We realize there is widespread interest in tracking COVID-19 developments, and thus, please feel free to forward these updates to anyone who has interests.

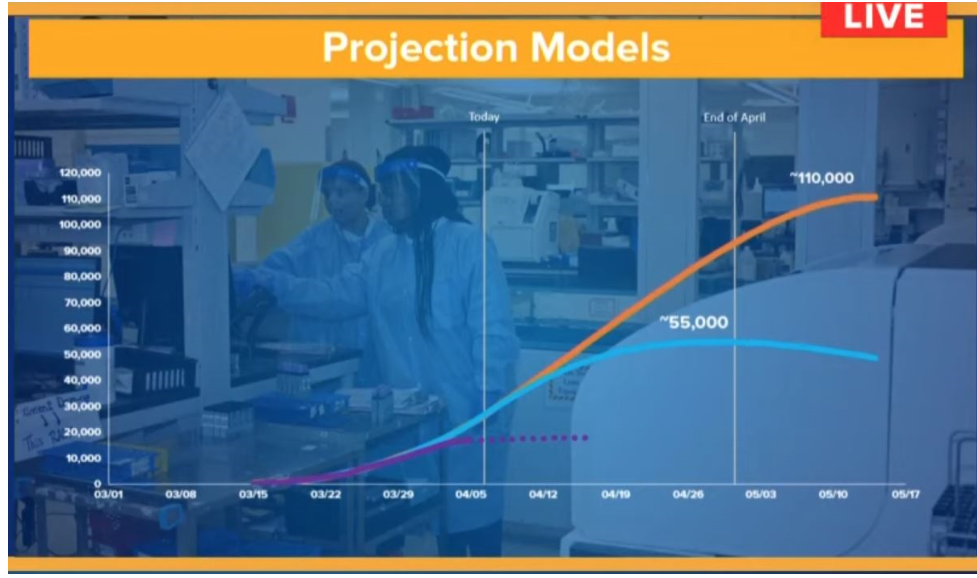

There is some positive development today, with the most notable being Gov. Cuomo, during his daily briefing, introduced a new “purple” line showing a new potential mortality trajectory. Take a look below. The top line was NY state’s original baseline which expected 110,000 NY-ers to perish by late May. And then the light blue line reflected strict social distancing measures, but still projected 55,000 deaths by late April (1 month earlier).

– this new “purple line” is kind of flatlining at 12,000-15,000 deaths (hard to tell).

– Gov. Cuomo referred to this purple line as the new “possible” trajectory, based on recent data (which remains encouraging).

– And a new message was introduced — “KEEP UP SOCIAL DISTANCING, DON’T GO OUT AND CELEBRATE” and PAUSE remains in place until 4/29.

If mortality peaks at 12,000-15,000 statewide, this remains a human tragedy, but far less carnage than the 110,000 which was the basis for much of the Governor’s actions three weeks ago. This falls into the category that the “realized” results are beating Cuomo’s best case (recall, last week, he said the apex was “7 –> 14 –> 28 days” based on various models they use).

We will give only a brief update on NYC because there seems to be a broader story of US-wide case counts decelerating and this leads us to highlight when peak mortality may happen (based on 19 countries).

POINT #1: New York City remains stable on new cases, and we squint, it is probably turning downwards. Deaths similar story.

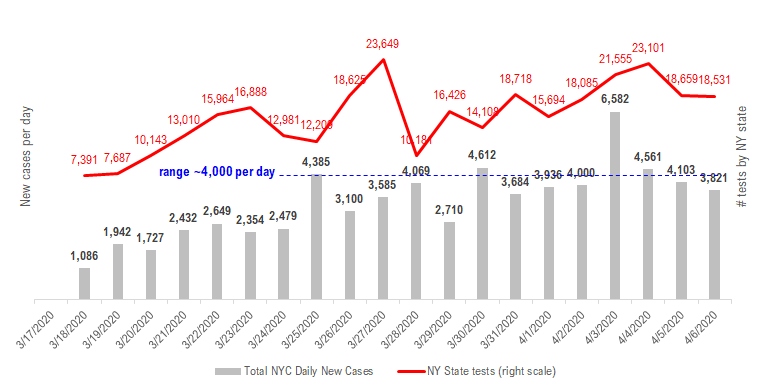

As we have noted many times, NY state is the epicenter of the US COVID-19 breakout and NYC is ground zero. And the relatively stable/improving trends in NYC continue. Total new cases were 3,821 which is flat (at worst) and potentially turning downwards.

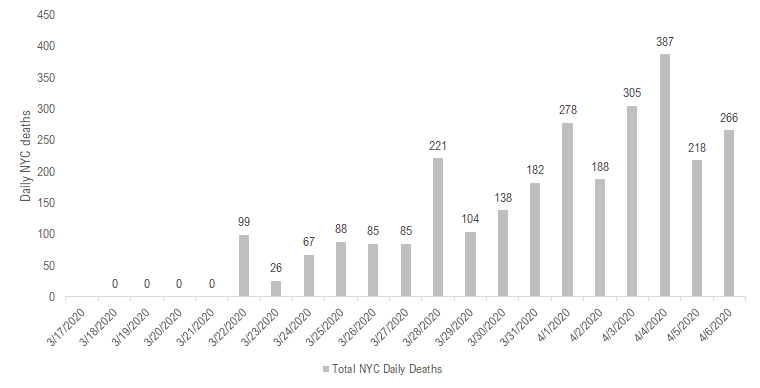

– Deaths per day have leveled off at 266.

Now 266 deaths per day is a big number for NYC, which normally sees 450 deaths per day. Thus, flat deaths still mean many NYC residents are senselessly perishing. But this figure remaining stable is pointing to the spread flattening or at least moving from exponential growth to linear.

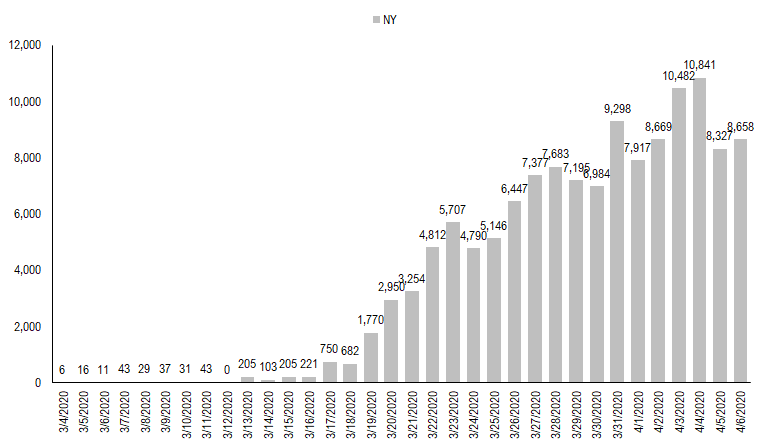

The improvements are statewide and Cuomo cited many encouraging statistics. But the leading indicator figure remains case count and as shown below, the case count was stable at +8,658 (vs 8,327 on the prior day).

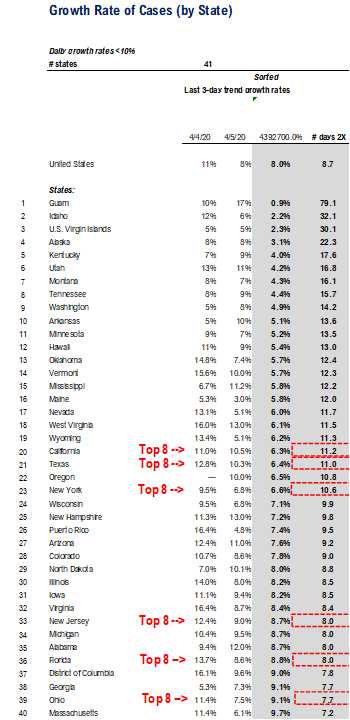

POINT #2: 41 states now see case growth <10% per day (+4) and using Linear charts to show Top 8 REALLY beating NY state…

There are now 41 states (+territories) that see daily case growth <10% daily. This means total cases double >7 days (or better). Now doubling every week is still rapid case growth.

– But the overall growth rate of 8% nationwide is better than the 11% seen just 2 days ago. In other words, if case growth is flattening, this 8% could drop even faster.

– For instance, NY state saw case growth today of 6.6% (2X ~10.6 days) and it was 9.5% two days ago and just last week, it was nearly doubling every 4 days.

– Thus, daily case growth in US-wide <8% is moving in the right direction.

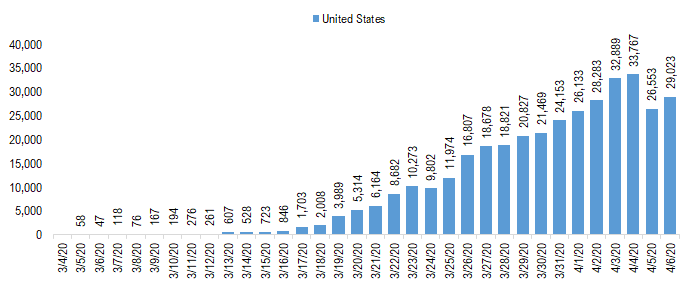

In aggregate, total new cases was 29,023 (up from 26,553 yesterday) but lower than the >30,000 seen two consecutive days recently. But the most important leading indicator, in our view, remains NY-state. This was ground zero and also where the worst outbreak has taken place. And if NY is peaking, we can all start to develop a framework for the rest of the country.

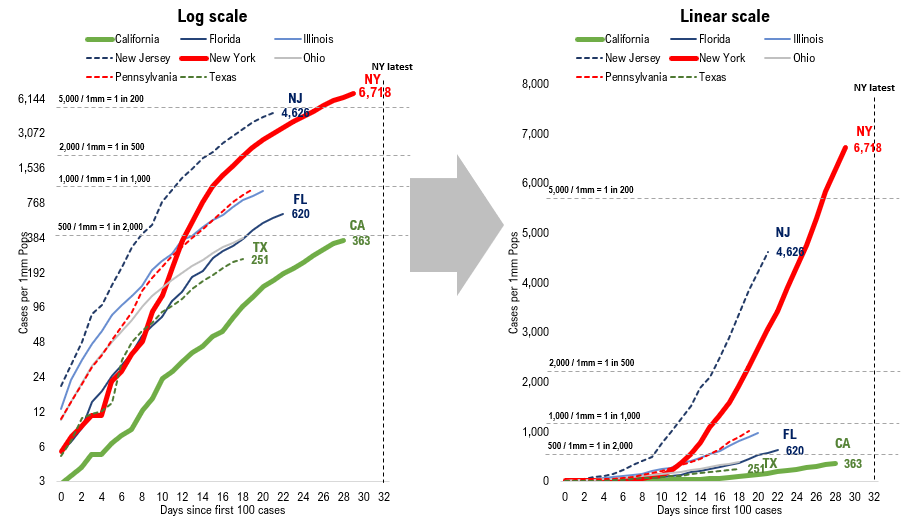

One may need to use a linear chart to see how much worse the NY state is versus the rest of the top 8 states…

We have used cases per 1mm residents to measure the penetration/spread of COVID-19 and the chart on the bottom left starts day 0=100 cases. And for the most part, the other 8 states have seen better outcomes based on days beyond 100 cases (except NJ).

– But a log scale (left chart) disguises how different the outcome of NY is versus the rest of the top 8 (top 8 states in GDP terms = 50% of US).

– The right chart is the same plot on a linear scale. As this chart shows, NY and NJ saw an absolute explosion of cases per 1mm compared to CA, FL, TX, OH, IL, PA.

Thus, with strict social distance measures in place, the risk of exhausting medical resources is currently much lower for these other states.

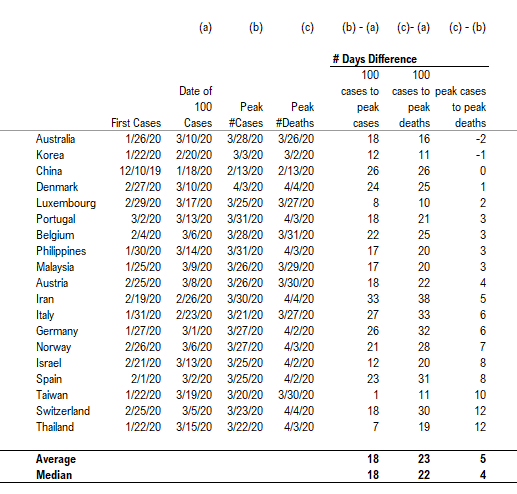

POINT #3: Based on 19 other countries, peak in mortality is 4-5 days after the case peak (range -2 to +12 days)…

19 nations have seen a decisive downturn in daily case counts (past the ‘apex’) and those are listed on the table below. This table is sorted based on the number of additional days before mortality peaks (rightmost column).

– Australia saw daily cases peak 3/28/2020 (+18 after the first 100 cases) and deaths peaked on 3/26/2020, 2 days earlier. South Korea was similarly -1 day before cases peaked.

– At the longer end, Switzerland, Thailand and Taiwan saw deaths peak 12, 12 and 10 days after the peak in cases.

– This is a 14-day range (-2 to +12 days) with a median of 4 days.

Using the above 19 nation table, we can make some range of dates for death peak in NYC and NY state…

If NYC cases peaked 4/3/2020 (cannot be conclusive), then deaths peak range is:

– 4/1/2020 (Australia) to 4/15/2020 (Switzerland, Thailand)

– The median date is 4/7/2020 (Tuesday this week)

If NY state cases peaked 4/20/2020, then deaths peak range is:

– 4/2/2020 (Australia) to 4/15/2020 (Switzerland, Thailand)

– The median date is 4/8/2020 (Wednesday this week)

This may sound surprising, but there is a reasonably good chance of death in NYC and NY state will see a peak this week. Of course, we cannot be conclusive until after the fact. The reason this matters, however, is that once mortality peaks, the focus can shift towards the economic recovery cycle. Austria today announced plans to restart its economy (Time.com article on this here).

MARKET STRATEGY: Stocks with “low market value/ employee” could see marginal benefit from rising unemployment, another “the epicenter” stocks could outperform, ala 2008…

We have been writing (in some of these recent comments) about our rationale for expecting the “epicenter” of this COVID-19 crisis to outperform. That is the stocks that are worst hit from the “social distance” and full government shutdown.

Our initial rationale is as follows:

– these companies were overwhelmed by social distance measures, which these companies cannot control.

– US policymakers will treat these companies fairly (except cruise lines, due to public fallout).

– these companies often rely on affordable labor supply, which is now abundant due to the economic fallout

– in GFC, many of the “epicenter” stocks saw tremendous gains from 10/2008 to 3/2009 (interim low to low low)

Is looking at “low market value/ employee” a way to buy the epi-center?

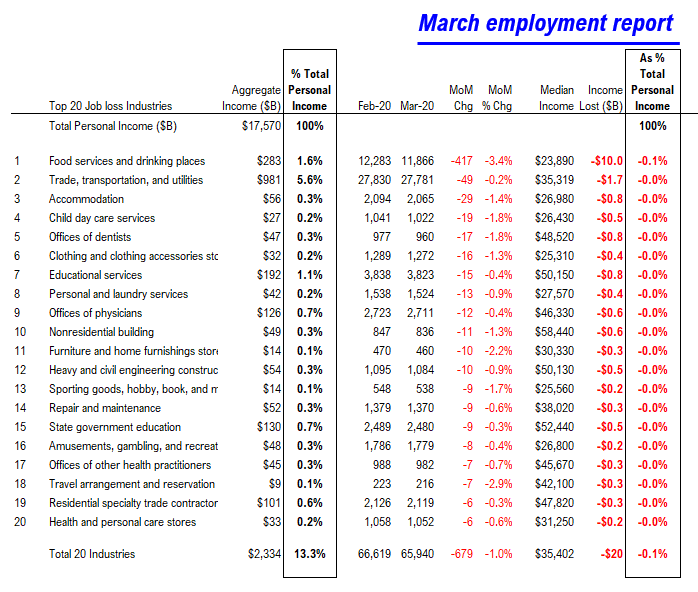

The job losses from the March employment reported were highly concentrated. 96% of the job losses were in 20 industries, 679,000 of the 701,000 (there are >129 total industries). Topping the list is food services, followed by other hospitality-related groups (see below).

– naturally, these 20 industries will likely see the greater losses in the coming months (April, May, etc).

– these groups represent 43% of the employed labor in the US (66mm of 151mm)

– but only 13% of the total personal income of the US (wage income is 65% of personal income) and 20% of wage income in the US

In other words, these industries have below-median income compared to the rest of the US. For instance, 12 million Americans are employed in food service (8% labor force) but with a median income of $23,890, this is only 1.6% of total income for households.

Low market cap/employee stocks have high exposure to employee cost but addressable market based on total US income…

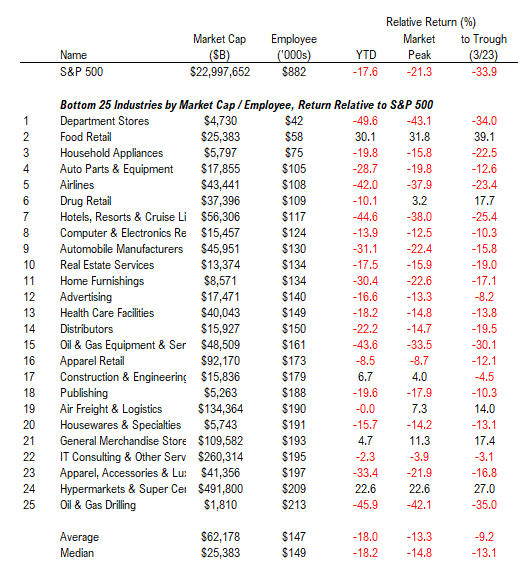

We have listed the 25 industries with the lowest market cap per employee. This is not a typical metric, but it measures how much equity value is attributable to each employee. The lower the equity value, the greater the labor intensity–aka, high labor-intensive groups.

Looking at stocks and industries this way is quite revealing:

– Department stores have $42,000 of equity value per employee (the lowest of the GICS4 S&P 500). According to the employment report (above), the median income of a worker in this field is $25,000. Thus, a 5% raise to employees, reduces equity value by 3% ($1,250 is the raise).

– Thus, labor costs have an outsized impact on the equity value of low market value per employee sectors.

As the US emerges from this downturn, aggregate household income will recover. But many businesses will close leaving surplus labor supply. It is these industries with low market value/ employee that could see their equities rise faster, from this labor surplus.

The list below is full of epicenter groups: Household Appliances, Airlines, Autos and Auto parts, Hotels, Apparel Retail, Construction and Engineering, etc.

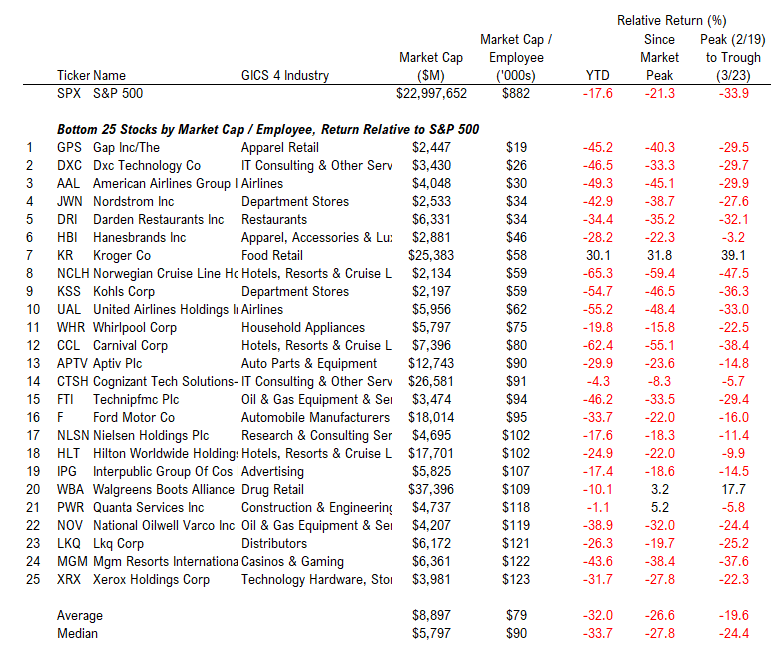

Below is the list of 25 stocks with the lowest market value per employee… this is the heart of the epicenter…

The 25 S&P 500 stocks with the lowest market value/ employee are below. The lowest is GAP (GPS) with $19,000 of market value per employee. These companies were vulnerable to labor pressures in a tight labor market before they were hard hit by the demand shock.

– But these stocks might be where we could see really strong recoveries with the benefit of reduced wage pressures.

– It is interesting to see how grocers, like Krogers, have high labor intensity ($58,000 market cap per employee) but have done well, because, naturally, demand for grocery has been strong.

To conclude, we are highlighting market value/ employee as a potential metric to screen “epicenter” stocks for recovery. We would be glad to send you the full list — just shoot us an email.

We continue to believe shifting to a “half-full” framework makes sense, as we are moving through the peak of the healthcare crisis. And while there remains a painful business cycle ahead, policymakers stepped in early. This gives us some confidence that much of the worst is behind us. And as we pointed out many times, stocks bottom well ahead of fundamentals. In fact, it happens to be stocks bottom before peak jobless claims.

That said, there remains a lot unknown about this contraction.

– we don’t know how deep the contraction will be

– we don’t know how long the recession will last

– we don’t know which businesses will recover