VIDEO: There is a trifecta of factors supporting small-cap outperformance in 2024 and we detail the fundamental case for small-caps in this video (duration: 3:26).

Recently, I was a panelist at an investment conference (thank you, Stephanie Link, for inviting me) and a snarky panelist, a hedge fund manager, started to ridicule the idea of buying small-caps. To me, this was a confirmation signal that small-caps are so disdained – that a wrong-way-Charlie type can be so confident small-caps will not work.

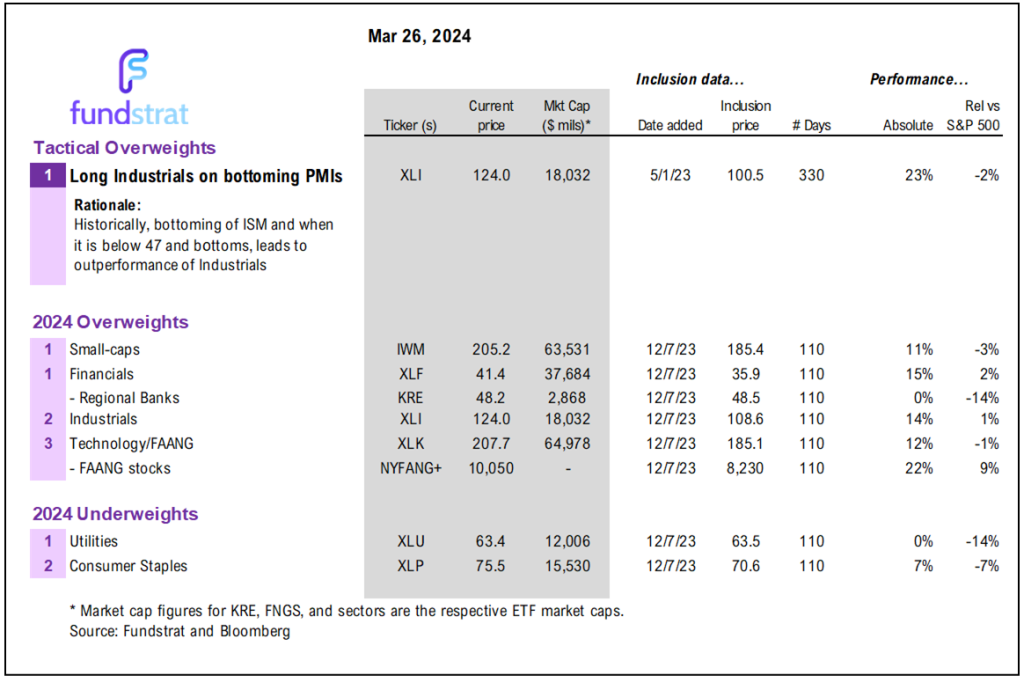

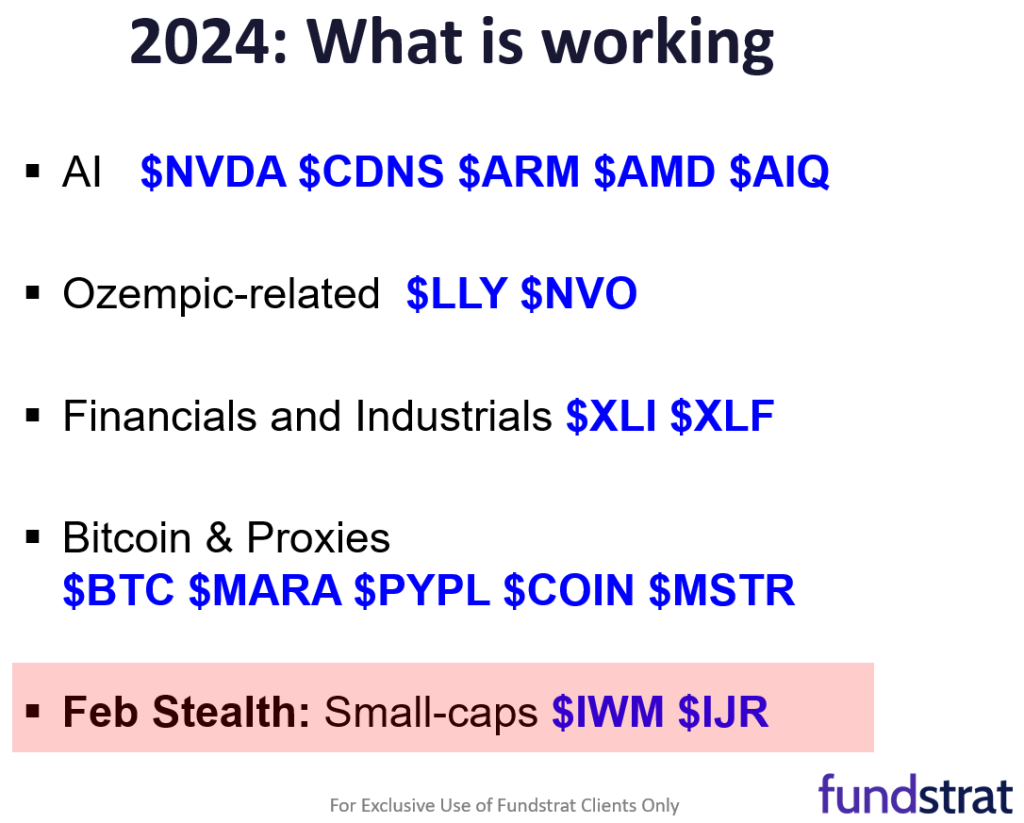

Our top idea for 2024 is small-caps, where we see at least 50% upside, and in today’s note I want to provide the 3 empirical (and fundamental) reasons for this:

