________________________________________________

- SMID Granny Shots November Quarterly rebalance today

- Updating list of Top Stock Ideas

- Updating 5 Super and 5 Sleeper SMID Grannies

- Chartbook linked below

- See below for SMID Granny Shots adds and deletes

To download the slide deck for our Market Update Webinar, please click HERE.

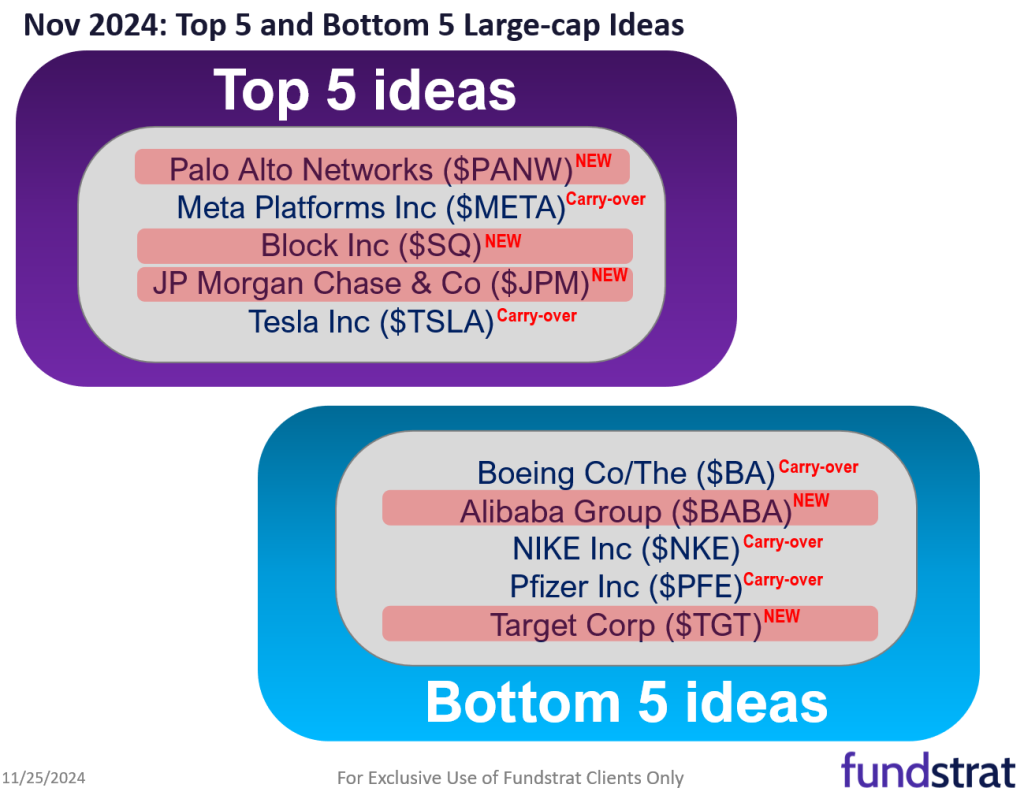

Investment Ideas: Top large-cap stock picks + Super SMID Grannies

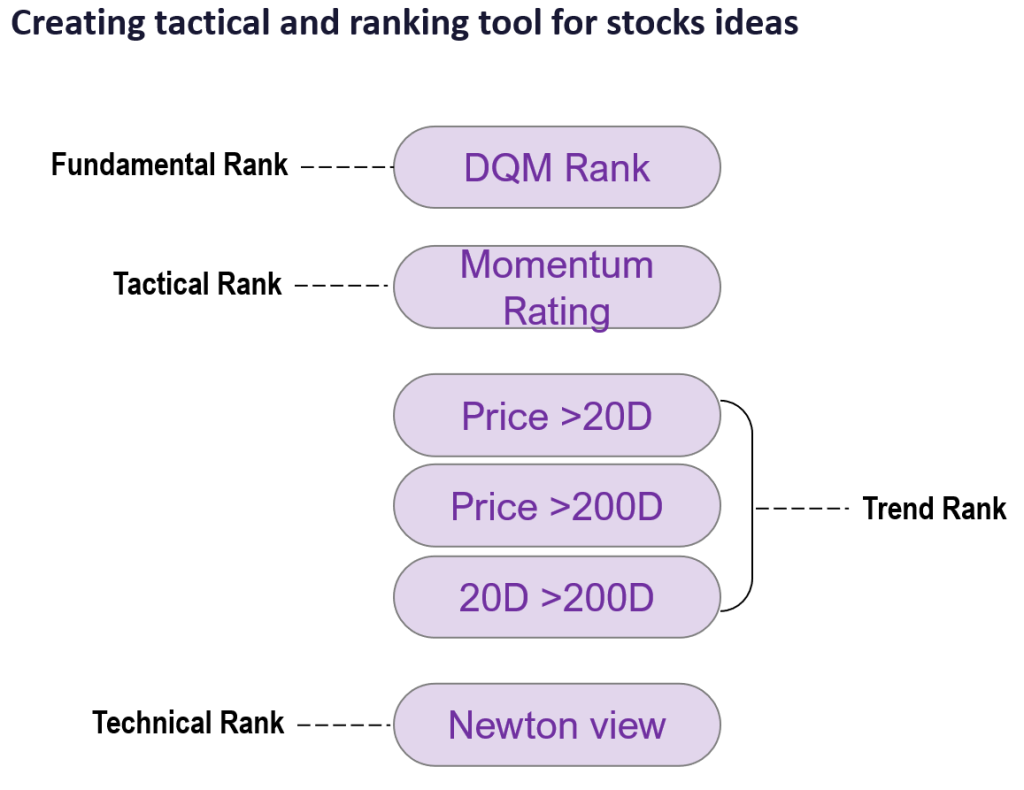

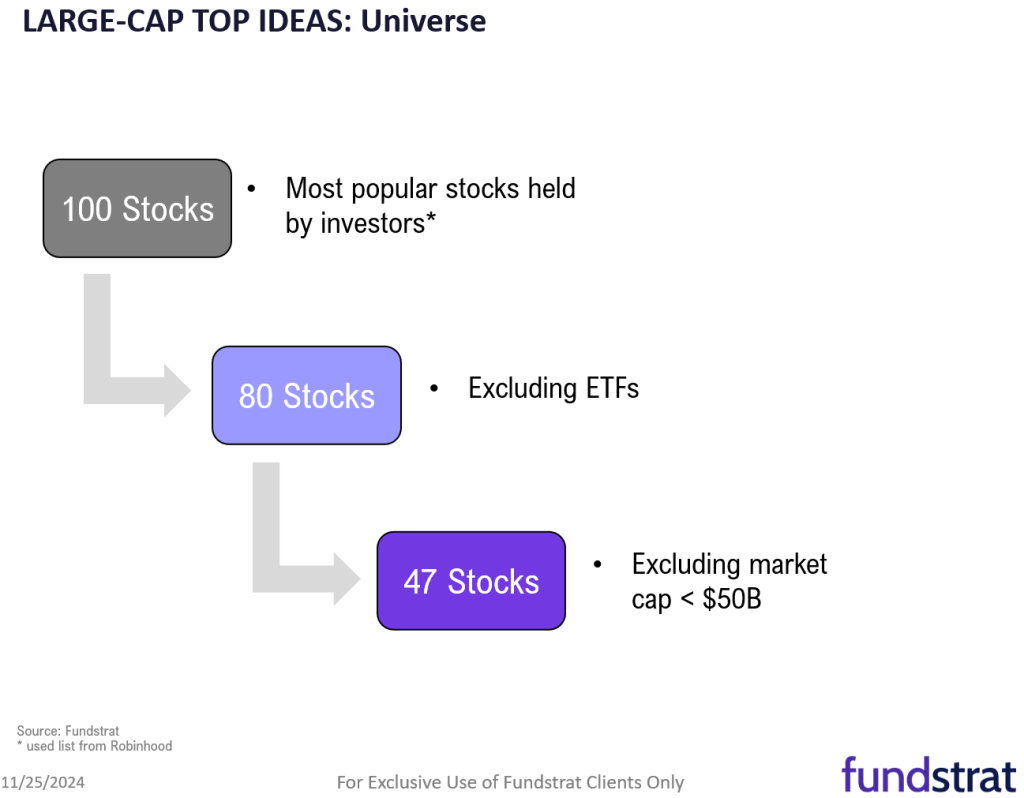

As we are rebranding our monthly webinar, we are introducing a new section of top stock ideas:

- The top large-cap stock ideas are based on a universe of 47 large-cap stocks that are widely held by investors and market cap >$50b

- The new top stock ideas follow the similar methodologies we use to identify super SMID granny ideas

- Essentially, we aim to identify the most timely stock ideas by cross referencing the trend analyses, quantamental works and technical studies.

- In more detail, the framework is composed of a criteria of 4 factors to narrow down to tactical buys:

– fundamentals using DQM model managed by “tireless Ken”

– momentum rating based weighted average performances of recent period

– technical strength measured by Price >20 DMA, 20 DMA vs 200 DMA and combos

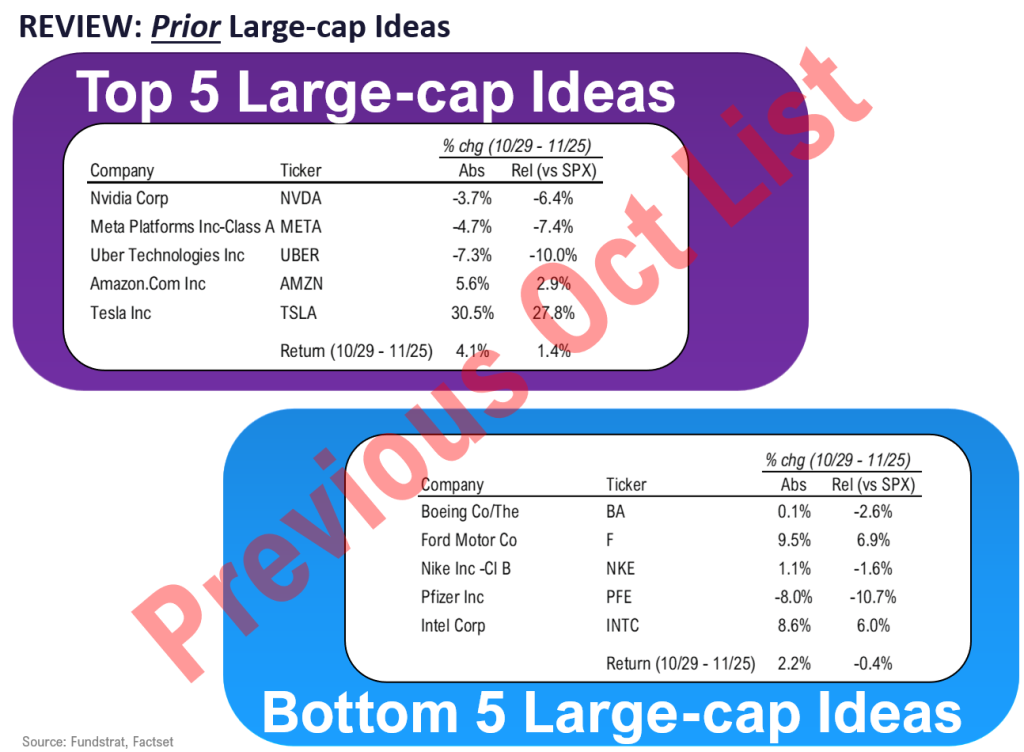

– Mark Newton’s judgement on the technical outlook - Our top 5 Stock Ideas for November 2024:

– Meta Platforms Inc (META -2.68% ) <– carry over

– Tesla Inc (TSLA -1.27% ) <– carry over

– JP Morgan Chase & Co (JPM -0.63% )

– Block Inc (SQ)

– Palo Alto Networks (PANW 0.69% )

- The bottom 5 stock ideas (to avoid) are:

– Boeing Co/The (BA 1.35% ) <– carry over

– NIKE Inc (NKE 1.69% ) <– carry over

– Pfizer Inc (PFE 0.82% ) <– carry over

– Alibaba Group (BABA 5.79% )

– Target Corp (TGT 1.58% )

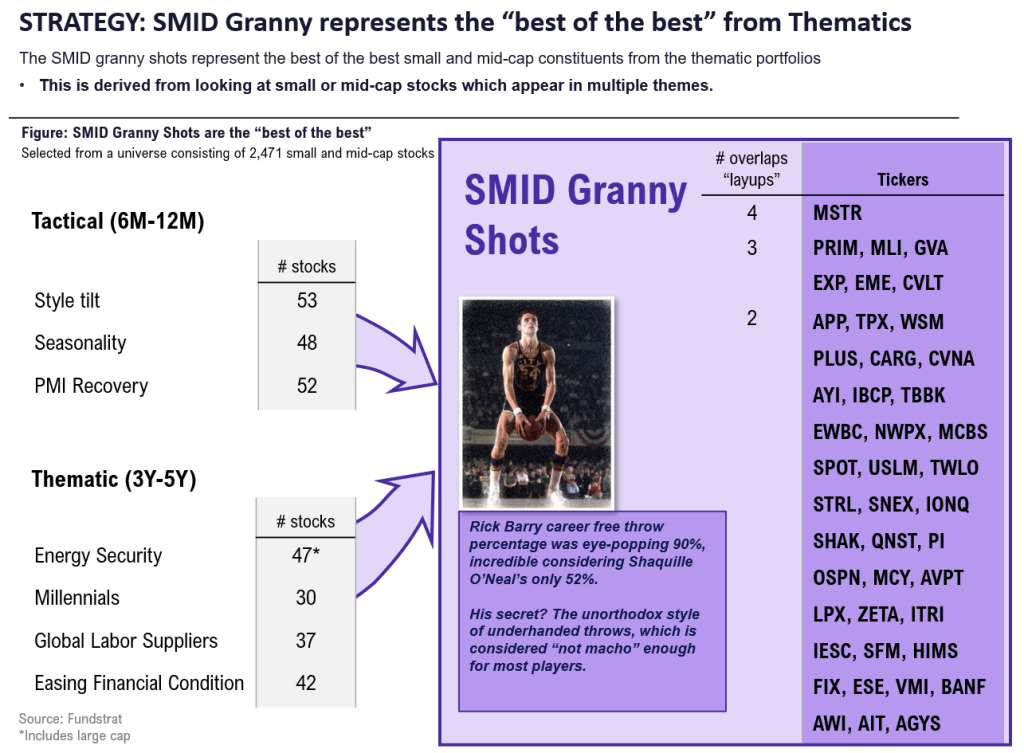

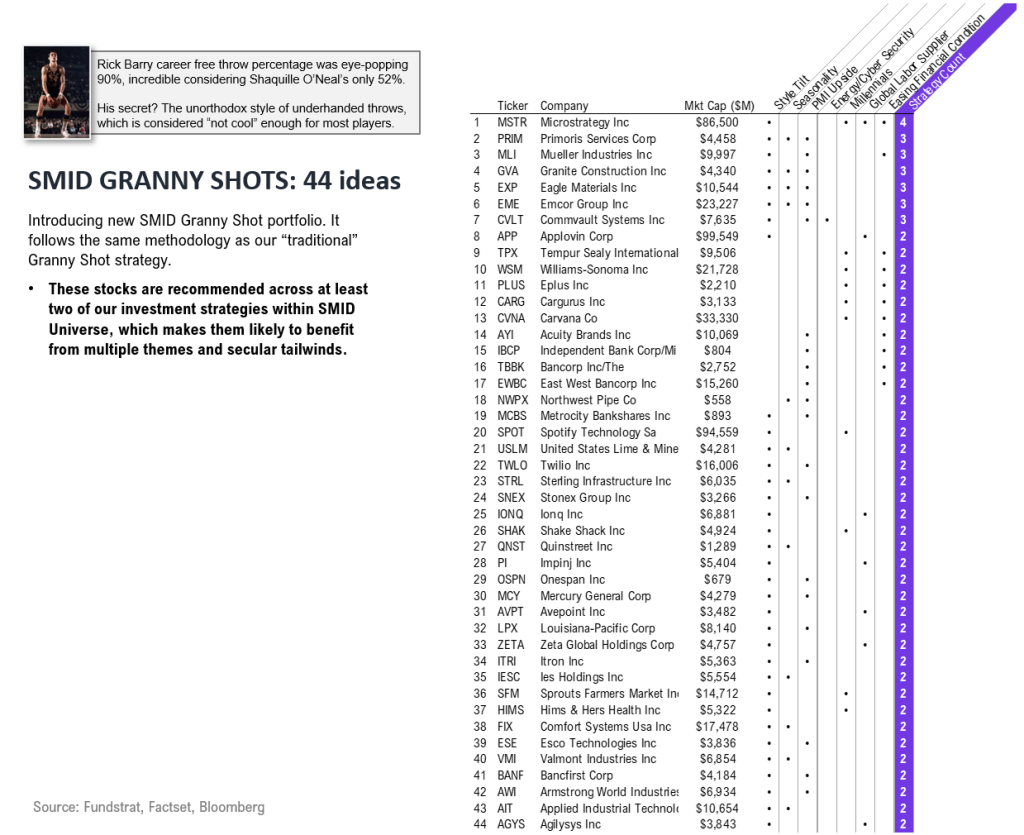

REBALANCE SMID GRANNY SHOTS: +27 adds, (-25 deletes). YTD outperformance +2,497 bps

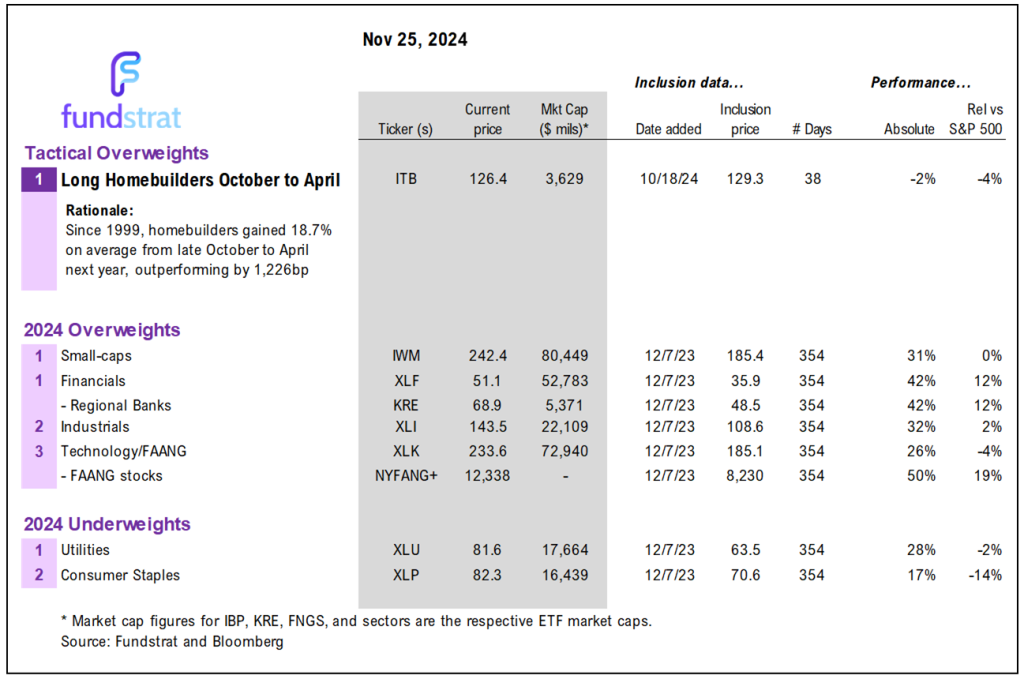

Last December, we upgraded Small-caps to be the #1 recommendation in our 2024 year-ahead outlook. We also created the SMID granny shot portfolio strategy as many of our clients asked us for our Top SMID stock picks.

- We believe the SMID Grannies could benefit from the multiple themes and secular tailwinds

- The SMID Grannies shots were selected from a universe consisting of 2,471 small and mid-cap stocks.

- From the SMID granny shots portfolio, we employed the same framework mentioned above to identify the 5 most timely ideas and 5 least timely ideas within the SMID granny shots portfolio.

27 rebalance additions are:

- Comm. Services: QNST 0.46%

- Discretionary: SHAK 0.35%

- Financials: BANF 1.27% , EWBC 3.10% , MCY 1.16% , SNEX 4.70%

- Healthcare: HIMS 3.97%

- Industrials: AIT 0.25% , AWI 0.22% , AYI -0.37% , EME 0.54% , ESE -1.04% , FIX 0.81% , GVA -0.95% , IESC 4.97% , NWPX 1.17% , PRIM 1.07% , STRL 3.36% , VMI 0.08%

- Materials: LPX 0.45% , USLM 1.60%

- Staples: SFM 2.05%

- Technology: IONQ -3.26% , ITRI 0.38% , OSPN 0.21% , TWLO -0.51% , ZETA -2.16%

25 rebalance deletions are:

- Discretionary: BLD 1.24%

- Energy: LNG 0.61%

- Financials: CFB, TREE 6.05%

- Healthcare: ADMA 7.78% , BPMC 2.09% , DNTH 6.25% , MIRM 1.06% , MNKD N/A% , NRIX 7.77% , RNA 5.20% , TGTX 4.63%

- Industrials: AIR 1.54% , BLBD 3.31% , FLS 0.52%

- Technology: ACLS 0.91% , AMKR 2.66% , CRUS 1.32% , DAKT 0.24% , FORM 1.46% , NSSC 2.27% , PLTR 3.31% (Moved to Large-Cap Universe), SPNS 0.35% , UCTT -0.15% , VECO 1.21%

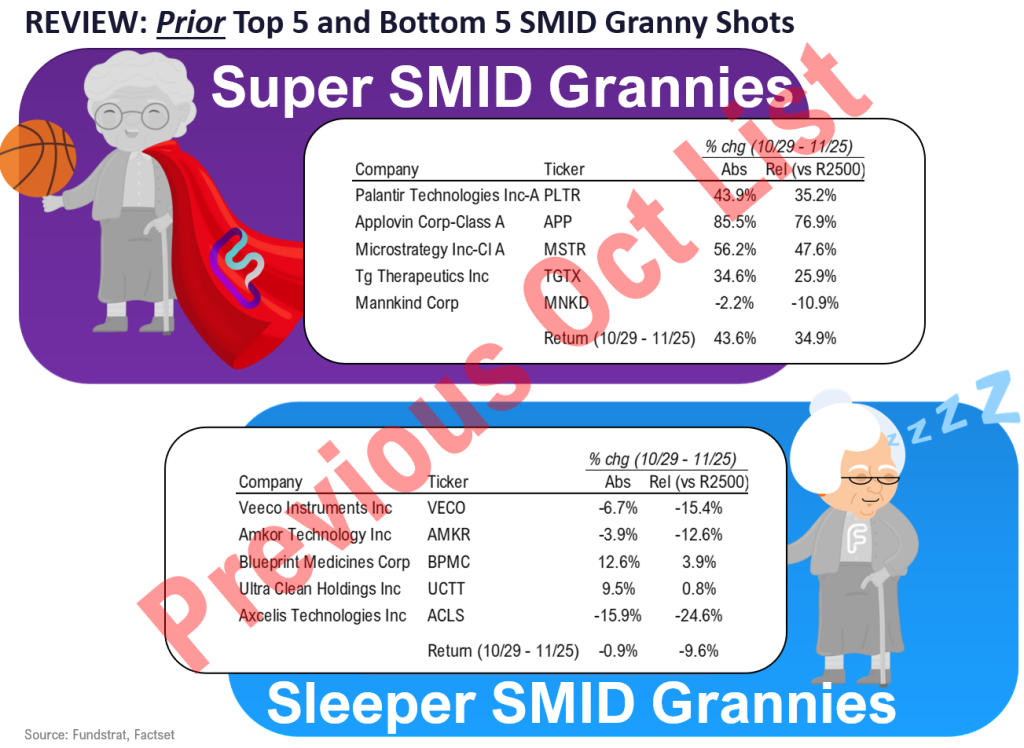

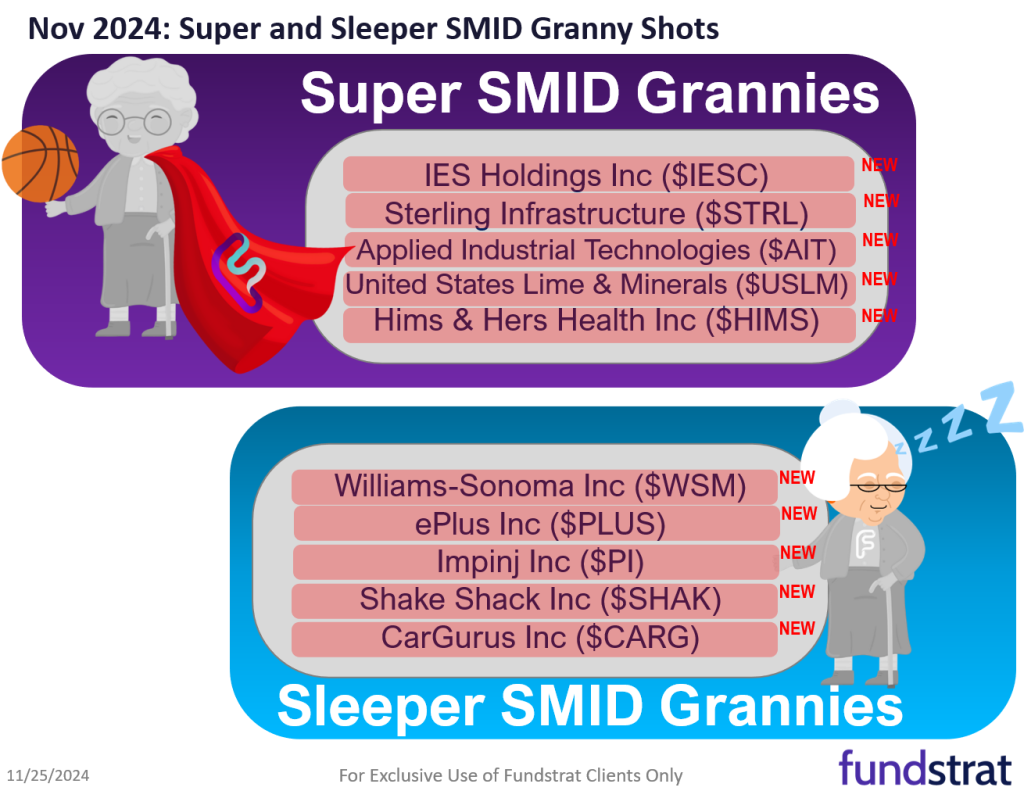

SUPER SMID GRANNIES: 5 Super and 5 Sleeper

“Super SMID Grannies” (long) and “Sleeper SMID Grannies” are derived from our SMID stock list of 44 ideas called “SMID Granny Shots”

- We have 5 tactical buys aka “Super SMID Grannies”

– IES Holdings Inc (IESC 4.97% )

– Sterling Infrastructure (STRL 3.36% )

– Applied Industrial Technologies (AIT 0.25% )

– United States Lime & Minerals (USLM 1.60% )

– Hims & Hers Health Inc (HIMS 3.97% ) - The bottom 5 “Sleeper SMID Grannies” are:

– Williams-Sonoma Inc (WSM -2.02% )

– ePlus Inc (PLUS -0.05% )

– Impinj Inc (PI 1.87% )

– Shake Shack Inc (SHAK 0.35% )

– CarGurus Inc (CARG N/A% )

Please see Mark’s technical note tonight for commentary on the Top 5 Stock Ideas and 5 Super SMID Grannies.

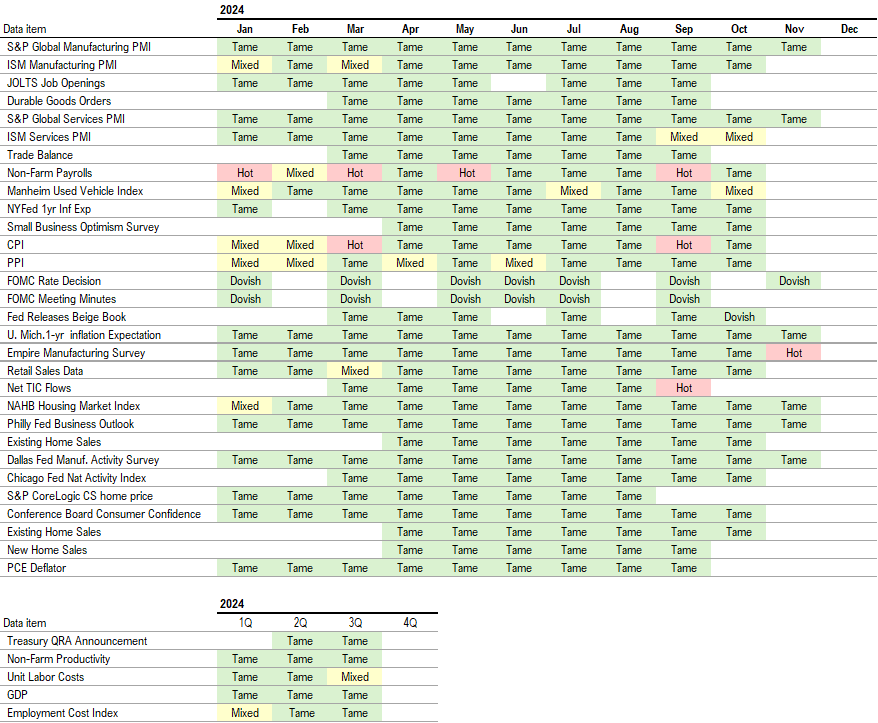

Key incoming data November:

11/1 8:30 AM ET: Oct Non-Farm PayrollsTame11/1 9:45 AM ET: Oct F S&P Global Manufacturing PMITame11/1 10:00 AM ET: Oct ISM Manufacturing PMITame11/4 10:00 AM ET: Sep F Durable Goods OrdersTame- 11/5: US Presidential Election 2024

11/5 8:30 AM ET: Sep Trade BalanceTame11/5 9:45 AM ET: Oct F S&P Global Services PMITame11/5 10:00 AM ET: Oct ISM Services PMIMixed11/7 8:30 AM ET: 3Q P Non-Farm ProductivityTame11/7 8:30 AM ET: 3Q P Unit Labor CostsMixed11/7 9:00 AM ET: Sep F Manheim Used vehicle indexTame11/7 2:00 PM ET: Nov FOMC DecisionDovish11/8 10:00 AM ET: Nov P U. Mich. Sentiment and Inflation ExpectationTame11/12 6:00 AM ET: Oct Small Business Optimism SurveyTame11/12 11:00 AM ET: Oct NY Fed 1yr Inf ExpTame11/13 8:30 AM ET: Oct CPITame11/14 8:30 AM ET: Oct PPITame11/15 8:30 AM ET: Oct Retail Sales DataTame11/15 8:30 AM ET: Nov Empire Manufacturing SurveyHot11/18 10:00 AM ET: Nov NAHB Housing Market IndexTame11/18 4:00 PM ET: Sep Net TIC FlowsHot11/19 9:00 AM ET: Oct M Manheim Used vehicle indexMixed11/21 8:30 AM ET: Nov Philly Fed Business OutlookTame11/21 10:00 AM ET: Oct Existing Home SalesTame11/22 9:45 AM ET: Nov P S&P Global Manufacturing PMITame11/22 9:45 AM ET: Nov P S&P Global Services PMITame11/22 10:00 AM ET: Nov F U. Mich. Sentiment and Inflation ExpectationTame11/25 8:30 AM ET: Oct Chicago Fed Nat Activity IndexTame11/25 10:30 AM ET: Nov Dallas Fed Manuf. Activity SurveyTame- 11/26 9:00 AM ET: Sep S&P CoreLogic CS home price

- 11/26 10:00 AM ET: Nov Conference Board Consumer Confidence

- 11/26 10:00 AM ET: Oct New Home Sales

- 11/26 2:00 PM ET: Nov FOMC Meeting Minutes

- 11/27 8:30 AM ET: Oct PCE Deflator

- 11/27 8:30 AM ET: 3Q S 2024 GDP

- 11/27 10:00 AM ET: Oct P Durable Goods Orders

Economic Data Performance Tracker 2024:

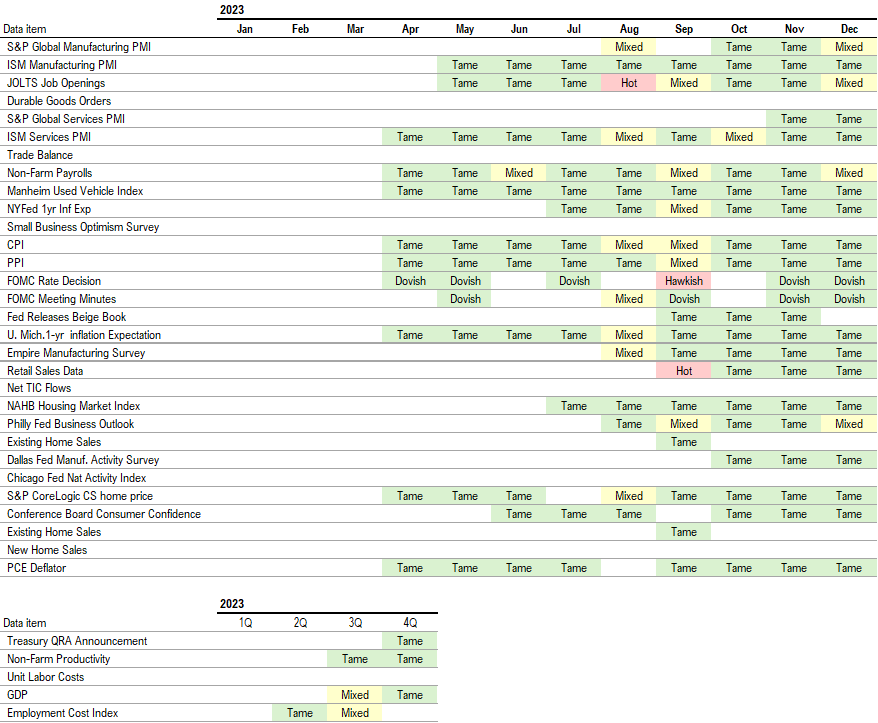

Economic Data Performance Tracker 2023:

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

___________________________