In Tuesday’s session, SPX and QQQ have rallied sufficiently to think that a short-term low should be in place, which could lead back to new high territory. This is based on wave structure, breadth, momentum, seasonality and cycles. Furthermore, US Dollar and Yields both began to turn lower today on April’s sub-par Flash PMI data, which is encouraging for risk assets based on the correlation over the past year. While this move might not prove to be a straight shot higher, it looks right to expect that lows very well could be in place, and higher prices are likely into May. SPX target on this move should materialize near 5400.

Simply stated, SPX’s move off the lows was impressive in terms of technical structure, breadth and outperformance from recently hard-hit sectors like Technology and Healthcare.

While no corresponding DeMark-related exhaustion signals were ever confirmed at this week’s bottom, there was a prominent cycle that suggested that 4/20 could bring about a low to the recent decline in risk assets.

The decline in US Dollar and US Treasury yields on the heels of massive Commodity Trading Advisor (CTA) shorts looked to be an important catalyst as to why US Equities were able to push higher on very constructive breadth.

Furthermore, sectors like Healthcare, which had been hard hit over the last few months, managed to show some impressive stabilization and turn in the fourth best (out of 11) performance of any of the 11 major S&P 500 sectors.

As shown below, SPX has retraced 38.2% (Fibonacci retracement level) of the prior decline from late March within two trading days. This has been an impressive bounce, with Tuesday’s advance occurring on breadth of roughly 5/1 positive.

I don’t expect that this two-day advance should get much above 5148 before backing and filling, which likely doesn’t give back more than 50% of this week’s rally. Thereafter, a rally back to near 5200 looks likely, initially.

Healthcare being raised back to Overweight. Some sharp outperformance looks likely between now and July

I chose to take Healthcare down from an Overweight to Neutral, technically speaking, about six weeks ago upon seeing the sector deteriorate in relative terms to the S&P 500, snapping a multi-month uptrend.

At present, the underperformance likely has run its course, as relative charts of Equal-weighted Healthcare (RYH) vs. Equal-weighted S&P 500 have reached former lows and begun to stabilize.

Just in the last week, Healthcare has turned in the 4th best performance of any of the 11 major sectors that represent SPX.

Furthermore, the relative chart of RYH vs RSP 0.77% has just formed a TD Buy Setup, based on its weekly DeMark count, which directly followed a daily TD Sequential buy signal.

As we know, Healthcare is a vital part of the S&P 500, representing the 2nd largest sector within the index. Thus, the degree of broad-based rally sufficient to lift SPX higher by 10% in the 1st quarter despite a dismal showing from Healthcare looks quite important.

Furthermore, any evidence of this group starting to turn higher would be quite important and positive towards creating a tailwind for S&P to advance in the months to come.

While I’m uncertain that Healthcare will run higher throughout the 2nd half of 2024, I expect strong performance between now and August, with June and July representing a traditionally strong seasonal time for Healthcare.

I’ll list some of my favorites in this sector as I further explain my thesis in the days to come. At present, I expect that Healthcare should stabilize here and not break 2023 lows in relative terms to SPX and begin to turn higher.

TSLA could possibly bottom out this week, technically

TSLA 3.60% has certainly disappointed in recent trading days and its breakdown under $160 resulted in a steep pullback which has now reached ~142. However, there do look to be a few important factors as to why TSLA might soon bottom out, and this could happen this week with earnings on deck.

Initially, the stock has reached an area of trendline support stretching from its 3/2020 lows connecting 1/2023 lows, which currently intersect near current levels. Furthermore, at a price of $142, TSLA has declined exactly half the amount from the 7/2023 peaks as it did from 11/21 into 1/23 lows. (In other words, its former 312 point decline lines up with a current 156 point decline as measured from 7/23 peaks, representing an alternative 50% price retracement.)

Furthermore, DeMark’s exhaustion tools show TSLA to be near an exhaustion point based on its daily TD Buy Setup count, which is nearing the first Buy Setup since early April (To be perfected, however, this would require a decline in TSLA back under $138.80 this week.)

Moreover, it’s also insightful to see that TSLA made a prominent swing low back on 4/27/23 of last year and has just revisited (and broken a bit under these levels) heading into this 1-year anniversary low. Historically, revisiting a key point after a complete roundtrip during a yearly anniversary level can prove important, based on Gann theory. Thus, while TSLA technically remains trending down, I expect that the combination of TSLA possibly forming a TD Buy Setup heading into earnings could allow for a trend reversal.

As always, to have real confidence of a low at hand in stock which is near its 52-week lows, it’s important to see TSLA 3.60% reclaim the area of its former breakdown, which would involve this reclaiming $160 initially. Such a development would be quite promising, allowing for rallies up to $220-$238. Overall, despite the recent underperformance and poor technical trend of TSLA, I’m inclined to keep this stock on my UPTICKS list given reasons of near-term oversold conditions combined with cyclical positives heading into late April. Earnings might prove to be a catalyst for this stock at a time when pessimism on the entire EV marketplace has reached very high levels.

Looking back, TSLA has had an impressive tendency to bottom between 15-16 weeks of having formed a peak (See below)

1/29/21 – 5/21/21 = 16 weeks

11/5/21 – 2/25/22= 16 weeks

9/23/22 – 1/6/23= 15 weeks

7/21/23 – 11/3/23= 15 weeks

CURRENT: 12/29/23 – 4/23/24 = 17 weeks

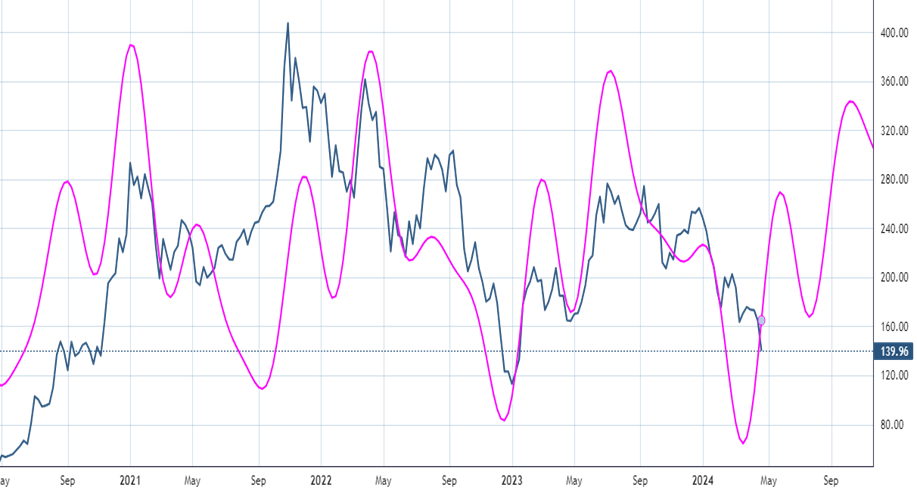

TSLA cycles seem to indicate a bottom could be possible

My own cycle composite, created from the Foundation of the Study of Cycles, shows a sharp advance starting in April, which should take the stock higher in a stair-stepping motion into this Fall.

This composite is based on the combination of a 16-week and 22-week cycle, along with lengthier cycles like 67 weeks and 203 weeks, which show harmonicity to the shorter-term cycles. At present, a low seems overdue and might happen sometime this week.

China outperformance might continue into May/June given this week’s surge coinciding with a declining US Dollar

China has made a very good recovery in recent days following nearly a month of sideways churning. The near-7% gains in China’s Technology ETF (KraneShares CSI China Internet ETF – KWEB 1.34% ) is set to make the highest daily close of the year after rising rapidly back to near the highs of its recent range.

Additionally, it’s notable also that FXI 0.53% could confirm its first MONTHLY TD Sequential buy signal by the end of April with a close over $24.02. Technically, gains back over $25.02 should help this rally extend up to the low $30’s. Short-term, trends arguably are bullish and a daily close over $27.42 in KWEB should help this rally to $29.

While greater intermediate-term strength is necessary before weighing in on the prospect of gains throughout 2024, I anticipate that rallies into late May/early June are likely for China’s Equity market.