VIDEO: This week, stocks have sold off during the day. In our view, there are two reasons. First, this is a consequential macro week, so investors are nervous especially into Friday. Second, this is the end of the month and stocks are up >2.5% already.

Please click below to view our Macro Minute (duration: 4:42).

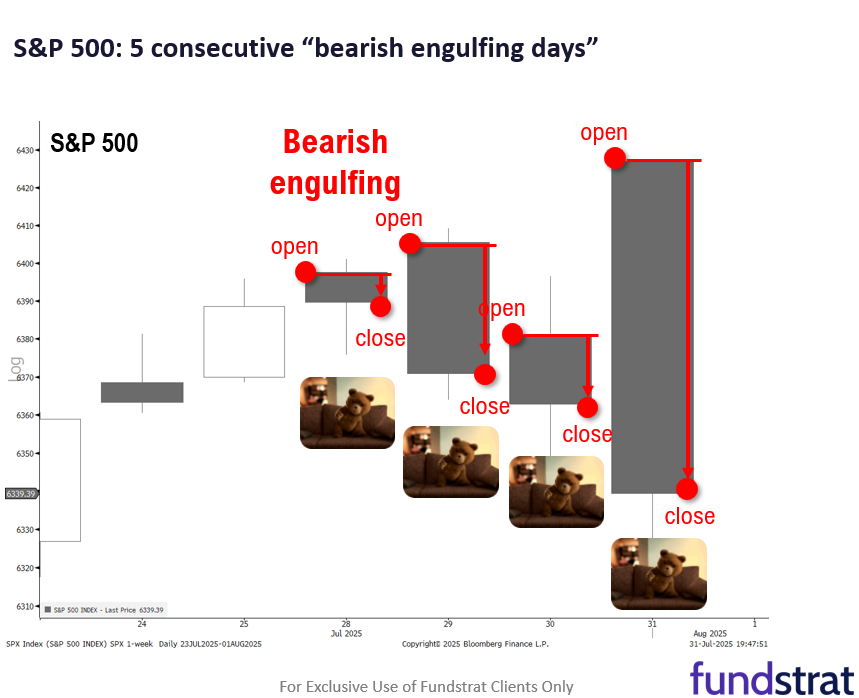

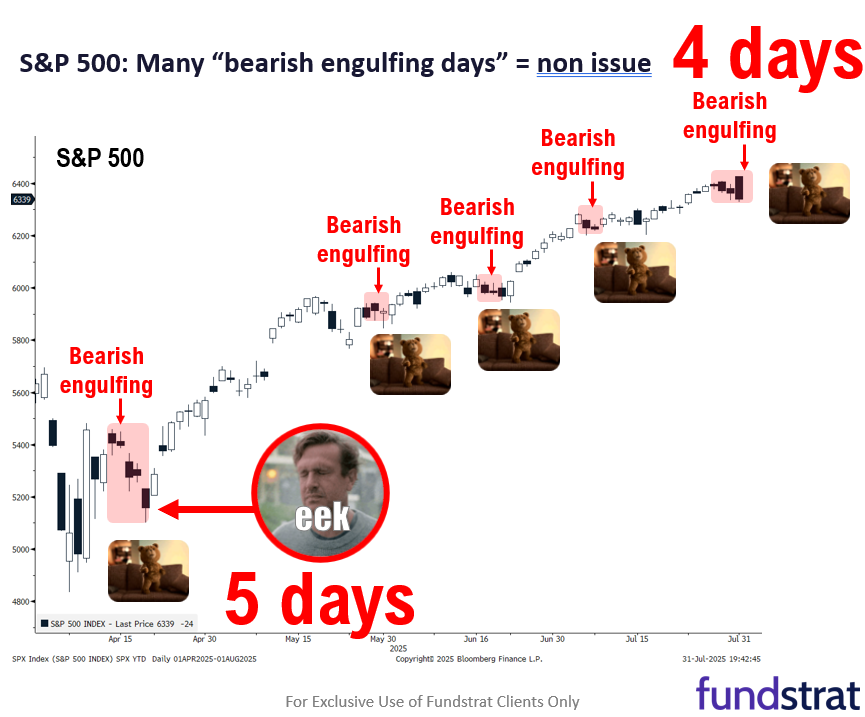

This has been a disappointing week for markets, because each day of this week, the S&P 500 has a “bearish engulfing” pattern — a higher open and a down close. As we noted earlier this week, the prevalence of bearish engulfing patterns is common since the April 2025 lows, but this still is unsettling. But we see two reasons markets might be behaving this way:

- The two reason are:

– first, this is a heavy week for both macro data and for 2Q25 EPS (heaviest week).

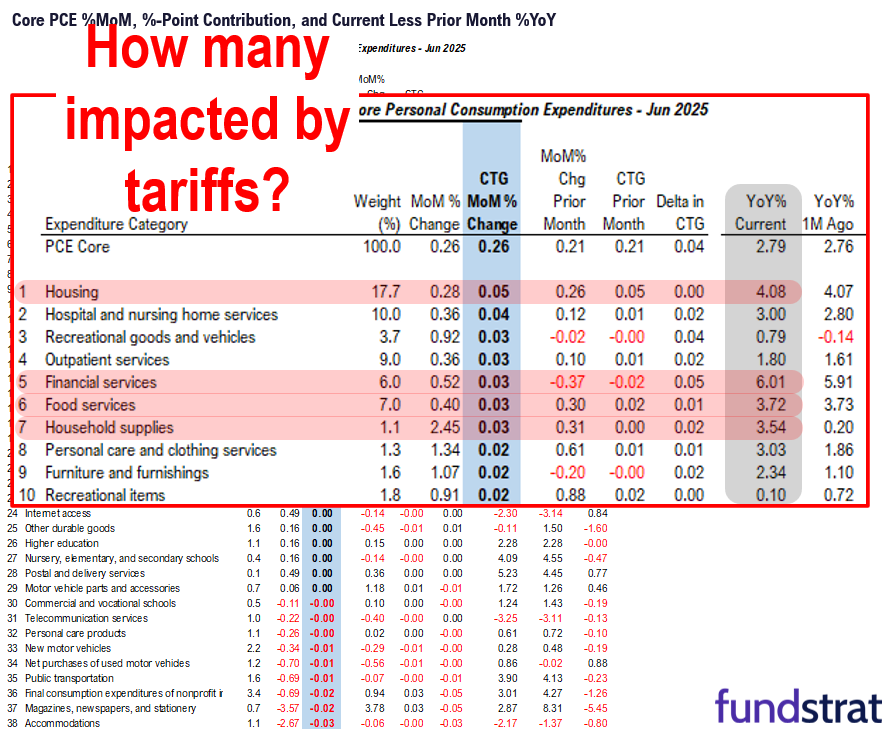

– second, this was the last week of July and the S&P 500 was already up 2%. - Looking at the week so far, to me, things are tracking better than expected. Both 2Q25 EPS season (53% reported, 84% beating, magnitude +6.7%) and economic data. June Core PCE was reported Thursday and the +0.2% MoM was a slight beat.

- And as we discuss in the video tonight, many of the components with higher YoY (above 2.79%) are items not directly affected by tariffs:

– housing +4.08% YoY

– financial services +6.01% YoY (stock market gains)

– food services +3.72% YoY

– household supplies +3.54% YoY - As above notes, I don’t see how housing, financial services or food services are tariff related. And housing itself is in a process of cooling. Hence, we understand why the Fed is on hold, but to us, inflation is not necessarily accelerating.

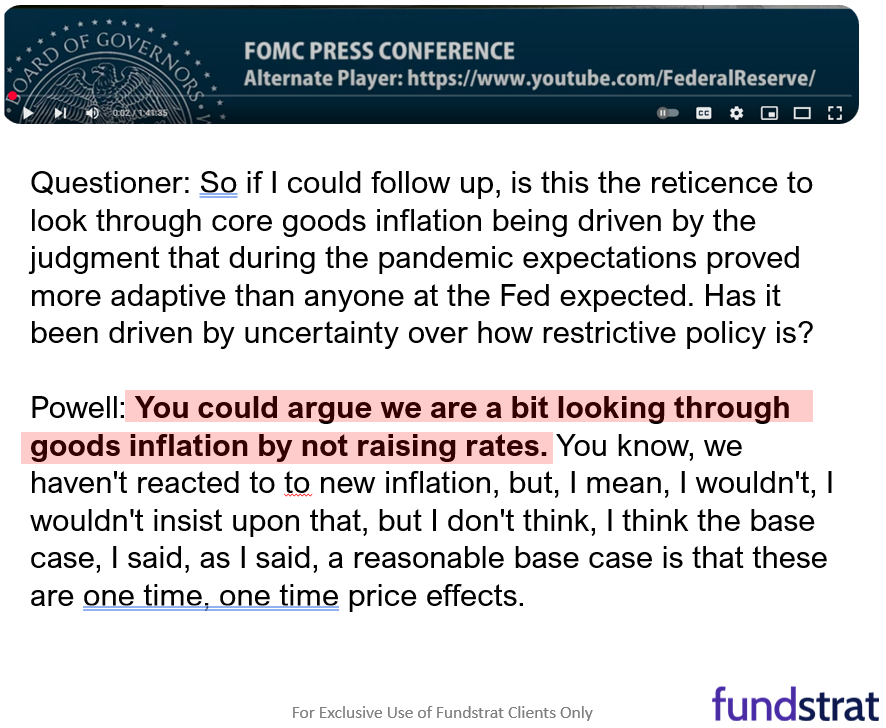

- The July FOMC meeting held Wednesday, was a hawkish meeting. And perhaps the most striking quote was Fed Chair Powell stating:

“You could argue we are a bit looking through goods inflation by not raising rates.“

– to me, that is a Fed exerting its independence. - As for Friday, there is a lot of macro data that will be closely watched:

– 8/1 Fri 12:01 AM ET: Reciprocal Tariff Pause Extension Expires

– 8/1 Fri 8:30 AM ET: Jul Non-farm Payrolls 105ke

– 8/1 Fri 9:45 AM ET: Jul F S&P Global Manufacturing PMI 49.7e

– 8/1 Fri 10:00 AM ET: Jul ISM Manufacturing PMI 49.5e

– 8/1 Fri 10:00 AM ET: Jul F U. Mich. 1yr Inf Exp 4.40%e - The S&P 500 and equities are overbought. So a bit of consolidation is expected. But we believe the risk/reward for stocks remains favorable. And we think stocks will likely be higher two weeks from now.

BOTTOM LINE: Still “most hated rally”

This still remains the “most hated” V-shaped stock rally. We view Bitcoin as a leading indicator and thus, we expect stocks to reattain all time highs, which Bitcoin achieved last week. We see S&P 500 reaching 6,600 by year-end.

And the expected drivers for this upside are:

- Still most hated rally

- Sizable perception gap: Tariff “bark worse than bite”

- Hedge funds increased short interest recently

- $7 trillion cash on sidelines

- Investment outlook better now than in Feb 2025:

– tariff visibility

– tax and de-regulation visibility

– US cos survived 5th major “stress test”

– Fed more dovish in 2026

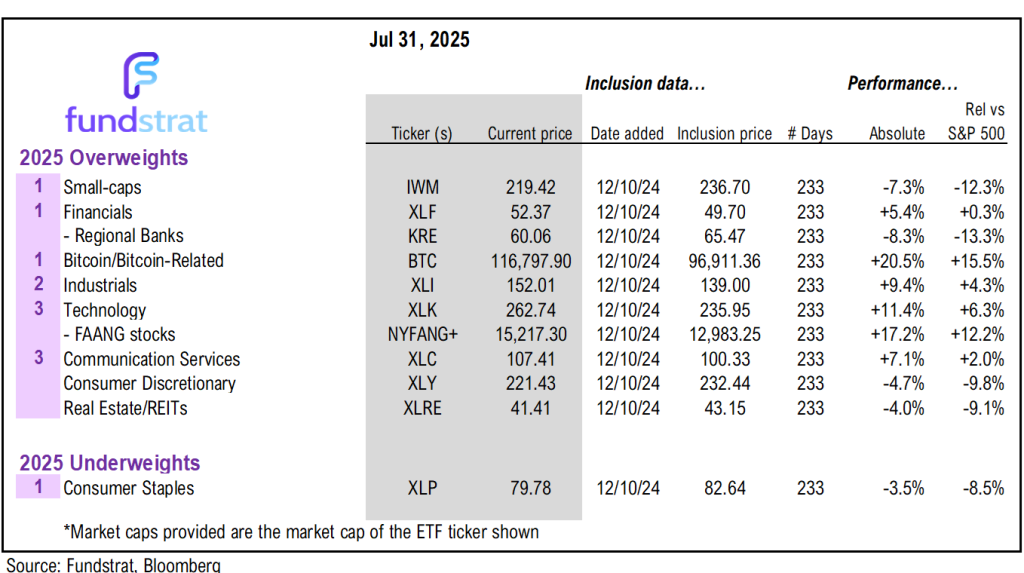

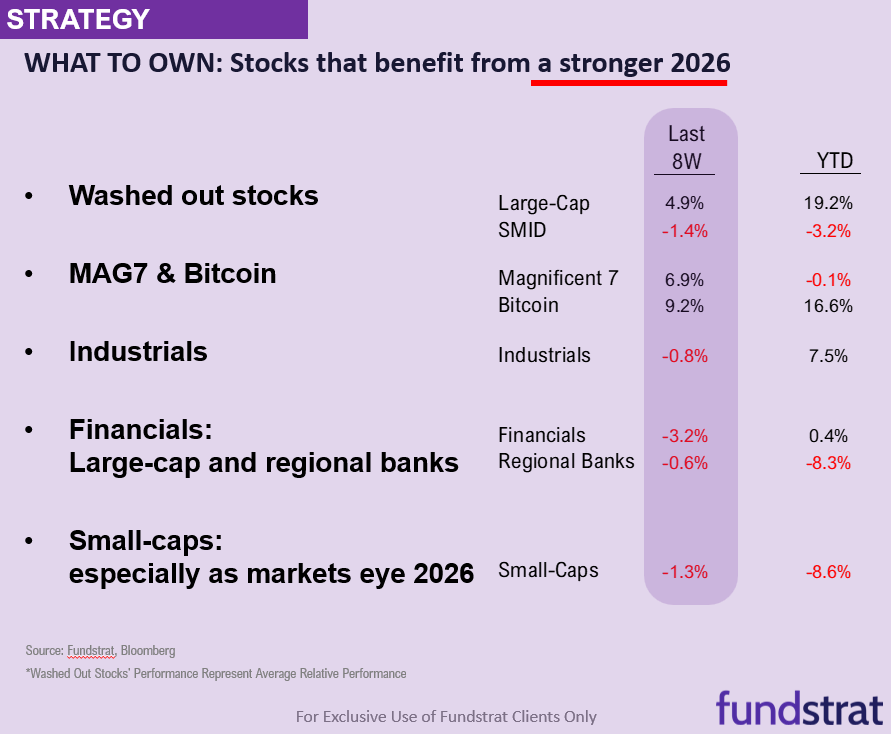

As for what we would buy

- Washed out stocks

- MAG7 & Bitcoin

- Industrials

- Financials: Large-cap and regional banks

- Small-caps

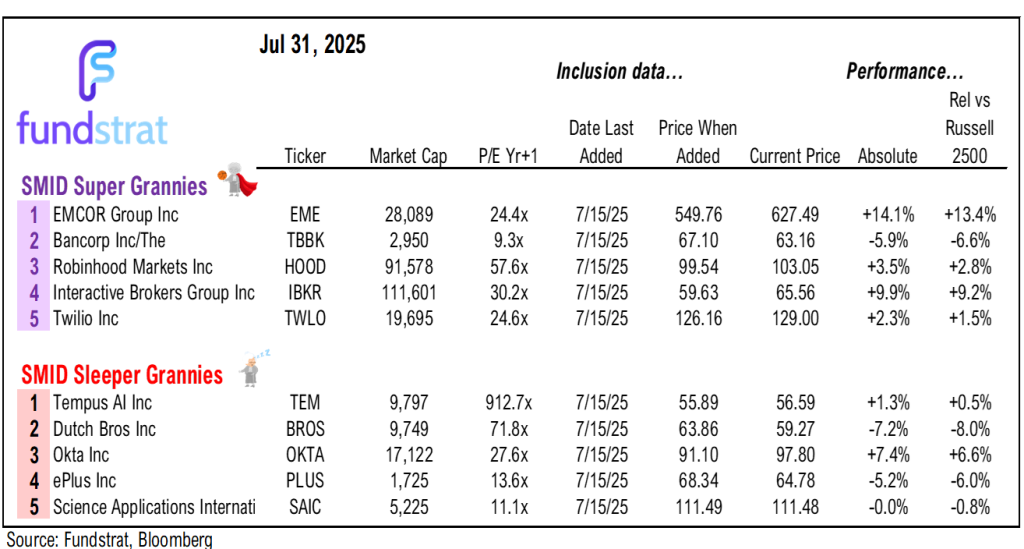

The bull market has proven itself intact. We previously identified two lists of “washed out” stocks, both large-cap (22 names) and SMID-cap (27 names). We want to look at stocks which did not make a new low between April 1-April 8, even as the S&P 500 fell to new lows.

The large-cap criteria are as follows:

- Current Market Cap >$15 Billion

- Declined more than 30% before Feb 18th

- Didn’t make new closing low between April 1st & April 8th

- Current price down more than 25% from 52W High

The large-cap “washed out” tickers are:

WBD 0.98% LULU 1.62% TSLA -3.59% DKNG 8.68% DG 3.42% DLTR 3.66% BF STZ -0.23% RKT 3.52% COIN 4.40% HOOD 3.09% HUM 0.55% UAL 1.73% LDOS 1.14% TEAM 1.09% HUBS 0.03% MSTR 1.98% CRM 0.25% NET 3.06% SMCI -1.00% EIX 0.85% VST 3.18%

The SMID-cap criteria are as follows:

- Current Market Cap <$15 Billion

- Declined more than 30% before Feb 18th

- Didn’t make new closing low between April 1st & April 8th

- Current price down more than 25% from 52W High

- Short interest Day to Cover Ratio >2

The SMID-cap “washed out” tickers are:

DJT -1.05% ROKU -2.92% AS -0.44% LCID -3.84% RIVN 0.20% LKQ 1.17% CROX 0.54% NCLH 4.61% WBA CELH -8.06% SOFI 3.94% MKTX 0.92% COLB 1.93% GRAL -0.82% INSP -2.41% PRGO -3.28% CNXC -5.11% DAY -0.28% LUV 2.19% LYFT 3.53% CFLT -1.31% DT 2.52% ESTC 3.97% PCOR 0.64% LITE 0.18% ALAB 1.64% AES -0.42%

_____________________________

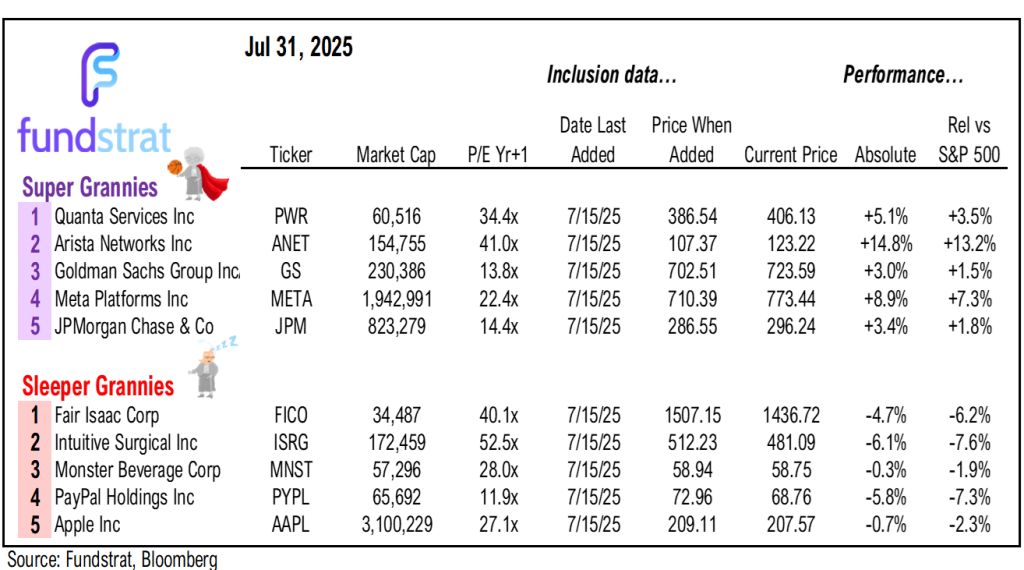

45 SMID Granny Shot Ideas: We performed our quarterly rebalance on 5/22. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review

Key Incoming Data August:

- 8/1 8:30 AM ET: Jul Non-farm Payrolls

- 8/1 9:45 AM ET: Jul F S&P Global Manufacturing PMI

- 8/1 10:00 AM ET: Jul F U. Mich. 1yr Inf Exp

- 8/1 10:00 AM ET: Jul ISM Manufacturing PMI

- 8/4 10:00 AM ET: Jun F Durable Goods Orders MoM

- 8/5 8:30 AM ET: Jun Trade Balance

- 8/5 9:45 AM ET: Jul F S&P Global Services PMI

- 8/5 10:00 AM ET: Jul ISM Services PMI

- 8/7 8:30 AM ET: 2Q P Unit Labor Costs

- 8/7 8:30 AM ET: 2Q P Nonfarm Productivity QoQ

- 8/7 9:00 AM ET: Jul F Manheim Used Vehicle Index

- 8/7 11:00 AM ET: Jul NYFed 1yr Inf Exp

- 8/12 6:00 AM ET: Jul Small Business Optimism Survey

- 8/12 8:30 AM ET: Jul Core CPI MoM

- 8/14 8:30 AM ET: Jul Core PPI MoM

- 8/15 8:30 AM ET: Aug Empire Manufacturing Survey

- 8/15 8:30 AM ET: Jul Retail Sales

- 8/15 10:00 AM ET: Aug P U. Mich. 1yr Inf Exp

- 8/15 4:00 PM ET: Jun Net TIC Flows

- 8/18 10:00 AM ET: Aug NAHB Housing Market Index

- 8/19 9:00 AM ET: Aug M Manheim Used Vehicle Index

- 8/20 2:00 PM ET: Jul FOMC Meeting Minutes

- 8/21 8:30 AM ET: Aug Philly Fed Business Outlook

- 8/21 9:45 AM ET: Aug P S&P Global Services PMI

- 8/21 9:45 AM ET: Aug P S&P Global Manufacturing PMI

- 8/21 10:00 AM ET: Jul Existing Home Sales

- 8/25 8:30 AM ET: Jul Chicago Fed Nat Activity Index

- 8/25 10:00 AM ET: Jul New Home Sales

- 8/25 10:30 AM ET: Aug Dallas Fed Manuf. Activity Survey

- 8/26 8:30 AM ET: Jul P Durable Goods Orders MoM

- 8/26 9:00 AM ET: Jun S&P CS home price 20-City MoM

- 8/26 10:00 AM ET: Aug Conference Board Consumer Confidence

- 8/26 10:00 AM ET: Aug Richmond Fed Manufacturing Survey

- 8/28 8:30 AM ET: 2Q S GDP QoQ

- 8/28 11:00 AM ET: Aug Kansas City Fed Manufacturing Survey

- 8/29 8:30 AM ET: Jul Core PCE MoM

- 8/29 10:00 AM ET: Aug F U. Mich. 1yr Inf Exp

Key Incoming Data July:

7/1 9:45 AM ET: Jun F S&P Global Manufacturing PMITame- 7/

1 10:00 AM ET: May JOLTS Job OpeningsMixed 7/1 10:00 AM ET: Jun ISM Manufacturing PMITame7/3 8:30 AM ET: Jun Non-farm PayrollsMixed7/3 8:30 AM ET: May Trade BalanceTame7/3 9:45 AM ET: Jun F S&P Global Services PMITame7/3 10:00 AM ET: May F Durable Goods Orders MoMTame7/3 10:00 AM ET: Jun ISM Services PMITame7/8 6:00 AM ET: Jun Small Business Optimism SurveyTame7/8 9:00 AM ET: Jun F Manheim Used Vehicle IndexMixed7/8 11:00 AM ET: Jun NYFed 1yr Inf ExpTame7/9 2:00 PM ET: Jun FOMC Meeting MinutesMixed7/15 8:30 AM ET: Jun Core CPI MoMTame7/15 8:30 AM ET: Jul Empire Manufacturing SurveyTame7/16 8:30 AM ET: Jun Core PPI MoMTame7/17 8:30 AM ET: Jul Philly Fed Business OutlookTame7/17 8:30 AM ET: Jun Retail SalesTame7/17 9:00 AM ET: Jul M Manheim Used Vehicle IndexTame7/17 10:00 AM ET: Jul NAHB Housing Market IndexTame7/17 4:00 PM ET: May Net TIC FlowsTame7/18 10:00 AM ET: Jul P U. Mich. 1yr Inf ExpTame7/22 10:00 AM ET: Jul Richmond Fed Manufacturing SurveyTame7/23 10:00 AM ET: Jun Existing Home SalesTame7/24 8:30 AM ET: Jun Chicago Fed Nat Activity IndexTame7/24 9:45 AM ET: Jul P S&P Global Services PMITame7/24 9:45 AM ET: Jul P S&P Global Manufacturing PMITame7/24 10:00 AM ET: Jun New Home SalesTame7/24 11:00 AM ET: Jul Kansas City Fed Manufacturing SurveyTame7/25 8:30 AM ET: Jun P Durable Goods Orders MoMTame7/28 10:30 AM ET: Jul Dallas Fed Manuf. Activity SurveyTame7/29 9:00 AM ET: May S&P CS home price 20-City MoMTame7/29 10:00 AM ET: Jul Conference Board Consumer ConfidenceTame7/29 10:00 AM ET: Jun JOLTS Job OpeningsTame7/30 8:30 AM ET: 2Q A GDP QoQTame7/30 2:00 PM ET: Jul FOMC DecisionMixed7/31 8:30 AM ET: Jun Core PCE MoMTame7/31 8:30 AM ET: 2Q ECI QoQTame

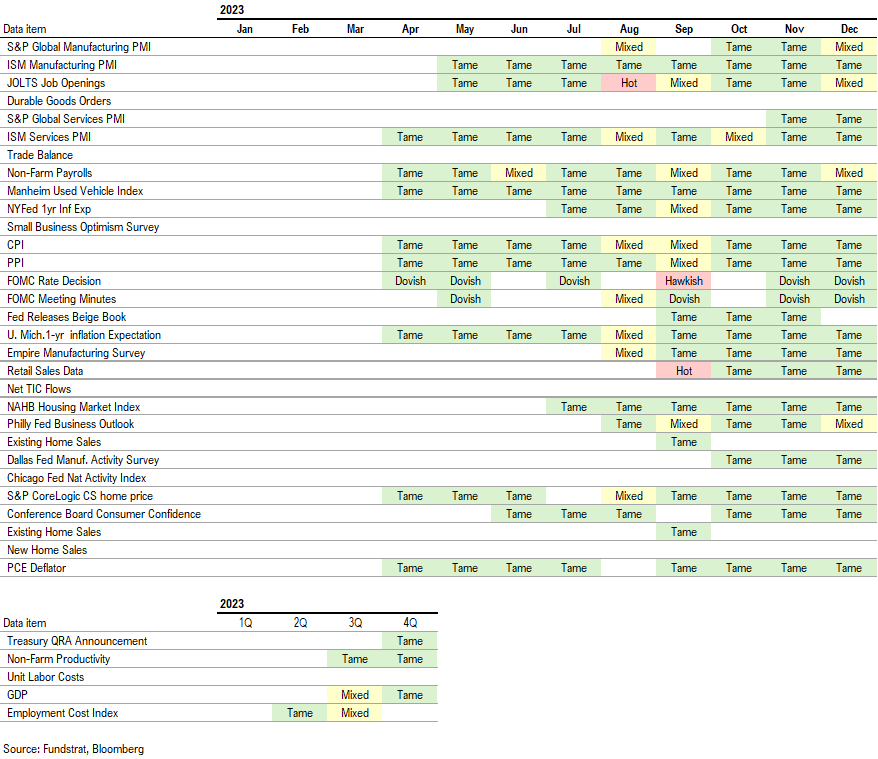

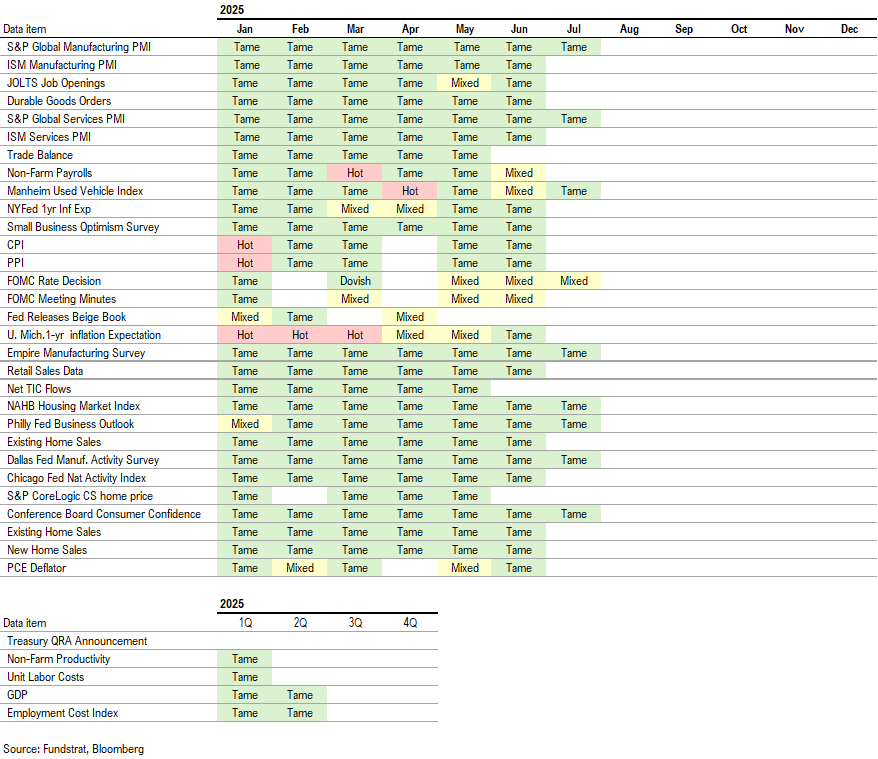

Economic Data Performance Tracker 2025:

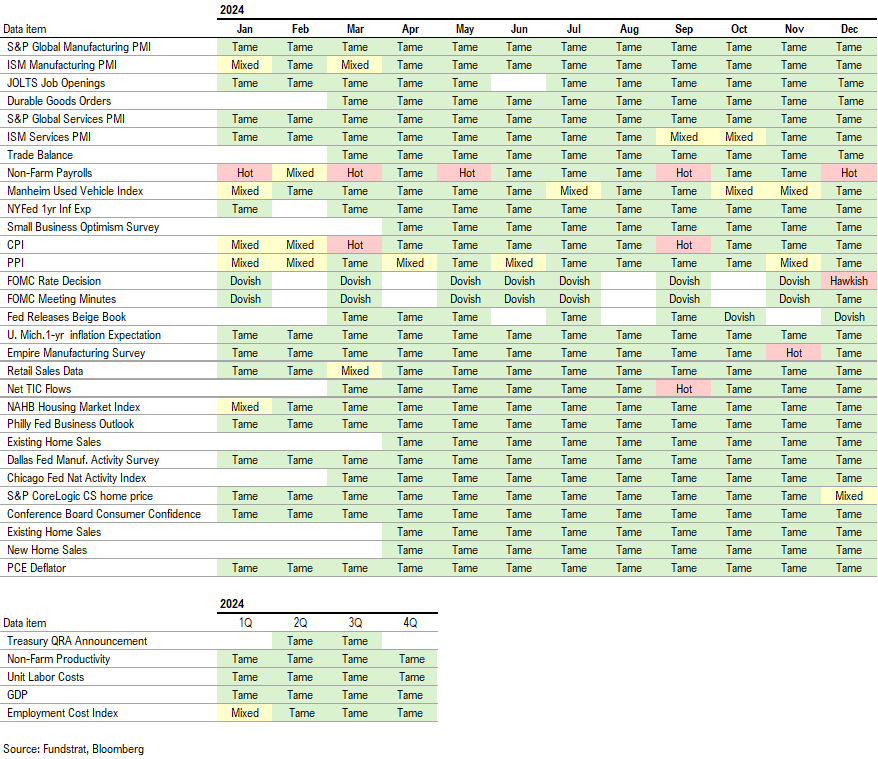

Economic Data Performance Tracker 2024:

Economic Data Performance Tracker 2023: