-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 1

How to Maximize Return Without Getting Into Your Own Way

“A bull market shouldn’t be described as a percentage price movement. For me, it’s best described by what it feels like, the psychology behind it, and the behavior that psychology leads to.” -Howard Marks

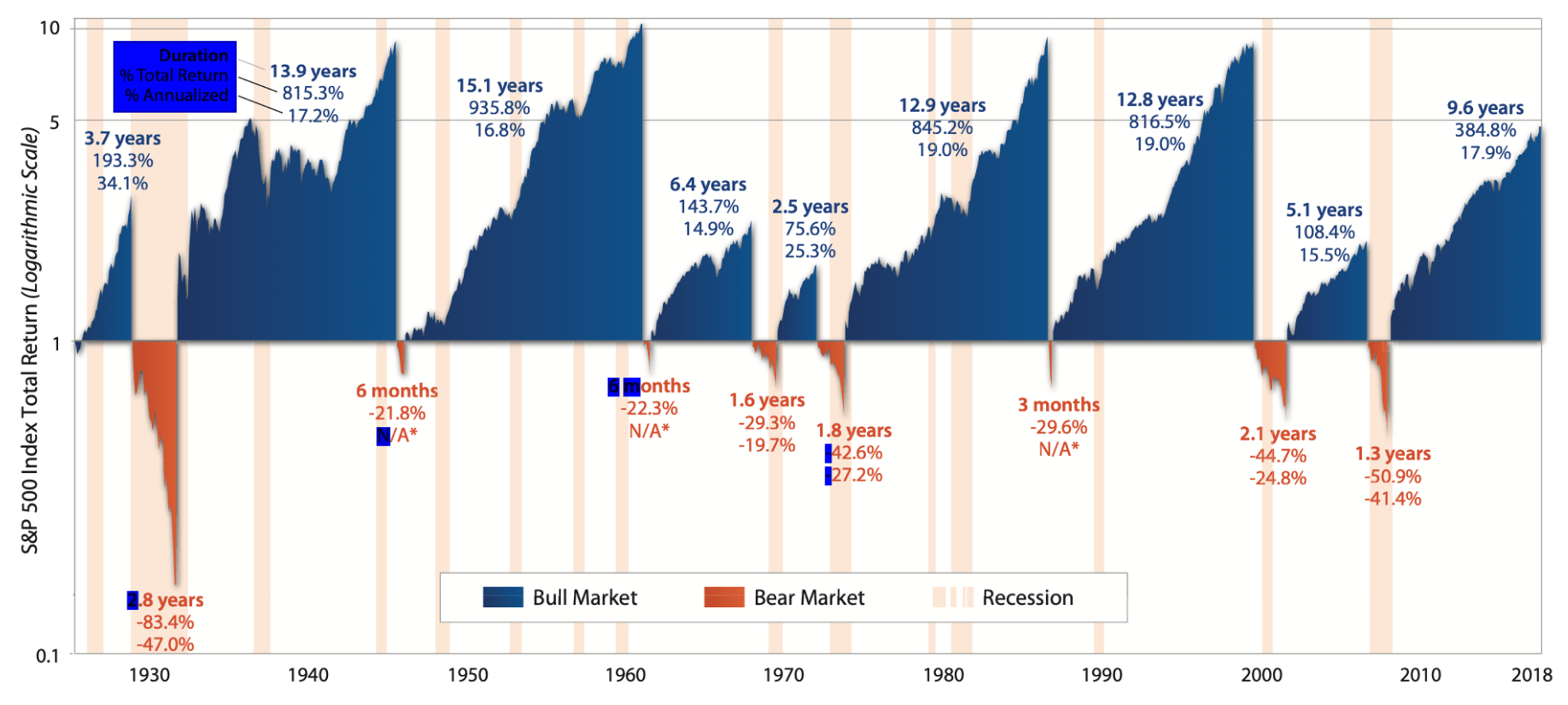

Lions and tigers, bulls and bears, alpha and beta, oh my. Much of the market vocabulary and key investing concepts that regularly are thrown around can confuse the uninitiated and those who are “green” in the world of markets. As Mr. Marks points out above, while there is a technical definition of a bull and bear market (20% gains or declines in either respective direction), the psychological character of the market is perhaps a more important determinant than some arbitrary level of gains or losses. Bull markets are marked by optimism and the Fear of Missing Out (FOMO), leading to forced liquidation. Bear markets are characterized by pessimism and declining economic prospects. The market is in a bull market most of the time, and they tend to last longer and produce more returns to the upside than bear markets result in to the downside.

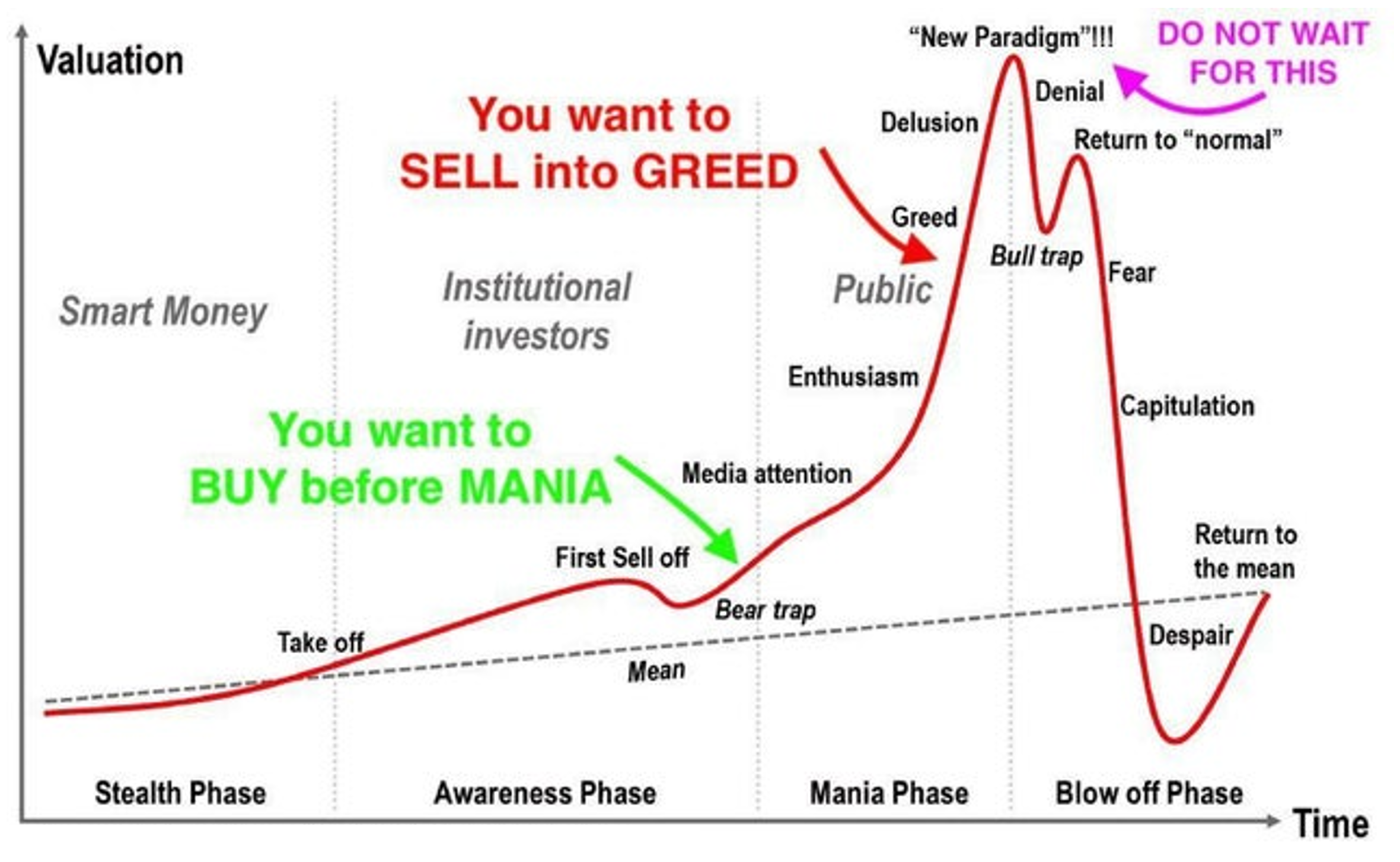

This forced liquidation, or essentially panicked selling, tends to bring asset prices irrationally low which then entices discerning investors to start purchasing again. As the prices improve, it can often signal to other investors that things aren’t as bad as the panic suggested. As prices rise, more and more investors begin to feel that recent history will continue repeating itself and so buy as asset valuations continue to appreciate, sometimes to levels unjustified by underlying cash flows.

As the expectation becomes ubiquitous that times are good, the risk of the whole process starting over again rises. Sometimes, an exogenous shock like COVID-19 can knock markets off their kilter, or sometimes investor ebullience naturally resolves itself when no more buyers are left. Then comes the forced liquidation that resets this delicate psychological dance. While analysis at the security level is critical, analysis of markers of where investor psychology is can be equally crucial in determining whether it’s time to buy or sell stocks.

Buy low, sell high. Sounds easy, right? Only it is not. Investors behave in strange ways that often defy logic, and if you think markets are easy and can’t understand what all the fuss is about, you might be right on the verge of being humbled. The market routinely bests even the Wall Street Pros. You might hear about this year’s hot hedge fund or portfolio manager that is outperforming the market by however much percent. The odds are that they will be trailing the market level of return in the next year or two. A sizeable intellectual contingent of academic and financial thinkers believes that beating the market over time is impossible. The numbers somewhat vindicate them but don’t explain the cream of the crop of active managers who have outperformed the market successfully over time.

Prolific investment theorist Benjamin Graham famously described the market as a voting machine in the shorter term while describing it as a weighing machine in the longer term. Since the S&P 500 was introduced in its modern form in 1957, it has returned an average of 10% a year. However, in only six of those years was, the annual return between 8% and 12%. This means there’s massive divergence in returns every year and that most of the time, the annual returns will most likely be far from the long-term average in either direction.

