VIDEO: While the chasm between macro (bearish) and equity internals (bullish) is wide, Thursday we got the 4th confirming signal.

Please click below to view our Macro Minute (duration: 8:18).

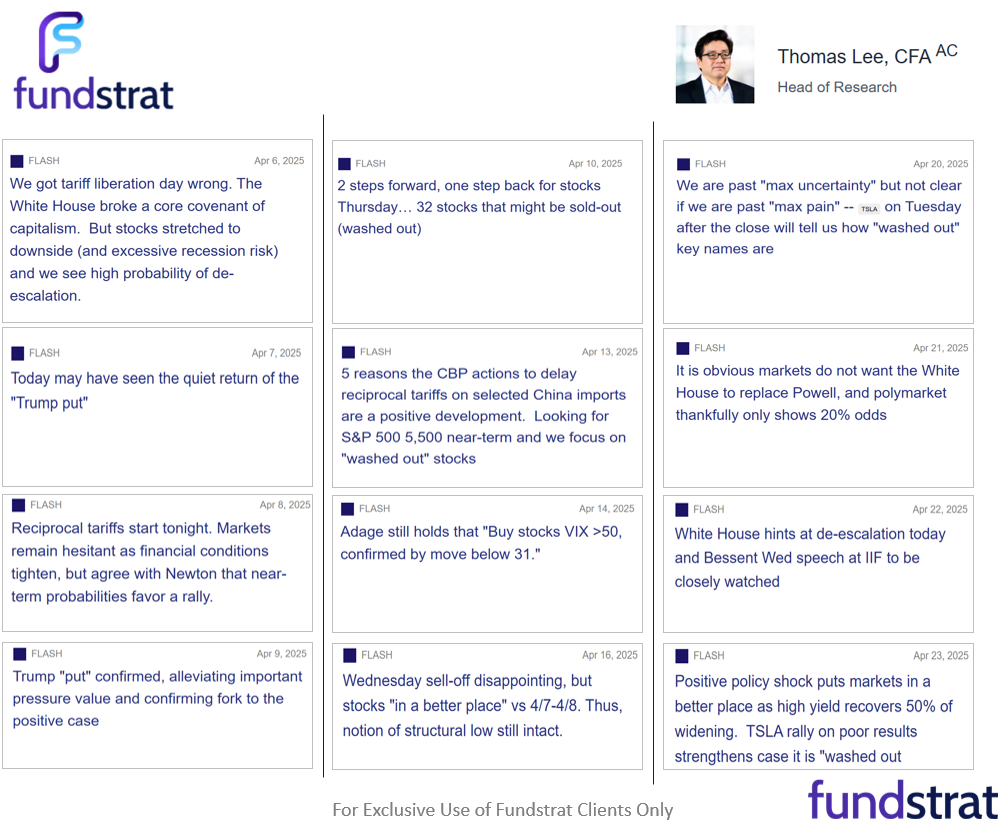

At the start of this week, we believed that we were past the point of “maximum uncertainty” but it was not clear if we were past the point of “max pain” — but we were watching the market’s reaction to TSLA 9.87% earnings (Tue post-close) as a tell. There were several key developments this week (see below) that in our view, have raised the probability “the low is in” to more than 90%. In other words, the bull market is intact, after suffering a mighty 20% correction:

- Since tariff “liberation day” April 2, equity and risk markets have been caught in downward vortex, also buffeted by a continuously darkening macro picture. This has made this 3 week period the most difficult we have navigated in 30 years, moreso than even COVID and the GFC.

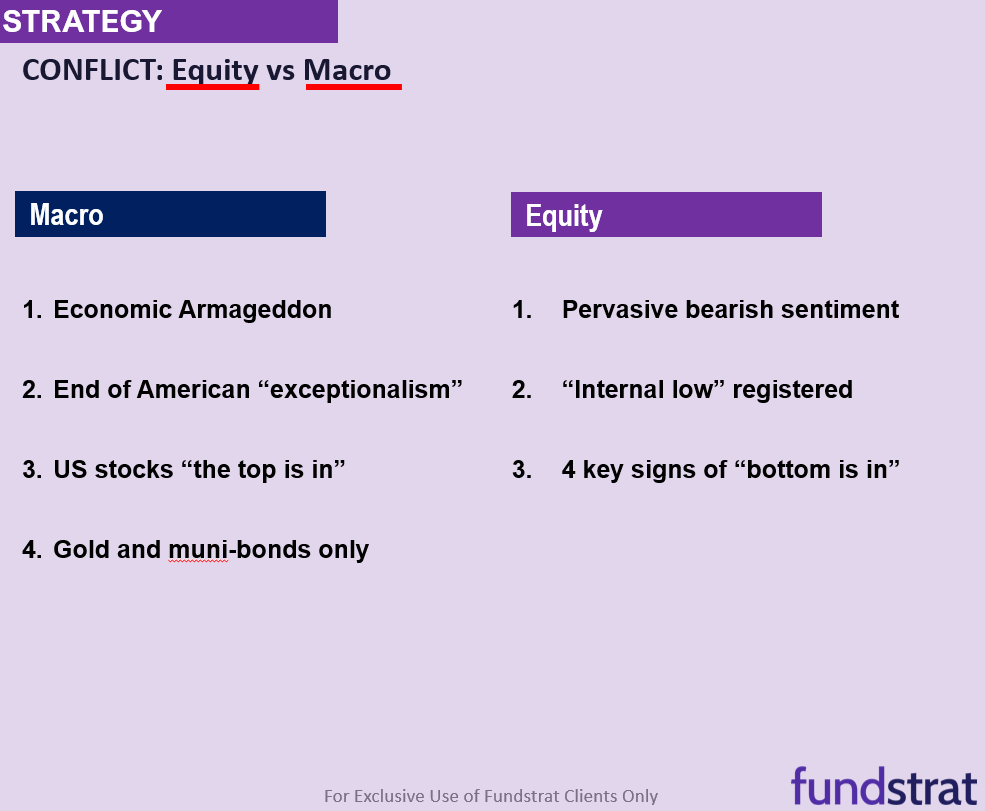

- The conflict that we have talked about is the worsening macro against what looks like signs stocks had priced in a lot of bad news. The macro bears story has these elements:

