The Nasdaq Composite closed above 20,000 points for the first time on Wednesday, though it slipped slightly to end last week at just under the 20K mark. The rally has been driven by tech heavyweights such as Google, Tesla and Apple. However, the S&P 500 slipped into what Fundstrat Head of Research Tom Lee has called the “zone of uncertainty” this week, with the broad-based index dipping slightly after three consecutive weeks of gains.

As Lee had anticipated, investors responded to worries about inflation, particularly after CPI and PPI reports. Head of Technical Strategy Mark Newton noted that the CPI numbers showed “big progress” on two inflation components that have proven stubborn throughout 2024 – used cars and housing. However, the war against price increases continued to weigh on the broad-stock index. Worries about continued “stickiness” in inflation ramped up after Thursday’s PPI report showed hotter-than-expected wholesale-inflation numbers. (The PPI report is considered to be a precursor to consumer-inflation trends.)

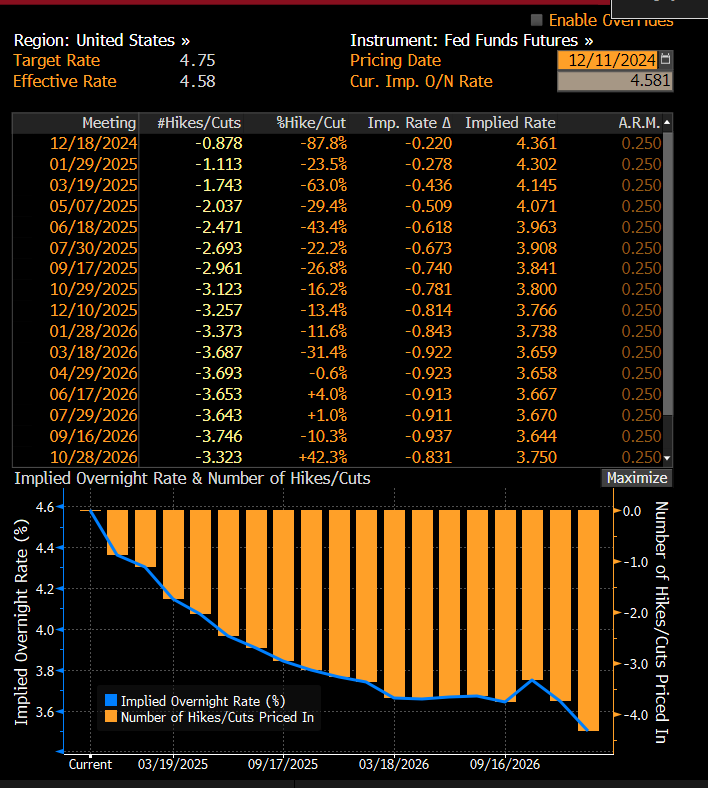

This in turn raised worries about prospects for further rate cuts from the Federal Reserve. While the market continues to anticipate that the Federal Open Market Committee (FOMC) will cut rates by 25 bps on December 18 (as implied by Fed Funds futures trading), it also largely anticipates that the Fed will then pause its cutting cycle on January 29, 2025. (Fed Funds futures trading implied odds of a January pause at 81.0% as of Friday afternoon.)

For those worried that inflation will return, Lee has this to say: “I think a lot of people are making the mistake of seeing inflation as something that has an on-off switch. Inflation is probably going to have a second wave, but it’s not actually a spike or a resurgence. It’s more that we overshot to the downside and so it’s bouncing. I’d call it more of an echo.” In other words, Lee continues to see inflation tanking and declining.

The market’s reaction to the PPI numbers had Newton telling us that “backing and filling is possible next week ahead of the FOMC meeting,” but his work nevertheless shows that “the bull market rally looks back underway.” Furthermore, his examination into trends in the equal-weighted S&P 500 (RSP 0.64% ) has him optimistic about “small-caps, Transports, and the DJIA all pushing back to new highs into the end of the year.” That’s consistent with Lee’s base-case constructive scenario for the rest of the December.

