VIDEO: July is already up nearly 3% and we think stocks will finish July strong. Seasonally, July is a favorable month and 2025 is certainly mirroring this. There are a lot of catalysts next week, the final week of July.

Please click below to view our Macro Minute (duration: 3:51).

To me, the biggest takeaway this week is that the S&P 500 continues to drift higher, as the “most-hated V-shaped rally” continues to strengthen. Week to date, S&P 500 is up +1%, month to date +2.6%, and YTD +8%. One would think with performance figures this solid investors would be cheering, but at Fundstrat, the feedback continues to be that many investors are skeptical of gains.

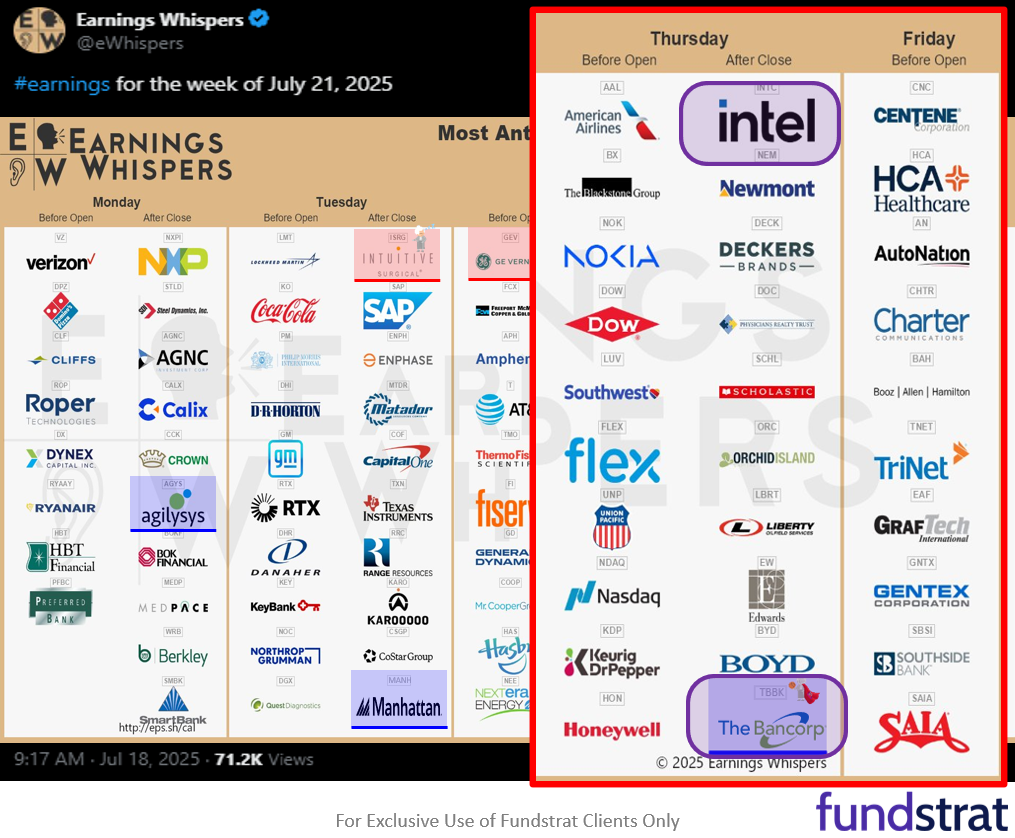

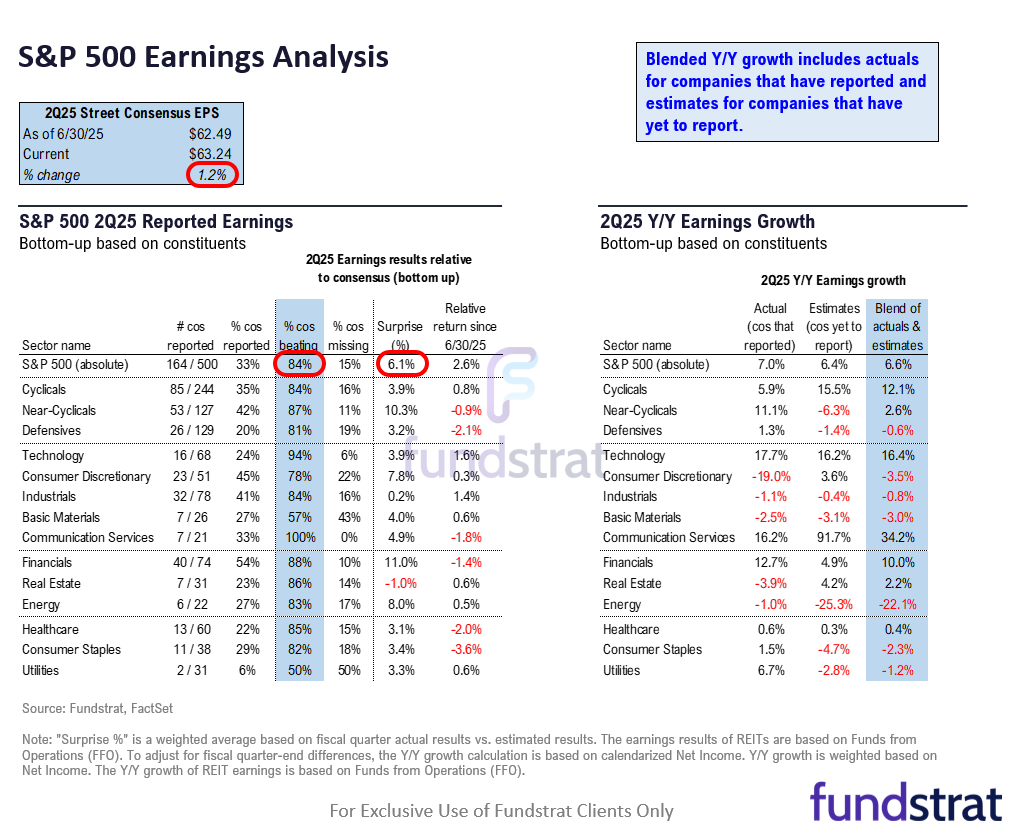

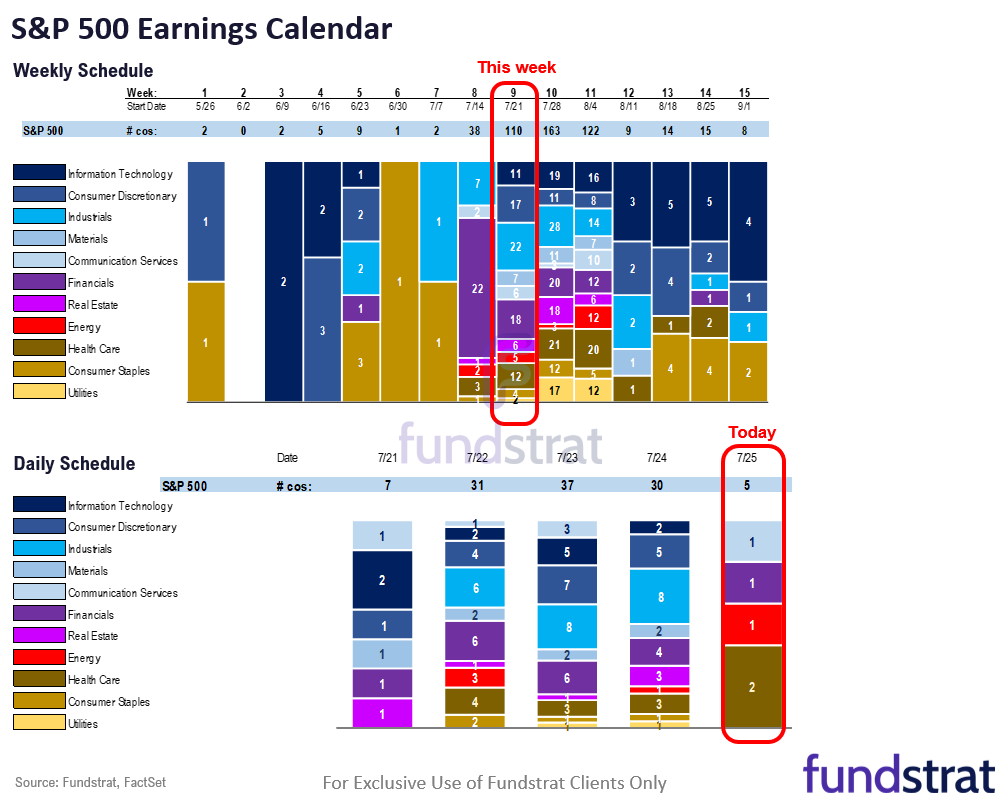

- In our view, solid fundamentals are anchoring the rise in stocks. For instance, 2Q25 EPS season has been solid, with 83% of companies beating, and total EPS beats average +6%. We are 33% through earnings season. Next week is the heaviest.

- The incoming data has been solid. Weekly claims were solid. Although this week has been light in macro data, with a lot of Regional Fed Releases:

– 7/22 Tue 8:30 AM ET: Powell Gives Welcome Remarks at Regulatory Conference

– 7/22 Tue 10:00 AM ET: Jul Richmond Fed Manufacturing Survey -20 vs -2.0e

– 7/23 Wed 10:00 AM ET: Jun Existing Home Sales 3.9m vs 4.0me

– 7/24 Thu 8:30 AM ET: Jun Chicago Fed Nat Activity Index -0.10 vs -0.15e

– 7/24 Thu 9:45 AM ET: Jul P S&P Global Manufacturing PMI 49.5 vs 52.5e

– 7/24 Thu 9:45 AM ET: Jul P S&P Global Services PMI 55.2 vs 53.0e

– 7/24 Thu 10:00 AM ET: Jun New Home Sales 627k vs 650ke

– 7/24 Thu 11:00 AM ET: Jul Kansas City Fed Manufacturing Survey 1 vs -1e

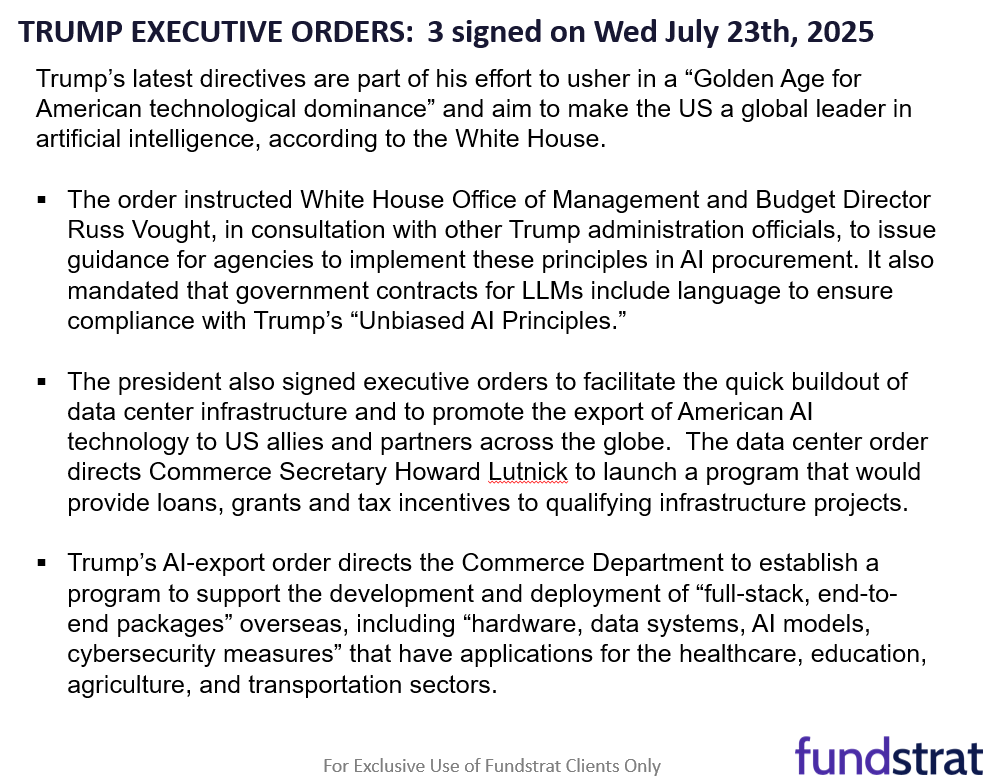

– 7/25 Fri 8:30 AM ET: Jun P Durable Goods Orders MoM -10.5%e - I was able to attend the All-in and Hill & Valley AI forum summit in DC Wednesday. This is the event where President Trump signed 3 Executive Orders. Basically, the White House wants to expand the US dominance in AI. There were many speakers. To me, the key takeaway is that there are many instances of AI helping existing workers multiply their skills. So, perhaps, AI will not replace as many jobs as feared.

- In terms of the week ahead, next week is important:

– 7/30 Wed 8:30am June Core PCE (Fed preferred inflation)

– 7/30 Wed 2:00pm FOMC July rate decision

– 8/1 Fri 8:30am July Jobs report

– 8/1 Fri 10:00am July ISM manufacturing

– 8/1 tariff implementation date - As you can see above, next week, the final week of July has many catalysts. In our view, we expect equities to end July on a high note. So we do not think the final weeks of July are a concern. And this is considering that next week is the heaviest week of earnings. 163 companies report.

BOTTOM LINE: Still “most hated rally”

This still remains the “most hated” V-shaped stock rally. We view Bitcoin as a leading indicator and thus, we expect stocks to reattain all time highs, which Bitcoin achieved last week. We see S&P 500 reaching 6,600 by year-end.

