________________________________________________

Today’s note will include a short video update. Please click below to view:

VIX is arguably the largest driver of equities YTD

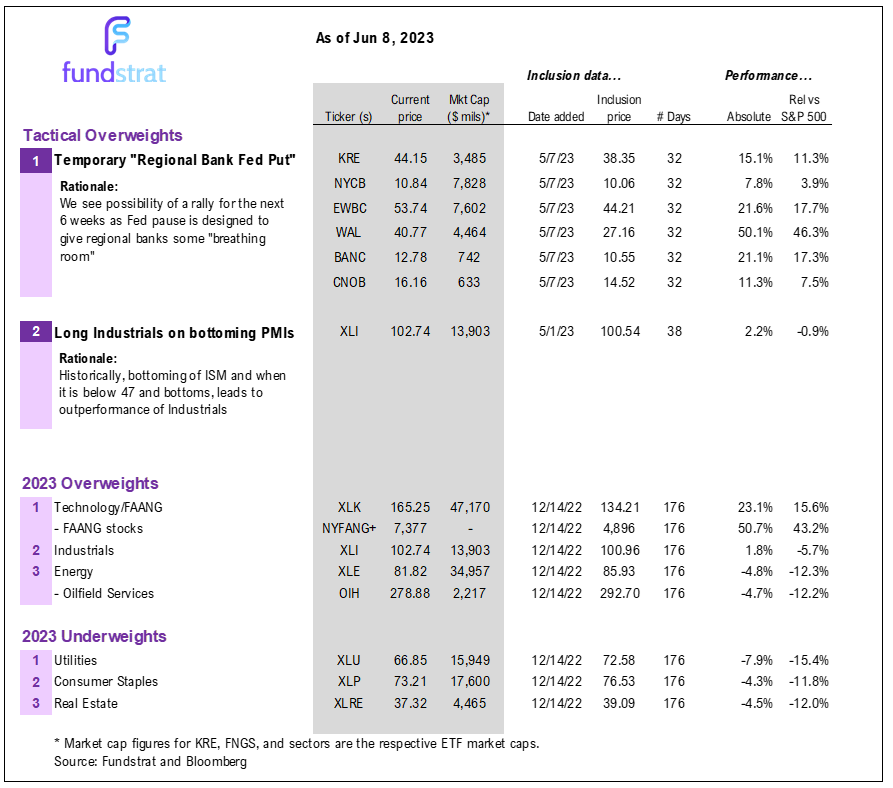

The upside breakout in equities puts the S&P 500 near 4,300, a key round number and near the August 2022 highs (4,325). Our base remains that S&P 500 will gain >20% in 2023, so the 4,300 level is a just a “waypoint” but will eventually give way to the idea that equity markets will make new highs this year. The caveat, however, is that next week will see two events that are arguably the most critical to 2H23:

- June 13: May CPI and the key is a Core MoM inflation <0.4% (Street 0.4% and prior 0.4%). A 0.3% or lower reading would be seen as a positive surprise.

- June 14: June FOMC and a pause is consensus. Oddly, the Fed futures sees 28% chance of a June hike and ~80% of a July hike (cum prob). If May Core CPI <0.4%, then we see these odds dropping to zero for each month.

- So one can see why next week might be the most consequential week for the rest of 2023. Our view remains that inflation is tracking lower than consensus/Fed see and it is just a matter of time before the lagged CPI/PCE reports reflect this reality. We are not the only ones with this view and Professor Jeremy Seigel of Wharton has talked about this many times. Using real-time measures of CPI, inflation is already nearing target (even see Truflation.com).

- And if this plays out, the Fed’s pause will morph into a data dependent mode, where the bar is raised for further hikes. Implicitly, we expect investors to see this as a green light for risky assets, which means equity investors will not be fighting the Fed.

- There has been a lot of talk about the drop in the VIX which fell to 13.65, the lowest close since before the pandemic. In our view, the VIX drop from 25 (average in 2022) to 13.65 explains a large share of the 12% rise in equities. Meaning, the fact that it is now 13.65 is not suggesting this will be a future driver of gains.

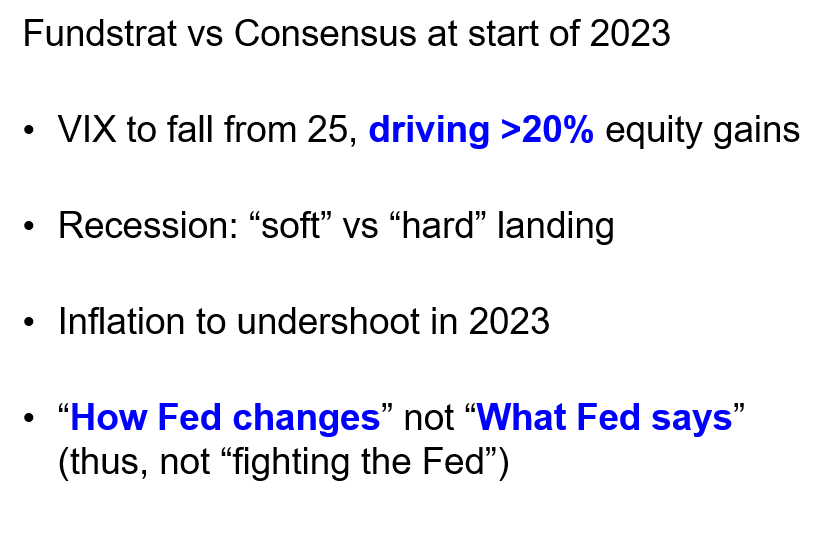

- Clients asked us to explain the variance in our thesis vs consensus at the start of this year, in part to explain why consensus is changing. Among multiple, there are 4 differences (more):

– we expected VIX to fall from 25 (’22 avg) driving >20% gains

– we expected “soft landing” not recession (Consensus)

– we expected inflation to undershoot vs “sticky” <– mixed verdict

– we focused on “how Fed might change” not “what Fed says”

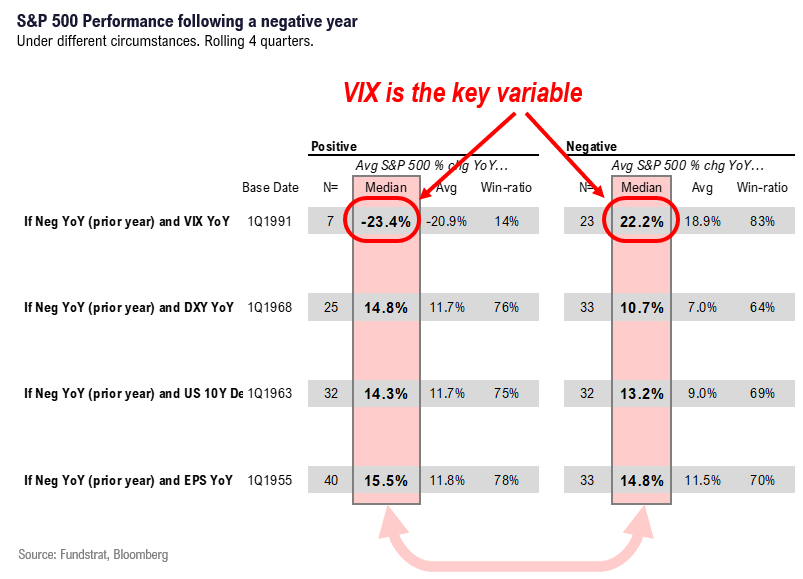

– this latter point key, thus, we are not “fighting the Fed” - The VIX impact is the least appreciated. Our work from December 2022 shows that in last 30 years, post-negative equity year (2022), when VIX is down YoY, the median gain is 22% (n=7). And this differential is even larger than impacts from USD, EPS or even yields. VIX trajectory, in other words, was the single biggest determinant at the start of 2023. This seems to be playing out today

BOTTOM LINE: Still want to buy dips, as market breadth expanding

So while we do not necessarily see the VIX at 13.65 a “buy signal” on its own, we still see upside drivers for the S&P 500 over the next 6 months. The main driver being that inflationary pressures ease faster than consensus expects and at a pace that will allow the Fed to slow its pace of hikes. Even if the Fed raises rates a few more times in 2023, to us, the key is whether this is in response to rising inflationary pressures. And our view is that these pressures are diminishing. As for investment strategy, we stick with our existing recommendations.

- the laggards of FAANG META 0.58% AMZN 0.70% TSLA -3.59% NFLX 0.68% as we believe FAANG has done heavy lifting YTD and remains our favorite sector pick

- OW Industrials, which we see benefitting from an easing of financial conditions and positively leveraged to a rising ISM (which we believe bottomed) XLI 0.47% . Earlier this week we flagged 17 of the most attractive Industrial stocks (see Monday’s report)

- OW Regional banks tactically on the heels of a temporary Fed put and if the Fed is on hold in June, this gives further berth KRE 1.45% NYCB EWCB WAL 1.66% BANC -0.06% CNOB -0.86% .

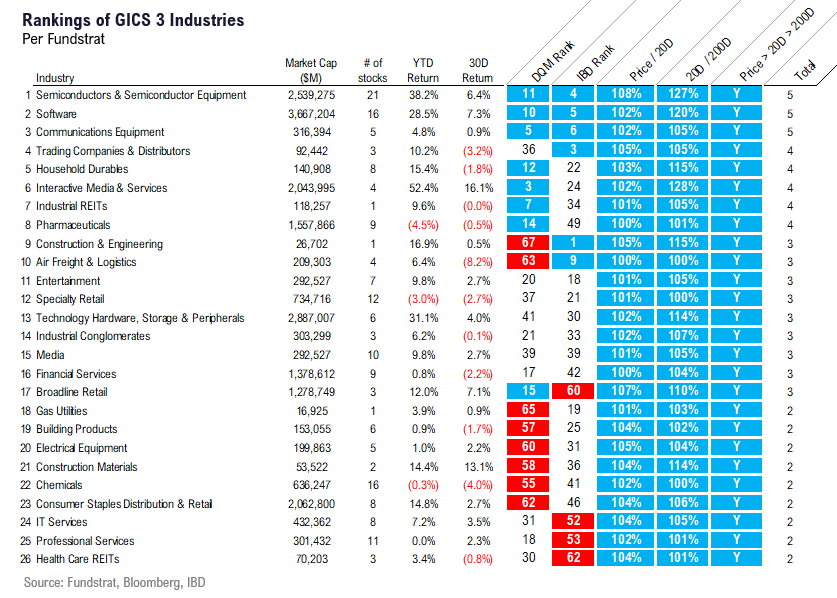

- Market breadth is notably improving, and we have listed the 26 groups (GICS Level 3) that are attractive on our composite analysis using a methodology developed by tireless Ken. See this group below.

- Additionally, by the outperformance of small-caps IWM 0.63% this week, and overall measures of breadth are improving. Our other top 3 sector is Energy XLE 1.50% and while this group has lagged YTD, the overall 3-5 year outlook remains attractive.

Top 26 Groups — per Tireless Ken Composite Ranking

GICS Level 3

VIX: The drop in VIX in 2023 is what happens after an elevated VIX in 2022

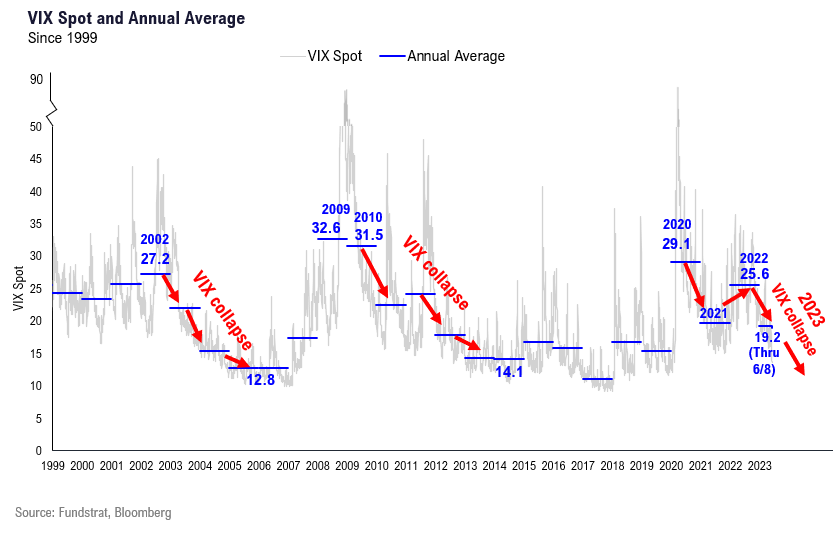

The drop in the VIX in 2023 is typical and what is expected after a surge in VIX in 2022. As shown below, when the VIX is elevated ala 25.6 in 2022, those surges are typically followed by a multi-year VIX collapse.

- the VIX in 2023 has fallen to its lowest level since prior to the pandemic.

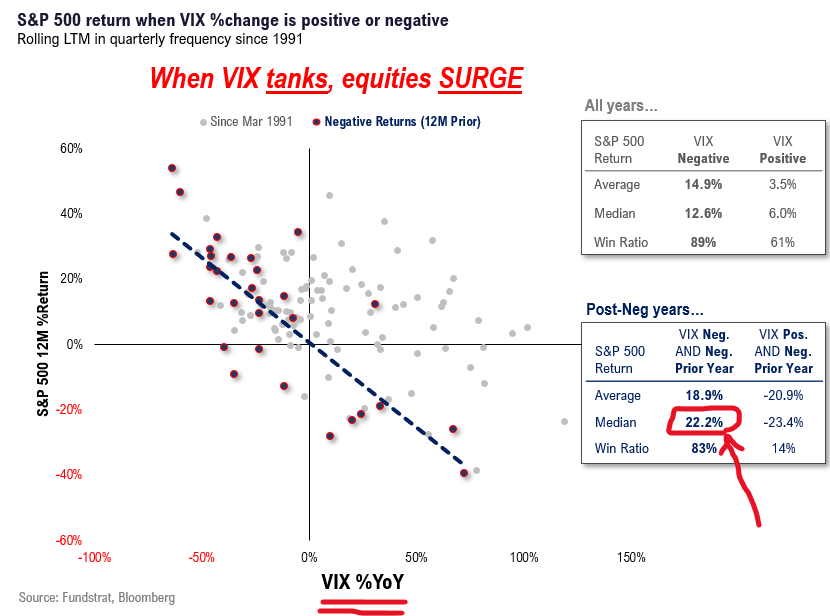

And as this scatter below shows, when the VIX falls YoY (x-axis), the equity markets typically see strong gains.

- when VIX is down YoY, median gain is 12.6%

- when VIX is down YoY AND S&P 500 was down the prior year, forward return is +22%

- far better

And as shown below, when looking at differential returns, the biggest factor is the drop in VIX

- changes in USD, EPS or even rates, have less influence compared to VIX

VS CONSENSUS: Economists and pundits far too gloomy at the start of 2023

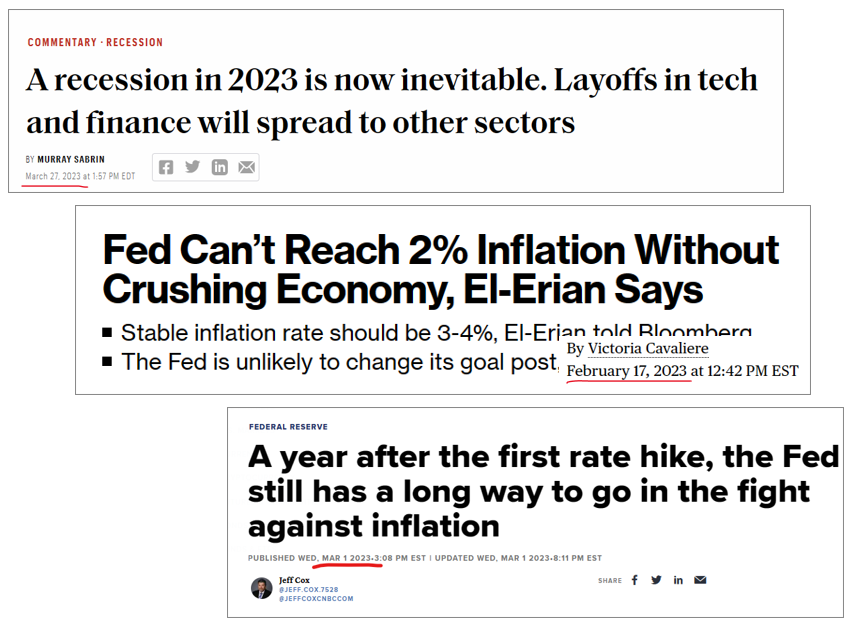

The rise in equity markets is also explained by the fact that the US economy has outperformed expectations. Look below and we can see a sample of views that were widely held at the start of 2023:

- many believe a recession was imminent and “inevitable” citing inverted yield curves

- many said Fed cannot achieve its targets without “crushing the economy”

- many said Fed has to go far more aggressive than its plan, but turns out it is “pausing” instead

So from a macro perspective, the economy has been better.

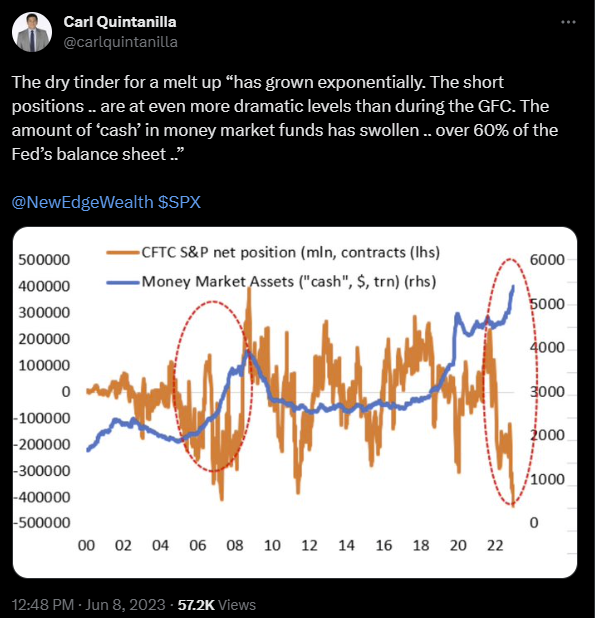

And perhaps we could see sparks given positioning. This chart from Ben Emons of NewEdge highlights two sources of liquidity (shared by @carlquintanilla):

- >$5T of money market cash on sidelines

- massive short position in CFTC futures

We have talked about both in the past, but this point is worth noting again.

ECONOMIC CALENDAR: FOMC key in June

Key incoming data June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame- 6/9 Atlanta Fed Wage Tracker April

- 6/13 8:30am ET May CPI

- 6/14 8:30am ET May PPI

- 6/14 2pm ET April FOMC rates decision

- 6/16 10am ET U. Mich. May prelim 1-yr inflation

- 6/27 Conference Board Consumer Confidence

- 6/30 8:30am ET May PCE

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

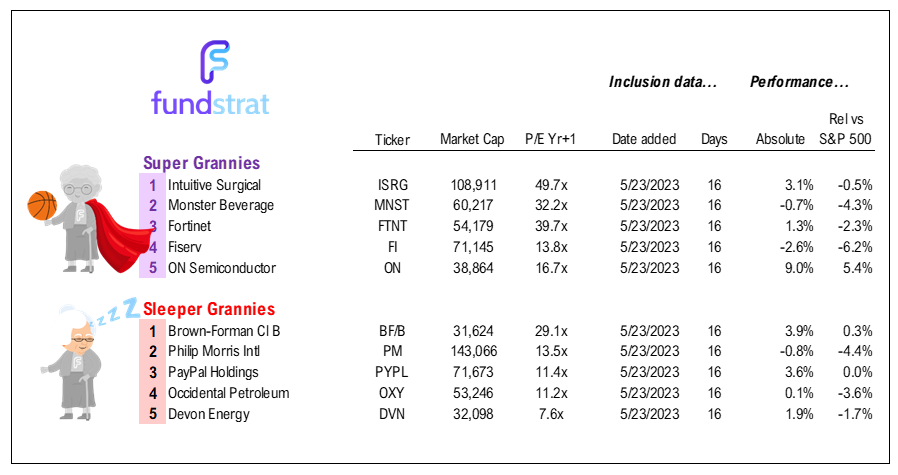

34 Granny Shot Ideas: We performed our quarterly rebalance on 4/26. Full stock list here –> Click here

______________________________

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday