-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 3

What types of ETFs are there?

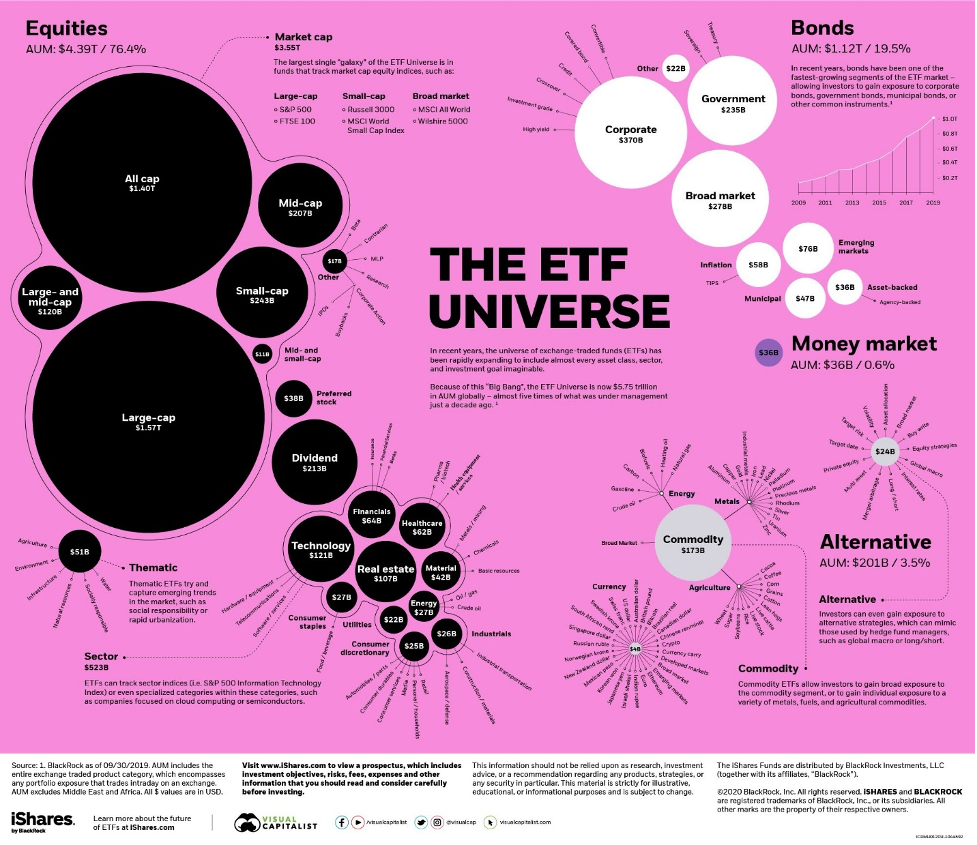

Well, the answer to this question changes not every day, but probably pretty close to it. There has been an exponential proliferation in ETFs. Today there’s everything from your standard SPY shares of the S&P 500 to Rare Earth Elements ETFs and even more specialized than that. It’s not gotten to the point that if you can dream it, then there’s an ETF.

