-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 5

How do companies that offer ETFs make money? What about the risks?

The main way folks make money from devising and offering ETFs is from the management fees associated with them. The massive competition related to the gigantic flows in this burgeoning corner of financial products has put pressure on the fees as different funds vie for the business of increasingly cost-conscious retail and institutional investors. Factor ETFs and Actively Managed ETFs will usually have higher fees associated with the higher amount of activity and labor required for that model.

What about the risks associated with ETFs? Well, one of their primary purposes is to use diversification to mitigate risk. They can also be subject to several different perils. Pricing risk is most apparent, like any other asset, if you pick the wrong ETF and it goes in the wrong direction, all diversification aside, you’re still going to lose money like any other security. The example we highlighted from USO also illustrates the considerable execution risk that can arise.

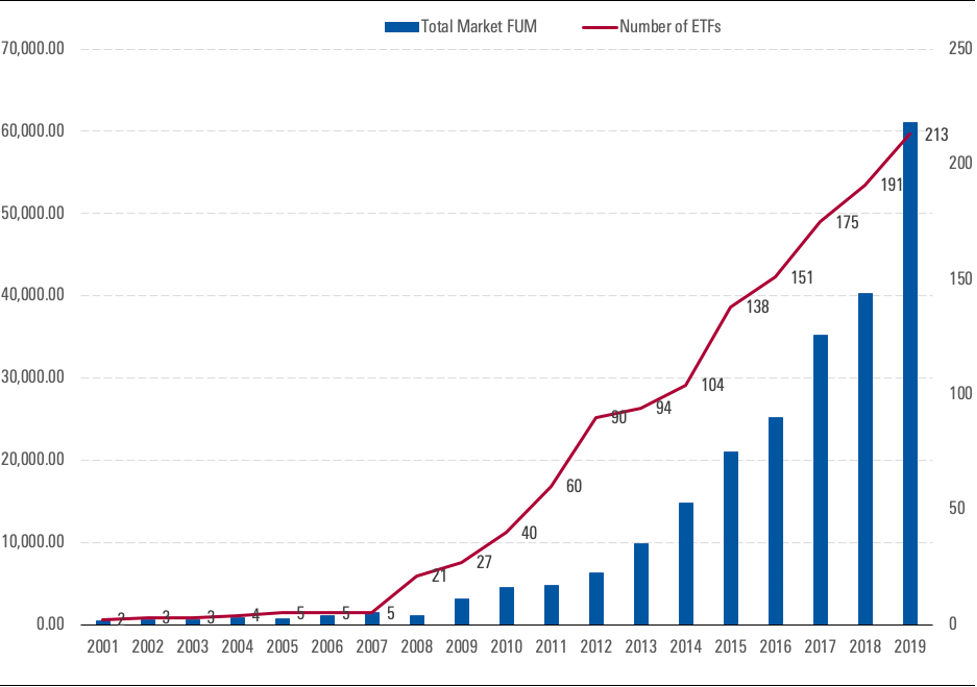

Source: Morningstar

Even if a company has a specified goal in mind, it doesn’t mean they have devised a clever way of getting there. Many times the individual approaches of various ETFs matter. It is always up to you to do additional due diligence on any ETF you buy. You may agree with buying USO and trying to track the price of crude, but you didn’t know that you would get smoked when backwardation biblically hit the futures market. So, even though these tools are a great way to mitigate risk and increase your access to a plethora of diverse assets, there are still risks you should always be conscious of.

Visit our FSI Sector allocation, a strategy designed to outperform the S&P 500 by actively managing one’s sector exposure without taking on additional portfolio risk

Take me to the FSI Sector AllocationNet Asset Value (NAV) is an important term to understand when thinking about ETFs and whether or not you should purchase them. This is the actual value of the assets owned by the firm. The funds can trade at a discount or a premium to NAV. Usually, this is corrected by either having the fund acquire buy-up shares and remove them from the market. This helps push share prices up.

If the shares are instead trading at a significant premium to NAV (which has often happened with crypto ETFs), then the fund can flood the market with creation units and help return the price toward NAV. So, generally, any severe deviations from NAV will likely revert to NAV over time. However, this could also signify that you want to avoid the ETF because of liquidity issues or other things afoot you don’t want afoot.

Related Guides

-

Series of 3~5 minutesLast updated2 months ago

Series of 3~5 minutesLast updated2 months agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated1 year ago

Series of 3~9 minutesLast updated1 year agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis