-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 2

The Great Debate: Active Versus Passive

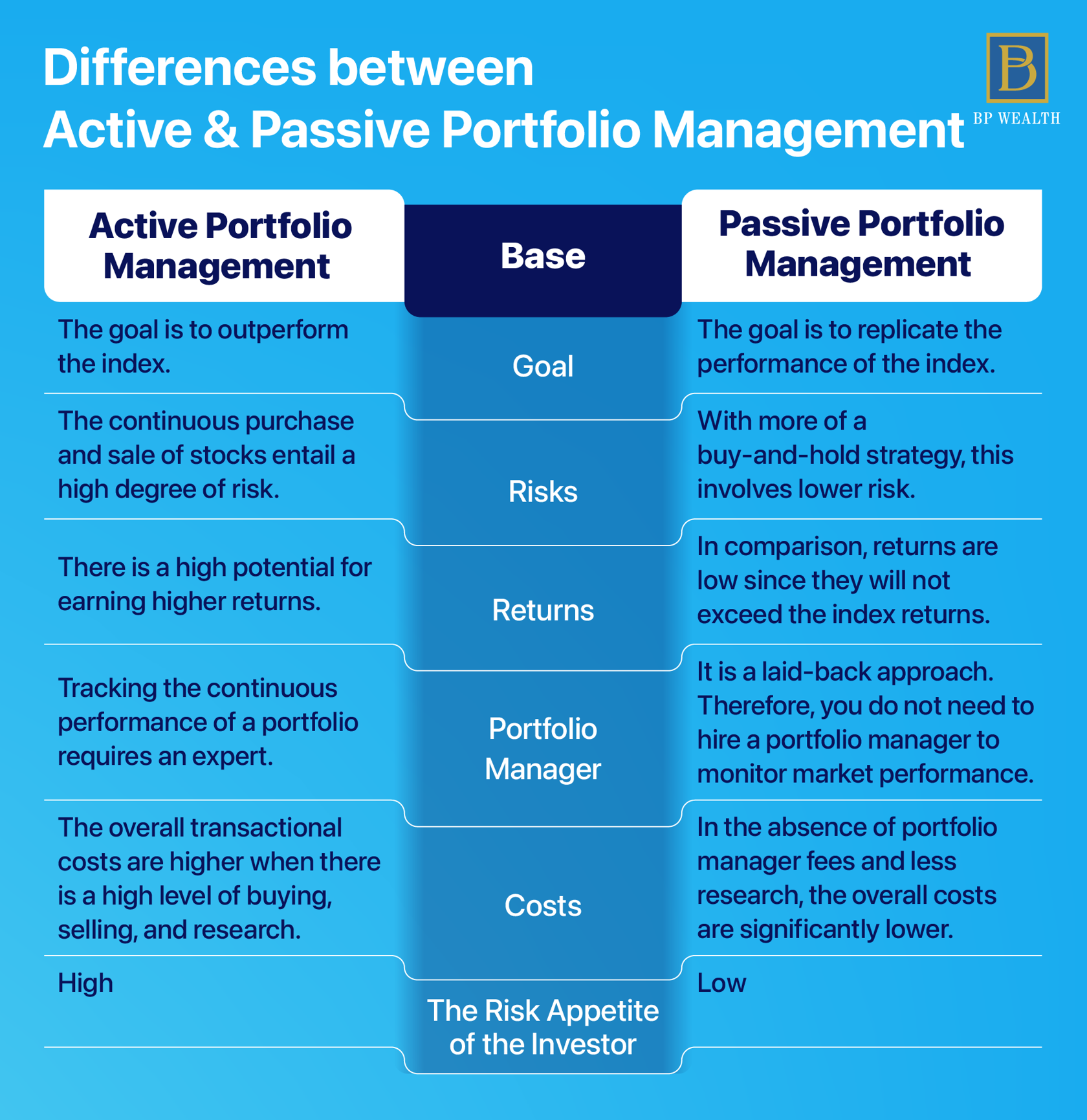

So, some investors believe the best thing to do is buy the haystack rather than find a needle in it. This concept is called passive management,and it aims to mimic the returns of a given index or group of securities rather than seeking to get a return above the benchmark. This type of management is mainly responsible for the rapid proliferation of ETFs over the past decade, which are usually passive vehicles. Active management seeks to outperform the market by actively allocating capital to assets in different proportions than that of the index or benchmark. This is one of the great divides on Wall Street in terms of investing styles, and it will result in very different actions by investment professionals.

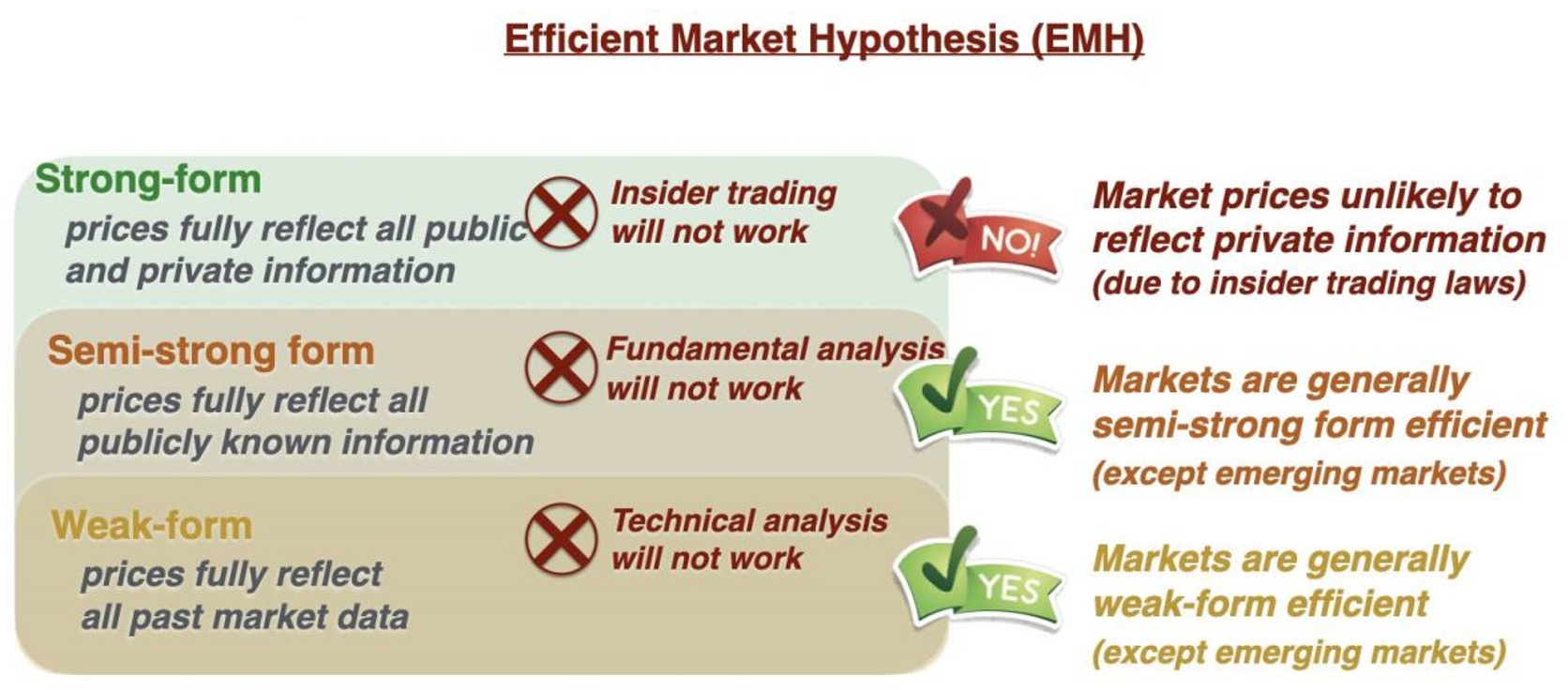

Acclaimed American Economist and writer Burton Malkiel, who wrote the finance classic A Random Walk Down Wall Street, is a major proponent of the Efficient Market Hypothesis (EMH). This theory is essential to understand before investing as it is one of the main differentiating philosophies between different groups of investors. According to the critical view, markets should efficiently consider all the public information when determining asset prices. Therefore, stocks are trading at their fair value at any given time, according to the EMH.

Taken to its’ extreme, as Mr. Malkiel does in his book, this implies that monkeys randomly throwing darts to select stocks should perform just as well, if not better, than any active management strategy over time. Only 17% of active managers beat the market over ten years, and if you stretch that out to 20 years, the number dwindles to a mere 6%. The longer funds are managed actively, the less chance they offer consistently lucrative returns than the overall market.

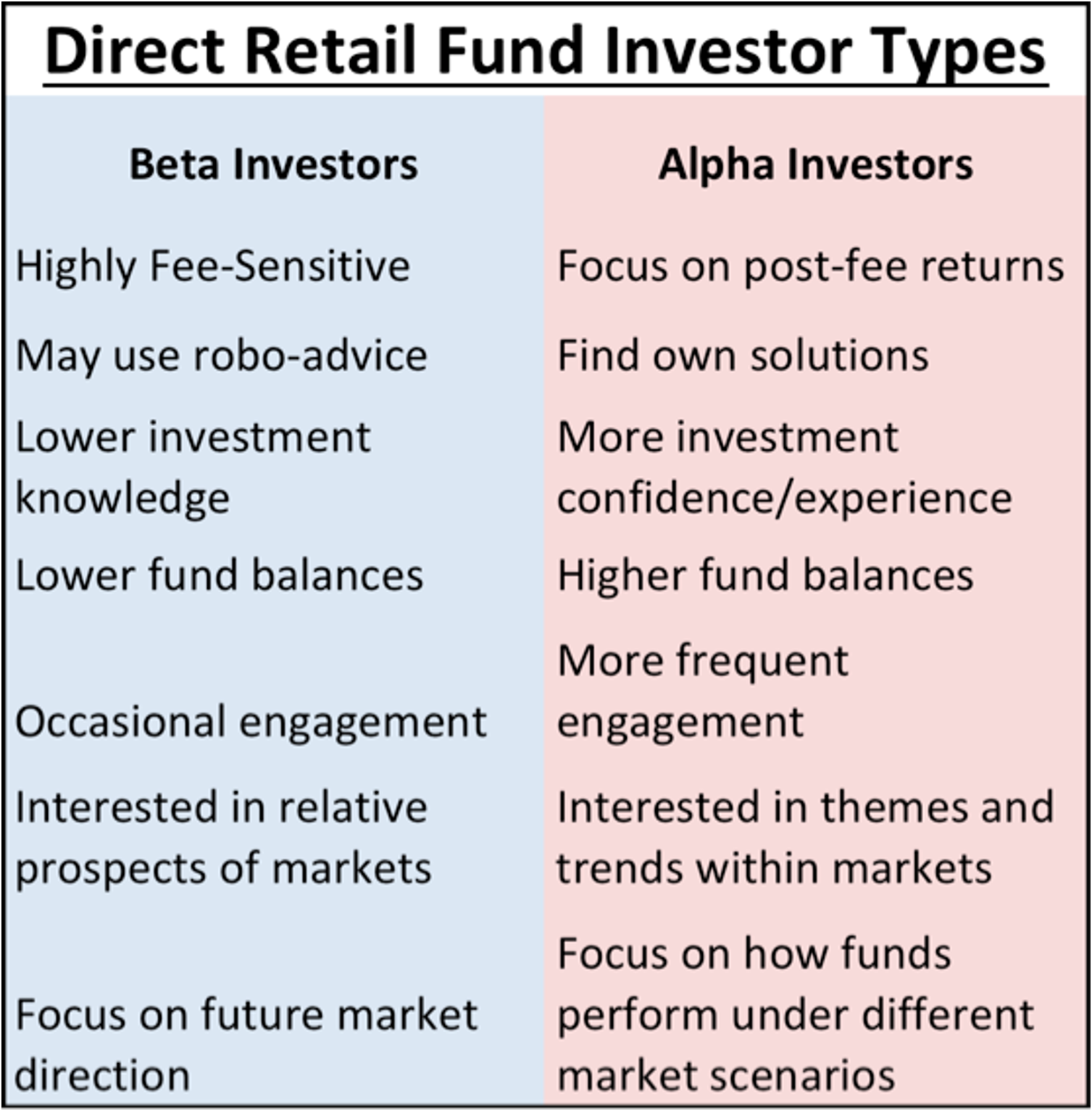

Alpha and Beta

Those who disagree with the efficient market hypothesis believe that markets may not correctly value assets over time because of asymmetric information. Proponents believe they can achieve Alpha by successfully identifying mispriced securities. Alpha is an important term in the discourse of investing, particularly for the institutional crowd. This term refers to the measurement of an investment’s return compared to the broader market or a particular index that it is being compared to. Alpha is also sometimes used interchangeably with the term risk-adjusted return.

Alpha = End Price + Distribution Per Share – Start Price/ Start Price

On the other hand, Beta refers to an investment’s relative volatility compared to the market or a specified benchmark. So, a stock with a beta of 1.0 has the same volatility as an investment. A stock with a .8 beta will be 20% less volatile than the overall market. A stock with a beta of 1.2 will be 20% more volatile than the market or benchmark. Both Alpha and beta are historical measures. Beta should not be thought of as a static variable that never changes. It very much changes with the drivers and catalysts that affect the market at any time.

Beta = Covariance of Asset’s Return With Market Return/Variance of Market’s Return

Alpha and Beta are inextricably linked. Risk-adjusted return essentially measures what you are getting paid for the risk you’re taking. If you’re taking more risk than owning the index, you should get better compensated for that risk. If you’re getting a better return than the market, then the price is usually at least partially enduring volatility. Volatility is often the “price,” so to speak, of market-beating returns. Beta cuts both ways, a stock with a high beta will tend to overperform when the market goes up and will also perform worse when the market goes down. Risk-averse investors tend to prefer lower beta stocks, while more aggressive investors seek out a high beta. Remember, alpha and beta are always backward-looking as well.

In a nutshell, the goal of most investors is to get the best return possible for the volatility they are shouldering. There has also been the rise of strategies that mix active and passive management as a smart beta strategy. These aren’t quite the same as actively managed strategies and use active allocation of passive ETFs in an attempt to outperform the market. It is a hybrid approach since it aims to outperform using certain guiding factors but generally uses passive ETFs.

Related Guides

-

Series of 4~7 minutesLast updated3 months ago

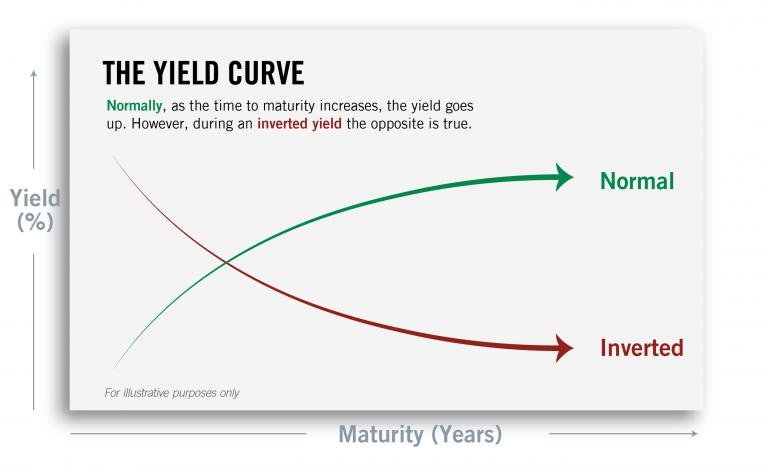

Series of 4~7 minutesLast updated3 months agoWhy The Mysterious R-Star Should Be on Your Radar

Economists lose sleep over it. Central bankers get asked if we’re close to it. Most Americans don’t realize it, but their lives are quietly guided by it. The it here is the neutral rate of interest, also known as r-star or r*, which powers, penetrates, and binds all aspects of the economy.

-

Series of 4~13 minutesLast updated1 year ago

Series of 4~13 minutesLast updated1 year agoThe Federal Reserve: What it is and why we care about it

Overview of the history, structure, and market impact of the Federal Reserve

-

Series of 8~18 minutesLast updated3 years ago

Series of 8~18 minutesLast updated3 years agoHow To Pick Stocks?

Learn some stock-picking techniques to master your strategies.