And the expected drivers for this upside are:

- Still most hated rally

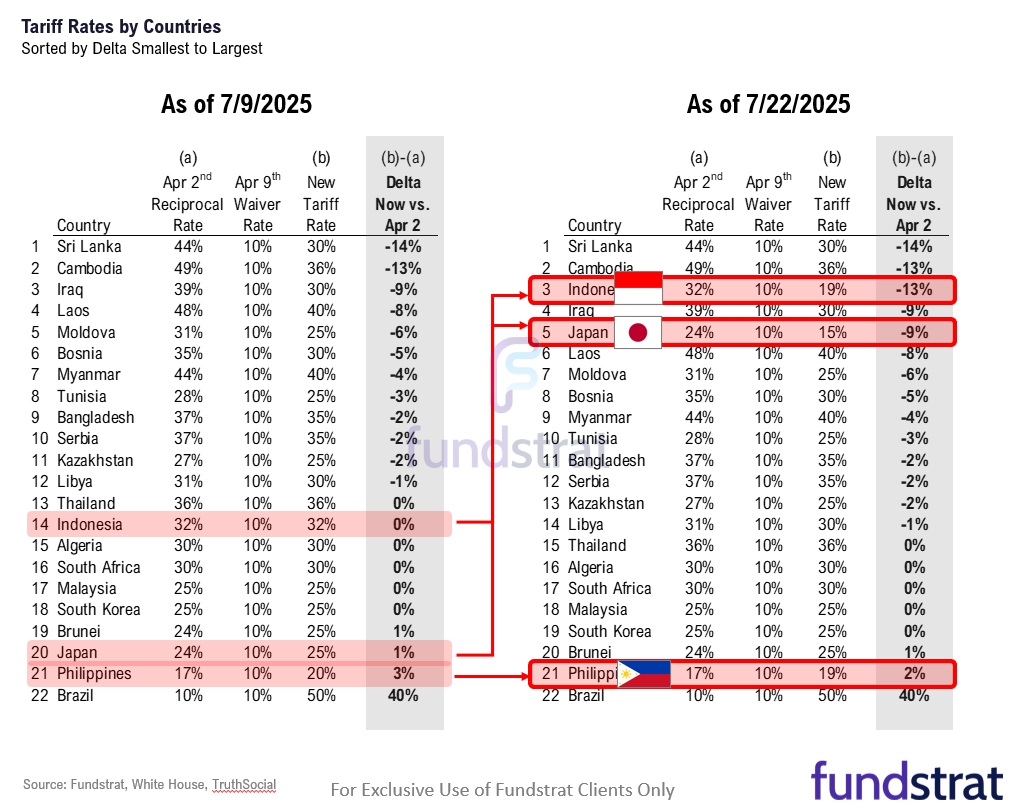

- Sizable perception gap: Tariff “bark worse than bite”

- Hedge funds increased short interest recently

- $7 trillion cash on sidelines

- Investment outlook better now than in Feb 2025:

– tariff visibility

– tax and de-regulation visibility

– US cos survived 5th major “stress test”

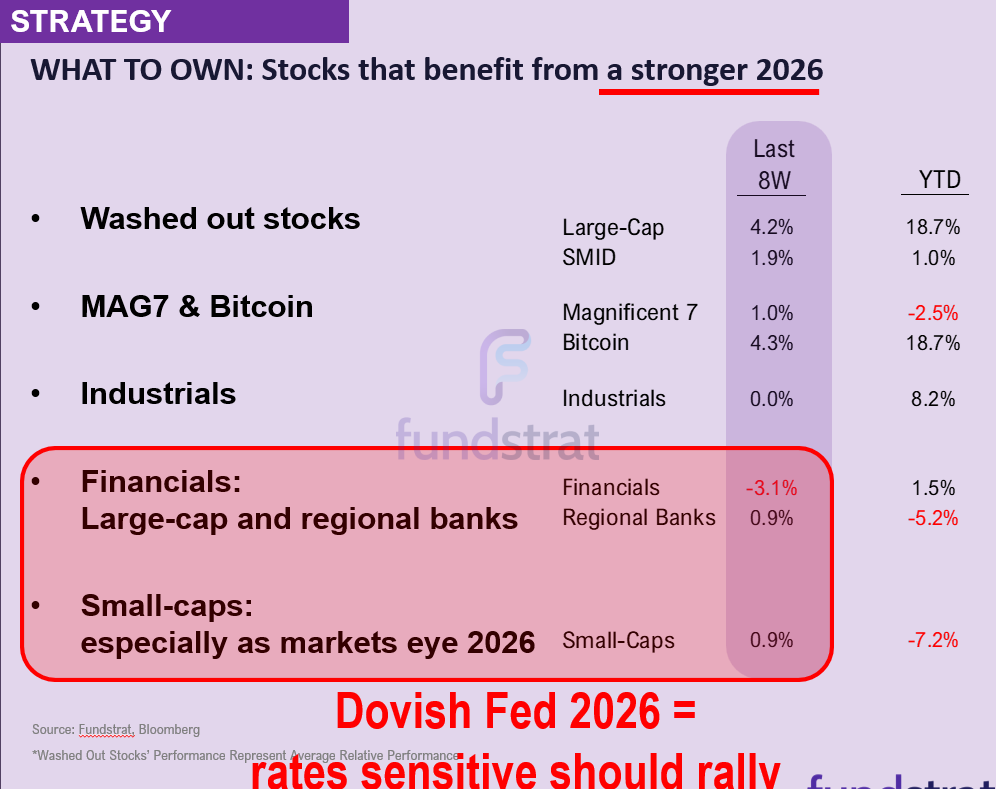

– Fed more dovish in 2026

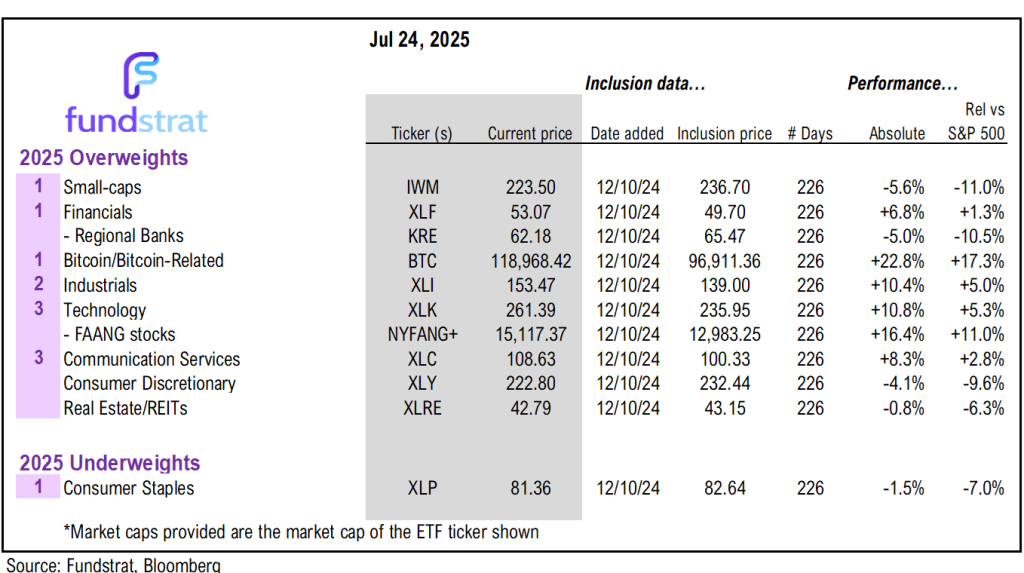

As for what we would buy

- Washed out stocks

- MAG7 & Bitcoin

- Industrials

- Financials: Large-cap and regional banks

- Small-caps

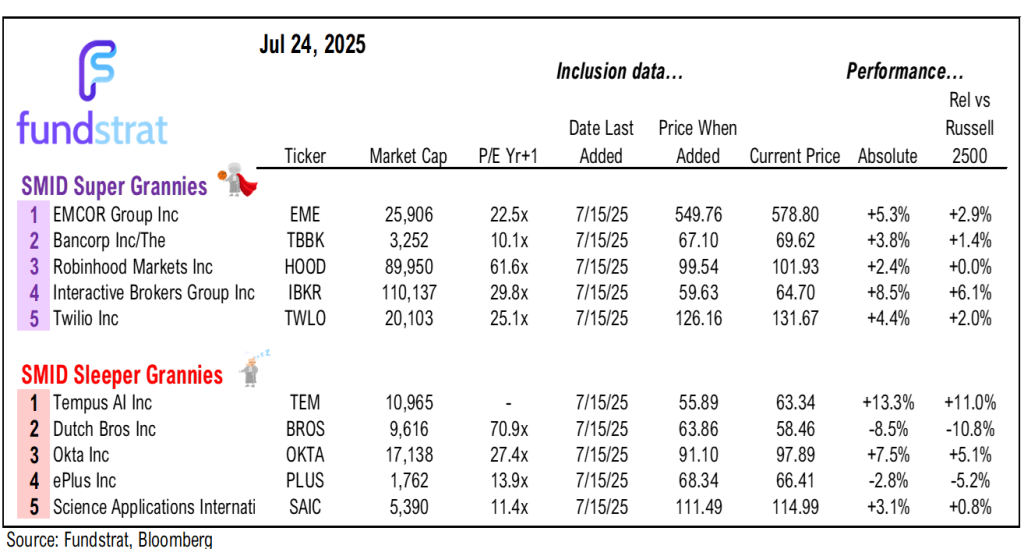

The bull market has proven itself intact. We previously identified two lists of “wash out” stocks, both large-cap (22 names) and SMID-cap (27 names). We want to look at stocks which did not make a new low between April 1-April 8, even as the S&P 500 fell to new lows.

The large-cap criteria is as follows:

- Current Market Cap >$15 Billion

- Declined more than 30% before Feb 18th

- Didn’t make new closing low between April 1st & April 8th

- Current price down more than 25% from 52W High

The large-cap “washed out” tickers are:

WBD 0.98% LULU 1.62% TSLA -3.59% DKNG 8.68% DG 3.42% DLTR 3.66% BF STZ -0.23% RKT 3.52% COIN 4.40% HOOD 3.09% HUM 0.55% UAL 1.73% LDOS 1.14% TEAM 1.09% HUBS 0.03% MSTR 1.98% CRM 0.25% NET 3.06% SMCI -1.00% EIX 0.85% VST 3.18%

The SMID-cap criteria is as follows:

- Current Market Cap <$15 Billion

- Declined more than 30% before Feb 18th

- Didn’t make new closing low between April 1st & April 8th

- Current price down more than 25% from 52W High

- Short interest Day to Cover Ratio >2

The SMID-cap “washed out” tickers are:

DJT -1.05% ROKU -2.92% AS -0.44% LCID -3.84% RIVN 0.20% LKQ 1.17% CROX 0.54% NCLH 4.61% WBA CELH -8.06% SOFI 3.94% MKTX 0.92% COLB 1.93% GRAL -0.82% INSP -2.41% PRGO -3.28% CNXC -5.11% DAY -0.28% LUV 2.19% LYFT 3.53% CFLT -1.31% DT 2.52% ESTC 3.97% PCOR 0.64% LITE 0.18% ALAB 1.64% AES -0.42%

_____________________________

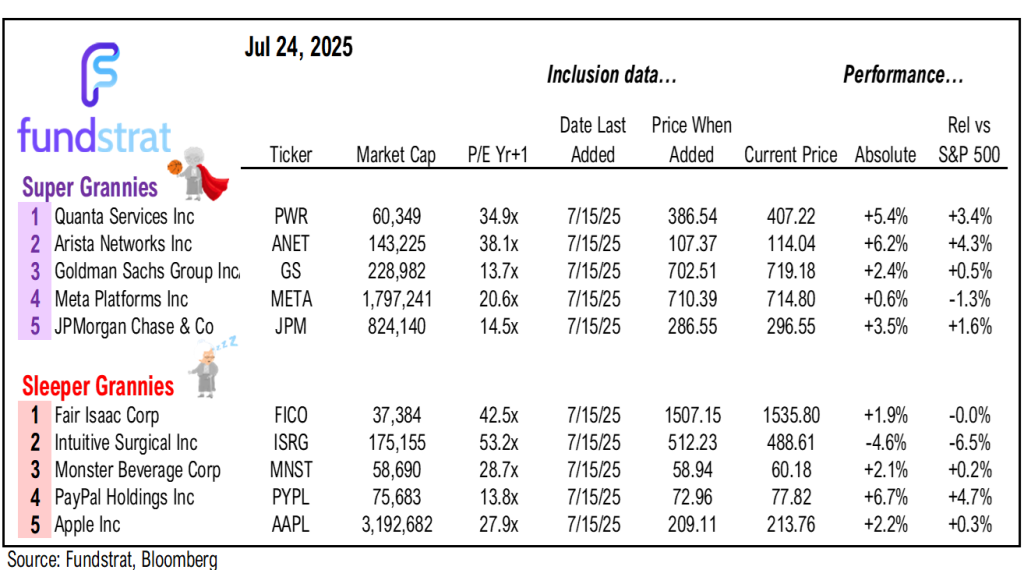

45 SMID Granny Shot Ideas: We performed our quarterly rebalance on 5/22. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review

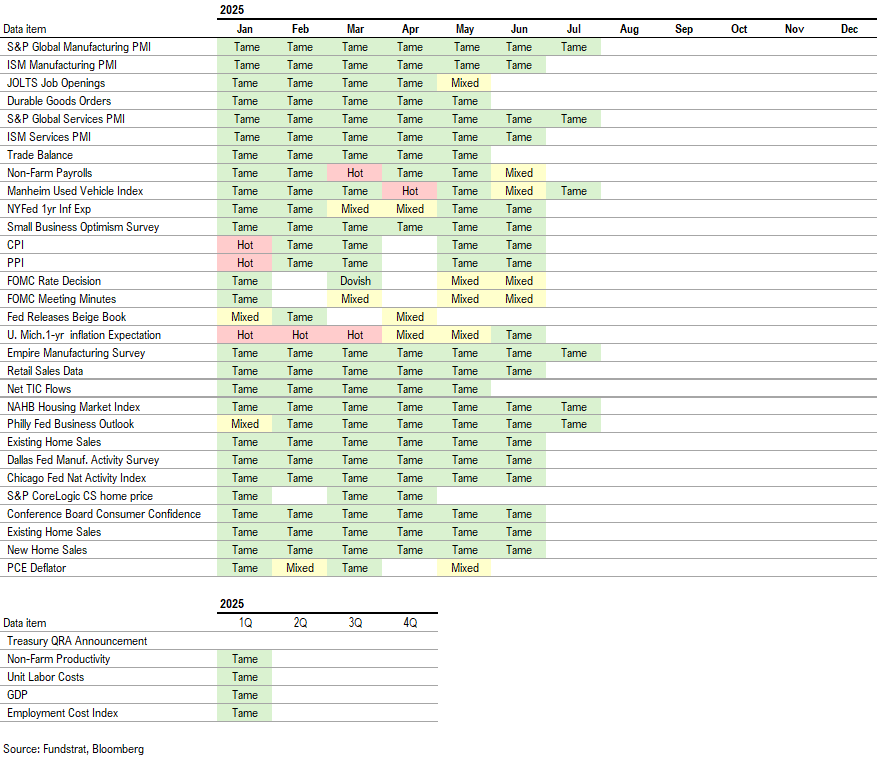

Key Incoming Data July:

7/1 9:45 AM ET: Jun F S&P Global Manufacturing PMITame- 7/

1 10:00 AM ET: May JOLTS Job OpeningsMixed 7/1 10:00 AM ET: Jun ISM Manufacturing PMITame7/3 8:30 AM ET: Jun Non-farm PayrollsMixed7/3 8:30 AM ET: May Trade BalanceTame7/3 9:45 AM ET: Jun F S&P Global Services PMITame7/3 10:00 AM ET: May F Durable Goods Orders MoMTame7/3 10:00 AM ET: Jun ISM Services PMITame7/8 6:00 AM ET: Jun Small Business Optimism SurveyTame7/8 9:00 AM ET: Jun F Manheim Used Vehicle IndexMixed7/8 11:00 AM ET: Jun NYFed 1yr Inf ExpTame7/9 2:00 PM ET: Jun FOMC Meeting MinutesMixed7/15 8:30 AM ET: Jun Core CPI MoMTame7/15 8:30 AM ET: Jul Empire Manufacturing SurveyTame7/16 8:30 AM ET: Jun Core PPI MoMTame7/17 8:30 AM ET: Jul Philly Fed Business OutlookTame7/17 8:30 AM ET: Jun Retail SalesTame7/17 9:00 AM ET: Jul M Manheim Used Vehicle IndexTame7/17 10:00 AM ET: Jul NAHB Housing Market IndexTame7/17 4:00 PM ET: May Net TIC FlowsTame7/18 10:00 AM ET: Jul P U. Mich. 1yr Inf ExpTame7/22 10:00 AM ET: Jul Richmond Fed Manufacturing SurveyTame7/23 10:00 AM ET: Jun Existing Home SalesTame7/24 8:30 AM ET: Jun Chicago Fed Nat Activity IndexTame7/24 9:45 AM ET: Jul P S&P Global Services PMITame7/24 9:45 AM ET: Jul P S&P Global Manufacturing PMITame7/24 10:00 AM ET: Jun New Home SalesTame7/24 11:00 AM ET: Jul Kansas City Fed Manufacturing SurveyTame- 7/25 8:30 AM ET: Jun P Durable Goods Orders MoM

- 7/28 10:30 AM ET: Jul Dallas Fed Manuf. Activity Survey

- 7/29 9:00 AM ET: May S&P CS home price 20-City MoM

- 7/29 10:00 AM ET: Jul Conference Board Consumer Confidence

- 7/29 10:00 AM ET: Jun JOLTS Job Openings

- 7/30 8:30 AM ET: 2Q A GDP QoQ

- 7/30 2:00 PM ET: Jul FOMC Decision

- 7/31 8:30 AM ET: Jun Core PCE MoM

- 7/31 8:30 AM ET: 2Q ECI QoQ

Economic Data Performance Tracker 2025:

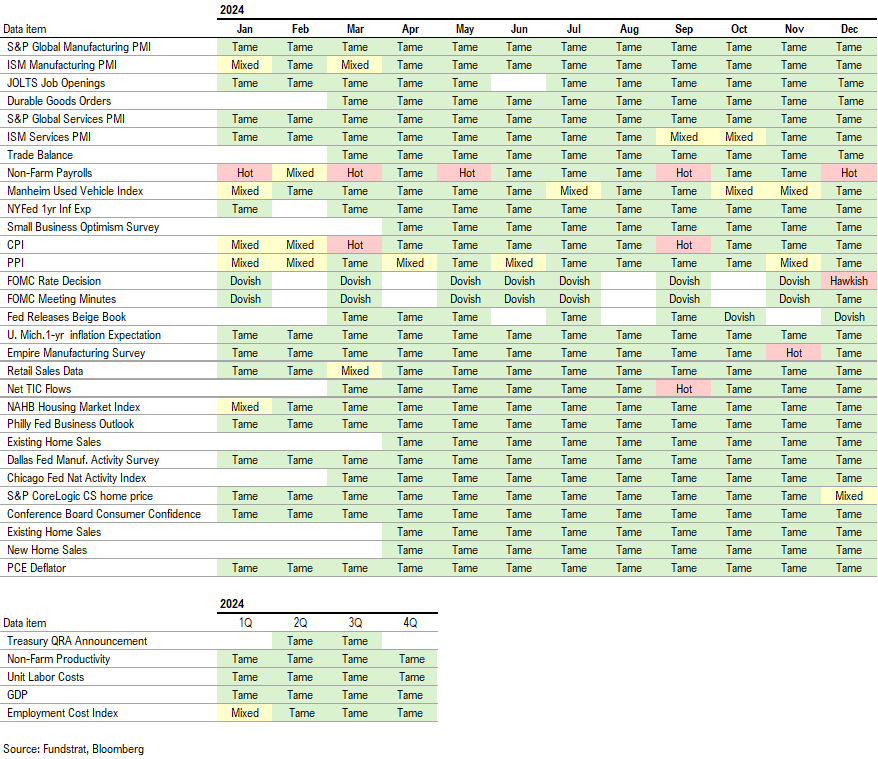

Economic Data Performance Tracker 2024:

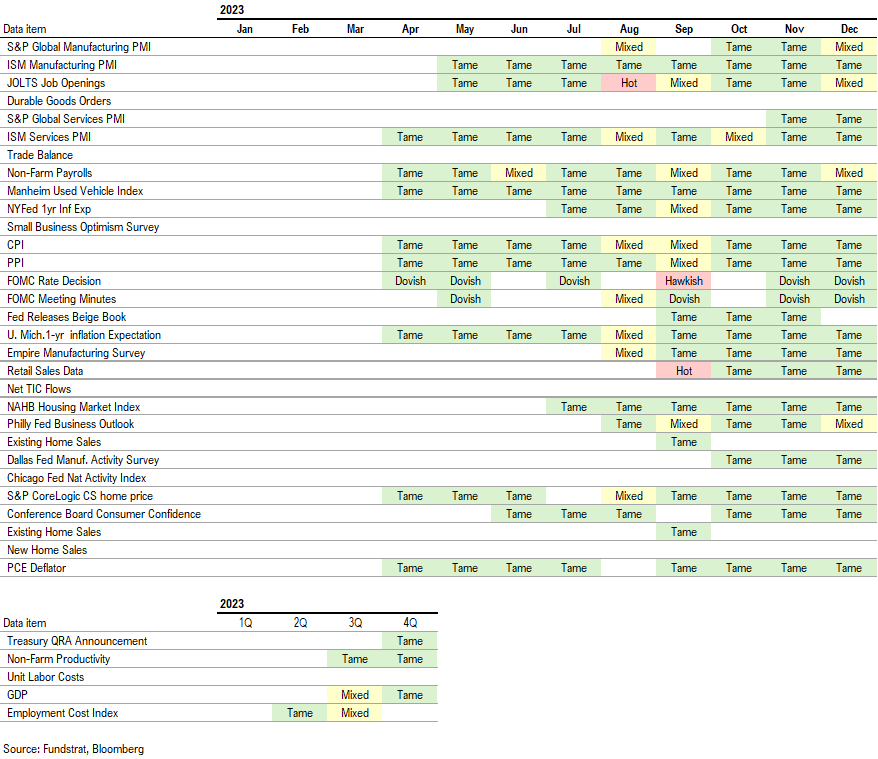

Economic Data Performance Tracker 2023: