We publish on a 3-day a week schedule:

SKIP MONDAY <– Christmas

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

The key catalyst is a drop in inflation towards 2%….

This past week, one of my long-time clients (and friend) acknowledges stocks have fallen so much in 2022 that a turn eventually happens, but asked:

- “What will get retail investors to buy stocks again?” Most investors will say the catalyst is when “earnings bottom.” We disagree

- We believe “the catalyst” is when inflation is convincingly headed towards 2%

- The high level of inflation is what drove the Fed and other central banks to full “hawk” mode. And while some might say wage inflation is the new goalpost, that is overlooking that the key is inflation convincingly heading towards 2%.

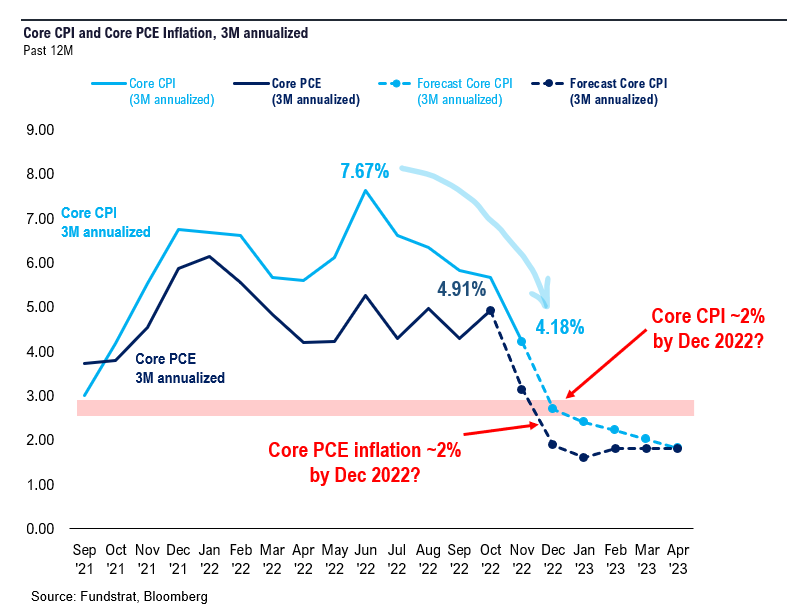

- The Fed said it wanted to see consistent progress, which they once termed as three months of progress. Thus, a metric is when 3-month annualized core CPI and core PCE fall to 2.5% or so. The last two months of Core CPI are below 0.20%, so only one more month of below 0.2% and 3M annualized will be there.

- Based on our forecasts, we expect Core CPI to be ~2% (3M annualized) by Dec 2022 (released 1/12/23) and Core PCE inflation by Dec 2022 as well. Core PCE for Nov/Dec PCE is 12/23 and 1/27, respectively. Yes, we believe 3M annualized core inflation is falling towards 2% before YE.

- We expect this to be positive for markets for two reasons.

- First, Fed framework likely changes to “predictable Fed” as inflation is now operating near their long-term goal of 2%. This would be a massive dovish pivot, in our view, and could mean Fed pauses entirely in 2023 (maybe). This is true even if labor markets remain solid.

- Second, we expect equity and bond volatility to fall 20% or more. The VIX averaged >25 in 2022, and since inception, the VIX falls a median 19.5% in the following year.

- By the way, the bond market has already sniffed this out. This is why we believe 2Y (4.212%) and 10Y (3.721%) yields are both well below Fed Funds currently (4.330%). And why 1-yr inflation breakevens are down to 1.89% (USGGBE01 Index on Bloomberg).

In the next few weeks, we get 3 key inflation data points:

- 12/23: Nov Core PCE inflation –> TO BE GOOD Fundstrat 0.15% vs Street 0.20% vs InflationNOW 0.26%

- 12/23: Dec U Mich 1-yr inflation –> TO BE GOOD Fundstrat 4.4% vs Street 4.6%

- 1/12/23: Dec Core CPI –> TO BE GOOD Fundstrat 0.15% vs No Consensus

If these 3 inflation items track as we expect, this will result in 3M annualized core inflation for both CPI and PCE to be ~2%.

- These figures were ~8% in mid-2022

- So this is a massive collapse

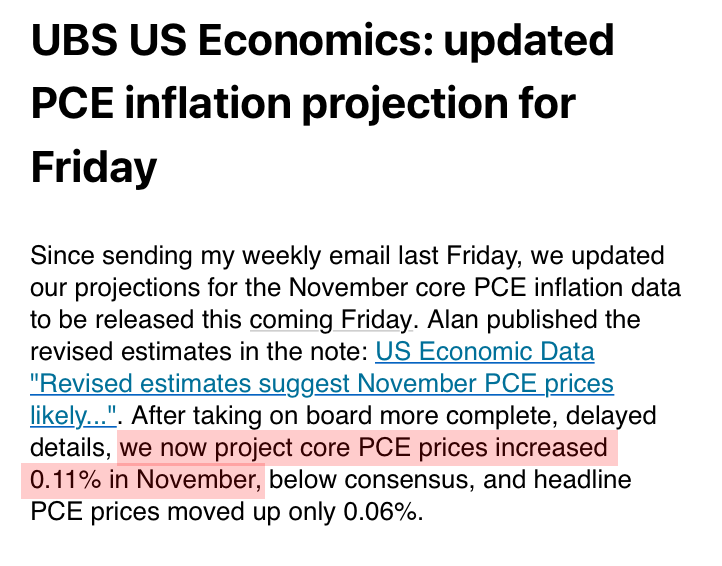

UBS Economists forecast Nov Core PCE inflation of 0.11% (12/23), a major positive

There are many investors who closely watch the inflation forecast from UBS.

- UBS forecast Nov Core PCE inflation (coming this friday) to be 0.11%.

- that is an undershoot of Street consensus looking for +0.20%

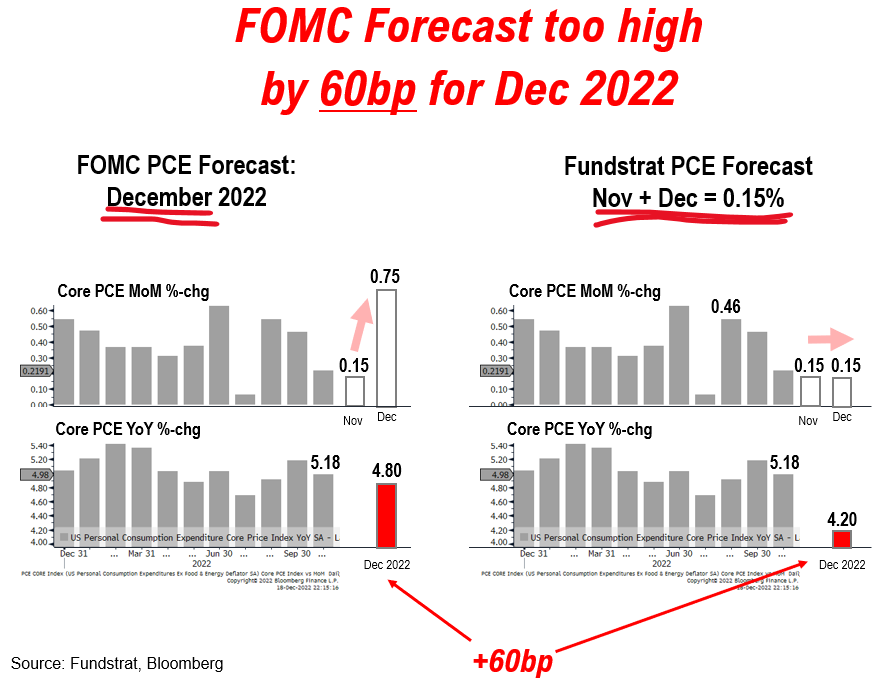

CORE PCE INFLATION: If 0.10% in Nov, 2022 Core PCE inflation tracking to 4.2%, 60bp below Fed forecast

This sharp drop in Core PCE inflation has major Fed policy implications, in our view:

- If Core PCE inflation MoM falls to +0.10% each of next two months (Nov and Dec):

- Core PCE inflation 2022 will fall to 4.2% (see right chart)

- (Left) The FOMC 2022 inflation forecast of 4.8%, December Core PCE inflation needs to explode to +0.75%

- Thus, actual 2022 Core PCE could be -60bp below FOMC Dec SEP

- See what we mean?

- Why did Fed raise its 2022 inflation forecast which is the “jump-off” point for their future forecasts

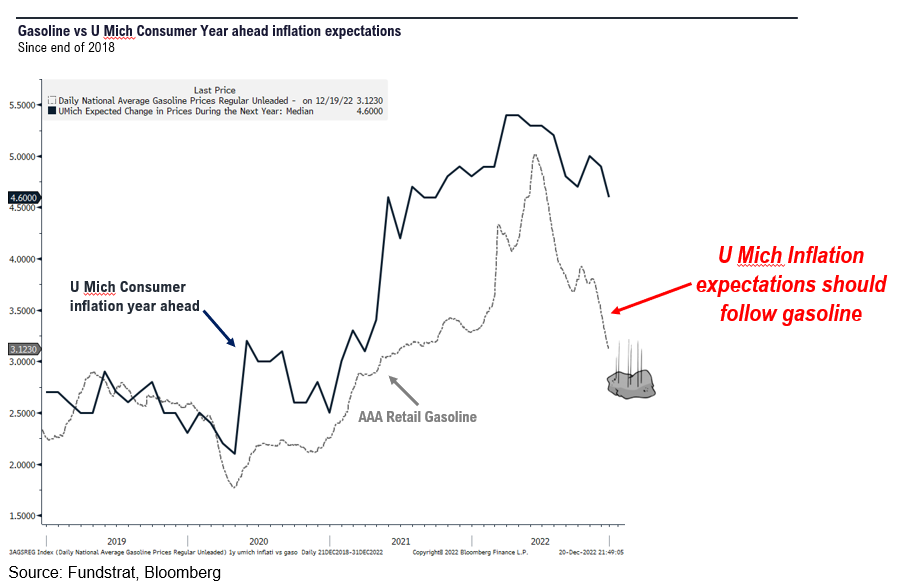

U Mich Consumer Inflation Year Ahead just tracks gasoline which has been plunging

Gasoline price have been in a free fall since mid 2022 and as shown below are now nearing early 2021 levels.

- we expect this to drive a sharp drop in U Mich inflation expectations

- Mid-Dec came in at 4.6%

- On 12/23, Dec final will be released and we expect this to fall to 4.4% or lower

- This is below Street of 4.6%

- This shows consumers are expecting a decline in inflation.

STRATEGY: If Fed framework shifts = lower volatility = higher stock gains

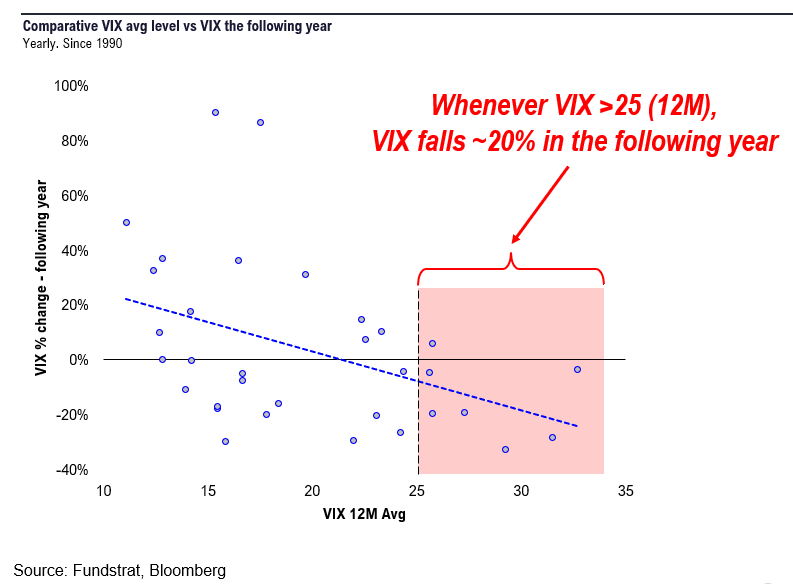

The VIX averaged >25 in 2022. This is an extraordinarily high level. There are only a few years where VIX averaged greater than 2022 levels:

- 2008, 2009, 2020, 2002 and 2001

And shown below, on average, when VIX >25 in a year, the following year sees a huge drop:

