Short-term trends remain bullish while market breadth continues to expand, given the recent improvement in the Equal-weighted S&P 500. It’s important that market participation is expanding after this push back to new all-time highs for SPX, and helps to establish some credibility to this move, which was lacking in both breadth and momentum back in May. Given the broadening out in the US Stock market over the last week, my view is that the push to new all-time highs will prove difficult to fade right away. Bond yields could very well diverge from the US Dollar’s weakness and bounce into mid-July as the Yield curve starts to re-steepen. Meanwhile, precious metals likely begin to turn back up in July, and Gold should push back to new all-time highs. Overall, I don’t sense that markets show much stalling out until after the Independence Day holiday, and even on a minor dip post 7/4, it’s likely that July should mirror the historically bullish seasonality trend in post-Election years that’s been working thus far in 2025. This calls for July strength in Equities, which might not show much consolidation until the month of August, which might prove more important.

As seen below, Invesco’s Equal-weighted S&P 500 ETF (RSP 0.19% ) has broken out and begun to push sharply higher, which is encouraging to the rally in risk assets.

Despite a nearly 3% decline in NVDA 2.05% on Tuesday, the fact that many Discretionary, Transportation-related, and Financial stocks rallied helped the Equal-weighted ^SPX close up strongly on the day with a big low-to-high range.

Small and mid-caps both outperformed, while the DJ Transportation Average rose by nearly 3% on the session.

Thus, while the Financial media was quick to point out that Trump might fail to extend the Tariff pause come July 9th, the bigger news, in my view, is the broad-based rally starting to accelerate on the breadth of nearly 3/1 positive on Tuesday.

Overall, I suspect an upcoming test of all-time highs is likely in RSP into the July 4th holiday, which lies approximately 2% higher than Tuesday’s closing price. Following this week’s holiday, there might be a brief stalling out in Equal-weighted and cap-weighted ^SPX next week. However, I do not expect meaningful weakness, and it might prove to be a 2-3 day affair ahead of further strength into August.

Invesco S&P 500 Equal Weight ETF

Regional Banks are also accelerating sharply, which should aid Financials on deregulation hopes

KRE 0.66% -This is arguably very bullish for Regional Banks today. The equal-weighted ^SPX breakout is now coinciding with the Regional Banks sector to also turn sharply higher, as KRE 0.66% has joined RSP 0.19% in breaking out of the recent consolidation that started in May. Treasury Secretary Scott Bessent spoke about helping community banks by ending some of the regulations via his plan on loosening up the Capital Rules.

It’s widely understood that lessening the Supplemental Leverage Ratio will allow the Regional banks to be able to lend more freely and buy Treasuries as their balance sheet is freed up. I expect a short-term rally up to $66 in to test February 2025 peaks before much stalling out and today’s move should kick off a rally which eventually tests all-time highs near $70.

SPDR S&P Regional Banking ETF

July Seasonality in post-election years tends to be quite bullish

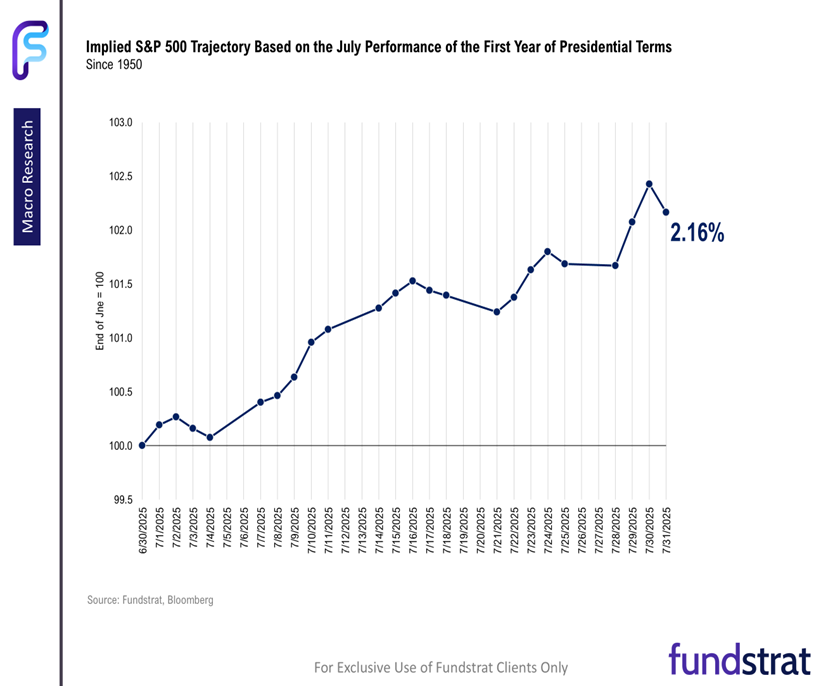

Following suit on our discussion of June seasonality last month, which played out nearly perfectly (rising in early June before peaking and declining into June expiration before a rally takes place), I think it’s informative to take a close look at July seasonality.

As shown below, July tends to be quite bullish for Post-Election years and has averaged approximately more than 2% on average since 1950.

Thus, while the back half of June proved to be quite bullish, I anticipate that July might be even better in helping this recent breakout to extend in the weeks to come.

Until/unless evidence of waning breadth materializes or signs of cyclical weakness, or DeMark-based exhaustion turns up, it will be right to stick with this rally, even if minor consolidation happens post-Independence Day holiday.

Equal-weighted ^SPX might require another 1-2 months to bottom out vs. SPY 0.02%

Many are wondering if the recent uptick in performance from Equal-weighted ^SPX means that it should start to outperform SPY 0.02% .

At present, it’s still premature to make this call, technically.

The rise in Technology has proven so positive that it’s now leading all sectors on a one-week, one-month, and three-month basis. This kind of momentum in Technology makes it difficult to expect a sudden downturn or period of underperformance from SPY 0.02% .

Thus, while the breakout in RSP 0.19% is impressive and bullish this week for further gains, I still feel it’s early to expect that Equal-weighted ^SPX will outperform the cap-weighted ^SPX.

DeMark exhaustion indicators on monthly relative charts of RSP 0.19% vs SPY 0.02% show that exhaustion might be possible within two months’ time. If this happens and the signal is confirmed, then some possible mean reversion is possible for RSP 0.19% vs SPY 0.02% after a lengthy period of underperformance.

At present, Technology arguably remains too strong to fade, and it’s right to embrace both RSP 0.19% and SPY 0.02% on an absolute basis. However, relatively speaking, my view is that this ratio should still pull back to new lows in August/September timeframe. Thus, SPY still looks like the winner, performance-wise, relatively speaking.

Note, this downtrend has persisted for nearly three years. Thus, if/when a signal does appear, and is confirmed this Fall, it might point to eventual Technology underperformance after its steep runup in recent months. At present, this is premature.

RSP/SPY