Near-term trends for US Equities are bullish, but getting extended as part of negative momentum conditions on weekly and monthly charts, in my view. Treasury yields and US Dollar should be close to bottoming. Equity rallies likely could peak temporarily this week and consolidate into mid-December before any year-end rally.

Monday showed just minor weakness and also negative breadth in Advancers vs Declining issues as well as volume. However, there wasn’t any real evidence of markets showing a meaningful reversal and post-holiday volume proved understandably muted in US trading.

Many key Technology names like AAPL, NVDA, GOOGL among others showed evidence of making minor peaks in price. Yet, more is needed to think that these stocks and Technology as a whole is starting to weaken. Given confirmed DeMark-based exhaustion (TD Combo Countdown 13) on QQQ daily charts as of Monday’s close under 390.74 and TD Sell Setups on SPY in place since last Thursday’s close, it seems like markets have reached a key make-or-break. Overall, movement down under 378.50 on QQQ and/or below 4500 on SPX should provide better clarity as to the possibility of near-term weakness for “Market Bears”.

However, TNX closed down sharply as did the US Dollar index during Monday’s trading, and it’s thought that both could be nearing lows and start to turn higher in the coming week. This would be a key “tell” that risk assets have begun a probable consolidation period.

Overall, my thesis for December remains intact given the visible signs of stalling out in US Equities over the last few trading sessions. I expect that SPX and QQQ should retrace at least 50% of the rally from October before any push back up above SPX-4600 and QQQ-409 can occur. While fighting seasonal bullish trends this time of year is normally difficult, the risk/reward for investors to initiate new longs with indices right at key resistance looks challenging.

SPX daily charts show the steep rally which has now come within striking distance of Summer 2023 peaks. As discussed before, it should be difficult technically for SPX to immediately climb over this level without consolidation. Thus, I view this as a tricky spot for Longs until either breakouts above SPX 4600 occur, or a meaningful correction to this recent advance occurs.

S&P 500 (^SPX)

Retail looks to be nearing a peak despite the lengthy breakout

Technically speaking, Retail likely shouldn’t continue to demonstrate strength throughout December. Despite early reports of a robust Black Friday, Retail is now facing the possibility of meaningful consolidation over the next month.

Technically speaking, the SPDR S&P Retail ETF has now retraced 61.8% of the decline since July which looks to be important. Furthermore, its Wave structure appears like a minor corrective bounce following a very sharp decline from July 2023.

While one can’t rule out a minor rally attempt to $65-$66, technically the risk/reward looks poor for longs heading into December. Any decline back under $62.50 would argue for a decline down to $60 and could eventually hit $57.50.

As my seasonality table will show in the next chart, Retail is entering one of the worst seasonal months of the year. Thus, the spotlight this week on Retail could prove short-lived before this begins to retrace recent gains.

For those involved in Retail, I’ll provide some long ideas in the days to come through FS Insight’s Flash Insights program. However, I view this sector as being sub-par for longs over the next 4-6 weeks.

SPDR S&P Retail ETF (XRT 1.38% )

Retail has a difficult time outperforming during December

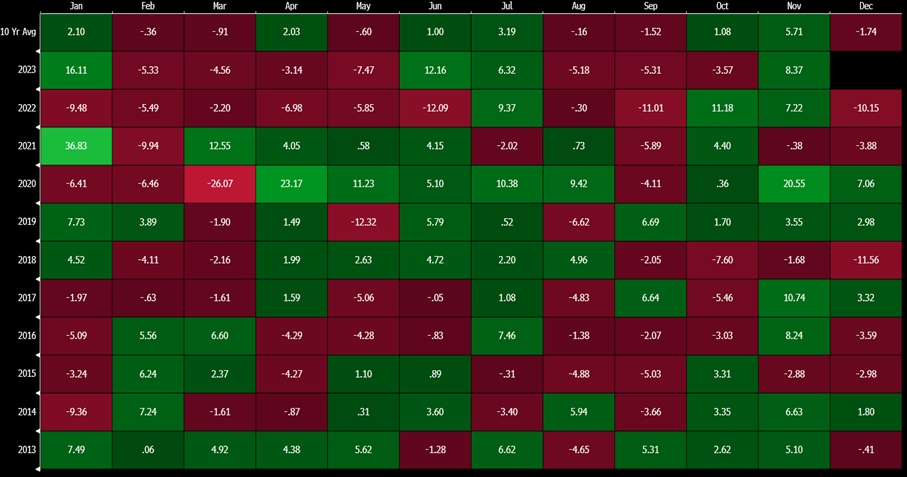

This table showing 10 years of history shows the historical seasonal trends for the Retailing sector.

As can be seen, Retail normally shows an average return of worse than -1.7% over a 10-year average.

While this group tends to thrive ahead of the early holiday season, outperforming in October and November, that trend normally comes to a halt as December gets underway.

Overall, I expect that XRT should be avoided technically until January and expect weakness in XRT in the coming month.

Silver likely to outperform Gold as the Metals start to shine

The last week has brought about a rapid period of catch-up for Silver which as quickly begun to show outperformance over Gold in the last few weeks.

As shown below, the Silver Trust ETF by Ishares, SLV 0.83% , has exceeded a meaningful downtrned from this past Spring which should help jump-star a further rise into year end.

While I’ve spoken about Gold and gold cycles in these reports in recent weeks, it looks to be Silver’s time to show some outperformance over Gold as December gets underway.

Bottom line, I am technically fond of both Silver and Gold and expect the Precious metals recent gains should likely continue into year-end. While both gold and Silver could show absolute gains, it looks more likely that Silver can outperform Gold.

Silver ETF”s like SLV are attractive tehnically and should advance back to test and exceed former 2023 highs. Silver miners also look appealing and SILJ 2.78% , (ETMFG Prime Junior Silver Miners ETF) looks techincally bullish as a vehicle which might outperform on a rise in Silver.

Silver Trust iShares (SLV 0.83% )