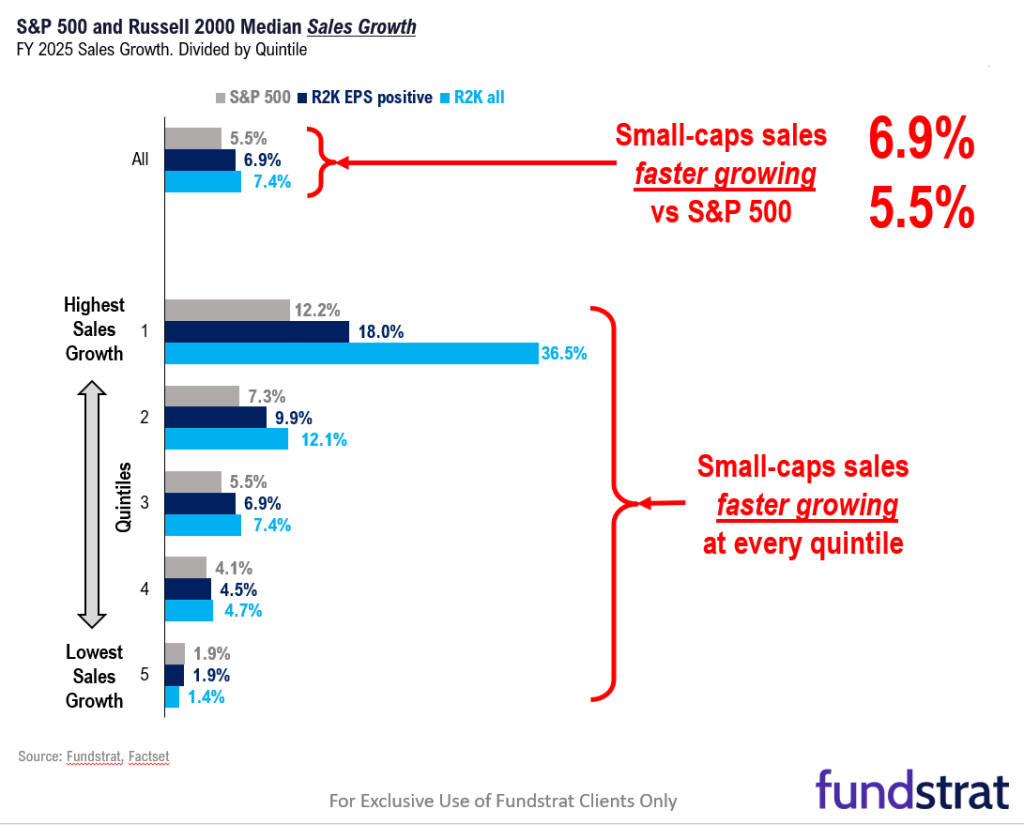

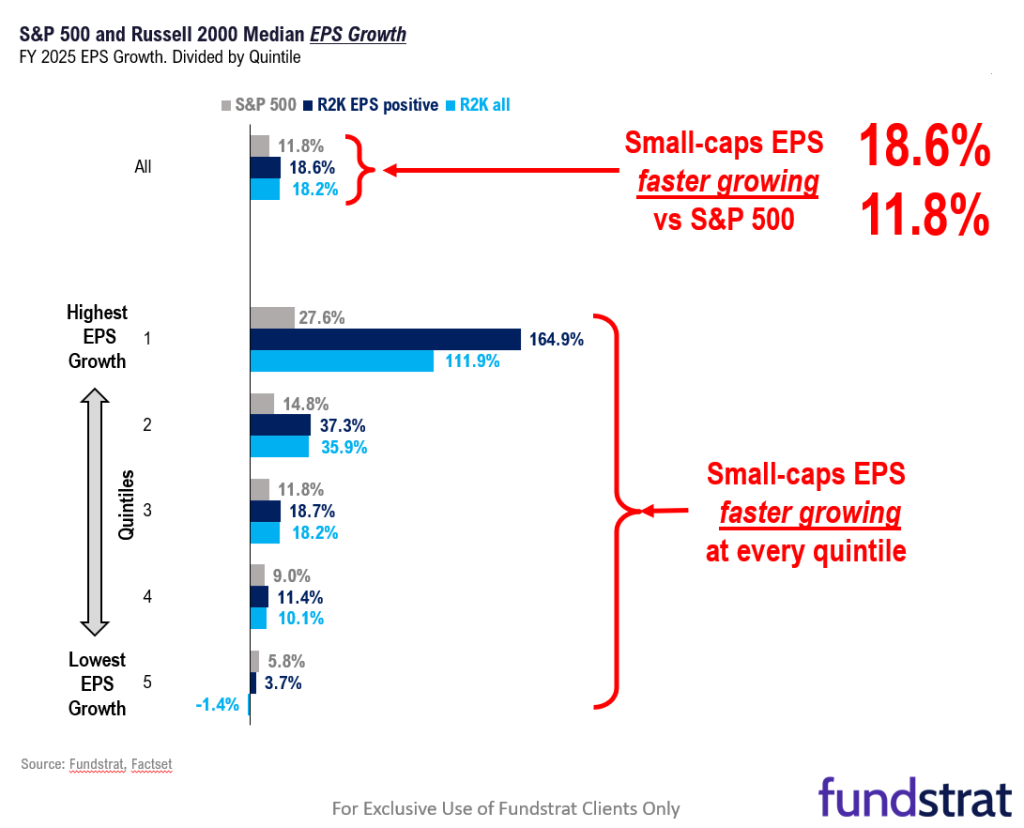

- First, the Russell 2000 (IWM 1.85% ) companies are set to grow revenues and EPS faster than the S&P 500 (SPY 1.51% ), by a large margin in 2025 (vs 2024)

– R2K vs S&P 500

– median sales +6.9% vs +5.5%

– true at every quintile of sales (see below)

– median EPS growth +18.6% vs +11.8%

– true at every quintile of EPS (see below). - The faster sales and EPS growth may surprise many pundits who view smaller cos as growing slower. The drivers for this are sustainable:

– Fed is easing = improved credit liquidity

– ISM is bottoming = cyclical upturn

– global inflation is ebbing = confidence improving

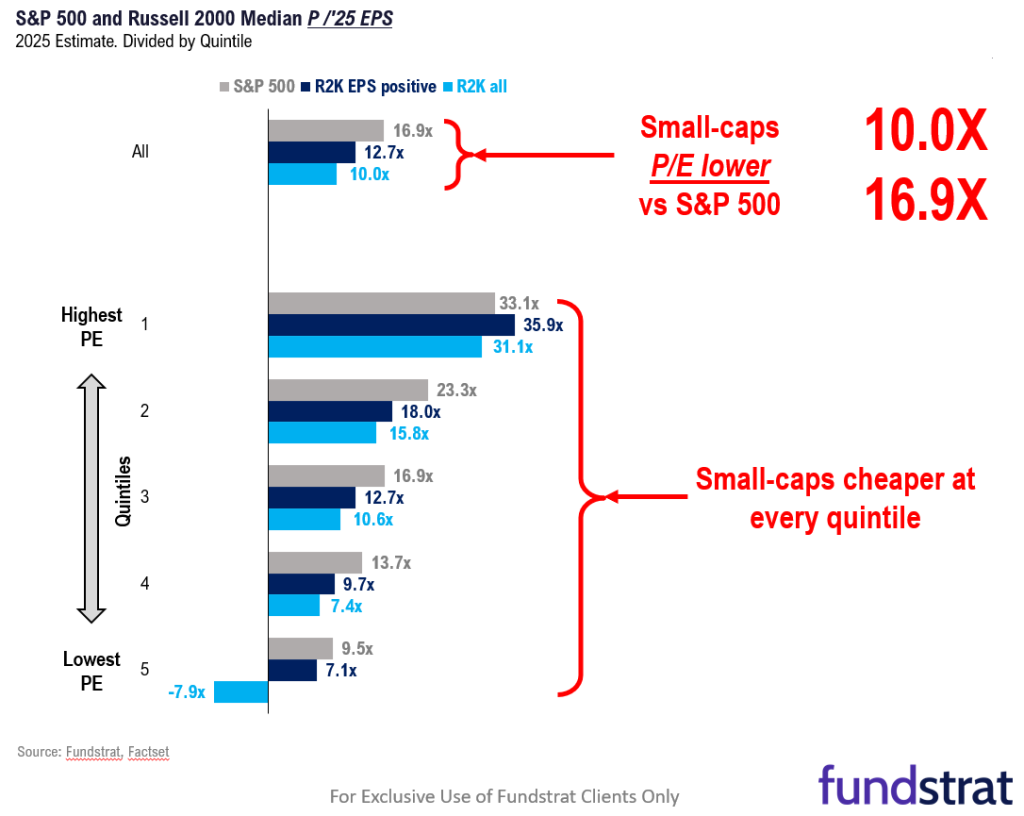

– CEO caution is ending. - Valuations are far more attractive in small-caps vs large-caps:

– R2K vs S&P 500

– median P/E (2025) 10.X vs 16.9X

– true at every quintile of P/E (see below)

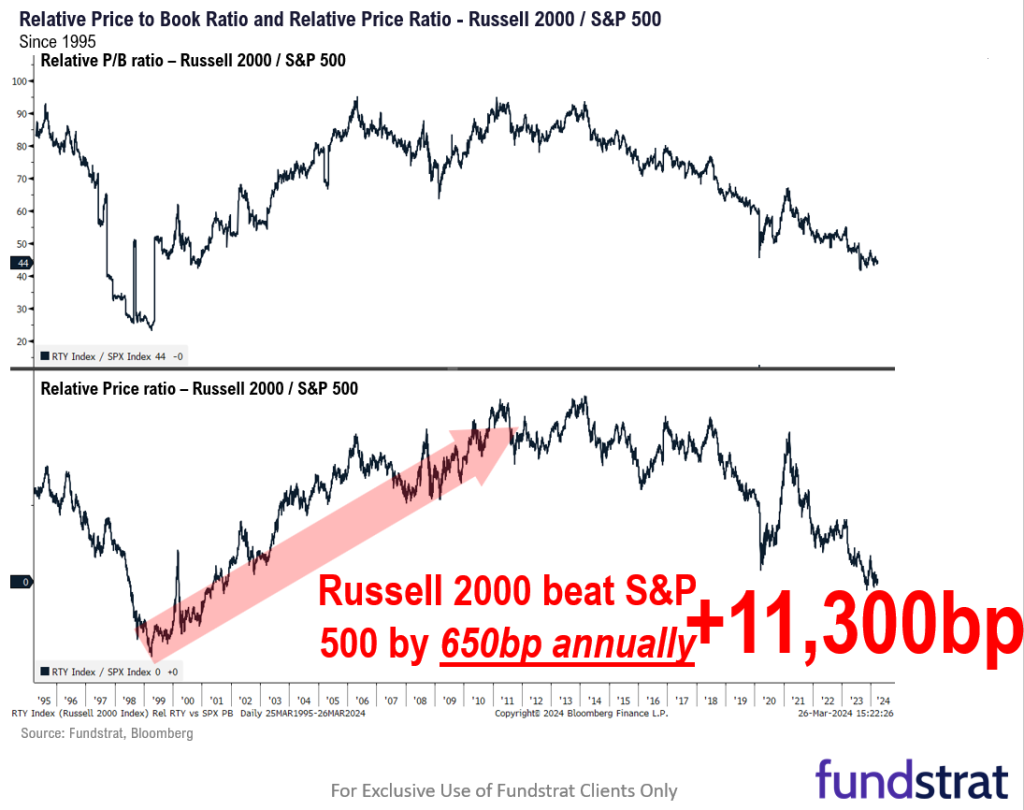

– P/B discount (vs S&P 500) 44%

– Only less than that in 1999, exact bottom. - Shouldn’t Small-caps trade at a valuation premium, arguably, given the higher top-line (revs) and EPS growth? So, does a 41% P/E discount make sense? Or a 44% P/B discount. This is not “cheap for a reason.”‘ And when CEO confidence recovers, we also see the low valuations as setting the stage for synergistic M&A and consolidation.

- In 1999, this was also the same exact launching point for 12-years of outperformance. From 1999 to 2011, small-caps outperformed by 650bp annually and a cumulative 113% (11,300bp). Wow.

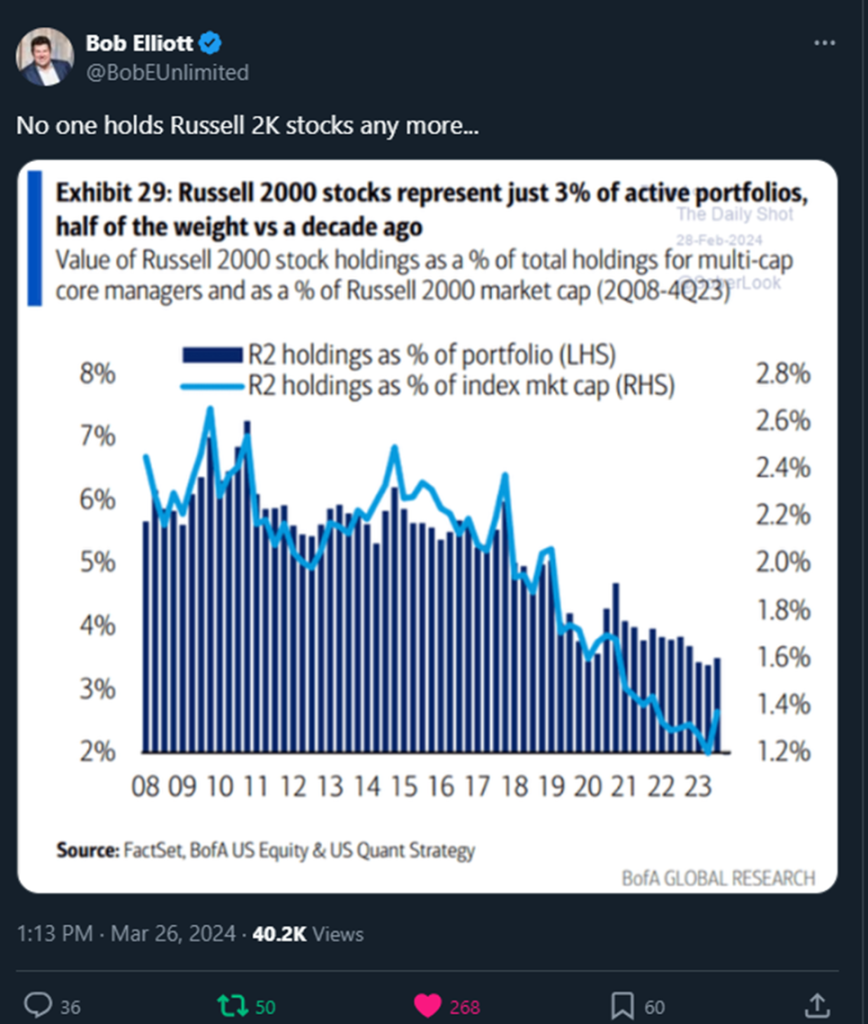

- Finally, small-caps have been essentially abandoned by institutional investors. As the X (tweet) by Bob Elliot highlights, multi-cap investors have multi-decade low allocations to small-caps even as small-caps have begun to outperform. We see this performance chasing as a key factor for small-caps to sustain gains.

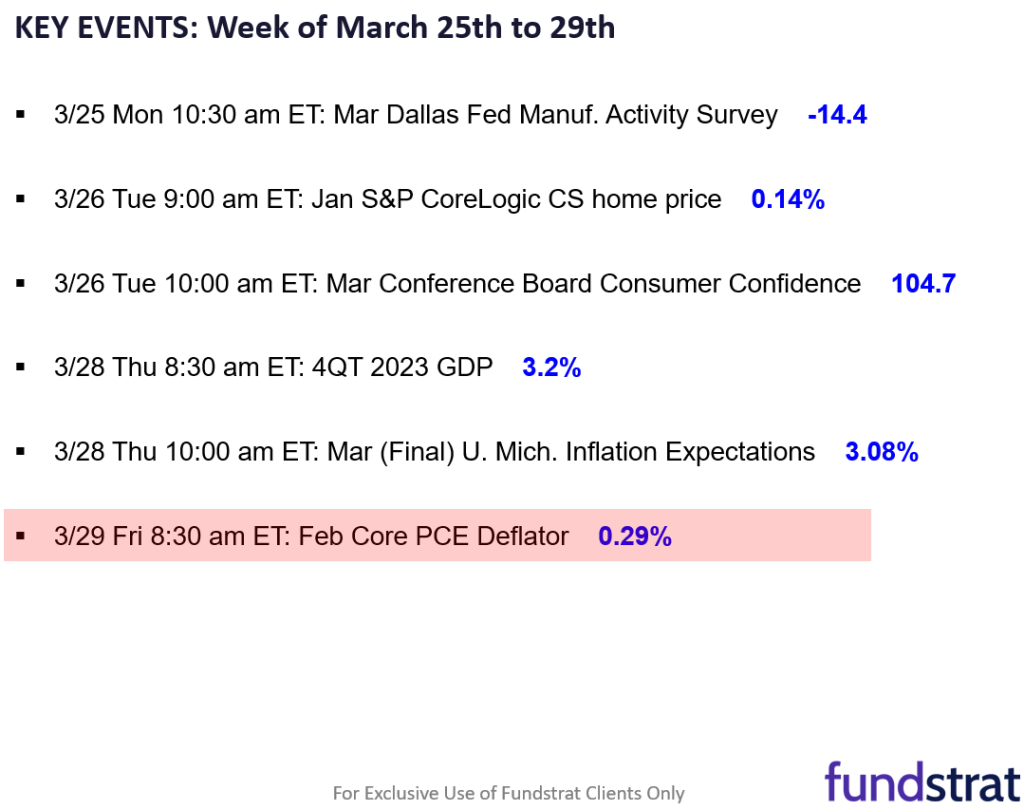

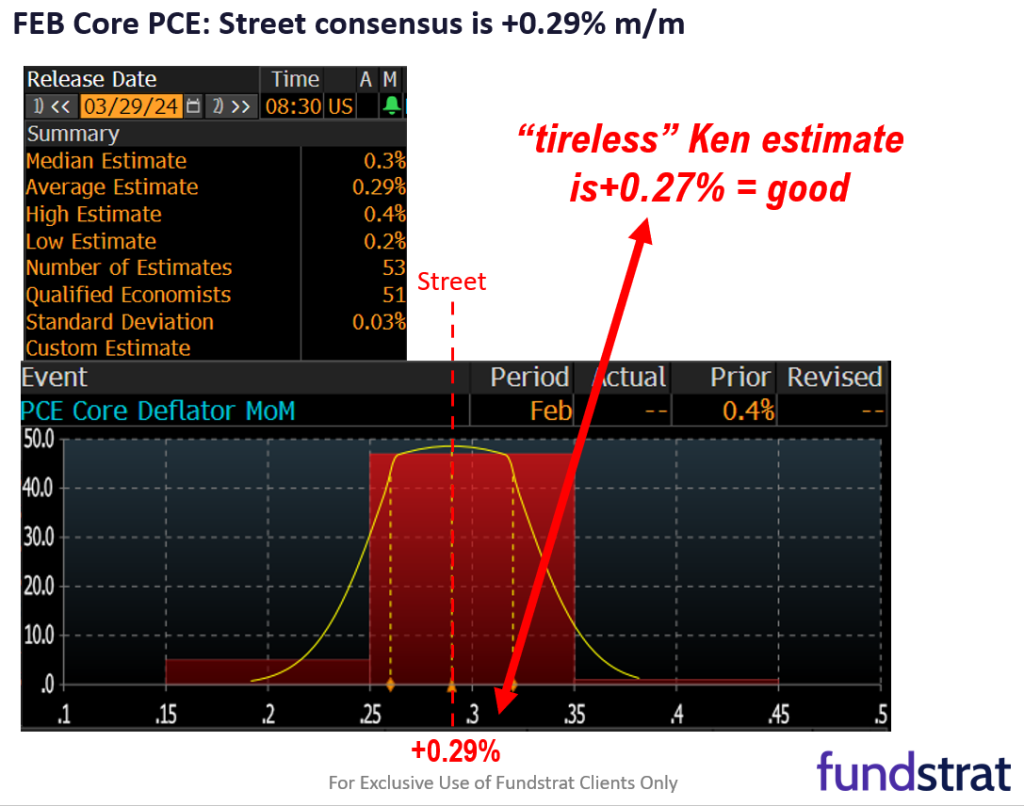

- As for economic data this week, Friday is when BEA releases Feb PCE Core deflator, the Fed’s preferred measure of inflation. Our head of data science, “Tireless Ken,” expects +0.27%, below Street consensus of +0.29% and this should be supportive of equities next week. Inflation is cooling and continues to “fall like a rock.” This is not the stubborn inflation that skeptics argue exists. Equity markets are closed this coming Friday for the Easter holiday (Good Friday).

Bottom line: Still gas in the tank, especially in small-caps.

We see 2024 as the year small-caps meaningfully outperform. The timing becomes more favorable once the Fed actually cuts interest rates – Fed futures see June as the first cut, the reason being the material benefit from liquidity.

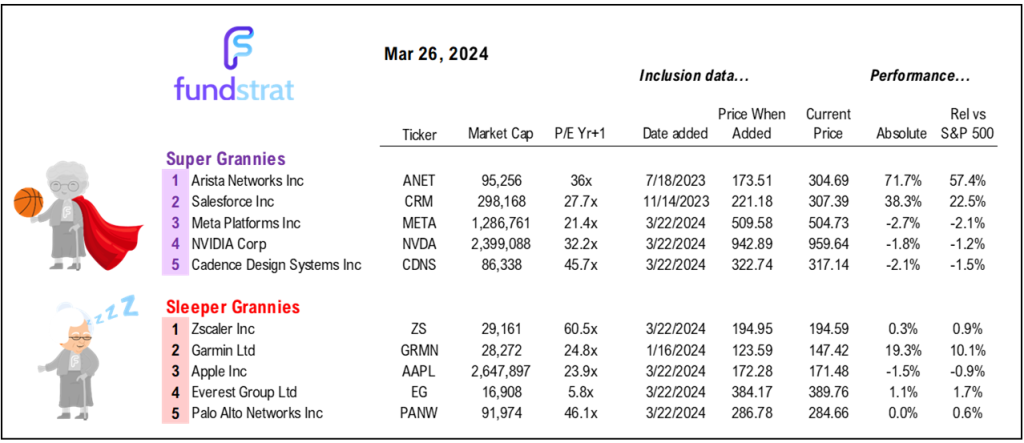

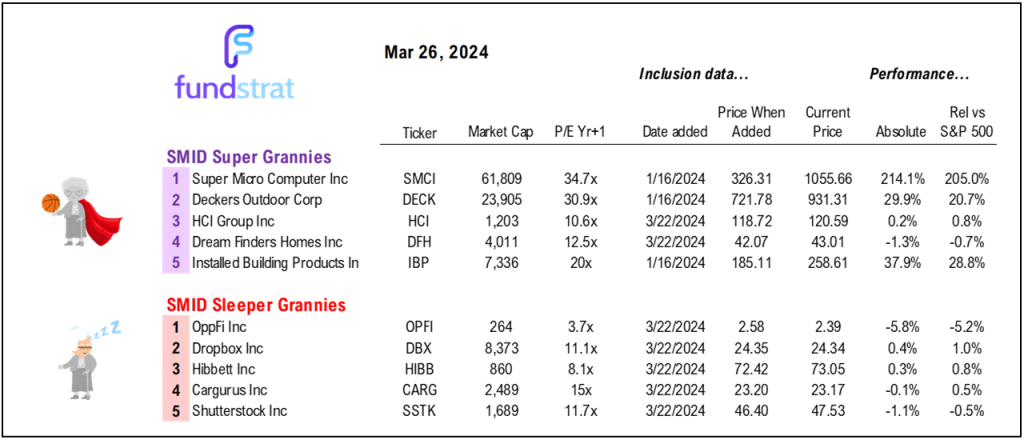

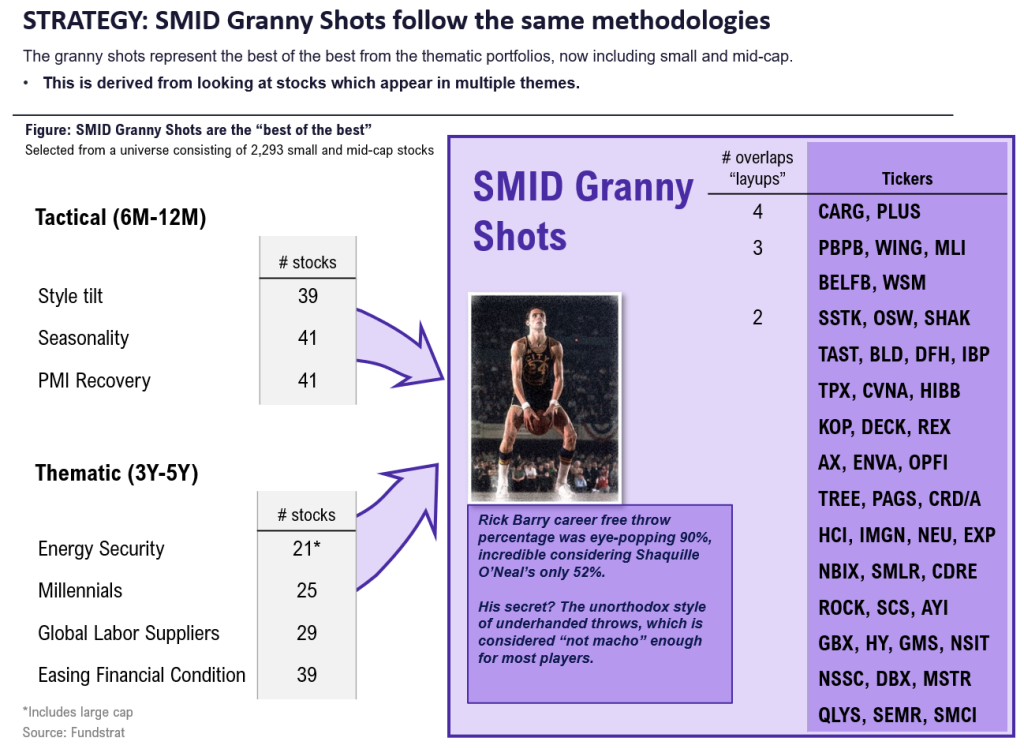

As for specific ideas, our SMID Granny Shots of 45 stocks is our core recommended list. The list is below. We provide updated views on this list on the third Wednesday of each month via our Super Granny webinars.

- Communication Services: CARG 1.71% , SSTK -1.75%

- Consumer Discretionary: BLD -0.29% , CVNA 6.78% , DECK -2.35% , DFH -3.60% , HIBB, IBP 0.30% , OSW -1.77% , PBPB, SHAK -1.81% , TAST, TPX, WING -1.33% , WSM -2.36%

- Energy: REX -1.64%

- Financials: AX 0.77% , CRD/A, ENVA 1.58% , HCI 0.42% , OPFI 0.22% , PAGS 1.65% , TREE 0.89%

- Healthcare: NBIX -0.41% , SMLR 9.72%

- Industrials: AYI 1.68% , CDRE 1.42% , GBX -0.41% , GMS, HY 0.82% , MLI 1.32% , ROCK 1.48% , SCS -0.93%

- Information Technology: BELFB 3.50% , DBX 0.74% , MSTR 5.28% , NSIT -0.29% , NSSC 0.54% , PLUS -0.67% , QLYS -1.78% , SEMR 0.08% , SMCI 3.70%

- Materials: EXP 0.67% , KOP 1.21% , NEU 1.50%

_____________________________

36 Granny Shot Ideas and 46 SMID Granny Shot Ideas: We performed our quarterly rebalance on 1/17. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

Key incoming data March:

3/01 9:45 am ET: Feb F S&P Global Manufacturing PMITame3/01 10:00 am ET: Feb ISM ManufacturingTame3/01 10:00 am ET: Feb F U. Mich. Sentiment and Inflation ExpectationTame3/05 9:45 am ET: Feb F S&P Global Services & Composite PMITame3/05 10:00 am ET: Feb ISM ServicesTame3/06 10:00 am ET: Powell Testimony before US House Financial Services CommitteeDovish3/06 10:00 am ET: Jan JOLTS Job OpeningsTame3/06 2:00 pm ET: Fed Releases Beige BookTame3/07 8:30 am ET: 4QF 2023 Nonfarm ProductivityTame3/07 9:00 am ET: Feb F Manheim Used Vehicle IndexTame3/07 10:00 am ET: Powell Testimony before US Senate Committee on Banking, Housing, and Urban AffairsDovish3/08 8:30 am ET: Feb Jobs ReportMixed- 3

