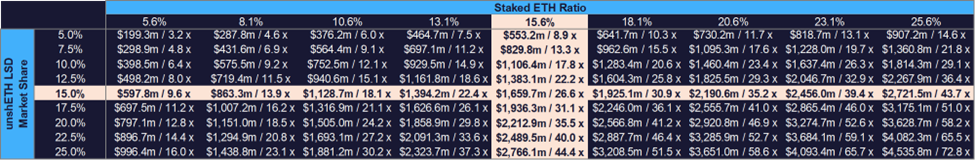

Since the Beacon Chain launch in Dec 2020, Ethereum users could stake bundles of 32 ETH to secure the network in exchange for priority fee rewards. While these staked ETH[1] are ‘productive,’ many have opted against staking given its operational complexity and illiquidity. Liquid staking projects solve for this by managing validator uptime and offering liquid staking derivatives (LSDs) to stakers. However, most of LSDs today are congregated amongst the top few protocols. Lido, Coinbase and Rocket Pool occupy 95% of LSD market share, compromising on the decentralization ethos of crypto.

Given the myriad of LSDs coming onto market, DeFi protocols are also faced with the challenge of integrating multiple LSDs on their platforms. This generates friction for the developers and to end users who want exposure to an aggregate of staked ETH yields instead of periodically swapping between LSDs in search of the best yields. As a result of these pain points, we believe there is a market demand for an LSD aggregator to solve for this. Similar to how Wrapped Ethereum (WETH 2.21% ) and Wrapped Bitcoin (WBTC) serve as the bedrock of ETH and BTC in DeFi, unshETH can be the equivalent for staked versions of ETH.

Figure: ETH Liquid Staking Balances Time Series

Introduction

unshETH aims to improve validator decentralization by creating competition among LSD protocols and offering the best yield to users. Leveraging a dual ERC-20 token model of USH and $unshETH, the protocol strives to create new LSDfi primitives that guide it towards a governance-determined optimal composition ratio of LSDs. Some of these primitives include (i) Validator Decentralization Mining (vdMining), a coordination mechanism that rewards all users if the unshETH composition aligns to that voted in governance, (ii) Validator Decentralization AMM (vdAMM), an automated market maker that allows users to swap between LSDs within the unshETH token, and (iii) Validator Dominance Options (VDOs), a put-based instrument that generates yield for non-dominant LSD holders.

Apart from solving for decentralization, unshETH has the potential to become the front-page of LSDs by offering several features. Similar to Curve being the front page of stablecoins, users can get 1-click access to an aggregate of LSD yields. Instead of integrating multiple LSDs, incumbent DeFi protocols can also integrate one LSD (unshETH) that represents an aggregate of LSDs in the market. From the perspective of new LSD projects, unshETH also represents a platform to quickly incentivize liquidity and usage, in lieu of inefficiently bootstrapping usage on their native platforms.

Since early April, unshETH has been an Omnichain token on both ETH mainnet and BNB chain. unshETH can be transferred for free across chains, bringing staked ETH to the second largest chain by TVL and users. Powered by integration partner LayerZero, unshETH will be natively deployable across all the major ETH L2s (e.g. Arbitrum, Optimism, zkSync) and alt L1s (e.g. Polygon PoS), potentially tapping into millions in both additional users and capital in unstaked ETH.

Token Value Accrual

As alluded to above, unshETH leverages two tokens to promote validator decentralization, $unshETH and USH. USH is the protocol token of unshETH that will also be used for governance, revenue sharing, and bribes. While USH today is purely a farm token, the developers have hinted at Curve/Convex-esque governance mechanisms through their documentation and Twitter AMAs, further expanded in Upcoming Catalysts below. Simply put, protocol treasuries and LSD projects will be incentivized to purchase (& lock) USH to direct future USH emissions to their own LSD liquidity pools through governance, which will reduce supply and create a flywheel effect for the token.

Meanwhile, $unshETH is a diversified index for staked ETH. Minting and redeeming unshETH works similarly to a TradFi ETF product – users can mint the unshETH token by depositing one of the supported ETH LSDs. Currently, the platform supports wstETH (Lido), cbETH (Coinbase), rETH (RocketPool), and sfrxETH (Frax Finance).

The amount of unshETH minted when depositing a supported LSD corresponds to exactly the amount of staked ETH underlying that LSD. Put differently, 1 ETH “worth” of any of the LSDs equals 1 unshETH at the time of deposit. unshETH token can then be redeemable into the basket of LSDs in its vault at the same 1 ETH = 1 staked ETH ratio. As the underlying LSDs accrue staking yield, unshETH also accrues value.

Through future governance, unshETH will have configurable target weights and risk caps for each supported LSD token. So if one LSD were to become unfavorable / depegged / slashed, the protocol could limit risk exposure through risk caps and subsequently adjusting target weights through governance. As a security measure, redemption into underlying LSDs is currently paused until ~1 week after the much-anticipated Shanghai Upgrade.

Upcoming Catalysts & Roadmap

Shanghai Upgrade

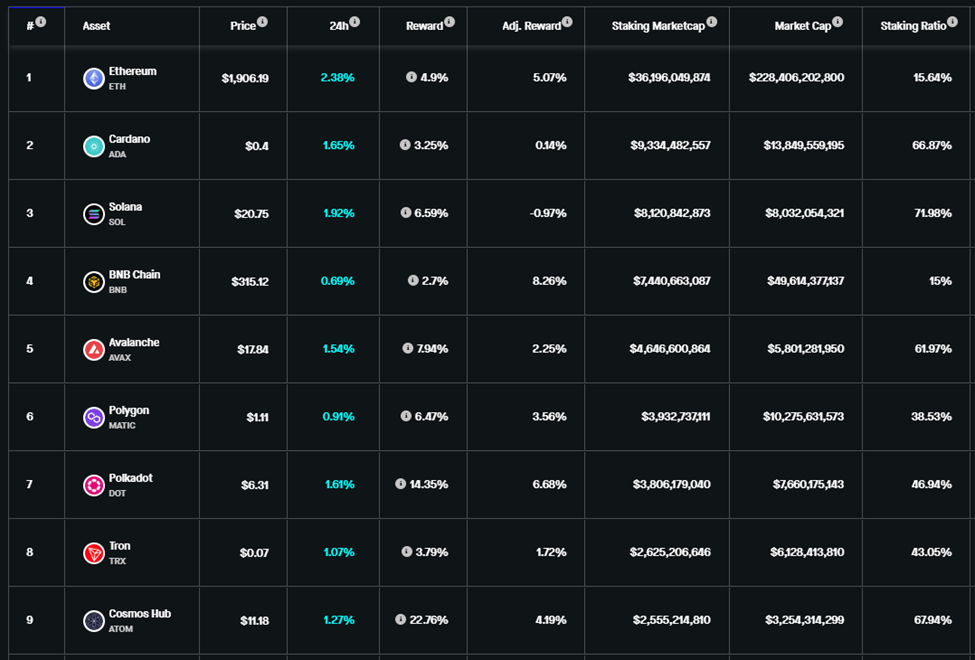

Much of unshETH’s thesis hinges on the completion of the Shanghai Upgrade (scheduled for 4/12), where previously staked ETH (and their rewards) will be made available to be unstaked in tranches. While many expect ETH’s staking ratios to decline given the unlocked liquidity, we posit that staking ratios will actually increase instead given the de-risking of liquidity and smart contracts. ETH’s current staking ratio sits around ~15% (vs ~50% among comps), and we expect it to catch up to comps at least partially post-Shanghai.

Figure: Staking Ratios of PoS Networks

Validator Decentralization Automated Market Maker (vdAMM)

Moreover, the team is planning to launch vdAMM in the coming weeks, allowing users to use the unshETH vault of LSDs as a liquidity pool to swap between LSDs. Swap fees will initially accrue to unshETH holders, and later to vdUSH holders when the fee switch is turned on. At a high level, swaps or redemptions that rebalance the index towards its target weights will be free, while those that remove LSDs unshETH desires from the vault will charge increasing fees. No swap can take place beyond the configurable risk cap of that LSD.

This makes unshETH similar to spot swaps for GLP (liquidity pool for popular perp DEX GMX), albeit with a lower risk profile since unshETH assets are composed of closely correlated assets backed by ETH instead of via lagging oracles.

Tokenomics Roadmap

Alluded to above, USH is a farm token today that is meant to bootstrap unshETH liquidity. Nonetheless, the developers have plans to release vdUSH in the coming weeks, which has similar features to locked staking models implemented by DeFi heavyweights like Curve, Balancer, and Stargate.

Preliminary communications with the team point to the vote-escrowed model with a few tweaks:

- Single-sided locked staking of USH (vdUSH) will earn more vdUSH, an IL-free option for long-term aligned users, team members and investors

- USH-unshETH locked liquidity will earn vdUSH at the highest rate, bootstrapping semi-permanent liquidity

- vdUSH stakers will govern the inclusion of LSD protocols, target weights, and risk caps for the unshETH index token, allowing new and incumbent LSD protocols to participate in governance and direct liquidity to their protocols

- vdUSH stakers will govern the fee switch and decide whether fees accrue to unshETH holders, the protocol treasury, or vdUSH stakers

Balancer Integration

While the unshETH team has initially launched their LP on SushiSwap, the recent exploit on the DEX has expedited the migration of liquidity towards Balancer, another AMM that leverages multi-asset LPs. Coupled with vdUSH that will be launching, the Balancer LP will be incentivized to accommodate deep liquidity on any chain. The proposal to add USH/ETH LP on Balancer passed with an overwhelming majority, kickstarting a partnership with another DeFi incumbent and its ecosystem of partners.

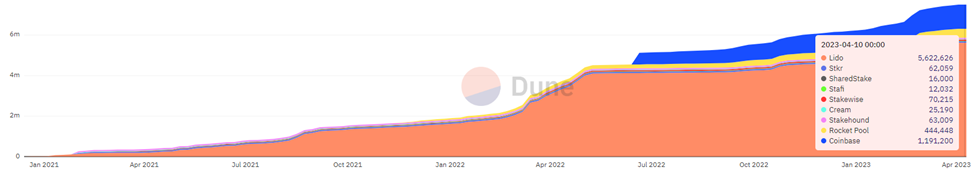

Valuation Target

USH has retraced from $0.62 to $0.48 at time of writing, implying a ~$68m FDV. To gauge the target valuation of USH, we apply Curve’s FDV / TVL ratio (0.70) to the unshETH’s potential TVL by assuming a 15% market capture among existing LSD products. We further assume that the LSD market share (as a % of staked ETH) will remain constant at ~43% to be conservative.

In our view, the two key levers anchoring the thesis are the aggregate staked ETH ratio and unshETH’s LSD market share. One day out from the Shanghai Upgrade, the former sits at 15.64%, which we expect to increase post-Shanghai but assume to be base case for conservatism. Assuming our average execution price is equal to the current price, we then project the following valuation scenarios and MOIC returns and sensitize them against staked ETH ratios and unshETH’s LSD market share.

Our base case projects a $1.66b FDV assuming a 15.6% staked ETH ratio and 15% market share, representing a 26.6x increase from the current FDV. In our view, these projected returns are attractive, especially since they hinge on conservative assumptions. Should staked ETH ratios reach 20.6% and unshETH achieve a 20% market share, the projected returns jump to $3.2b and 53x.

Perhaps more importantly, the valuation hinges on Curve’s FDV / TVL ratio of 0.70 applying to unshETH. As Balancer and Stargate have ancillary products and features that do not make them directly comparable to unshETH, we have utilized the FDV / TVL ratio of Curve as the only comp set.

Launch Tokenomics and Noteworthy Investors/Wallets

USH has a total supply of 143.5m (1b / 6.969), and has earmarked 75% of tokens to the community, 20% to core team and 5% to contributors. 7.5% of the total supply was distributed to the community via an airdrop specifically rewarding early users of various LSDs.

Modeling out specific inflation schedules will be futile given vdUSH. However, 80% of all tokens will be unlocked over 12 months by all beneficiaries, net of the ~30% community allocation pre-Shanghai. This translates to very high inflation for USH pre-Shanghai, but is necessary given the thesis of decentralization and lack of VCs behind the project.

Some of the notable early holders of USH token include @samczsun, @0xSisyphus, @0xTrinity, @DoveyWan, and other DeFi heavyweights. Moreover, members from Euler, Lido, and Polygon have tuned into their Twitter & Discord AMAs, pointing to their affiliation with the unshETH team.

Risks

Execution & Smart Contract Risk

Given the concept novelty, the two key risks for unshETH are execution risk and smart contract risk. To illustrate, VDOs are only executable post-Shanghai, and are dependent on the developers building out features as promised, including a new token standard EIP-1435. The smart contract risk is also somewhat mitigated by Certik’s (top tier audit firm) audit. While the developers are pseudo anonymous, they have doxxed to many, most recently in ETH Denver.

Their previous work experience also points to an intimate understanding of the underlying problem. Alta1r previously worked on MakerDAO, Set Protocol, and even founded an LSD project. Other team members have been on Lido and Euler’s core teams. Moreover, the devs have renounced their ownership of the contract, significantly eliminating rug risk through infinite minting.

Competitor Risk

Given the growing significance of LSDs (and the LSDfi narrative) especially post-Shanghai, multiple competitors have emerged, including 0xAcid, Ion Protocol, and LSDx. However, most of these protocols are forks of unshETH, with none of the partnerships that the protocol has. LayerZero is an official partner for unshETH in their multichain expansion, which bears weight given the former’s recent monster raise and reputation in the space.

Incumbent DeFi protocols have also jumped in, perhaps validating the demand for a unified wrapper for staked versions of ETH. Yearn teased in February that they are launching yETH, an LSD of LSDs. While DeFi 1.0 protocols stand to benefit from their lindy effect, their longstanding dominance and limited unissued tokens also mean that they would not ship as quickly or offer as compelling yields as newer protocols like unshETH.

Bottom Line

As LSDs and ETH staking ratios continue to gain prominence post-Shanghai, unshETH represents a new DeFi primitive to capitalize on this trend while solving for multiple pain points. unshETH is a diversified liquid staked ETH index that earns an aggregate ETH staking yield and facilitates swaps between different LSDs, while USH accrues value from swapping between and redemptions from LSDs. From the perspective of protocols, unshETH is a single wrapper that alleviates friction from integrating multiple LSDs and reduces unnecessary liquidity incentives.

[1] Staked ETH are productive versions of ETH that are used to to secure PoS blockchains and generate new blocks.