Investors getting more “bearish” in front of Wed Fed Chair Powell at Brookings Institution

In the first two trading days of this week, equities have been soft. Ostensibly, there are 3 near-term factors that are weighing on equities:

- Concerns about China protests turmoil and impact on US cos (AAPL 0.17% , etc)

- Fed Chair Powell is set to speak at Brookings Institution Wed and investors expect him to bring the “hawk hammer” and talk down markets

- S&P 500 is approaching 200D and downtrend line, and investors expect stocks to fail here and turn lower.

- But we think the key macro reports will be Oct PCE (12/1) and Nov jobs (12/2). The most consequential is likely the Oct PCE (see below).

There have been a number of pundits talking about equities failing at the above line. Certainly, this seems to be the case earlier in 2022, but in our view, the macro and fundamental backdrops have changed.

In fact, there are many important macro catalysts in the next two weeks. Below are some key ones flagged:

- 11/30 10am ET: JOLTS (Oct) –> not critical, should be soft

- 11/30 1:30pm ET: Fed Chair Powell at Brookings Institution –> expect “hawk” talk

- 12/1 8:30am ET: PCE Deflator (Oct) –> critical, expect soft

- 12/1 10am ET: ISM Manufacturing –> soft

- 12/2 8:30am ET: Nov Employment Report –> probably strong = Fed not happy

- 12/9 8:30am ET: PPI (Nov) –> probably soft

- 12/13 8:30am ET: CPI (Nov) –> DECISIVE. Inflation breaks to downside

Of these, the November CPI, in our view, will be the most decisive. The October CPI, as we commented previously, was a “game changer” as underlying components showed a persistent and repeatable set of downturns that should lead to softer CPI in coming months.

JOLTS: Oct Job openings should be soft, and keep in mind the trend is overwhelmingly weakening

October job openings (JOLTS) is released on 11/30. The Street consensus is looking for a material softening ~500k fewer job openings. This would be welcome news:

- The Sept JOLTS showed a surprising rise to 10.717 million from 10.280 million in August

- Oct of 10.250 million would be the lowest since June 2021, so a positive development

- But even if JOLTS is strong, the underlying trend is far weaker as Linkup data shows (below)

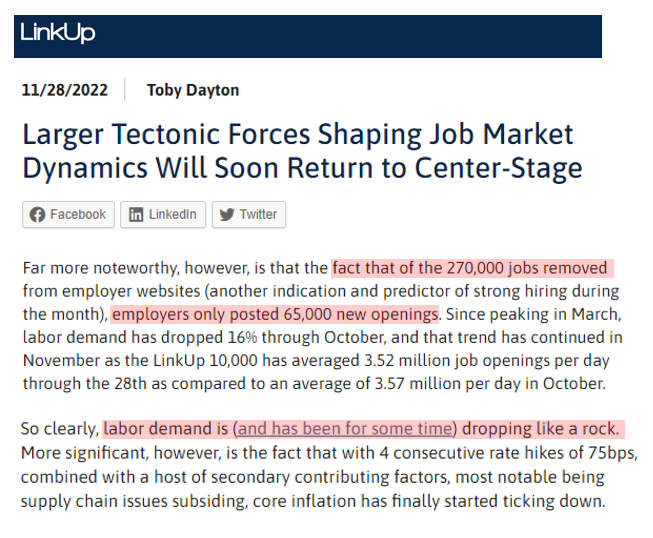

In the latest Linkup blog post, they point out that:

- “labor demand is (and has been for some time) dropping like a rock”

