Imminent Global Rate Cuts Send Stocks Soaring To Records

1 and can accesss 1

In this strategy briefing… |

FS Insight Investment Views

|

Your Weekly Roadmap

Imminent Global Rate Cuts Send Stocks Soaring to Records

It’s raining rate cuts. All over the world. And it appears that no one but senior savers are complaining.

Lo and behold, the result is a U.S. equity market that hits new high after new high. New highs never get boring, do they?

While we all know the U.S. Federal Board is expected—as in 100% probability—to reduce the Federal funds rate next week (see pages 4 and 6), the punch bowl was enlarged and deepened to include Europe. Thursday, the European Central Bank (ECB) signaled it is preparing to cut short-term rates and perhaps start its bond-buying program in order to stimulate the moribund eurozone economy.

Lately moribund and eurozone seem an oxymoron. Outgoing ECB president Mario Draghi described the eurozone economic outlook as “getting worse and worse.” It’s going to be a tough slog for a continent where governments are far too involved in business decisions, but here I digress. Central banks in Asia and South Africa reduced interest rates earlier in July. The world is easy, as in financially easy.

Here’s the risk for investors who follow the bear case and have remained on the sidelines or have sold. Tom Lee has been noting what happens after a Fed cut during a non-recessionary period, such as the current environment. Obviously, there’s risk the bears are correct. Trade tensions with China haven’t been resolved and global growth is soft. I put a low probability on this, low enough that the risk return favors owning stocks for the medium term.

There will eventually be a recession and a correction. Those are the laws of economics. But by the time the bears are right, the market might be much higher. Tom Lee, for example, sees upside beyond his current 3125 yearend target for the Standard & Poor’s 500 index.

Then there’s second quarter results, which are so far coming in better than expectations. For example, United Technologies (UTX) filed a classic bullish beat and raise report. UTX EPS was $2.20 per share, beating estimates and the year ago $1.97. Sales soared nearly 18%.

According to FactSet, 44% of the companies in the S&P 500 have reported actual results for Q2. Of companies that have reported EPS, some 77% beat estimates, which is above the five-year average. In aggregate, companies are posting profits 5.4% above the estimates, also above the five-year average. The blended (combines actual results for companies that have reported and estimated for those yet to report) earnings decline for the second quarter is -2.6%, lower than the minus 3.4% EPS Q2 decline expected last week. Not too shabby.

Among other bullish signs, the semiconductors group is on fire, with the PHLX Semiconductor Sector Index (SOX) is also at all-time highs. Semis don’t high new highs during the end of the economic cycle (for more on this see page 4).

The S&P 500 index closed at 3025, up almost 2% on the week. And yes, that is a new record high for the index. Friday’s volume was low.

For the record, in 2Q U.S. economic growth slowed but still expanded at a healthy clip, boosted by strong consumer spending, which offset a drop in business investment. GDP rose at a 2.1% annual rate, adjusted for seasonality and inflation, the Commerce Department said Friday. While that was a pullback from 3.1% in 1Q, it was still a bit higher than expected. Other data was positive as well. Demand for U.S. manufactured goods looks to firm: the country’s durable goods orders rose 2% in June, led by orders for transportation goods, and higher than expected.

Of course, the ever modest President Donald Trump blamed the Fed’s turn to a tighter stance last fall for the lower GDP. Let’s get one thing straight. While administrations can influence market sentiment, and that’s important, presidents aren’t directly responsible for the pace of economic growth or market moves. Yet, he might be right on this particular score.

Quote of the Week: From the WSJ: President Trump took aim at China again ahead of trade talks in Shanghai next week, pressing the World Trade Organization to change how it defines developing countries—which he says gives China and other countries an unfair advantage. “The WTO is BROKEN when the world’s RICHEST countries claim to be developing countries to avoid WTO rules and get special treatment. NO more!!!” Mr. Trump wrote in a tweet on Friday. “Today I directed the U.S. Trade Representative to take action so that countries stop CHEATING the system at the expense of the USA!

Questions? Contact Vito J. Racanelli at vito.racanelli@fsinsight.com or 212 293 7137. Or go to http://www.fsinsight.com/.

Tom Lee's Equity Strategy

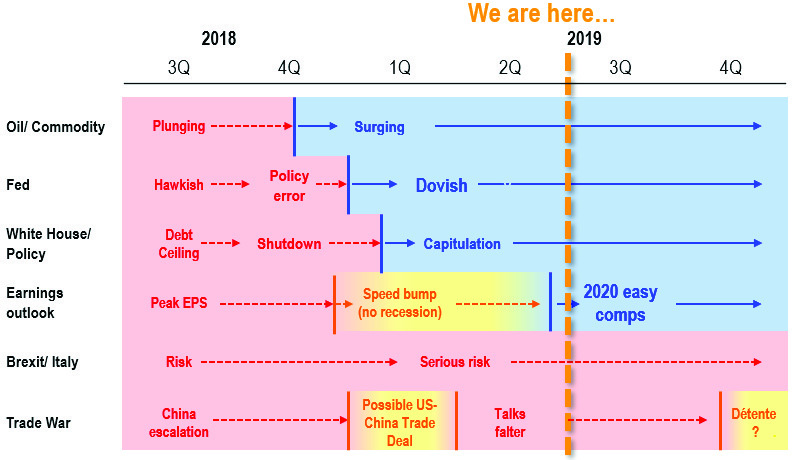

'Hated' Rally of 2019 Faces Crucial FOMC Meeting Week

– Probabilities favor an equity rally post FOMC rate cut

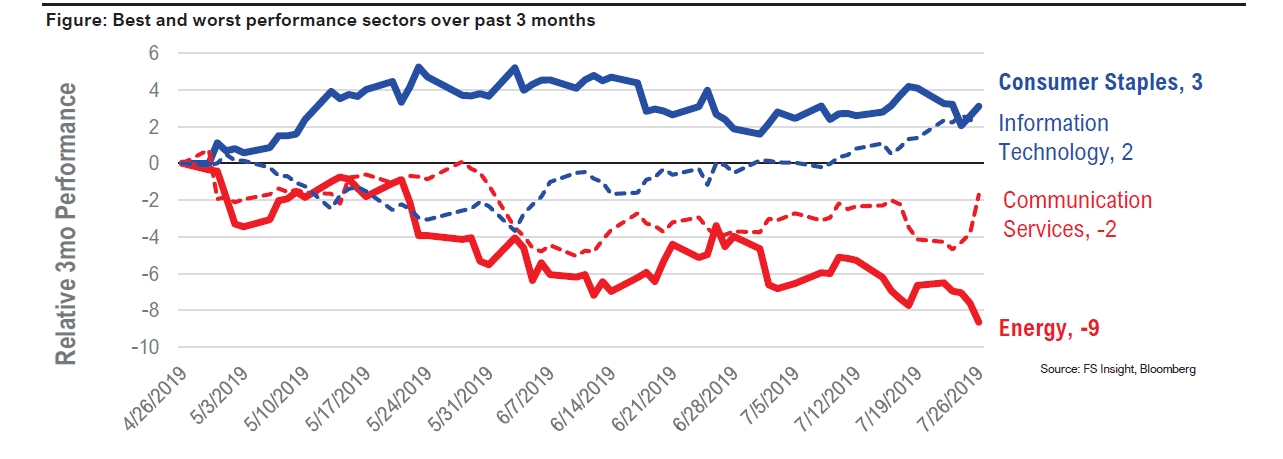

– Defensive sectors outperform in first three months after non-recessionary cut

– USD headwind for stocks to fade with cut

As just about anyone who isn’t living under a rock expects, the U.S. Federal Reserve Board is set to cut the Fed funds rate next Wednesday (for more on this see page 6). My anecdotal sense in talking with clients is that they are focusing on the last two rate cycles (2001 and 2007) and therefore see these cuts as both a negative signal and of limited benefit for stocks.

The bears need to refocus on the circumstances surrounding this cut. I’ve previously published multiple studies showing that stocks see positive gains every time the Fed cuts (100% of time, when LEIs positive). Consider the mechanisms.

The strong greenback has been a headwind for Corporate America and its EPS growth since 2018 (taking perhaps 5%-6% off the top-line). Consequently, a Fed cut should let the USD weaken. Moreover, because of either a shortage of USD or an oversupply of short-term Treasures, the Fed Funds rate is now higher than the IOER (interest on excess reserves). The Fed has intended to keep the funds rate below IOER, but in the past three months, the former has moved above this.

Finally, lowering interest rates is a further easing of financial conditions— and hence, positive. Despite the bearish headlines and the record market highs, there are actually multiple reasons for stocks to rise based on a Fed cut next week.

For example, there is also materially less market liquidity and depth in 2019 combined with overall cautious US hedge fund positioning. JPMorgan, in its recent “Flows and Liquidity” report, noted that trading across all markets is down double-digits across most markets (YoY) and 20%-plus for equities.

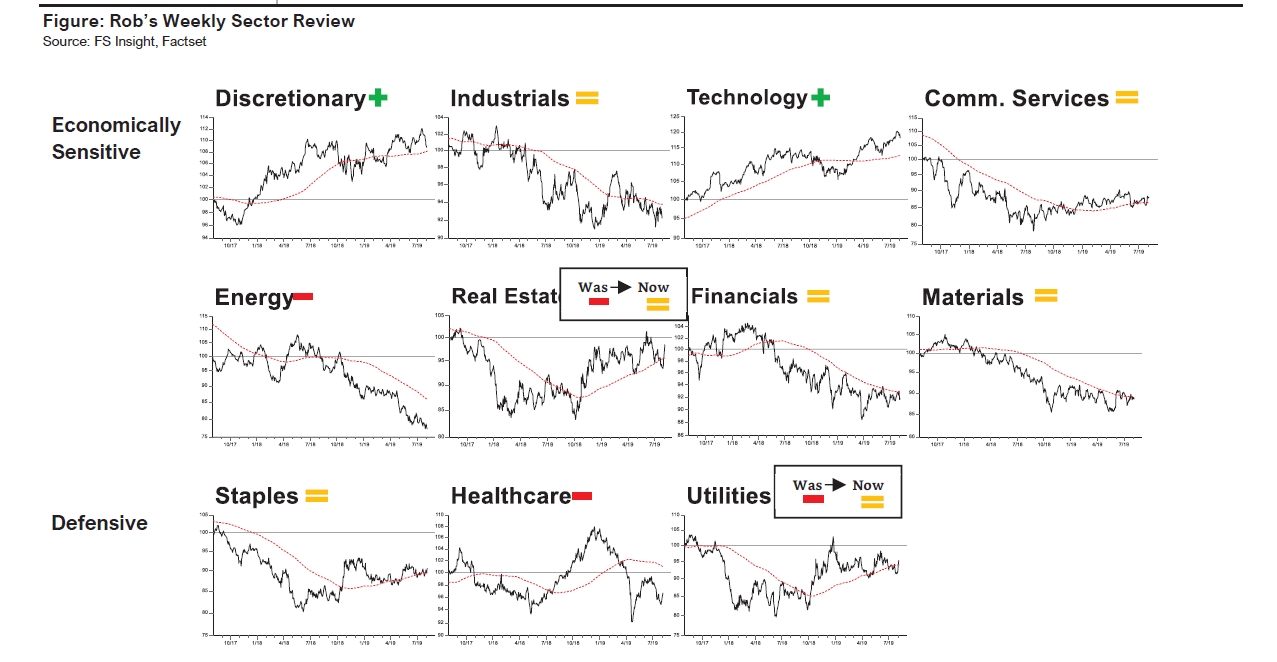

Note that Comm Services was defensive and basically Telecom stocks until 2018

And hedgies are cautiously positioned despite 20% gains in equities year-to-date, a major contrast to 2017-2018, when hedge fund equity beta (exposure) was elevated. Therefore, if hedge funds decide to increase equity exposure, given the more illiquid trading environment, we could see a large upside move in risky assets —this is bullish.

The S&P 500 index, which has been making new high after new high in July, is blessed with strong market internals. Perhaps the best measure is the advance-decline line. The rally since June is relatively healthy, given that A/D line has also pushed to new highs, which reinforces my view that new index highs are imminent.

And don’t ignore the semiconductor sector, which is hitting new highs as well. This would seem to quash the late-cycle view of the U.S. economy. Semis never rally nor make new highs late in the cycle. For example, semis saw failures in 2001 and 2007, in terms of both absolute price and relative to the S&P 500. If we are in late cycle, semis should be rolling over now. What we see is prices at new highs and strong ‘relative performance’ vs. the S&P 500 index.

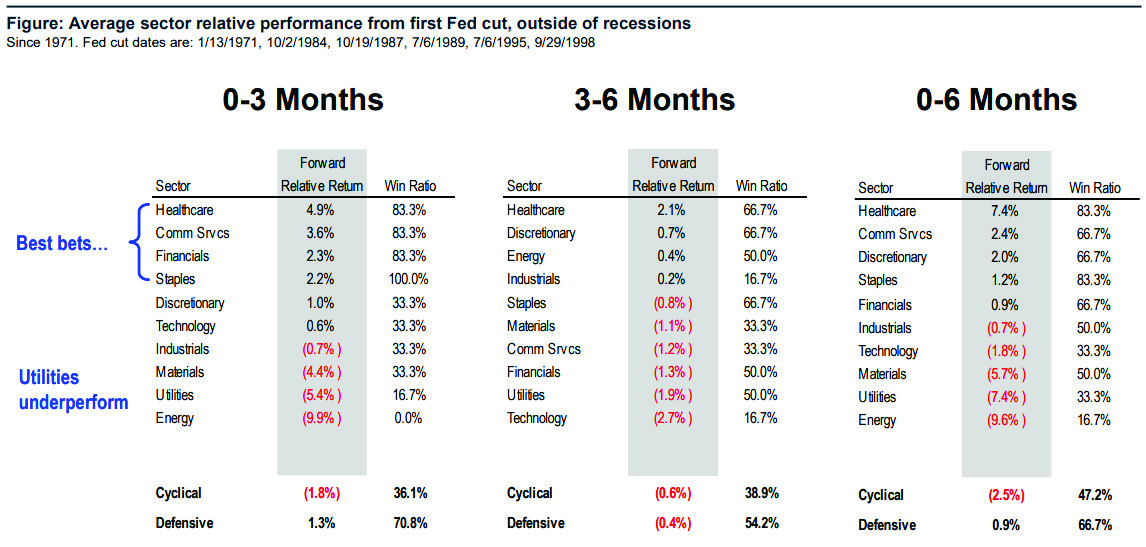

Post-cut sector performance isn’t all that consistent but it seems defensives and financials are the best bet in the first three months with win ratios of 83%, respectively (see table below). From there, returns should be based on the contour of the economic trajectory and there’s little consistency. The relative outperformance is likely reflecting stocks sensitive to lower interest rates and stocks that benefit from easing financial conditions. Hence, I think these sectors are the best bets in the next 3 months or so.

What could go wrong? Global central banks are easing and ECB seems to be tilting towards escalating measures. Given the high prevalence of negative yielding debt, this clearly signals investors are just not comfortable with financial conditions and therefore downside risk exists. But we see equity TINA (There is no alternative.)

Bottom line: We are positive on stocks in 2H19 and see upside beyond our 3,125 S&P 500 target. Semis hit new highs and, coupled with new highs S&P 500 and the A/D line, points to a powerful 2H19 rally. The following are 18 stocks to buy on the first Fed cut, based on best 4 sectors + DQM1 ranked: Healthcare, Telecoms, Financials and Staples: AMP, BLK, NTRS, COF, MTB, RE, CL, CLX, PG, MNST, MO, PM, AMGN, BIIB, GILD, HUM, BMY and MRK.

Fed Watch

Conjoined Twins: Bull Market and a Dovish Federal Reserve

The overwhelming consensus is that the Federal Open Market Committee meeting on July 30-31 will reduce the Fed funds rate. A Reuters poll shows 95% of economists are anticipating that and the CME futures market implies 100% probability of at least a 25 basis points reduction to 2-2.25%. So what happens next?

My colleague Tom Lee wrote last week that a market “blast off” occurs when the Fed cuts and US isn’t in recession. Well folks, it seems pretty unlikely we’re in the midst of a recession. And the average return of the S&P 500 index over the six months following one of those non-recessionary cuts is 13.5% and 16.5% over 12 months.

Assuming a cut happens, next year or so could be a very good time indeed for the equities markets, if history is any guide. The US economy seems healthy enough—second quarter gross domestic product growth was 2.1% on an annual basis, according to figures released Friday—and consumer metrics are in good shape. Lending is up, retails sales reached record highs in June, as did spending on motor vehicles and parts dealers.

Of course, this begs the questions why a cut is necessary. John Williams, vice chairman of the Fed’s rate-setting committee and head of the regional Fed bank in New York, said last week that “When you have only so much stimulus at your disposal, it pays to act quickly to lower rates at the first sign of economic distress….you don’t have to wait until data turns decisively if you can afford to.”

In other words, with rates already so low, the Fed would rather cut too soon by anticipating economic weakness than cut rates in response to existing economic weakness where bigger, frequent cuts are necessary but not possible. That implies the Fed is capable of anticipating economic conditions accurately and successfully “manage” a $21 trillion economy. Let’s be honest, economists are horrific forecasters.

Three of the biggest risks to the U.S. economy are US-China tariffs, slower global growth, and other unexpected geopolitical tensions like Middle East tension. But guess what the other big risk is? Fed policy. We saw last December (S&P 500 down 8% following a Fed hike) how much trouble Fed policy errors can bring to the market. That was the worst ever sell off in equities following a FOMC meeting. Afterward, the Fed pivoted to its now dovish stance. For now this bull market seems to need a dovish Fed, but the Fed needs this bull market. With these two joined at the hip, another market “fight” could get ugly.

The 10-year Treasury note yield is around 2.08 versus 2.05% the Friday before. As noted, CME Fed futures, a pretty accurate indicator of where rates are going, continues to place a 100% probability of at least one cut at the next FOMC meeting and another one in September.

Upcoming: 7/30-31 – FOMC meeting.

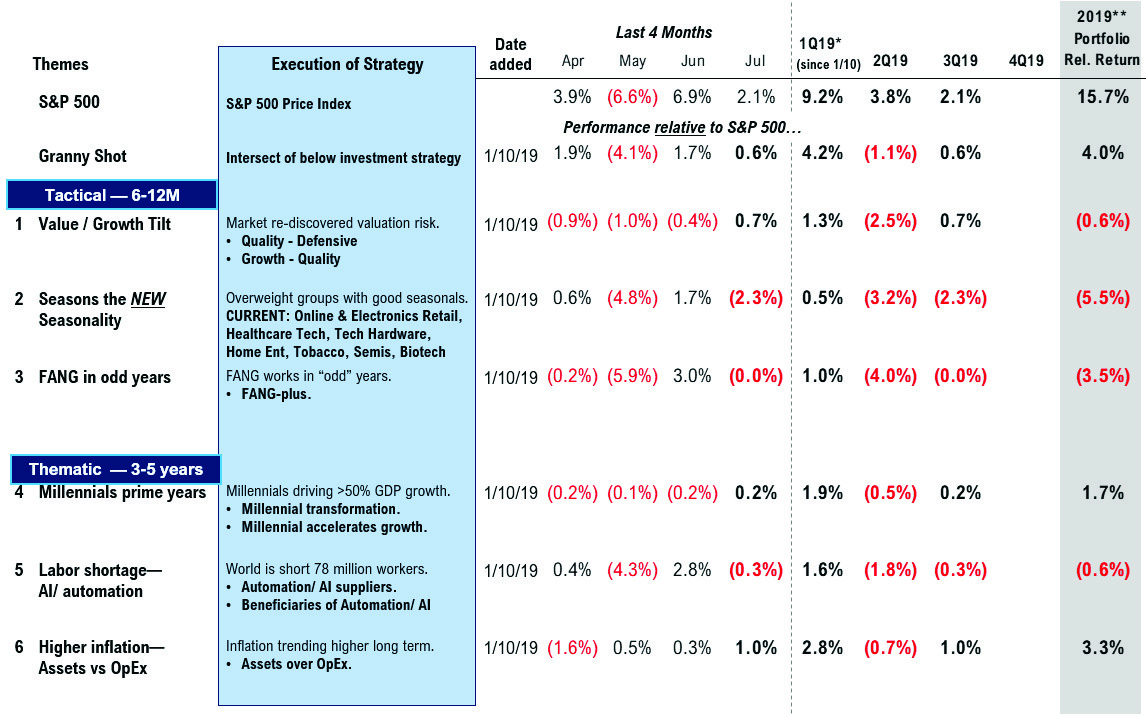

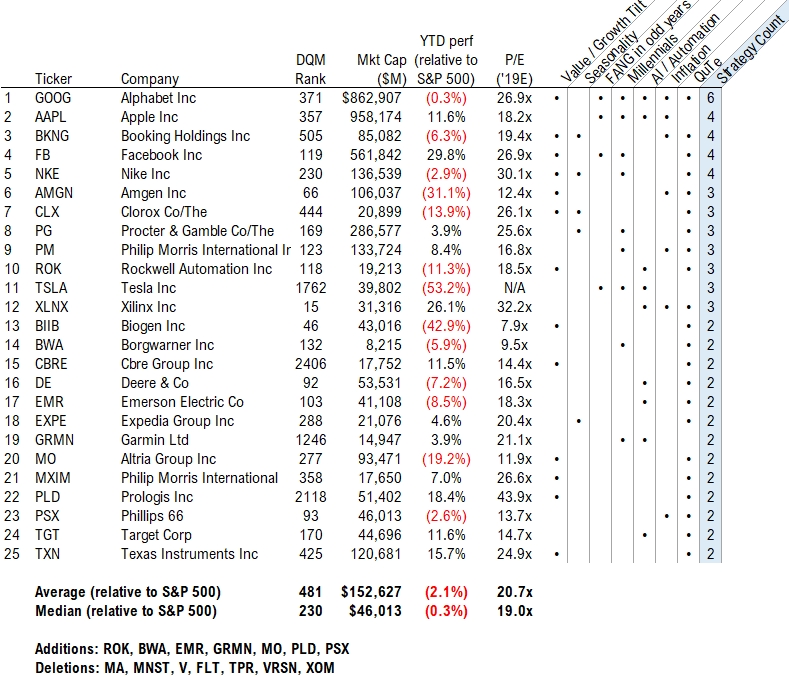

Recommended Stock Ideas

Focus Insight Stock List - Week 30

Below we’ve highlighted the FocuS stocks that we recommend across at least two of our investment strategies for 2019.

Figure: Focus Insight Stock List

As of 07/25/19, source: FS Insight, Factset

The Focus Portfolio underperformed the S&P 500 by 481 bps since its inception.

Technical Strategy

Swap Exposure to Cyclicals From Safety Stocks...NOW

It’s time for investors to position their portfolios for the change in leadership just beginning to take hold, and this means increasing exposure to the right sectors and groups in 2H19 and well into 2020.

There is a burgeoning evidence of a market rotation away from safety stocks, such as utilities and staples, and toward cyclicals, which is likely to significantly impact portfolio performance through year end and well into 2020.

As a starting point, I believe investors should have an opinion on where the current market cycle stands. And as regular readers know, I believe the S&P 500 index lows in December 2018 marked another multi-year cycle low at the rising 200-week moving average, similar to what developed in 2016 and 2011.

In theory, the current cycle should continue higher over the coming two to three years and looks similar to the four-year market cycle accelerations that developed during the secular bull markets of the 1950-1960s and the 1980-1990s. With the S&P 500 currently tracking the roadmap of a normal four-year cycle, the next question is how best to position a portfolio for the emerging cycle?

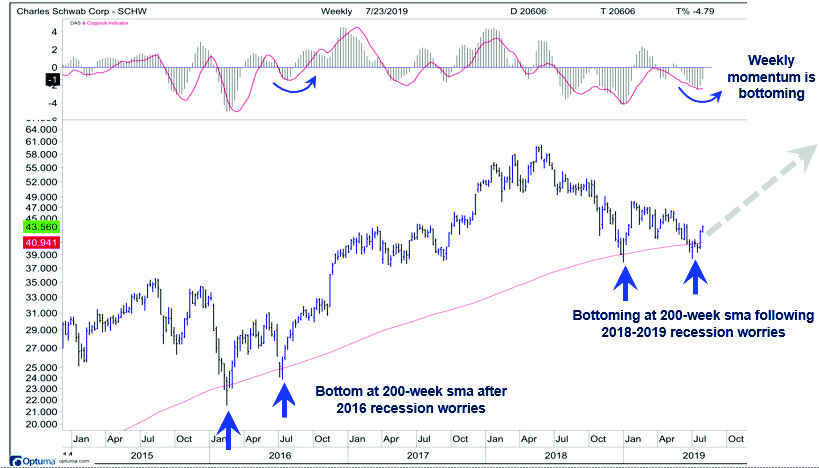

First, capitalize on changes in sector and group leadership. The most important technical development unfolding in Q3 is the nascent rotation from safety, such as utilities and staples, and towards more cyclical groups. The stock chart of Charles Schwab (SCHW) is particularly noteworthy as an example of a cycle low as it retests and bounces from important support at its rising 200-week moving average. (See below.)

Source: FS Insight, Bloomberg

As developed in July 2016, SCHW’s retest of its 200-week moving average appears to be part of a broader bottoming process that is developing for more cyclical groups from semiconductors to industrials to financials. Weekly momentum, which tracks one and two quarter shifts, is in the early stages of turning up from oversold levels and is consistent with a cycle low developing.

US Policy

More from the author

Articles Read 2/2

🎁 Unlock 1 extra article by joining our Community!

You’ve reached your limit of 2 free monthly articles. Please enter your email to unlock 1 more articles.

Already have an account? Sign In 83edad-bbbd7a-96cb5f-d1a4de-66693e

Already have an account? Sign In 83edad-bbbd7a-96cb5f-d1a4de-66693e