Stock Hit New Highs...Again; Fear of Missing Out Takes Hold 1 and can accesss 1

In this strategy briefing… |

FS Insight Investment Views

|

The Wall Street Debrief

Stocks Hit New Highs…Again; Fear of Missing Out Takes Hold

With 2019 rapidly coming to an end, frankly I’m running out of words to describe this “aging” bull market, as the bears have called it. I’m running out of superlatives and out of adjectives. The old bull has life yet, now having broken out of a slow trot in recent weeks to a nice steady canter. I’ll get worried when it begins a full out gallop.

I’ve made the point in the past that this hated bull market—which has the least enthusiasm of any I’ve ever experienced—has shown the kind of resilience not seen in rising markets for a long time. Forget for a moment that the bull is verging on 11 years old. At some point, it will turn into something to worry about, but not now, it seems.

Look at what happened this past week. Another all time high. Ho hum right. The Standard & Poor’s 500 index rose nearly 2% on the week to around 3,220, the eleventh weekly finish at a new high out of the past 12 weeks. The other major indexes also set new records this week.

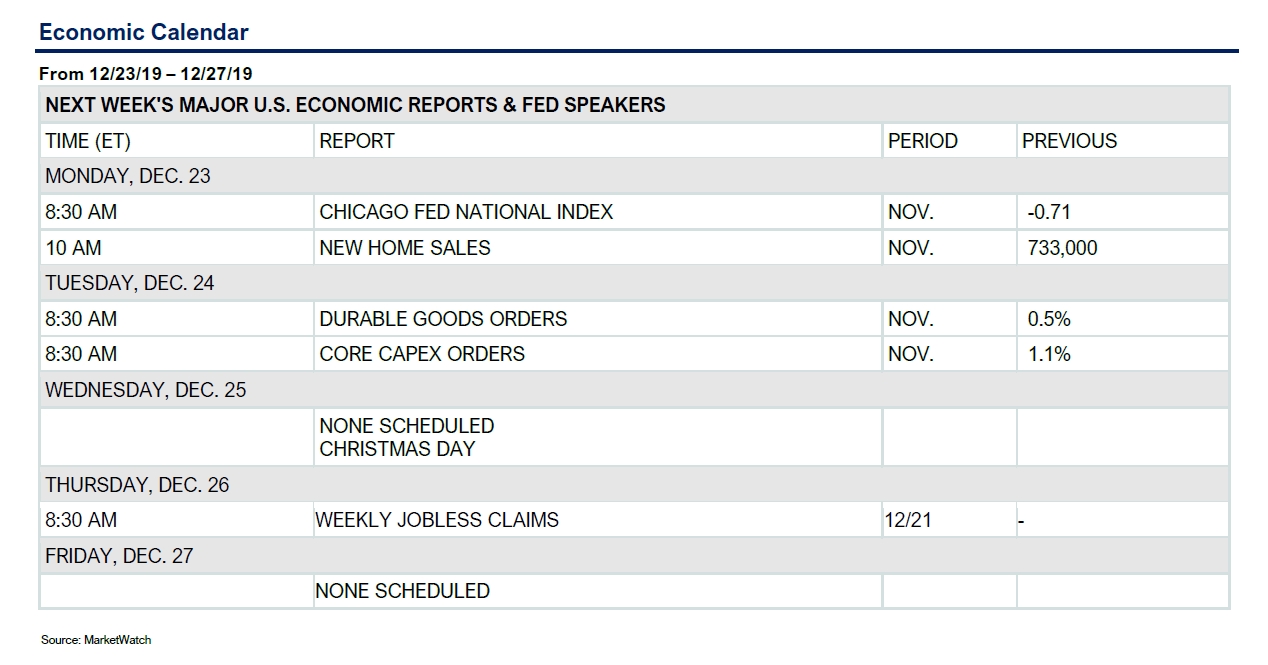

This takes place at a time when there’s not much big-time economic data to speak of, data that one could point to and say, well, that drove it higher. It happens when where the Federal Reserve Board says nothing and sits on its hands.

Yes, there seems to be some kind of trade deal having been reached between the U.S. and China, and that should be considered a long-time boost—if it holds. But the market knows it’s preliminary and that a single Trump tweet could blow it apart. Truth be told, Congress did get around to passing another temporary budget and the House approved the new NAFTA deal, helpfully known as USMCA, or the U.S. Mexico Canada Agreement.

And, oh, by the way, President Donald Trump was impeached last week. Stocks shrugged it off. Wow. I doubt that this news was even considered by most institutional investors, given the Senate is highly unlikely to convict. (For more, see page 10.)

Trading volumes are beginning to diminish, as might be expected at the end of the year when the holiday season begins. The next two weeks should be quiet and probably the default market drift will be up. In terms of activity, there are a couple of data points I’d point to that might help explain the rally this week.

First, Bloomberg reported that the BlackRock’s exchange-traded fund iShares Core S&P 500 ETF (IVV) took in $4.5 billion Monday, the largest-ever single day inflow in the $204 billion fund’s near 20-year existence. To me that smells like fear of missing out pure and simple. The train is leaving the station and everyone is trying to get on board before it’s gone.

What about animal spirits? My colleague Tom Lee talks about this in his report, beginning page 3. A recent Bank of America Merrill Survey showed money manager expectations about the economy swung to a net +6% from -37% a month ago, a type and size change that is unusual and followed by bullish market moves.

I might add that this rally to the yearend is something that Tom referred to right here in these pages back on November 8, A Very Strong 2019 Should Get Even Better. Back then he suggested a yearend rally might take the market above 3200. That’s where we are. Tom produced his 2020 Outlook this week and it is well worth a read. We’ll piggy back on that next week.

Folks, the market is verging on a 30% rise this year, and while some of that is a function of the poor fall in 2018, when we entered a bear market on Christmas Eve, it remains a pretty darn good year. But think back to December last, when the market looked to go into the dumpster. If you remember, Tom Lee was bullish then too.

There’s reason to be optimistic this year. Big up years like this one are rarely followed by down years. Moreover, Barron’s recently published its survey of Wall Street bank and institutional strategists, who as a group look for a 4% rise in 2020. The survey has often been a good contrarian indicator and my own personal experience with it is that the strategists often don’t stray too far from the mean. They are rarely bullish or bearish enough for what actually happens in the following year.

One good bit of news Friday was the personal-consumption expenditures, or household spending, which rose a seasonally adjusted 0.4% in November from October, the Commerce Department said. Spending in November was up 2.4% from a year earlier.

On behalf of my colleagues here, we thank all our clients and members for their patronage and wish you all a very happy and healthy holiday season, full of good cheer. Thank you for following us.

Quote of the Week: WSJ: Britain’s new Parliament voted overwhelmingly Friday to back Prime Minister Boris Johnson’s Brexit accord, a significant step toward the country’s departure from the European Union on Jan. 31.

“This is the time when we move on and discard the old labels of leave and remain. In fact the very words seem tired to me,” Mr. Johnson said. I couldn’t agree more.

Questions? Contact Vito J. Racanelli at vito.racanelli@fsinsight.com or 212 293 7137. Or go to www.fsinsight.com.

Tom Lee's Equity Strategy

In 2020 Animal Spirits Reviving, Market Could Rise 10%+

It’s the time of year for reflection, both on what has transpired—very good in markets if perhaps bumpy—and on what might be in 2020. For investors, it’s particularly important. Afterall, how does one follow up a stock market that has risen a white hot 25% in 2019. Can you top this?

The way I read the economic data is that there are at least two keys to stock market action next year, and both lead to the potential revival of animal spirits. Let’s face it, we haven’t seen that kind of pro-market, enthusiastic sentiment in a long time, thanks to how painful the 2008-2009 bear market was. This bull is still not accepted by many investors but that might change soon and many investors remain gun shy.

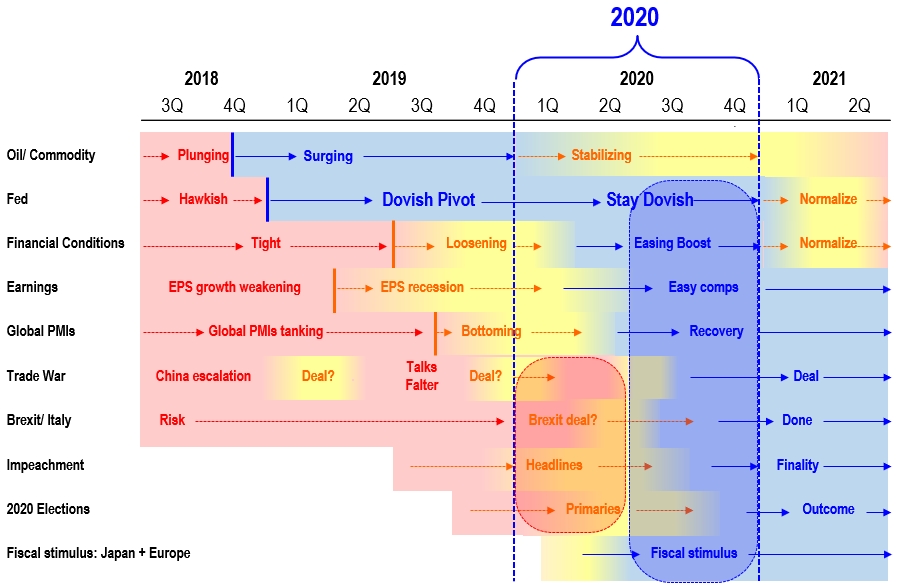

In my view, 2018 was a proper bear market—down 20% in December—and a reset of economic and fundamental expectations. So 2020 looks to me as Year 2 of a new bull market, analogous to 2010 after 2009’s sharp rise from lows. 2010 was ultimately a strong year but saw a weak first half.

In summary, investors should not fight the central banks of the world, which are generally in an accommodative or non-hiking rate mode, a positive for stocks. (For more see page 6.) Second, the Standard & Poor’s 500 index aggregate earnings per share (EPS) will rise about 10% to about $178 from the expected $163 this year, according to FactSet.

Given that, our forecast is for the SPX to reach about 3,450 (from about 3200 now) in our base case, or a bit less than 18 times price/earnings ratio on that $178 EPS. How we get there I’ll explain below. Our best case scenario is for $184 EPS, to which we apply an 18 multiple for a level of nearly 3600 on the SPX.

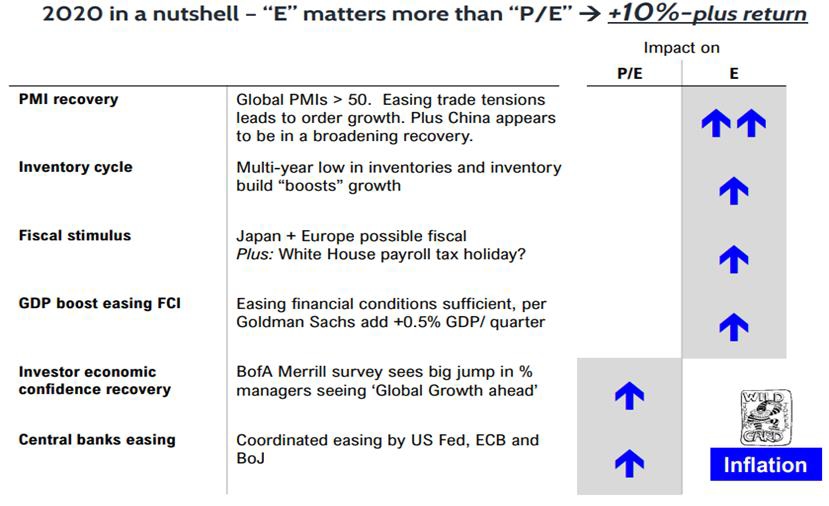

EPS growth for the SPX should be much better than 2019’s flat earnings on 2018, with an acceleration due to, among other reasons, the anticipated recover in Purchasing Manage Indexes (PMI) both in the U.S. and globally. Given this paucity of growth in 2019, I also expect that in 2020 the E of the P/E will matter more.

Additionally, earnings growth will likely get a boost from an improving inventory cycle, which is at a multi-year low, so inventory build should “boost” growth. Japan and possibly Europe could provide a fiscal stimulus to their consumers, and easing financial conditions should—according to Goldman Sachs—ad about 0.5% per quarter to the U.S. growth domestic product.

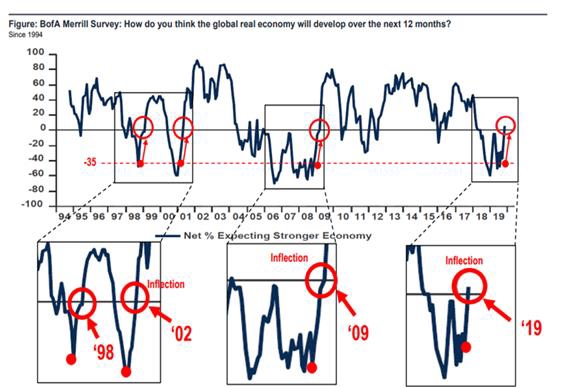

And what about those “animal spirits?” Well, they might already be here according to the most recent Bank of America Merrill Survey, which shows a pronounced flip in fund manager expectations about the economy to a net +6% from -37% a month ago. This type and size change is unusual, particularly after extended negative readings.