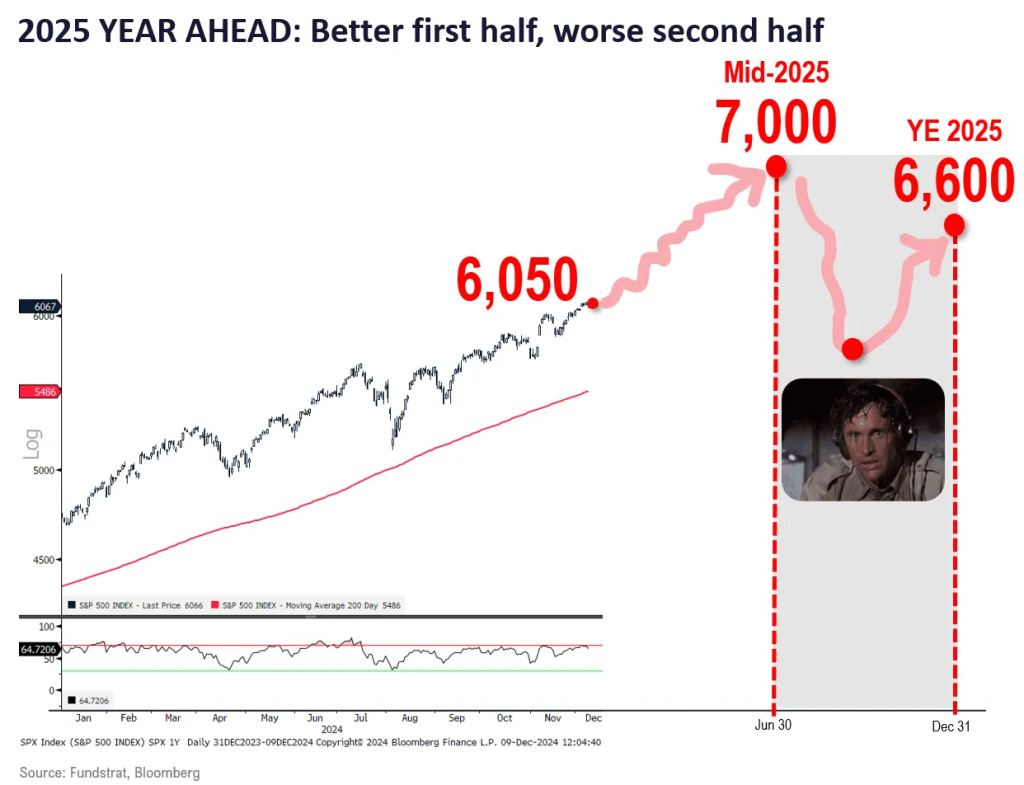

Chart of the Week

Fundstrat Head of Research Tom Lee presented his highly anticipated 2025 Market Outlook last week, taking viewers through all the reasons why markets could continue to climb until the end of 2025. Importantly, however, Lee does not see the all sectors of the market rising in unison. Nor, as illustrated in our Chart of the Week, does he see the advance continuing in a straight line.

Recent ⚡ FlashInsights

FSI Video: Weekly Highlight

Key incoming data

12/9 11:00 AM ET: Nov NY Fed 1yr Inf ExpTame12/10 6:00 AM ET: Nov Small Business Optimism SurveyTame12/10 8:30 AM ET: 3Q F Non-Farm ProductivityTame12/10 8:30 AM ET: 3Q F Unit Labor CostsTame12/11 8:30 AM ET: Nov CPITame12/12 8:30 AM ET: Nov PPIMixed- 12/16 8:30 AM ET: Dec Empire Manufacturing Survey

- 12/17 8:30 AM ET: Nov Retail Sales Data

- 12/17 9:00 AM ET: Dec P Manheim Used vehicle index

- 12/17 10:00 AM ET: Dec NAHB Housing Market Index

- 12/18 2:00 PM ET: Dec FOMC Decision

- 12/19 8:30 AM ET: 3Q T 2024 GDP

- 12/19 8:30 AM ET: Dec Philly Fed Business Outlook

- 12/19 10:00 AM ET: Nov Existing Home Sales

- 12/19 4:00 PM ET: Oct Net TIC Flows

- 12/20 8:30 AM ET: Nov PCE Deflator

- 12/20 10:00 AM ET: Dec F U. Mich. Sentiment and Inflation Expectation

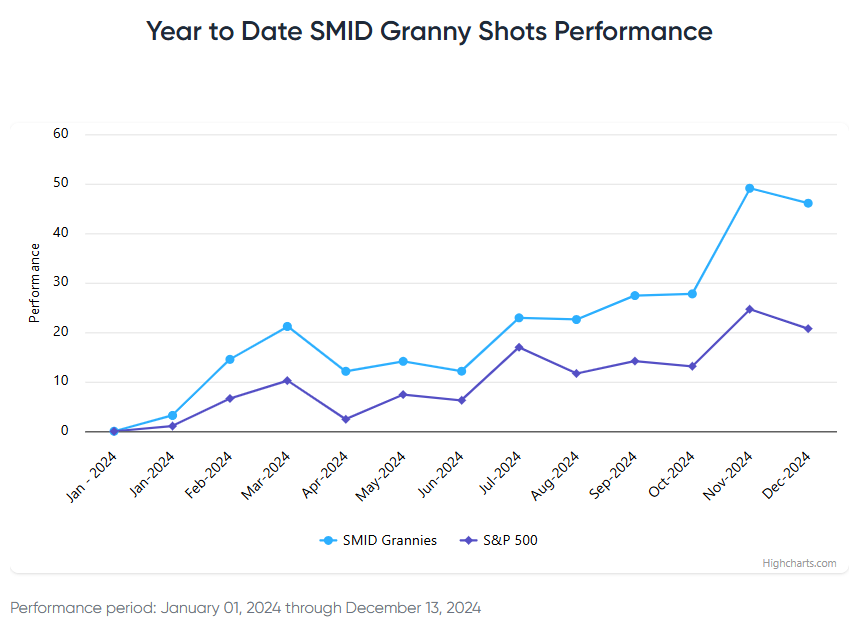

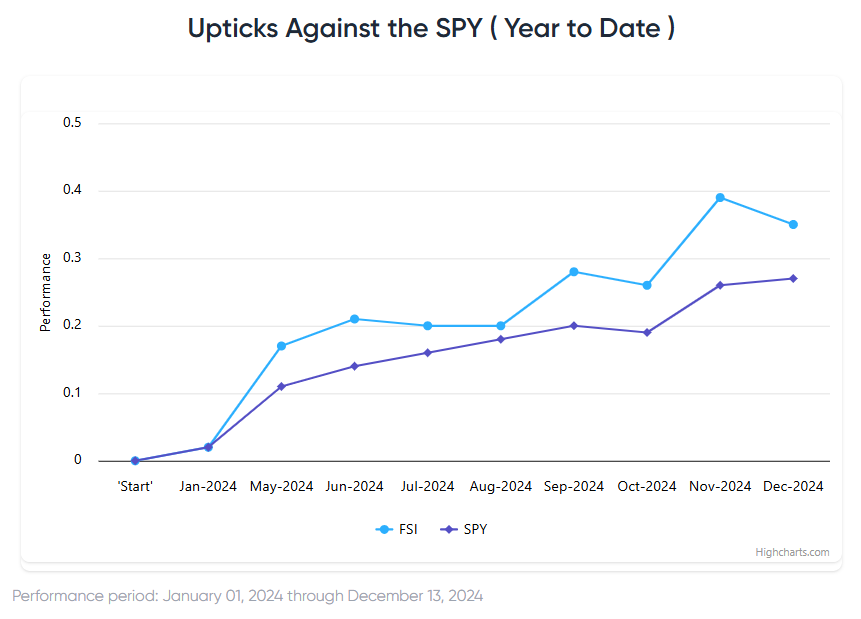

Stock List Performance

In the News

| More News Appearances |