– Economic Armageddon

– End of American “exceptionalism”

– US stocks “the top is in”

– Gold and muni-bonds only - By contrast, we have written about the pervasive signs stocks had priced in a lot of bad news. In a summary sense, these are the 3 elements:

– Pervasive bearish sentiment

– “Internal low” registered

– 4 key signs of “bottom is in” (see below)

- But quantitatively, there are 4 confirming signs of a bottom (and waiting for a 5th):

– On 4/14: VIX surged to >50 and then closed below 31:

– bottom in 2009 and 2020

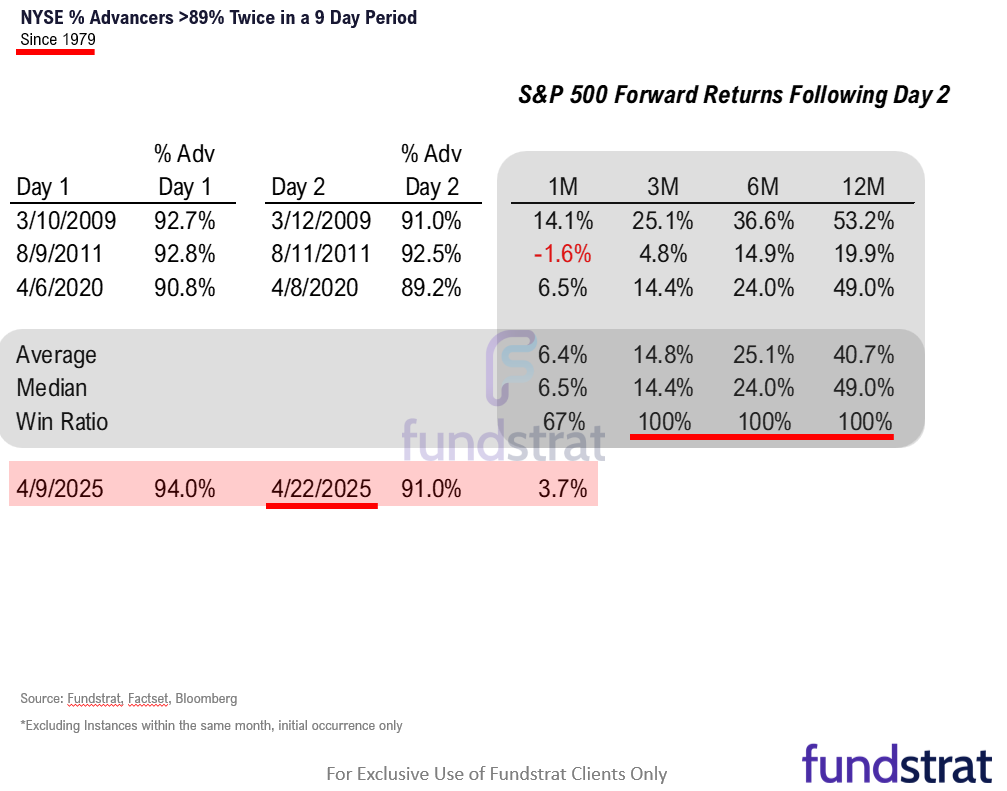

– On 4/22: Two consecutive +90% advancer days,

– 3 of 3 times previously confirmed low (3/12/09, 8/9/11 and 4/6/20)

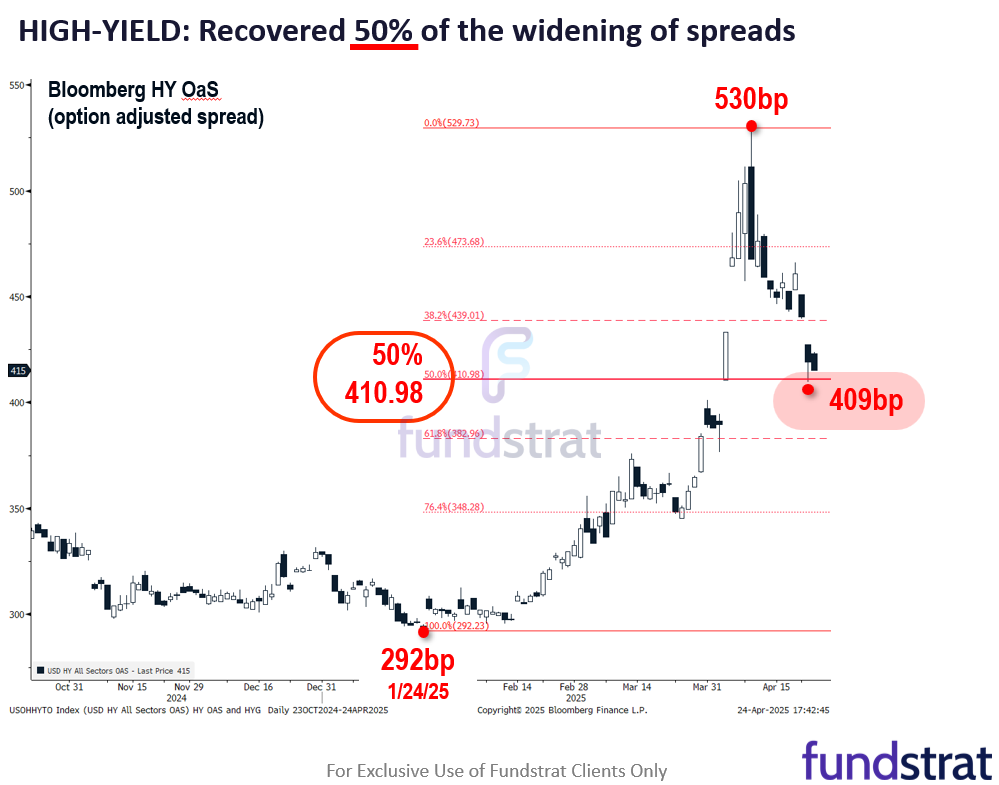

– On 4/23: High-yield OaS recover 50% widening

– confirms we are walking back from recession

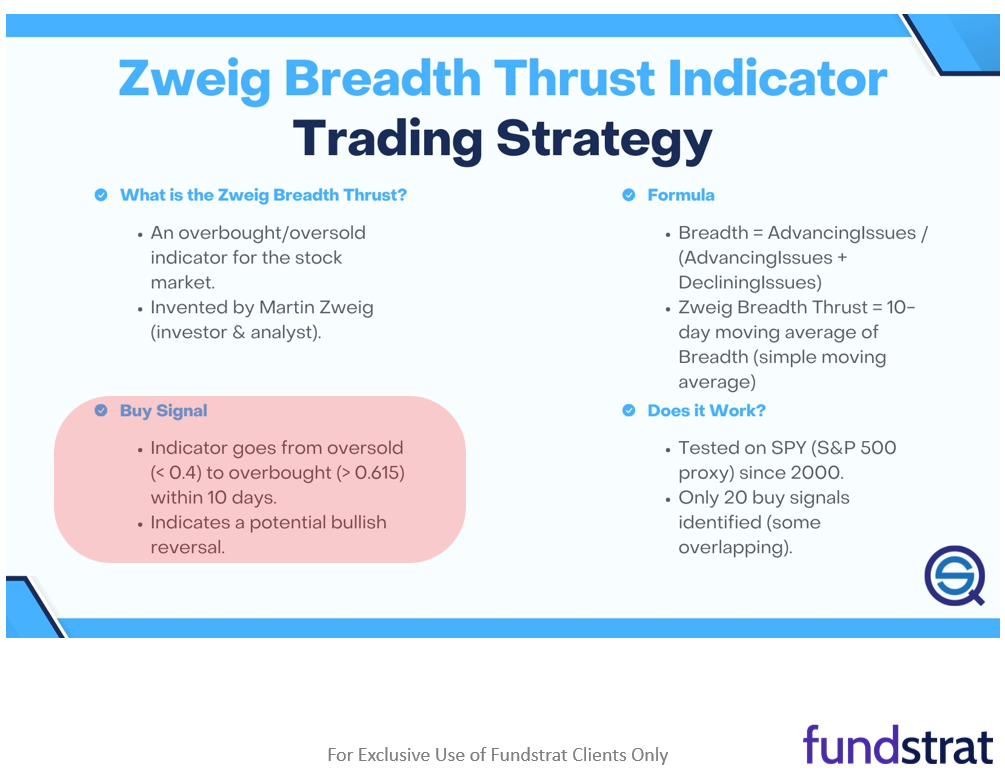

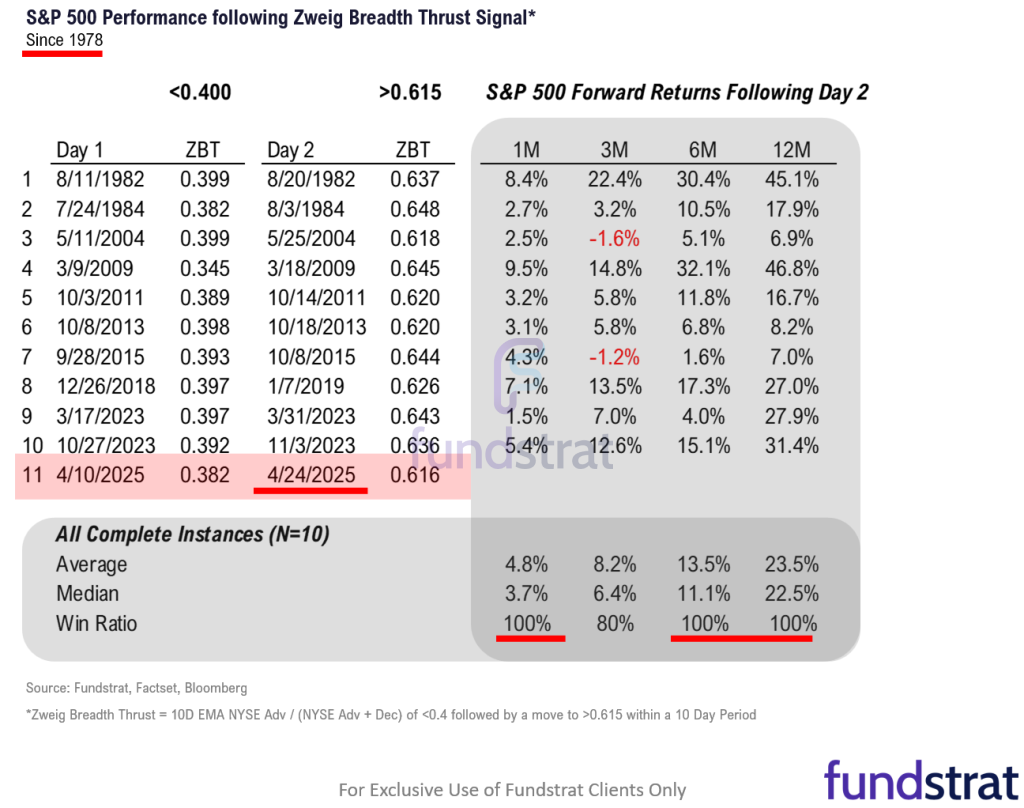

– On 4/24: Zweig Breadth Thrust triggered

– 11 previous signals, 100% win-ratio 1M, 6M and 12M later

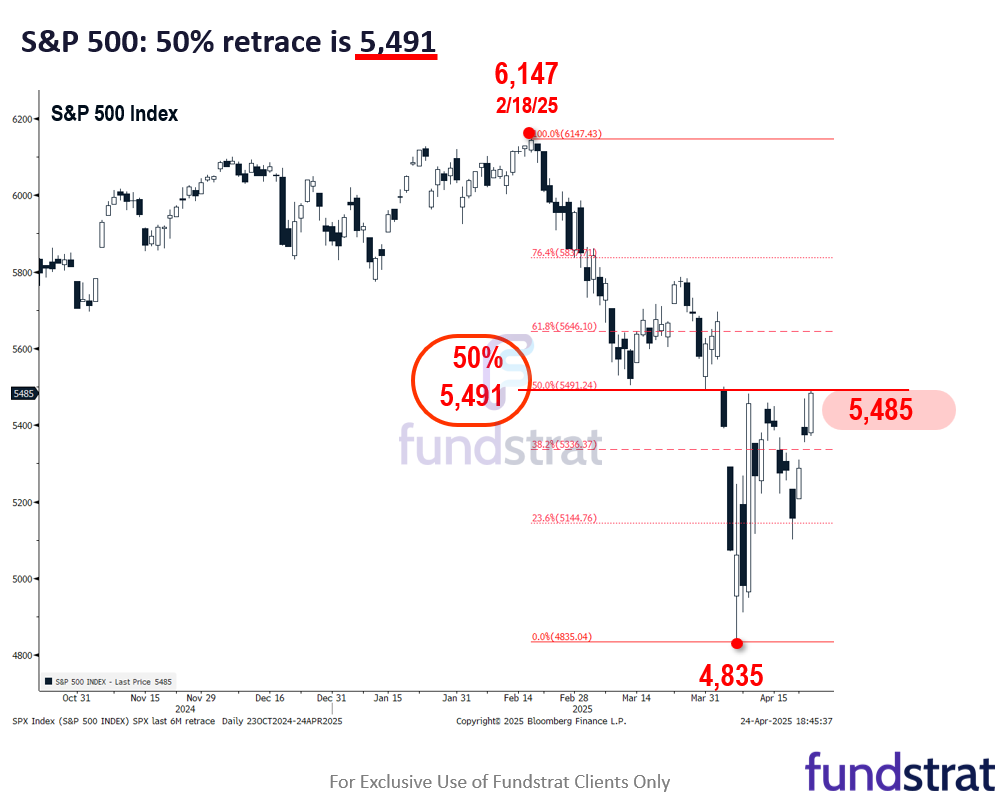

– WAITING: 50% retrace, S&P 500 5,491 <– current 5,485 CLOSE! - The S&P 500 is close to confirming a 50% retracement of the decline (2/18/25 to 4/8/25). This level is 6 points higher than the close on Thursday.

- The Zweig Breadth thrust is a 10-day moving average of advancing vs declining issues and when it is oversold (0.4) and then above 0.615, this is a breadth thrust. This was triggered on Thu close.

- The fact that 4 triggers and possibly 5 (near term) raise the probability the low is in. This is in the context we realize the macro remains pretty uncertain.

- WHAT COULD GO WRONG? The other shoes to drop (worrying investors) are:

– Tariff war turns into “Cold War”

– Economic ripples from “shock” lead to global recession