Buying low and selling high is deceptively straightforward advice, kind of like “just hit the ball straight at the hole and get there in as few strokes as possible” is definitely sound advice in the game of golf. Achieving such an outcome is infinitely more complex. As in golf, investing is simultaneously a game against opponents and yourself. Your score is kept in relation to the score of other golfers, but if you don’t master your temperament and discipline, you might end up hacking up the fairway and scoring double digits on a par three.

Many things can lead to investors making poor decisions. However, before understanding how to score well, we must understand a few basic concepts that are crucial to understanding how people keep score in investing. We will then walk you through some critical ways investors score poorly compared to others. Mastering the concepts of investors’ psychology is an intellectual house of mirrors but learning how to spot the folly of the crowd, or whether you even want to compete with it at all, can significantly lower your stress and help you get better returns. Remember, while every time has unique catalysts and factors that drive markets, the perennial presence of irrational investor behavior is also always a factor at play as well.

Related Guides

-

Series of 4~7 minutesLast updated2 months ago

Series of 4~7 minutesLast updated2 months agoWhy The Mysterious R-Star Should Be on Your Radar

Economists lose sleep over it. Central bankers get asked if we’re close to it. Most Americans don’t realize it, but their lives are quietly guided by it. The it here is the neutral rate of interest, also known as r-star or r*, which powers, penetrates, and binds all aspects of the economy.

-

Series of 4~13 minutesLast updated1 year ago

Series of 4~13 minutesLast updated1 year agoThe Federal Reserve: What it is and why we care about it

Overview of the history, structure, and market impact of the Federal Reserve

-

Series of 8~18 minutesLast updated3 years ago

Series of 8~18 minutesLast updated3 years agoHow To Pick Stocks?

Learn some stock-picking techniques to master your strategies.