Click HERE to access the FSInsight COVID-19 Daily Chartbook.

We publish on a 4-day a week schedule:

Monday

Tuesday

Wednesday

SKIP THURSDAY

SKIP FRIDAY

STRATEGY: Equities digesting and consolidating ahead of the prime seasonal period

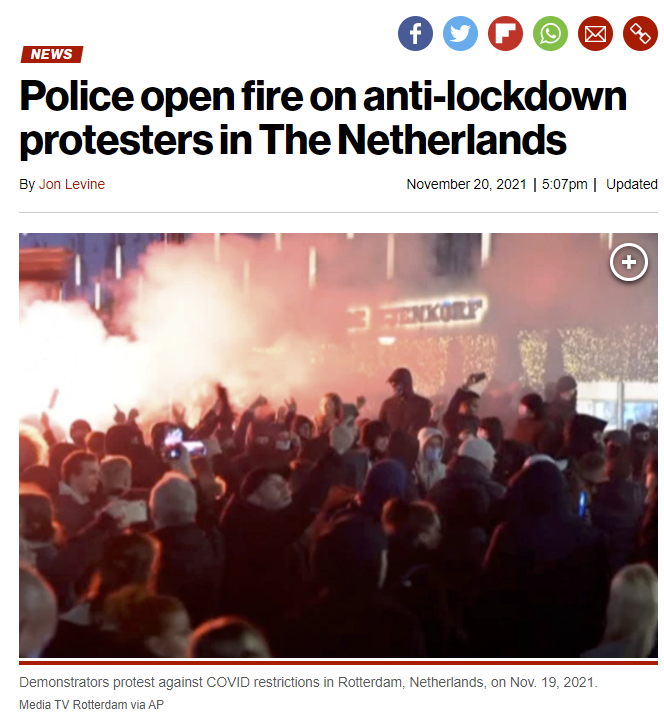

European COVID-19 fatigue triggering mass protests over new lockdowns and vaccine mandates

Over the weekend, protests erupted across Europe over new lockdown measures and vaccine mandates issued by policymakers:

– Dutch police opened fire on protestors

– 40,000 protestors marched in Europe

– French police clashed with protestors

– protests even in Croatia

– fires in Italy, Northern Ireland

Wow.

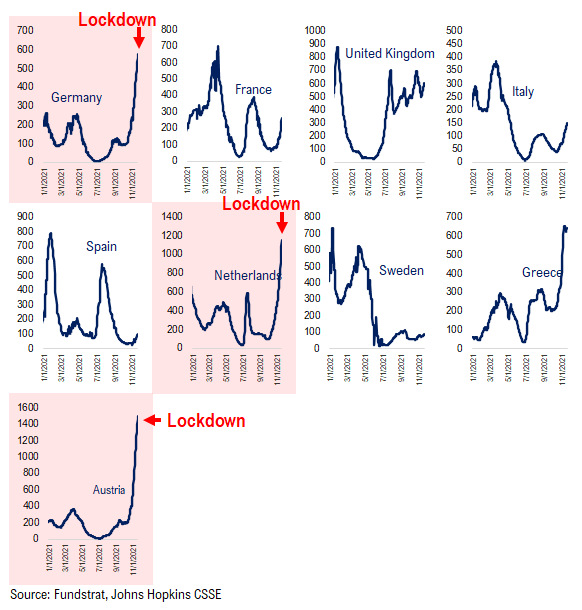

COVID-19 cases are surging across Europe, due largely to the Delta-variant (including Delta-plus). Last week, we noted that a recent WHO study showed 99.7% of cases worldwide (sampled) are Delta or Delta-plus. This is curious.

– it seems like an individual can only be infected with one variant

– if Delta burns out, do COVID-19 cases similarly burn out?

– unless it continues to mutate (probably)

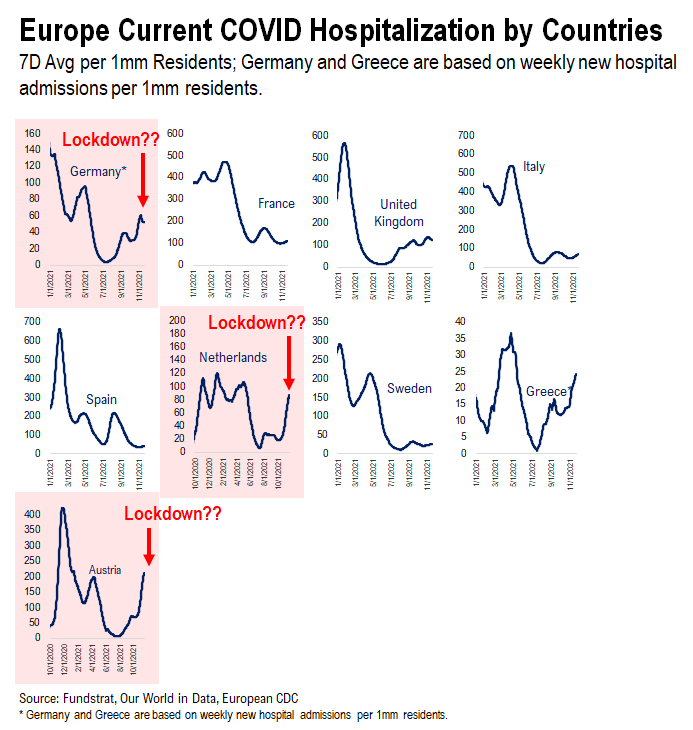

Lockdowns were meant to prevent overloading hospitals, if so, European policymakers are panicking far too early

I recall that early in the pandemic, the rationale for lockdowns, as explained by policymakers, was to prevent hospitals from being overloaded. This could lead to a catastrophe and indeed, in the early days, this was the story with places like NYC. And therefore, the rationale for lockdowns had less to do with detected cases and more to do with hospitalization. By this logic, the lockdowns in Europe are not warranted.

– the level of hospitalizations in Europe are far below prior peaks

– granted, hospitalizations are rising

– but far below levels that warrant new lockdowns

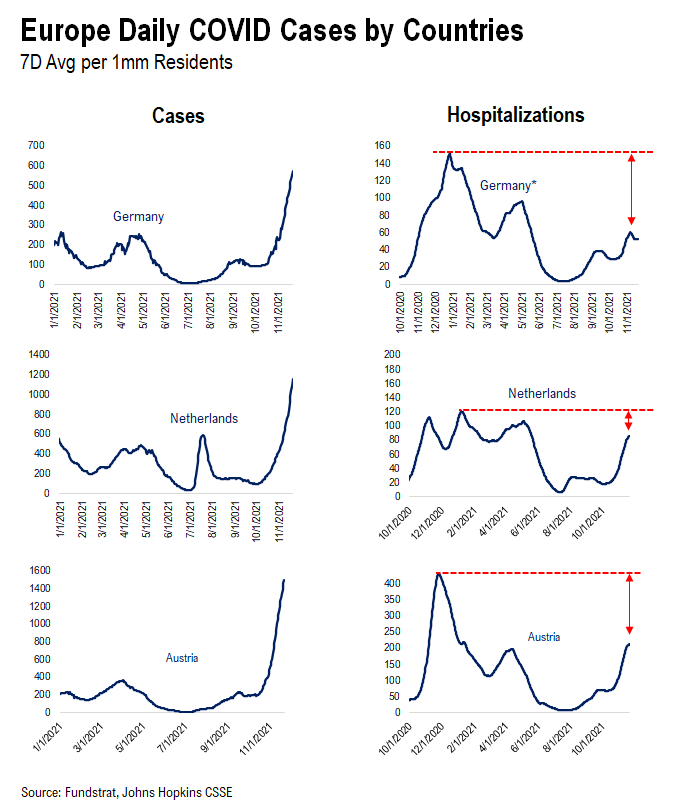

Let’s look at Austria, Netherlands and Germany more specifically. The countries have imposed stricter lockdowns in response to record cases:

– in every case, hospitalizations are far below peak

– and with anti-viral pills on the way from Merck and Pfizer

– hospitalization risk is falling even further

Hence, it does seem misguided for policymakers to impose new lockdown measures.

STRATEGY: Equities digesting and consolidating ahead of the prime seasonal period

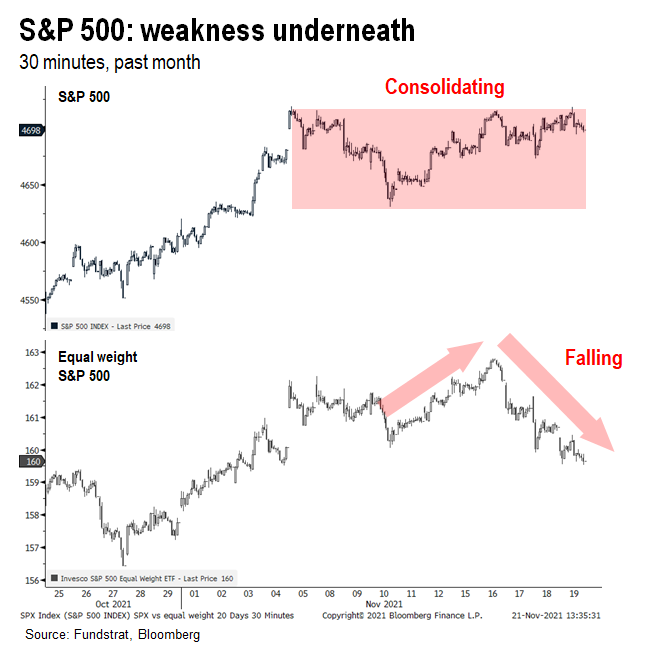

It has been a choppy few weeks for equities. This is not apparent if one is looking at the Nasdaq nor S&P 500, but it is apparent when looking at small-caps and the equal-weighted S&P 500. As we stated over the past week or so, there are both technical and fundamental factors explaining this:

– White House making market on edge due to Fed chair Powell confirmation risk

– White House making market on edge due to calling for FTC investigation of oil and gas companies

– these show significant interference by White House on normal capital markets and economy

– Supply chain woes muddying structural inflation question

– Consumer confidence is tanking, presumably due to inflation perceptions

– COVID-19 cases are surging across USA and Europe

– market is short-term overbought per Mark Newton, our Head of Technical Strategy (click here to learn more)

…rising “wall of worry” = base case remains a strong rally into YE taking S&P 500 beyond 4,800

But we remain constructive on stocks into YE. Even as this wall of worry continues to mount, we believe this resolves in equity upside into YE. The base case for this is:

– Fed chair Powell is confirmed for another term = best case and our base case

– COVID-19 cases surge but hospitalizations trail (see below)

– but the surge is keeping Fed dovish

– Supply chain eases

– lowers risk of intensifying inflation risk

– consumer confidence bottoms

So we stick with our base case that equities will finish 2021 strong, rallying beyond S&P 500 4,800.

…US economic outlook solid for 2022 (per JPMorgan) which is incongruent with tanking consumer confidence

In fact, JPMorgan published their 2022 US economic outlook. They see an overall economic outlook with firm demand, and coupled with inventory building, leads to a solid gain in GDP. But their timeline for Fed liftoff is now Sept 2022 as well.

– it is a firming economic outlook

– one which should lead to consumers gaining confidence, while consumer confidence is tanking

…curiously, why is Consumer Confidence still tanking?

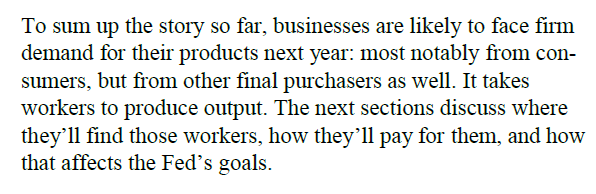

If one asked me why the “equal weight” S&P 500 is performing poorly, part of it, in my opinion, is the collapse in consumer confidence. Falling consumer confidence poses near-term risk for consumer spending, and potentially highlights a larger issue for the economy:

– Consumer confidence, per the UMich survey, is the worst since the start of the pandemic

– the worst since 2011

– a major driver is inflation expectations

– the inflation expectations is from the Conference Board survey

…Low levels of consumer confidence are good for “forward returns”

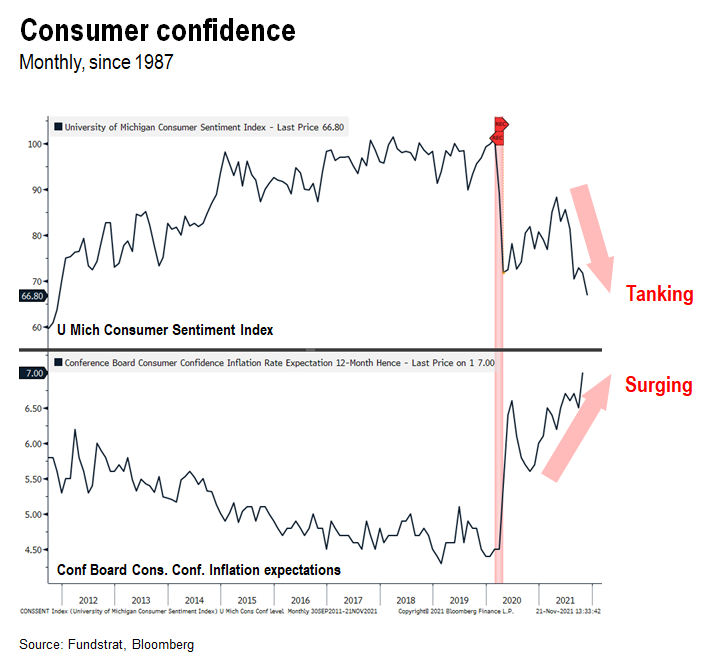

In the past, we have noted that low levels of consumer confidence are actually good for consumer discretionary stocks. The numbers speak this message clearly:

– whenever consumer confidence is <74

– Consumer Discretionary gains 21% to 30% over next 12 months

– win-ratio is 88% or higher

Why? It is about baking in bad news:

– falling confidence is a headwind for cyclicals

– cyclicals thus weaken into the nadir

– but at the bottom, consumer confidence can reverse higher

– this surge leads to outperformance of Discretionary stocks

…Pump is primed for a Consumer Confidence recovery

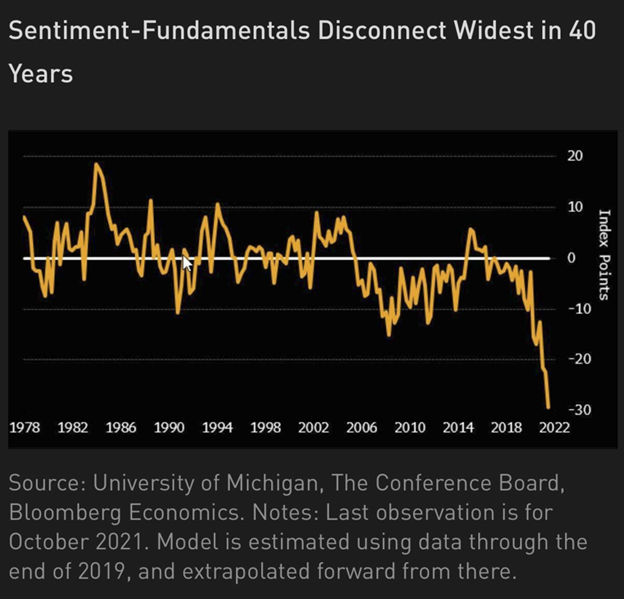

Bloomberg Economics team and writers produced the chart below. What they measured is the disparity between consumer confidence to the actual conditions impacting the consumer: credit access, labor conditions and inflation.

– notably, the gap is the widest ever

– meaning consumer confidence is unusually low, given the favorable economic conditions

– economic conditions are solid and as per JPMorgan economists above, should be good in 2022

This means we should see a “convergence” of the gap. That is, consumers might be unusually negative because of widespread media coverage. Or possibly because of social unrest.

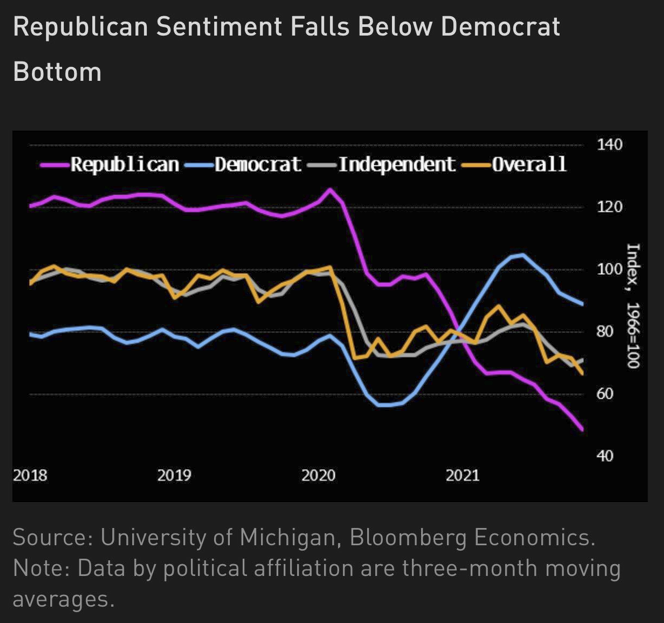

…Consumer Sentiment for Independents and Republican imploded –> tanking consumer confidence due to Washington

It seems like consumer confidence has imploded for Independents and Republicans. The UMich survey shows consumer confidence is imploding for voters affiliating with those parties. And at 45, is like Depression levels:

– Perhaps the Bloomberg model divergence is due to American’s being unsatisfied with Washington

– the below chart shows Independents and Republicans have tanking confidence

– Washington has dropped the ball on shutdowns, muddled passage of bills, handling of various crisis, Afghanistan, etc

– If this is the case, the midterms in 2022 could be much more pivotal than expected

– and Washington impact on consumer actions might be far less than the impact on consumer confidence

– hence, a case for a rebound in consumer confidence in 2022

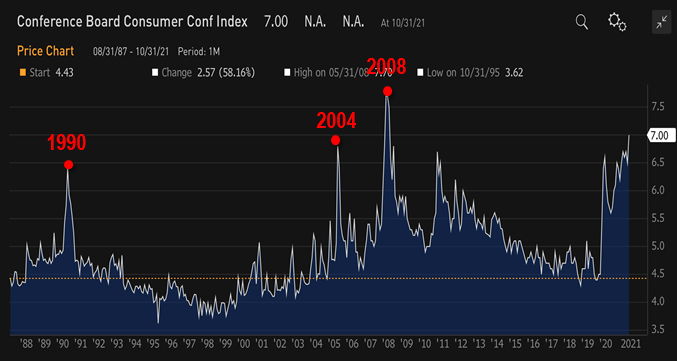

By the way, consumer inflation expectations is 7%???

As for inflation expectations, this is somewhat surprising. But the October consumer confidence expectations for inflation are elevated at 7%.

– this is from the Conference Board

– the next figure is released in a few weeks

– at 7%, it is only exceeded 3 times

– 1990, 2004 and 2008

– 2008 was a bad omen

– 1990 and 2004 were turning points

Thus, we think this requires further analysis and we will do this in coming weeks.

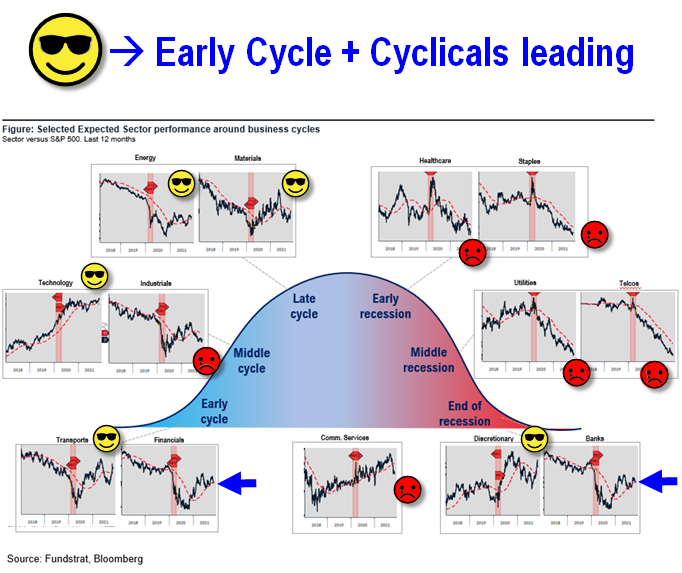

SECTORS: Leadership still Cyclicals/Early-cycle aka Epicenter

Relative sector performance is shown below and as we can see, 5 sectors are showing positive relative trend:- Energy

– Basic Materials

– Technology

– Transports

– Discretionary

– sort of Financials/Banks

These are all cyclical groups. And also have general positive exposure to reflationary trends. Inflation, incidentally, in isolation is not a bad word. The real risk to markets is:

– too much inflation hurting consumer confidence

– or unanchored inflation expectations, fear of uncontained inflation

This is not necessarily what markets seem to be pricing. If markets were worried about either of the above, Defensive stocks or Growth stocks would be leading. Instead, we are seeing Cyclicals lead.

Into YE, our recommended strategies are:

– Energy

– Homebuilders (Golden 6 months) XHB 0.83%

– Small-caps IWM 0.30%

– Epicenter XLI 0.29% XLF -0.31% XLB -0.43% RCD

– Crypto equities BITO -0.28% GBTC -0.15% BITW -0.88%

Into 2022…

– Industrials

30 Granny Shot Ideas: We performed our quarterly rebalance on 10/25. Full stock list here –> Click here

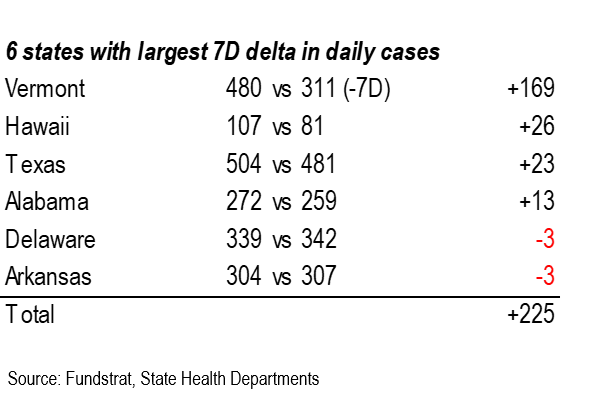

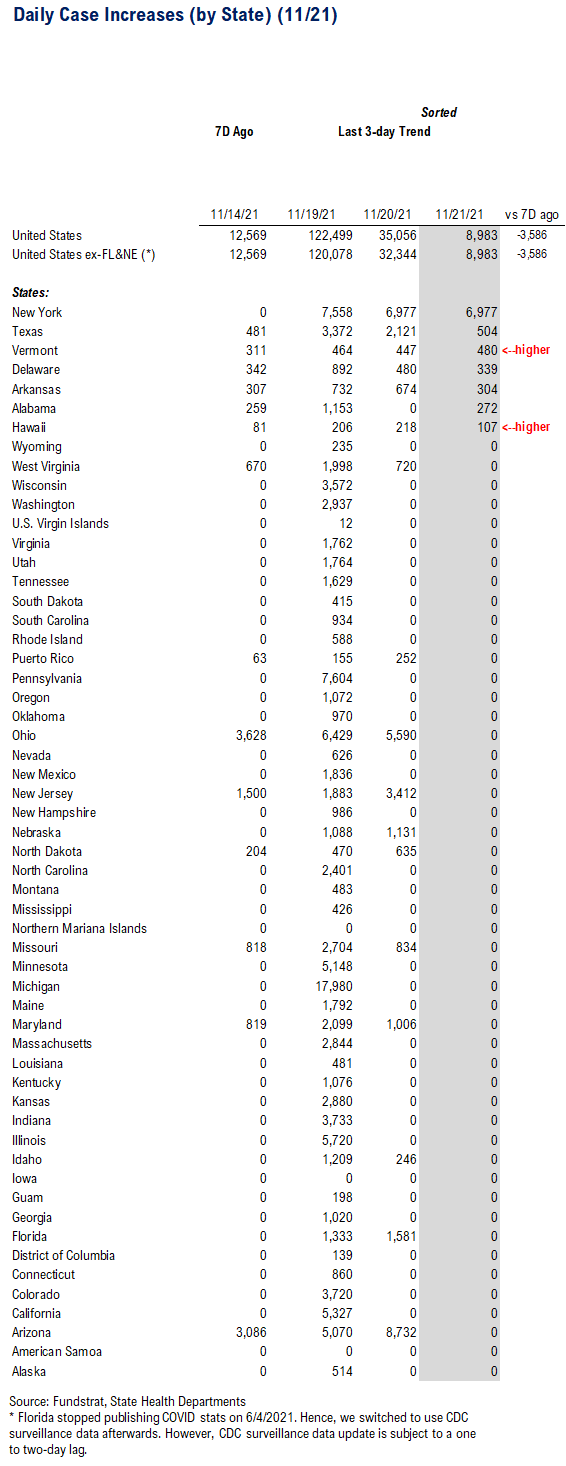

POINT 1: Daily COVID-19 cases 8,983, down -3,586 vs 7D ago…

Current Trends — COVID-19 cases:

- Daily cases 8,983 vs 12,569 7D ago, down -3,586

- Daily cases ex-FL&NE 8,983 vs 12,569 7D ago, down -3,586

- 7D positivity rate 7.2% vs 5.6% 7D ago

- Hospitalized patients 46,823, up +7.8% vs 7D ago

- Daily deaths 1,118, down -3.3% vs 7D ago

*** Florida and Nebraska stopped publishing daily COVID stats updates on 6/4 and 6/30, respectively. We switched to use CDC surveillance data as the substitute. However, since CDC surveillance data is subject to a one-to-two day lag, we added a “US ex-FL&NE” in our daily cases and 7D delta sections in order to demonstrate a more comparable COVID development.

The latest COVID daily cases came in at 8,983, down -3,586 vs 7D ago. The Labor Day distortion remains as evident by the recent fluctuating 7D deltas. Nonetheless, wave 4 is clearly underway; this is not surprising, and is our base case. We expect this surge to peak below the wave 3 peak of 300,000 cases per day. Case roll over will likely resume in the near future as booster vaccine rates are increasing.

Rolling 7D delta distorted due to observance of Veteran’s Day…

The rolling 7D delta is currently distorted due to the underreporting resulting from the observance of Veteran’s Day.

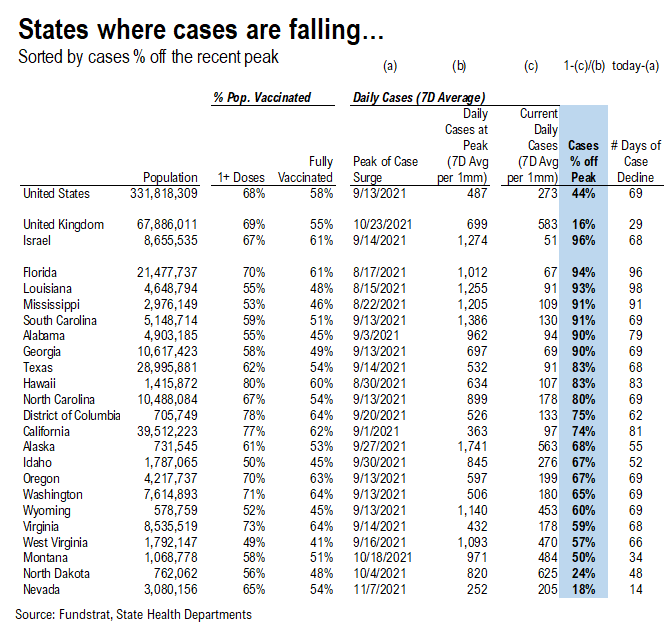

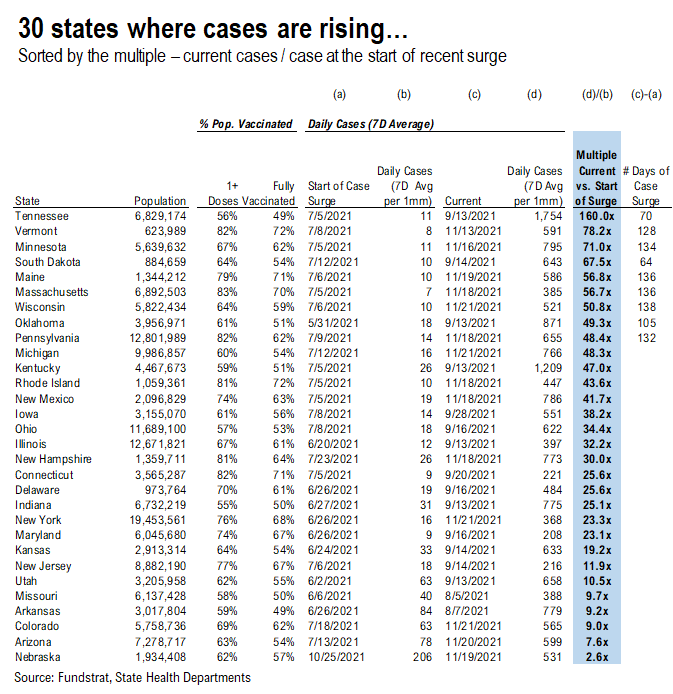

30 states are seeing a rise in cases while cases continue to decline in the remaining states…

*** We’ve split the “Parabolic Case Tracker” into 2 tables: one where cases are falling, and the other where cases are rising

In these tables, we’ve included the vaccine penetration, case peak information, and the current case trend for 50 US states + DC. The table for states where cases are declining is sorted by case % off of their recent peak, while the table for states where cases are rising is sorted by the current daily cases to pre-surge daily cases multiple.

- The states with higher ranks are the states that have seen a more significant decline / rise in daily cases

- We also calculated the number of days during the recent case surge

- The US as a whole, UK, and Israel are also shown at the top as a reference

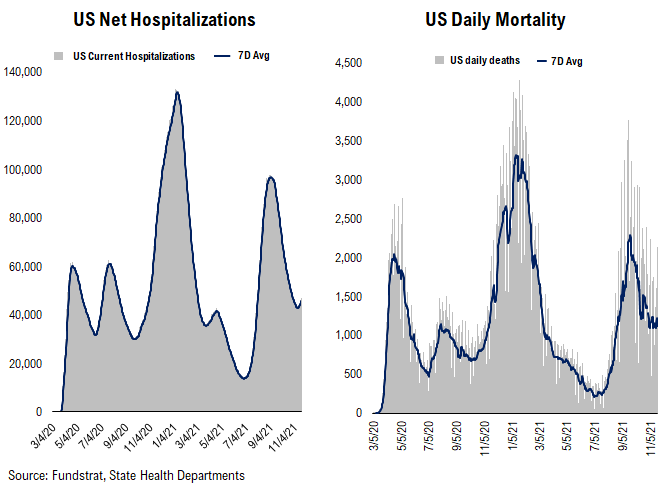

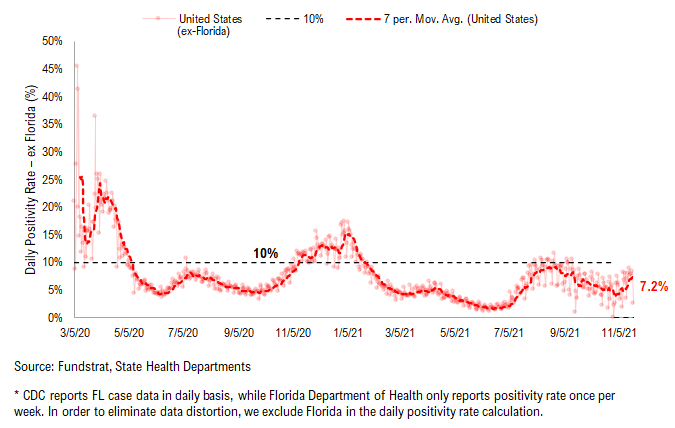

Hospitalizations, deaths, and positivity rates are rolling over amidst case rollover…

Below we show the aggregate number of patients hospitalized due to COVID, daily mortality associated with COVID, and the daily positivity rate for COVID.

– Net hospitalizations peaked below the Wave 3 peak and are currently rolling over

– Daily death peaked slightly above the Wave 2 peak and are currently rolling over

– As per the decline in daily cases, the positivity rate is currently rolling over

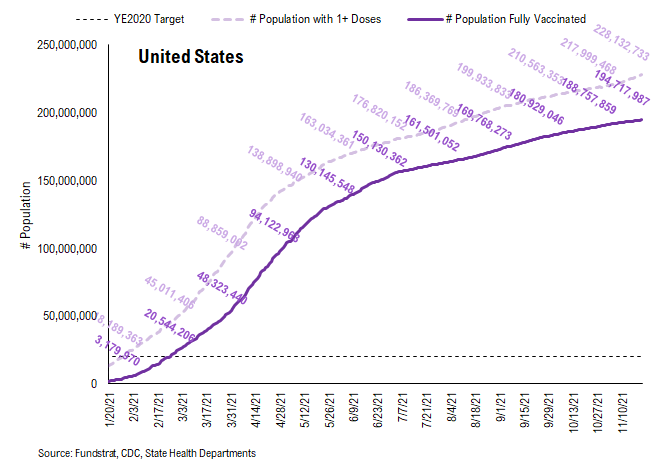

POINT 2: VACCINE: vaccination pace accelerates as boosters become more widely available…

Current Trends — Vaccinations:

– avg 1.5 million this past week vs 1.4 million last week

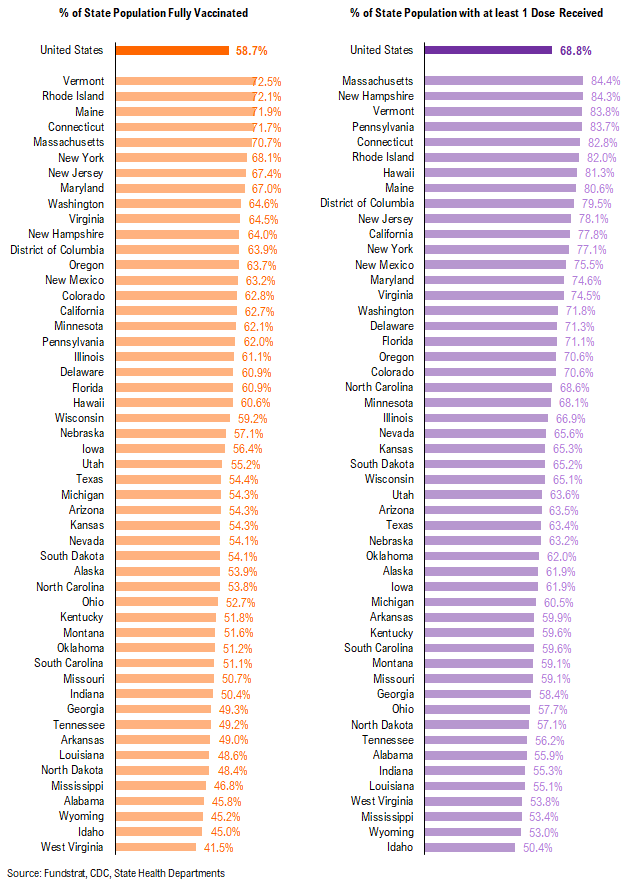

– overall, 58.7% fully vaccinated, 68.8% 1-dose+ received

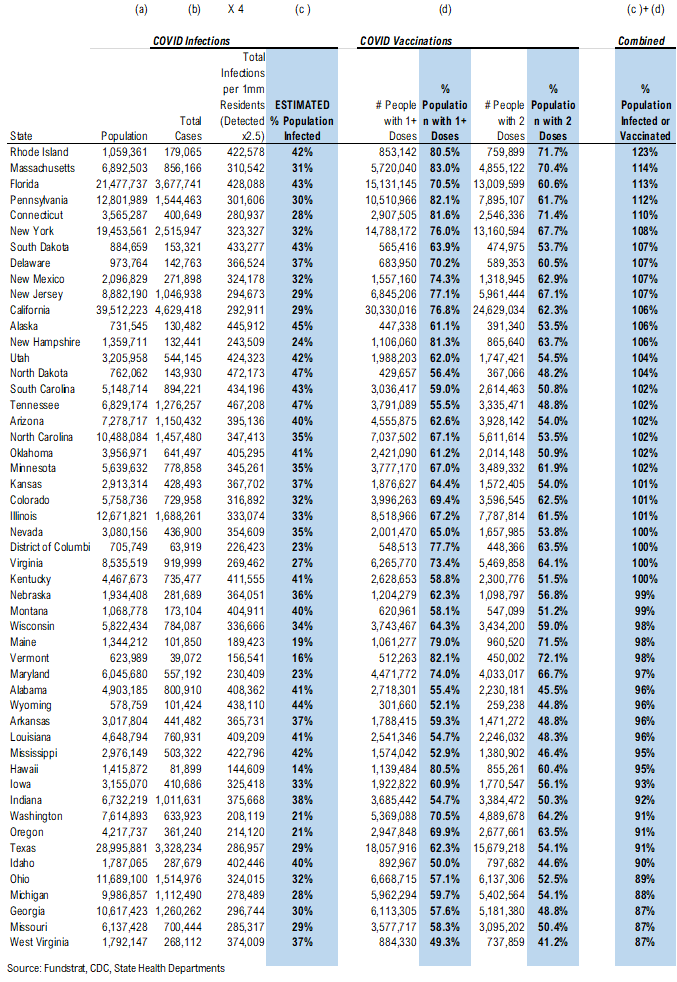

Vaccination frontier update –> all states now near or above 80% combined penetration (vaccines + infections)

*** We’ve updated the total detected infections multiplier from 4.0x to 2.5x. The CDC changed the estimate multiplier because testing has become much better and more prevalent.

Below we sorted the states by the combined penetration (vaccinations + infections). The assumption is that a state with higher combined penetration is likely to be closer to herd immunity, and therefore, less likely to see a parabolic surge in daily cases and deaths. Please note that this “combined penetration” metric can be over 100%, as infected people could also be vaccinated (actually recommended by CDC).

– Currently, all states are near or above 90% combined penetration

– Given the new multiplier. only RI, FL, MA, CT, NM, NY, NJ, IL, CA, PA, DE, SD, KY, UT, OK, ND, NH, AZ, SC, TN, AK, NC, CO, KS, MN, VA, DC, NE, and NV are now above 100% combined penetration (vaccines + infections). Again, this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within each state is either infected or vaccinated

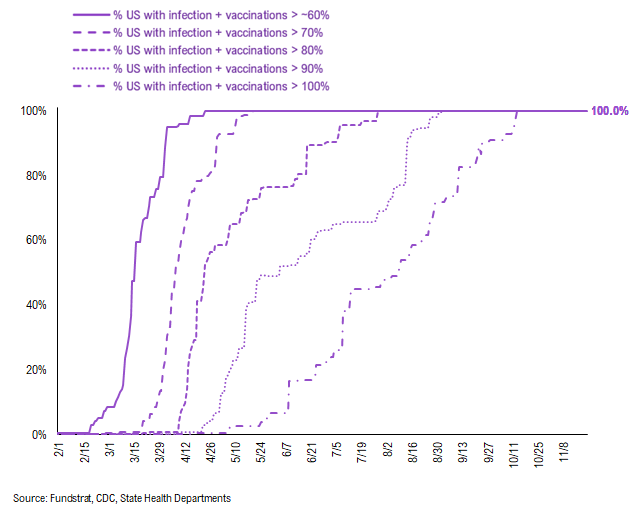

Below is a diffusion chart that shows the % of US states (based on state population) that have reached the combined penetration > 60%/70%/80%/90%/100%. As you can see, all states have reached combined infection & vaccination > 100% (Reminder: this metric can be over 100%, as infected people could also be vaccinated. But 100% combined penetration does not mean that the entire population within the state is either infected or vaccinated).

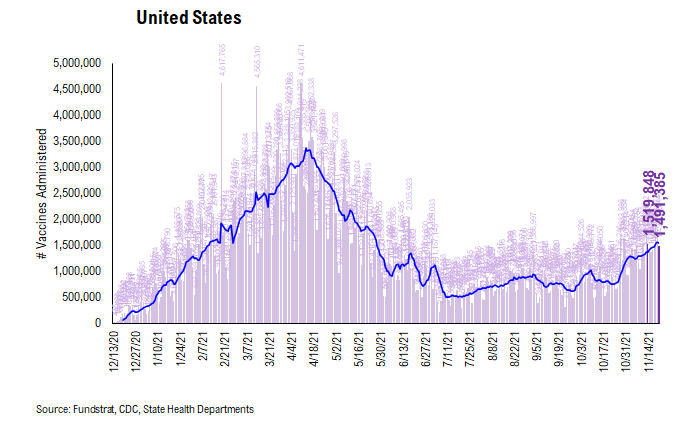

There were a total of 1,491,385 doses administered reported on Sunday, down 2% vs. 7D ago. We are seeing the vaccination pace accelerate as booster shots are becoming more widely available. Also, the same catalysts remain in place:

- Proof of vaccination required by many US cities and venues

- Booster shots

- Full FDA approval of Pfizer COVID vaccines (hopefully it could help overcome vaccine hesitancy)

- Biden’s vaccination plan

The daily number of vaccines administered remains the most important metric to track this progress and we will be closely watching the relevant data.

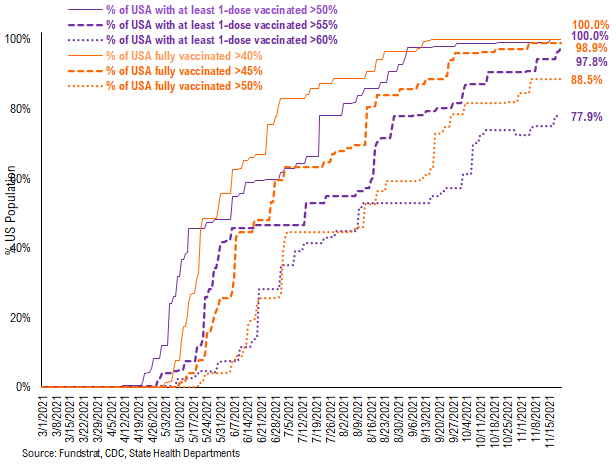

77.9% of the US has seen 1-dose penetration > 60%…

To better illustrate the actual footprint of the US vaccination effort, we have a time series showing the percent of the US with at least 45%/45%/50% of its residents fully vaccinated, displayed as the orange lines on the chart. Currently, 100% of US states have seen 40% of their residents fully vaccinated. However, when looking at the percentage of the US with at least 45% of its residents fully vaccinated, this figure is 98.9%. And only 88.5% of US (by state population) have seen 50% of its residents fully vaccinated.

We have done similarly for residents with at least 1-dose of the vaccination, denoted by the purple lines on the chart. While 100% of US states have seen 1 dose penetration > 50%, 97.8% of them have seen 1 dose penetration > 55% and 77.9% of them have seen 1 dose penetration > 60%.

This is the state by state data below, showing information for individuals with one dose and two doses.

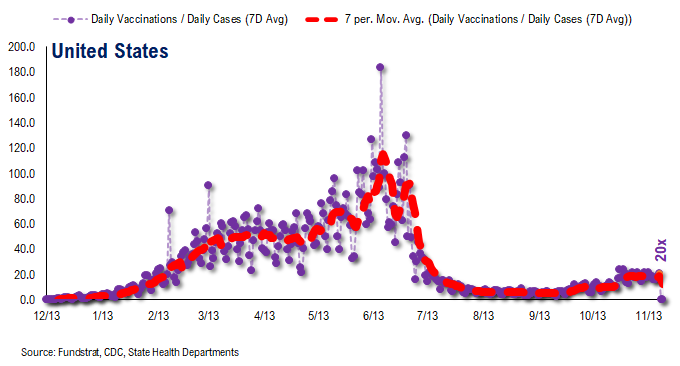

The ratio of vaccinations/ daily confirmed cases has been falling significantly (red line is 7D moving avg). Both the surge in daily cases and decrease in daily vaccines administered contributed to this.

– the 7D moving average is about ~20 for the past few days

– this means 20 vaccines dosed for every 1 confirmed case

In total, 423 million vaccine doses have been administered across the country. Specifically, 228 million Americans (70% of US population) have received at least 1 dose of the vaccine. And 195 million Americans (59% of US population) are fully vaccinated.

POINT 3: Tracking the seasonality of COVID-19

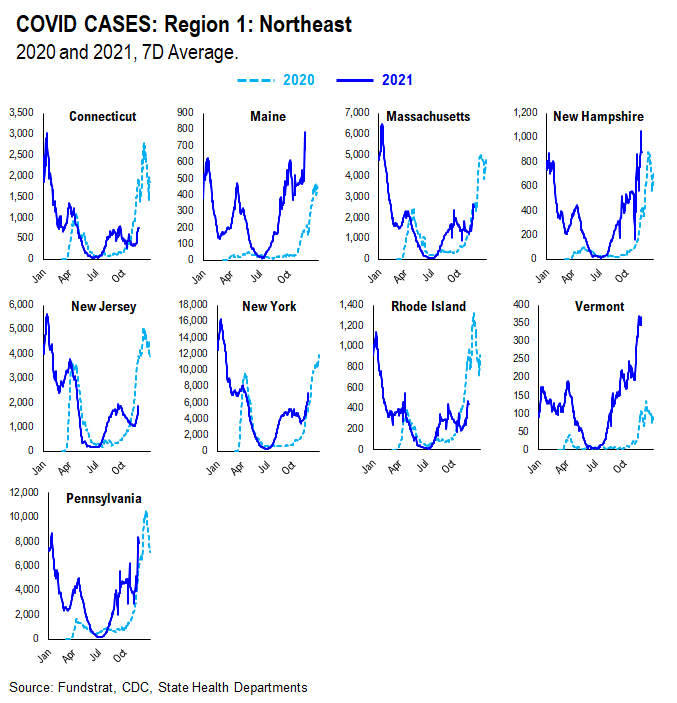

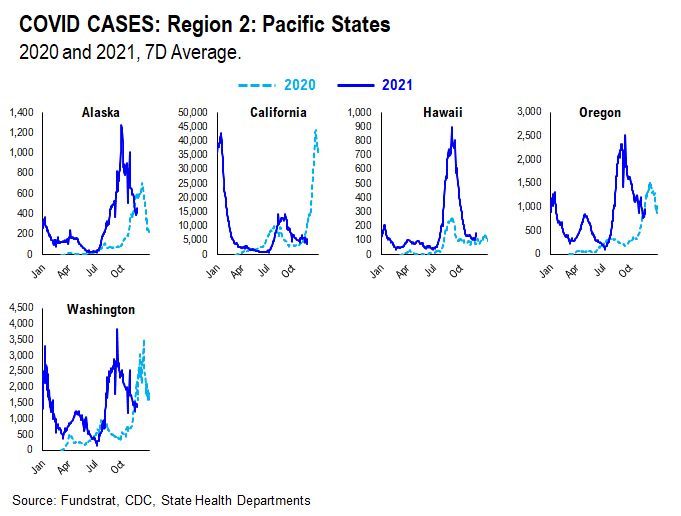

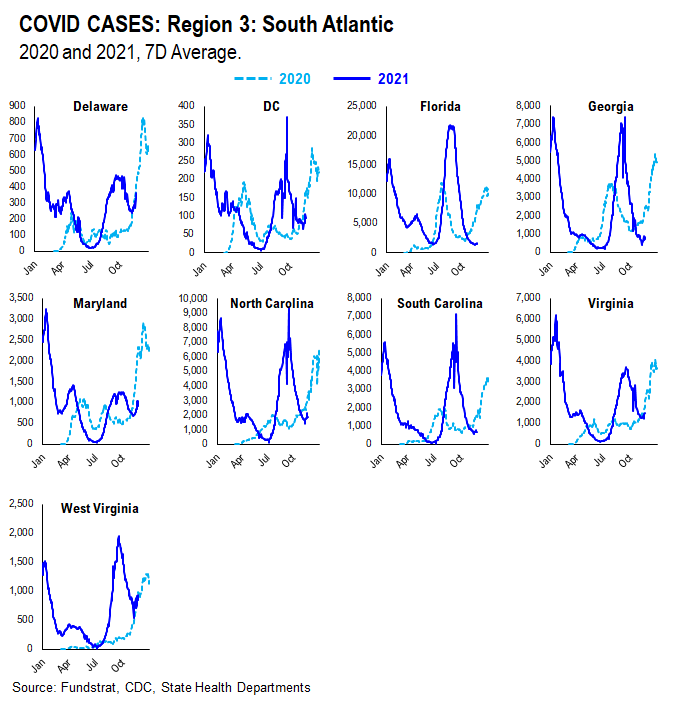

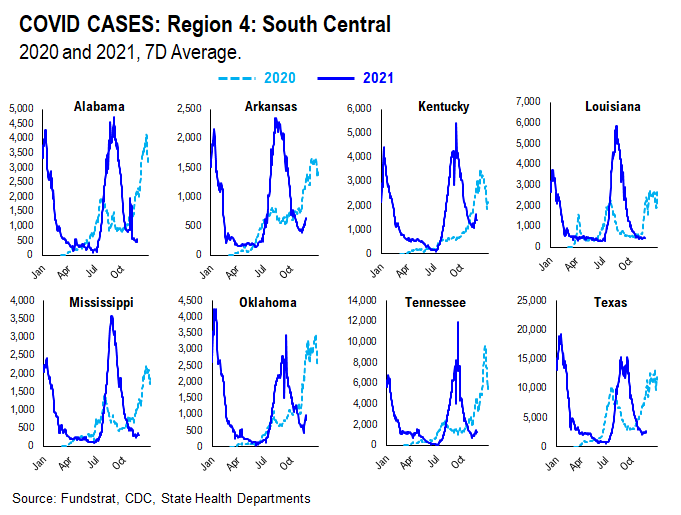

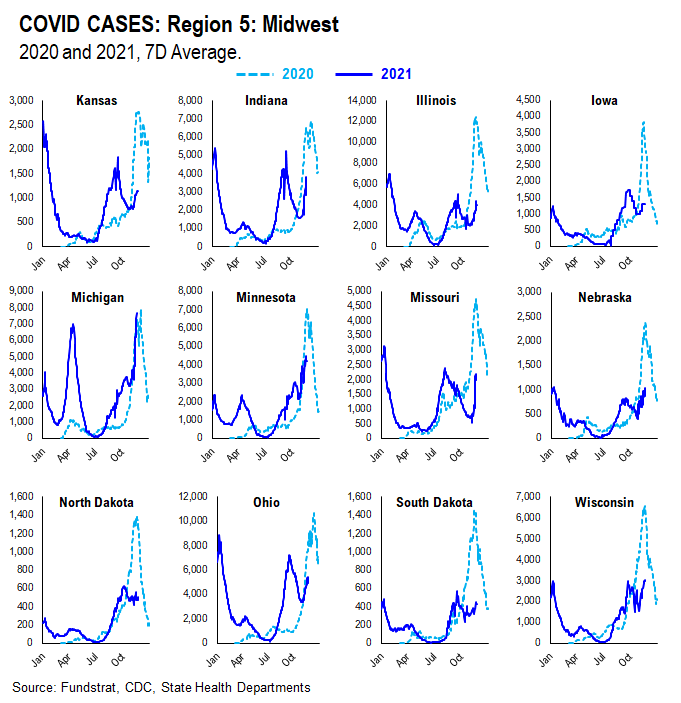

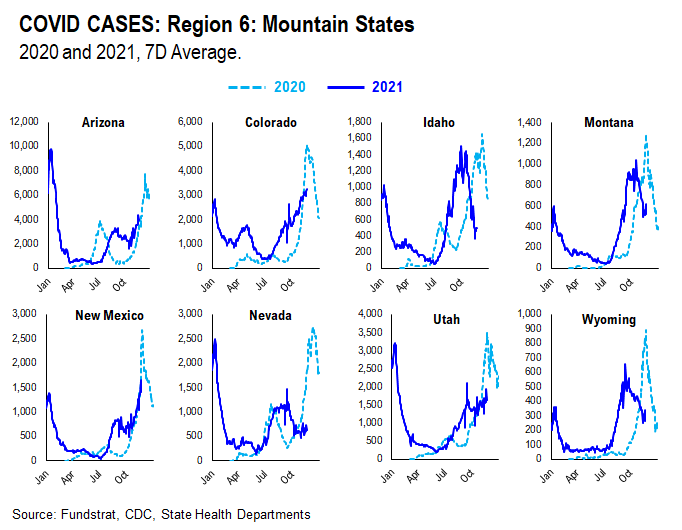

In July, we noted that many states experienced similar case surges in 2021 to the ones they experienced in 2020. As such, along with the introduction of the more transmissible Delta variant, seasonality also appears to play an important role in the recent surge in daily cases, hospitalization, and deaths. Therefore, we think there might be a strong argument that COVID-19 is poised to become a seasonal virus.

The possible explanations for the seasonality we observed are:

– Outdoor Temperature: increasing indoor activities in the South vs increasing outdoor activities in the northeast during the Summer

– “Air Conditioning” Season: similar to “outdoor temperature”, more “AC” usage might facilitate the spread of the virus indoors

If this holds true, seasonal analysis suggests that the Delta spike could roll over by following a similar pattern to 2020.

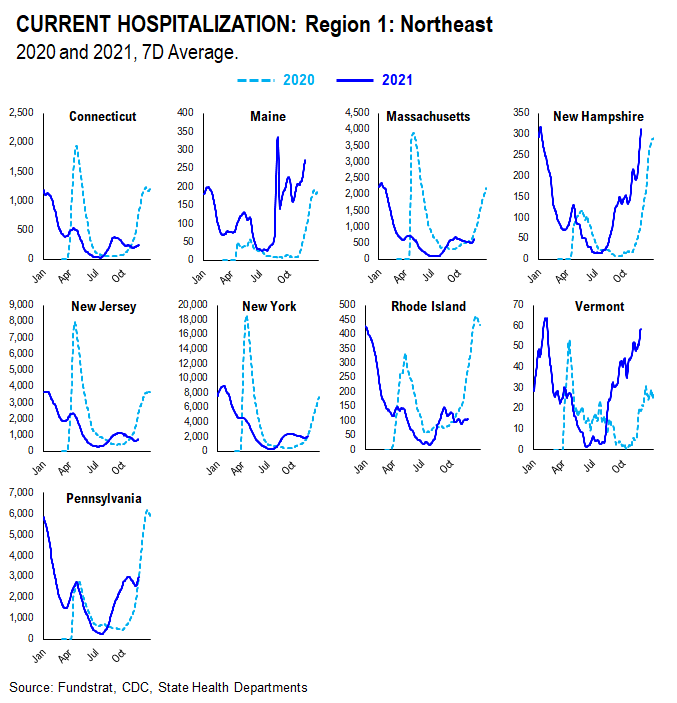

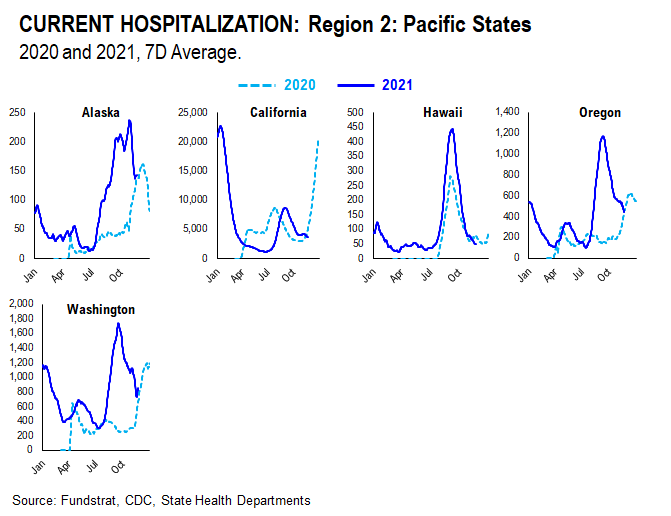

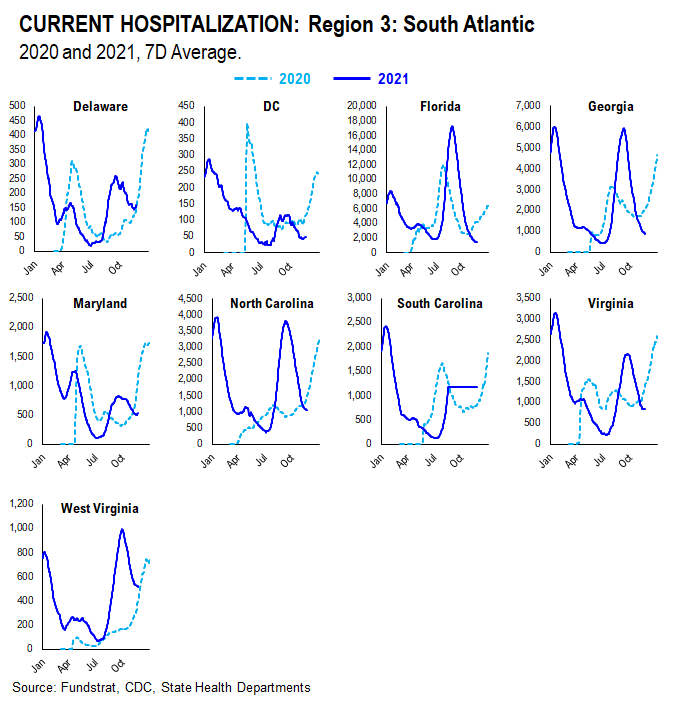

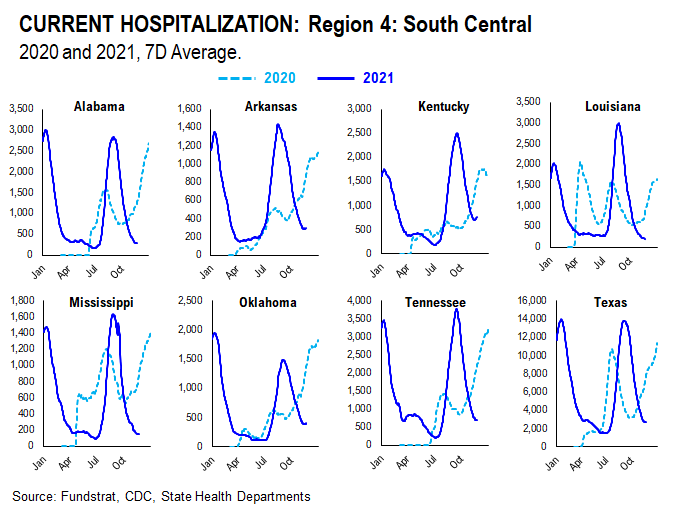

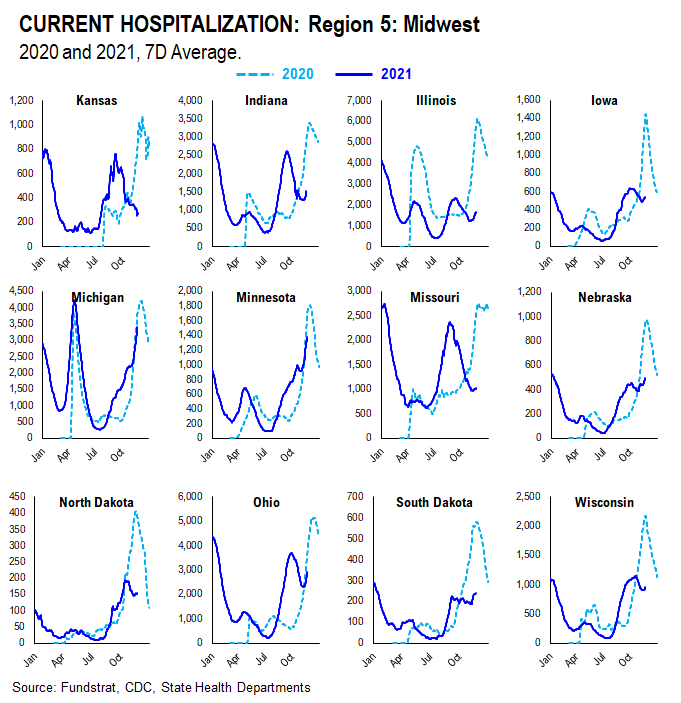

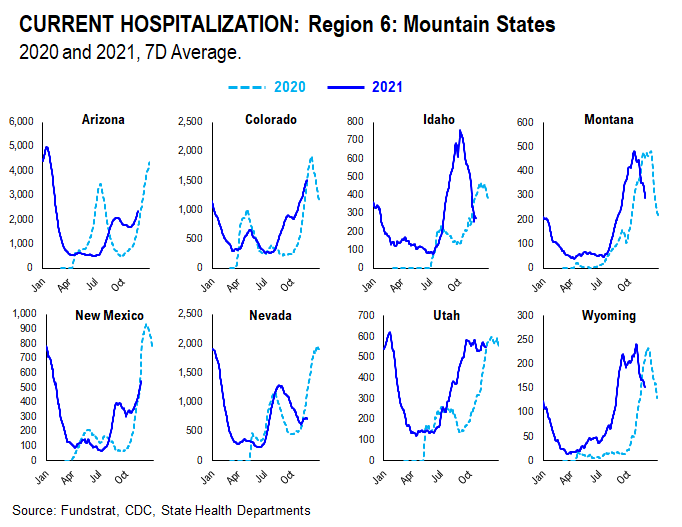

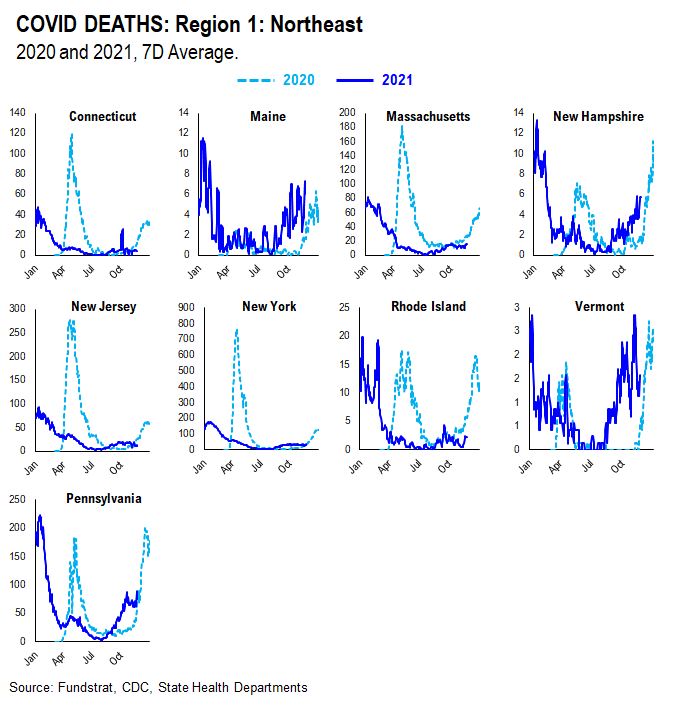

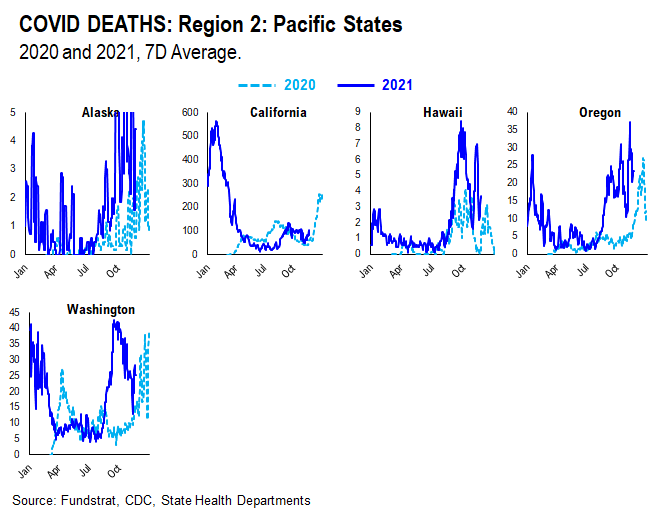

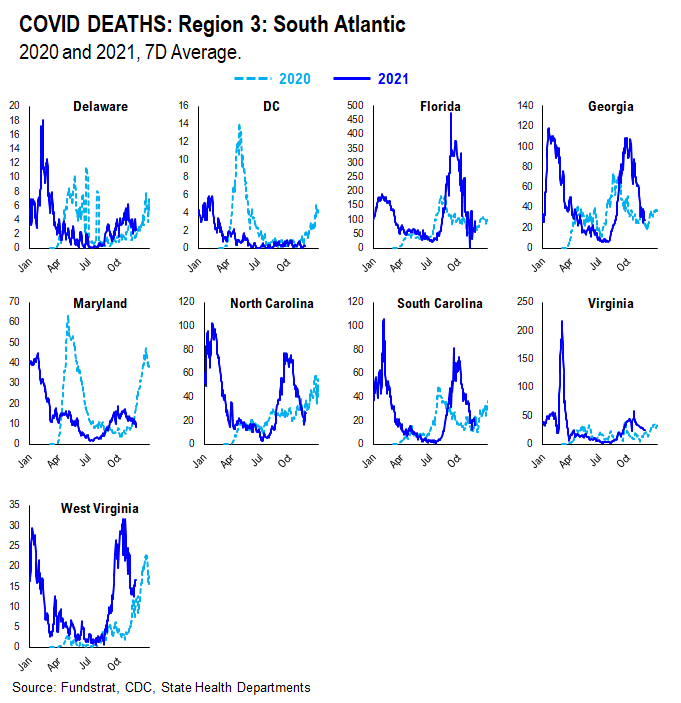

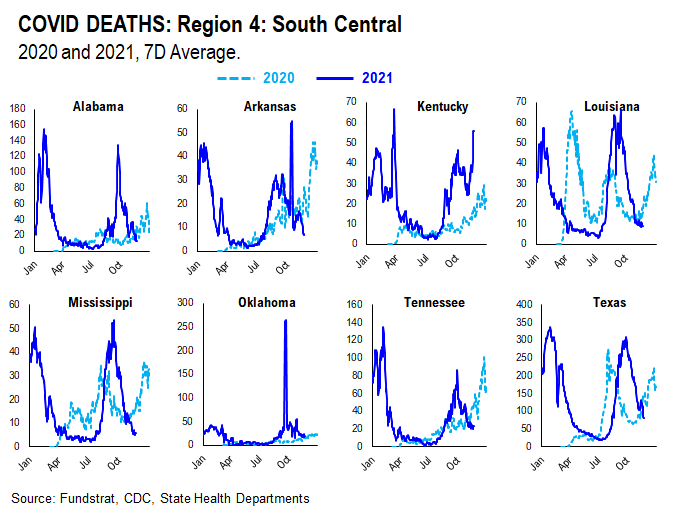

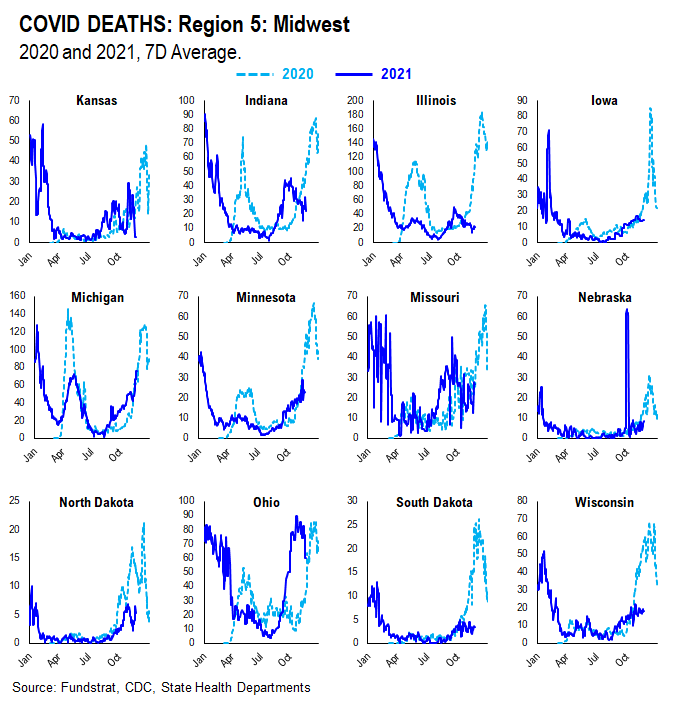

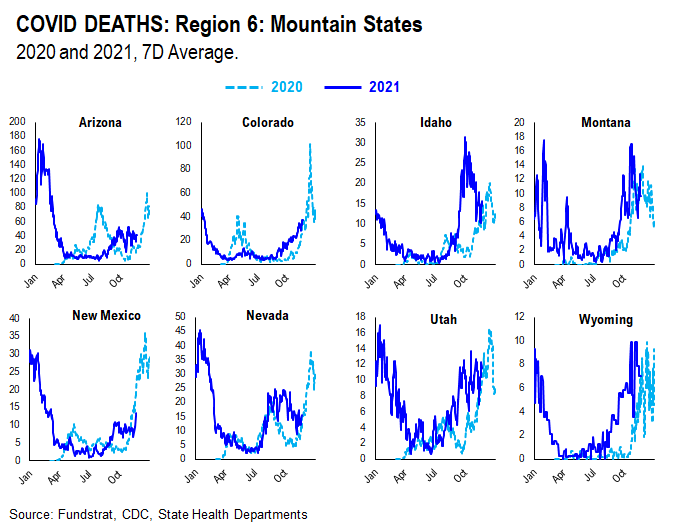

We created this section within our COVID update which tracks and compare the case, hospitalization, and death trends in both 2020 and 2021 at the state level. We grouped states geographically as they tend to trend similarly.

CASES

It seems as if the main factor contributing to current case trends right now is outdoor temperature. During the Summer, outdoor activities are generally increased in the northern states as the weather becomes nicer. In southern states, on the other hand, it becomes too hot and indoor activities are increased. As such, northern state cases didn’t spike much during Summer 2020 while southern state cases did. Currently, northern state cases are showing a slight spike, especially when compared to Summer 2020. This could be attributed to the introduction of the more transmissible Delta variant and the lifting of restrictions combined with pent up demand for indoor activities.

HOSPITALIZATION

Current hospitalizations appear to be similar or less than Summer 2020 rates in most states. This is likely due to increased vaccination rates and the vaccine’s ability to reduce the severity of the virus.

DEATHS

Current death rates appear to be scattered compared to 2020 rates. This is likely due to varying vaccination rates in each state. States with higher vaccination rates seem to have lower death rates given the vaccine’s ability to reduce the severity of the virus; states with lower vaccination rates seem to have higher death rates.