-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 3

Understanding Beta With A Real World Example

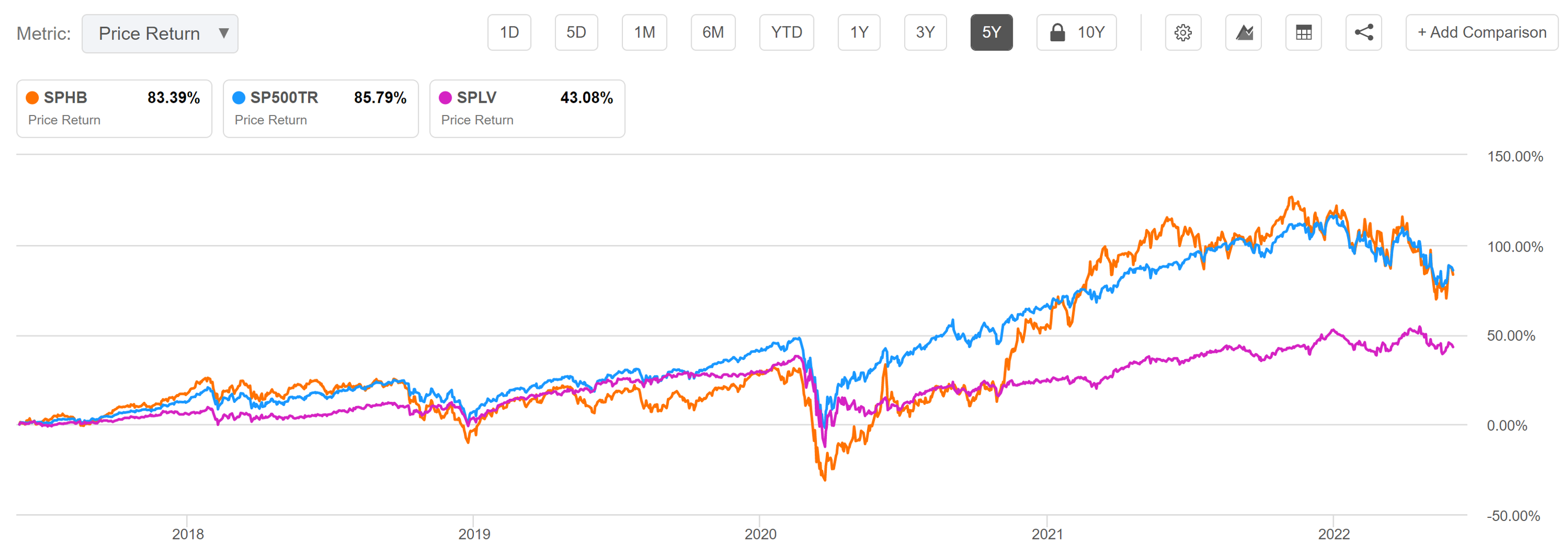

Our Head of Research, Tom Lee, made one of the great “blood in the streets” market calls of the 21st century when he told investors to pile into the worst affected stocks by COVID-19 or those at the “Epicenter” of the crisis. We did another guide on the rise of ETFs. One such ETF actually gives you direct exposure to the 100 stocks in the S&P 500 with the highest beta, the $SPHB. The nature of beta itself and which stocks exhibit the highest beta will change when the catalysts drive the market change. For example, when the market was processing the extraordinary economic impact of COVID-19.

About 7% of the economy were the heavily affected “social distancing casualties. When the catalyst of COVID-19 came to be a primary driver of markets, these stocks would routinely be up or down far more than the market since their fortunes were so heavily tied to COVID-19 cases and related restrictions. Because of this, these stocks had the highest beta for much of the period, dominated by COVID. We, therefore, suggested SPHB as a good way to get exposure to the Epicenter trade.

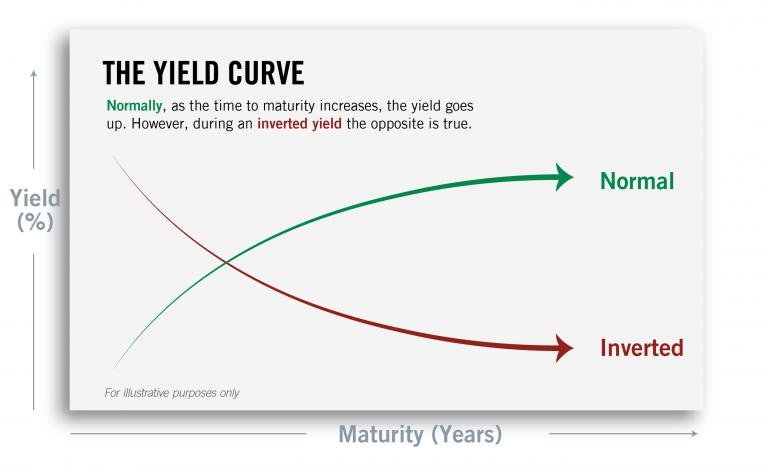

As you can see, in early 2021, the SPHB outperformed the broader index. When COVID was driving markets, the index, which is rebalanced quarterly, was primarily comprised of hard-hit travel names and cruise lines. There were also a lot of energy and financial components. However, as the Fed cycle transitioned to tightening around the End of 2021, interest rates rose. When interest rates rise, so does the discount rate for stocks, which means companies with more of their net present value comprised of future earnings get hit particularly hard.

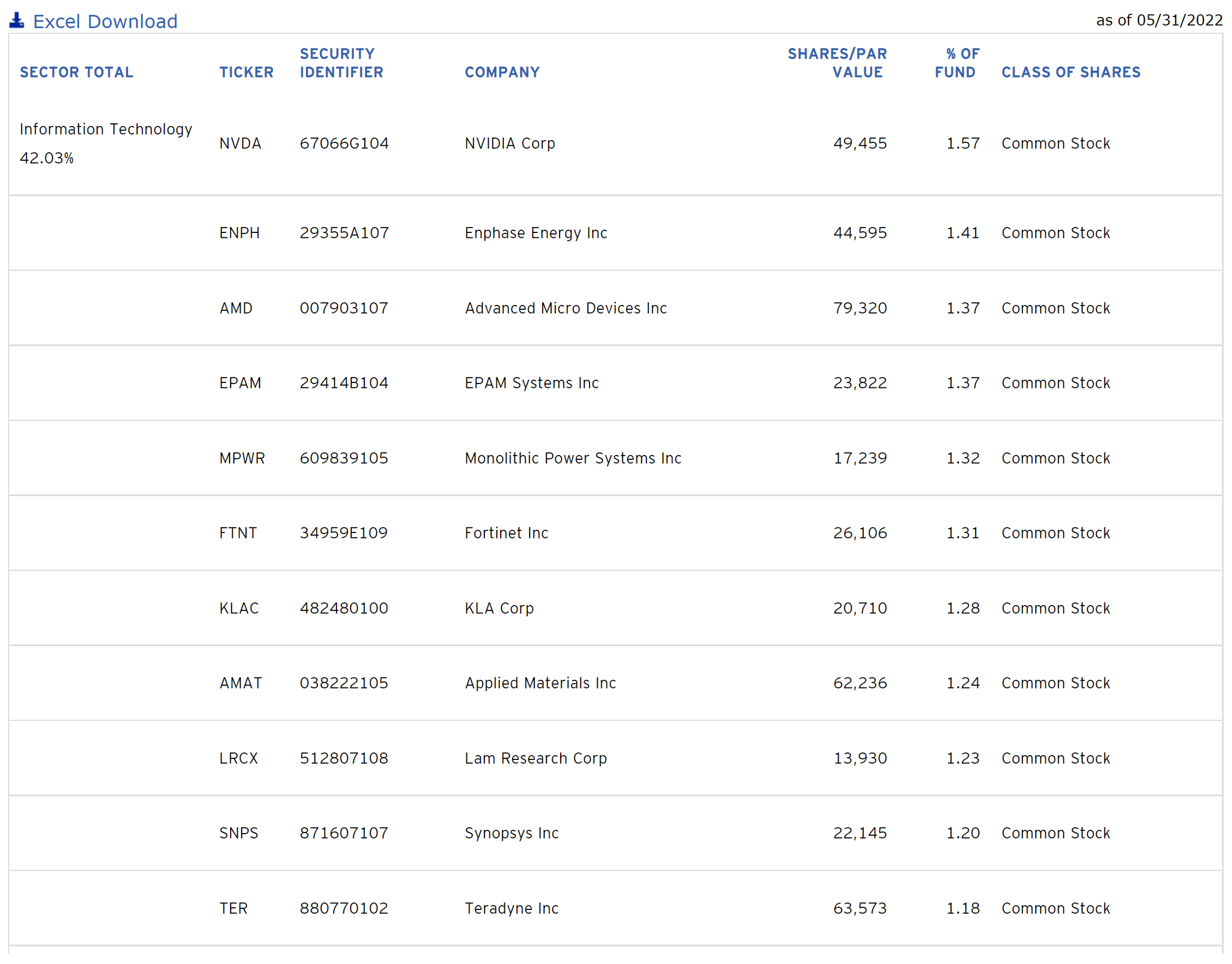

So, as the driver of a hawkish Fed and rising interest rates became more prevalent as COVID simultaneously retreated, the highest beta stocks in the market changed from the COVID-19 social distancing casualties to technology companies with high P/E ratios. These stocks experienced more significant losses than the overall market and stocks with lower P/E ratios and thus led the way down. So as the catalysts in the market change and as specific drivers for particular groups of stocks ebb and flow, the highest beta companies comprising the SPHB index will change dramatically.

Seeing what is in the SPHB ETF is one way of getting the market’s temperature. What is in the index will illuminate what key catalysts the market is attempting to discount. As the market digests new information, it often overshoots, undershoots, and then overshoots again. While catalysts may be unique to each time, this perennial pattern has been a feature of markets since their inception. You can see below that even though there was almost no technology in the SPHB in early 2021, by May 2022, the holdings of SPHB are dominated by Technology names that have suffered from multiple compression. The measurement of Beta certainly hasn’t changed, but the main catalysts driving prices certainly did.

Related Guides

-

Series of 4~7 minutesLast updated4 months ago

Series of 4~7 minutesLast updated4 months agoWhy The Mysterious R-Star Should Be on Your Radar

Economists lose sleep over it. Central bankers get asked if we’re close to it. Most Americans don’t realize it, but their lives are quietly guided by it. The it here is the neutral rate of interest, also known as r-star or r*, which powers, penetrates, and binds all aspects of the economy.

-

Series of 4~13 minutesLast updated1 year ago

Series of 4~13 minutesLast updated1 year agoThe Federal Reserve: What it is and why we care about it

Overview of the history, structure, and market impact of the Federal Reserve

-

Series of 8~18 minutesLast updated3 years ago

Series of 8~18 minutesLast updated3 years agoHow To Pick Stocks?

Learn some stock-picking techniques to master your strategies.