Trend bullish- Expect rally up to SPX 4550-65 initially into next Friday, while QQQ likely should stall out also by the end of next week. However, DJIA is now playing catch-up and both Small-caps along with DJIA might begin to outperform QQQ starting next week.

Friday proved to be a lackluster finish to an otherwise stellar week which produced lots of broadening to this rally at a time when the Dollar and Yields have begun to turn down sharply.

While Technology roared back to finish at the highest weekly close since February 2022, there could be some evidence of this sector starting to stall out next week along with Industrials (I’ll cover these both sectors in more detail next week.)

At present, DJIA has begun to play catchup and this week’s close represented the highest weekly close for 2023, and as shown below, DJIA’s momentum gauges are nowhere near overbought levels.

I feel the weeks ahead could prove to be trickier than what happened this past week, where many things worked well across many sectors along with commodities, Treasuries and Cryptocurrencies.

Bullish sentiment is climbing, slowly but surely, and DeMark exhaustion likely will be in place for many US benchmark indices and multiple sectors as of next week. Fortunately to the market’s credit, there hasn’t been much evidence of any Defensive positioning. Furthermore, there are no real signs of sector deterioration just yet in Technology, nor Financials, Industrials nor Discretionary.

Overall, DJIA looks likely to play catchup with SPX in the weeks to come, and might be a better bet than overweighting NASDAQ and large-cap Technology after this runup. (Friday’s trading showed how much Large-caps dominated performance Friday, as both XLK and XLY looked to be in good shape with gains in XLY and minimal damage in XLK. Yet the equal-weighted sectors for both Tech and Discretionary both fell sharply.

Overall, this DJIA chart below certainly doesn’t appear too Toppy, but rather looks to be on the verge of a larger base breakout.

Bottom line, it remains to be seen whether large-cap Tech and Industrials can stall out without causing any kind of selloff given other sectors failing to come to the rescue.

I suspect that Energy and Financials strength will be helpful, but the Materials sector strengthening based on the Commodities breakout won’t translate too much into helping the S&P. At present, this DJIA chart looks quite constructive.

Medical Devices have begun to show more strength

While Healthcare has proven to be a disappointment with numerous failed breakout attempts, groups like Medical Devices look to continue to be gaining ground.

While other sectors like Biotechnology have not yet found their footing, it’s been stocks like ALGN 4.53% , DVA 1.75% , ISRG -0.70% , XRAY -0.18% and IDXX 0.41% that have paved the way, higher by more than 30% year-to-date.

The daily chart of IHI 1.28% , the Ishares US Medical Devices ETF, just closed at the highest levels in more than two months as part of an ongoing modest rally since last October. Friday’s (7/14) rally certainly helped to buoy Healthcare and likely points to further strength in IHI up to $58.50-$59 from its current $56.84.

While Healthcare has been a disappointment in recent months, Medical Devices looks like the best part of Healthcare. I expect this sub-sector to continue to lead in the days and weeks ahead.

Healthcare requires more strength before expecting that this sector can begin to lead

Unfortunately the strength of Medical Devices is not providing too much comfort to Healthcare which is one of three sectors which remains lower over the last three months in Equal-weighted terms (The others are Utilities and Consumer Staples)

This weekly chart of Equal-weighted Healthcare (RSPH 2.10% ) vs. Equal-weighted S&P 500 (RSP 0.58% ) shows the violent pullback after its false breakout attempt this past Spring. The subsequent decline has since broken the minor uptrend from lows made last Fall in 2022.

Unfortunately, while US Equity sectors have certainly begun to work well and have gained ground after an early year hiatus, Healthcare has not begun to turn higher.

Initially, Healthcare needs to turn higher sufficiently to reclaim the area broken shown by the two blue trendlines below. Until this happens, Healthcare will require selectivity when investing.

My UPTICKS technical selection of ISRG -0.70% is still something I favor quite a bit and expect a push back up to former all-time highs. Others like ALGN 4.53% are also quite bullish technically and might be ones to consider within the space for those looking.

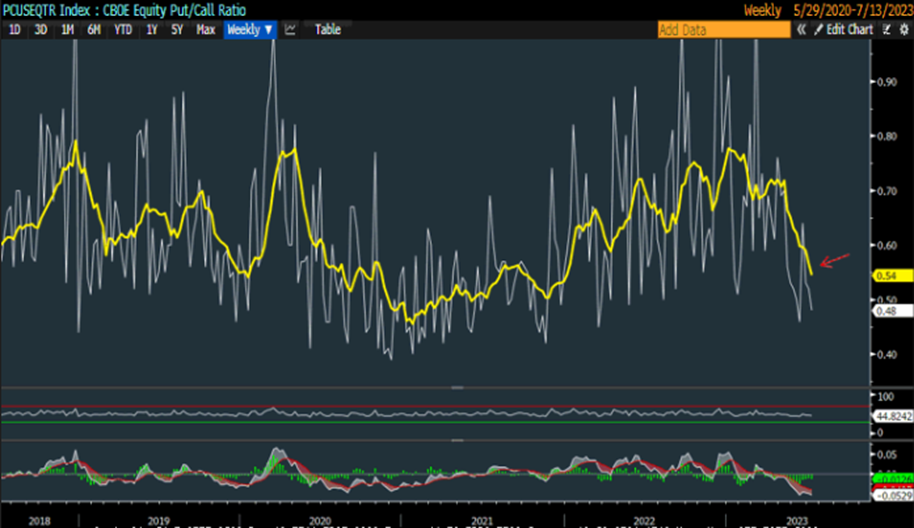

Equity Put/call ratio has started to plummet; This could be something to pay attention to in the weeks ahead.

Equity Put/call ratio has started to dip down under 0.50, or a level where two calls are being bought for every put option.

Technically while daily readings down under 0.45 are certainly a sign of complacency and/or speculation, it’s right to await a 10-week moving average declining under 0.50 before making too much of this first major pullback in Put/call ratio.

Other sentiment gauges have been slowly rising, but it’s still thought that fighting an uptrend based on sentiment alone is a difficult strategy. Until/unless price action begins to show deterioration, it’s still thought that buying markets during times of fear remains easier than selling markets based on complacency.

Recent sentiment data are getting more bullish. Yet these still don’t seem to reflect complacency, and market bears based on CFTC data, and/or cash levels and asset allocation percentages, remain plentiful.