- average decline is 20%

Inflation drop is catalyst for Fed which is catalyst for VIX

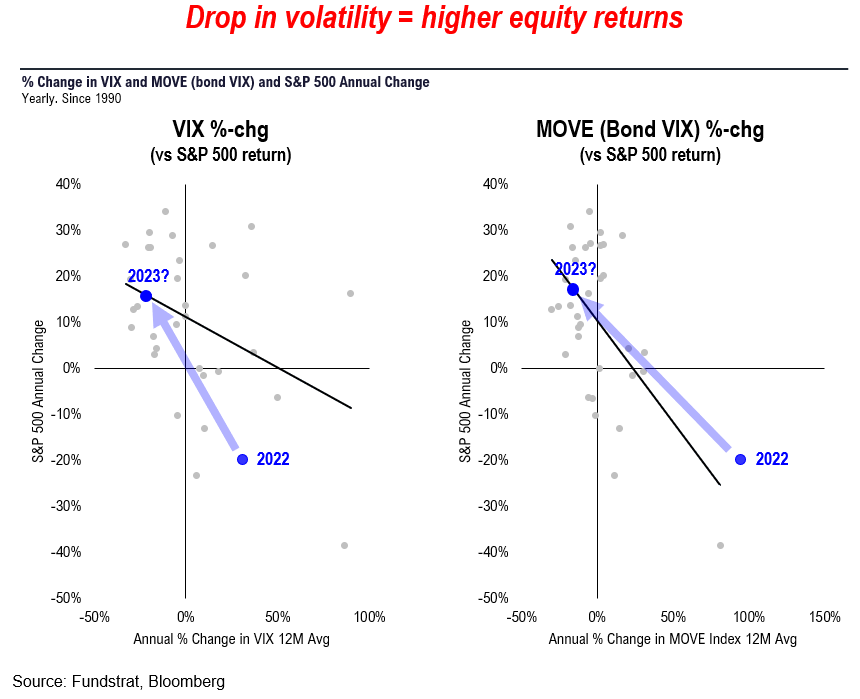

We think this drop in inflation towards 2% annualized will shift the Fed to “predictable” mode and therefore lead to lower volatility:

- thus, Fed is the catalyst

- we think both Bond VIX (MOVE) and equity VIX drop

- and as scatters below show, a drop in volatility is good for equity gains

Why? Lower volatility means investors will assign higher terminal multiples. And thus, P/E can expand. Think about it. In a world of high volatility, P/E would be lower.

If VIX falls 20%, equity gains average +20%, suggesting stocks could do very well in 2023

As shown below, whenever VIX falls, equities do well:

- There are 19 years when VIX 12M avg fell vs prior year

- Of these 18 times, equities posted positive gains

- There is an obviously positive relationship

- But if VIX falls 20% (expected after surging >25), equity gains are far higher averaging 20%

STRATEGY: Earnings yield (inverse of P/E) surged ~2.5% in past year, a historic move and supports view equities can rally 20% in 2023

2022 has been a year of multiple crises, from inflation to Russia-Ukraine War to China zero-COVID to FTX fraud:

- so it is possible the Fed got “dad-gummed” by a ransonware attack?

- yes

- as bizarre as it sounds

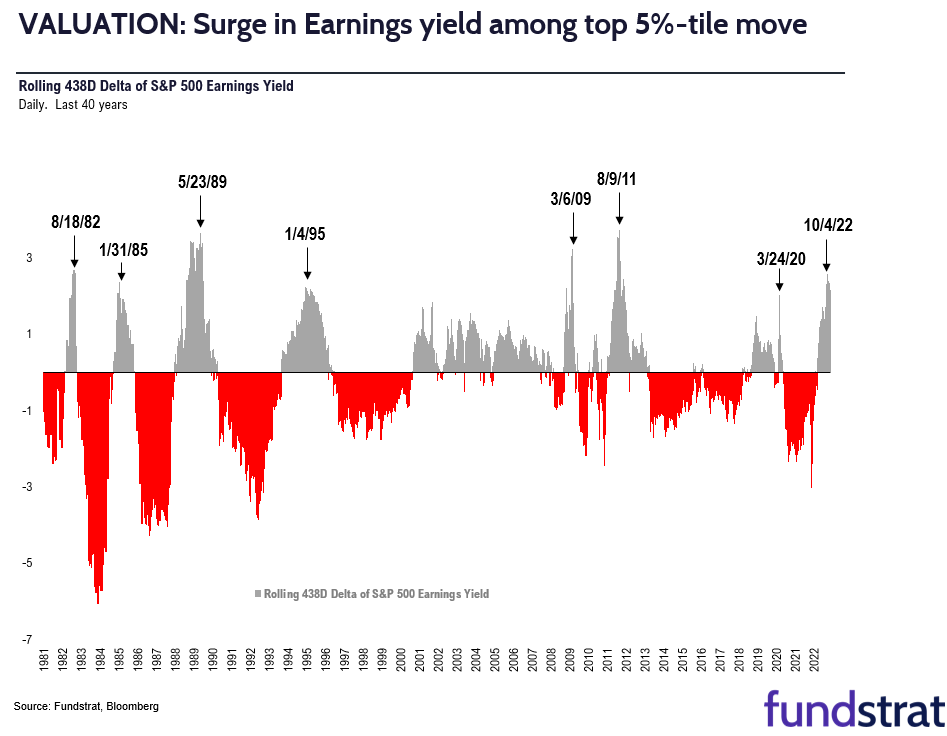

And this has contributed to a surge in the attractiveness of equity valuations. As one of our data scientists, Matt Cerminaro, points out:

