A daily market update from FS Insight — what you need to know ahead of opening bell

“Make living your life with absolute integrity and kindness your first priority.” — Richard Carlson

First news

- A once-thriving global brand, a Russian internet giant takes a massive haircut to escape its home country and live to do business another day, in another place

- Russia’s aviation industry, with no replacement parts for its mostly Western fleet, will soon need to ground more planes and have fewer flights in order to avoid fatal accidents.

Overnight

- With 29% approval ratings, S. Korea’s President Yoon addresses wife’s Dior bag uproar. link

- The 3 largest sports broadcasters: ESPN, Fox & WBD, are teaming up; ESPN still to launch separate streaming service. link

- Failed border deal leaves Ukraine aid in limbo as Kyiv’s forces run short on ammunition. link

- Nikki Haley captures 31% of the vote in Nevada primary, losing to “none of these candidates” (63%). link

- Ronna McDaniel, current RNC Chair, to step down, paving the way for N. Carolina GOP chair Michael Whatley, sympathetic to “stop the steal”. link

- PBOC lending to other depository cos. up 50% since mid-2022 as China’s smaller banks get squeezed. link

- Stripe data on new business incorporations suggests an entrepreneurship boom is afoot. link

- Roughly 500 former First Republic locations to return in next 3 years as JPMorgan branches. link

- Woodside Energy, Santos end talks over $57 billion merger. link

- Former Chilean President Sebastián Piñera dies in helicopter crash. link

MARKET LEVELS

| Overnight |

| S&P Futures -3

point(s) (-0.1%

) overnight range: -4 to +9 point(s) |

| APAC |

| Nikkei -0.11%

Topix +0.42% China SHCOMP +1.44% Hang Seng -0.34% Korea +1.3% Singapore +0.97% Australia +0.45% India +0.01% Taiwan flat |

| Europe |

| Stoxx 50 -0.17%

Stoxx 600 -0.22% FTSE 100 -0.42% DAX -0.31% CAC 40 -0.1% Italy +0.03% IBEX -0.87% |

| FX |

| Dollar Index (DXY) -0.11%

to 104.1 EUR/USD +0.1% to 1.0766 GBP/USD +0.25% to 1.263 USD/JPY +0.13% to 148.13 USD/CNY +0.07% to 7.1948 USD/CNH +0.11% to 7.2094 USD/CHF +0.33% to 0.8727 USD/CAD -0.05% to 1.3485 AUD/USD -0.06% to 0.6519 |

| Crypto |

| BTC -0.39%

to 42994.63 ETH -0.72% to 2363.43 XRP -1.43% to 0.5019 Cardano -3.86% to 0.4813 Solana -1.77% to 95.17 Avalanche +0.32% to 34.32 Dogecoin -0.38% to 0.0786 Chainlink +0.52% to 18.51 |

| Commodities and Others |

| VIX flat at 13.06 WTI Crude +0.57% to 73.73 Brent Crude +0.52% to 79.0 Nat Gas +0.3% to 2.02 RBOB Gas +0.71% to 2.233 Heating Oil +0.86% to 2.766 Gold -0.15% to 2033.09 Silver -0.86% to 22.23 Copper -0.26% to 3.771 |

| US Treasuries |

| 1M -1.4bps

to 5.3578% 3M +0.2bps to 5.3649% 6M -4.1bps to 5.1617% 12M -0.6bps to 4.8016% 2Y +1.3bps to 4.4162% 5Y +1.8bps to 4.0628% 7Y +1.8bps to 4.0986% 10Y +2.1bps to 4.1211% 20Y +2.0bps to 4.4189% 30Y +2.2bps to 4.3219% |

| UST Term Structure |

| 2Y-3

M Spread widened 1.3bps to -97.2

bps 10Y-2 Y Spread widened 0.8bps to -29.7 bps 30Y-10 Y Spread widened 0.1bps to 19.9 bps |

| Yesterday's Recap |

| SPX +0.23%

SPX Eq Wt +0.63% NASDAQ 100 -0.23% NASDAQ Comp +0.07% Russell Midcap +0.77% R2k +0.85% R1k Value +0.59% R1k Growth +0.07% R2k Value +0.7% R2k Growth +1.0% FANG+ -0.52% Semis -1.13% Software -0.17% Biotech +1.53% Regional Banks -1.26% SPX GICS1 Sorted: Materials +1.7% REITs +1.49% Healthcare +1.09% Indu +0.89% Cons Disc +0.37% Energy +0.32% Utes +0.31% Fin +0.28% SPX +0.23% Cons Staples +0.23% Comm Srvcs -0.21% Tech -0.48% |

| USD HY OaS |

| All Sectors +0.9bp

to 387bp All Sectors ex-Energy +1.0bp to 369bp Cons Disc +1.2bp to 327bp Indu -1.5bp to 292bp Tech -2.2bp to 481bp Comm Srvcs +3.5bp to 599bp Materials +3.4bp to 350bp Energy -0.2bp to 325bp Fin Snr -0.5bp to 360bp Fin Sub +3.6bp to 262bp Cons Staples +0.2bp to 317bp Healthcare -1.7bp to 461bp Utes +3.6bp to 235bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 2/7 | 8:30AM | Dec Trade Balance | -62.0 | -63.207 |

| 2/12 | 11AM | Jan NYFed 1yr Inf Exp | n/a | 3.01 |

| 2/13 | 6AM | Jan Small Biz Optimisum | n/a | 91.9 |

| 2/13 | 8:30AM | Jan CPI m/m | 0.2 | 0.3 |

| 2/13 | 8:30AM | Jan Core CPI m/m | 0.3 | 0.3 |

| 2/13 | 8:30AM | Jan CPI y/y | n/a | 3.4 |

| 2/13 | 8:30AM | Jan Core CPI y/y | 3.7 | 3.9 |

MORNING INSIGHT

Good morning!

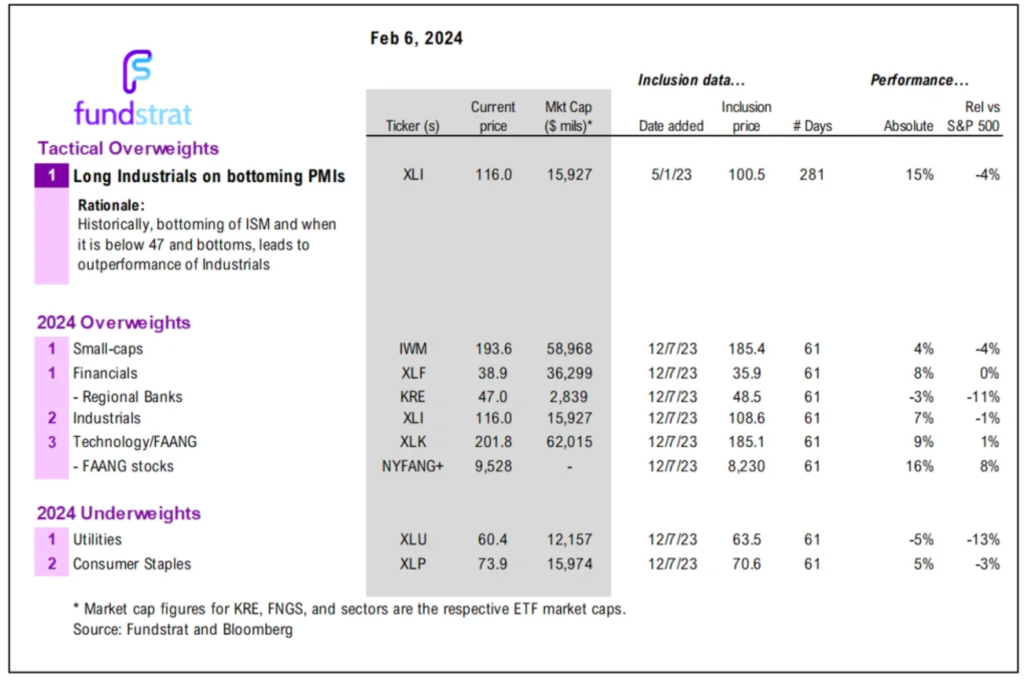

4Q23 EPS: There are four reasons EPS results are better than appears on the surface, including a potential China bottom. An improving China would strengthen the case that U.S. and global PMIs have bottomed. In turn, that supports improving EPS through 2024.

Click HERE for more.

TECHNICAL

Europe and China both look to be close to temporary outperformance vs. the U.S.

Divergence between the top-performing stocks within Technology and the broader market continues to be one of the most-discussed topics of 2024. Performance disparity has reached extreme levels, yet this doesn’t necessarily imply that a large selloff is imminent. A broadening out in performance can also happen to allow sectors to play catchup to recent large-cap Technology performance, and this seems to have started with Healthcare and Financials in recent weeks. Near-term, some negative breadth and momentum divergences could prove problematic into March. Still, there’s been no evidence of any price weakness in the larger indices to warrant concern just yet.

CRYPTO

Market Update

- Consensys, the software company behind MetaMask, has partnered with Robinhood to integrate Robinhood Connect with MetaMask. Robinhood Connect is the platform’s fiat on-ramp that connects customers directly to dApps. With the partnership, MetaMask users will be able to leverage Robinhood’s low-cost order engine, and Robinhood users can use MetaMask’s purchase aggregator. Consensys recently conducted a survey, finding that a third of respondents cited the complexity of Web3 technology as a barrier to entering the crypto ecosystem. The partnership should reduce friction for crypto purchasers and offer a self-custodial option for users who prefer, as Robinhood customers can send crypto assets directly to their MetaMask wallets.

- The Solana network suffered a major network outage Tuesday morning. Laine, a Solana validator, stated in an X post, “Solana Mainnet-Beta is experiencing a performance degradation, block progression is currently halted, core engineers & validators are actively investigating.” Core engineers quickly built a patch for validators to upgrade to, which also required a network restart. After almost five hours of downtime and a network restart, Solana was restored at approximately 10 AM EST. Although validators can process blocks, it will take additional time for dApps to restart and be fully functional. SOL 1.47% fell approximately 3% during the downtime but has since turned positive for the day, rising 0.56%.

FIRST NEWS

Fear & Greed Yandex. In August 2022, half a year into Russia’s invasion of Ukraine, the parent company of Yandex – Russia’s combination of Google and Uber, with notes of Spotify – sold its media interests, which included a news aggregation service, to a state-backed company, cementing the Kremlin’s control over the Russian internet. As with many times and spaces in a totalitarian country, it had scant choice.

Perhaps predictably, Yandex, which had previously built a presence in Europe, the Middle East, and the U.S. – where its robots did much to soothe pangs of hunger in Ann Arbor – had seen trading in its Nasdaq-listed shares suspended, its Moscow Stock Exchange-traded shares plummet in value, and its market capitalization fall to ~$10 billion, down from a peak of ~$30 billion pre-war.

The company realized that, in order to save limbs abroad, it would have to part with its Russian body. At the same time, the Kremlin had vowed that there would be no ‘free exit’ for foreign companies. But was Yandex foreign?

The ‘low countries’

The USSR, to whose worst instincts today’s Russia is full heir, was always a jealous and cannibalistic mother, eager to bite off a piece of those escaping children she did not swallow whole. As with children, so with companies. Even though Yandex is (was) a Russian company – home-grown – it had been registered in the Netherlands, and as the West swiftly imposed strict sanctions on Russia post its invasion of Ukraine, the Kremlin has made it maximally difficult for Western companies – and maximally income-producing for the Russian treasury – to exit the Russian market, including a lengthy approval process, currency controls, and exit taxes.

The Yandex sale price reflects a mandatory discount of at least 50%, which Russia requires from exiting companies registered in countries that Moscow considers unfriendly, including the Netherlands. The $5.2 deal is designed to protect Yandex’s business from sanctions imposed on Russia over its invasion of Ukraine. WSJ

Look, Motherland, No Brakes! In related news, for those companies that have no choice but to stay in Russia, such as the country’s domestic airlines, the future looks bleak, the skies decidedly unfriendly.

When Ural Airlines Flight 1383 to the Siberian city of Omsk suffered a technical fault with its hydraulics last September, the pilots decided to divert to a different airport – standard procedure – but then discovered the plane was rapidly running out of fuel.

With 165 souls onboard, the aircraft eventually made a successful emergency landing in a field in southern Russia, where the Airbus A320 remains, fenced in and under 24-hour security. Five months on, hopes for – not just moving the plane to a repair facility, but moving it, period – have dimmed. After paying compensation of 100,000 rubles (~$1,100) to each passenger, the airline has agreed to lease the land for a year. There are reports the jet could be harvested for parts.

Data show a safety incident occurred 9.9 times in every 100,000 departures in 2023 – more than double the 5 times in 2022 and 4.5 in 2019, per aviation-data company Cirium. Russia’s aviation regulator insists repeatedly that flight safety has not been compromised by Western sanctions. At the same time, Moscow has introduced new laws allowing Russian companies to perform heavy maintenance on their aircraft, manufacture their own components, and cannibalize parked aircraft for replacement parts. Regular maintenance is being put off. This is highly irregular behavior that is begging for consequences.

With one of the largest aircraft fleets in the world, almost two-thirds of the planes made by Western firms, Russia is feeling shortages of landing gear and brakes most sorely, and has had to send aircraft to Iran for maintenance per experts tracking the impact of sanctions. A meaningful move away from Western-built aircraft to domestic ones is not realistic until 2030. In the meantime, Russia’s total operational fleet is forecast to more than halve by 2026, i.e. in 2 years – a macroeconomic, infrastructure-level blow to the world’s largest country by territory, where air travel is essential to keeping the economy going. WSJ