US Equity markets are likely in a bottoming process, and I feel that time-wise, lows could likely be in place sometime this week. One can’t rule out a retest of lows which would bring about a mild undercut, and drive SPX likely to 4200-4225. However, this would mark an excellent risk/reward opportunity for an October rally. Importantly, Treasury yields and US Dollar might show a more impressive retreat as an Equity rally gets underway. Bottom line, pullbacks into October coinciding with bearish sentiment likely present opportunity.

Despite the minor pullback on Monday to kick off the first full week of Q4, it remains a “Tale of Two Markets”. Technology continues to show above-average relative strength. Meanwhile many defensive sectors continue to show weakness.

Indeed, this weakness is not limited to defensive sectors like Utilities or REITS, but has engulfed most of the stocks which are tied to the consumer. Both Staples and Discretionary have shown some outsized absolute and relative losses of late. However, Small-caps along with Regional Banks, and Transportation issues also suffered underperformance on Monday.

Moreover, assets that are interest-rate sensitive are being hit very hard to kick off the new week. Given the spike in real rates, gold and Silver have retreated sharply. Utilities showed nearly 4% losses in Monday’s trading alone while the REITS also underperformed.

As mentioned last week, despite markets being in a “window” for a possible bottom in US Equities, the first proof will come from evidence of Treasury yields and the US Dollar peaking out. It’s thought that Technology very well has the power to hold up the broader market while some of these laggard sub-groups attempt to carve out a bottom.

Bottom line, last week’s support and resistance targets remain important. It’s thought that SPX will need to exceed 4335 at a minimum for any type of conviction and DJIA needs to recoup $34029. QQQ, meanwhile, should need to get back over $364.50 for some added confidence.

Any move above SPX-4335 on a close likely signifies that the “rally is on” Therefore, while 4288 (current levels, based on 10/2/23’s close for SPX) has no real appeal for making big bets, any rise from here above 4335, or decline under 4238 would make SPX attractive for long positioning, in my view.

Ideal support if reached on/near 10/4-5 would materialize at 4190-4220. There’s no need for this area to have to be reached. However, it would signify an attractive risk/reward.

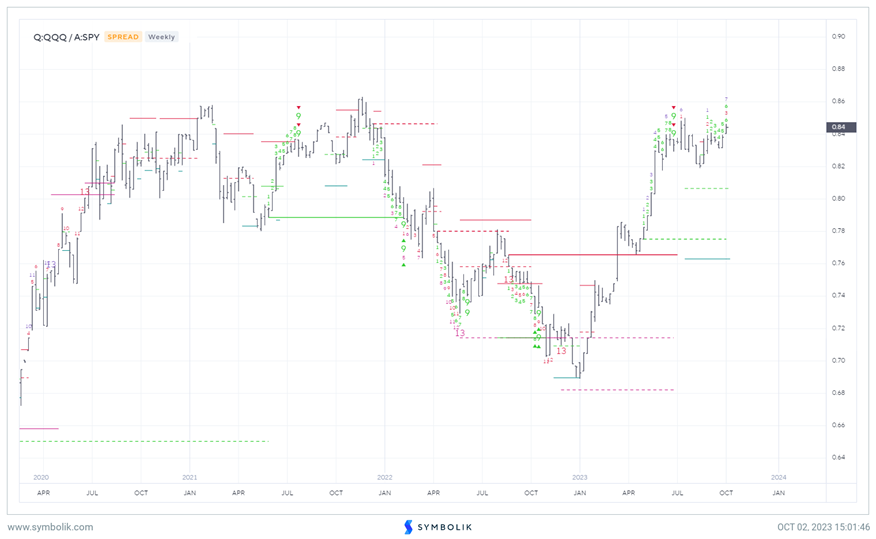

QQQ vs. SPY movement is quite constructive

Despite the SPX and DJIA turning in mixed performance on Monday, QQQ finished higher by 0.85%, thanks largely to ZS -0.38% , NVDA -1.62% , GOOGL 4.49% , ADBE -0.31% , and META -0.45% , all of which finished up more than 2%.

This push back to multi-week highs in this ratio of QQQ vs SPY is important, as it shows that Technology can indeed hold the broader market up quite well despite other areas like Small-caps, Financials, and Transports weakening.

This looks like the start of additional outperformance from QQQ, and I feel this can continue once there is more solid evidence of a Treasury rally. At present, while many parts of the market aren’t working, Technology remains a solid choice for technical outperformance and good relative strength, in my view.

Utilities sector hits lowest levels in three years

Incredibly enough, Utilities sector ETF XLU 0.90% has managed to decline to multi-year lows with its break of last October lows, which happened late last week. Pullbacks of greater than 5% in EVRG 0.95% , D 1.21% , PCG -0.15% , NI 0.47% , AES 1.27% , and NEE 1.32% today have resulted in Utilities growing very oversold very quickly.

Yet, it remains difficult to consider XLU attractive, despite the weakness. While a rollover in Yields might make XLU eventually seem appealing to consider, the large daily ranges of distribution in recent days make a pullback to the low $50’s more likely than not in the days ahead.

DeMark exhaustion remains 2-3 weeks away at a minimum for a meaningful weekly exhaustion signal via TD Sequential. Meanwhile, any turn back higher in US Equities likely won’t result in positive flows towards Defensive sectors like Utilities.

My Underweight rating for Utilities remains intact, technically speaking, and I anticipate further relative weakness.

Gold and Silver have nearly reached downside targets after severe weakness over the last week

Similar to weakness in defensive groups like Utilities, the precious metals have also suffered given the recent spike in Real rates, and Gold has officially violated its 50% retracement ratio of the rally off last 2020 lows.

I suspect that Gold and Silver are both nearing support and this might arrive within the next 1-2 weeks after a steep selloff.

At present, it remains difficult to buy from a trend following perspective, and counter-trend exhaustion signals as “buys” are still premature on weekly charts.

Yet the area at 1800-1810 looks important for Spot Gold based on weekly charts. Silver likely will find meaningful support just above March 2023 lows. ($20.708 in Continuous Silver contract)

Overall, both Gold and Silver are starting to look like interesting risk/rewards despite their ongoing downtrends for those who have timeframes of 6-9 months or greater. For those with shorter timeframes who are seeking the best risk/reward, it’s imperative that yields begin to retreat, and some evidence of stabilization show up in the precious metals. At present, both of these are premature but look close.