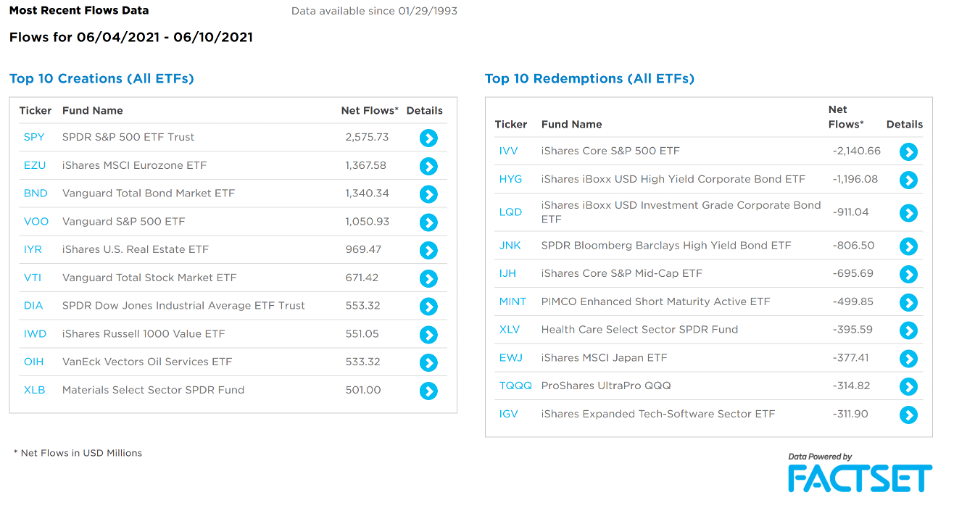

However, it’s closer to that reality than you might think—double, triple, leveraged ETFs, inverse ETFs, ETFs that are based on things like Beta. There is a vast and developed market for ETFs. Here’s a recent flows list of the most heavily traded in a recent week.

We’ve recommended the SPHB ETF in the past as a good proxy for the Epicenter trade, particularly during the dog days of COVID-19. Why? The travel and re-opening names were swinging day-to-day based on the prospects or COVID-19.

Visit our FSI Sector allocation, a strategy designed to outperform the S&P 500 by actively managing one’s sector exposure without taking on additional portfolio risk

Take me to the FSI Sector AllocationThus, the goal of this ETF which currently captures many of the stocks we recommend, could easily change if the high-beta names in the market change. This illustration shows how versatile these investment vehicles can be. ETFs can be used to get arbitrage in two ways; you can pick a specialized sliver of the market you think will perform and get access to it, or second, you can spot differences in ETF and NAV and try to capitalize on the arbitrage. This is more commonly a strategy utilized by institutions and shouldn’t be attempted by individual investors without considerable study.

There are currency ETFs, agricultural grains ETFs, Mid cap, Small Cap, Global Mining, and thousands more. The ETF revolution has changed the face of investing forever, and trillions of dollars are now invested in this influential financial innovation and its various improved-upon descendants.

Index ETFs are usually some of the highest traded by volume. You can get the entire S&P 500 index in the $SPY ticker. You can also get the GICS-1 Sectors ETFs. Our Head of Global Portfolio Strategy, Brian Rauscher, uses these GICS-1 ETFs to develop an active allocation that essentially, in simple terms, is trying only to own the winners and not hold the groups he deems likely to underperform. This is an excellent way to get higher than market returns without taking excessive levels of risk. See his product here.

There are commodity ETFs that generally try to track the price of an underlying commodity. These can be settled using paper assets exclusively (which can create problems as USO had in April 2020) or be physically settled futures. While most ETFs are passive instruments that are also some with active management components like Factor ETFs that attempt to beat the performance of the underlying index. While actively managed ETFs comprise a small slice of the massive amount of assets invested in ETFs, their inflows are growing at a pretty fast pace.

There are bond ETFs that are generally referred to under the broader term of Fixed Income ETFs. These are focused on debt obligations instead of stocks, and these tend to be actively managed more than equity-based ETFs.

Visit our FSI Sector allocation, a strategy designed to outperform the S&P 500 by actively managing one’s sector exposure without taking on additional portfolio risk

Take me to the FSI Sector AllocationHowever, they also tend to have reasonably low turnover and stable portfolios. Inverse ETFs are pretty simple. They are just designed to have a -1 correlation to the respective asset. So, instead of buying volatile VIX options with European expiry, which significantly complicates valuation, you could get an inverse SPY ETF that will go up one dollar for every one that the SPY goes down.

This allows a more precise hedge than the VIX for specific purposes. This is one example of how specialization that ETFs provide helps investors to manage their risks better. Rather than taking the complex steps and loads of time necessary to master all the risks associated with derivatives, ETFs provide a straightforward way of constructing customized portfolios that can help define risk with multi-directional strategies.

Related Guides

-

Series of 3~5 minutesLast updated2 months ago

Series of 3~5 minutesLast updated2 months agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated11 months ago

Series of 3~9 minutesLast updated11 months agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis