Technical Strategy Video (Recorded Tuesday, October 12th):

Key Takeaways

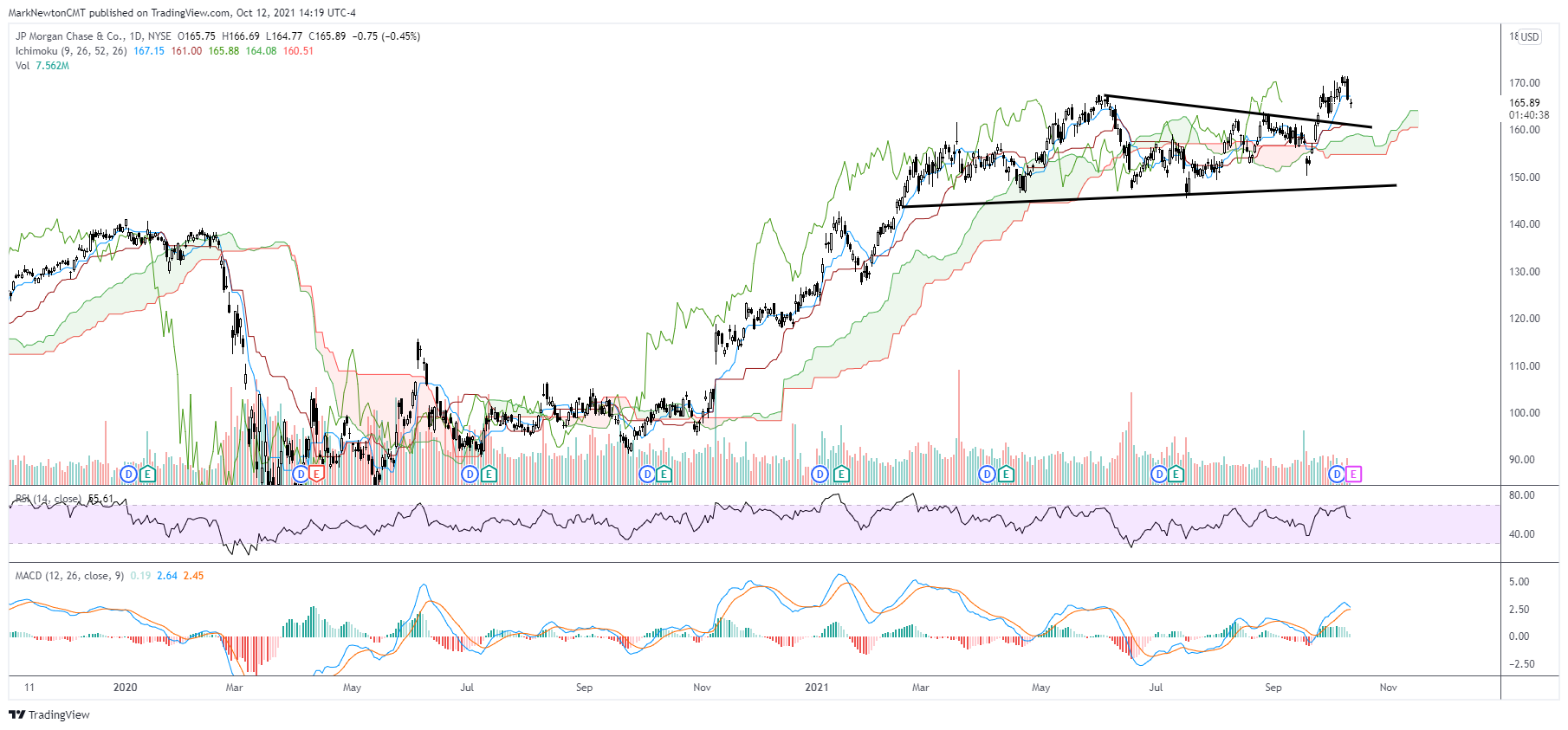

- Money Center banks look technically more appealing than Investment Bank/Brokers (JPM, BAC better than C)

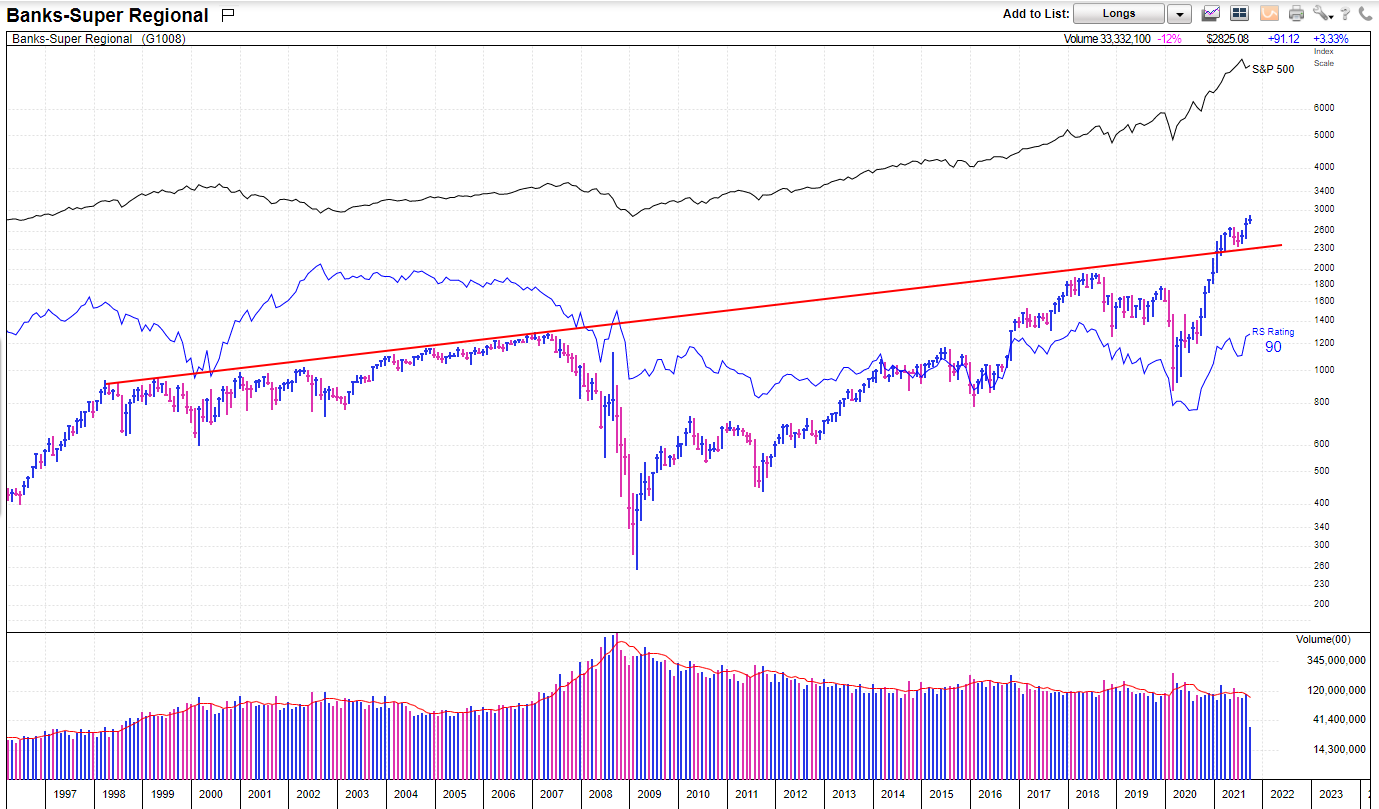

- Treasury yield breakout has driven outperformance in Regional Banks, and this looks to continue in the months to come. This should favor the Super Regionals (CMA, SIVB, PNC, USB) which remain one of the best areas in Financials

- Exchanges, Payment processors, Insurance, and Trusts also showing excellent strength and should be favored

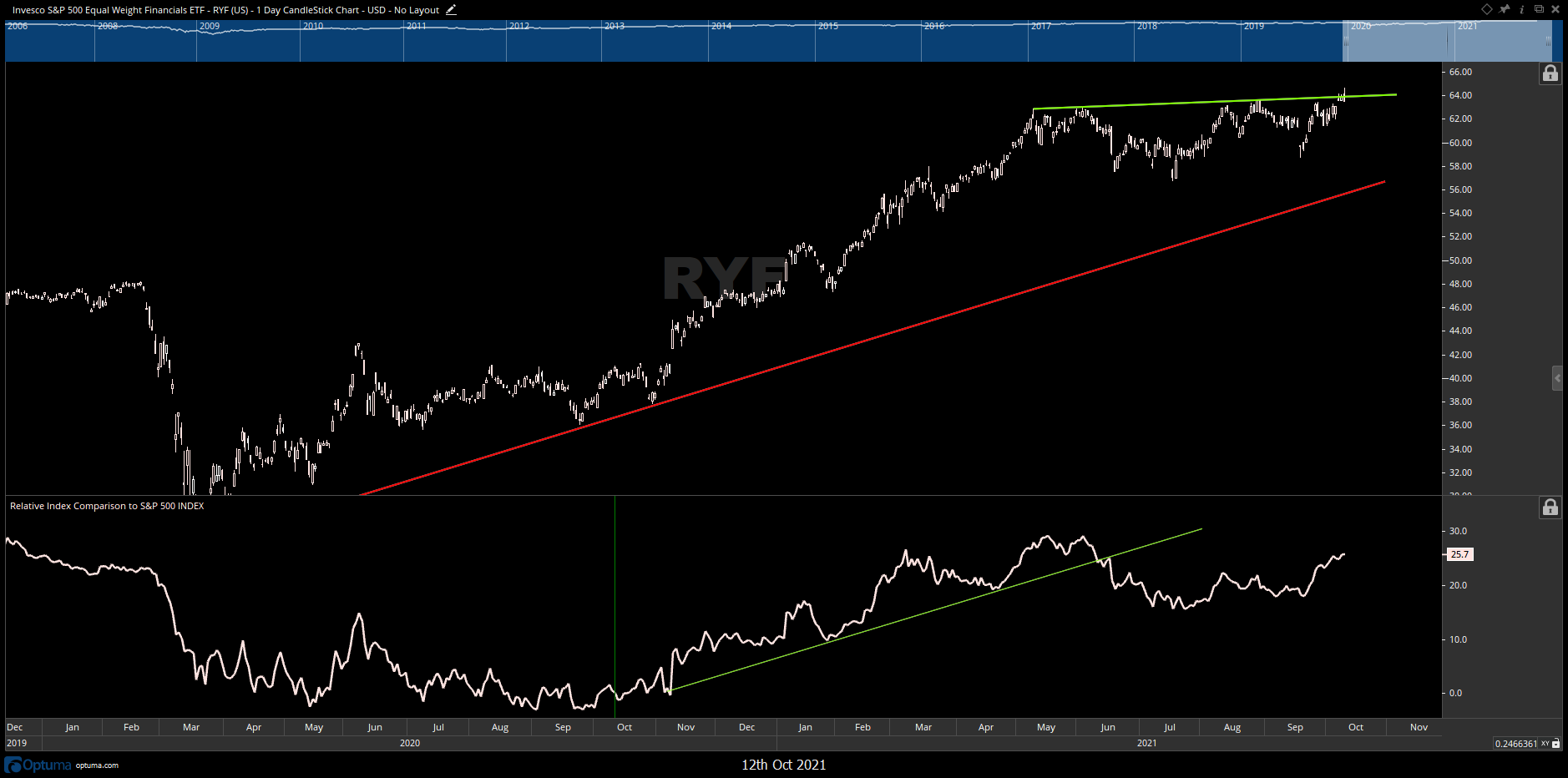

Financials, shown in Equal-weighted form (RYF) to strip out the large influences of Berkshire, JP Morgan and Bank of America, just pushed back to new all-time highs last week, one of the few major sectors to have accomplished this feat. The relative chart of RYF/RSP (shown in white) peaked this past Spring when interest rates made a minor top, then bottomed in July as rates also bottomed. Given that Treasury yields look to continue higher in the months to come, it looks likely that Financials should continue to be favored as an overweight, technically.

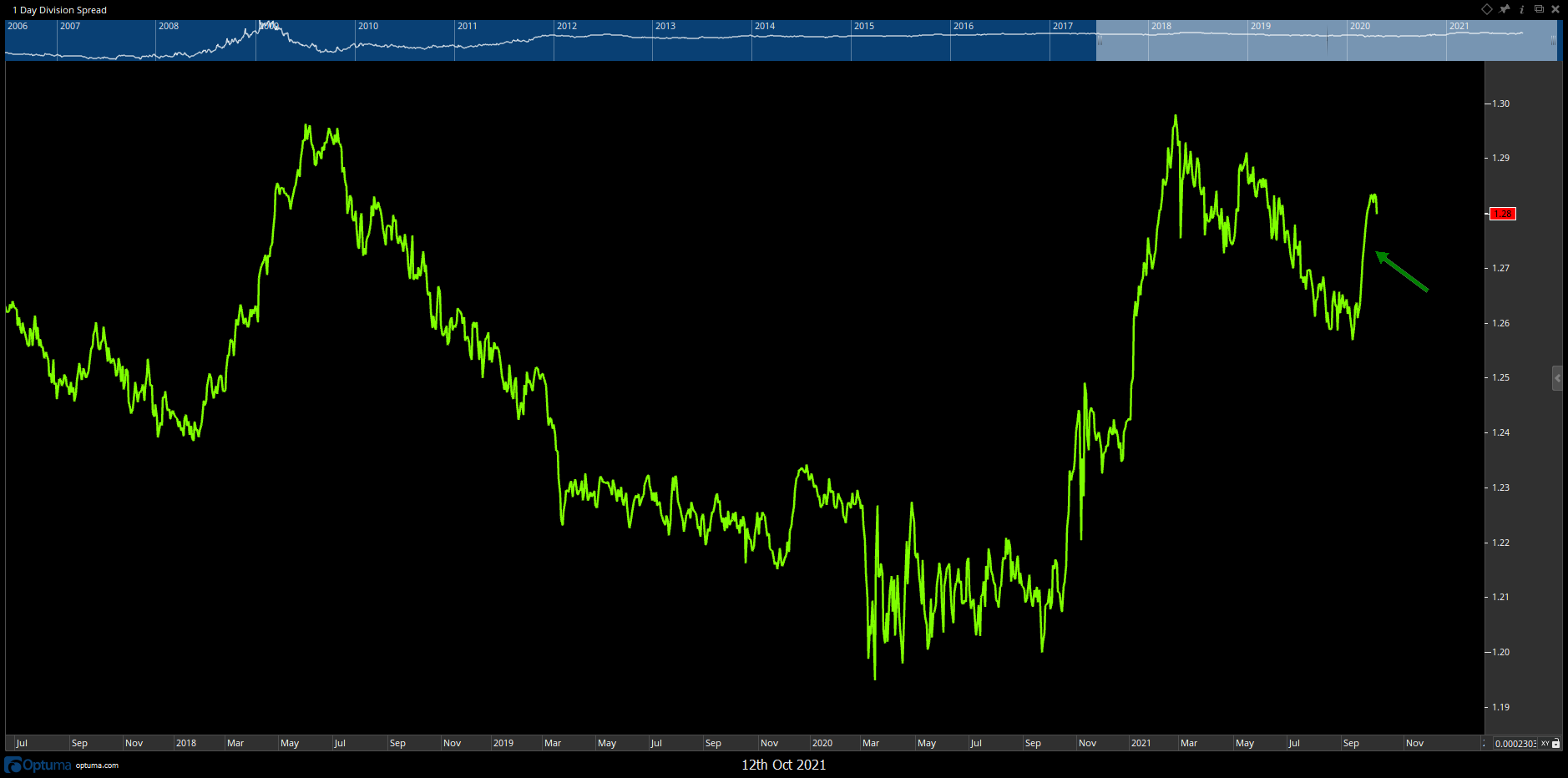

US 10-Year Treasury yields likely to slowly trend up to 1.80%. Looking at TNX below, yields broke out in mid-September which resulted in a sharp period of outperformance in Financials. Technically this Yield breakout (Treasury selloff) should persist in the next couple months, and should be likely to coincide with continued relative strength within the Financials

Regionals should continue to outperform given Yield curve steepening

This sector chart of the Super Regionals (SIVB, USB, PNC, TFC, NTRS, HBAN, KEY, RF, CMA, GWB) has proven to be one of the strongest areas of Financials since the March 2020 Equity market bottom. As shown below, this breakout of the longer-term trend connecting peaks since the mid-90’s keeps this group in good technical shape. Favored stocks of the group above are SIVB and CMA, which I believe should be overweighted for additional gains as yields rise.

Regional Banks should outperform Commercial, Investment bank/Brokerage (Ratio chart of KRE vs KBE) As might be expected, Regional bank outperformance over the broader banking sector has largely coincided with movement in Treasury yields. The sharp gains in relative terms since mid-September coincided with the breakout in Treasury yields across the curve, and still looks to continue in the months ahead.

Broker Dealers have lagged since mid-September– Another useful ratio is comparing Brokers to Banks (IAI vs KBE) Note that exactly when yields started trending higher, the Broker dealer stocks started to drop off in relative strength vs the Entire Banking sector as a whole. Given that rates are likely to trend higher in the months ahead, this should drive further underperformance in the Broker dealers, and one should ideally consider KRE for Regionals, or the KBE for the Entire banking space.

Finally, it’s worth noting that JPM and BAC both look quite appealing near-term after their breakouts back to new all-time highs. This last few days of consolidation in JPM (shown below) should represent an appealing technical opportunity to buy dips after retesting the area of the breakout near 160-2.