- most noteworthy, in November, 270,000 jobs removed from employer websites

- while only 65,000 new postings

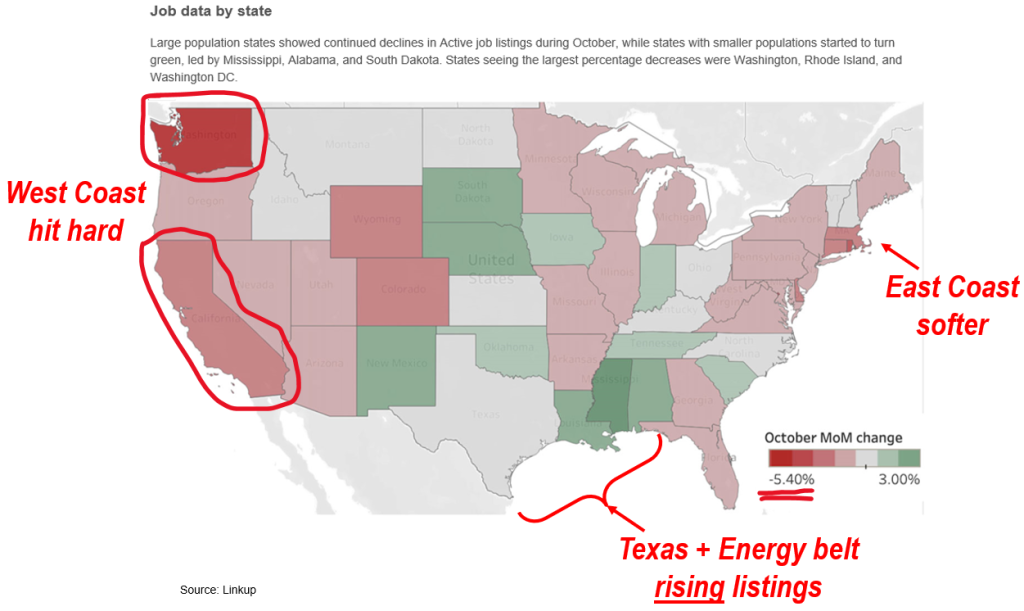

And as their data below shows, the two coasts of the US saw meaningful drops:

- worst declines seen in Seattle

- and California

- East Coast just as soft

- Only middle states (Energy-related states) are seeing rising job postings

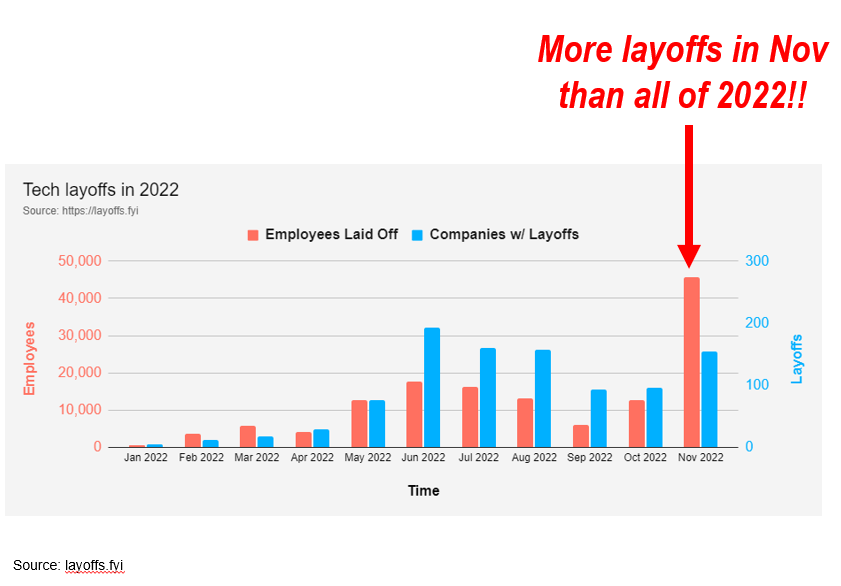

And even Layoffs.fyi show a massive surge in tech layoffs. There were more layoffs in November than the cumulative layoffs in 2022 so far. That is a parabolic surge.

OCT PCE on 12/1: Street looking for 0.4%/0.3% Headline/Core

October PCE deflator (personal consumption expenditures) will be released on 12/1. This is the inflation metric more closely watched by the Fed and foots more closely to GDP.

- Street is looking for

- Headline PCE 0.4%

- Core PCE 0.3%

- The core PCE was 0.5% in Sept and this 20bp cooling is significant

- Oct core CPI came in at 0.27% and down >33bp from 0.6% in Sept

- So, 20bp cooling would be welcome news and confirm the inflection in CPI

Many investors look at the Inflation Nowcast of the Cleveland Fed. This metric only has 2 real-time live inputs (gasoline and crude prices) and uses lagging historical published stats for the other inputs.

- this Nowcast sees numbers the same as Bloomberg consensus

- see below

Suffice it to say, if there is a downside read, this would be a positive.

