FS Insight

Fundstrat Research Only Available to Banks and Hedge Funds...

Until Now

Finally, you have access to the top-tier research on Wall Street.

We provide individuals with the same quality of research banks and hedge funds receive to make their investment decisions. Now, you can invest on a level playing field.

Join Tom Lee's Free Community for Investors

Receive our weekly newsletter and invitations to upcoming events and appearances featuring Tom Lee, the Fundstrat research team, and our network of experts.

Join Tom Lee's Free Community for Investors

Receive our weekly newsletter and invitations to upcoming events and appearances featuring Tom Lee, the Fundstrat research team, and our network of experts.

Top Wall Street Strategist

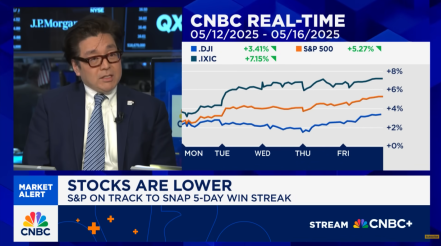

Tom Lee

Macro and Crypto Research at the Highest Level

Tom Lee is recognized as one of Wall Street’s top-ranked institutional analysts, with a loyal following for decades. The former chief U.S. Equities Strategist at JP Morgan is on a mission: to give individuals the research and tools to make informed investment decisions and level the playing field. Banks and Hedge Funds go to Tom for his authoritative research and advice. Now you can have access to the same high-level research by becoming an FSInsight.com member

Testimonials

What our clients think about our premium research

Peter Najarian

Market Rebellion

“Tom Lee is one of the most talented analysts on the street.”

Robert C. Doll

Nuveen Asset Management LLC

“We use Tom Lee because he does his homework”

Institutional Investor

INVESTMENT NEWS SITE

“Tom does a huge amount of work and he doesn’t rely on hunches. All of his arguments are data driven.”

The Cointelegraph

CRYPTO NEWS SITE

Thomas Lee was one of the first “traditional finance” professionals talking about Bitcoin.

What Our Clients Say

FSI Macro Analysis

Macro Research

Using comprehensive and differentiated data sets, including census data; economic activity; and historical, demographic and social trends, we look at key drivers and relative valuations for the 11 primary sectors as well as industry groups.

With a focus on businesses with pricing power or secular opportunities, we look to identify investment opportunities for our clients before the consensus discovers these companies.

FS Insight provides a roadmap for investors to understand the current equity market environment and the tools to generate outperformance.

FSI Crypto

Crypto Research

We are recognized as one of the only institutional research firms providing comprehensive market analysis and price analytics for cryptocurrencies and blockchain technology.

FS Insight is the pioneering thought leader in this rapidly growing investment space. Our digital assets research bridges the gap between the tech and investment worlds, providing investors with a framework for understanding fundamental valuations and market risks, and critical benchmarking tools.

We estimate more than 10% of all crypto funds, representing ~33% of crypto assets under management, as our paying clients. We are effectively the only paid research subscription service in crypto with widespread adoption.

Choose one of our yearly plans to save nearly 15%

The Complete Package

Macro + Crypto

Get all the research that FS Insight has to offer in one neat package.

Macro Research

A roadmap to understand the current equity market environment and the tools to generate outperformance.

Crypto Research

Our digital assets research bridges the gap between the tech and investment worlds, providing investors with a framework for understanding fundamental valuations and market risks, and critical benchmarking tools.

Our Research Heads

A Team of Finance and Market Experts Dedicated to Clients

Thomas J. Lee, CFA

Co-Founder, Head of Research

Former J.P. Morgan Chief Equity Strategist from 2007 to 2014. Top-ranked analyst by Institutional Investor every year since 1998.

L. Thomas Block

Washington Policy Strategist

Former Chief of Staff in the House, and Legislative Staff Director in the Senate. 21 years at J.P. Morgan as Global Head of Government Relations.

Sean Farrell

Head of Crypto Strategy

Sean Farrell is the Head of Crypto Strategy at FS Insight. Prior to joining FS Insight, Sean was a manager in the Transaction Opinions group at Alvarez & Marsal, and previously worked as an associate with Anvil Advisors.

Mark L. Newton, CMT

Head of Technical Strategy

Mark has more than 25 years of buy and sell-side experience in the financial services industry. He formerly worked with Diamondback Capital Management and Morgan Stanley as their technical strategist.