- the 438 day change in earnings yield has exceeded 2.25%

- and this type of surge has not been that common in the past 40 years

- as shown below, this has happened at key times in equities

- August 82 (bottom)

- March 6, 2009 (bottom)

- March 24, 2020 (bottom)

- and other key times

- So it shows the level of decline seen in equity valuations in 2022

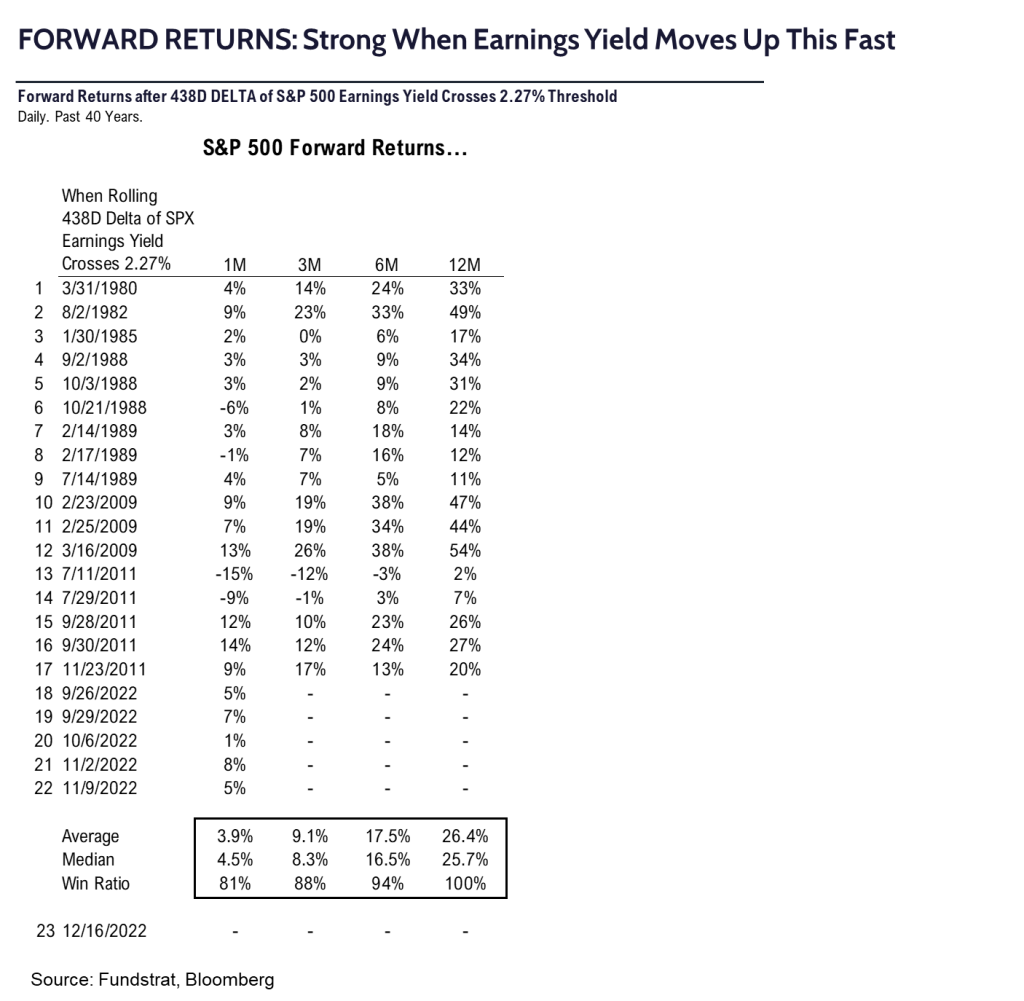

Forward returns tend to be quite solid as well.

- 12-month average return is ~26%

- 17 of 17 instances are positive 12-months later

- This lines up with our view that S&P 500 can rise 20% in 2023

_____________________________

37 Granny Shot Ideas: We performed our quarterly rebalance on 10/19. Full stock list here –> Click here

______________________________