PAYROLLS: Even if November NFP (payrolls) is strong, the job market is softening and payrolls is somewhat lagging “hard” data

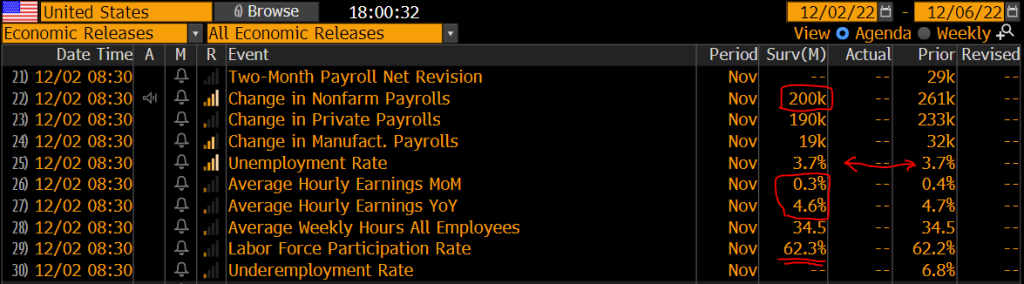

The November payrolls is released on Friday and this is also a key report. There are moving parts here but what matters is:

- NFP figure where 200k is consensus but Street prefers this to be soft

- Unemployment rate would be welcome to see this inch up from 3.7% but Street sees flat

- Cooling wage growth would be welcome and 0.3% is a slowing but downside would be good

DeepMacro forecasts a very strong 250k Nov Jobs = “hot” = Fed not happy = but labor is softening

DeepMacro is forecasting an above consensus payrolls of 250k. We like the analytical process of Jeff Young and team. And if their analysis is correct, this is not going to make Fed happy. But there are offsets:

- it will not just be payrolls added that matter

- unemployment rate and avg hourly earnings matter

- forward indicators like layoffs show job market is getting softer

- so this could be a lagging indicator

STRATEGY: November CPI likely breaks the 3 most consensus views towards our central view

If someone asked me where my view differs most sharply from consensus, it is the following:

- CONSENSUS: inflation “sticky” and will take years to fall to Fed target

- CONSENSUS: Fed won’t slow hikes until inflation ~2% or something breaks

- CONSENSUS: US economy tipping into a recession

- TAKEAWAY: Consensus is bearish and sees no reasons for stocks to sustain a recovery until AFTER a recession.

Our view:

- Inflation already breaking to downside and next few CPI prints are 0.2-0.3%, or ~3% annualized.

- Fed soon will see “sustained signs” of falling inflation rates and playbook will change. Fed last hike might be December 2022.

- US economy has been incredibly resilient and soft landing on tap, driven by a major softening of labor markets but not necessarily rise in unemployment.

- TAKEAWAY: So divergent from consensus, when consensus shifts towards this view, stocks will see “near vertical” rally

Our view for 2022 was 1H would be “treacherous” but in 2H, our view for markets is favorable. And given the risk-off positioning of institutional investors (see note from Monday) and given the extreme bearish retail sentiment (AAII, etc), there will be an abrupt market adjustment higher.

STRATEGY: Do you see the setup into YE?

So do you see the setup? It all comes down to whether inflation is convincingly cooling. The job market certainly is, as we noted above.

Sure, there are challenges still ahead but many of these are getting better now…

- EPS estimates –> too high? maybe but markets bottom 11 months ahead of EPS

- Labor market is tight –> this is no longer true

- Fed drives economy “off the cliff” –> yes, if Fed keeps looking at “hard data”

- Recession risk –> yes

STRATEGY: Given the above, we see possibility of S&P 500 reaching 4,400-4,500 by YE

We think this rally has more support compared to the June “false pivot” rally to 4,325 (see below).

- thus, we see S&P 500 rallying above that level towards 4,400-4,500

STRATEGY: Keep in mind the seasonals

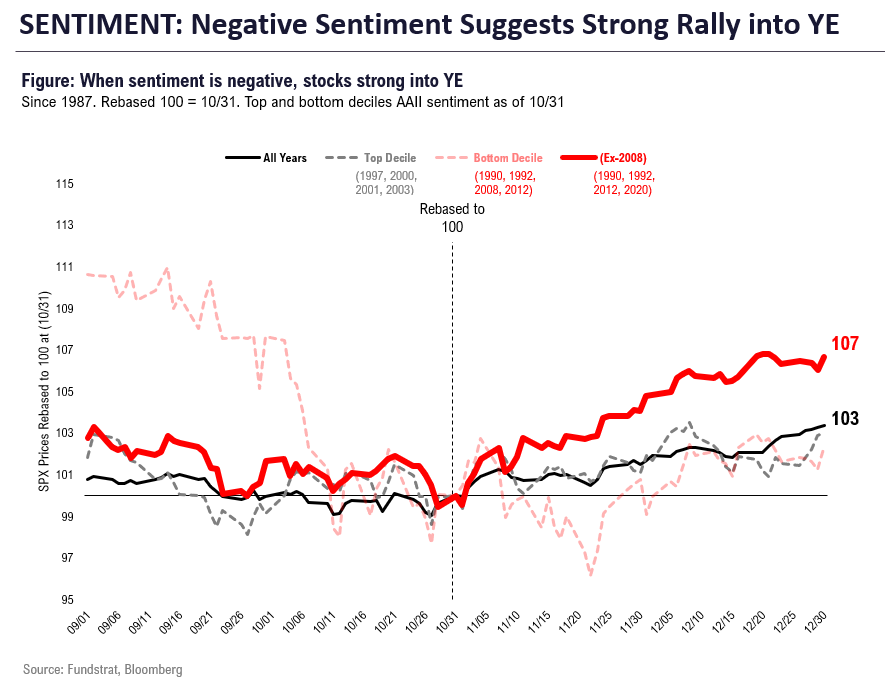

Keep in mind the positive seasonals in YE. We highlight market returns (since 1987) based upon sentiment.

- when sentiment is the most negative (see red line, ex-2008)

- stocks perform strongly into YE

- this is roughly 7-10% upside from here

Please don’t ignore the 6 key signals we noted in prior notes

Most of 2022 has been a cascade of ever more troubling developments, from surging inflation, Russia-Ukraine war, Fed going full Volcker, China issues and multiple seismic crypto events (terra luna, 3 Arrows, Voyager Digital, and now FTX). And this has pushed interest rates higher, panicked policymakers and punished equities. Still, equities found some sort of footing on 10/13 (day of Sept CPI) and since risen 15%.

Oct CPI was a “game changer” in our view, principally given it’s far softer than consensus and repeatable, but there were 6 signals generated last week. Each of these 6 are why we see a far different path forward for markets:

- Foremost is the positive Oct soft CPI (and repeatable) which showed a favorable break in 3 key inflationary areas: shelter/OER, medical care and goods (apparel and used cars). We expect this to be sufficient for Fed to slow pace of hikes, and possibly December 2022 may be the last hike.

- Second, bond volatility is collapsing (VXTLT or MOVE -9.22% ) and this is a point made repeatedly by one of macro clients (HA in NYC, who works at a major pod of macro HF). Similarly, Tony Pasquariello of Goldman Sachs notes bond volatility “is one asset that every other asset is priced off.” For perspective, TLT Vol (VXTLT) lows has marked every equity market high in 2022. The 8/12 low of 17 marked S&P 500 highs of 4,300.

- VXTLT has plunged from 33 to 21 in less than 15 sessions and we expect to fall to 15 or so. This collapse in volatility, in our view, would support S&P 500 surging to 4,400-4,500 before YE.

- Third, US yields saw a massive decline ranking in the bottom 1% largest downside moves in the past 50-years. Analysis by our data scientist, Matt Cerminaro, shows yield declines of this magnitude portend further declines in rates 6M and 12M forward. In other words, chances are rising the highs for the 2Y and 10Y yield are in further supportive of P/E multiple expansion.

- Fourth, USD (DXY) posted one its largest ever declines (6D) falling -5.8%, ranking it the 8th largest ever decline since 1970. As our data science team shows, USD historically lower 6M and 12M later. Increasingly looks like the top is in for USD as well. Several FX strategists are making similar comments including Deutsche Bank’s George Saravelos.

