COVID-19 trends are still showing consistent improvement…

The September jobs report came out Friday Morning and was disappointing at the headline. There were more reasons for optimism under the surface. We think the miss is more understandable when you consider that millions of people currently must stay home to take care of those with COVID. A close examination of labor markets also show that Travel and Leisure is not so significant for the wider economy given its proportion of total income.

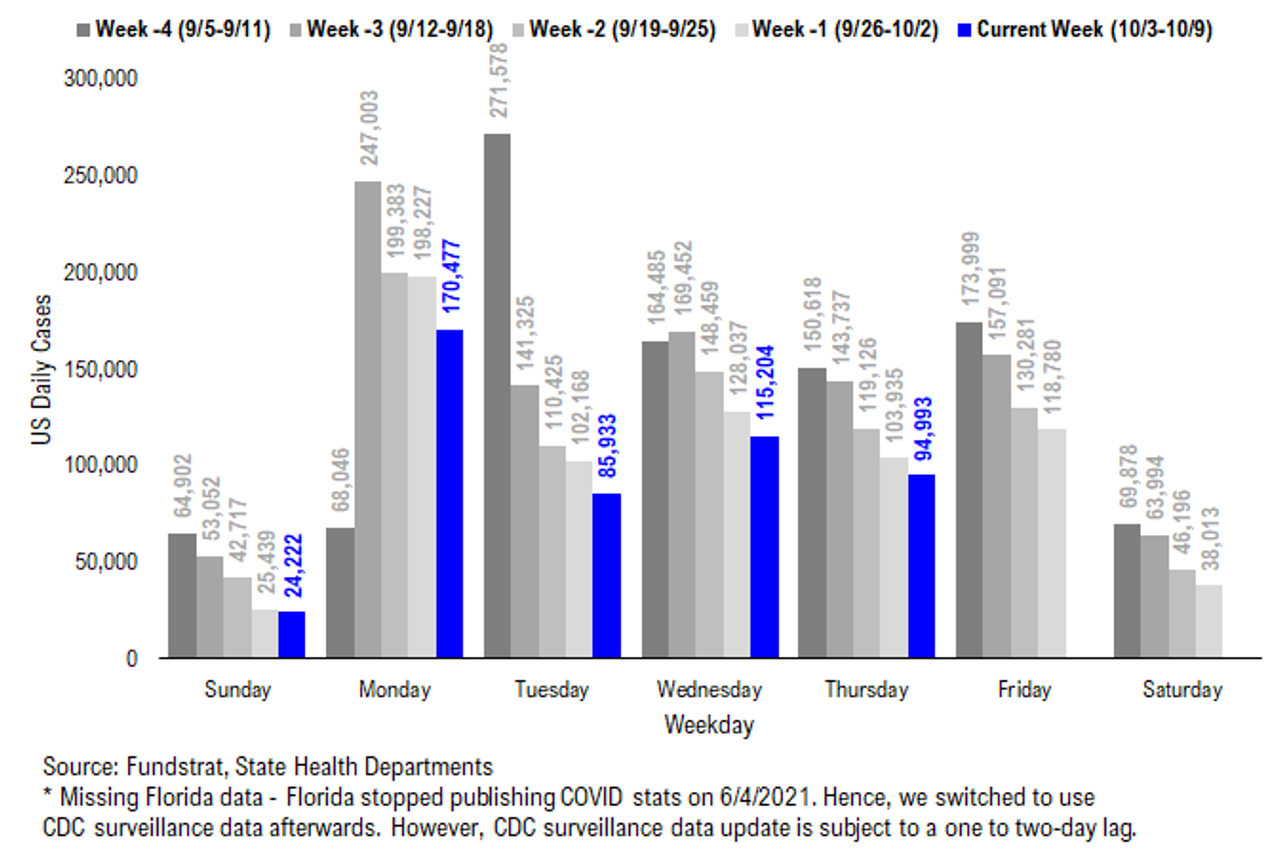

– The latest COVID daily cases came in at 94,993, down -8,942 vs 7D ago