Take a look at the chart below. The move to a positive reading from -40 or worse has only been seen at inflection points (to positive) in equity markets, such as 1998, 2002 and 2009. (See chart below.) In each case, this was a sustained risk-on signal.

To better understand my outlook, it might be useful to know the five guiding principles to my view. First, stocks are a “junior piece” to the capital structure and as such tend to follow other markets, leading indicators such as bonds, credit, derivatives and futures markets.

Secondly, history is a useful framework, while demographics and generational factors are the least appreciated consideration by investors, even as they explain a lot of market dynamics. I have found that the consensus is often looking just one to 3 months ahead, and it often overreacts to incoming data. Remember, the market is a voting contest in the short term, assessing popularity, but a weighing machine in the long run, assessing substance.

Bottom line: I see about a 10% rise in the SPX to 3450, as my base case.

Figure: Comparative matrix of risk/reward drivers in 2020

Per FS Insight

Figure: FS Insight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019

Fed Watch

Trump Calls for More Rate Cuts; the Fed Demurs Again

We haven’t even gotten to New Year’s Day 2020 and already President Donald Trump is again banging the drum for interest rate cuts from the Federal Reserve Board. Well, of course, it’s not like he has other stuff to do, like ward off impeachment.

And already Fed policymaking officials are defending the idea that the 2019 three rate cuts already put into force this year are enough to support the economy.

Haven’t we seen this movie before?

In several recent media interviews, Fed policy officials, such as James Bullard, president of the St. Louis Fed, went out of their way to emphasize two things: the Fed is happy where rates are and that it will take a lot in the way of inflation to change the current policy. The presidents of the Dallas and Boston Fed banks, in separate appearances Tuesday in New York, were happy with the current level of the Fed futures rate and upbeat about the U.S. economy.

Monetary policy is in a good place is the watchword from the Fed. Expect no change.

With the Fed quiescent, I turn to other central bank news, where the action is easing, as my colleague Tom Lee notes in his outlook, page 3. The Bank of Mexico, for example, reduced rates for the fourth consecutive time since August, hoping to support a faltering economy while inflation is under control. The overnight target rate was cut by a quarter percentage point to 7.25%. Mexico’s annual inflation was about 3% in November, close to the central bank’s target and the lowest level since September 2016.

Meanwhile, Sweden’s central bank, an early adopter of negative interest rates, became the first to move away from that. I wonder if this is a harbinger of things to come as the world’s economy starts to grind higher.

As I’ve always noted in these pages, don’t bother with the Fed’s dot plot for an indication of where U.S. rates are going. Just watch the CME fed futures market, which currently puts a rate change next year at less than 50%.

Separately, the New York Fed continues to add temporary liquidity to the money markets, but last week saw lower demand for overnight funding.

Bottom Line: The Fed will continue drift into the background for a while.

The U.S. Treasury 10-yr note yield was around 1.92% up from 1.84% last week and below 1.5% in September.

Upcoming: 1/28-29 – FOMC meeting. No action expected.

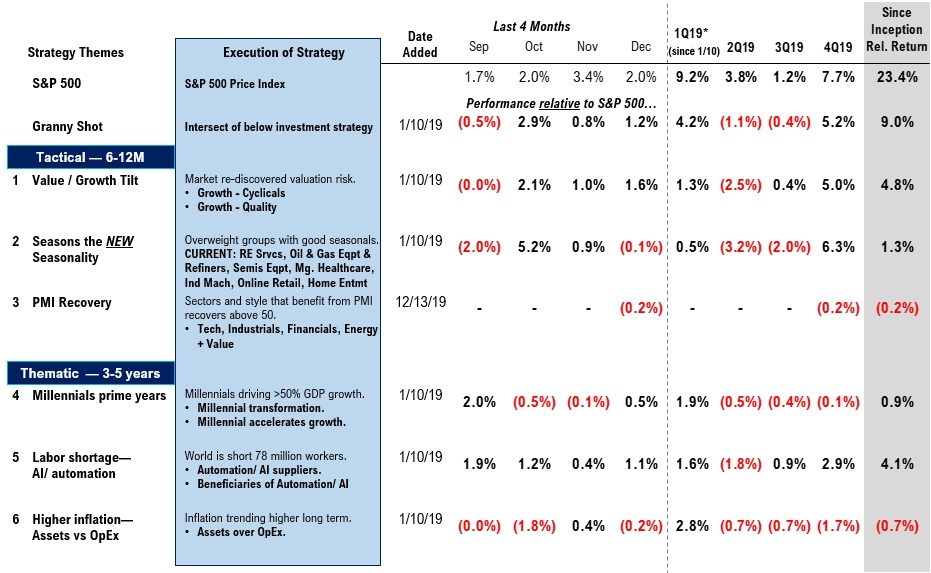

GRANNY SHOTS: Best bets in 2020

GRANNY SHOTS: Best bets in 2020 - Week 51

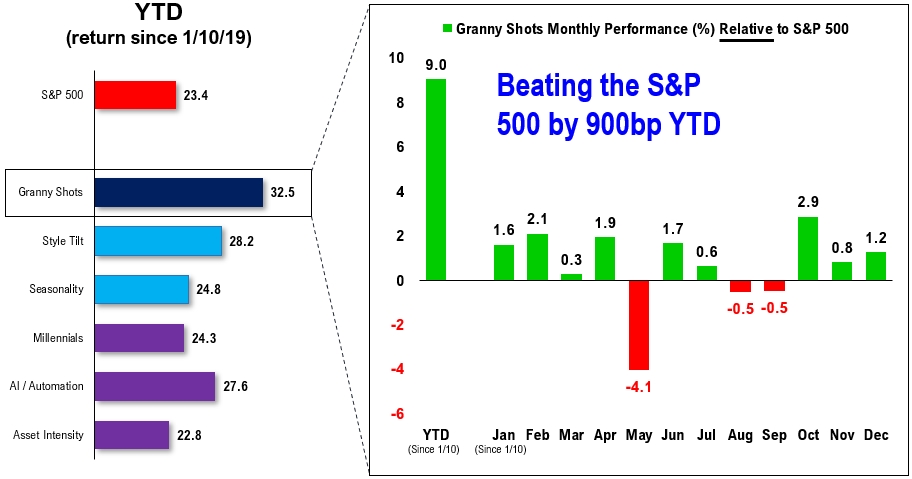

Below we’ve highlighted stocks that we recommend across at least two of our investment strategies for 2020. These companies could benefit from multiple themes and secular tailwinds – clear picks in our view for the first half of 2020.

Figure: Granny Shots are the “best of the best”

Stocks which appear in multiple themes. Source: FS Insight

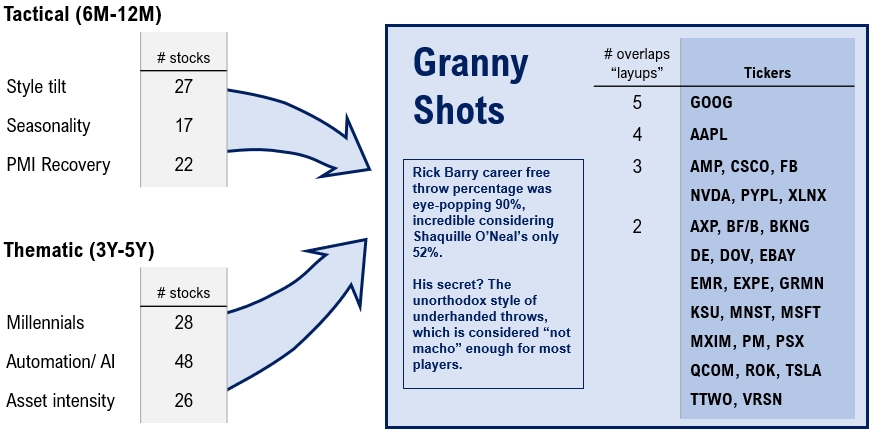

Figure: Granny Shots Portfolio Performance

Monthly. Source: FS Insight. FactSet as of 12/19/19.

Figure: Intersection of investment recommendations by strategy

As of 12/19/19, source: FS Insight, FactSet

The stocks in the Granny Shots portfolio collectively outperformed the S&P 500 by 830 bps since its inception (S&P 500 is up 22% during the same period).

Technical Strategy

Market Signals Bullish; Ten Cent Looks to be Bottoming

The equity backdrop remains positive as markets continue to trend skyward, defying so many traders and commentators overly focused on short-term indicators. That’s got to hurt. My expectation is that the intermediate-term, 1-2 quarter rebound that began in Q4 will start to peak somewhere in mid-late Q1 2020. Between now and then, shortterm pullbacks are likely to be shallow, short and not worth micro-managing.

Once the weekly momentum indicators begin to peak, I expect a broad choppy trading range to develop through Q2 into Q3. The technical picture also supports colleague Tom Lee’s fundamental view, outlined in his 2020 Outlook published this week. Part of it is available on page 3. As a reminder, Tom and I maintain independent views driven by different methodologies, but when they align, as they did throughout 2019, it’s usually a valuable signal for investors.

As the bull market adds upside momentum and participation broadens to more industry groups, from a tactical view many of 2019’s leading stocks are becoming advanced and less timely to be chasing. Sentiment indicators, such as the American Association of Individual Investors’ bullish readings, are climbing toward overbought levels. This suggests to me that investors should be looking at stocks that have advanced less or are in the early stages of bottoming.

This brings me to Tencent Holdings (TCEHY, 700 in Hong Kong). On October 8, I noted here that it was a laggard among Chinese peers but it remains timely now as it begins to complete a bottoming pattern at its longer term uptrend. While not all investors can purchase international stocks, given our expectation that global markets broadly improve through next year, Tencent, with a $500 billion USD market cap, is one of the more important international technology stocks to consider owning.

Why Tencent now? Weekly momentum indicators, which are helpful identifying 1-2 quarter directional shifts, are building to the upside as Tencent successfully completes a second retest and rally from its rising 200-week moving average. Relative performance versus the S&P 500, one of the key technical tools to identify changes in leadership, confirms the upside price move, as it begins to push above the May highs.

Overall, I view Tencent to be early in a new bull cycle and would use near-term pullbacks to accumulate.

Bottom Line: Remain bullish.

US Policy

Impeachment, Budget Passed; Government Goes on Holiday

You can rest easy now, at least for a few weeks, as Congress has gone home for the holidays and President Donald Trump will soon start his own break.

Congress managed to pass a federal budget to fund the government through the current fiscal year, and the House of Representatives approved the new NAFTA, the so-called USMCA. And while it was doing this heavy lifting, it also, by the way, approved the impeachment articles against Trump, on two counts, abuse of power and obstruction of Congress.

It’s not clear when the House will pass these approved 2 articles of impeachment to the Senate, where there is little or no likelihood of approval. Because the Speaker of the House Nancy Pelosi hasn’t sent the articles to the Senate, it’s not even clear legally if Trump has been impeached. The impeachment is an indictment, and as such must be passed to the court or jury, the Senate in this case, and it hasn’t been.

So the Senate wasn’t able to quickly act and dismiss the impeachment case, to Trump’s great frustration, and it now hangs, unresolved, over his holiday celebration. That’s probably how the Democrats want it.

The President views a Senate vote of not guilty as vindication, and appears irritated that he has not been able to go to campaign rallies and declare his innocence confirmed by a Senate vote. In the end there is no doubt that the Senate has nowhere near the 67 votes that would be required to remove President Trump from office.

The House, with its Democratic majority, was always going to be the toughest vote to get approval of the President’s priority to renegotiate NAFTA, but the approval assures that it will become law in the new year. The President should have no problem delivering a victory in the Republican controlled Senate.

Passage of the budget is simulative as it contains approximately $150 billion in new funding divided between defense and domestic programs. It temporarily—yet again— puts aside the controversial issues of the border wall as both sides agreed to another year of flat funding at $1.35 billion for new construction.

Figure: Top Trump Tweets

What is FS Insight?

FS Insight is a market-leading, independent research boutique. We are experts in U.S. macro market strategy research and have leveraged those fundamental market insights to become leading pioneers of digital assets and blockchain research.

Tom Lee's View

Proprietary roadmap and tools to navigate and outperform the equity market.

Macro and Technical Strategy

Our approach helps investors identify inflection points and changes in equity leadership.

Deep Research

Our pioneering research provides an understanding of fundamental valuations and risks, and critical benchmarking tools.

Videos

Our macro and crypto videos give subscribers a quick and easy-to-understand audiovisual updates on our latest research and views.

US Policy Analysis

Our 40-year D.C. veteran strategist cuts through the rhetoric to give investors the insight they need.