- Fifth, there is economic signal in the fact that Republicans fared poorly in 2022 midterm elections. It looks like Democrats will hold a majority in the Senate and Republicans have only a slim margin in the House. While many politicos call this an indictment of Trump, we think the bigger message is the economy is simply not bad enough for voters to kick out the Democrats. Inflation arguably is not bad enough that voters are blaming incumbents. Think about that. If inflation is “as bad as 1980s” I would have thought midterms would have been an incumbent massacre.

- Sixth, crypto had one of the tsunami of financial collapses ever (largest in dollar terms), with liquidations (to zero) of >300,000 accounts with leverage and the stranding of $10b or more in assets in FTX along with further contagion effects. Only Mt Gox hack was worse. Yet, the S&P 500 managed to post strong gains in the final two days of last week. This shows that investors are becoming more discerning, rather than “hit the sell button” on any bad news.

BOTTOM LINE: Case for a sustainable rally in equities is the strongest it has been in 2022

In our view, the case for owning equities is the strongest now than it has been in all of 2022. The reasons are cited above. But consider this additional perspective:

- Skeptics will say “growth is the problem now” and point to downside in EPS. But as we have written (see below), S&P 500 has historically bottomed 11-12 months before EPS troughs. So EPS is lagging.

- In 2020 and 2009, S&P 500 bottomed 12M and 10M before EPS bottomed. Since 1900, 13 of 16 major equity lows saw S&P 500 bottom before EPS.

- From 1982 to 1990, S&P 500 EPS only grew a cumulative 19% (or 2% per annum) but S&P 500 3X. Collapse in bond volatility (risk of higher rates) matters far more in our view

- If inflation is indeed slowing to a 3.5% annualized pace (0.2% to 0.3% per month, as we expect), this shows inflation is far less sticky than inflationistas have argued.

- While we have maintained that view “inflation not as sticky” (given the constellation of leading indicators), it is only now that we are seeing this in the “hard” data (CPI)

- Lastly, recency bias is keeping investors bearish. We have many clients telling us October CPI did “not change a thing. Inflation still too high and Fed will keep raising until something breaks”

- We still see a rally into YE

Rally should exceed the “June false dawn pivot”

As far as market implications, we think the case for a strong rally into YE has been strengthened:

- Foremost, Fed no longer has its “back to the wall” on inflation as October CPI beat looks repeatable and therefore the case for a pause after December is stronger. This counters the hawkish rhetoric of Powell post-FOMC but he did not have October CPI in hand.

- For most of 2022, Fed has not been able to point to measurable progress on containing inflation but a significant constellation of leading indicators showed deflation/soft inflation was in the pipeline. October CPI is the first month the “hard” data syncs with the “soft” data.

- Softening inflationary pressures strengthen the case for a “soft landing,” counter to the consensus narrative that Fed is spiraling economy to a hard landing. Core inflation running at 3.5% annualized (above) will not require Fed to bang out +75bp and arguably 4.5% Fed funds would be very tight.

- A Fed shifting from “higher in a hurry” to “predictable but possibly longer” is far better for risk assets. Fed has acknowledged serious and unknown lags in monetary policy and with inflation improving, Fed can gain some measure of patience.

- While some bears say the Fed doesn’t want equities to go up, this is an oversimplification. Fed just was in a hurry to slow things down in 2022. Stocks are far more complex than bonds which are arguably two variable assets (inflation and future Fed funds).

- Stocks are acting like “beach balls under water” because P/E averages 19X when 10Y between 3.5% to 5.5% — true since 1871. Thus, those arguing P/E should be 15X or less are just plain ignoring history.

- The “false dawn June pivot” rally lasted 23 trading days and saw S&P 500 rise +16%

- We believe this “Fed pause” rally should last closer to 50 days and push S&P 500 +25% higher. Thus, we think S&P 500 should surpass the 200D average of 4,100 and given possibility of another weak Dec CPI could see a move well beyond that. Why wouldn’t 4,400-4,500-plus be a possibility?

- Recall, in 1982, following the final low in August 1982, the S&P 500 reached a new all-time high within 4 months, erasing entire 27-month bear market. That was a vertical rally. Vertical.

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

_____________________________

37 Granny Shot Ideas: We performed our quarterly rebalance on 10/19. Full stock list here –> Click here

______________________________