Markets have entered a window for potential short-term trend change, but do not expect much selling until August. Near-term, an SPX-4500-4600 range might hold into last couple days of July before weakening down to 4350-4400 into mid-August before rally continues

US Equity markets showed some of the biggest signs of weakness in Technology in recent weeks, while most of the Defensive sectors strengthened (and in some cases, broke out)

Trends have not yet been broken, but QQQ has taken the lead in turning down, and has quickly neared the first area of potential support ( On a 2-3 day basis)

Of the 10 warning signs I typically look for to anticipate a possible market correction, about six of these are now intact (See my 2H 2023 Outlook for more details)

Specifically, the following are problematic and normally signal a pullback is near:

- Breadth and momentum divergence on hourly and daily charts

- DeMark exhaustion on multiple timeframes and on multiple benchmark indices

- Exiting a bullish seasonal time and entering a bearish one (Both Aug and Sept )

- “Short-term” individual investor sentiment gauges have entered extreme bullish territory

- Cycles show weakness in August

- Defensive trading looks to be coming back with a vengeance just this week

- Resistance has been reached on NYSE Composite and Equal-weighted S&P 500

To the Bulls credit, however, a lot remains right with this market, and these are as follows:

- Weekly uptrends remain intact, and while QQQ is overbought, other equal-weighted indices are not really that overbought, i.e. Equal-weighted S&P 500, or Value Line’s Arithmetic index show RSI readings in the mid-50’s.

- Rally has broadened out substantially in the last couple months, exactly the opposite of what typically happens before a correction starts (Narrowing of market)

- DJIA and DJ Transportation Average have broken out to 15-month highs to eliminate Dow Theory divergences and aren’t that overbought

- None of the heaviest constituent sectors within SPX, namely Technology or Financials, have broken their respective relative uptrends vs. S&P 500. Healthcare has actually strengthened.

- Key market constituents like AAPL -0.44% and MSFT -0.02% have just pushed back to new all-time highs this past week.

- Institutional sentiment has NOT gotten as bullish, and despite CFTC data showing some short-covering, this remains largely neutral, not bullish

- No evidence of weekly negative momentum divergence and this remains a very important piece of the puzzle as a positive. To expect a large correction after a 10% rally just since mid-March in SPX, markets will need to start to wither more than they have.

(Normally a big market pullback is initiated with weakness, which then retests a number of times and momentum starts to turn down. At present, weekly momentum remains quite strong and showing zero evidence of divergence.)

Bottom line, I do NOT anticipate a large correction, but feel such a decline likely approximate 5%, and might take another 1-2 weeks before this truly starts to get underway. (Thus, some choppy back and forth trading looks possible over the final week of July, but momentum and breadth could show further deterioration during this time ahead of a trend break.

QQQ looks to have strong initial support near 370 which might hold Friday and attempt to bounce into early next week. However, a break of 370 on a weekly close would be notable and important.

DeMark indicators now close to lining up to show exhaustion on multiple indices and ETF’s

SPX daily charts showing TD Sequential and TD Combo signals looks to be two days away from possibly registering an official 9-13-9 pattern. ( Sell setup, 13 countdown, followed by Sell Setup) This looks important for a possible turn

QQQ weekly chart by Symbolik now shows its first TD Combo (13 Countdown) signal since a “buy” happened last December 2022 at the lows. This current signal is a “Sell” but is not confirmed. Notice that the prior all-time high peak in late 2021 also had a similar signal.

(It’s important not to overestimate what kind of selling pressure might result of these signals. First, they need to be confirmed, requiring a weekly close under the close from four weeks prior. However, it’s notable that TD Sequential is currently on a 9 count. Thus, minor selling might occur next month before another run higher which helps the TD Sequential signal to form in a few months. )

Industrials, in Equal-weighted form (RGI 0.66% ), also is very close to signaling a TD Sell setup after this huge breakout back to new highs, and could materialize by next week.

As we know, despite what many Financial media anchors are saying, the US market rally over the last month has not been technology dominated. Tech actually underperformed more than half the major S&P Sectors in Equal-weighted terms, and actually underperformed the Equal-weighted SPX!!.

