___________________________________

- Granny Shots July Quarterly rebalance today

- Updating 5 Super and 5 Sleeper Grannies

- Updating 5 Super and 5 Sleeper SMID Grannies

- See below for adds and deletes

To download the slide deck for our Granny Shots Webinar, please click here.

GRANNY SHOTS: July 2024 Rebalance

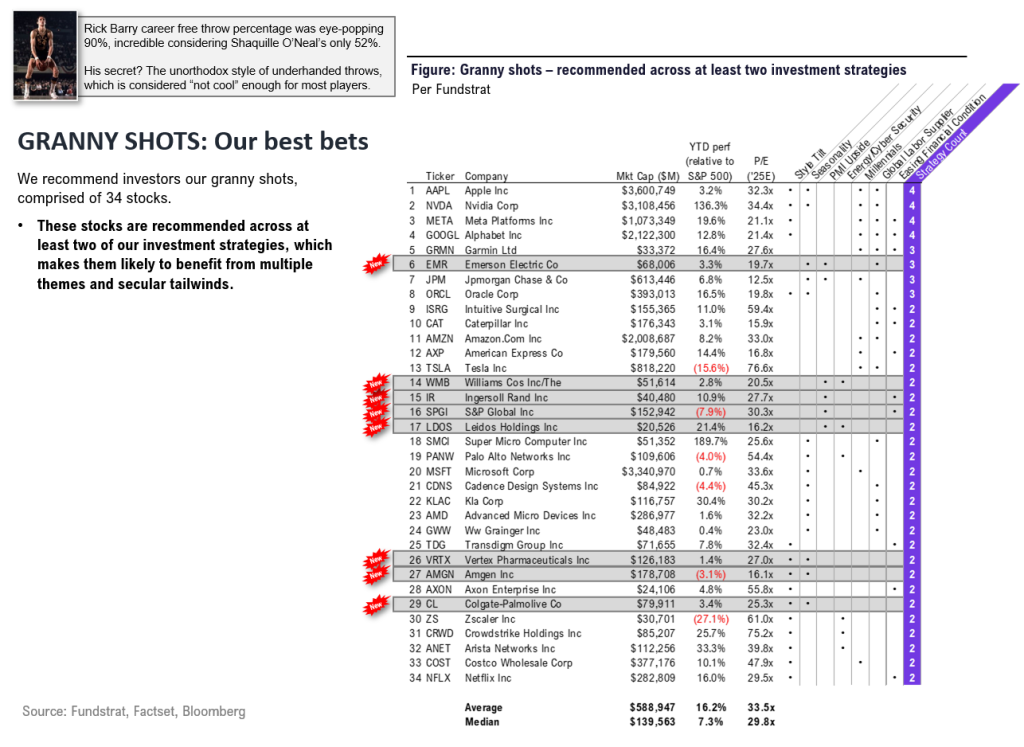

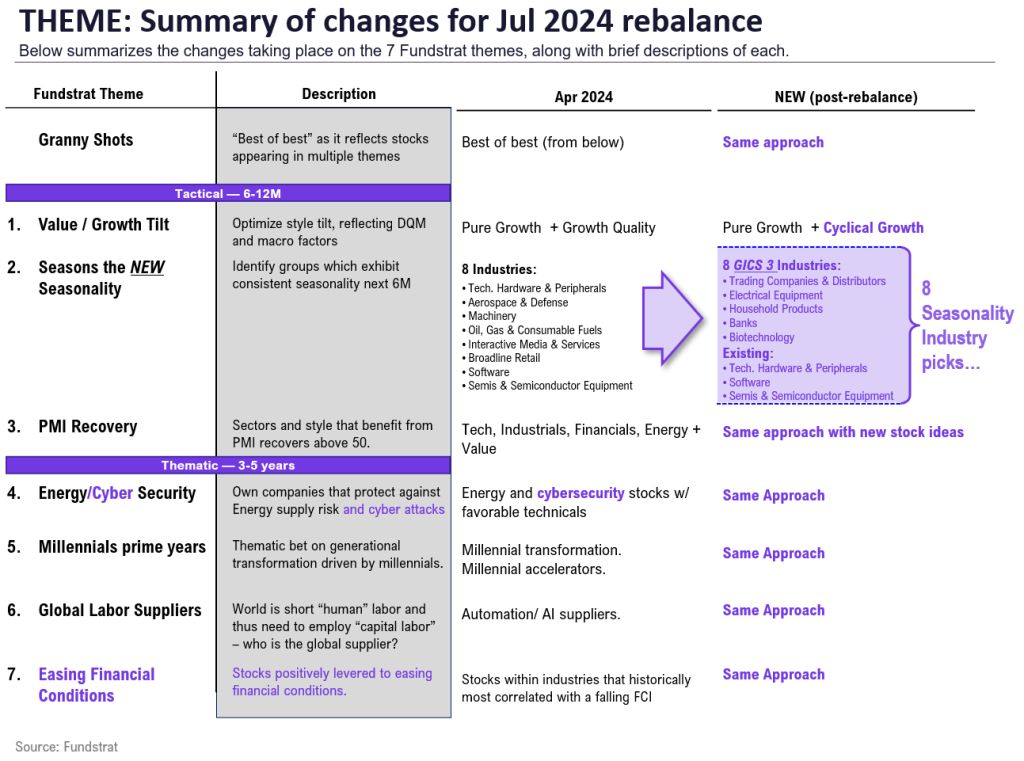

This note is focused on the quarterly rebalance of Granny Shots, and also the updated list of Super and Sleeper Grannies. We view Granny Shots as a core portfolio of stocks and the portfolio is adjusted to reflect seasonal and structural changes:

- For our Large-Cap Granny Shots Portfolio:

The additions: AMGN 4.62% , CL 1.27% , EMR -0.35% , IR 0.10% , LDOS 0.70% , SPGI 0.79% , VRTX 1.90% , WMB N/A%

The deletions: CMG -2.07% , COP 2.79% , CRM 0.99% , DECK 3.59% , EOG 2.60% , FANG 2.36% , MPC 1.92% , NOW -0.65% , ODFL 1.27% , PSX 1.65% - For our SMID Granny Shots Portfolio:

The additions: ACLS -2.10% , ADMA 8.97% , AIR 0.64% , AVPT 2.29% , BPMC, CFB, CVLT -1.38% , DAKT -1.31% , DNTH -1.39% , FORM -3.94% , IBCP -0.03% , LNG 0.21% , MCBS -0.11% , MIRM 2.31% , MNKD -3.32% , NRIX 4.98% , PI -3.37% , RNA 1.23% , SPNS -0.02% , TBBK 3.03% , TGTX 2.41% , UCTT -4.44% , VECO -1.58%

The deletions: AVAV -1.73% , AYI -1.15% , DASH -1.61% , DFH -0.53% , ELF -2.24% , ENV, FSS -1.88% , GBX -1.95% , GMS, HCI -0.66% , HIBB, HUBS 1.87% , IBP 0.79% , KOP 2.17% , NEU -0.19% , NOV 0.32% , NPK -0.06% , OVV 1.49% , PLAB -2.22% , REX 2.40% , SEMR 1.36% , SHAK -1.68% , TEX -1.89% , TPL -0.47% , WING 0.47% - There are a lot of moving parts in a rebalance and these are both on style changes and seasonally attractive industry groups. We don’t necessarily want to focus on these as stand alone factors, but the industry groups are shown below.

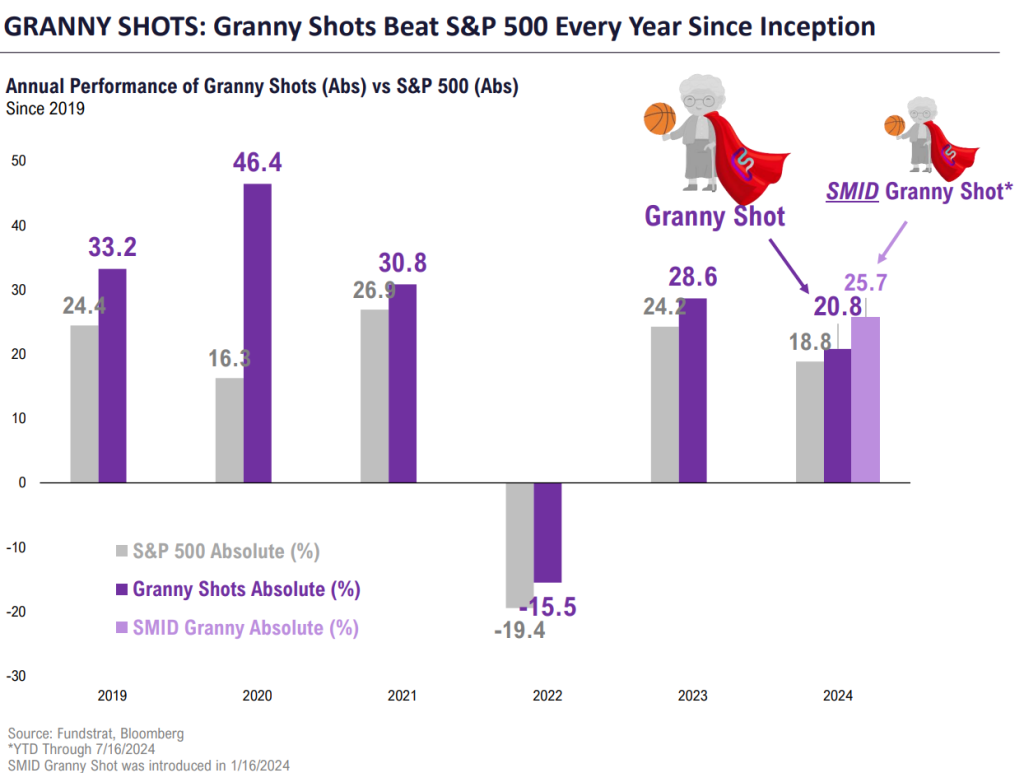

- YTD Granny Shots is up 1.97% (outperforming by +197bp vs S&P 500). YTD SMID Granny Shots is up 11.89% (outperforming by +1,189bp vs Russell 2500). This is tracking to be one of the strongest years for Granny Shots. Grannies have outperformed every single year since inception in January 2019.

- We know many do not want to buy a 34 stock list. So we have launched Super and Sleeper Grannies:

– Top 5 “most attractive” are Super Grannies

– Bottom 5 “least attractive” are Sleeper Grannies

– We refresh these lists the third Wed of every month

For our Large-Cap Granny Shots Portfolio:

- Top 5 tactical buys aka “Super Grannies”

– Amazon Inc (AMZN 0.29% )

– Alphabet Inc (GOOGL 0.46% ) <– carry over

– Axon Enterprise Inc (AXON -2.41% )

– Vertex Pharmaceuticals Inc (VRTX 1.90% )

– S&P Global Inc (SPGI 0.79% ) - Bottom 5 “Sleeper Grannies” are:

– Zscaler Inc (ZS 0.73% ) <– carry over

– Super Micro Computer Inc (SMCI -3.43% )

– Netflix Inc (NFLX 1.46% )

– Advanced Micro Devices Inc (AMD -2.56% )

– Oracle Corp (ORCL -1.95% )

