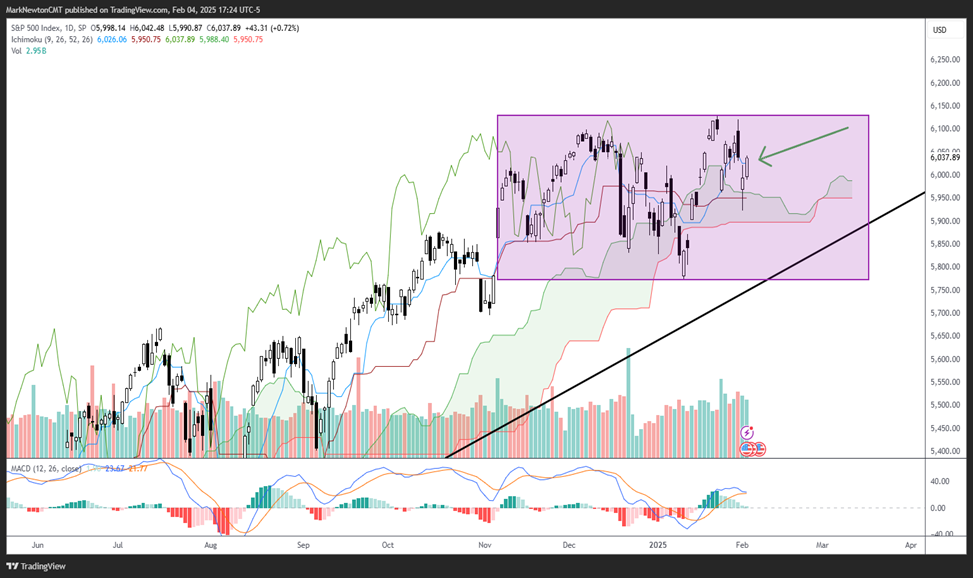

Regardless of the negatives of Monday’s downdraft, along with the ongoing worry of tariffs, US indices continue to hold up in resilient fashion, with SPX having closed within 85 points of the early month all-time highs. The recent consolidation over the last two months has not served to derail the intermediate-term rally, and while I still can’t rule out the possibility of a pullback in the short run, this was always thought to be a temporary affair which should make SPX attractive on weakness over the next 1-2 weeks. At the current time, SPX arguably is running out of time to engineer a selloff and can’t afford to move much higher without postponing any further selloff and steering indices back to new all-time highs.

Two factors look specifically important:

- Treasuries look to be on the verge of a large rally (Given the former (and ongoing) correlation with SPX, this stands to likely be a bullish development for risk assets.

- Sentiment remains quite subdued on the retail front, with many investors, along with legacy media, quite concerned about the effect of tariffs. While I also share those concerns, my takeaway after the last couple of days is: “Don’t believe anything until it actually occurs, as tariffs look to be very much open to negotiation.”

Overall, not much changed on Tuesday as the Equal-weighed S&P 500 rallied just +0.12%. As shown below, this did not recapture the weakness of the prior two days, making this pattern still very much a consolidation pattern.

However, it’s thought that movement back over 181 by tomorrow’s close likely would be sufficient to postpone any decline for now, as RSP rallies back to test late November peaks near $188.

Conversely, any break of $177.70 would put a short-term technical selloff back into place, erasing a bit more (yet likely not violating January lows) before prices bottom.

The bottom line, the near-term trend remains tricky and unhelpful technically, given the lack of any true trend over the last week. However, in the larger scheme of things, trends remain in good shape, and it won’t take too much more progress before the fears of a selloff would be postponed as indices rally back to new highs, in my view. I think the answer to this should be known within the next couple days.

Invesco S&P 500 Equal Weight ETF

SPX large range hasn’t shown any damage despite tariff fears

One point that remains important to continue making is that despite the early fear this year, SPX has shown little to no technical damage.

Even with large-cap Technology having shown some of the worst performance of any major sector in January, other sectors like Healthcare and Financials served to make up the slack.

Overall, I don’t see current levels as being too attractive for making any type of larger call until resolved.

However, the facts remain that:

–SPX remains higher by +17.8% since just last August’s lows, which were made roughly five months ago.

-SPX remains higher by +47.1% from its lows back in October 2023, 15 months ago.

-SPX is higher by 72.9% from the lows back in October 2022, 27 months ago.

Thus, to have a real technical concern, we’ll need to see January lows broken, something I do not expect to happen right away.

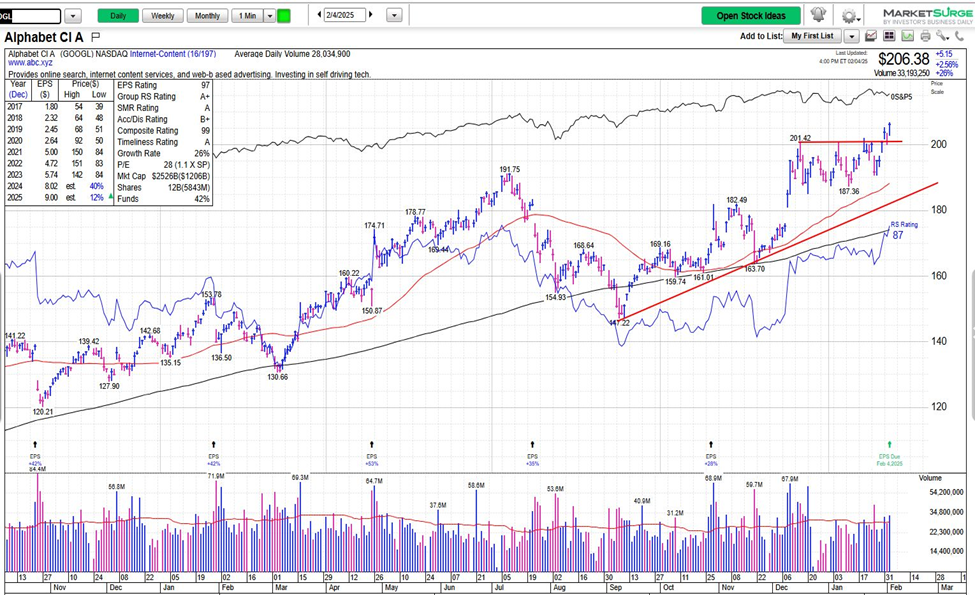

Furthermore, the act of MSFT -0.02% reaching the lows of its 1-year range and GOOGL potentially finding support near $190 on weakness, similar to NVDA having traded down under $120, looks appealing for these names, even if they haven’t made exact short-term lows.

S&P 500 Index

Bottom line, a move back above 6090 should put any short-term selloff fears back on the “back burner” as prices push higher to near 6300 in SPX.

While February normally remains a difficult month seasonally, in post-election years following a shift in administration, prices simply aren’t providing much proof.

I’ll address weakness when I see it technically. However, market bears look to have a very small window before having to “hibernate” yet again as stocks move higher. My thinking is that some definitive answers on this likely will happen by the end of the week.

GOOGL weakness likely represents an opportunity

GOOGL -1.99% did successfully break out of its one-month range prior to today’s earnings last Friday, and while the broader market remains within near-term consolidation since last month, overall GOOGL looks attractive technically.

The stock did trade lower in after-hours trading following the announcement of its Cloud revenue missing, despite its higher-than-expected CapEX numbers, and GOOGL looks to potentially open for trading back in its former consolidation from early last week.

My expectations are that this pullback should prove temporary and not cause much damage to this bullish structure, provided that GOOGL -1.99% does not break $190 on any downside volatility. This is the first meaningful area of support that I expect should hold on to downside weakness by Wednesday’s close, with mid-January lows near $187.36 also being important.

While it’s right to be bullish on GOOGL given this structural progress for a 3-5 month period or longer, the near-term pullback intra-day into earnings might still result in some choppiness near-term before this can follow-through higher.

Keep in mind that the peak late last year occurred near a 100% alternative projection of the rally from Sept into Nov, measured from late Nov. A similar projection to this latest 11/21-12/17 rally has targets near 222.50 which is an intermediate-term technical target for GOOGL.

Technically speaking, it’s important for this to stabilize on Wednesday, not violate $187.36 by the end of the week, and then begin to turn back higher. The ability of GOOGL -1.99% to recapture $200 should help this begin a rally back to just over $222.

Alphabet CI A

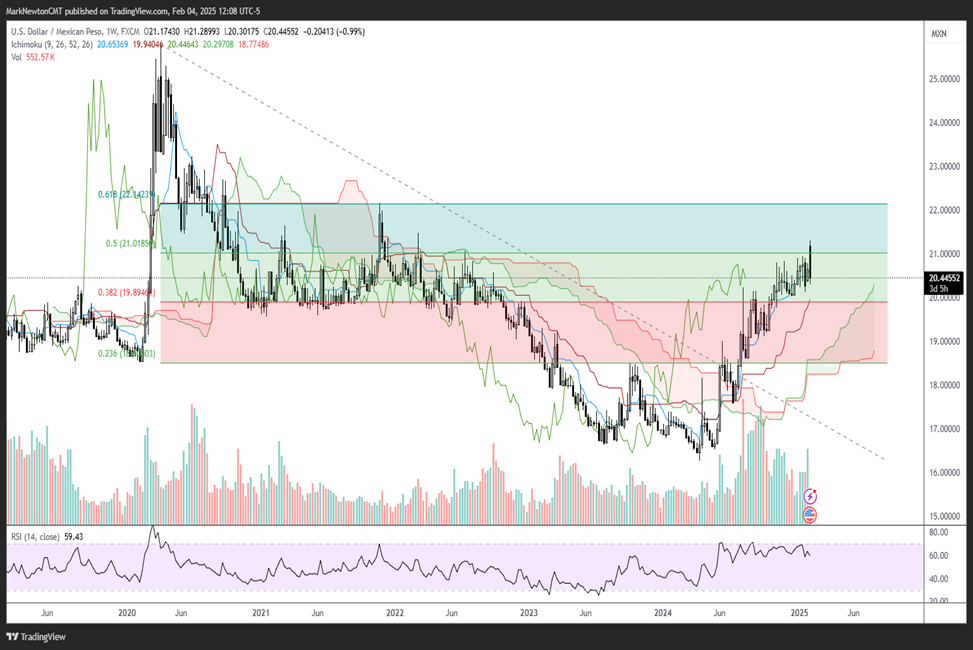

Tariff fears were temporarily postponed, and both the Mexican Peso and Canadian Dollar showed big gains

Both the Mexican Peso and the Canadian Dollar rallied sharply yesterday following the announcement that Tariffs would be postponed for a month, and following early selloffs, both rallied back into their pre-existing ranges. USDMXN, shown here, had been rallying since last Spring as Trump’s lead began to grow, but largely began trading sideways after the Election, awaiting announcements and/or concessions.

My thinking is that yesterday’s reversal was a short-term important development, and likely keeps the further decline of Mexican Peso at bay for now, until further details are know. The large Reversal happened right near a key 50% retracement level of the prior decline from 2020 into 2024 but also coincided with a TD Combo sell signal which was confirmed on the large bearish engulfing pattern.

Overall, I do not expect too much of a rally in the weeks ahead, but I do think that 20 is possible from the current 20.47. Thereafter, news of tariffs might coincide with pushback to new monthly lows for the Peso (highs for USD/MXN), which might reach 22, which is also an important level, representing both a 61.8% Fibonacci retracement level along with prior peaks from late November 2021. So the key takeaway is that the decline in the Peso has stopped for now, and minor gains might be likely, but eventually, I see a further decline, and the Peso might reach 22 to the US Dollar.

U.S. Dollar / Mexican Peso