/12 8:30 am ET: Feb CPISlightly Hot (as anticipated) 3/14 8:30 am ET: Feb PPIMixed3/14 8:30 am ET: Feb Retail Sales DataTame3/15 8:30 am ET: Mar Empire Manufacturing SurveyTame3/15 10:00 am ET: Mar P U. Mich. Sentiment and Inflation ExpectationTame3/18 8:30 am ET: Mar New York Fed Business Activity SurveyTame3/18 10:00 am ET: Mar NAHB Housing Market IndexTame3/19 9:00 am ET: Mar Mid-Month Manheim Used Vehicle IndexTame3/20 2:00 pm ET: Mar FOMC Rate DecisionDovish3/21 8:30 am ET: Mar Philly Fed Business Outlook SurveyTame3/21 9:45 am ET: Mar P S&P Global PMITame3/25 10:30 am ET: Mar Dallas Fed Manufacturing Activity SurveyTame3/26 9:00 am ET: Mar S&P CoreLogic CS home priceTame3/26 10:00 am ET: Mar Conference Board Consumer ConfidenceTame- 3/28 8:30 am ET: 4QT 2023 GDP

- 3/28 10:00 am ET: Mar F U. Mich. Sentiment and Inflation Expectation

- 3/29 8:30 am ET: Feb PCE

Key incoming data February:

2/01 8:30am ET 4QP 2023 Nonfarm ProductivityMixed2/01 9:45am ET S&P Global Manufacturing PMI January FinalTame2/01 10am ET January ISM ManufacturingMixed2/02 8:30am ET January Jobs ReportHot2/02 10am ET: U. Mich. Sentiment and Inflation Expectation January FinalTame2/05 9:45am ET S&P Global Services & Composite PMI January FinalTame2/05 10am ET January ISM ServicesTame2/07 9am ET Manheim Used Vehicle Index January FinalMixed2/09 CPI RevisionsTame2/13 8:30am ET January CPIMixed2/14 PPI RevisionsTame2/15 8:30am ET February Empire Manufacturing SurveyTame2/15 8:30am ET February Philly Fed Business Outlook SurveyTame2/15 8:30am ET January Retail Sales DataTame2/15 10am EST February NAHB Housing Market IndexTame2/16 8:30am ET January PPIMixed2/16 8:30am ET February New York Fed Business Activity SurveyTame2/16 10am ET U. Mich. Sentiment and Inflation Expectation February PrelimTame2/19 9am ET Manheim Used Vehicle Index February Mid-MonthTame2/21 2pm ET January FOMC Meeting MinutesTame2/22 9:45am ET S&P Global PMI February PrelimTame2/26 10:30am ET February Dallas Fed Manufacturing Activity SurveyTame2/27 9am ET February S&P CoreLogic CS home priceTame2/27 10am ET February Conference Board Consumer ConfidenceTame- 2/

28 8:30am ET 4QS 2023 GDPTame 2/29 8:30am ET January PCETame

Key incoming data January:

1/02 9:45am ET S&P Global Manufacturing PMI December FinalMixed1/03 10am ET December ISM ManufacturingTame1/03 10am ET JOLTS Job Openings NovemberTame1/03 2pm ET December FOMC Meeting MinutesTame1/04 9:45am ET S&P Global Services & Composite PMI December FinalTame1/05 8:30am ET December Jobs ReportMixed1/05 10am ET December ISM ServicesTame1/08 9am ET Manheim Used Vehicle Index December FinalTame- 1/

11 8:30am ET December CPIDetails Suggest Tame 1/12 8:30am ET December PPITame1/16 8:30am ET January Empire Manufacturing SurveyTame1/17 8:30am ET January New York Fed Business Activity SurveyTame1/17 8:30am ET December Retail Sales DataStrong1/17 9am ET Manheim Used Vehicle Index January Mid-MonthTame1/17 10am EST January NAHB Housing Market IndexMixed1/18 8:30am ET January Philly Fed Business Outlook SurveyTame1/19 10am ET U. Mich. Sentiment and Inflation Expectation January PrelimTame1/24 9:45am ET S&P Global PMI January PrelimMixed1/25 8:30am ET 4QA 2023 GDPMixed1/26 8:30am ET December PCETame1/29 9:30am ET Dallas Fed January Manufacturing Activity SurveyTame1/30 9am ET January S&P CoreLogic CS home priceTame1/30 10am ET January Conference Board Consumer ConfidenceTame1/30 10am ET JOLTS Job Openings DecemberMixed1/31 2pm ET FOMC Rate DecisionTame

Key incoming data December

12/01 9:45am ET S&P Global Manufacturing PMI November FinalTame12/01 10am ET November ISM ManufacturingStrong12/05 9:45am ET S&P Global Services & Composite PMI November FinalStrong12/05 10am ET JOLTS Job Openings OctoberTame12/05 10am ET November ISM ServicesStrong12/06 8:30am ET 3QF 2023 Nonfarm ProductivityStrong12/07 9am ET Manheim Used Vehicle Index November FinalTame12/08 8:30am ET November Jobs ReportTame12/08 10am ET U. Mich. Sentiment and Inflation Expectation December PrelimTame12/12 8:30am ET November CPITame12/13 8:30am ET November PPITame12/13 2pm ET FOMC Rate DecisionDovish12/14 8:30am ET November Retail Sales DataTame12/15 8:30am ET December Empire Manufacturing SurveyTame12/15 9:45am ET S&P Global PMI December PrelimTame12/18 8:30am ET December New York Fed Business Activity SurveyTame12/18 10am ET December NAHB Housing Market IndexTame12/19 9am ET Manheim Used Vehicle Index December Mid-MonthTame12/20 10am ET December Conference Board Consumer ConfidenceTame12/21 8:30am ET 3QT 2023 GDPMixed12/21 8:30am ET December Philly Fed Business Outlook SurveyMixed12/22 8:30am ET November PCETame12/22 10am ET: U. Mich. Sentiment and Inflation Expectation December FinalTame12/26 9am ET December S&P CoreLogic CS home priceTame12/26 10:30am ET Dallas Fed December Manufacturing Activity SurveyTame- 12/29 9:45am ET December Chicago PMI

Key incoming data November

11/01 9:45am ET S&P Global PMI October FinalTame11/01 10am ET JOLTS Job Openings SeptemberMixed11/01 10am ET October ISM ManufacturingTame11/01 10am ET Treasury 4Q23 Quarterly Refunding Press ConferenceTame11/01 2pm ET FOMC Rate DecisionDovish11/02 8:30am ET: 3Q23 Nonfarm ProductivityTame11/03 8:30am ET October Jobs ReportTame11/03 10am ET October ISM ServicesMixed11/07 9am ET Manheim Used Vehicle Index October FinalTame11/10 10am ET U. Mich. November prelim Sentiment and Inflation ExpectationHot11/14 8:30am ET October CPITame11/15 8:30am ET October PPITame11/15 8:30am ET November Empire Manufacturing SurveyResilient11/15 8:30am ET October Retail Sales DataResilient11/16 8:30am ET November New York Fed Business Activity SurveyTame11/16 8:30am ET November Philly Fed Business Outlook SurveyTame11/16 10am ET November NAHB Housing Market IndexTame11/17 9am ET Manheim Used Vehicle Index November Mid-MonthTame11/21 2pm ET Nov FOMC Meeting MinutesTame11/22 10am ET: U. Mich. November final Sentiment and Inflation ExpectationTame11/24 9:45am ET S&P Global PMI November PrelimMixed11/27 10:30am ET Dallas Fed November Manufacturing Activity SurveyTame11/28 9am ET November S&P CoreLogic CS home priceTame11/28 10am ET November Conference Board Consumer ConfidenceTame11/29 8:30am ET 3QS 2023 GDPStrong11/29 2pm ET Fed Releases Beige BookTame11/30 8:30am ET October PCETame

Key incoming data October

10/2 10am ET September ISM ManufacturingTame-

10/3 10am ET JOLTS Job Openings AugustHot -

10/4 10am ET September ISM ServicesTame 10/6 8:30am ET September Jobs ReportMixed-

10/6 9am ET Manheim Used Vehicle Index September FinalTame 10/10 11am NY Fed Inflation ExpectationsMixed-

10/11 8:30am ET September PPIMixed 10/11 2pm ET Sep FOMC Meeting MinutesTame-

10/12 8:30am ET September CPIMixed -

10/13 10am ET U. Mich. September prelim 1-yr inflationMixed 10/16 8:30am ET October Empire Manufacturing SurveyTame10/17 8:30am ET October New York Fed Business Activity SurveyTame10/17 8:30am ET September Retail Sales DataHot10/17 9am ET Manheim October Mid-Month Used Vehicle Value IndexTame10/17 10am ET October NAHB Housing Market IndexTame10/18 8:30am ET September Housing StartsTame10/18 2pm ET Fed releases Beige BookTame10/19 8:30am ET October Philly Fed Business Outlook SurveyTame10/19 10am ET Existing Home SalesTame10/19 12pm ET Fed (including Powell) at Economic Club of New York10/24 9:45am ET S&P Global PMI October PrelimTame-

10/26 8:30am ET 3Q 2023 GDP AdvanceStrong 10/27 8:30am ET September PCETame10/27 10am ET Oct F UMich Sentiment and Inflation expectationTame10/30 10:30am ET Dallas Fed September Manufacturing Activity SurveyTame10/31 8:30am ET 3Q23 Employment Cost IndexMixed10/31 9am ET August S&P CoreLogic CS home priceMixed10/31 10am ET October Conference Board Consumer ConfidenceTame

Key incoming data September

9/1 8:30am ET August Jobs ReportTame9/1 10am ET August ISM ManufacturingTame9/6 10am ET August ISM ServicesMixed9/6 2pm ET Fed releases Beige BookTame9/8 9am ET Manheim Used Vehicle Index August FinalTame9/8 2Q23 Fed Flow of Funds ReportTame-

9/13 8:30am ET August CPIMixed -

9/14 8:30am ET August PPITame -

9/15 8:30am ET September Empire Manufacturing SurveyTame 9/15 10am ET U. Mich. September prelim 1-yr inflationTame-

9/18 8:30am ET September New York Fed Business Activity SurveyTame -

9/18 10am ET September NAHB Housing Market IndexTame 9/19 9am ET Manheim September Mid-Month Used Vehicle Value IndexMixed9/20 2pm ET September FOMC rates decision-

9/21 8:30am ET September Philly Fed Business Outlook SurveyMixed 9/22 9:45am ET S&P Global PMI September Prelim9/25 10:30am ET Dallas Fed September Manufacturing Activity Survey9/26 9am ET July S&P CoreLogic CS home price9/26 10am ET September Conference Board Consumer Confidence

Key incoming data August

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame8/10 8:30am ET July CPITame8/11 8:30am ET July PPITame8/11 10am ET U. Mich. July prelim 1-yr inflationTame8/11 Atlanta Fed Wage Tracker JulyTame8/15 8:30am ET Aug Empire Manufacturing SurveyMixed8/15 10am ET Aug NAHB Housing Market IndexTame8/16 8:30am ET Aug New York Fed Business Activity SurveyNeutral8/16 2pm ET FOMC MinutesMixed8/17 8:30am ET Aug Philly Fed Business Outlook SurveyPositive8/17 Manheim Aug Mid-Month Used Vehicle Value IndexTame8/23 9:45am ET S&P Global PMI Aug PrelimWeak8/25 10am ET Aug Final U Mich 1-yr inflationMixed8/28 10:30am ET Dallas Fed Aug Manufacturing Activity SurveyTame8/29 9am ET June S&P CoreLogic CS home priceTame8/29 10am ET Aug Conference Board Consumer ConfidenceTame8/29 10 am ET Jul JOLTSTame8/31 8:30am ET July PCETame

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings