The rally which started Monday likely should carry SPX back to 5400. A five-wave advance higher represented the first real positive structural effort off the lows, and both US Dollar and Treasury yields look close to turning back lower. As I indicated in recent days, Technology as a sector is near support and the GOOGL and MSFT earnings data arguably should set the stage for higher prices in both on Friday which should help the market start to push higher. Overall, I expect that gains to SPX-5200 are underway and ultimately 5400.

The minor stalling out from Wednesday looks complete given Thursday’s lift off the lows ahead of MSFT 0.53% and GOOGL -1.52% earnings data. Despite the ongoing rise in Treasury yields on higher than expected Quarterly Core PCE data, US equities managed to push sharply higher over the last couple hours with Technology and Energy both leading performance.

Post-market close earnings from MSFT and GOOGL looked to have surprised positively on both revenues and earnings and could set an early positive tone for markets given the size of both of these constituents within ^SPX and QQQ 0.01% . The act of GOOGL -1.52% announcing a quarterly dividend seems to have been a very positive factor for this stock in after-hours trading. (As always, it’s proper to hold off on making too much of after-hours trading data, but on first glance, both MSFT and GOOGL seem to have delivered what the market wants to see.)

As discussed in recent days, the five-wave advance from this past Monday’s lows looks bullish for SPX and QQQ, and now very well could help to facilitate upside follow-through in the days to come. Movement back over SPX-5090 would confirm that a rally back to 5200 should be underway.

Specifically, Thursday’s reversal following early weakness managed to break the downtrend over the last 24 hours and looks to have formed a successful ABC-type reversal pattern that should be helpful for both SPX and QQQ pushing back to new highs into May.

Only on a break of 5000 on a closing basis would this rally likely be postponed, but Thursday’s gains look to be a clear positive for markets.

S&P 500 E-mini Futures

Tech weakness likely will stabilize following the pullback to the pivot area of the former breakout

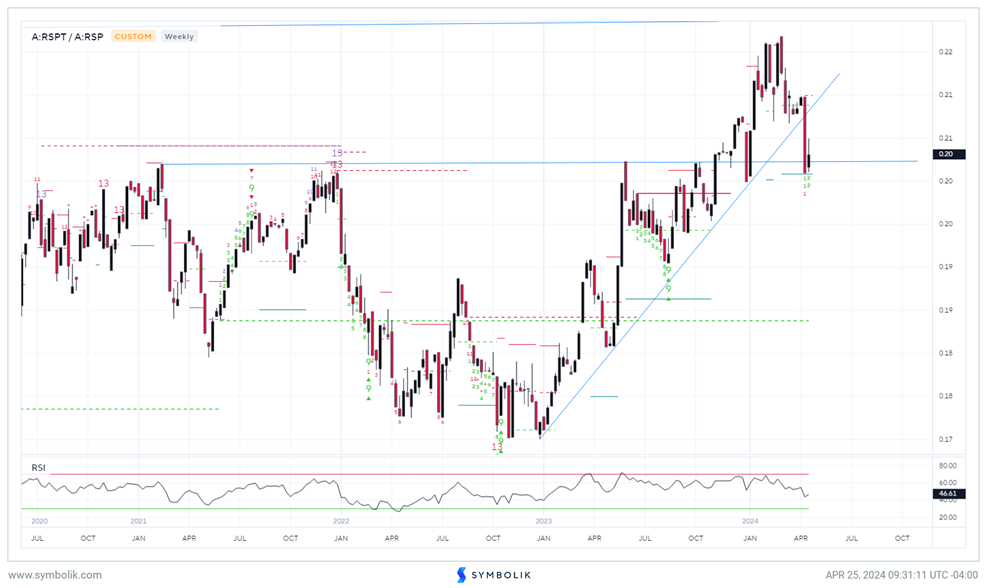

Despite the underperformance in Technology over the past month (which lagged all other 10 major Sectors on a rolling one-month basis through 4/24/24), this view shown below of Equal-weighted Technology (RSPT 0.35% ) vs. Equal-weighted S&P 500 (RSP 0.49% ) shows the sector in relative terms having possibly reached support.

The act of revisiting the pivot area of a former breakout can often signify support on weakness, which makes Technology interesting despite an uptrend of the last few months which has been violated (Daily relative chart of RSPT vs. RSP).

I sense that Thursdays’ earnings data will allow for upside follow-through for Technology in the days and weeks to come and should help this sector begin to outperform again after recent underperformance.

GOOGL -1.52% looks to have short-term resistance near $180, while MSFT has resistance near $431, with intermediate-term levels near $460. I expect that Friday shouldn’t be a time to “Take a victory lap” in these stocks in the event the after-hours Thursday strength translates into gains for Friday.

High volume upward gaps on bullish earnings which occur on higher than average volume typically don’t represent optimal selling opportunities, from a technical perspective for most investors with investment timeframes longer than 2-3 weeks.

Heading into Friday and the following week, any minor backing and filling from an opening gap on Friday would make both GOOGL -1.52% and MSFT 0.53% even more technically attractive, and as I discussed in Wednesday’s note, I endorse both of these names. However, at this time, GOOGL -1.52% is the clear technical favorite between the two given its recent push back to new all-time highs.

S&P 500 Equal Weight Technology / S&P 500 Equal Weight Ratio

TNX has broken out again on higher Core PCE data

The early 3.7% reading on Core PCE QoQ data certainly spooked both the stock and bond market with 2-year yields knocking on the door of 5%, and TNX (shown below) spiking up to 4.70%.

However, the rise in rates today failed to keep stock indices lower, and the late-day gains in Technology helped stock indices cut initial losses in half. The question of course, is whether rising rates actually matter for stocks, as several periods historically have witnessed rising rate environments where stock indices showed gains.

Bloomberg reports that two-year rallies in bond yields from periods from 1971-3, 1977-9, 1986-9, and 2003-6 along with 2016-18 were also accompanied by rising stock prices.

Overall, my cycle work shows Treasury yields on the verge of peaking out, which might occur between now and early May, particularly when the Treasury refunding announcement materializes on 5/1/24.

Thus, potentially early May in 2024 won’t be too different from late October of 2023, when rates peaked out and plummeted following the Refunding announcement.

Bottom line, I don’t feel that 5.00% will be exceeded in the near future in US 10-Year Treasury yields. However, it’s imperative to wait for rates to show some evidence of breaking the recent trend before growing too bullish on Treasuries.

As the chart below illustrates, a move down under 4.50% would be sufficient to break this uptrend, giving rise to the thoughts of a falling trend for Treasury yields.

US 10Y Yield

Sentiment has contracted sharply, which from a contrarian standpoint, is bullish

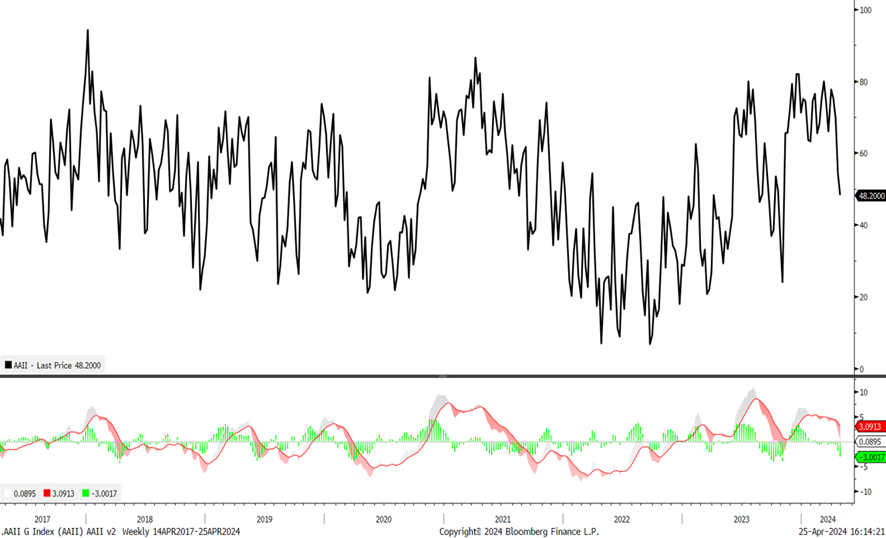

Recent AAII data now shows a greater percentage of Bearish investors at 33.9%, then Bullish investors at 31%, the first time in recent months that this sentiment poll has switched polarity.

Recall that just a month ago, this Bull-Bear spread had widened out to more than 30 percentage points between Bulls to Bears, favoring Bulls. Thus, the act of having converged back to “Largely neutral” territory with slightly more Bears than Bulls is seen as positive for risk assets.

Other sentiment gauges don’t show bullish nor bearish readings, but are largely neutral. However, this switch in AAII Bears noticing, as it’s the first flip in months towards showing more Bears than Bulls.

AAII Investor Sentiment Data