Near-term trends for US Equities are bullish, but getting extended as part of negative momentum conditions on weekly and monthly charts. Treasury yields and US Dollar might weaken into US Thanksgiving holiday, but larger breakdowns look premature. An Equity rally looks likely into 11/24 or 11/27-28 before consolidating into early to mid-December.

Tuesday’s NVDA 1.70% earnings, as of 5pm Tuesday EST, had failed to turn in meaningful upside, nor downside volatility for the stock in the after-market session ahead of the earnings call. (Current after-market price was $493 at $5:00 pm EST vs a closing price of $499.44.) Their earnings call might be important towards setting guidance which might provide some further clarity.

Overall, volume has started to wane ahead of the Thanksgiving holiday in US trading. As discussed yesterday, investors need to be on alert for any hint of negative market breadth, or DeMark-based exhaustion appearing on indices and/or on Treasury yields which might be important towards signaling that consolidation might be overdue. SPX and DJIA are not likely to surpass late July peaks right away in my view. Furthermore, QQQ should find strong resistance at or slightly below 2021 peaks before some minor consolidation into mid-December.

Charts below of XLV -0.47% the SPDR Healthcare Sector ETF, show a pronounced breakout of the former downtrend from late July. This is encouraging for Healthcare, which had lagged sharply in recent months. Stocks like A -0.05% , WAT 0.03% , MDT -0.28% , XRAY -3.93% , MTD -0.64% , DHR N/A% and TMO were all meaningful outperformers in Tuesday’s trading.

While much work remains left to do for this sector before one can claim that outperformance is possible in the months to come, Tuesday’s finish at $129.81 would allow for a push up to $132, which lies near October highs. To expect that outperformance is possible for December, it will be necessary for XLV to eclipse $134, which will take some time. However, judging solely based on Tuesday’s (11/21) session, this was a very encouraging “first step” for Healthcare.

Gold’s holiday Luster returns as the push towards all-time highs looks to be underway

Technically speaking, gold’s gains back to near $2000/oz. represented the highest daily close of November and any movement during Wednesday and/or Friday’s trading session above $2006.37 would represent the highest weekly close since this past Spring.

This is quite positive technically, and I expect that gold has begun its push back to new all-time highs.

Cycle composite charts shown last week suggest that an upward bias from now until Year-end could be possible for Gold and it looks attractive at current levels.

Technically a move above 2009.41 should lead to 2060-2080, which has held three separate times since 2020.

However, while this area does look significant as an important level, I suspect gold can surpass this to move back to new all-time highs.

My technical target for gold is $2500/oz, and it looks appealing to be long precious metals given falling real rates, rising cycles and ongoing geopolitical conflict.

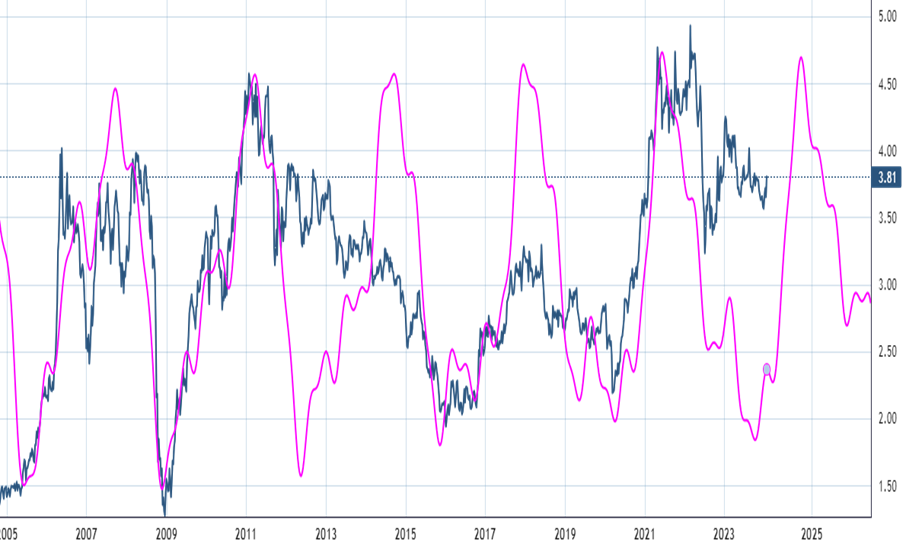

Copper’s recent rebound likely can extend technically with cycles pointing higher into late 2025.

Copper’s recent gains from $3.51 to $3.80 since late October in generic Copper Futures contracts look positive technically and should lead prices up to $4.00/lb. and higher into year-end.

Movement above $3.85/lb. would exceed a downtrend from January, arguing for a push back to test and exceed $4.35 next year.

Overall, cycles look positive for gains into year-end. Furthermore, following any minor consolidation in early 2024, further gains look possible which would finally help Copper begin its long-awaited rally back to test March 2022 peaks near $5.00/lb.

Freeport McMoran (FCX -0.94% ) is a holding within my current technical stock list (Upticks) which I feel has technical promise and might be able to rally as Copper pushes higher given its current positive correlation.

The weekly Copper cycle composite is shown below:

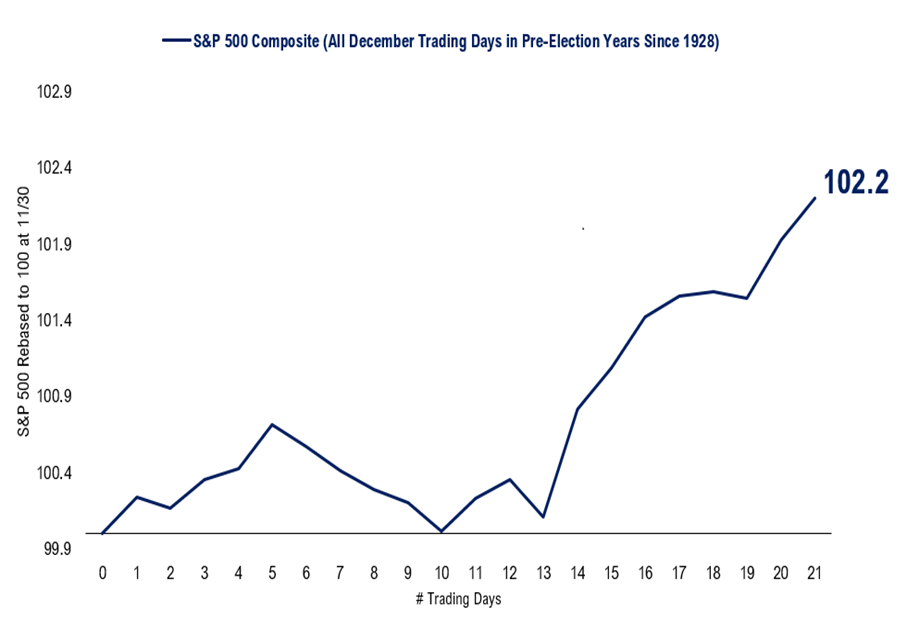

December Seasonality suggests the front half of the month might prove choppy before a bullish 2nd Half

The Pre-election year seasonal tendencies for the month of December since 1928 show that US markets typically experience consolidation into mid-month before bullish trends take hold.

If this continues for 2023, this would directly line up with the potential for consolidation that my cycle composite and also Elliott-wave and DeMark indicators suggest might be possible into mid-December.

Following consolidation, it should be right to expect higher prices in the back half of December.

Wishing all who celebrate a happy Thanksgiving holiday!