Near-term trend remains negative for SPX until 6770 can be exceeded, and despite the two-day bounce, more will be needed to help restore the technical health in US Equities after last week’s breakdown. SPX has now largely weakened enough to satisfy the 3-5% consolidation that was thought possible for November; Yet some trend improvement remains necessary before trying to call a low. Both Market breadth and momentum will need to begin to strengthen more meaningfully to suggest that markets can push up into the end of the year, as right now this projection lacks confidence. While NY Fed President Williams helped to boost the chances of a December rate cut based on Fed fund futures pricing, this looks anything but clear. It’s thought that both the US Dollar and the US Treasury yields might begin to rally in unison ahead of the FOMC before dropping back to new monthly lows into January. Technology remains the area of focus following the sharp drawdown last week, followed by Monday’s strong rally.

Overall, this remains a tricky time for US Equities as momentum, breadth, and trends have all worsened in recent weeks. The lack of clarity with regard to FOMC’s December plans, along with a lack of clarity regarding the liquidity, remains a big issue that certainly could come together to derail rally attempts.

As discussed last week, Elliott-wave theory, Cycles, and DeMark all seem to converge on late November to provide support and a rally. Last Friday’s snap-back rally happened on above-average bullish market breadth, and now Monday’s rally also occurred on better market breadth after having started out the session on a weaker note.

Resistance lies at 6770, while breaks of 6521 could lead to 6418, a level which has some importance based on the most recent trend down from 11/12 highs. For QQQ 2.65% , any break of 580 would put the price into a very attractive area of support from a risk/reward perspective, with an ideal area for a low near 567-570.

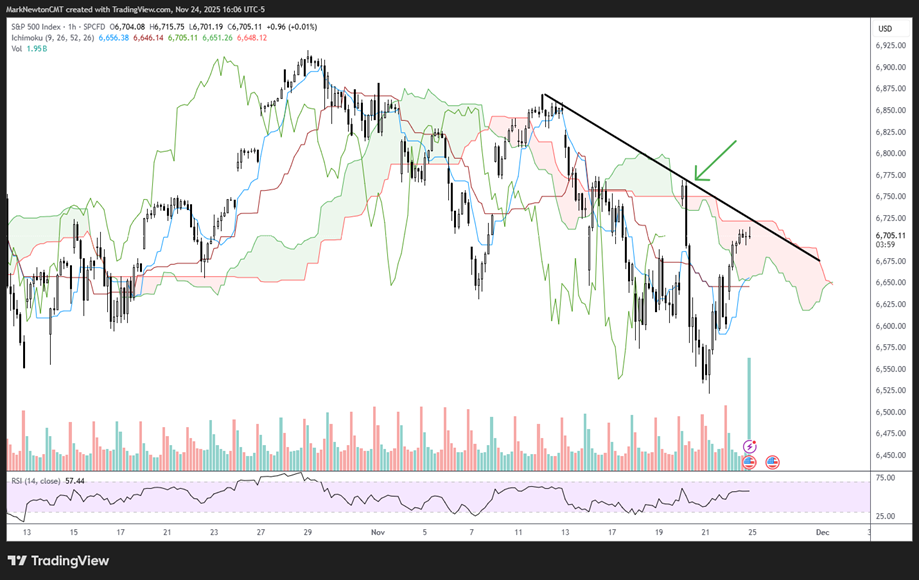

As seen below, the downtrend from mid-November intersects 6725, which certainly has some importance and served to thwart Monday’s equity rally as four straight hours of afternoon trading failed to lift prices above this downtrend.

However, last Thursday’s peak at approximately 6770 looks more significant, and is an area to watch, which would turn the trend back to bullish if exceeded.

S&P 500 Index

Magnificent 7 ETF (MAGS 3.21% ) looks to have rallied to an important area

All eyes are on Technology following the sharp decline over the last couple of weeks, followed by the gains last Friday into Monday’s close.

As seen below, the Magnificent 7 ETF by Roundhill (MAGS 3.21% ) did not break down under October lows, but rather held support and has bounced.

Moreover, this bounce has now rallied back to what’s considered technical resistance on this snapback bounce within the existing downtrend from late October.

Overall, I think it’s going to be important to keep a close eye on this area in the next few days.

Stocks like AAPL 1.68% and GOOGL 6.36% have experienced very positive moves in recent days, which have served to help provide a minor tailwind to ^SPX’s rally efforts. However, others like META 3.16% , MSFT 0.40% , and NFLX 2.20% remain under pressure and are well off their all-time highs.

(NVDA 2.29% also would join this group of stocks, which pulled back sharply from its highs and is now trying to stabilize.)

Overall, I feel that if AAPL 1.68% exceeds $277 on a close, then MAGS 3.21% might break out and allow for a larger snap-back rally in Technology.

However, at present, one cannot make this call, and MAGS 3.21% lies within a pretty prominent one-month downtrend.

I view any daily close above $66.11 in MAGS 3.21% to be bullish and might help Technology demonstrate a bullish technical recovery rally.

The next 2-3 days should be important in this regard, as for now, Technology’s short-term trend turned more negative last week and now lies at its first important area of resistance.

Roundhill Magnificent Seven ETF

Medical Device ETF is now breaking out to the highest levels since Winter 2025

One area of interest within the Healthcare sector, which looks to be suddenly trying to play “catch-up,” is the Medical Device names.

IHI 1.04% is the iShares Medical Device ETF, which closed on Monday at $63.35, the highest level since early March 2025. Stocks like BFLY 23.77% , INSP 30.51% , QDEL 9.16% , TMDX 6.42% , and AXGN 6.33% were all higher by more than 20% in the rolling five-day period. Today’s rally should help IHI push higher to $65.18, and possibly $67.29 to test all-time highs

My favorite technical stocks within Medical Research/Equipment/Services are: A 1.55% , MEDP 4.51% , and CNTA 4.97% from a trend following perspective. For those who wish to look at high momentum names that are well off all-time highs, I would suggest looking at FLGT 2.17% and RGEN 2.92% .

iShares U.S. Medical Devices ETF

Is Healthcare going to continue to strengthen or begin to pull back?

We heard today that Treasury Secretary Scott Bessent discussed a possible announcement this week concerning the Administration’s plans on bringing down US health-care costs. We’ll see if this announcement adversely affects this sector, which has shown a stellar run-up in the last month.

Indeed, many investors know that Healthcare has been the best performing sector over the last month, along with the last three months, at a time when the majority of the major sectors have weakened. (Equal-weighted RSPH performance (1-month +3.47% and 3-month performance +6.91% through 11/24/25.))

While I expect an eventual stalling out in Healthcare, it still looks hard to do so with Biotech, Pharmaceutical, and Medical Devices sub-sectors all doing well.

Charts on sub-sector ETFs like XBI 2.43% , PPH 0.15% , XHS 2.32% , along with IHI 1.04% (shown above), all look very good in the near-term, and it might take longer than anticipated before this sector starts to show absolute weakness.

As shown below, the weekly chart of RSPH 0.98% vs. RSP 0.41% looks to be at a critical juncture, and this relative ratio is showing a TD Sell Setup this week (9 Consecutive weekly closes above the close from four weeks prior), which often can drive some exhaustion in performance.

However, the downtrend looks to be clearly broken this week, which necessitates some waiting before weighing in that Healthcare should begin to underperform.

Given that many parts of Healthcare are starting to show excellent strength, I feel this sector still offers an attractive opportunity on an absolute basis. Furthermore, I expect that any minor stalling out in relative terms of Healthcare to the broader market might just prove to be a buy signal on Technology, which might be poised to come back.

RSPH/RSP