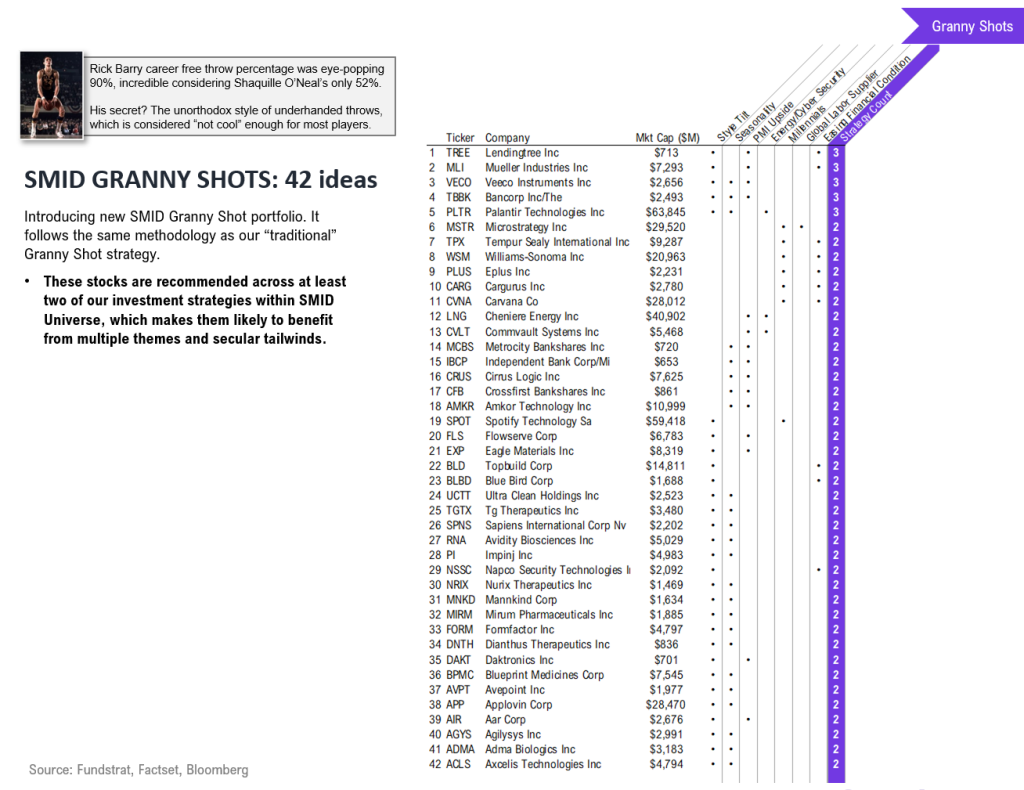

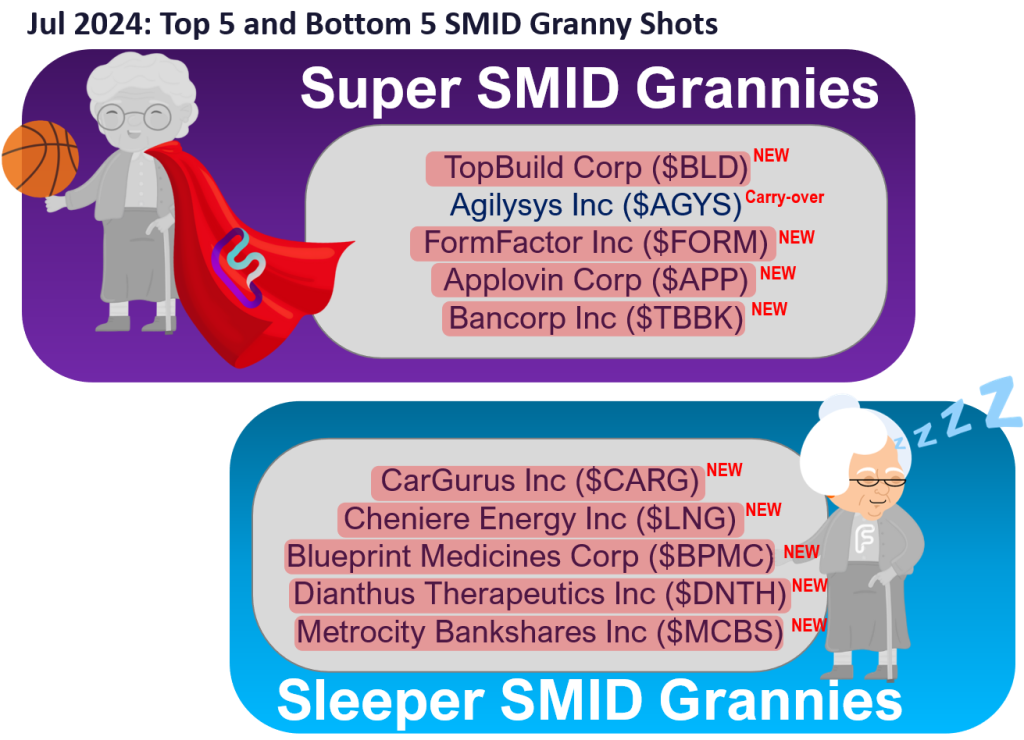

For our SMID Granny Shots Portfolio:

- Top 5 tactical buys aka “Super SMID Grannies”

– TopBuild Corp (BLD N/A% )

– Agilysys Inc (AGYS 0.59% ) <– carry over

– FormFactor Inc (FORM -3.94% )

– Applovin Corp (APP -8.66% )

– Bancorp Inc (TBBK 3.03% ) - Bottom 5 “Sleeper SMID Grannies” are:

– CarGurus Inc (CARG -2.23% )

– Cheniere Energy Inc (LNG 0.21% )

– Blueprint Medicines Corp (BPMC)

– Dianthus Therapeutics Inc (DNTH -1.39% )

– Metrocity Bankshares Inc (MCBS -0.11% )

___________________________________

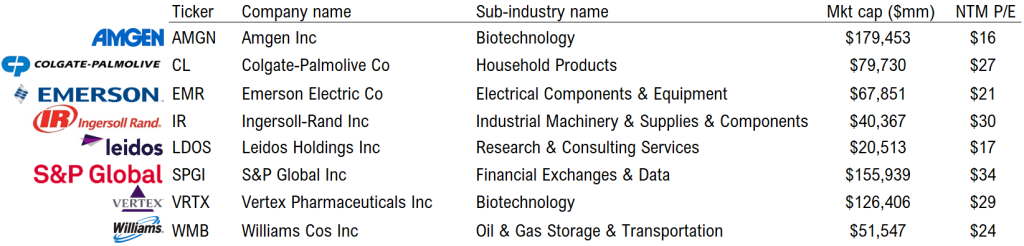

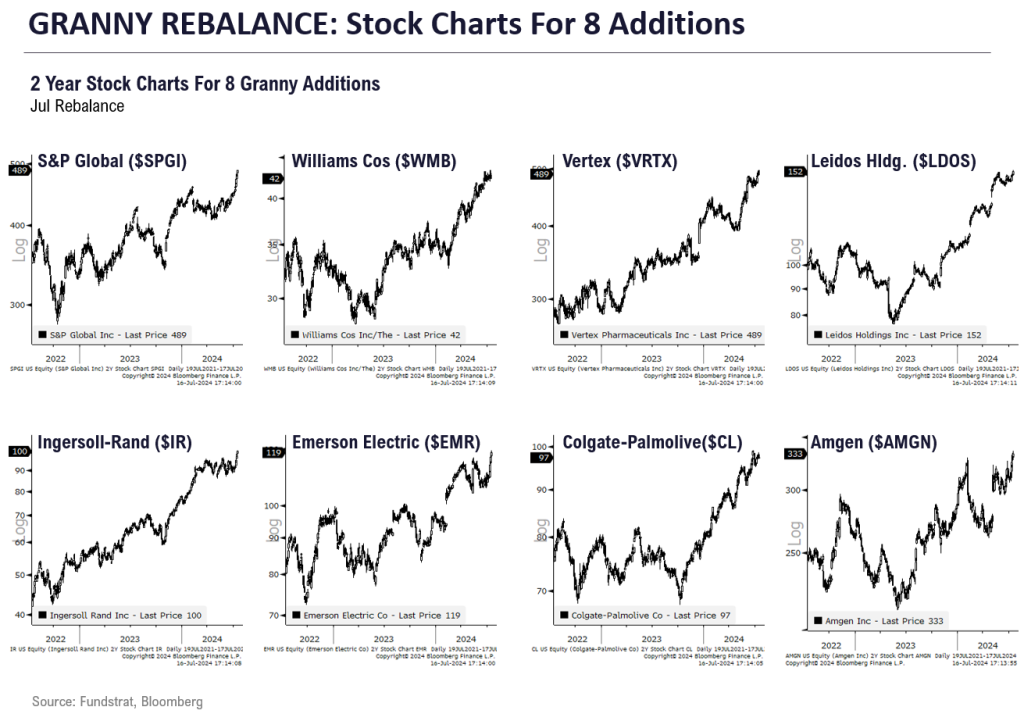

REBALANCE GRANNY SHOTS: +8 adds, (-10 deletes). YTD outperformance +197bps

Today is the July quarterly rebalance of our Granny Shots portfolio.

8 rebalance additions are:

AMGN 4.62% , CL 1.27% , EMR -0.35% , IR 0.10% , LDOS 0.70% , SPGI 0.79% , VRTX 1.90% , WMB N/A%

- Amgen Inc (AMGN 4.62% )

- Colgate-Palmolive Co (CL 1.27% )

- Emerson Electric Co (EMR -0.35% )

- Ingersoll-Rand Inc (IR 0.10% )

- Leidos Holdings Inc (LDOS 0.70% )

- S&P Global Inc (SPGI 0.79% )

- Vertex Pharmaceuticals Inc (VRTX 1.90% )

- Williams Cos Inc (WMB N/A% )

Below are the 2-year stock charts for the 8 additions

10 rebalance deletions are:

- CMG -2.07% , COP 2.79% , CRM 0.99% , DECK 3.59% , EOG 2.60% , FANG 2.36% , MPC 1.92% , NOW -0.65% , ODFL 1.27% , PSX 1.65%

Think about Granny Shots as a “core portfolio” that we rebalance every quarter. The Granny Shots is a list of our core stock holdings, using 7 thematic/quantitative portfolios and is designed to identify long-term EPS growers. Since inception in 2019, Granny Shots has outperformed every year:

- 2019 +879bp –> great year

- 2020 +3,015bp –> great year

- 2021 +392bp –> good year

- 2022 +395bp–> good year

- 2023 +440bp–> good year

- 2024 +197bp–> great start

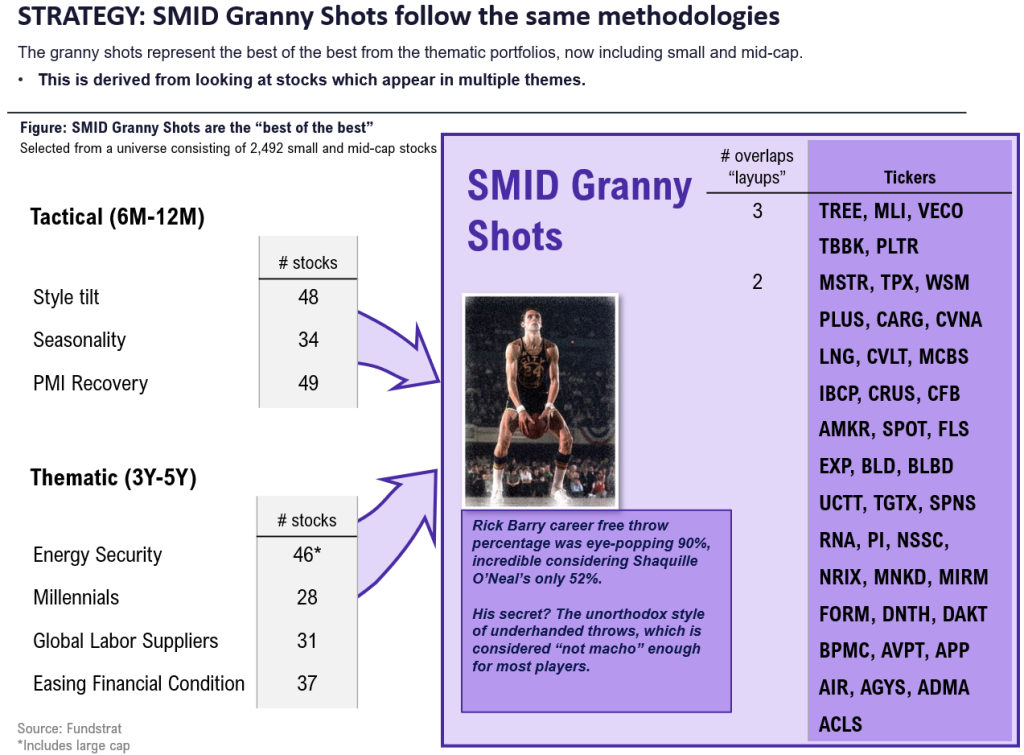

REBALANCE SMID GRANNY SHOTS: +23 adds, (-25 deletes). YTD outperformance +1189 bps

We introduced our Granny Shots 5 years ago (exact date Jan 10, 2019). Over the past 5 years, Granny Shots, our core portfolio recommendation, have beaten S&P 500 every year. Last December, we upgraded Small-caps to be the #1 recommendation in our 2024 year-ahead outlook. Many of our clients asked us for a SMID version of our Granny Shots. And here you go:

- The new SMID granny shots follow the same methodology as our “traditional” Granny Shots

- We believe the SMID granny shots could benefit from the multiple themes and secular tailwinds as well, similar to our “traditional” Granny Shots.

- The SMID granny shots were selected from a universe consisting of 2,492 small and mid-cap stocks.

- One key difference between our regular Granny Shots and SMID Granny Shots is that we used Asset Turnover as a key criterion in stock selection for the SMID list. The SMID Granny Shots are those with higher asset turnover rates vs their peers, or the ones that demonstrate a clear trend of improvement regarding the conversion of assets to sales.

23 rebalance additions are:

- ACLS -2.10% , ADMA 8.97% , AIR 0.64% , AVPT 2.29% , BPMC, CFB, CVLT -1.38% , DAKT -1.31% , DNTH -1.39% , FORM -3.94% , IBCP -0.03% , LNG 0.21% , MCBS -0.11% , MIRM 2.31% , MNKD -3.32% , NRIX 4.98% , PI -3.37% , RNA 1.23% , SPNS -0.02% , TBBK 3.03% , TGTX 2.41% , UCTT -4.44% , VECO -1.58%

25 rebalance deletions are:

- AVAV -1.73% , AYI -1.15% , DASH -1.61% , DFH -0.53% , ELF -2.24% , ENV, FSS -1.88% , GBX -1.95% , GMS, HCI -0.66% , HIBB, HUBS 1.87% , IBP 0.79% , KOP 2.17% , NEU -0.19% , NOV 0.32% , NPK -0.06% , OVV 1.49% , PLAB -2.22% , REX 2.40% , SEMR 1.36% , SHAK -1.68% , TEX -1.89% , TPL -0.47% , WING 0.47%

SUPER GRANNIES: 5 Super and 5 Sleeper + 5 Super SMIDS and 5 Sleeper SMIDS

“Super Grannies” (long) and “Sleeper Grannies” are derived from our core stock list of 34 ideas called “Granny Shots”

- The rationale is many clients ask us to narrow this list of 34 names down to a list of “fresh money” ideas.

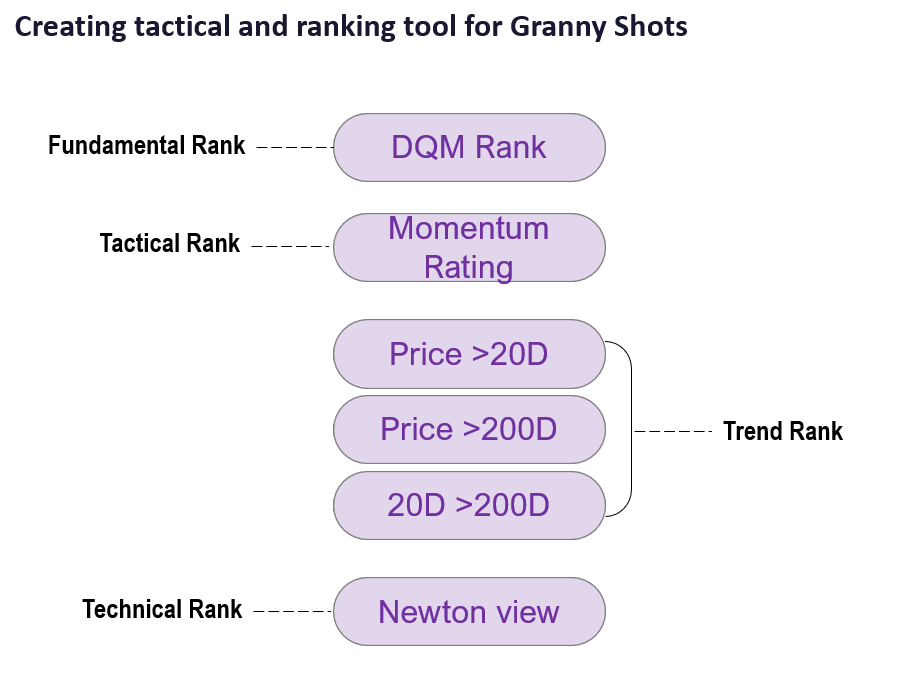

- We established a criteria of 4 factors to narrow the list to tactical buys:

– fundamentals using DQM model managed by “tireless Ken”

– Momentum rating

– technical strength measured by Price >20 DMA, 20 DMA vs 200 DMA and combos

– Mark Newton’s judgement on technical outlook

For our Large-Cap Granny Shots Portfolio:

- Top 5 tactical buys aka “Super Grannies”

– Amazon Inc (AMZN 0.29% )

– Alphabet Inc (GOOGL 0.46% ) <– carry over

– Axon Enterprise Inc (AXON -2.41% )

– Vertex Pharmaceuticals Inc (VRTX 1.90% )

– S&P Global Inc (SPGI 0.79% ) - Bottom 5 “Sleeper Grannies” are:

– Zscaler Inc (ZS 0.73% ) <– carry over

– Super Micro Computer Inc (SMCI -3.43% )

– Netflix Inc (NFLX 1.46% )

– Advanced Micro Devices Inc (AMD -2.56% )

– Oracle Corp (ORCL -1.95% )

For our SMID Granny Shots Portfolio:

- Top 5 tactical buys aka “Super SMID Grannies”

– TopBuild Corp (BLD N/A% )

– Agilysys Inc (AGYS 0.59% ) <– carry over

– FormFactor Inc (FORM -3.94% )

– Applovin Corp (APP -8.66% )

– Bancorp Inc (TBBK 3.03% ) - Bottom 5 “Sleeper SMID Grannies” are:

– CarGurus Inc (CARG -2.23% )

– Cheniere Energy Inc (LNG 0.21% )

– Blueprint Medicines Corp (BPMC)

– Dianthus Therapeutics Inc (DNTH -1.39% )

– Metrocity Bankshares Inc (MCBS -0.11% )

TECHNICALS ON 5 SUPER GRANNY SHOTS: By Mark Newton

Alphabet (GOOGL-$183.92) – GOOGL remains one of the more technically attractive names within the “Magnificent 7” following its 16% rally after it broke back out to new all-time highs in April.

-Its pullback over the last three out of four trading days has brought the stock near meaningful uptrend line support where this should stabilize (176-182).

-DeMark’s counter-trend exhaustion indicators suggest another 6-8 weeks of gains might be possible before any real consolidation gets underway.

-Rally above initial upside resistance $192 arguably should lead to $199 without much trouble. Furthermore, intermediate-term targets based on the high to low range from 2021 projects up to $220-$225.

-Near-term weakness should be held near initial support at $176. However, structural intermediate-term support lies at $154, and until breached, any larger pullback in GOOGL in the months ahead would be thought to make this stock more technically appealing.

Amazon (AMZN-$193.02) – Successful breakout above 2021 highs helps to keep AMZN in good shape technically speaking.

Two weeks of consolidation post breakout to new all-time highs makes this attractive to buy dips with ample support near former April-May highs at $188-192.

Barring a move back lower under $188 on a weekly close, minor consolidation makes AMZN attractive from a risk-reward standpoint.

Rally back to $212 looks possible initially and would require a weekly close back under $166 to avoid this stock.

Axon Enterprises (AXON-$319.43) – Minor consolidation since February looks complete given this past week’s push up to multi-week highs.

Movement back to new all-time highs appears underway and little resistance above $330 until near $376.

The consolidation from early this year remains part of an ongoing uptrend, and now looks to be giving way to re-acceleration back to new highs. AXON remains quite bullish technically.

Upside targets lie near 330 initially and then 345 on gains into August.

Vertex Pharmaceuticals- (VRTX-$488.98) – Push back to new highs into July helps to resolve the one-month consolidation as part of VRTX’s ongoing uptrend.

Despite overbought conditions, VRTX shows no evidence of any trend deterioration and has managed to show improving technical follow-through despite Healthcare having underperformed SPX in recent months.

VRTX has shown some of the best performance of any of the 64 members within the SPDR S&P Healthcare ETF (XLV) having returned 24.05% over the last three months, making this the 5th best performer of all 64 names.

Upside resistance lies initially at $522-523 and I believe movement above this level should lead to $559.

S&P Global (SPGI- $488.79) – SPGI is in the process of pushing back to new all-time highs this week, exceeding former peaks made back in 2021 at $484.21.

While momentum is short-term stretched, the technical structure has improved materially with this week’s breakout.

Rallies to $520-$525 look possible in the near-term, and following consolidation, a push up to $550 with intermediate-term targets near $607 can’t be ruled out.

Only weekly closes back down under $407 would serve to postpone its rally, and any near-term consolidation after this sharp breakout should offer attractive risk/reward opportunities to buy dips near $461, which approximates highs made in early 2024.

TECHNICALS ON 5 SUPER SMID GRANNY SHOTS: By Mark Newton

TopBuild (BLD-$465.48) – BLD is one of the more attractive of the Homebuilder names maintaining short-term and intermediate-term bullish uptrends.

Its push back to new all-time highs over the last two weeks follows a three-month period of mild consolidation that failed to do much technical damage.

Interest rates pulling back sharply across the curve looks to be positive for Homebuilders, and this remains the top-ranked technical stock across the Home building and construction names within Granny Shots.

Upside targets could materialize near $528, representing the 1.618x projection of BLD’s rally from 2018 into November 2021, when measured from November 2022 lows.

Agilysys (AGYS-$108.95) – Breakout of the 15-month Cup and Handle pattern on heavy volume helped AGYS push back to new all-time highs two months ago which was very constructive for its larger pattern.

Short-term breakout last week of May highs has helped near-term acceleration continue, and weekly momentum indicators are not yet overbought.

Short-term technical targets lie near $118-120 while intermediate-term projections lie at $130.

Volume spiked to help confirm this technical progress in May, and the act of having rallied back to new all-time highs makes this quite attractive.

Form Factor (FORM-$62.16) – FORM’s May 2024 rally over 2021 peaks has helped this to accelerate and keeps the technical structure quite bullish on an intermediate-term basis.

Despite momentum having reached overbought levels, no evidence of any technical deterioration has appeared in recent weeks. FORM continues to move higher in a stair-stepping fashion since May’s breakout and volume has been supportive of gains.

Movement up to $67 looks initially likely and then pullbacks should make this attractive for intermediate-term gains to $85.

From an Elliott perspective, the entire 2021-2022 decline appeared like an ABC-type corrective pattern before the push back to new highs. Given that the initial rally from 2012-2021 lasted nine years, even a 38.2% time-based alternative retracement of this first rally should carry FORM higher into 2025.

Applovin (APP-$86.53) – Minor consolidation since May looks to be giving way to an upside breakout given the progress of the last couple weeks.

Movement back over $88.50 should have little resistance until $93 and then a push back to challenge all-time highs from 2021 just over $116 looks possible.

Steep gains over the last 18 months have helped APP recover more than 60% of its former losses on relatively higher than average volume, particularly in 2024.

Given that minor consolidation from May has helped to lessen APP’s overbought status, a push back to new 2024 highs should help this intermediate-term rally continue.

The Bancorp (TBBK-$48.16) – TBBK has just begun to accelerate back to new all-time highs given a breakout in Regional Banks this past week.

The long-term structure looks quite appealing given a 2023 breakout above its 2007 peaks followed by choppy consolidation into 2024. The recent push higher in the last few weeks has helped to jumpstart TBBK’s intermediate-term momentum and can allow for a push to the high-$50s.

Despite daily momentum being overbought, the act of its volatile swings since 2022 have helped monthly momentum stay neutral, not overbought, despite this past month’s surge to new highs. TBBK’s pattern over the last 20 years remains quite attractive technically and should allow for further intermediate-term gains into late August/early September with initial targets found near $58.

Key incoming data July 2024:

7/1 9:45 AM ET: Jun F S&P Global Manufacturing PMITame7/1 10:00 AM ET: Jun ISM Manufacturing PMITame7/2 9:30 AM ET: Powell, Lagarde, Campos Neto Speak in SintraTame7/2 10:00 AM ET: May JOLTS Job OpeningsTame7/3 8:30 AM ET: May Trade BalanceTame7/3 9:45 AM ET: Jun F S&P Global Services PMITame7/3 10:00 AM ET: Jun ISM Services PMITame7/3 10:00 AM ET: May F Durable Goods OrdersTame7/3 2:00 PM ET: Jun FOMC Meeting MinutesTame7/5 8:30 AM ET: Jun Jobs ReportTame7/8 11:00 AM ET: Jun NY Fed 1yr Inflation ExpTame7/9 6:00 AM ET: Jun Small Business Optimism SurveyTame7/9 9:00 AM ET: Jun F Manheim Used vehicle indexTame7/9 10:00 AM ET: Fed’s Powell Testifies to Senate BankingTame7/10 10:00 AM ET: Fed’s Powell Testifies to House Financial ServicesTame7/11 8:30 AM ET: Jun CPITame7/12 8:30 AM ET: Jun PPIMixed7/12 10:00 AM ET: Jul P U. Mich. Sentiment and Inflation ExpectationTame7/15 8:30 AM ET: Jul Empire Manufacturing SurveyTame7/15 12:00 PM ET: Fed’s Powell Interviewed by David RubensteinTame7/16 8:30 AM ET: Jun Retail Sales DataTame7/16 10:00 AM ET: Jul NAHB Housing Market IndexTame- 7/17 9:00 AM ET: Jul M Manheim Used vehicle index

- 7/17 2:00 PM ET: Jul Fed Releases Beige Book

- 7/18 8:30 AM ET: Jul Philly Fed Business Outlook

- 7/18 4:00 PM ET: May Net TIC Flows

- 7/22 8:30 AM ET: Jun Chicago Fed Nat Activity Index

- 7/23 10:00 AM ET: Jun Existing Home Sales

- 7/24 9:45 AM ET: Jul P S&P Global Manufacturing PMI

- 7/24 9:45 AM ET: Jul P S&P Global Services PMI

- 7/24 10:00 AM ET: Jun New Home Sales

- 7/25 8:30 AM ET: 2QA 2024 GDP

- 7/25 10:00 AM ET: Jun P Durable Goods Orders

- 7/26 8:30 AM ET: Jun PCE Deflator

- 7/26 10:00 AM ET: Jul F U. Mich. Sentiment and Inflation Expectation

- 7/29 10:30 AM ET: Jul Dallas Fed Manuf. Activity Survey

- 7/30 9:00 AM ET: May S&P CoreLogic CS home price

- 7/30 10:00 AM ET: Jul Conference Board Consumer Confidence

- 7/30 10:00 AM ET: May JOLTS Job Openings

- 7/31 8:30 AM ET: 2Q ECI QoQ

- 7/31 2:00 PM ET: Jul FOMC Decision

Key incoming data June 2024:

6/3 9:45 AM ET: May F S&P Global Manufacturing PMITame6/3 10:00 AM ET: May ISM Manufacturing PMITame6/4 10:00 AM ET: Apr JOLTS Job OpeningsTame6/4 10:00 AM ET: Apr F Durable Goods OrdersTame6/5 9:45 AM ET: May F S&P Global Services PMITame6/5 10:00 AM ET: May ISM Services PMITame6/6 8:30 AM ET: 1Q F Nonfarm ProductivityTame6/6 8:30 AM ET: Apr Trade BalanceTame6/6 8:30 AM ET: 1Q F Unit Labor CostsTame6/7 8:30 AM ET: May Jobs ReportHot6/7 9:00 AM ET: May F Manheim Used vehicle indexTame6/10 11:00 AM ET: May NYFed 1yr Inf ExpTame6/11 6:00 AM ET: May Small Business Optimism SurveyTame6/12 8:30 AM ET: May CPITame6/12 2:00 PM ET: Jun FOMC DecisionTame6/13 8:30 AM ET: May PPITame6/14 10:00 AM ET: Jun P U. Mich. Sentiment and Inflation ExpectationTame6/17 8:30 AM ET: Jun Empire Manufacturing SurveyTame6/18 8:30 AM ET: May Retail Sales DataTame6/18 9:00 AM ET: Jun M Manheim Used vehicle indexTame6/18 4:00 PM ET: Apr Net TIC FlowsTame6/19 10:00 AM ET: Jun NAHB Housing Market IndexTame6/20 8:30 AM ET: Jun Philly Fed Business OutlookTame6/21 9:45 AM ET: Jun P S&P Global Manufacturing PMITame6/21 9:45 AM ET: Jun P S&P Global Services PMIMixed6/21 10:00 AM ET: May Existing Home SalesTame6/24 10:30 AM ET: Jun Dallas Fed Manuf. Activity SurveyTame6/25 8:30 AM ET: May Chicago Fed Nat Activity IndexTame6/25 9:00 AM ET: Apr S&P CoreLogic CS home priceTame6/25 10:00 AM ET: Jun Conference Board Consumer ConfidenceTame6/26 10:00 AM ET: May New Home SalesTame6/27 8:30 AM ET: 1Q T 2024 GDPTame6/27 10:00 AM ET: May P Durable Goods OrdersTame6/28 8:30 AM ET: May PCE DeflatorTame6/28 10:00 AM ET: Jun F U. Mich. Sentiment and Inflation ExpectationTame

Key incoming data May 2024:

5/1 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/1 10:00 AM ET: Apr ISM Manufacturing PMITame5/1 10:00 AM ET: Mar JOLTS Job OpeningsTame5/1 2:00 PM ET: May FOMC DecisionDovish5/2 8:30 AM ET: 1Q P Nonfarm ProductivityTame5/2 8:30 AM ET: Mar Trade BalanceTame5/2 8:30 AM ET: 1Q P Unit Labor CostsMixed5/2 8:30 AM ET: Mar F Durable Goods OrdersTame5/3 8:30 AM ET: Apr Jobs ReportTame5/3 9:45 AM ET: Apr F S&P Global Services PMITame5/3 10:00 AM ET: Apr ISM Services PMITame5/7 10:00 AM ET: Apr F Manheim Used vehicle indexTame5/10 10:00 AM ET: May P U. Mich. Sentiment and Inflation ExpectationMixed5/13 11:00 AM ET: Apr NYFed 1yr Inf ExpTame5/14 6:00 AM ET: Apr Small Business Optimism SurveyTame5/14 8:30 AM ET: Apr PPIMixed5/15 8:30 AM ET: Apr CPITame5/15 8:30 AM ET: Apr Retail Sales DataTame5/15 8:30 AM ET: May Empire Manufacturing SurveyTame5/15 10:00 AM ET: May NAHB Housing Market IndexTame5/15 4:00 PM ET: Mar Net TIC FlowsTame5/16 8:30 AM ET: May Philly Fed Business OutlookTame5/17 10:00 AM ET: May M Manheim Used vehicle indexTame5/22 10:00 AM ET: Apr Existing Home SalesTame5/22 2:00 PM ET: May FOMC Meeting MinutesTame5/23 8:30 AM ET: Apr Chicago Fed Nat Activity IndexTame5/23 9:45 AM ET: Apr F S&P Global Manufacturing PMITame5/23 9:45 AM ET: Apr F S&P Global Services PMITame5/23 10:00 AM ET: Apr New Home SalesTame5/24 8:30 AM ET: Apr P Durable Goods OrdersTame5/24 10:00 AM ET: May F U. Mich. Sentiment and Inflation ExpectationTame5/28 9:00 AM ET: Mar S&P CoreLogic CS home priceTame5/28 10:00 AM ET: May Conference Board Consumer ConfidenceTame5/28 10:30 AM ET: May Dallas Fed Manuf. Activity SurveyTame5/29 2:00 PM ET: May Fed Releases Beige BookTame5/30 8:30 AM ET: 1Q S 2024 GDPTame5/31 8:30 AM ET: Apr PCE DeflatorTame

Key incoming data April 2024:

4/01 9:45 am ET: Mar F S&P Global Manufacturing PMITame4/01 10:00 am ET: Mar ISM ManufacturingMixed4/02 10:00 am ET: Feb JOLTS Job OpeningsTame4/03 9:45 am ET: Mar F S&P Global Services PMITame4/03 10:00 am ET: Mar ISM ServicesTame4/05 8:30 am ET: Mar Jobs ReportHot4/05 9:00 am ET: Mar F Manheim Used Vehicle IndexTame4/10 8:30 am ET: Mar CPIHot4/10 2pm ET: Mar FOMC Meeting MinutesTame4/11 8:30 am ET: Mar PPITame4/12 10:00 am ET: Apr P U. Mich. Sentiment and Inflation ExpectationTame4/15 8:30 am ET: Apr Empire Manufacturing SurveyTame4/15 8:30 am ET: Mar Retail Sales DataMixed4/15 10:00 am ET: Apr NAHB Housing Market IndexTame4/16 8:30 am ET: Apr New York Fed Business Activity SurveyTame4/17 9:00 am ET: Apr Mid-Month Manheim Used Vehicle IndexTame4/17 2:00 pm ET: Fed Releases Beige BookTame4/18 8:30 am ET: Apr Philly Fed Business Outlook SurveyTame4/22 8:30 am ET: Mar Chicago Fed Nat Activity SurveyTame4/23 9:45 am ET: Apr P S&P Global PMITame4/25 8:30 am ET: 1QA 2024 GDPTame4/26 8:30 am ET: Mar PCETame4/29 10:30 am ET: Apr Dallas Fed Manufacturing Activity SurveyTame4/30 8:30 am ET: 1Q ECI Employment Cost IndexMixed4/30 9:00 am ET: Feb S&P CoreLogic CS home priceTame4/30 10:00 am ET: Apr Conference Board Consumer ConfidenceTame

Key incoming data March 2024:

3/01 9:45 am ET: Feb F S&P Global Manufacturing PMITame3/01 10:00 am ET: Feb ISM ManufacturingTame3/01 10:00 am ET: Feb F U. Mich. Sentiment and Inflation ExpectationTame3/05 9:45 am ET: Feb F S&P Global Services & Composite PMITame3/05 10:00 am ET: Feb ISM ServicesTame3/06 10:00 am ET: Powell Testimony before US House Financial Services CommitteeDovish3/06 10:00 am ET: Jan JOLTS Job OpeningsTame3/06 2:00 pm ET: Fed Releases Beige BookTame3/07 8:30 am ET: 4QF 2023 Nonfarm ProductivityTame3/07 9:00 am ET: Feb F Manheim Used Vehicle IndexTame3/07 10:00 am ET: Powell Testimony before US Senate Committee on Banking, Housing, and Urban AffairsDovish3/08 8:30 am ET: Feb Jobs ReportMixed- 3

/12 8:30 am ET: Feb CPISlightly Hot (as anticipated) 3/14 8:30 am ET: Feb PPIMixed3/14 8:30 am ET: Feb Retail Sales DataTame3/15 8:30 am ET: Mar Empire Manufacturing SurveyTame3/15 10:00 am ET: Mar P U. Mich. Sentiment and Inflation ExpectationTame3/18 8:30 am ET: Mar New York Fed Business Activity SurveyTame3/18 10:00 am ET: Mar NAHB Housing Market IndexTame3/19 9:00 am ET: Mar Mid-Month Manheim Used Vehicle IndexTame3/20 2:00 pm ET: Mar FOMC Rate DecisionDovish3/21 8:30 am ET: Mar Philly Fed Business Outlook SurveyTame3/21 9:45 am ET: Mar P S&P Global PMITame3/25 10:30 am ET: Mar Dallas Fed Manufacturing Activity SurveyTame3/26 9:00 am ET: Mar S&P CoreLogic CS home priceTame3/26 10:00 am ET: Mar Conference Board Consumer ConfidenceTame3/28 8:30 am ET: 4QT 2023 GDPTame3/28 10:00 am ET: Mar F U. Mich. Sentiment and Inflation ExpectationTame3/29 8:30 am ET: Feb PCETame

Key incoming data February 2024:

2/01 8:30am ET 4QP 2023 Nonfarm ProductivityMixed2/01 9:45am ET S&P Global Manufacturing PMI January FinalTame2/01 10am ET January ISM ManufacturingMixed2/02 8:30am ET January Jobs ReportHot2/02 10am ET: U. Mich. Sentiment and Inflation Expectation January FinalTame2/05 9:45am ET S&P Global Services & Composite PMI January FinalTame2/05 10am ET January ISM ServicesTame2/07 9am ET Manheim Used Vehicle Index January FinalMixed2/09 CPI RevisionsTame2/13 8:30am ET January CPIMixed2/14 PPI RevisionsTame2/15 8:30am ET February Empire Manufacturing SurveyTame2/15 8:30am ET February Philly Fed Business Outlook SurveyTame2/15 8:30am ET January Retail Sales DataTame2/15 10am EST February NAHB Housing Market IndexTame2/16 8:30am ET January PPIMixed2/16 8:30am ET February New York Fed Business Activity SurveyTame2/16 10am ET U. Mich. Sentiment and Inflation Expectation February PrelimTame2/19 9am ET Manheim Used Vehicle Index February Mid-MonthTame2/21 2pm ET January FOMC Meeting MinutesTame2/22 9:45am ET S&P Global PMI February PrelimTame2/26 10:30am ET February Dallas Fed Manufacturing Activity SurveyTame2/27 9am ET February S&P CoreLogic CS home priceTame2/27 10am ET February Conference Board Consumer ConfidenceTame- 2/

28 8:30am ET 4QS 2023 GDPTame 2/29 8:30am ET January PCETame

Key incoming data January 2024:

1/02 9:45am ET S&P Global Manufacturing PMI December FinalMixed1/03 10am ET December ISM ManufacturingTame1/03 10am ET JOLTS Job Openings NovemberTame1/03 2pm ET December FOMC Meeting MinutesTame1/04 9:45am ET S&P Global Services & Composite PMI December FinalTame1/05 8:30am ET December Jobs ReportMixed1/05 10am ET December ISM ServicesTame1/08 9am ET Manheim Used Vehicle Index December FinalTame- 1/

11 8:30am ET December CPIDetails Suggest Tame 1/12 8:30am ET December PPITame1/16 8:30am ET January Empire Manufacturing SurveyTame1/17 8:30am ET January New York Fed Business Activity SurveyTame1/17 8:30am ET December Retail Sales DataStrong1/17 9am ET Manheim Used Vehicle Index January Mid-MonthTame1/17 10am EST January NAHB Housing Market IndexMixed1/18 8:30am ET January Philly Fed Business Outlook SurveyTame1/19 10am ET U. Mich. Sentiment and Inflation Expectation January PrelimTame1/24 9:45am ET S&P Global PMI January PrelimMixed1/25 8:30am ET 4QA 2023 GDPMixed1/26 8:30am ET December PCETame1/29 9:30am ET Dallas Fed January Manufacturing Activity SurveyTame1/30 9am ET January S&P CoreLogic CS home priceTame1/30 10am ET January Conference Board Consumer ConfidenceTame1/30 10am ET JOLTS Job Openings DecemberMixed1/31 2pm ET FOMC Rate DecisionTame

Key incoming data December 2023:

12/01 9:45am ET S&P Global Manufacturing PMI November FinalTame12/01 10am ET November ISM ManufacturingStrong12/05 9:45am ET S&P Global Services & Composite PMI November FinalStrong12/05 10am ET JOLTS Job Openings OctoberTame12/05 10am ET November ISM ServicesStrong12/06 8:30am ET 3QF 2023 Nonfarm ProductivityStrong12/07 9am ET Manheim Used Vehicle Index November FinalTame12/08 8:30am ET November Jobs ReportTame12/08 10am ET U. Mich. Sentiment and Inflation Expectation December PrelimTame12/12 8:30am ET November CPITame12/13 8:30am ET November PPITame12/13 2pm ET FOMC Rate DecisionDovish12/14 8:30am ET November Retail Sales DataTame12/15 8:30am ET December Empire Manufacturing SurveyTame12/15 9:45am ET S&P Global PMI December PrelimTame12/18 8:30am ET December New York Fed Business Activity SurveyTame12/18 10am ET December NAHB Housing Market IndexTame12/19 9am ET Manheim Used Vehicle Index December Mid-MonthTame12/20 10am ET December Conference Board Consumer ConfidenceTame12/21 8:30am ET 3QT 2023 GDPMixed12/21 8:30am ET December Philly Fed Business Outlook SurveyMixed12/22 8:30am ET November PCETame12/22 10am ET: U. Mich. Sentiment and Inflation Expectation December FinalTame12/26 9am ET December S&P CoreLogic CS home priceTame12/26 10:30am ET Dallas Fed December Manufacturing Activity SurveyTame- 12/29 9:45am ET December Chicago PMI

Key incoming data November 2023:

11/01 9:45am ET S&P Global PMI October FinalTame11/01 10am ET JOLTS Job Openings SeptemberMixed11/01 10am ET October ISM ManufacturingTame11/01 10am ET Treasury 4Q23 Quarterly Refunding Press ConferenceTame11/01 2pm ET FOMC Rate DecisionDovish11/02 8:30am ET: 3Q23 Nonfarm ProductivityTame11/03 8:30am ET October Jobs ReportTame11/03 10am ET October ISM ServicesMixed11/07 9am ET Manheim Used Vehicle Index October FinalTame11/10 10am ET U. Mich. November prelim Sentiment and Inflation ExpectationHot11/14 8:30am ET October CPITame11/15 8:30am ET October PPITame11/15 8:30am ET November Empire Manufacturing SurveyResilient11/15 8:30am ET October Retail Sales DataResilient11/16 8:30am ET November New York Fed Business Activity SurveyTame11/16 8:30am ET November Philly Fed Business Outlook SurveyTame11/16 10am ET November NAHB Housing Market IndexTame11/17 9am ET Manheim Used Vehicle Index November Mid-MonthTame11/21 2pm ET Nov FOMC Meeting MinutesTame11/22 10am ET: U. Mich. November final Sentiment and Inflation ExpectationTame11/24 9:45am ET S&P Global PMI November PrelimMixed11/27 10:30am ET Dallas Fed November Manufacturing Activity SurveyTame11/28 9am ET November S&P CoreLogic CS home priceTame11/28 10am ET November Conference Board Consumer ConfidenceTame11/29 8:30am ET 3QS 2023 GDPStrong11/29 2pm ET Fed Releases Beige BookTame11/30 8:30am ET October PCETame

Key incoming data October 2023:

10/2 10am ET September ISM ManufacturingTame-

10/3 10am ET JOLTS Job Openings AugustHot -

10/4 10am ET September ISM ServicesTame 10/6 8:30am ET September Jobs ReportMixed-

10/6 9am ET Manheim Used Vehicle Index September FinalTame 10/10 11am NY Fed Inflation ExpectationsMixed-

10/11 8:30am ET September PPIMixed 10/11 2pm ET Sep FOMC Meeting MinutesTame-

10/12 8:30am ET September CPIMixed -

10/13 10am ET U. Mich. September prelim 1-yr inflationMixed 10/16 8:30am ET October Empire Manufacturing SurveyTame10/17 8:30am ET October New York Fed Business Activity SurveyTame10/17 8:30am ET September Retail Sales DataHot10/17 9am ET Manheim October Mid-Month Used Vehicle Value IndexTame10/17 10am ET October NAHB Housing Market IndexTame10/18 8:30am ET September Housing StartsTame10/18 2pm ET Fed releases Beige BookTame10/19 8:30am ET October Philly Fed Business Outlook SurveyTame10/19 10am ET Existing Home SalesTame10/19 12pm ET Fed (including Powell) at Economic Club of New York10/24 9:45am ET S&P Global PMI October PrelimTame-

10/26 8:30am ET 3Q 2023 GDP AdvanceStrong 10/27 8:30am ET September PCETame10/27 10am ET Oct F UMich Sentiment and Inflation expectationTame10/30 10:30am ET Dallas Fed September Manufacturing Activity SurveyTame10/31 8:30am ET 3Q23 Employment Cost IndexMixed10/31 9am ET August S&P CoreLogic CS home priceMixed10/31 10am ET October Conference Board Consumer ConfidenceTame

Key incoming data September 2023:

9/1 8:30am ET August Jobs ReportTame9/1 10am ET August ISM ManufacturingTame9/6 10am ET August ISM ServicesMixed9/6 2pm ET Fed releases Beige BookTame9/8 9am ET Manheim Used Vehicle Index August FinalTame9/8 2Q23 Fed Flow of Funds ReportTame-

9/13 8:30am ET August CPIMixed -

9/14 8:30am ET August PPITame -

9/15 8:30am ET September Empire Manufacturing SurveyTame 9/15 10am ET U. Mich. September prelim 1-yr inflationTame-

9/18 8:30am ET September New York Fed Business Activity SurveyTame -

9/18 10am ET September NAHB Housing Market IndexTame 9/19 9am ET Manheim September Mid-Month Used Vehicle Value IndexMixed9/20 2pm ET September FOMC rates decision-

9/21 8:30am ET September Philly Fed Business Outlook SurveyMixed 9/22 9:45am ET S&P Global PMI September Prelim9/25 10:30am ET Dallas Fed September Manufacturing Activity Survey9/26 9am ET July S&P CoreLogic CS home price9/26 10am ET September Conference Board Consumer Confidence

Key incoming data August 2023:

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame8/10 8:30am ET July CPITame8/11 8:30am ET July PPITame8/11 10am ET U. Mich. July prelim 1-yr inflationTame8/11 Atlanta Fed Wage Tracker JulyTame8/15 8:30am ET Aug Empire Manufacturing SurveyMixed8/15 10am ET Aug NAHB Housing Market IndexTame8/16 8:30am ET Aug New York Fed Business Activity SurveyNeutral8/16 2pm ET FOMC MinutesMixed8/17 8:30am ET Aug Philly Fed Business Outlook SurveyPositive8/17 Manheim Aug Mid-Month Used Vehicle Value IndexTame8/23 9:45am ET S&P Global PMI Aug PrelimWeak8/25 10am ET Aug Final U Mich 1-yr inflationMixed8/28 10:30am ET Dallas Fed Aug Manufacturing Activity SurveyTame8/29 9am ET June S&P CoreLogic CS home priceTame8/29 10am ET Aug Conference Board Consumer ConfidenceTame8/29 10 am ET Jul JOLTSTame8/31 8:30am ET July PCETame

Key incoming data July 2023:

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June 2023:

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May 2023:

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings