In the midst of the general good holiday cheer, I’m the Grinch. I have to admit I expect a temporary near-term pullback. Temporary remember.

As the S&P 500 index impressively trends to new highs almost each day heading into year-end, a pullback appears likely from a technical perspective. In early December, I expected the SPX to trend toward 3300 by mid-February but with it near 3240 already, some profit taking sooner than later is likely.

Daily trading indicators, tracking 2-4 week shifts, are again signaling a reason to be near-term cautious given daily relative strength index (RSI) momentum has moved from neutral levels (50) at the December 3rd pullback low (3070) back to overbought (78) following the SPX’s +5.7% rally to above 3245.

Trading support begins at the 15-day moving average of 3188 followed by the 50-dma at 3110. In addition, the bellwether semiconductor group has begun to lag the S&P over the past week with daily RSI momentum peaking on December 20th above 70. My expectation is for a short-term pullback to take hold followed by another upside rally into February.

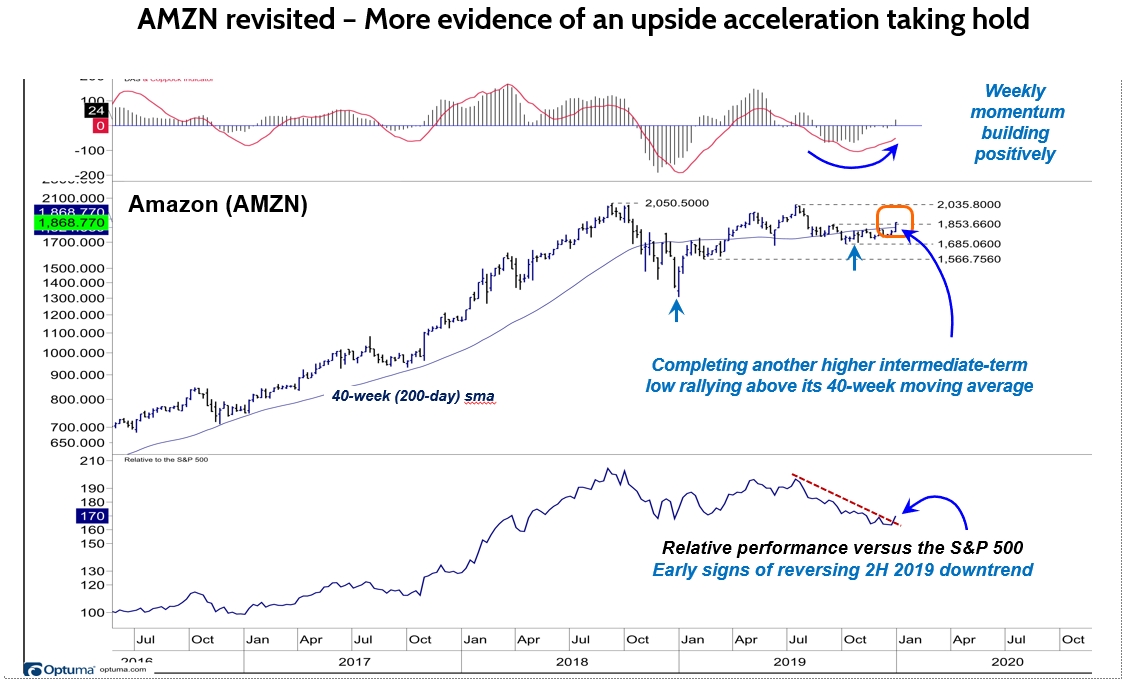

Moving to stocks, Amazon (AMZN) is a timely long position. I featured AMZN’s chart on November 29th as a bottoming candidate. It’s noteworthy this week after it surged 4.5% Thursday, above two key technical hurdles. The first was its 200-dma simple moving average (sma) at 1825 followed by the September highs at 1853.

But is it too late to buy shares of the giant online retailer? The two reasons I cited in late November to add AMZN exposure remain valid. First, in bull markets like the current one, leadership often gets passed from one leading group to another, like a baton in a relay race. As cyclicals, such as semiconductors, pause then other lagging growth stocks reaccelerate.

That’s why I have featured Chinese internet stocks, such as Alibaba (BABA), NetEase (NTES) and Tencent Holdings (TCEHY) in this space recently. Secondly, while some traders may view taking a position after a 4.5% rally as late to the party, I argue that opinion misses the bigger picture pattern, which is in the early stages of developing.

AMZN’s longer-term uptrend remains intact, weekly momentum is relatively early building to the upside and, as I stated above, AMZN is still in the early stages of completing an important intermediate-term bottoming pattern.

Bottom line: Accumulate AMZN at current levels and on near-term pullbacks.