– Financial crisis ensues from rapid financial de-leveraging

– Inflation expectations surge leading to “greed-flation” and Fed is forced to hike rates

– S&P 500 EPS estimates fall >20% from here - In terms of macro data, this week was on-balance better than expected. U Mich inflation is this coming Friday:

– 4/22 Tue 10:00 AM ET: Apr Richmond Fed Manufacturing Survey -13 vs -7e

– 4/23 Wed 9:45 AM ET: Apr P S&P Global Manufacturing PMI 50.7 vs 49.0e

– 4/23 Wed 9:45 AM ET: Apr P S&P Global Services PMI 51.4 vs 52.8e

– 4/23 Wed 10:00 AM ET: Treasury Sec Bessent Speaks IIF

– 4/23 Wed 10:00 AM ET: Mar New Home Sales 724k vs 684ke

– 4/23 Wed 2:00 PM ET: Apr Fed Releases Beige Book

– 4/24 Thu 8:30 AM ET: Mar P Durable Goods Orders MoM 9.2% vs 2.0%e

– 4/24 Thu 8:30 AM ET: Mar Chicago Fed Nat Activity Index -0.03 vs 0.18e

– 4/24 Thu 10:00 AM ET: Mar Existing Home Sales 4.0m vs 4.1me

– 4/24 Thu 11:00 AM ET: Apr Kansas City Fed Manufacturing Survey -4 vs -5e

– 4/25 Fri 10:00 AM ET: Apr F U. Mich. 1yr Inf Exp

BOTTOM LINE: Probabilities favor “bottom is in”

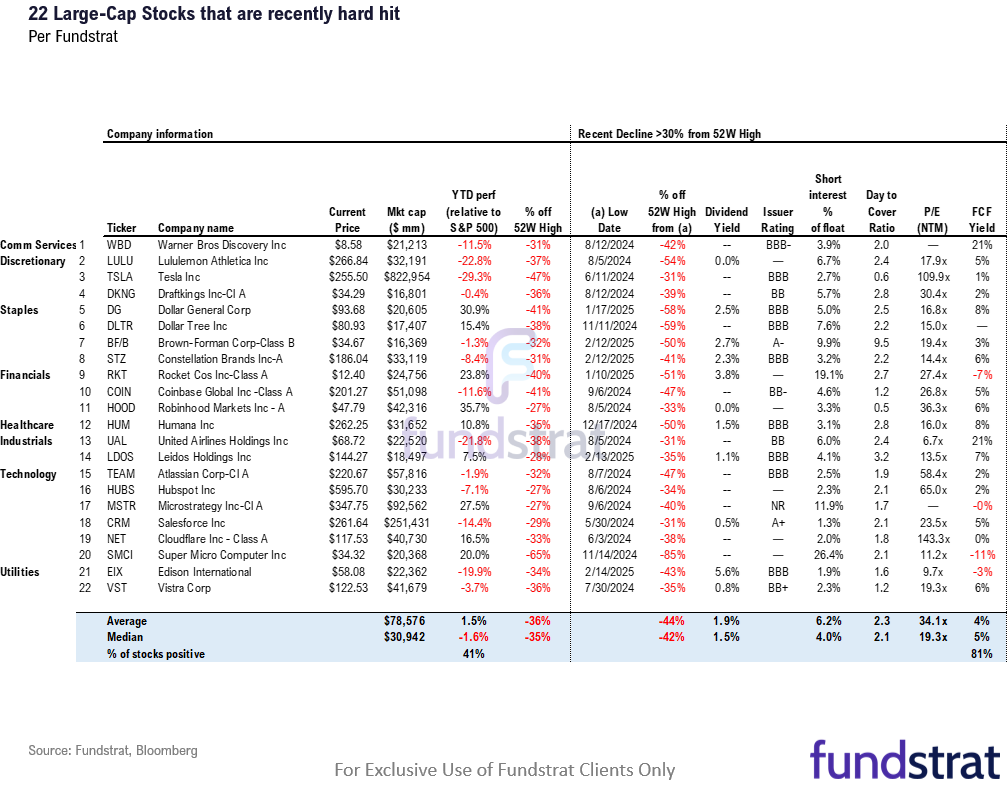

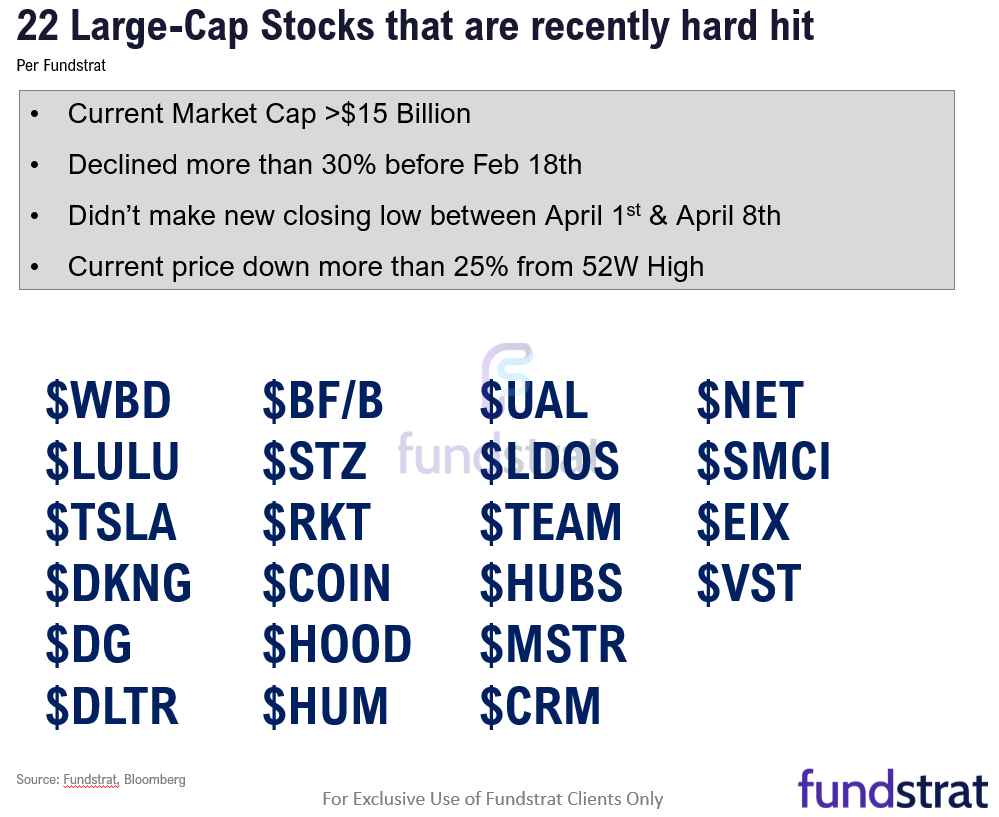

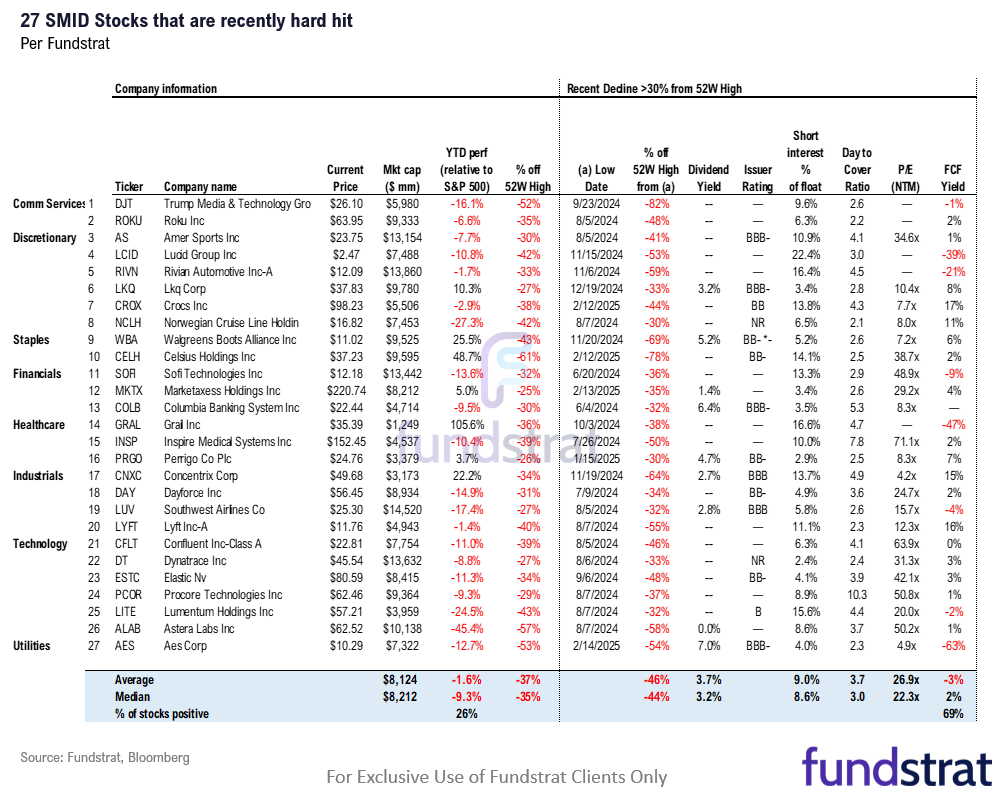

The bull market has proven itself intact. We have identified two lists of “wash out” stocks, both large-cap (22 names) and SMID-cap (27 names). We want to look at stocks which did not make a new low between April 1-April 8, even as the S&P 500 fell to new lows.

The large-cap criteria is as follows:

- Current Market Cap >$15 Billion

- Declined more than 30% before Feb 18th

- Didn’t make new closing low between April 1st & April 8th

- Current price down more than 25% from 52W High

The large-cap “washed out” tickers are:

WBD 1.41% LULU -1.01% TSLA 9.87% DKNG -1.11% DG -0.25% DLTR -0.65% BF STZ -1.15% RKT -2.51% COIN 2.51% HOOD 2.91% HUM -1.28% UAL -1.51% LDOS 0.10% TEAM 1.60% HUBS 2.50% MSTR 5.08% CRM 1.43% NET 2.30% SMCI 1.98% EIX -0.41% VST 2.17%

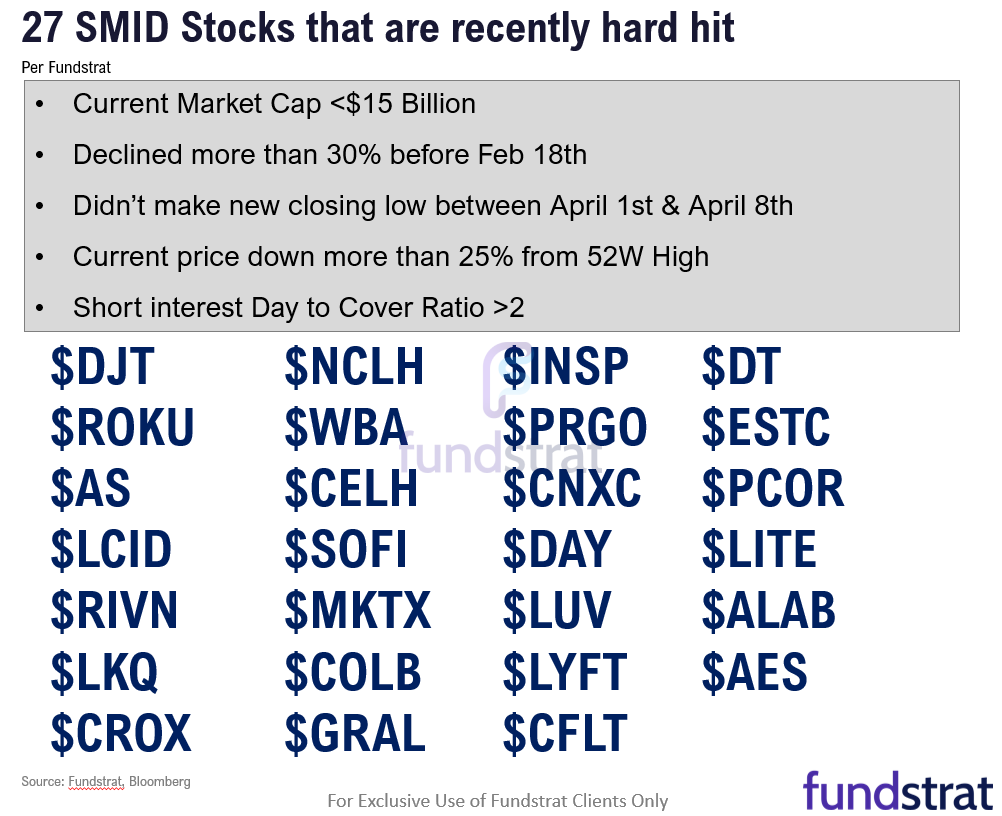

The SMID-cap criteria is as follows:

- Current Market Cap <$15 Billion

- Declined more than 30% before Feb 18th

- Didn’t make new closing low between April 1st & April 8th

- Current price down more than 25% from 52W High

- Short interest Day to Cover Ratio >2

The SMID-cap “washed out” tickers are:

DJT -0.12% ROKU 2.37% AS 0.42% LCID 1.63% RIVN 4.47% LKQ 0.40% CROX -0.74% NCLH 0.52% WBA -0.18% CELH -1.69% SOFI 4.87% MKTX 0.37% COLB -2.96% GRAL -4.19% INSP 0.54% PRGO 1.33% CNXC -1.76% DAY 0.94% LUV 0.04% LYFT 1.74% CFLT 3.87% DT 0.63% ESTC 3.39% PCOR 1.19% LITE 9.02% ALAB 2.42% AES -0.79%

_____________________________

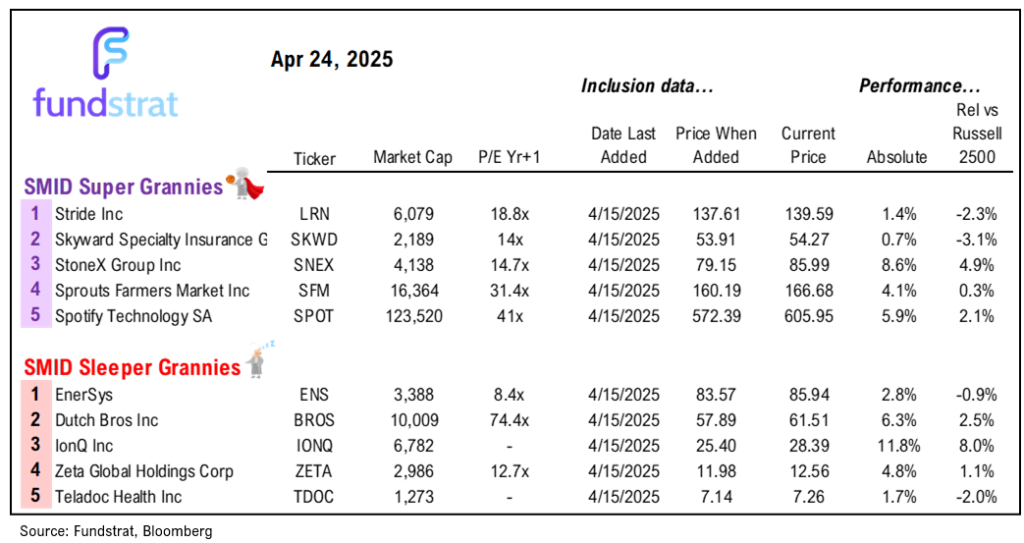

45 SMID Granny Shot Ideas: We performed our quarterly rebalance on 2/18. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

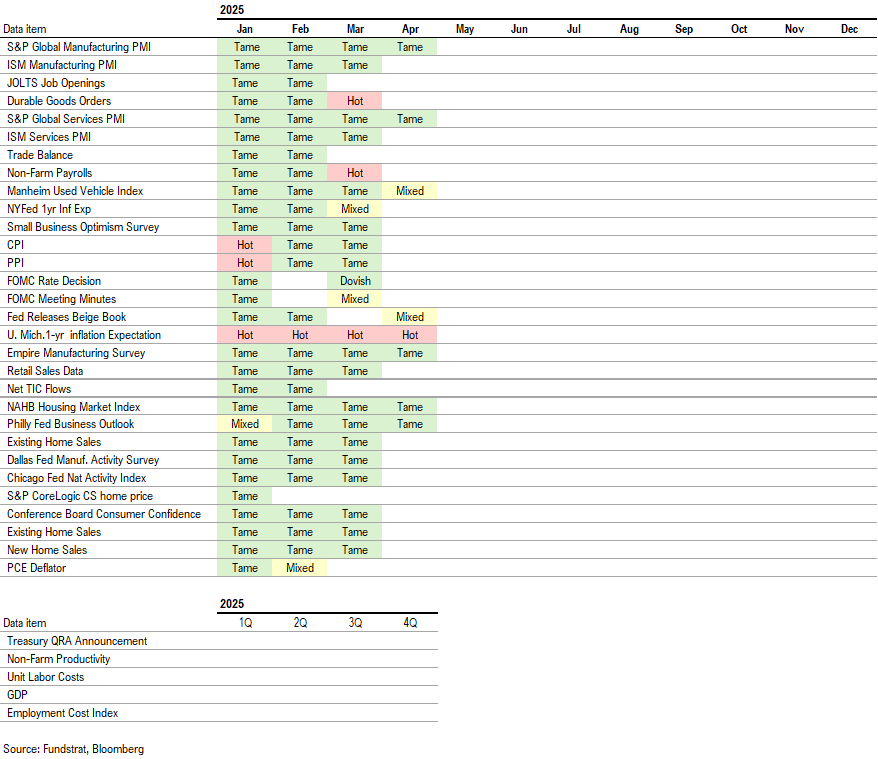

Key incoming data April:

4/1 9:45 AM ET: Mar F S&P Global Manufacturing PMITame4/1 10:00 AM ET: Mar ISM Manufacturing PMITame4/1 10:00 AM ET: Feb JOLTS Job OpeningsTame4/2 10:00 AM ET: Feb F Durable Goods Orders MoMTame4/3 8:30 AM ET: Feb Trade BalanceTame4/3 9:45 AM ET: Mar F S&P Global Services PMITame4/3 10:00 AM ET: Mar ISM Services PMITame4/4 8:30 AM ET: Mar Non-farm PayrollsHot4/7 9:00 AM ET: Mar F Manheim Used Vehicle IndexTame4/8 6:00 AM ET: Mar Small Business Optimism SurveyTame4/9 2:00 PM ET: Mar FOMC Meeting MinutesMixed4/10 8:30 AM ET: Mar Core CPI MoMTame4/11 8:30 AM ET: Mar Core PPI MoMTame4/11 10:00 AM ET: Apr P U. Mich. 1yr Inf ExpHot4/14 11:00 AM ET: Mar NYFed 1yr Inf ExpMixed4/15 8:30 AM ET: Apr Empire Manufacturing SurveyTame4/16 8:30 AM ET: Mar Retail SalesTame4/16 10:00 AM ET: Apr NAHB Housing Market IndexTame4/16 4:00 PM ET: Feb Net TIC FlowsTame4/17 8:30 AM ET: Apr Philly Fed Business OutlookTame4/17 9:00 AM ET: Apr M Manheim Used Vehicle IndexMixed4/23 9:45 AM ET: Apr P S&P Global Services PMITame4/23 9:45 AM ET: Apr P S&P Global Manufacturing PMITame4/23 10:00 AM ET: Mar New Home SalesTame4/23 2:00 PM ET: Apr Fed Releases Beige BookMixed4/24 8:30 AM ET: Mar P Durable Goods Orders MoMHot4/24 8:30 AM ET: Mar Chicago Fed Nat Activity IndexTame4/24 10:00 AM ET: Mar Existing Home SalesTame- 4/25 10:00 AM ET: Apr F U. Mich. 1yr Inf Exp

- 4/28 10:30 AM ET: Apr Dallas Fed Manuf. Activity Survey

- 4/29 9:00 AM ET: Feb S&P CS home price 20-City MoM

- 4/29 10:00 AM ET: Apr Conference Board Consumer Confidence

- 4/29 10:00 AM ET: Mar JOLTS Job Openings

- 4/30 8:30 AM ET: 1Q A GDP QoQ

- 4/30 8:30 AM ET: 1Q ECI QoQ

- 4/30 10:00 AM ET: Mar Core PCE MoM

Economic Data Performance Tracker 2025:

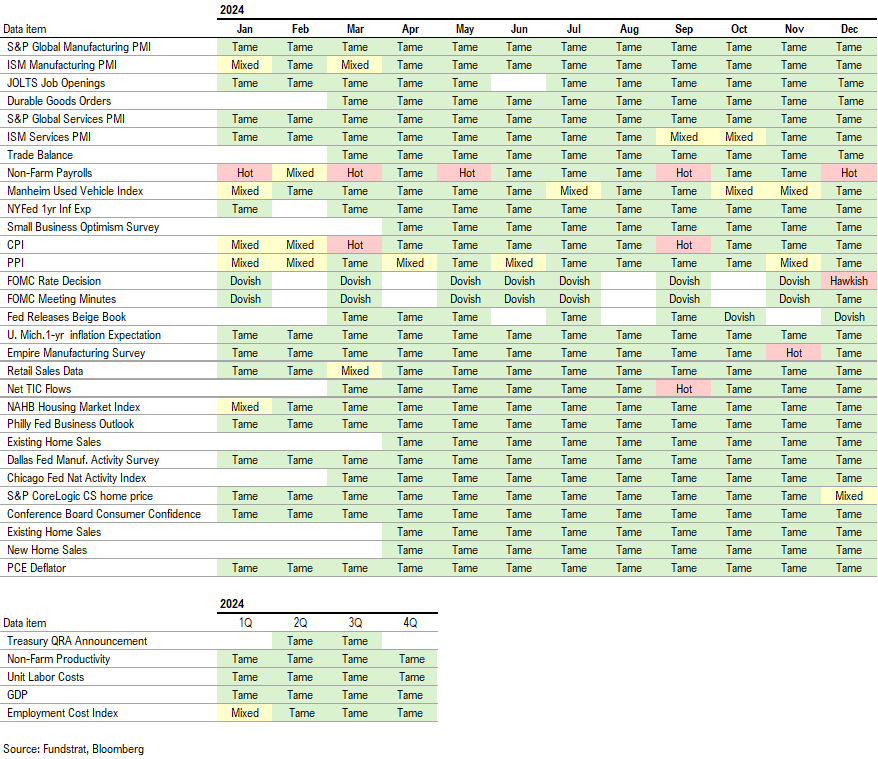

Economic Data Performance Tracker 2024:

Economic Data Performance Tracker 2023: