US Stocks Fall Sharply in Volatile Bear Market Trading 1 and can accesss 1

In this strategy briefing…

Ursa major, the bear, has arrived, supplanting what had been a furiously fast correction in prior weeks. Indeed, it was a wild, volatile descent, and the fastest in history into a bear market. Just 16 trading sessions, ... – The Wall Street Debrief –

Read more

Markets have become deeply pessimistic because the “cure” for the pandemic seems worse than the disease. So the disruption is becoming tangible in the US. and “price discovery” remains non-existent in equities. – Tom Lee's Equity Strategy –

Read more

Call me chicken or ambition challenged, but I wouldn’t want to be in the shoes of Federal Reserve chairman Jerome Powell right about now. Sure, he has free limousine rides everywhere, bodyguards and everyone hangs on ... – Fed Watch –

Read more

|

FS Insight Investment Views

|

The Wall Street Debrief

US Stocks Fall Sharply in Volatile Bear Market Trading

Ursa major, the bear, has arrived, supplanting what had been a furiously fast correction in prior weeks. Indeed, it was a wild, volatile descent, and the fastest in history into a bear market. Just 16 trading sessions, from an all-time high (Feb. 19), was all it took.

Having lived through three major bear markets, including a down 23% day in 1987, and a few near bears in between, I thought I had seen everything. Yet I have never seen the kind of selloff, in terms of speed of momentum reversal, even though 2008-2009 was scarier (so far) and 1987 was basically one day. In the case of the latter, the market had been going down already for over two months before dropping precipitously.

This grizzly is unexpected and unprecedented. It has been coming only for days. Make no mistake: The bears will tell you it was in the cards, but don’t be fooled. No one but no one absolutely knew the coronavirus would appear, and more so, that the market would take it so badly.

Unfortunately, a lot of price damage has been done this week to the U.S. equity market, as well as emotional, economic and technical harm. For more on the latter see Rob Sluymer’s comments on page 9. For the week, the Standard & Poor’s index fell to 2,711, or down about 9% on the week. The SPX entered a bear market Thursday, which was the second worst single market day in history, so at least you can tell your children. I’ve experienced the top two. The MSCI global stock market index had the worst day on record.

The Dow is off 22% from its Feb. 12 record, while the S&P 500 and Nasdaq are 20% and 18% from their Feb. 19 peaks, respectively. There have been times when the market has been able to recover (see page 9) but also times when it has not. In the 1987 bear, stocks returned to new highs in 22 months. But I don’t have to tell you what happened in 1929. For the record, on average, a bear market for the DJIA lasts 206 trading days, while the average bear period for the S&P 500 is about 146 days, according to Dow Jones Market Data.

Now there are several reasons investors have abandoned stocks, but they are all connected to the spread of the coronavirus, because there is likely to be a global economic slowdown. How deep is hard to tell. Some expect a global recession, some do not.

Investors left stocks for bonds because of the travel ban to Europe, announced by President Donald Trump and what’s viewed as his poor response to the virus spread; the precipitous drop in oil prices to around $31 per barrel from $53 in mid-February; and the declaration of a global pandemic by the World Health Organization Wednesday. Whether the latter proves to be the bottom marker if stocks recover remains to be seen, but that’s my bet.

What the Federal Reserve will do continues to be a big investor concern. Markets are expecting an outsized response soon from the Fed. For more on this see page 6. The president has called for the FOMC to drop the Fed funds rate to zero.

What gives me some pause for the near term is that the market tried to mount rallies more than once last week, and that of Friday’s in particular basically fizzled. I have to admit it’s not very encouraging.

As my colleague Tom Lee says in his report below, investors are looking for signs on the trajectory of this pathogen. Will it fade fairly quickly with few fatalities and minor economic disruption or not? The market typically makes knee-jerk emotional reactions, shooting first and asking questions later. Our shop believes the outbreak will be in months not quarters. Once the peak has been reached, the market can make a better assessment of the economic damage.

It’s a given that the first and second quarters will be hurt. According to The Wall Street Journal, economists sharply cut forecasts for the U.S. economy this year, predicting it will contract in the second quarter and raising expectations for a recession as the coronavirus spread around the world. For more on this see page 6.

Perhaps investors will give corporates a pass in 2Q EPS when all the CEOs likely line up to say how bad coronavirus was on profits. Seems discounted already. Lawmakers and the Trump administration are nearing an agreement on legislation aimed at aiding Americans affected by the COVID-19 spread. For more on this see page 11.

As of Friday, according to the John Hopkins Center for Systems and Science Engineering, compared to one week ago there were about 137,500 confirmed cases of COVID-19 vs. 101,000 last week and 84000 the week before; deaths are 5,100 vs 3,460 and 3,000, respectively, with the overwhelming majority of both in China.

Questions? Contact Vito J. Racanelli at vito.racanelli@fsinsight.com or 212 293 7137. Or go to www.fsinsight.com.

Tom Lee's Equity Strategy

Bear Arrives; Markets Want to See U.S COVID-19 Case Peak

I asked for a sanity check last week since the S&P 500 index was selling at a 16 P/E and Treasuries at over a 100 P/E but the response was simple panic. Indeed, in the frenzied and sharply downward trading last week in reaction to the spread of coronavirus, or COVID-19, it seems the market sees the cure as worse than the disease.

That is, it appears increasingly possible that the volatile lurching in financial markets could drive the US economy into a recession, a self-fulfilling prophecy. The market has digested a lot of negative news in the past week, leaving little room for a sanity check.

Several companies drew down credit facilities, like Boeing (BA), Wynn Resorts (WYNN); the World Health Organization declared COVID-19 a pandemic; President Trump’s initiatives fell short of expectations. Tom Hanks and his wife Rita revealed they tested positive for COVID-19 and major league sports have suspended their play.

So the disruption is becoming tangible in the US. and “price discovery” remains non-existent in equities. By that, I mean the market is so uncertain that stock prices are moving in unison on one or two simple macro factors, with high correlations to each other, instead of on their own corporate merits.

Markets have become deeply pessimistic because the “cure” for the pandemic seems worse than the disease. Social distancing, limiting movement, managing intercity and international movements look to be disruptive. Already, industries linked to travel and entertainment, among others, are suffering.

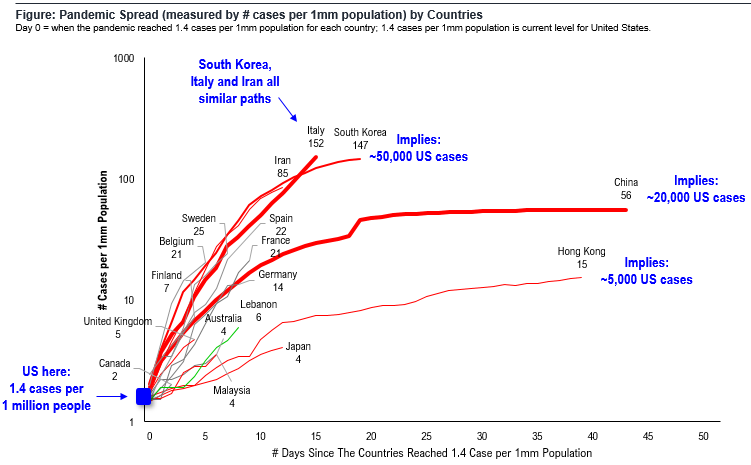

The financial markets volatility is worsening an already weak liquidity environment. Italy has now taken drastic measures to curtail movement. What remains unknown is the ultimate path and level of spread in the US, which has a case count ~1,300 and growing. The paths seen by Iran and even Europe are very similar but Italy seems to be accelerating at a pace that makes this the worst case scenario. This is the reason many investors say the US is two weeks behind Italy.

Despite the panic, rationality is required, and the best way to compare COVID-19 spread between countries, in my view, is to look at cases per 1 million population. Among the fastest spreads have been Italy, Iran and South Korea which saw 85-152 cases per 1 million within two weeks after passing the US milestone (1.4 cases, or 100 times increase in two weeks). This particular measure implies the U.S. could see 50,000 cases by the end of March. (See chart above.)

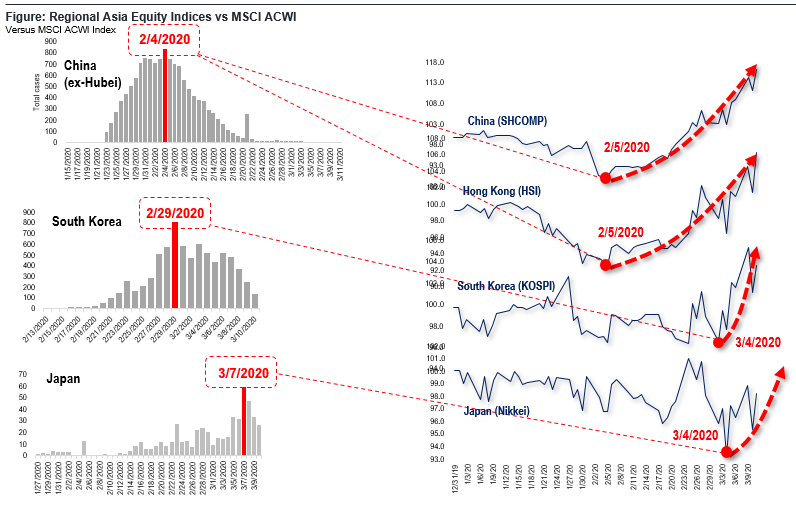

However, this is only one potential path and if cases peak towards the end of the month (Italy seems the exception), this should result in a turning point for the equity markets. This was the case with China, Hong Kong, South Korea and even Japan, so that’s the “bright side” of an adverse case.

I will also point out that the countries with the highest number of cases have the lowest level of toilet hygiene (measured as “percent of people washing hands after using toilet, as China and South Korea are among the worst). Perhaps this could be differentiating national experiences. The U.S. is in the middle on this metric.

Currently, the US has about 1.5 cases per 1 million pop, about the same as Canada. Both nations have reported their first case 40 days ago. This is curious, as it suggests both countries are tracking similarly in terms of disease outbreak. Yet, the US is only testing 5 people per 1 million Pops vs Canada at 222. In a sense, while we expect the cases in US to grow sharply in coming weeks (and no doubt there are many undiagnosed cases), perhaps the path does not have to follow Italy or Iran. The market bottom in the Asia equity markets (vs MSCI) all coincided with the peak in Corona COVID reported cases. (See chart above.) This is why the Street is so fixated on the “case count” in the US and Europe.

In the meantime, stocks remain relentless oversold by many metrics. Some 75% of cumulative 10-day volume is down, an event that has happened only four times since 1990. Just 1.6% of industries are up month over month, something not seen since December 24, 2018 and before that, January 21, 2016.

Those times turned out to both be good times to be long. Finally, another positive development last week was the yield curve fixed itself and is no longer “inverted” from 1 month forward.

What could go wrong? COVID-19 could indeed morph into a more dangerous disease, changing the risk profile and the required response of markets. The good news is China’s cases seem to have peaked and are falling. Moreover, US policy makers and central bankers are ready to take necessary action.

BOTTOM LINE: Price discovery remains non-existent as investors view fundamentals as uncertain. In our view, the panic by US households and markets, while disruptive, is likely to limit the spread of COVID-19. Case peak remains key bogey for markets at the moment.

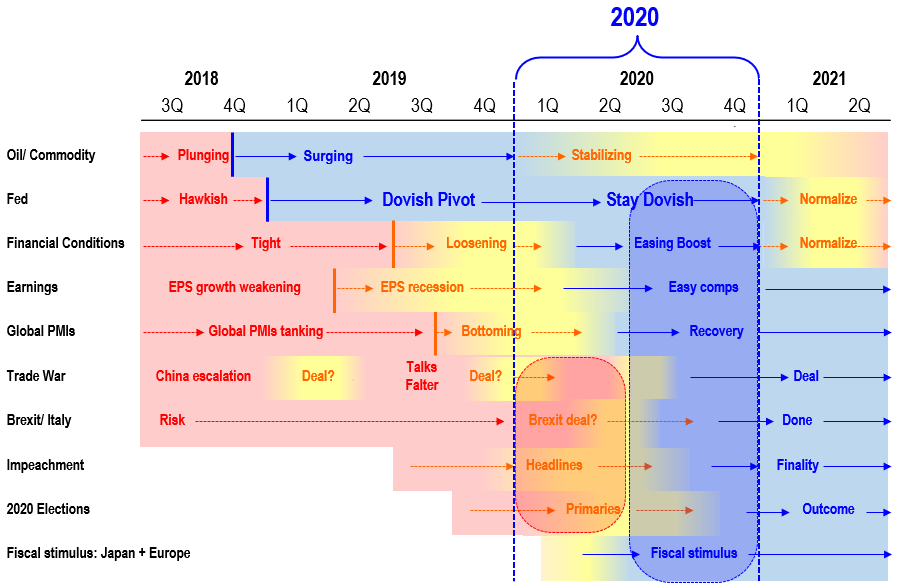

Figure: Comparative matrix of risk/reward drivers in 2020

Per FS Insight

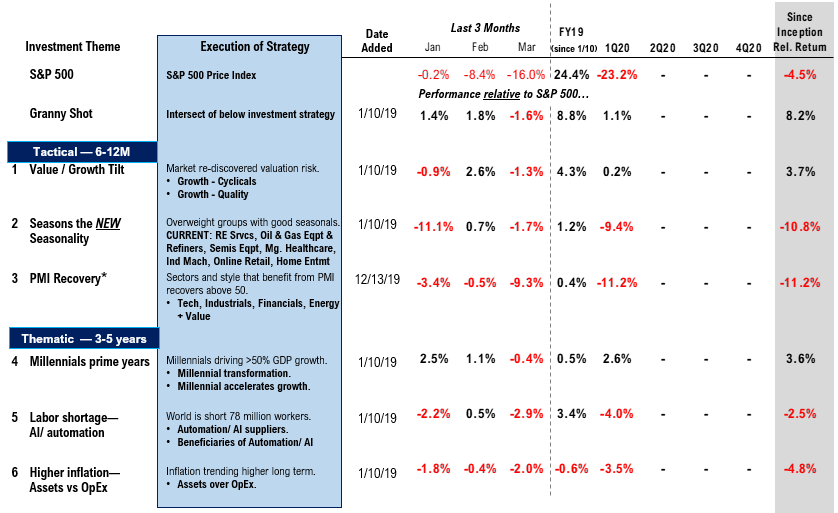

Figure: FS Insight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019

Fed Watch

Market Expects Big Fed Rate Cut in Coming Days; New QE?

Call me chicken or ambition challenged, but I wouldn’t want to be in the shoes of Federal Reserve chairman Jerome Powell right about now. Sure, he has free limousine rides everywhere, bodyguards and everyone hangs on his every word.

But right now Powell and his crew are facing the worst stock market bear since the Great Recession. He cannot just stand there, even if it were to be the best to let the market sort itself out. He has to do something.

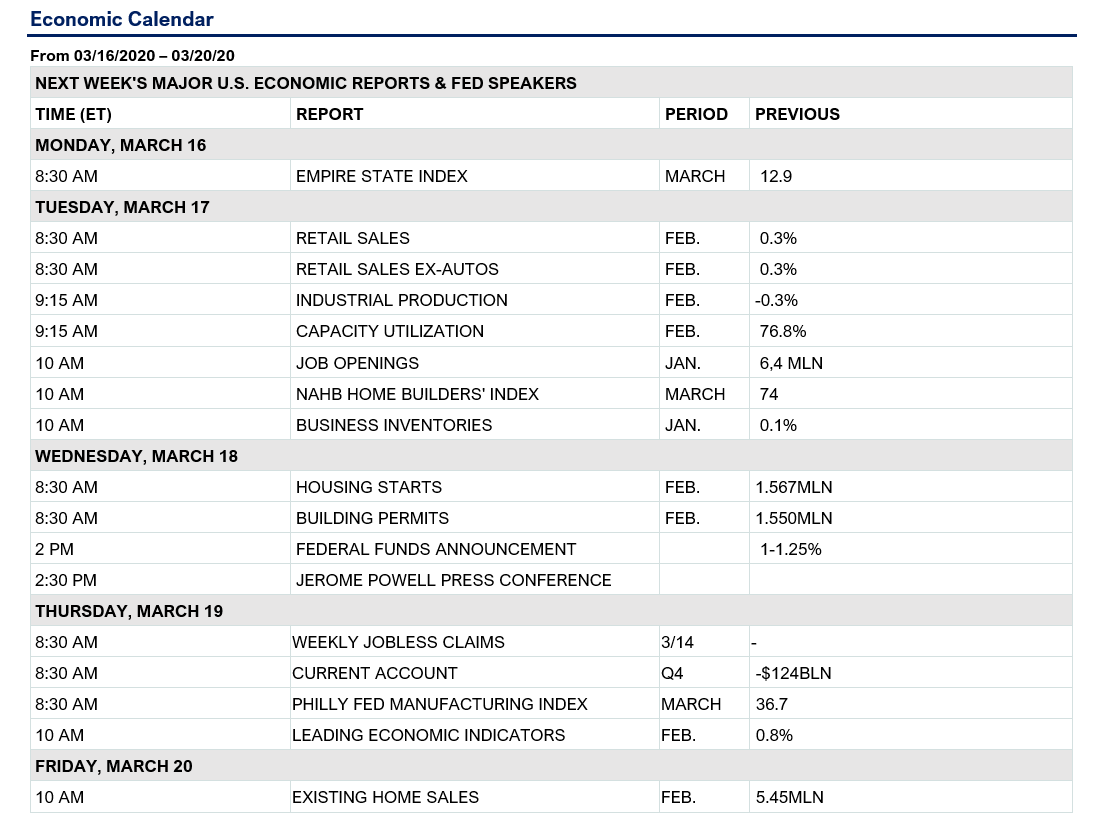

Given we are only days away from the next Fed Open Market Committee (FOMC) meeting (March 17-18), I think we might not see Fed action until then—unless the market continues to tank before then. As bad as things look, the Fed might want the dust to settle before loosening shock and awe.

The CME’s Fed futures market, which has been historically a better predictor of Fed funds rate moves than the famous Fed “dot plots,” is effectively saying there is a very strong probability that the Fed funds rate will drop from 1.00%-1.25% to 0.25%-0.75% and strong probability it will return to zero-0.25%.

That appears to be taken as a given by investors. The wildcard is Quantitative Easing, or QE. The market is buzzing with speculation that some kind of new QE program will be announced. The previous QE saw the Fed expand its balance sheet (and the U.S. money supply) enormously through its purchase of U.S. Treasury bonds in order to bring more liquidity to markets. There is even talk that the Fed would buy equities, which might or might not help the stock market. Some investors could see that as a panic move by the Fed.

In the meantime, the NY Fed surprised markets last week with an announcement Thursday that it would offer up to $1.5 trillion in short-term loans to big banks, in order to “address highly unusual disruptions in Treasury financing markets associated with the coronavirus outbreak.” This represents an expansion of its previous program of supplying liquidity through repo operations and short-term loans in the money markets.

The Wall Street Journal reported that its monthly economists’ survey expects, on average, gross domestic product to contract to 0.1% in 2Q vs a previous projection of 1.9%. They see growth of 1.2%, down from 1.9%. Annual growth was 2.3% in 2019.

Separately, European Central Bank President Christine Lagarde unveiled a modest stimulus package to shield the region’s economy from the fast-spreading coronavirus, but investors weren’t impressed. She suggested the bank might cut rates further if the economic outlook worsens, but analysts were unconvinced. The eurozone economy could shrink 1.2% in 2020, as workers stay home and households cut back on travel, entertainment and large purchases, according to research firm Capital Economics.

The yield on the benchmark 10-year U.S. Treasury note settled at 0.78%, new historic lows, compared to 0.78% one week ago and 1.00% the previous week ago. Unless you think U.S. bond yields are going negative, that asset class looks vulnerable to a Fed trying very hard to lift rates.

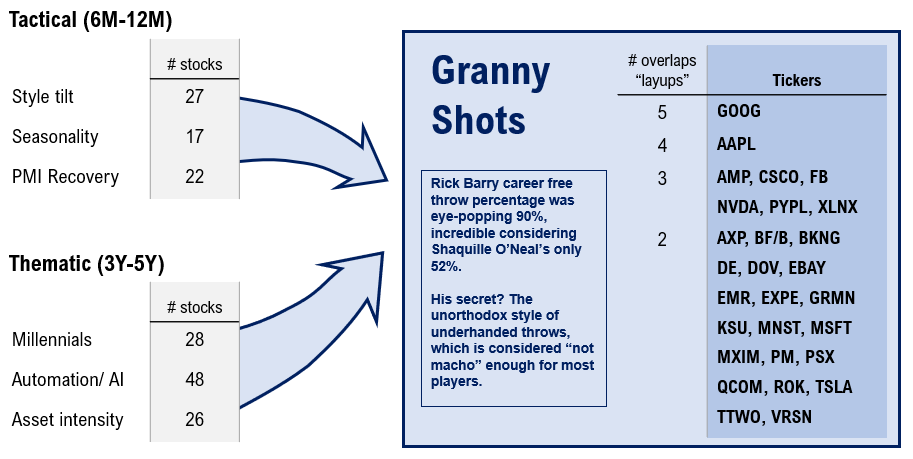

GRANNY SHOTS: Best bets in 2020

GRANNY SHOTS: Best bets in 2020 - Week 11

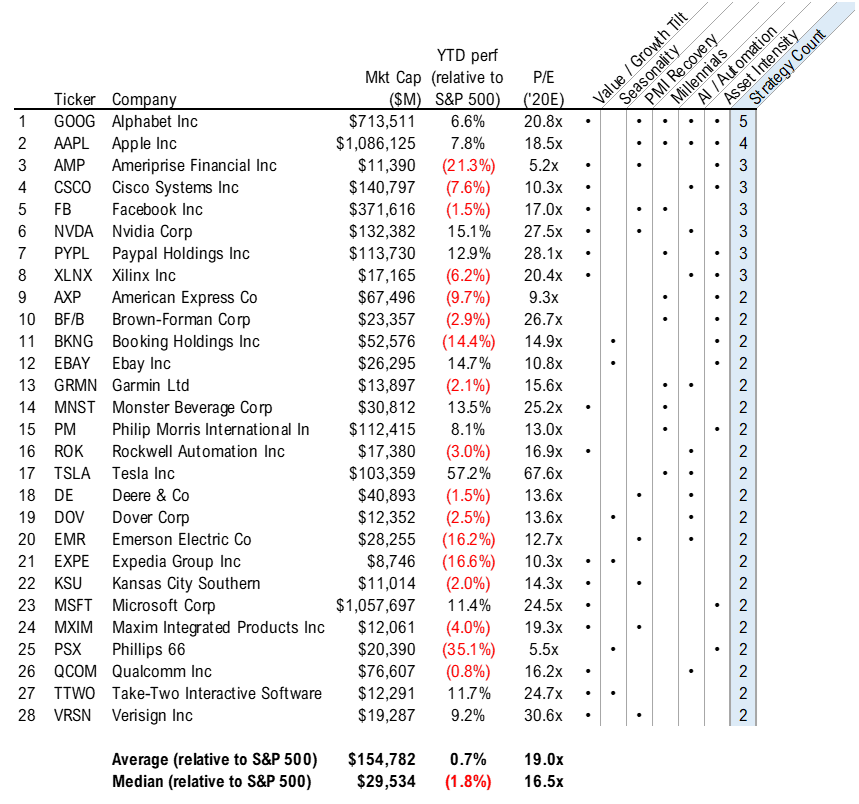

Below we’ve highlighted stocks that we recommend across at least two of our investment strategies for 2020. These companies could benefit from multiple themes and secular tailwinds – clear picks in our view for the first half of 2020.

Figure: Granny Shots are the “best of the best”

Stocks which appear in multiple themes. Source: FS Insight

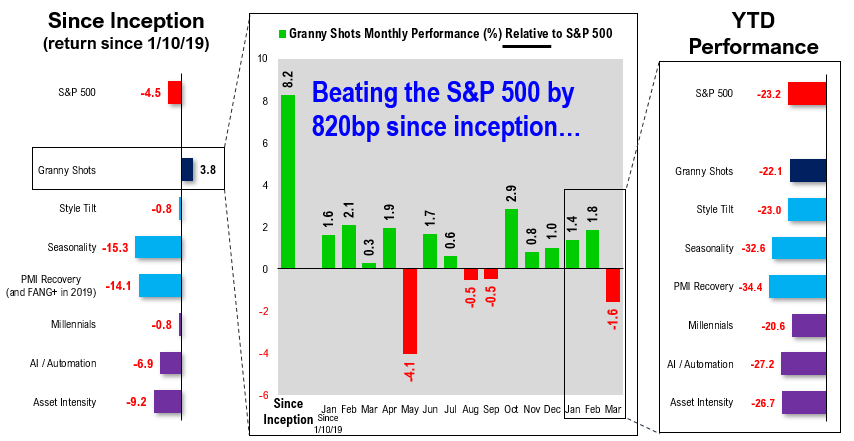

Figure: Granny Shots Portfolio Performance

Monthly. Source: FS Insight. FactSet as of 03/12/20.

Figure: Intersection of investment recommendations by strategy

As of 03/12/20, source: FS Insight, FactSet

The stocks in the Granny Shots portfolio collectively outperformed the S&P 500 by 820 bps since its inception (S&P 500 is down 4.5% during the same period).

Technical Strategy

Market Down But Not Out; Could Follow 2011 Similar Move

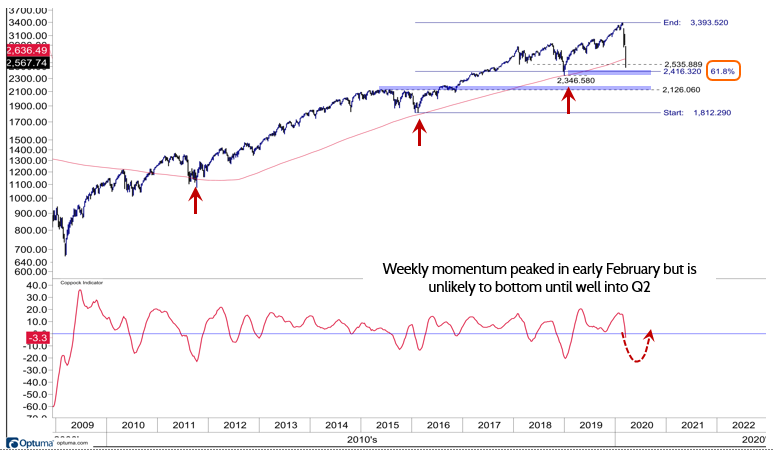

The S&P 500 index’s (SPX) historic decline last week sliced through most of the moving averages at the heart of technical analysis, with a break below the 200-week simple moving average at 2636 the most recent casualty. That four-year moving average is a proxy for the secular uptrend of the SPX seen during the bull markets in the 1950s-1960s, 1980s-1990s and 2009-2020.

In other words, the break below the 200-week sma at 2636 raises the risk the recent equity sell-off has ended the secular bull-market. Of course, the 20% plus drop already herald’s the bear market’s arrival.

While this week’s break below the 200-week is a major concern, particularly given the looming global economici slowdown, I believe it is premature to conclude the secular bull market is broken. Of course, I am concerned and not blindly ignoring the risk to equities, but I also believe there are two key technical points to consider before we can declare the secular bull market to be DOA.

Is the secular uptrend broken with SPX below its 200-week sma or just dented?

First, the chart above illustrates the past three pullbacks to the 200-week sma since 2009. The cycle lows in 2016 and again in December of 2018 were almost textbook examples of a major cycle low developing at that key support level. The correction in 2011, however, could be what is developing today.

It’s premature to make any definitive conclusions, but the low in 2011 undercut the 200-week sma by 5-6%, then traded in a very volatile range only to make a marginal new low a month later before recapturing 200-week sma on the upside. Additionally, the four-year cycle lows in late 1957, 1962 and 1966 spent many weeks in volatile ranges below 200-week sma before reaccelerating to the upside 1-3 months later.

I would also note that Friday the SPX was near a cluster of key support levels starting with 2416 which is the important 61.8% Fibonacci retracement level of the 2016-2020 rally followed by the December 2018 lows at 2346. I can’t state for sure these levels will hold but it would be an important technical development to see the S&P begin to stabilize near current levels. Keep your eyes on that.

Secondly, after peaking in early February, weekly momentum indicators continue to decline and are unlikely to signal an intermediate-term, tactical bottom until well into 2Q. I expect these should begin to bottom in late April-May, which coincides with markets better understanding the scope of Covid-19 and potential impact to earnings.

Bottom line: My expectation is that the S&P is likely to begin to stabilize near the support levels outlined above followed by a very choppy trading well into 2Q similar to what developed in 2011 and during the cycle lows in the 1950s.

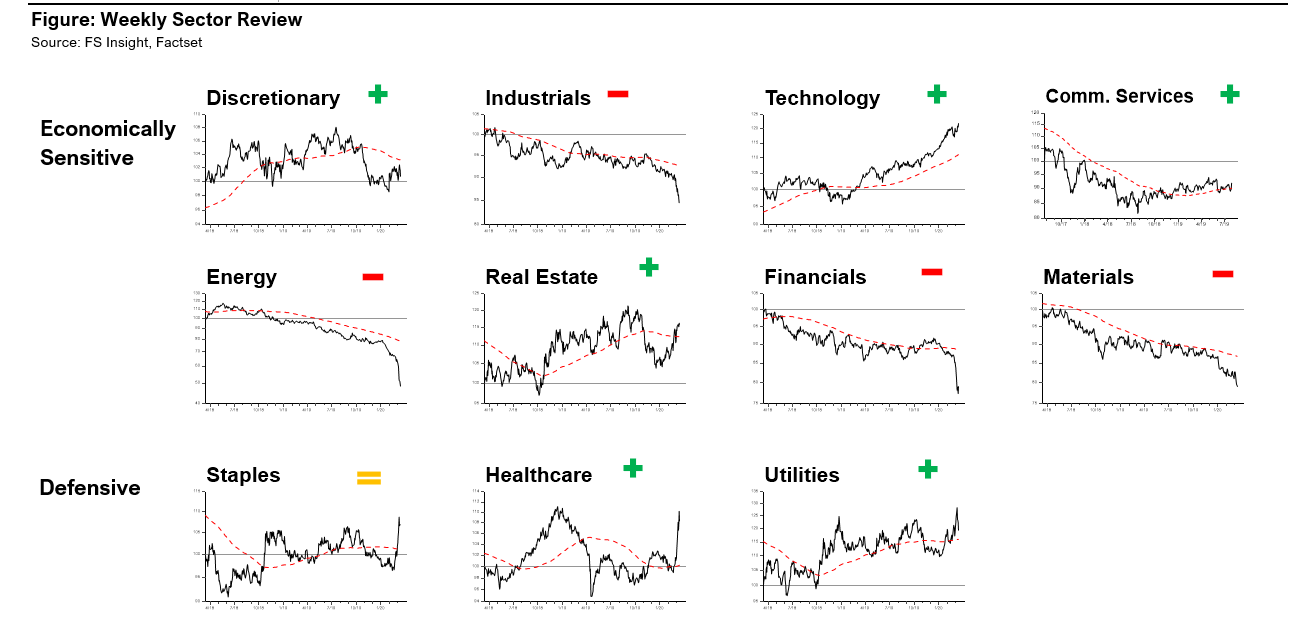

Figure: Weekly Sector Review

Source: FS Insight, Factset

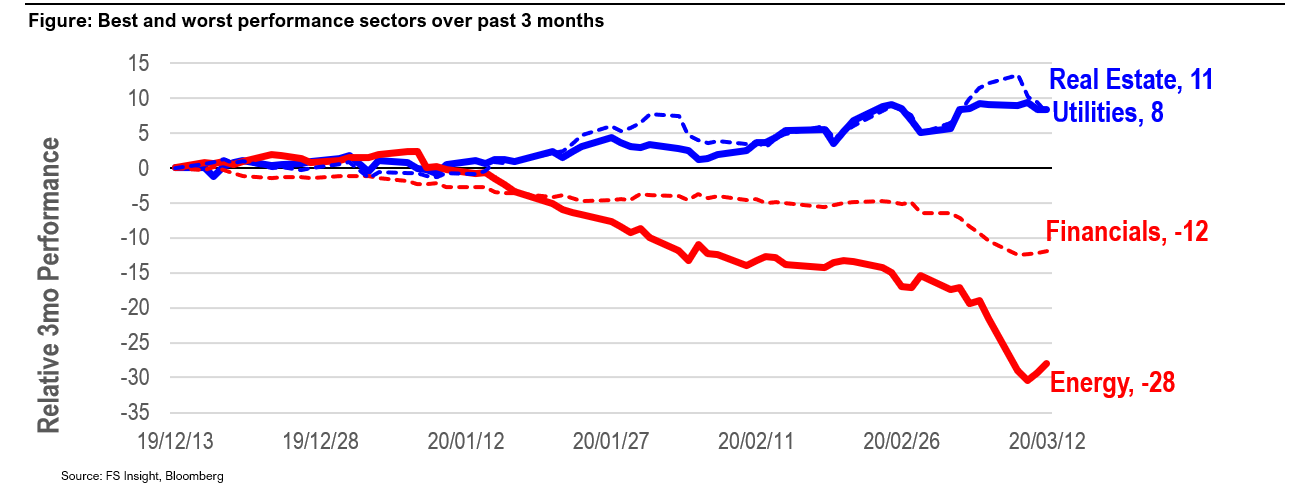

Figure: Best and worst performance sectors over past 3 months

US Policy

Govt Virus Response Dominates; Biden-Sanders Debate Next

It’s been coronavirus news all day, all the time. The effort of the U.S. federal government to get a handle on COVID-19 dominates all public policy in Washington. With this week’s steep market decline making action essential, Speaker of the House Nancy Pelosi unveiled a bill Wednesday night that has become the focus of negotiations between the White House, represented by Treasury Secretary Mnuchin, and the House Democrats.

Friday, President Trump declared national emergency in response to coronavirus. This could be in reaction to the poor response to his speech on Wednesday. A declaration of a national emergency allows him to issue wider executive orders and use FEMA. This is a sharp turnabout in White House strategy after weeks of declaring there is low risk for most Americans, a statement he made as recently as his Wednesday night speech.

The bill is aimed at providing immediate relief to those who miss work due to the virus, get sick and need testing or hospital care, through an infusion of funding to state unemployment funds, and a boost in food assistance programs. In the negotiations the Speaker agreed to have the sick leave provisions sunset with the end of the coronavirus crisis and also agreed to the so-called Hyde Amendment language that has traditionally been added to all spending bills and limits funding for abortion.

The Speaker reportedly hopes to pass the bill on Friday, but House Republicans are looking for the personal assurance of the President that he will support and sign the bill. If the House can pass a bipartisan bill the Senate will act over the weekend or early next week. Senate Leader Mitch McConnell has promised to pass any deal that is struck between the House and the White House. The President, after the disappointing reaction to his speech on Wednesday night, is looking for positive action to assure the public that the government is at work, hence he is anxious for a bill that he can sign.

The legislation will not have relief for the business community and there is likely to be another bill in the next few weeks. At this point the hard-hit travel industry has not yet come up with its “ask” but is said to be reviewing its options. I would expect legislation with tax breaks and perhaps some direct aid to be put forward in the next few weeks.

2020 Election

Despite the virus spread, the politics of 2020 proceed, though on new terms. Gone are the large rallies that have been the life blood of politics in recent years. However, from my days in politics I always had to remind candidates that, while rallies were great, probably less than 1% of all voters would actually see a candidate at an event. Free media on the evening news, and paid commercials are the real currency of modern political campaigns and that is now more important than ever.

Sunday night will be the first one-on-one debate between former Vice President Joe Biden and Senator Bernie Sanders. The vice president enters the debate on a wave of electoral victories and is closing in on the nomination. Biden has run for president three times before and has always floundered, so being the leader is new terrain for him and a two-person debate could be a high wire performance. Debates with President Trump will be central to the fall campaign and passing the test on Sunday will be a big step towards the nomination.

Figure: Top Trump Tweets