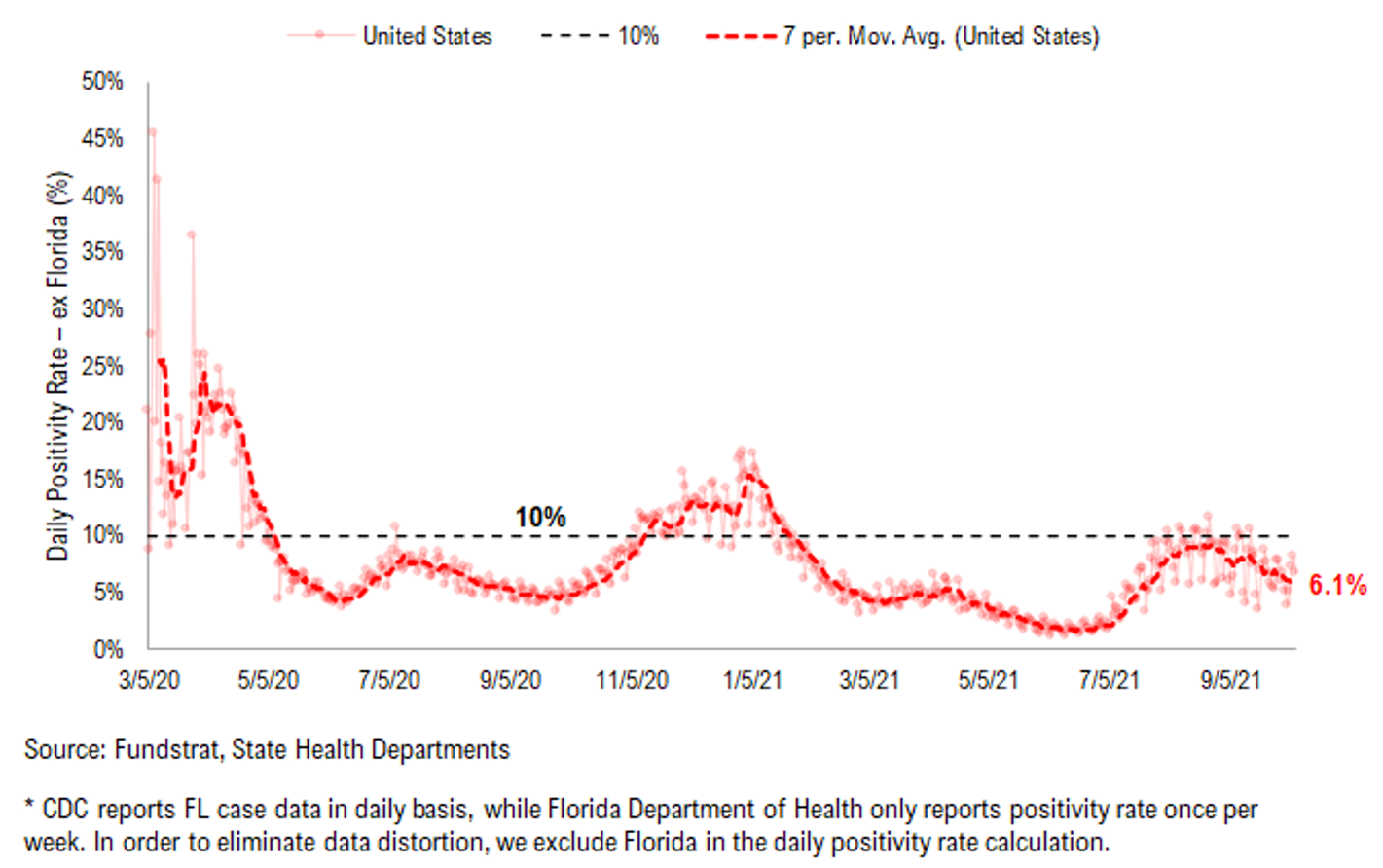

– The positivity rate continues to fall as it is down to 6.1% and has clearly fallen since its recent high of nearly 10%

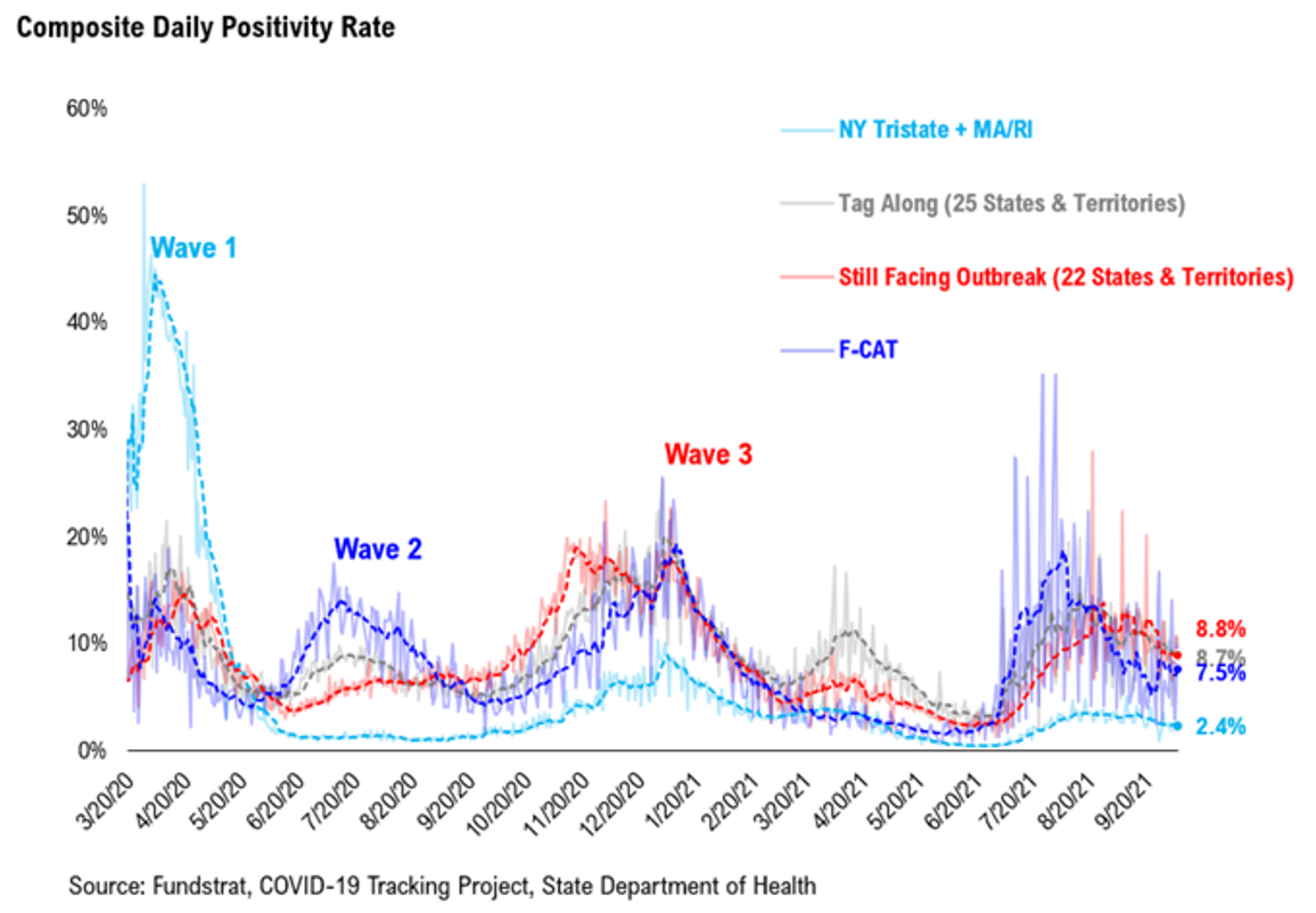

…Next surge in COVID-19 will be “led” by a rise in positivity rates

And looking at positivity rates by region, we can see the generalized decline across all regions. Something self-evident: the next COVID-19 wave will be driven by a rise in positivity rates, along with cases. Thus, the continued and sustained move downwards is encouraging.

INFLATION: Oil could rise a further 40% before it even begins to impact demand

For those in the “peak everything” camp, $80 oil is likely a key factor for expecting global economic growth to cool substantially in 2022. One doesn’t have to look far to see such predictions of calamity. Below is a headline from theStreet.com and cites a strategist who says $80 oil leads to beginning of demand destruction.

– foremost, the future is uncertain, so anything is possible

– however, the price of the commodity itself doesn’t matter

– it is whether the burden on households becomes too great

How big a burden is $80 oil for US households? Not much

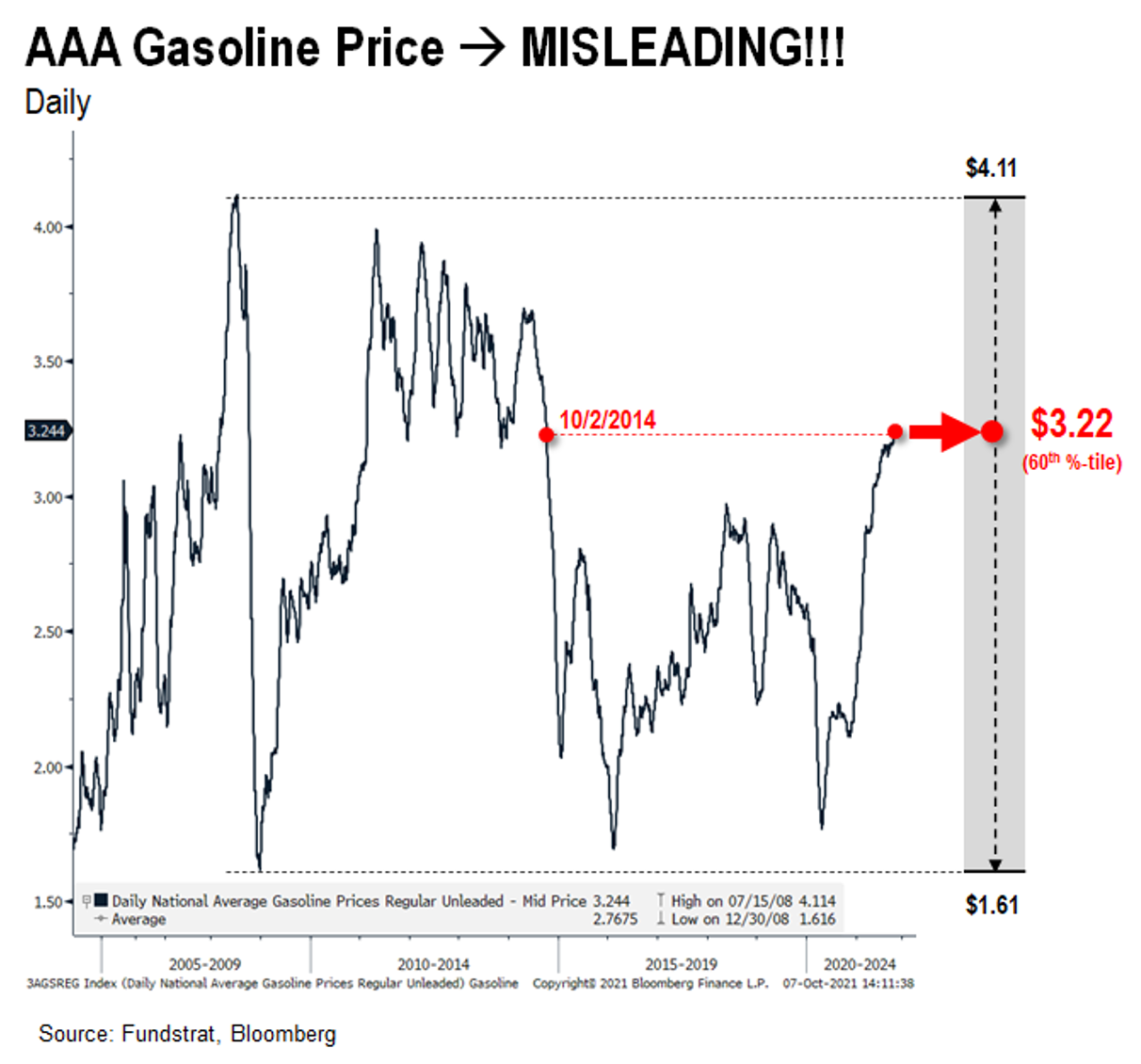

Oil has reached close to $80 recently, matching its price in 2014. This means oil is at a 7-year high. But that figure simply lacks context. The real question is how $80 oil impacts household finances.

Consider the following:

– $80 oil = $3.22 gasoline

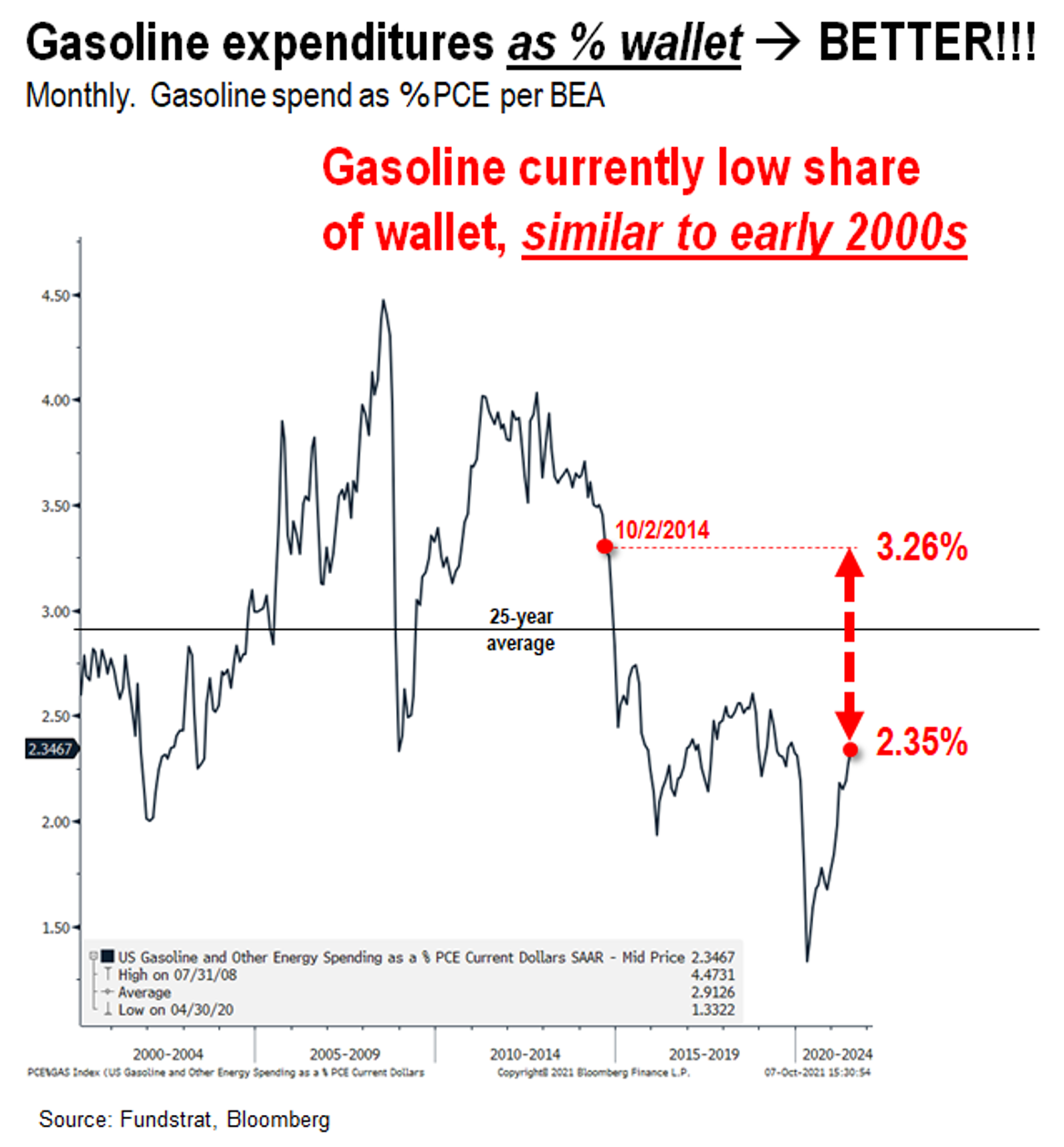

– Based on BEA data, gasoline purchases as percent of household purchases is now 2.35% of all expenses

We think this hardly represents a burden to households:

– 2.35% share of wallet is quite small and barely a top 20 category

– in 2014, $80 oil = $3.22 gasoline = 3.26% of wallet

– gasoline has shrunk wallet share from 3.26% to 2.35%

– since 2014, other consumer items have risen in cost

– big macs, iPhones, coffee, cars and cereal

$80 oil is 2.35% of consumer wallet, down from 3.26% when oil was last $80 (2014)

This is the key point, in our view. Below, we have plotted the daily price of gasoline. And as shown, at AAA average price of $3.22, gasoline is identical to its price in October 2014:

– interesting that its price is identical to where it was exactly 7 years ago

– looking at the 20-year range, the price of gasoline is at the 60th percentile

The problem is context, specifically, inflation.

2.35% now vs 3.26% in 2014: makes more sense to look at gasoline as % consumer PCE (personal consumption expenditures)

Naturally, it makes more sense to look at the actual burden that $80 represents for consumer wallets. Fortunately, the US government actually tracks this.

– They have a dataset that looks at gasoline as a percent of PCE (personal consumption expenditures)

– Data is available since 2000, or 21 years

The time series is shown below. As of the most recent month, gasoline is 2.35% of PCE aka wallet.

– today, gasoline is 2.35% of wallet

– 2014 (same gasoline price), gasoline was 3.26%of wallet

– current wallet share is below the 20-year average of 2.91%

Taking a step back, how is $80 oil going to create demand destruction? Granted, I understand there is a rate of change issue here. Plus, there is a crowding effect. But this is not demand destruction:

– inflation of a price of a good

– doesn’t mean the whole economy comes crashing down

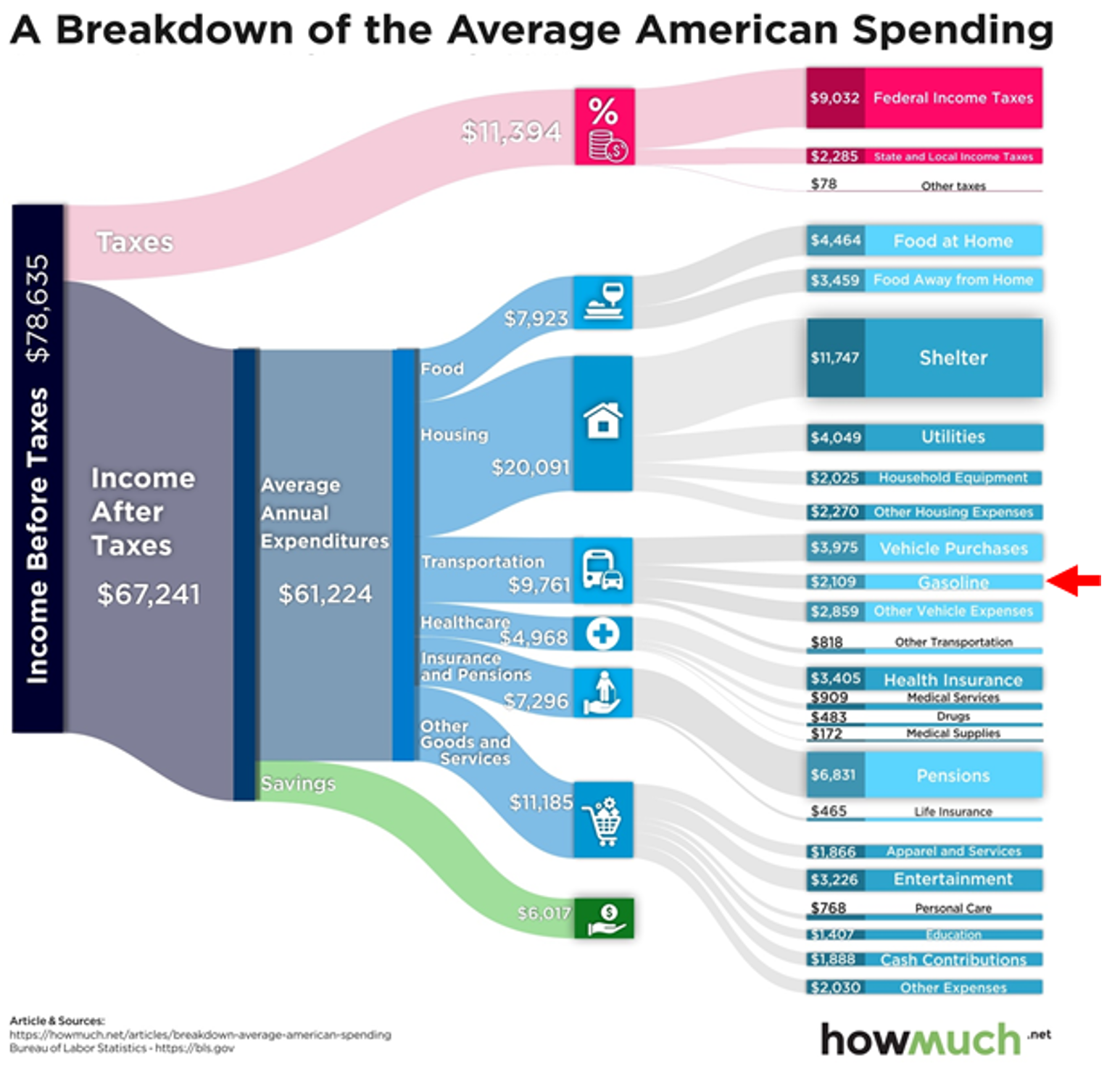

To put gasoline in perspective, take a look at this chart by howmuch.net. We highlighted gasoline share of total wallet. And you can see that it is among the top 20 categories, but hardly the top expenditure.

…Shouldn’t we worry more about the surge in cost of a Starbucks latte? Or a Big Mac?

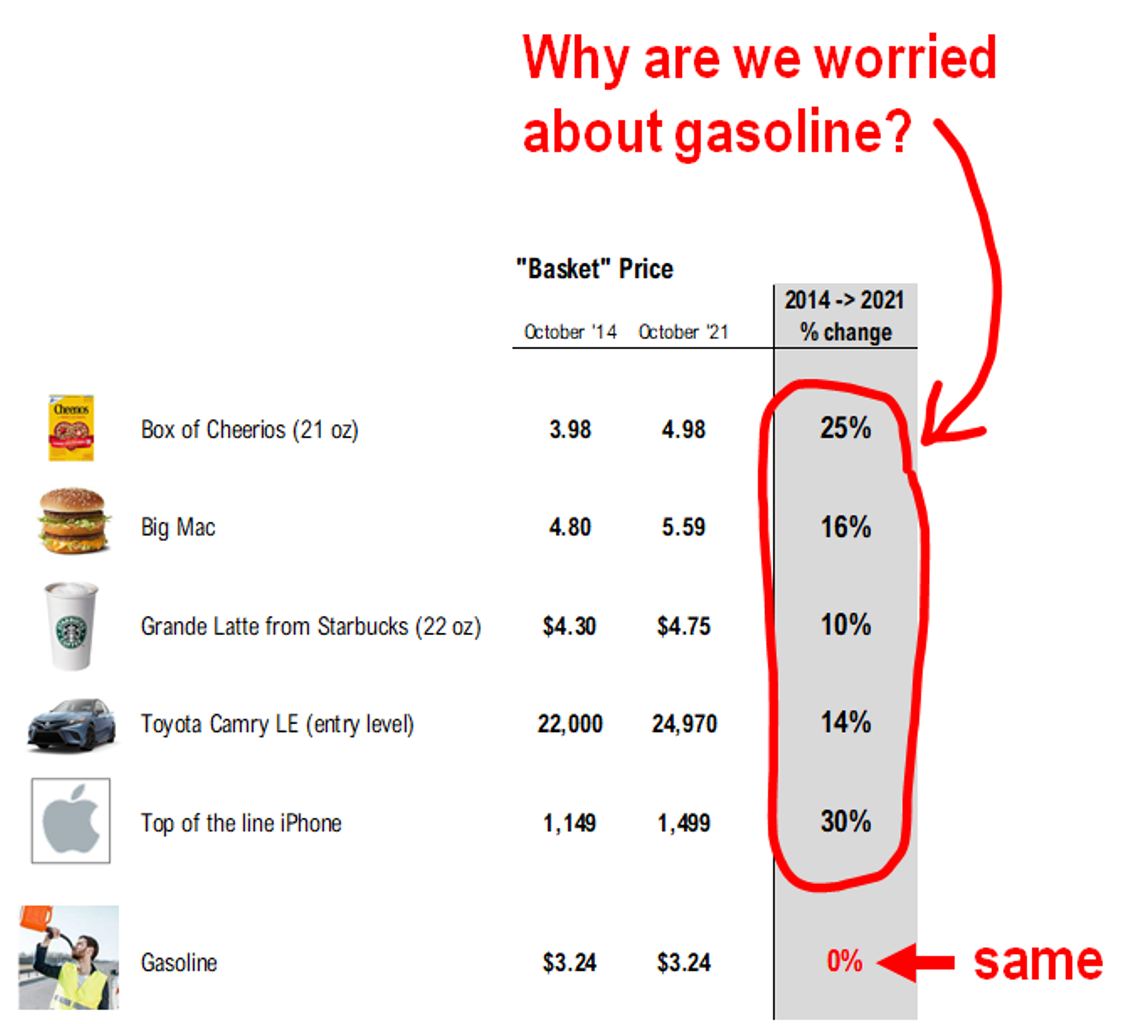

To give you perspective, our data science team compiled comparative 2021 vs 2014 prices for a selection of well-known and commonly consumed items. This is where the comparative changes in those prices is striking, particularly against gasoline:

– Wut?

– Big mac +16% from $4.80 to $5.59 and a latte is +10% from $4.30 to $4.75

– Even cars surged as the entry-level Toyota Camry is +14% more expensive from $22k to $24.970k

– Gasoline 2021 vs 2014 is FLAT

– Yup

So, again, is $80 oil aka $3.22 gasoline, really that alarming?

…Oil needs to be $110 to match 2014 burden and $252 to match 2008 burden

One last comment on oil and its associated household burden. As we noted, household burden from gasoline is really “share of wallet” and we have a simple list below to show where oil needs to be to match the burden of oil in past years:

Hist. 2021

Year Price Share wallet —> Equivalent

2021 $80 2.35%

2014 $80 3.26% $110

2008 $133** 4.47% $252

**monthly average price

Source: FSInsight

So oil has a long way to rise before it matches the wallet impact of 2014 or 2008. This is merely a framework. Because consumer confidence is impacted by the general perceptions of prices. And if the collective view is that $80 oil today is negative, consumers act in a way that reflects demand destruction. We saw this happen already with Consumer Confidence broadly, which collapsed even as contemporaneous conditions did not deteriorate:

– a long-winded way of saying that it is not really that clear what level of oil is a required to cause demand destruction

– or even more mildly, negatively hurt sentiment

STRATEGY: Investor bearishness highest since April 2020 –> wow –> means lots of bad news baked in

Equity markets have been very treacherous for the past 6-8 weeks. And in the past 4 weeks, markets endured a 5% drawdown – the largest since October 2020. It got really choppy over the past week. As many our clients know, we have highlighted how stocks have become so oversold and sentiment so negative, in many ways, we have to go back to March-May 2020 to find similar sentiment. We can now add the Investors Intelligence survey to this:

– % bulls is down to 40%

– this is the lowest figure since April 2020

– Investors Intelligence is a survey of newsletter writers and advisors

Think about that for a moment. Does it make sense that the level of negativity should match what we saw during the depths of the panic. Similarly, we know that market internals, such as % stocks >50D, have fallen to the same levels.

– when everyone is negative

– case can be made that a lot of bad news is baked in

That is the point of looking at sentiment. When investors are extreme, either negative or positive, it is time to counter-trade that view. That is what happened this week.

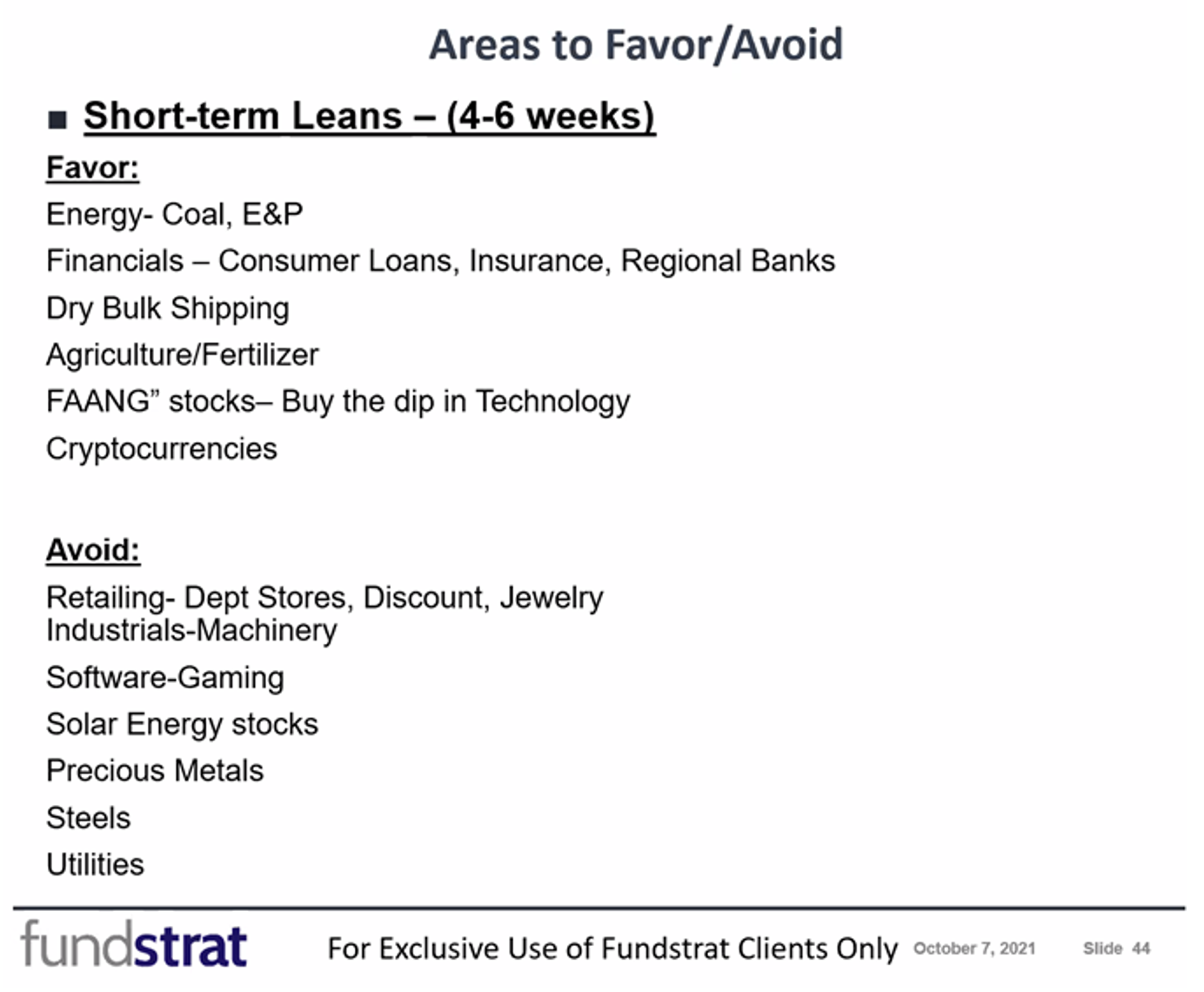

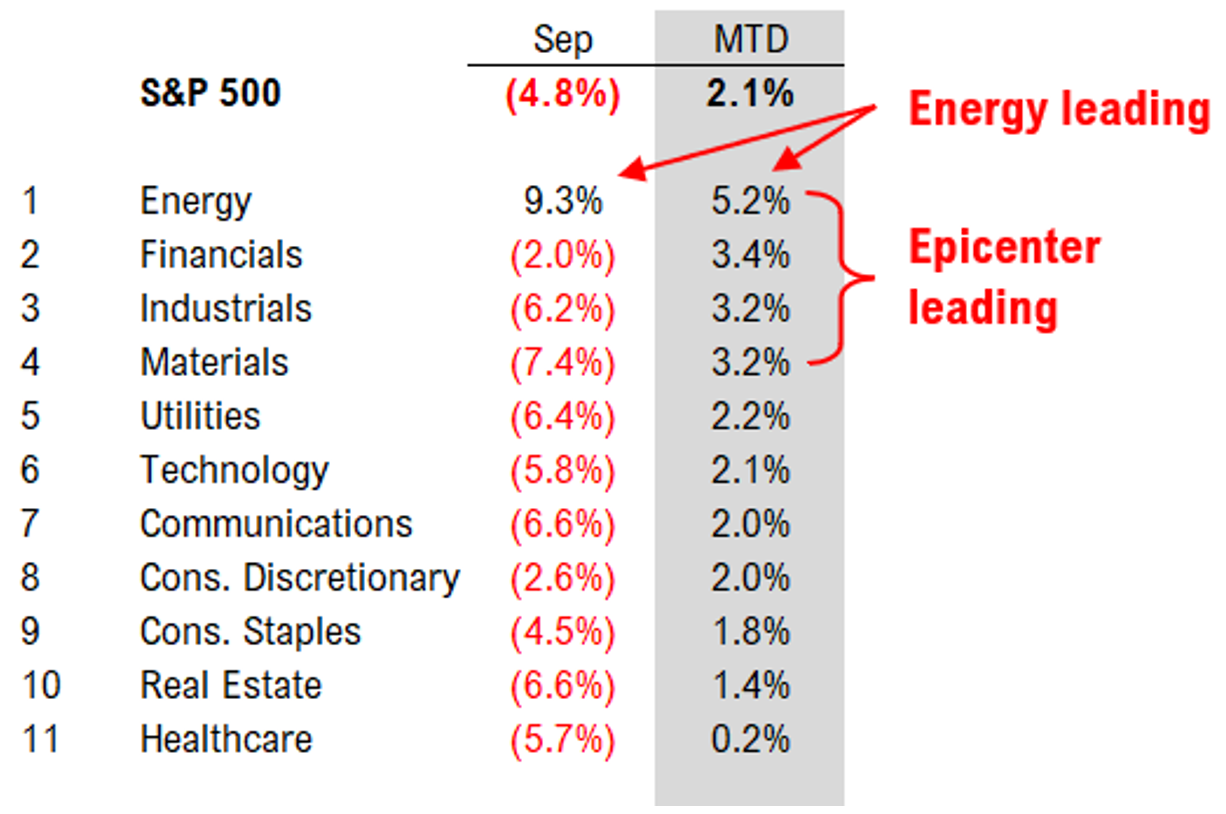

…Mark Newton, Head of Technical Strategy, likes both Epicenter and FAANG = “everything rally”

Our new head of Technical Strategy, Mark Newton, hosted a webinar yesterday. A replay is available and I believe that link was emailed to you already. The slide I want to highlight is his sector favors and avoids:

– He likes Epicenter, Energy and Financials

– and FAANG

– so it is consistent with our “everything rally”

– I found his recommendation of dry bulk shippers interesting

– one of our clients, ES of SF, is also an advocate of these names

As for avoids, these are consistent with our views, except for some consumer stocks.

Energy sector has revealed its relative strength — rallying in September and continuing to lead in October

We think Energy stocks remain attractive risk/reward. There are multiple factors (see our previous notes) which we have cited multiple times. The most incremental comment today is that oil at $80 is less a burden than many perceive. Thus, we continue to favor Energy stocks into YE.

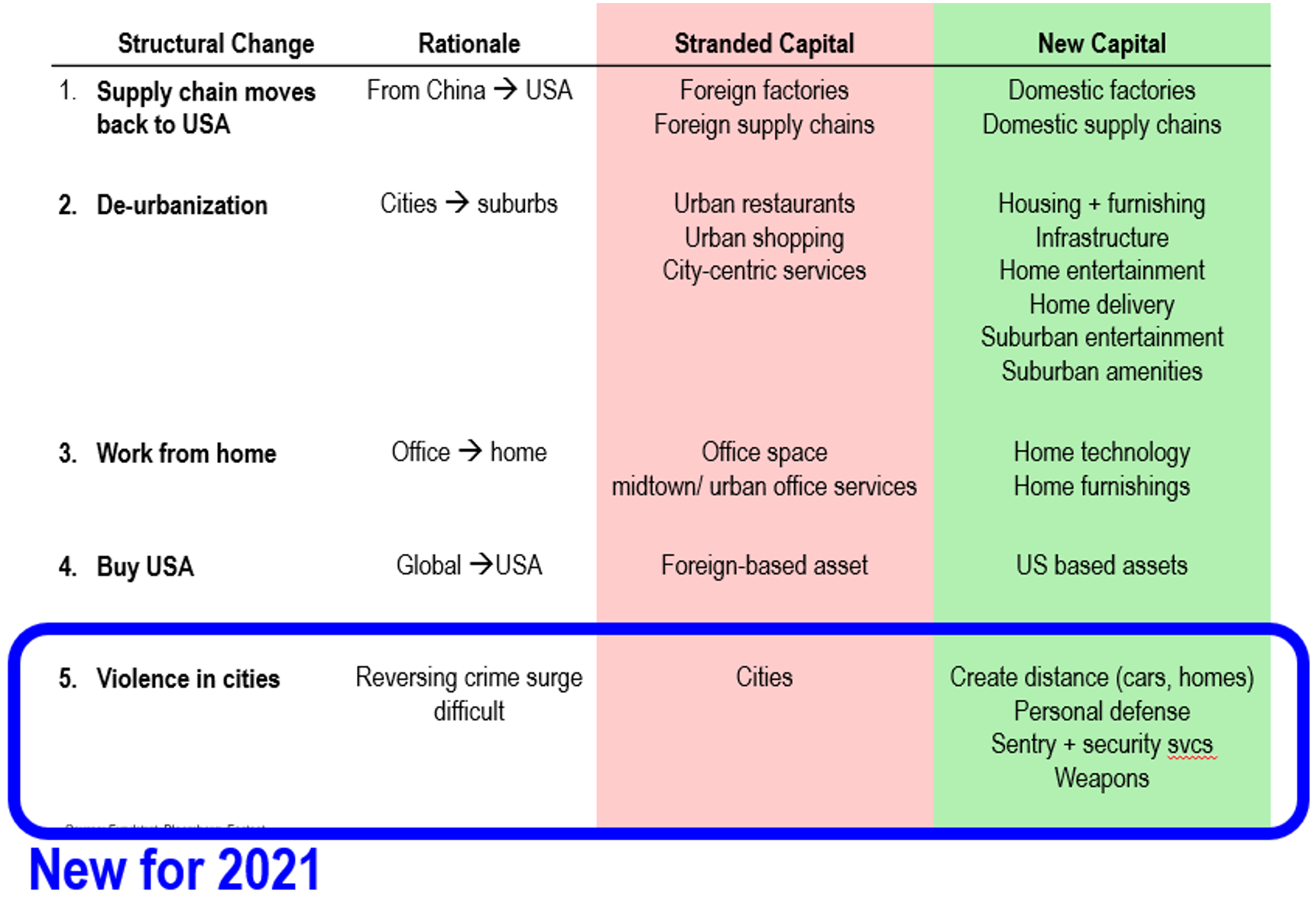

Figure: Way forward ➜ What changes after COVID-19

Per FSInsight

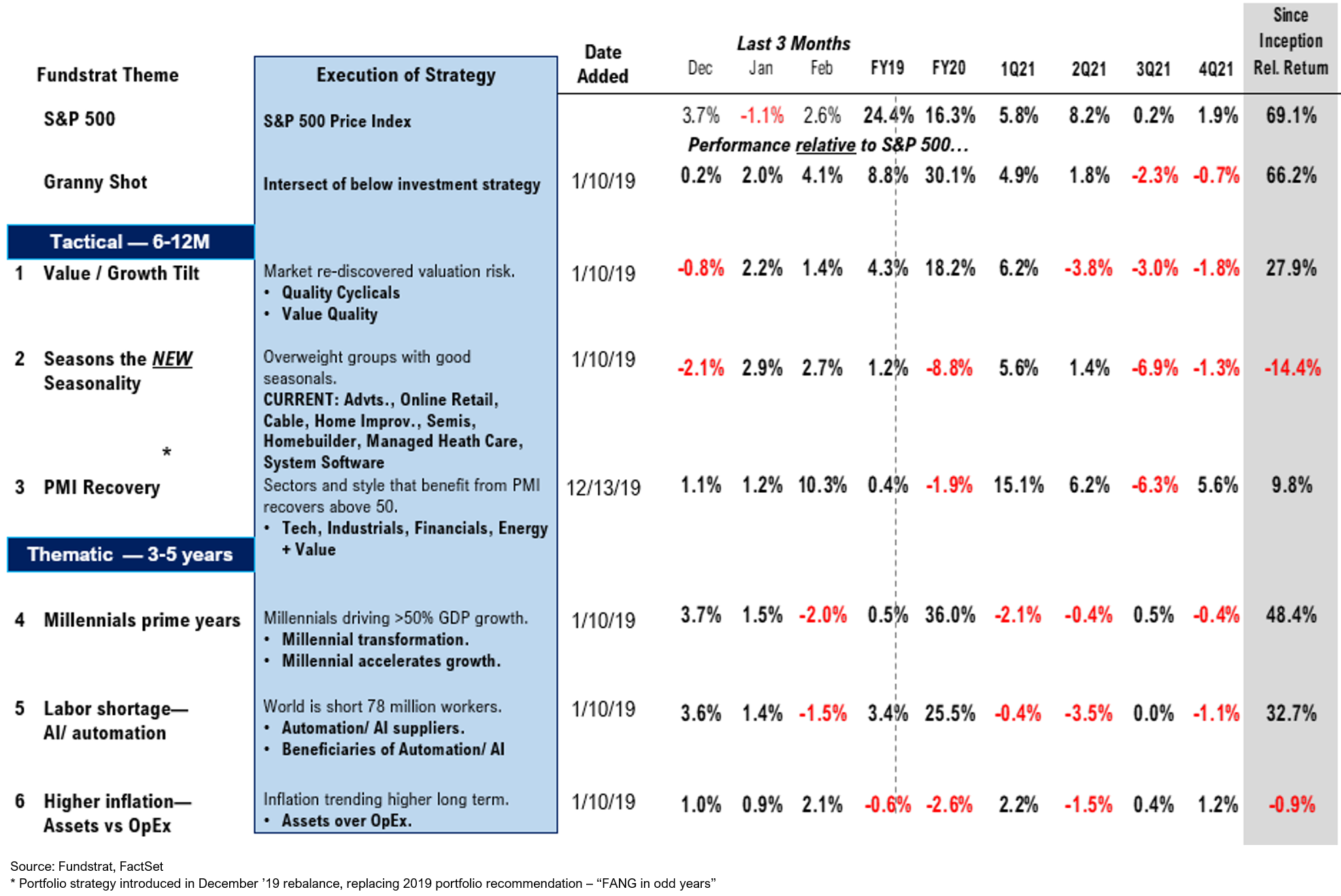

Figure: FSInsight Portfolio Strategy Summary – Relative to S&P 500

** Performance is calculated since strategy introduction, 1/10/2019