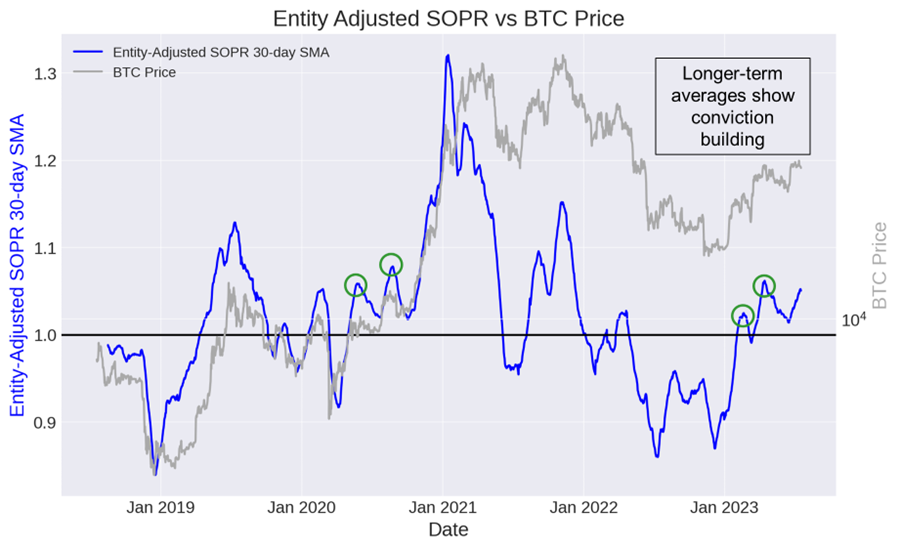

As a reminder, SOPR stands for “Spent Output Profit Ratio.” It is a metric used to assess the profitability of bitcoin holders when they sell their coins. SOPR measures the ratio between the price at which bitcoins were last moved on-chain and their current price.

If the SOPR value is greater than 1, it indicates that, on average, the coins being spent are sold at a profit. Conversely, if the SOPR value is below 1, it suggests that bitcoins are being sold at a loss. SOPR is often used to gauge market sentiment and identify potential selling or buying pressure in the bitcoin market. If SOPR trends higher, it means that holders are more confident in holding the underlying asset as they are anticipating selling at a higher margin. If SOPR is declining, it generally reflects a market that is either taking profits or capitulating below cost.

Below, we see a mixed short-term moving average for SOPR. The bias is clearly bullish since the start of the year, but it is evident that holders are taking profits following major rallies and capitulating during extended periods of flat price performance. This pattern is emblematic of the earlier portions of prior bull markets.

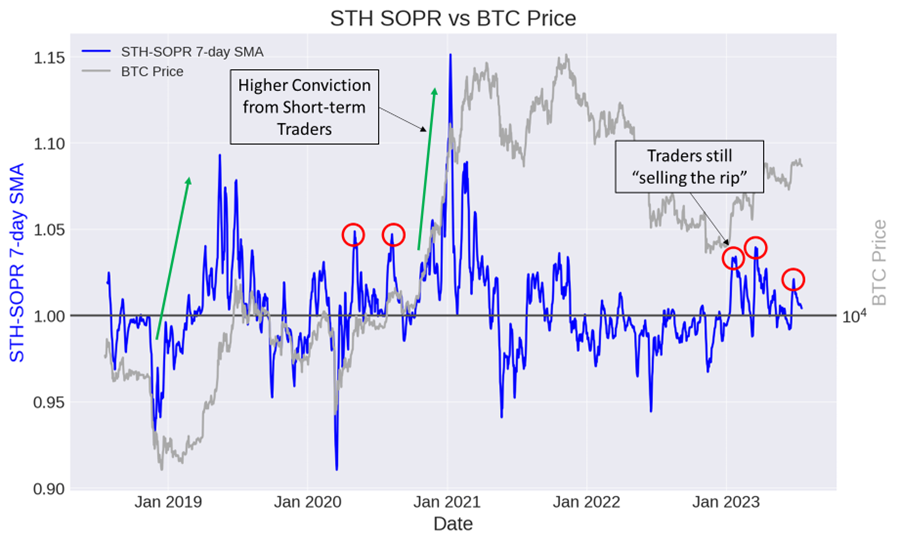

Looking under the hood, we can attribute this broad lack of market confidence to the short-term holder cohort of bitcoin investors. These are the traders who maintain positions for 5 months or less. It is possible that the miners who are selling comprise many of these short-term holders. This could also be a function of a sustained lack of new retail participation.

Important to note that longer-term moving averages for SOPR (all cohorts) show increasing conviction, making higher highs and higher lows since the market bottom in November. This is a positive indicator of growing investor confidence and the emergence of a new bull market.

Core Strategy

We believe that the market is currently in a “sentiment sweet spot” where both narrative-driven factors (such as the potential spot ETF, Ripple victory over the SEC, and the return of US investors) and fundamental factors (such as the upcoming halving event in a few quarters and expanding global liquidity) are bullish. Despite the majors giving back some gains in recent days, the risk asymmetry is skewed to the upside.