Crypto Market Update

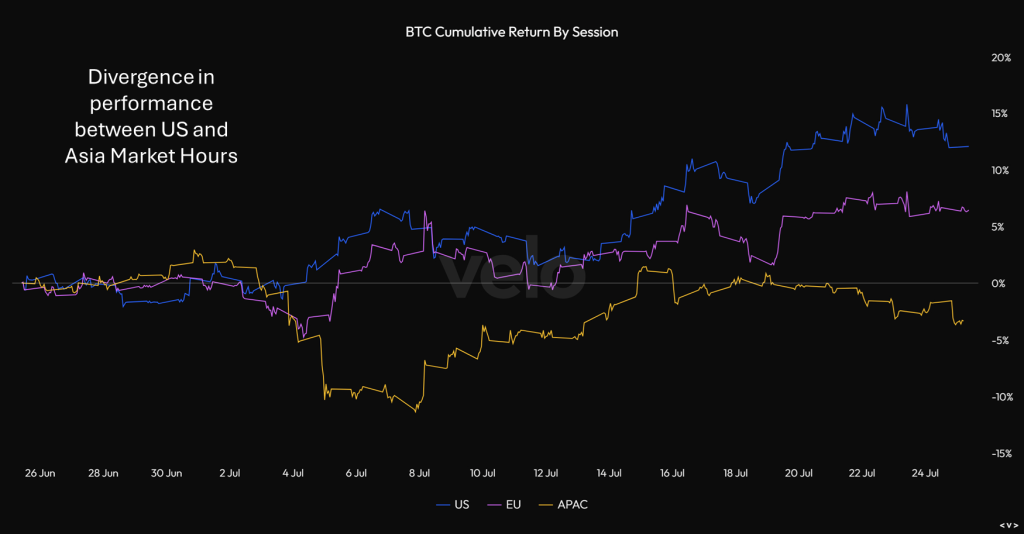

Crypto was certainly looking strong relative to equities yesterday until Asian market hours commenced. Shortly after the HK market opened, we saw increased sell pressure and approximately $100 million in liquidations across all crypto assets, bringing BTC down to below $64,000, ETH down to $3,150, and SOL to just below $170. This contrast in price action during U.S. and Asia market hours has been consistent throughout July. Over the past month, BTC is up 12.2% during U.S. hours and down 3.4% during the APAC session. Crypto prices have rebounded since the U.S. market opened, in line with the broader bounce in risk assets. This is despite a hotter-than-expected GDP, which led to an upward impulse in rates. Equities are showing a strong bounce, with small caps once again outperforming large caps. All eyes will now turn to the PCE and possible BTC conference-related catalysts tomorrow.

AAVE Weighs a Fee Switch

Aave’s latest proposal, led by Marc Zeller of the Aave Chan Initiative (ACI), seeks governance feedback on implementing a “fee switch” to redistribute a portion of the protocol’s net excess revenue to key users. The proposal outlines a roadmap for this redistribution as part of an updated “AAVEnomics.” It aims to segregate and enhance the efficiency of the Safety Module by eliminating reliance on secondary liquidity, thus allowing for slippage-free debt coverage. The proposal also introduces the concept of Aave protocol restaking, which could provide new revenue streams. This initiative is designed to bolster the protocol’s long-term sustainability and efficiency, potentially increasing net excess revenue and aligning user incentives more closely with protocol growth. The proposal is currently open for community feedback and will proceed to a snapshot vote if consensus is reached. Investors certainly found the proposal favorable, with AAVE token outperforming this morning.

MARA Buys $100 Million of BTC

According to a press release today, Marathon Digital (MARA -1.79% ) has purchased $100 million worth of bitcoin and reinstated its strategy to hold all mined BTC on its balance sheet, now totaling over 20,000 bitcoins valued at approximately $1.3 billion. CFO Salman Khan cited Bitcoin’s recent price decline and Marathon’s strong balance sheet as key factors behind returning to this strategy, while CEO Fred Thiel emphasized their confidence in Bitcoin’s long-term value as a treasury reserve asset. Marathon held $268 million in cash as of June 30 and will report its Q2 earnings on August 1st. While this does not affect the operations of MARA, it should increase its beta to BTC going forward.

Technical Strategy

TRON continues to show exemplary relative strength and remains one of the more favored Cryptocurrencies, after having suffered just minor weakness during the early part of July following its steep runup from May lows. Recent consolidation has not served to give much technical damage to its larger trend, and a rally back to recent highs looks likely into the month of August. Technically, the area of $0.14890 looks important, and weekly TRX closes above this level should allow for acceleration up to challenge all-time highs from April 2021 near $0.18. It maintains an excellent intermediate-term technical structure, and has formed a large Cup and Handle pattern from early 2021 which should give way to an upside breakout of its Handle in the weeks ahead. Only a move back under $0.105 would serve to postpone its rally, which isn’t anticipated in the coming weeks.

Daily Important MetricsAll metrics as of 2024-07-25 12:08:24 All Funding rates are in bps Crypto Prices

All prices as of 2024-07-25 12:45:00 Exchange Traded Products (ETPs)

News

|