Tune in to CNBC at 8:00am EST Friday 1/5 to catch me on Squawk Box.

Technically, our recent consolidation in US risk assets likely marks an attractive opportunity following the huge run-up into late December. SPX has managed to alleviate near-term overbought conditions while weekly momentum and breadth remain bullish. Trends in both US Dollar and Treasury yields remain lower despite recent bounce attempts, and an upcoming pullback in yields should coincide with Equities turning back up to test and exceed late 2023 highs. Bottom line, this New Year’s hangover looks nearly complete

A few near-term Positives to mention:

- RSI is no longer overbought on daily nor weekly timeframes on SPY and QQQ.

- 2nd largest SPX sector, Healthcare, has just achieved a relative breakout vs SPX

- Technology’s pullback failed to do any damage to its relative chart vs. SPX

- Trends remain lower in Yields and US Dollar which is supportive of risk assets

- Seasonality remains conducive to bullish gains

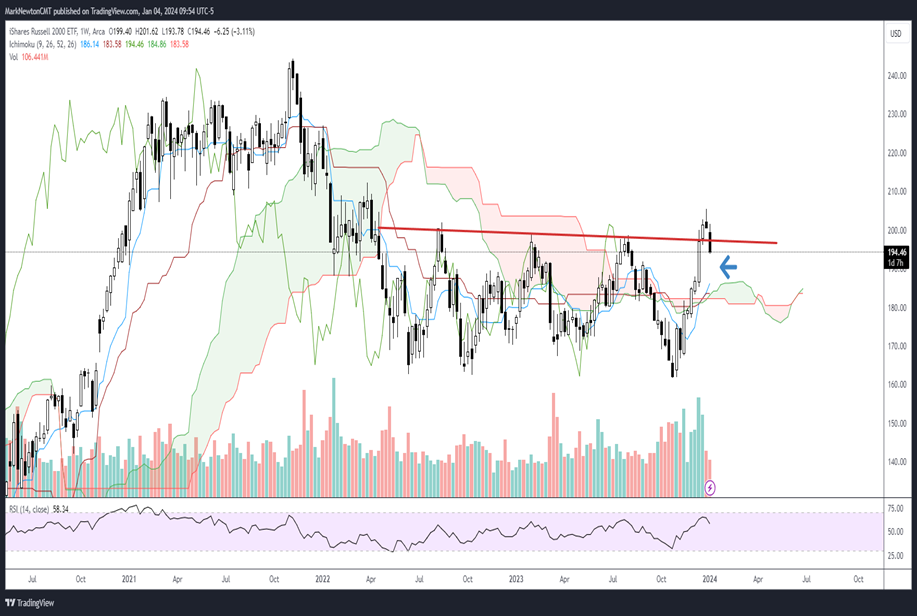

Many investors and strategists wondered if Small-caps might outperform in 2024 as interest rates started to recede and mean reversion helps to lift some of last year’s chronic underperformers. I agree with this and feel that the recent breakout can’t be considered false, despite weakness in recent weeks.

As daily charts show, prices have given back nearly 25% of the rally from late October, but are nearing key support which should help prices stabilize and turn back higher. My thinking on this is based on a few key metrics:

- Weekly momentum remains quite positive on IShares Small-cap ETF, IWM -0.12%

- IWM did achieve a breakout to the highest levels of 2023 ahead of recent weakness

- Relative breakout vs. S&P helped momentum on a ratio of Small-caps to SPX turn up sharply. Despite this pullback of late, this bullish momentum has not been reversed

- Interest rate trends remain sharply lower since October and bounce has not been sufficient to argue that yields are turning back up

- IWM -0.12% has now given back 25% of prior rally from October. For those who loved Small-caps given the breakout, this recent pullback should make them a better technical risk/reward given ongoing bullish weekly momentum.

My technical target for IWM -0.12% is $191.50-$193.50 and this range might be reached on Friday, and should be strong support. This would allow IWM to completely fill the gap from 12/13-12/14 and also represents an area of daily Ichimoku support. Thereafter, I expect a push back to new monthly highs into late January.

Russell 2000

IWM vs. Equal-weighted S&P 500 has nearly retraced 50% of gains which should be important

Here’s another perspective of Small-caps, when viewed in relative terms to the Equal-weighted S&P 500. (Ratio chart of IWM -0.12% to RSP -0.39% )

As the weekly chart shows below, this ratio moved to the highest levels in more than a year into year-end 2023 before giving back nearly 50% of this outperformance in short order over the last two weeks.

As can be seen below, weekly momentum remains quite positive and should afford buying opportunities for those who might have missed the recent advance and might be looking to add Small-cap exposure.

Overall, I don’t view recent underperformance as being all that damaging for IWM, either in absolute nor in relative terms. Thus, recent weakness should spell opportunity as the risk/reward looks far improved, particularly given the ongoing three-month downtrend in Treasury yields.

January seasonality typically shows some early month weakness in Election years before rally resumes

Looking at Election year seasonality going back since 1950, we see that January trajectory can often be a bit choppy, which dovetails with recent US Equity market price action.

Regardless of looking at 70-year history or 90-year history, early January weakness tends to lead higher into mid-month before some Expiration week consolidation.

Thereafter, a strong rally has typically ensued which takes prices back to highs.

Interestingly enough, rallying into late January this year would line up with a possible three-month anniversary of prior October price lows in SPX last year, along with a six-month anniversary of the prior peak from last July. As many investors are aware, three-and six-month anniversaries from prior turning points can often be important to monitor for a potential change of trend.

Additionally, this anniversary would happen to coincide right near the next US Treasury quarterly refunding and last October’s announcement coincided with a fairly pronounced reversal in the bond market.

Overall, I view that US Equities likely bottom by the 8th day of January, but this month could still offer some choppy trading, if history is any guide, ahead of a month-end rally.

Biotechnology should be favored within Healthcare in January

Biotechnology looks to be finally starting to show some strength following a very lackluster 2023. Similar to Small-caps, Biotech could show some mean reversion and outperform this year as the Healthcare trade begins to kick back into favor.

While Healthcare as a group has gotten stretched lately, and XLV is now trading near three different prominent peaks going back over the last few years, Biotech should be able to relatively outperform.

My thesis is based on rates continuing to slide, along with mean reversion playing out in Biotech stocks this year relative to the broader Healthcare space.

As this weekly relative chart of XBI -0.86% vs. RSPH -0.52% shows (SPDR Series Trust S&P Biotech ETF, relative to Equal-weighted Healthcare ETF (by Invesco)), Biotech has been slowly but surely strengthening in recent months.

This downtrend from 2022 was actually exceeded last week in the ratio of Biotech to the broader Healthcare space, which was considered a technical breakout. Moreover, no evidence of any counter-trend exhaustion is present which would argue that this breakout is false (unlike what happened in Spring of 2023)

Bottom line, Biotech should be favored for outperformance in Healthcare in the weeks to come. While Pharmaceutical stocks took an early January lead, I expect this sub-sector relative strength to shift to more Biotech related names in the last few weeks of January.

Note, this also is a Small-cap play, as 80%+ of XBI is comprised of Small and micro-cap stocks.

FAVORITE TECHNICAL NAMES

DYN -1.31% , VYGR -2.69% , KROS -4.33% , ATAI -3.69% , ARDX -6.11% , SANA -3.97% , RXRX -3.73% , ARWR -2.55% are some of my technical favorites within the Small-cap Biotechnology space.

Larger Biotech favorites include VRTX -3.35% , REGN -2.71% , INCY -2.43% , EXEL -1.68% , INSM 0.48% to name a few.