The long-awaited rate cut by the Federal Open Market Committee came to pass last week. Though widely anticipated, Fundstrat Head of Research Tom Lee viewed this cut as a decidedly dovish development for stocks. “To us, this is the start of an easing cycle rather than ‘one and done,'” he wrote. As he reminded us, an easing cycle is likely to lead to positive developments for liquidity and risk assets (including cryptocurrency), as well as business confidence and activity, hiring, and the housing market.

“The Fed is making cash less attractive, which to us is risk-on,” he added.

As has often been the case, the rate decision was less scrutinized than the accompanying Summary Economic Projection (SEP). The SEP indicates that the Committee as a whole anticipates another two cuts (assuming 25 bps per cut) before we bid farewell to 2025, but perhaps the real story is the widened dispersal of opinions underlying that figure. Of 19 voting members, seven anticipate no further cuts, two see just one more, nine see two more cuts, and one member even indicated expectations for five additional cuts. That is perhaps unsurprising in light of the unusual economic and policy developments we’ve seen in 2025, but it also signals the potential for contentiousness in the next few meetings.

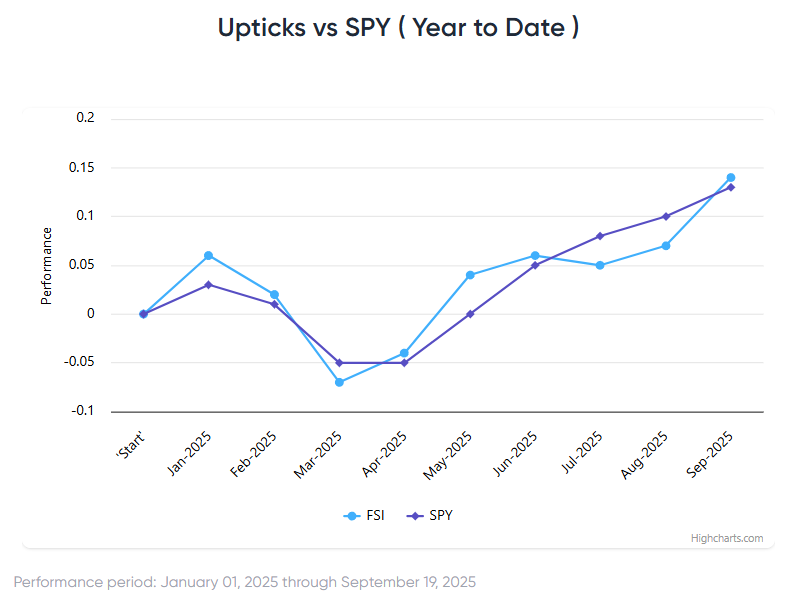

Markets appeared to view the FOMC meeting overall as a positive. The S&P 500 and Nasdaq Composite each hit all-time highs on Monday, Thursday, and again on Friday on their way to posting weekly gains of 1.22% and 2.21%, respectively.

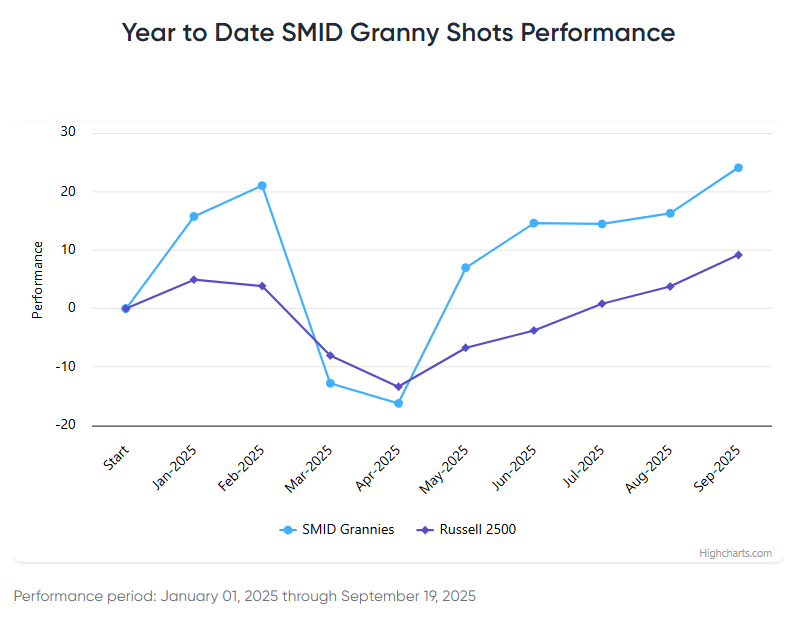

The small-cap Russell 2000 (IWM -0.71% ) outperformed the S&P 500, advancing 1.95%. “This is a very bullish four-year base which has just been exceeded, technically speaking,” wrote Head of Technical Strategy Mark Newton. He added that in his view, “This bodes well for a likely push up to $260, and can allow for near-term outperformance vs. both the equal- and cap-weighted S&P 500 in the short run.”

That would represent a gain of 7% from Friday’s close and suggest that investors might be starting to come around to Lee’s longtime constructive view of the rate-sensitive sector.

Looking at the overall market, Newton remains constructive, and so does Lee. Sentiment also remains subdued, something that both Lee and Newton view as a positive. As Lee put it: “If you think people are too bullish and we’re in a bubble, take a look at the American Association of Individual Investors sentiment survey. It’s still net negative.” he remarked, and far from the exuberance that is often seen right before a correction.

Chart of the Week

Despite the latest challenges and pressures facing Nvidia, Fundstrat’s Tom Lee remains constructive on the company. “To me, Nvidia is the scarcest company today,” he noted. Furthermore, despite Nvidia’s gains in recent years, Lee still views the stock’s valuation favorably. “Its [fiscal year] forward P/E is only 26.6X while Costco’s and Walmart’s are trading at 49X and 34X. So, until NVDA forward P/E is 50X or so, it is hard to argue NVDA is a bubble,” he said. This is illustrated in our Chart of the Week.

Recent ⚡ FlashInsights

- The Street is expecting 25bp and I think that sounds right

- Consensus thinks stocks will sink in disappointment at 25bp

- This is what I am hearing from many investors as well

- Stocks are hesitant today and tentative to Fed

- Investors are expecting stocks to be down

- We would expect the best to be

- Crypto BTC and ETH Bitcoin and Ethereum

- Financials and small-caps XLF 0.13% IWM -0.71%

- MAG7 NVDA 0.20% AAPL 3.18% GOOGL 1.18% TSLA 2.19% NFLX 1.59% AMZN 0.16% AVGO -0.03%

FS Insight Video: Weekly Highlight

Key incoming data

9/15 8:30 AM ET: Sep Empire Manufacturing SurveyTame9/16 8:30 AM ET: Aug Retail Sales DataTame9/16 10:00 AM ET: Sep NAHB Housing Market IndexTame9/17 9:00 AM ET: Sep M Manheim Used Vehicle IndexTame9/17 2:00 PM ET: Sep FOMC DecisionDovish9/18 8:30 AM ET: Sep Philly Fed Business OutlookTame9/18 4:00 PM ET: Jul Net TIC FlowsTame- 9/22 8:30 AM ET: Aug Chicago Fed Nat Activity Index

- 9/23 9:45 AM ET: Sep P S&P Global Services PMI

- 9/23 9:45 AM ET: Sep P S&P Global Manufacturing PMI

- 9/23 10:00 AM ET: Sep Richmond Fed Manufacturing Survey

- 9/23 10:00 AM ET: Aug Existing Home Sales

- 9/24 10:00 AM ET: Aug New Home Sales

- 9/25 8:30 AM ET: Aug P Durable Goods Orders

- 9/25 8:30 AM ET: 2Q T GDP

- 9/25 11:00 AM ET: Sep Kansas City Fed Manufacturing Survey

- 9/26 8:30 AM ET: Aug Core PCE Deflator

- 9/26 10:00 AM ET: Sep F U. Mich. Sentiment and Inflation Expectation

Stock List Performance

In the News

| More News Appearances |