Click HERE to access the FSInsight COVID-19 Daily Chartbook.

__________________________________

For this week, we are going to be publishing on a shortened holiday schedule:

Week of 12/27…

Monday 12/28

Tuesday 12/29

Wednesday 12/30

__________________________________

STRATEGY: Signing of Relief Bill + COVID-19 rollover = stronger case for S&P 500 4,000 by early 2021

As many of you are aware, strong markets finish strong. Thus, we see positive risk/reward for equities into YE and with strong follow through continuing through much of 1Q2021. Seasonals are favorable at the moment, but add in:

– President Trump signs relief bill (better late than never)

– COVID-19 Wave 3 seems definitively rolling over

– Growing market skepticism of rally

– Seasonals

And this adds to a good environment for equities. And Epicenter stocks are due for a catch-up trade. In addition, our central case is equities will see a strong start in 2021 before an anticipated pause. As shown below, we see stocks peaking at ~4,000 in Feb-April 2021. So, with the S&P 500 at 3,725 currently, we see ~300 points of equity upside, or ~10%.

Costco is making it easier to travel with COVID-19 test kits…

This move by Costco and the Bermuda Tourism Authority is quite clever. Costco is selling at-home saliva tests to screen for COVID-19 to make it easier to travel to Bermuda.

– The homekit costs $140 and managed by Costco Pharmacy + AZOVA Health.

– the test is taken with video observation and then results are delivered by AZOVA app within 12 to 48 hours

– Bermuda requires a test no more than 5 days prior

– The initial run is 100 Costco locations

To me, this is a great bridge to facilitate customer travel and if this works, would be really positive for the Epicenter trade. After all, Costco would make take a lot of the hassle out of traveling again, particularly if this is expanded/replicated to cruise lines, airline travel, other nations.

Source: NY Post

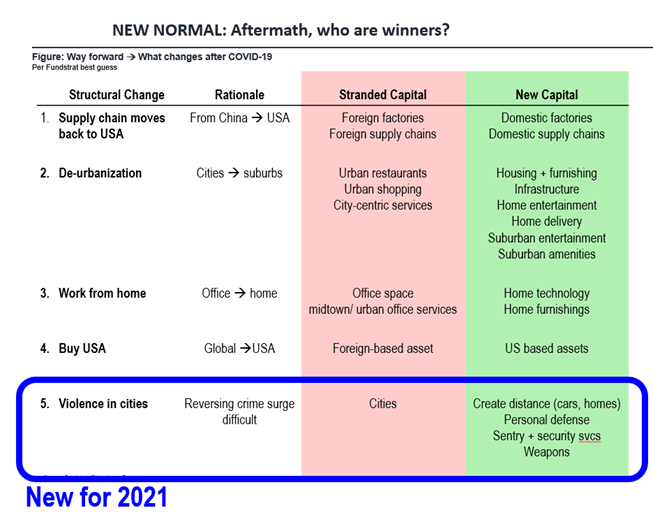

2021 Investment theme #5 –> Personal Security in an increasingly violent USA

There will be many lingering scars from COVID-19, impacts on behaviors and social structures. And we have talked about some of these in prior commentaries (see below), including the more obvious ones like de-urbanization and work from home.

As we close out 2020, we would add “rising violent crime” as another lingering issue. Many cities are reporting 50% to >100% rise in shootings in 2020 (vs 2019), setting back decades of progress on crime mitigation (see Point #3). And the rise in crimes is intuitive — economic hardship, plus social unrest stemming from BLM protests.

But this increase in violent crimes does not seem to have a symmetric solution. That is, once the economy begins to recover, I am not sure that crime will necessarily abate in a neighborhood. The simple observation is that if this was true, then crime should plunge in high crime areas once the economy expands. But this is not the case. There are a series of negative feedback loops that are difficult to reverse, even as the initial “shock” is gone.

