Stocks built on their advances from last year to rally to records in the new year, trudging higher despite rising geopolitical tensions with Venezuela and mixed jobs reports.

The S&P 500 rallied 1.6% to finish the week at fresh all-time highs of 6,966.28 points — up 1.8% for 2026. In a sign of the rally broadening, 10 out of 11 sectors participated in the gains, with only utilities closing in the red. The information technology sector barely finished in the green, up 0.02% for the week.

“The broader market has been performing much better than large-cap technology, and most Magnificent Seven stocks — outside of Alphabet and Amazon — have largely been consolidating,” Fundstrat Head of Technical Strategy Mark Newton said.

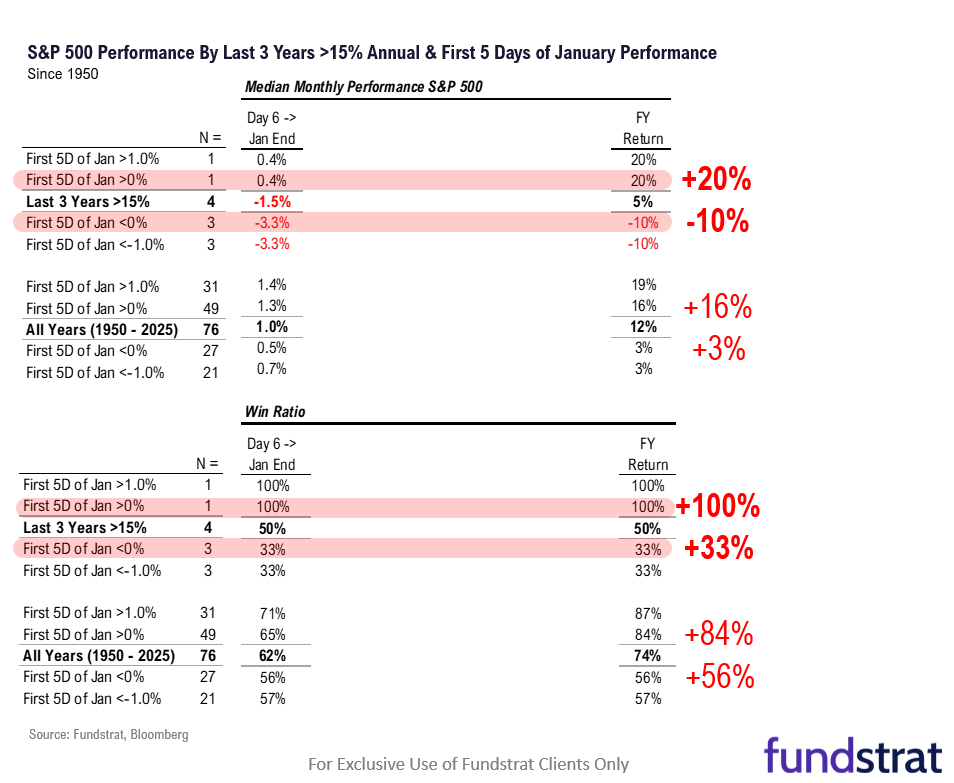

One indicator suggests that the gains could continue for the year. The January Barometer dictates that “as January goes, so goes the full year,” with a special focus on the first five days of the month, so it could be perceived as a good thing that the S&P 500 increased 1.1% during that period this year.

Historical data backs up this claim. Since 1950, the S&P 500’s average annual return is 12%. Out of that sample size of 76 years, the index has finished in the green during the first five days for 49 years, and in those instances, the full year gain is 16%. During the 27 years that the index declined during the first five days, the calendar year gain is a mere 3%, according to Fundstrat’s research team, which makes the argument that the January Barometer is important to watch.

“Part of me says it’s intuitive because if stocks do well out of the gate, then it kind of shows you there’s demand for equities,” Fundstrat Head of Research Tom Lee said. “So, I don’t think it’s so crazy.”

Multiple labor market reports were released this week, though investors remain focused on Friday’s monthly nonfarm payrolls data. The U.S. economy added 50,000 jobs in December, coming in below expectations of 73,000 jobs, but the unemployment rate edged down to 4.4% and the November level was revised down to 4.5% from 4.6%.

It reassured investors that there is still room for the Federal Reserve to cut interest rates.

“In December, Fed Chair Powell says he’s not contemplating hikes and is now dependent on the evolution of the jobs market. A put on the economy is a put on the stock market,” Lee said.

Investors were arguably even more relieved Friday to know that the Supreme Court decision pertaining to tariffs was pushed back to next week.

Chart of the Week

Given that there’s been three years of back-to-back bonanza gains, some investors are still bearish. An analysis by Lee’s team sheds some light there. There’s been four times in history when the S&P 500 has gained over 15% for three straight years. In one of those instances, when stocks rallied during the first five days, the annual return was 20%. For the other three instances, stocks declined an average of 10% when they didn’t inch higher during the first five days. That suggests that 2026 could shape up to be another year of gains.

Recent ⚡ FlashInsights

FS Insight Video: Weekly Highlight

Key incoming data

1/2 9:45 AM ET: Dec F S&P Global Manufacturing PMITame1/5 10:00 AM ET: Dec ISM Manufacturing PMITame1/6 9:45 AM ET: Dec F S&P Global Services PMITame1/7 10:00 AM ET: Oct F Durable Goods Orders MoMTame1/7 10:00 AM ET: Nov JOLTS Job OpeningsTame1/7 10:00 AM ET: Dec ISM Services PMITame1/8 8:30 AM ET: Oct Trade BalanceTame1/8 8:30 AM ET: 3Q P Unit Labor CostsTame1/8 8:30 AM ET: 3Q P Nonfarm Productivity QoQTame1/8 11:00 AM ET: Dec NYFed 1yr Inf ExpTame1/9 8:30 AM ET: Dec Non-farm PayrollsTame1/9 10:00 AM ET: Jan P U. Mich. 1yr Inf ExpTame- 1/13 6:00 AM ET: Dec Small Business Optimism Survey

- 1/13 8:30 AM ET: Dec Core CPI MoM

- 1/13 10:00 AM ET: Oct New Home Sales

- 1/14 8:30 AM ET: Nov Retail Sales

- 1/14 8:30 AM ET: Nov Core PPI MoM

- 1/14 10:00 AM ET: Dec Existing Home Sales

- 1/15 8:30 AM ET: Jan Philly Fed Business Outlook

- 1/15 8:30 AM ET: Jan Empire Manufacturing Survey

- 1/15 4:00 PM ET: Nov Net TIC Flows

- 1/16 10:00 AM ET: Jan NAHB Housing Market Index

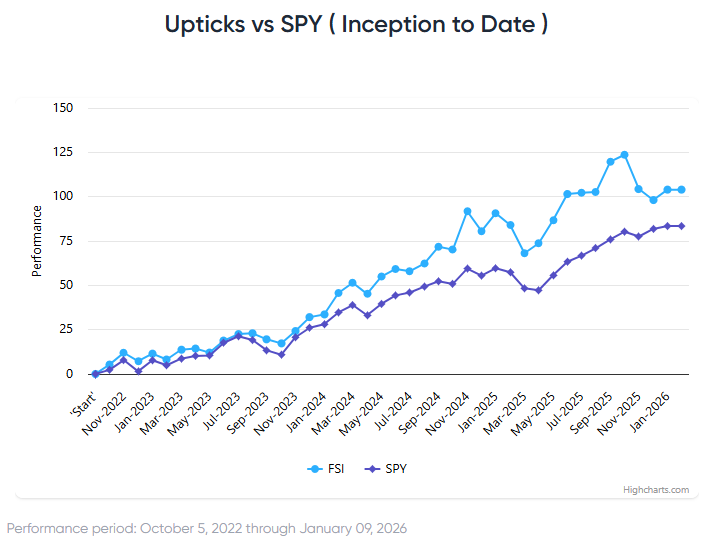

Stock List Performance

In the News

| More News Appearances |