-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 2

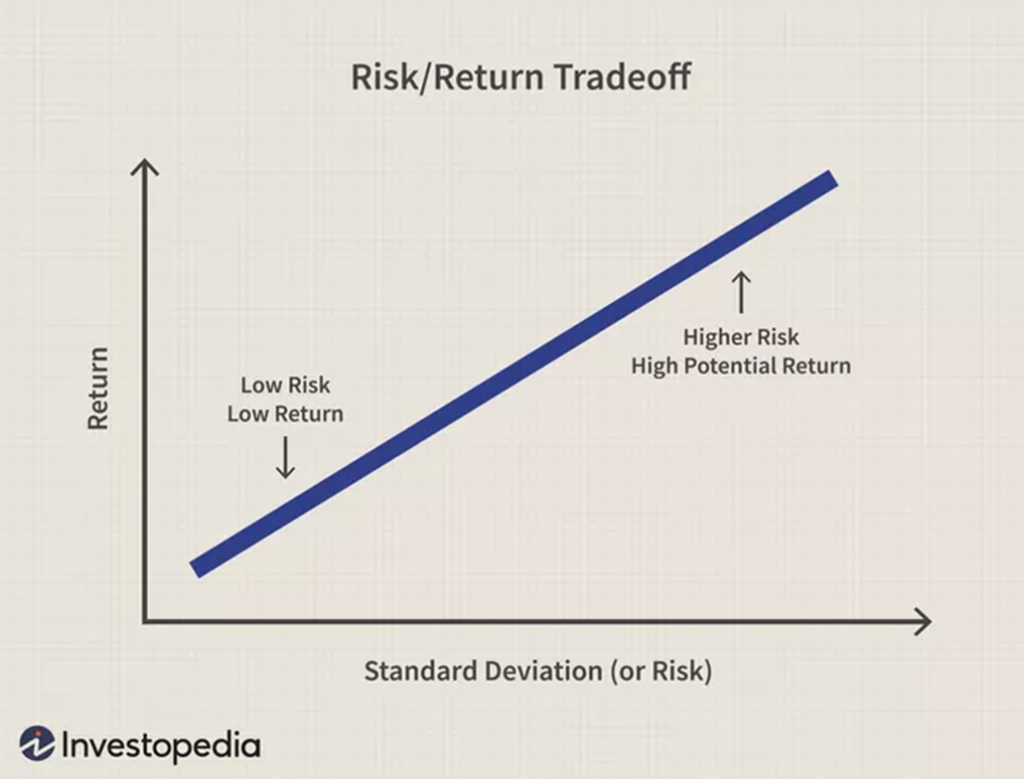

Recognizing Risk Starts With Knowing Yourself & Your Goals

To perform well, we must understand risk, then recognize when it’s high, then control it. This is easier said than done but knowing yourself is a good place to start. Much of an investor’s risk tolerance has to do with soft skills, upbringing, background, life experiences, and objectives. Time horizon and risk profile are floated around investing circles as cliches, and there’s good reason for it. They matter.

For an individual investor, knowing your risk tolerance and investing goal is crucially important, says Adam Gould, our Head of Quantitative Strategy. “You must think about what your goal is: Do you want to outperform? Are you good with the overall market return?” Gould says, adding that most of us are risk averse. In general, we’d prefer taking on less risk. So, when considering an investment, Gould says that the decision process lies in the risk entailed as well as the return. Return tells just half the story. Risk assessment is required.

In other words, the returns mean only so much by themselves. The risk taken must be assessed as well. Was the return achieved taking on a lot of risky, or with a safer strategy? Timing also matters: Time risk is generally defined as when an investment might work as you expect, but not when you expect.

There are many risks, almost always. Whether in plain sight or lurking, they are there: Freakish, once-in-a-lifetime events. Pandemics. Federal Reserve blunders. These risks are a common example of the importance of diversification, which is different for everybody. But in general, diversifying across stocks and sectors can minimize risk without sacrificing too much return.

“If you structure a portfolio properly, and it’s properly diversified, you can expect more return for the same level of risk,” Gould says. “Again, you must know your risk tolerance. If you concentrate your wealth in one stock, if stock goes up, it works for you. But that’s where diversification comes in. If the stock goes down, you want to be diversified.”

Overall, humans are naturally wired to be terrible investors. There’s a reason most of the pack buys high and sells low when the reverse strategy works much more effectively. In surging bull markets such as that of 2019-21, many investors might have felt the riskier the investment, the better the return. But riskier investments don’t necessarily mean greater return. If riskier investments reliably produced higher returns, Howard Marks once noted, they wouldn’t be riskier.

“It’s an oversimplifying – but not a grievous one – to say the inevitable hallmark of bubbles is a dearth of risk aversion,” Marks once wrote. “In crashes, on the other hand, investors fear too much. Excessive risk aversion keeps them from buying even when no optimism – only pessimism – is embodied in prices and valuations are absurdly low… When investors in general are too risk-tolerant, security prices can embody more risk than they do return. When investors are too risk-averse, prices can offer more return than risk.”

Of course, you could remove nearly all risk. But you’d probably be avoiding returns as well. After all, risk makes the whole game interesting and rewarding.

Said Will Rogers: “You’ve got to go out on a limb because that’s where the fruit is.”

Related Guides

-

Series of 3~5 minutesLast updated1 month ago

Series of 3~5 minutesLast updated1 month agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated11 months ago

Series of 3~9 minutesLast updated11 months agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis

-

Series of 4~10 minutesLast updated2 years ago

Series of 4~10 minutesLast updated2 years agoCommodities 100

An introduction to commodities for novice investors.