There lies a definite potential for short-term rotation, where Tech, Discretionary, and Industrials “take a breather” while Energy, Financials and Healthcare strengthen. This looks to have happened to a limited extent this past week. Now the defensive sectors are coming back to life.

Healthcare breaking out on absolute basis

First of all, Healthcare (Shown by XLV 0.04% ) broke out of its entire downtrend from last December in Thursday’s session (7/20/23) While this sector typically performs quite well in June and July, and has risen, it’s been a relative disappointment up until lately.

XLV 0.04% was higher by +1.66%, while the Equal-weighted Healthcare ETF by Invesco (RSPH 0.53% ) was higher by +1.07%. Thus, there was some definite large-cap bias in this strength, but both XLV and also RSPH both broke out of key ranges. (JNJ -0.25% , ABT 1.13% , MDT 2.38% , BDX 0.25% , ABBV 0.05% , BAX 0.11% were all up more than 3% on Thursday)

I expect XLV to push higher to $140-$145, and this is a very bullish move. Note, a lot of this strength occurred in large-cap Pharma (more Defensive) while Biotech faltered.

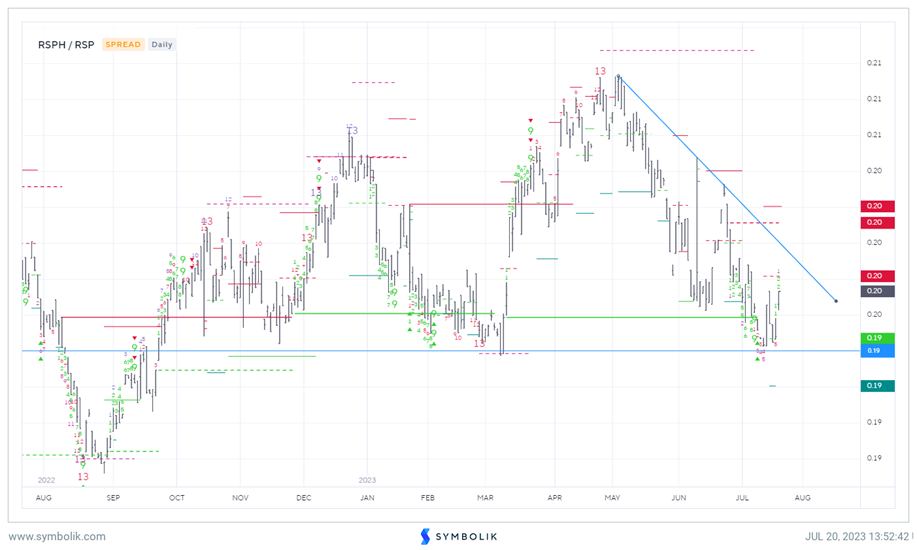

Healthcare has not yet broken out on relative basis to S&P 500

Despite the absolute breakout, Healthcare has not yet broken out in relative terms. This is truly what’s needed to expect meaningful strength out of this group. I expect this might be forthcoming if/when US Equities begin to sputter.

Chart below shows Equal-weighted Healthcare ETF vs. the Equal-weighted S&P 500 (RSPH vs RSP 0.86% )

Consumer Staples just broke out to the highest levels since May. This is an important short-term move in Staples and I expect to see a move up to $35 in the Equal-weighted Consumer Staples ETF by Invesco, shown below (RHS 1.58% )

ADM 0.46% , KR 2.33% , JWN, WMT 0.88% , PEP 0.97% , HRL 1.43% , CAG 2.53% all rose more than 1.6% today. See the daily chart of RSPS below.

Utilities also looks close to breaking out. Note, this might face strong resistance at $68 and show some backing and filling in the next 3-5 days before eventually breaking out.

The coiling of this XLU chart, technically, looks quite positive. However, it’s necessary to await the actual breakout before getting too bullish on Utilities.

Moreover, relative charts of XLU 1.38% to ^SPX just broke down to new yearly lows. Thus, a lot of work is needed in Utilities to think this group begins to meaningfully outperform. But I do expect a breakout sometime in August and might happen in the next week.