But we know that Americans will want to protect themselves from this increase in violence. There are simple solutions and more complex:

– simple –> more to suburbs/low crime areas –> deurbanization

– create distance –> home security, car security, more to suburbs

– create deterrence –> sentry products, home and personal security

– create defense –> weapons, self-defense

– create defense against cybercrime –> security software + Bitcoin

I am still trying to think about what particular stocks benefit. But to me, doorman buildings vs walk-ups. Or dashcams. Or security products, etc. This is probably enough of an issue that we believe will be an investment theme in 2021. We highlight the other 4 below:

1. Supply chain moves back to USA

2. De-urbanization

3. Work from home

4. Buy USA

5. Violence in cities

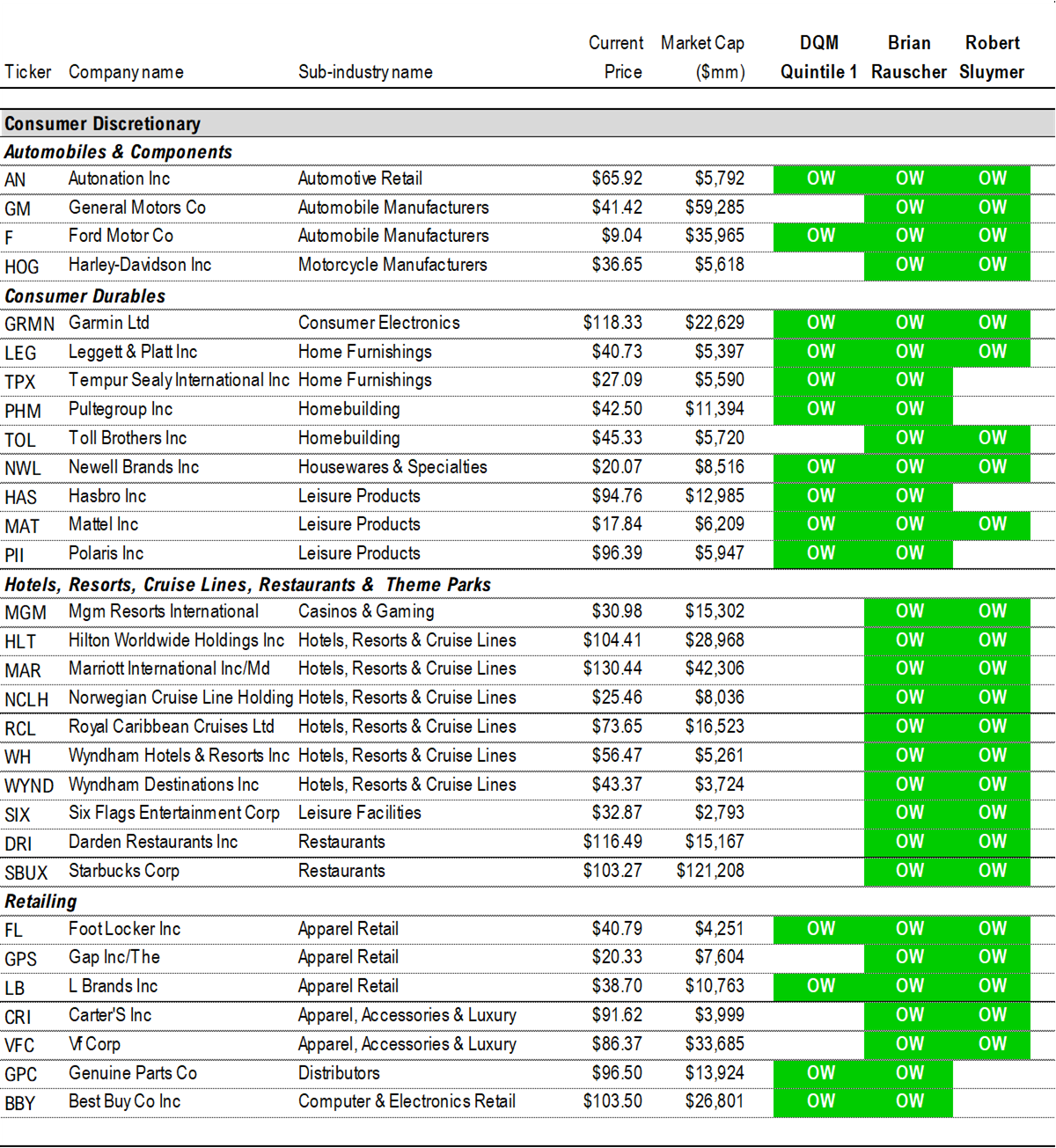

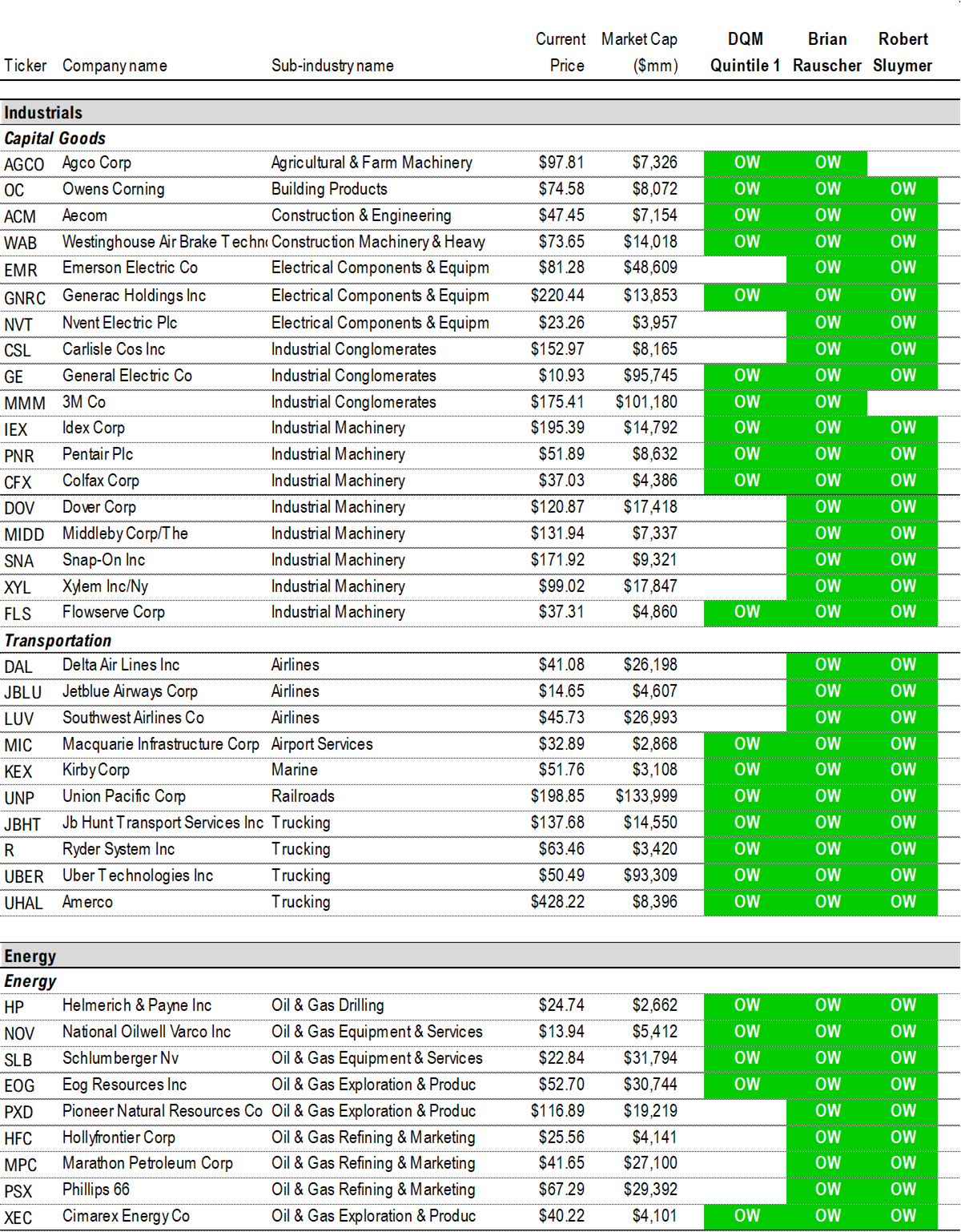

STRATEGY: 67 stocks (*) in the ‘Top 3’ sectors…

Our data science team, led by tireless Ken, has put together the trifecta list of stocks, coming from the ‘top 3’ sectors: Discretionary, Industrials and Energy. These are stocks that there is consensus between myself, Rauscher and Sluymer.

Consumer Discretionary (30 stocks)

AN, GM, F, HOG, GRMN, LEG, TPX, PHM, TOL, NWL, HAS, MAT, PII, MGM, HLT, MAR, NCLH, RCL, WH, WYND, SIX, DRI, SBUX, FL, GPS, LB, CRI, VFC, GPC, BBY

Industrials (28 stocks)

AGCO, OC, ACM, WAB, EMR, GNRC, NVT, CSL, GE, MMM, IEX, PNR, CFX, DOV, MIDD, SNA, XYL, FLS, DAL, JBLU, LUV, MIC, KEX, UNP, JBHT, R, UBER, UHAL

Energy (9 stocks)

HP, NOV, SLB, EOG, PXD, HFC, MPC, PSX, XEC

Source: Fundstrat

(*) The 67 stock ideas are the subset of the “Epicenter” Trifecta stock list we published on December 11th, 2020. To view the full list of stock idea, click here. Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

ADDENDUM: We are attaching the stock lists for our 3 portfolios:

We get several requests to give the updated list for our stock portfolios. We are including the links here:

– Granny Shots –> core stocks, based on 6 thematic/tactical portfolios

– Trifecta epicenter –> based on the convergence of Quant (tireless Ken), Rauscher (Global strategy), Sluymer (Technicals)

– Biden vs Trump –> based on correlation to either candidate odds

Granny Shots:

Full stock list here –> Click here

Tickers: AAPL, AMZN, AXP, BF.B, CSCO, EBAY, GOOG, GRMN, GWW, INTC, KLAC, LEN, LOW, MNST, MSFT, MXIM, NVDA, OMC, PM, PYPL, QCOM, TSLA, XLNX

Trifecta Epicenter (*):

Full stock list here –> Click here

Tickers: AN, GM, F, HOG, GRMN, LEG, TPX, PHM, TOL, NWL, HAS, MAT, PII, MGM, HLT, MAR, NCLH, RCL, WH, WYND, SIX, DRI, SBUX, FL, GPS, LB, CRI, VFC, GPC, BBY, FITB, WTFC, ASB, BOH, FHN, FNB, PB, PBCT, RF, STL, TFC, WBS, PNFP, SBNY, NYCB, MTG, AGNC, EVR, IBKR, VIRT, BK, STT, SYF, BHF, AGCO, OC, ACM, WAB, EMR, GNRC, NVT, CSL, GE, MMM, IEX, PNR, CFX, DOV, MIDD, SNA, XYL, FLS, DAL, JBLU, LUV, MIC, KEX, UNP, JBHT, R, UBER, UHAL, HP, NOV, SLB, EOG, PXD, HFC, MPC, PSX, XEC, LYB, EXP, MLM, CF, MOS, ESI, NEU, NUE, RS, SON, STOR, HIW, CPT, UDR, KIM, NNN, VNO, JBGS, RYN

Biden White House vs. Trump White House:

Full stock list here –> Click here

(*) Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

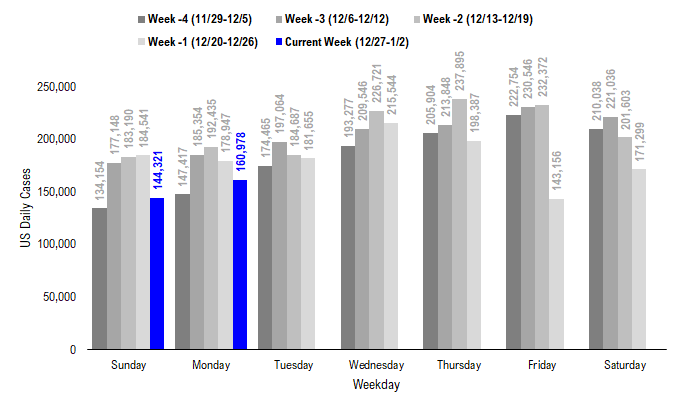

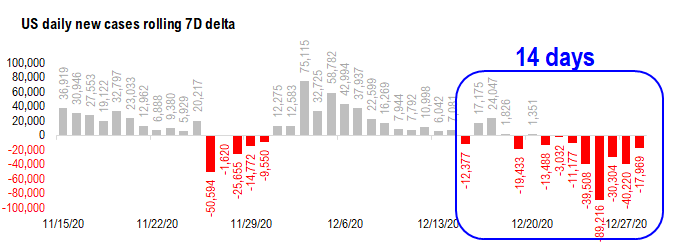

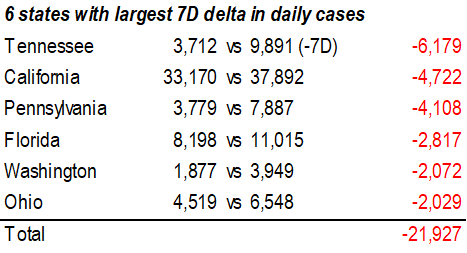

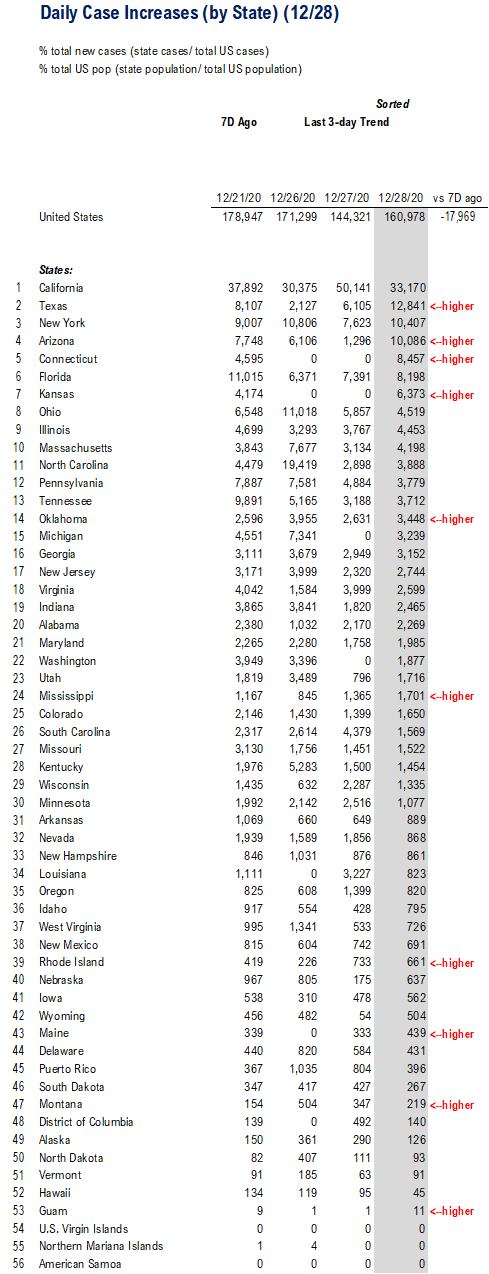

POINT 1: Daily cases 160,978, -17,969 vs 7D ago. 7D delta in daily cases remains negative = Good.

The latest COVID-19 daily cases came in at 160,978, down -17,969 vs 7D ago.

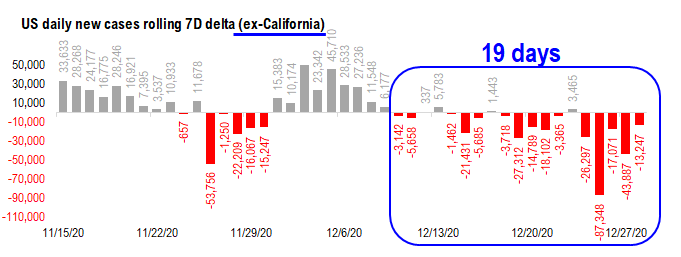

– Cases have been rolling over for most of the states for some time now (7D delta ex-CA almost straight negative in the past 19 days)

– Christmas day saw a distorted collapse

– But it has been falling consistently since mid-December

Source: COVID-19 Tracking Project and Fundstrat

The 7D delta is again negative and ex-CA, daily cases are rolling over more noticeably.

– ex-CA, daily cases are indeed rolling over in the US for the past 19 days

Source: COVID-19 Tracking and Fundstrat

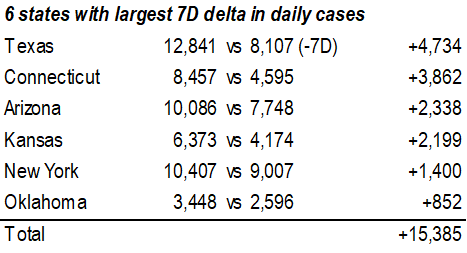

CA remains the state with the highest daily count in cases. TX sees the largest jump of new cases vs. 7D ago, but this is primarily due to the “under-reported” stats during the Christmas holiday. Connecticut has not reported COVID stats since Christmas day. Hence, Monday’s cases for CT represented the new cases over the past 4 days.

Source: COVID-19 Tracking and Fundstrat

Source: COVID-19 Tracking and Fundstrat

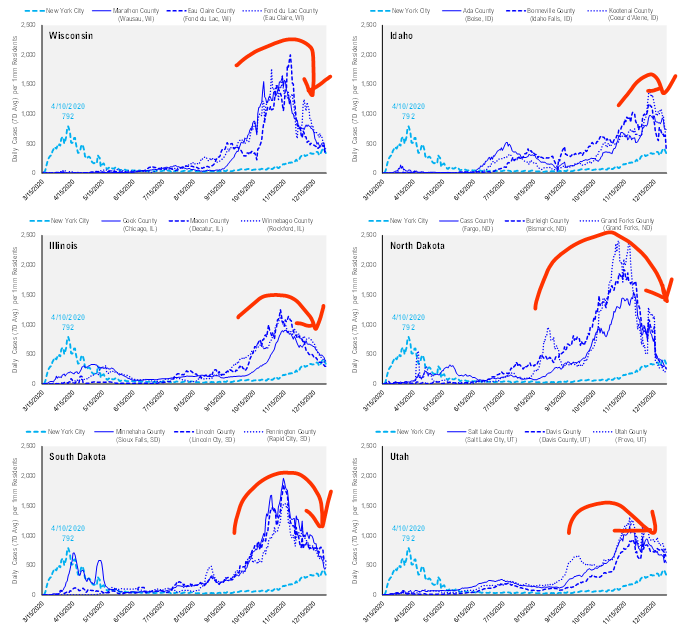

POINT 2: Positivity rate is “flattening” (and not surging), further sign that Wave 3 peaked

As many of our clients are aware, we have used 6 states as the “leading edge” of Wave 3:

– WI, ID, IL, ND, SD, UT, or WIINSU

As shown below, these 6 states have all rolled over hard. What makes this particularly interesting, is these 6 states did not necessarily pursue the same strict restrictive measures of the other states. Yet, daily cases have rolled over hard.

– Is this evidence of herd immunity?

– we are not sure

But as we commented several weeks ago, if these states see a turn downwards in cases, this is a sign for the trajectory in other states.

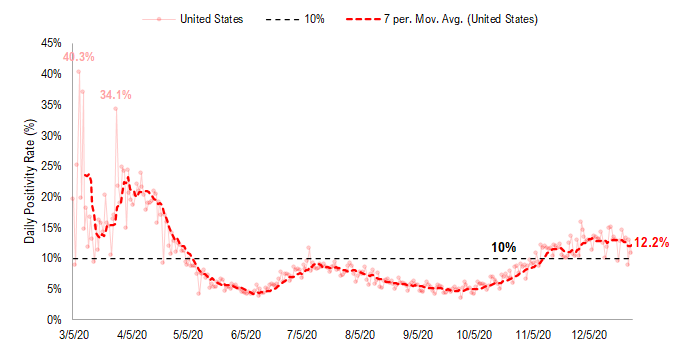

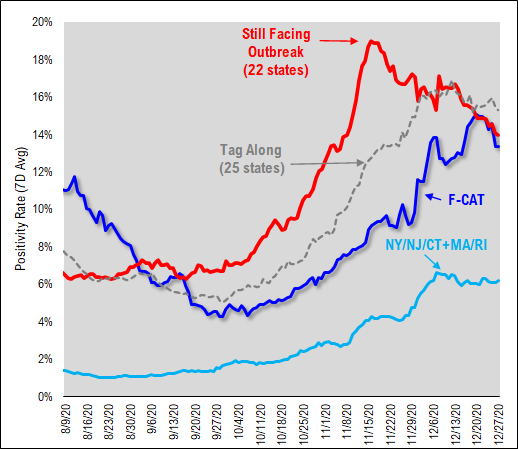

Another sign that Wave 3 has peaked is the flattening of the positivity rate at ~12%. As shown below, this flattening was seen in March and in August and subsequently rolled over.

– thus, the key is whether this positivity rate begins to roll over

– falling below 10% would also be a key level

Source: COVID-19 Tracking and Fundstrat

Across the various regions of the US, we also see that positivity rates are rolling over. In fact, the only region where it has been flat vs rolling over is NY tristate. But in every other region, it is rolling over.

– thus, the state level data on positivity suggests we should see this roll in the coming weeks

Source: COVID-19 Tracking and Fundstrat

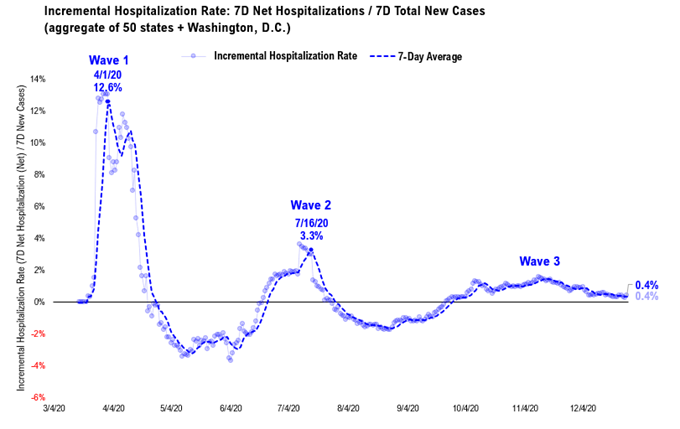

And incremental hospitalizations are also falling and now down to 0.4%. This is a substantial improvement from >1% a few weeks ago.

– for every 100 incremental cases, only 0.4 are being hospitalized

– this is way down from 1.3 a few weeks ago

– well below the ~13 in wave 1 peak

Thus, from a healthcare burden, it also looks like Wave 3 has peaked

Another reasons to see the Epicenter stocks see a “catch up” rally

Source: COVID-19 Tracking and Fundstrat

POINT 3: COVID-19 pandemic has made America more violent…

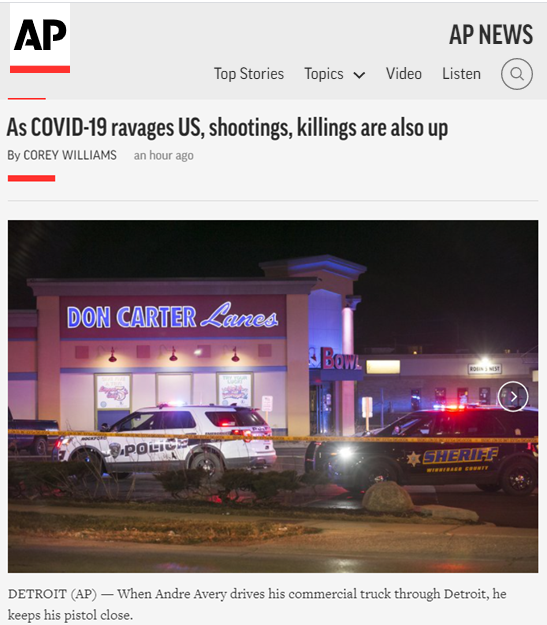

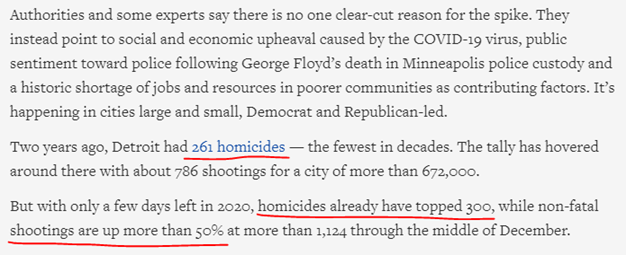

Shooting deaths have increased in the US, enough so that in many major cities, decades of improving crime statistics have suddenly reversed. We highlight a few instances below:

– NYC shootings up 100% in 2020

– Detroit shooting victims up 50% in 2020

These are staggering outbreaks in violence. Why in 2020 and is this pandemic related? Media reports attribute to the economic hardship and emotional toll from COVID-19. And to a lesser extent, it seems authorities are attributing this to violence stemming from BLM and other social protests.

This is important as we think about 2021. As the pandemic fades in 2021, it could be that urban violence lingers. After all, how easy is it to regain a neighborhood that has turned violent? I don’t personally think it is easy.

And has several key implications:

– growing violence is hard to reverse

– if so, de-urbanization, or the Millennial flight to suburb continues

– if violence continues, does this risk the US economy expansion?

– if violence continues, a 2021 investment theme = personal security

The latter being opportunities:

– self-defense

– emergency assistance

– sentry products (video monitoring etc.)

– weapons?

– creating personal distance –> more car demand, homes vs cities, etc.

This article cites the surge in criminal violence in 5 major cities. But I was struck by the surge in Detroit. I grew up in Michigan, so perhaps this is more personal for me.

https://apnews.com/article/shootings-chicago-philadelphia-michigan-violence-00f58bd0043aab2861a073b337662631

Detroit has seen a 50% increase in shootings in 2020. Wow. I think 5% would be considered troubling. But 50%? This just seems utterly shocking.

https://apnews.com/article/shootings-chicago-philadelphia-michigan-violence-00f58bd0043aab2861a073b337662631

And as the WSJ reports, NYC is doing even worse. In NYC this year, shootings are up 100%. Again, I think this is a crisis level surge. And really lends credence to all those saying NYC seems a lot less safe in 2020.

– If this worsens in 2021, this will only accelerate the de-urbanization of cities.