Near-term US Equity trends are bullish, and despite the minor pullback from the highs of the trading channel, AMZN, GOOGL, TSLA, NVDA, PLTR, and AAPL all still look quite bullish and have not shown proper evidence that they have peaked out. While the bifurcation between large-cap Technology/Discretionary and the broader market has grown more severe, the Elliott structure of this minor pullback from 10/29 peaks doesn’t look compelling as being a peak of any magnitude. Overall, I expect that US stock indices have entered a much choppier trading environment between now and the end of November. However, I still envision that Technology can make another run for new highs into November. The power of that alone can help markets to stabilize despite the recent breadth deterioration. Over the next 24 hours, I’m expecting that QQQ very well could be bottoming after having reached 618 support. Meanwhile, SPX has shown some minor positive divergence but might require a drop to 6735-6750 before this stabilizes and begins to turn higher. I am expecting a bottom in Equities this week in the short run, while cryptocurrencies might take another 3-5 days, but also look close.

Short-term pullbacks in US Equity indices now look to be nearing initial support, which might offer some stabilization after the recent drawdown over the past week.

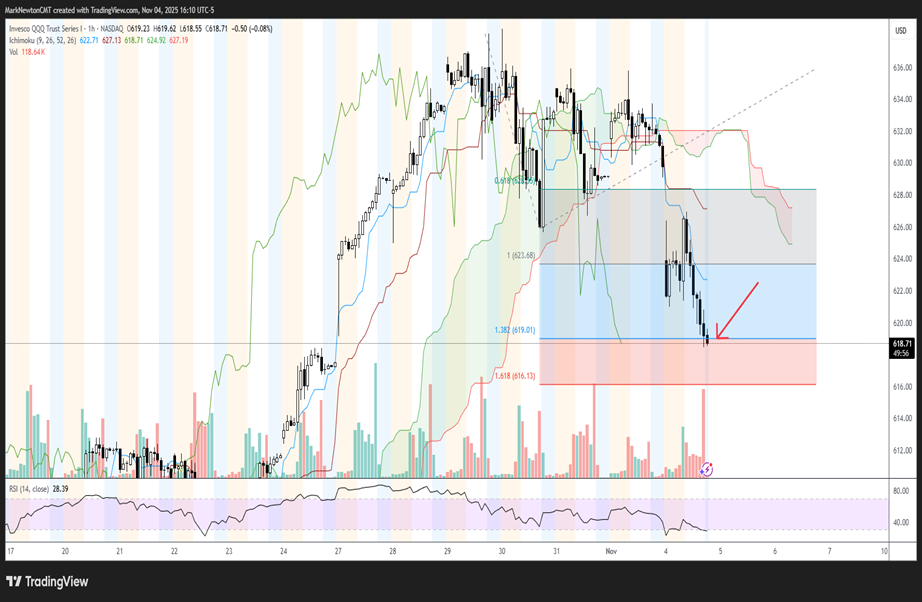

Both the ^SPX pattern and the QQQ 2.65% pattern show a corrective pullback underway, which resembles an ABC-type decline.

Thus, while I did expect some consolidation in November, it’s hard for me to make the case for additional selling to grow too pronounced this week.

QQQ 2.65% target, which I listed on Flash insights today, was 618, while ^SPX targeted support is 6735-50. As shown below, ^SPX has pulled back to near the prior high, which was made in early October. Moreover, it might also fill both of the open gaps in the last two weeks.

Ideally, ^SPX should begin to stabilize on Wednesday and turn back higher for new highs.

S&P 500 Index

QQQ pattern looks to possibly be complete after this pullback

I had mentioned in Flash Insights early Tuesday morning that the open gap might lead to a false bounce attempt, followed by a test and break of the early morning Tuesday lows.

That has happened, and now the price looks to be very close to support, where ideally this should begin to stabilize and turn back higher.

Reasons for optimism have to do with two important factors:

- Wave structure from 10/29 looks corrective, and the hourly chart shows a likely completed five-wave Elliott-wave decline (5th wave down of C), which might have bottomed Tuesday near 618.

- It looks unlikely that NVDA 2.29% , AAPL 1.68% , PLTR 5.27% , TSLA 6.80% , and GOOGL 6.36% have made peaks of any seriousness. Thus, the last couple of days of pullback likely offer attractive opportunities in all of these stocks to push even further to the upside into mid-November.

If my thinking is correct, then QQQ 2.65% likely should begin to stabilize and turn back higher starting on Wednesday.

Invesco QQQ Trust Series

Insurance stocks strengthened on Tuesday and look to be bottoming where they need to be

One of the stronger sub-sectors of the market on Tuesday was the Insurance stocks with UNM N/A% TRV 0.27% , AJG -1.27% , MCY 1.56% , and CNO 0.94% all higher by more than 3%.

While Insurance was very hard hit from April into July of this year, the group has begun to stabilize in recent days following KIE 0.20% bottoming near the lows of the recent range.

This looks appealing at a time when the Financials sector has been showing DeMark-related exhaustion signals, and much of the weakness in recent months came from the Insurance stocks.

I find this area to be appealing at a time when markets have turned choppy. Stocks like CNO 0.94% , LNC 1.03% , AFL -0.54% , MCY 1.56% , UNM, and GNW N/A% are some of my favorites at this time, technically.

S&P Insurance ETF SPDR – KIE

Natural Gas has some short-term appeal after bottoming out

Natural Gas has begun to stabilize lately, and the act of the US Natural gas Fund LP (UNG -1.77% ) hitting the highest levels since July creates a near-term bullish scenario for UNG -1.77% .

I suspect that the act of having exceeded former peaks from early October at $14.07 should help to drive prices higher to test $15.04 initially, followed by $16.43.

Overall, while the technicals on WTI -2.69% Crude oil should start to turn back lower sometime in November, I suspect that Natural gas can enjoy a short-term pop into December or January before pulling back.

The act of bottoming out takes time, and UNG -1.77% looks to be in the first stages of showing some strength after its lengthy downtrend from March into August of this year.

United States Natural Gas Fund LP